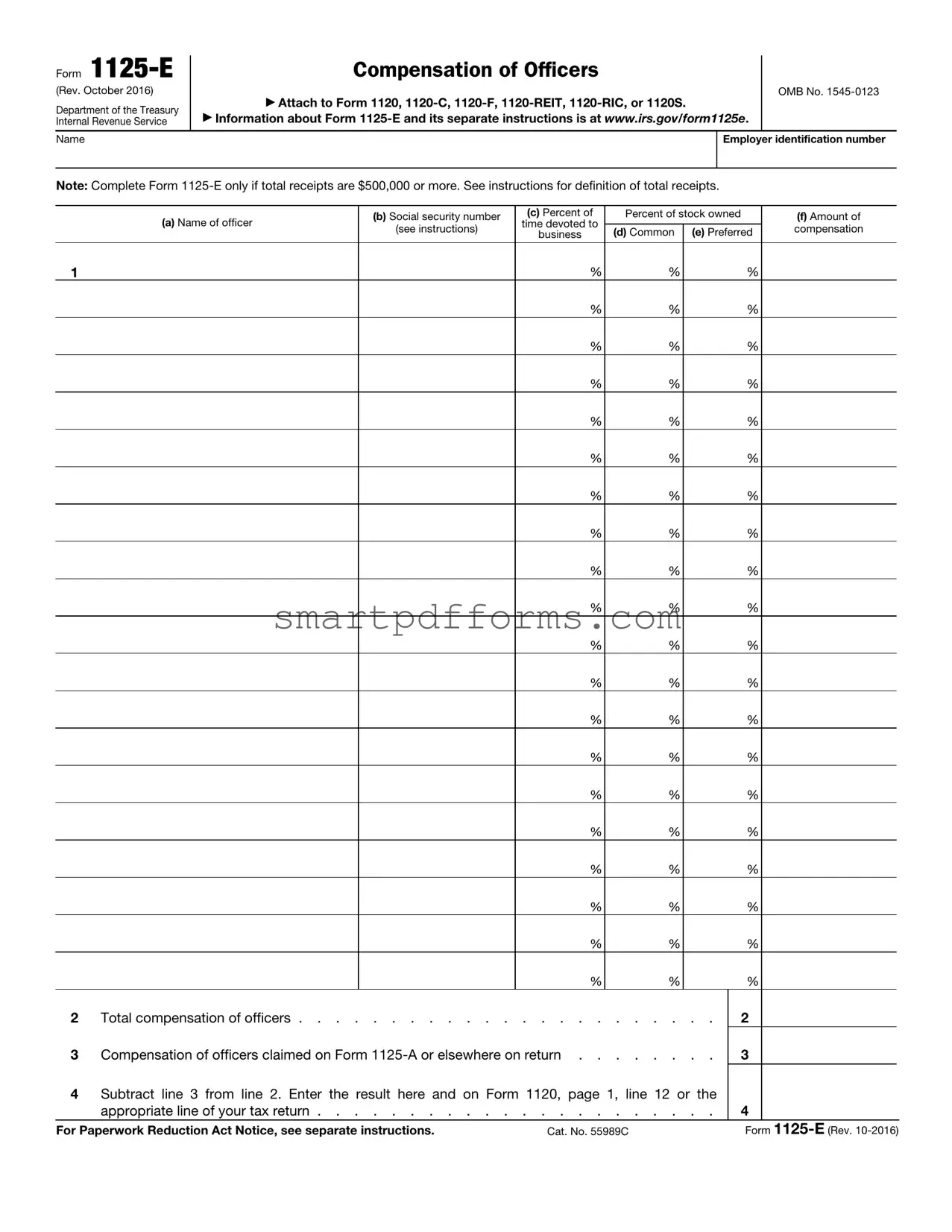

Blank 1125E PDF Template

Understanding the nuances and obligations tied to Form 1125-E, Compensation of Officers, is crucial for entities seeking to navigate their tax responsibilities effectively. This form bolsters transparency and accountability by detailing the compensation of each officer within a company, ensuring a meticulous breakdown of their earnings and the extent of their stake and involvement in the company. Designed to be attached to various corporate tax returns such as Form 1120, 1120-C, 1120-F, 1120-REIT, 1120-RIC, or 1120S, it comes into play only when a company's total receipts hit the $500,000 threshold. This threshold underscores the Internal Revenue Service's (IRS) aim to scrutinize more closely the financial activities of larger entities. The form demands specific information, including the name and social security number of each officer, their stock ownership percentage, the amount of compensation, and the time devoted to the business, painting a comprehensive picture of their financial engagement. With implications for taxation and the internal financial structuring of a company, ensuring accuracy and compliance when completing Form 1125-E is paramount, aided by guidance available directly from the IRS.

Preview - 1125E Form

Form |

Compensation of Officers |

|

|

(Rev. October 2016) |

▶ Attach to Form 1120, |

OMB No. |

|

Department of the Treasury |

|

||

▶ Information about Form |

|

||

Internal Revenue Service |

|

||

Name |

|

Employer identification number |

|

|

|

|

|

Note: Complete Form

|

(a) Name of officer |

(b) Social security number |

(c) Percent of |

Percent of stock owned |

(f) Amount of |

||

|

time devoted to |

|

|

|

|||

|

(see instructions) |

(d) Common |

(e) Preferred |

compensation |

|||

|

|

business |

|||||

|

|

|

|

||||

|

|

|

|

|

|

|

|

1 |

|

|

% |

% |

|

% |

|

|

|

|

% |

% |

|

% |

|

|

|

|

% |

% |

|

% |

|

|

|

|

% |

% |

|

% |

|

|

|

|

% |

% |

|

% |

|

|

|

|

% |

% |

|

% |

|

|

|

|

% |

% |

|

% |

|

|

|

|

% |

% |

|

% |

|

|

|

|

% |

% |

|

% |

|

|

|

|

% |

% |

|

% |

|

|

|

|

% |

% |

|

% |

|

|

|

|

% |

% |

|

% |

|

|

|

|

% |

% |

|

% |

|

|

|

|

% |

% |

|

% |

|

|

|

|

% |

% |

|

% |

|

|

|

|

% |

% |

|

% |

|

|

|

|

% |

% |

|

% |

|

|

|

|

% |

% |

|

% |

|

|

|

|

% |

% |

|

% |

|

|

|

|

% |

% |

|

% |

|

2 |

Total compensation of officers |

. . . . |

. . |

2 |

|

||

3 |

Compensation of officers claimed on Form |

. . . . |

. . |

3 |

|

||

4Subtract line 3 from line 2. Enter the result here and on Form 1120, page 1, line 12 or the

appropriate line of your tax return |

4 |

For Paperwork Reduction Act Notice, see separate instructions. |

Cat. No. 55989C |

Form |

Form Data

| Fact Name | Description |

|---|---|

| Form Revision Date | October 2016 |

| Primary Use | Reporting compensation of officers |

| Associated Forms | Attach to Form 1120, 1120-C, 1120-F, 1120-REIT, 1120-RIC, or 1120S |

| OMB Number | 1545-0123 |

| Income Threshold for Filing | Must be completed if total receipts are $500,000 or more |

| Information Requirement | Includes officer's name, Social Security Number, stock ownership, time devoted to the business, and compensation |

| Official Source | Information and form available on the IRS website |

| Paperwork Reduction Act Notice | Referenced separately in instructions |

Instructions on Utilizing 1125E

Fulfilling the requirements for Form 1125-E is a critical step for businesses that meet the specific threshold. This form, designed to report compensation of officers, attaches directly to a company's primary tax return forms such as Form 1120, 1120-C, and others as specified. It's a vital document for businesses with total receipts of $500,000 or more, acting as a transparent record of compensation for key individuals within the organization. The necessity of accuracy and thoroughness in completing this form cannot be overstressed, as it plays a significant role in the overall tax filing process. Below are the detailed steps to accurately fill out Form 1125-E.

- Begin with providing the name of the business at the top of the form, ensuring that it matches the name on the primary tax return form to which Form 1125-E will be attached.

- Enter the Employer Identification Number (EIN) of the business accurately. This number is crucial for identifying the company within the Internal Revenue Service (IRS) system.

- For each officer, start filling out the columns from left to right beginning with column (a), where you write the name of the officer. Ensure the full legal name is used to avoid any discrepancies or confusion.

- In column (b), input the officer's Social Security Number (SSN). This personal identifier must be accurate for IRS records.

- Proceed to column (c), detailing the percent of stock owned. This includes both common and preferred stock, represented in columns (d) and column (e) respectively, and requires a careful review of the company's records.

- Column (f) requires an input of the percentage of time the officer devotes to the business. This represents a commitment level and must be estimated accurately.

- Lastly, report the total amount of compensation for each officer in the appropriate column. This includes all forms of compensation provided to the officer by the business.

- Add up the total compensation of all listed officers and enter this amount in the "Total compensation of officers" line at the end of the listing.

- If compensation has been claimed on Form 1125-A or elsewhere in the return, note this amount in the designated space. This helps in ensuring that compensation is not double-counted.

- Subtract the amount in the previous step from the total compensation of officers to find the final figure. This number should then be reported on the main tax form, as instructed on Form 1125-E.

After completing these steps, double-check all entered information for accuracy. Any inaccuracies in reporting can lead to issues with the IRS, including audits or penalties. Once assured of the accuracy of all details, attach Form 1125-E to the appropriate tax return form as indicated. This form becomes a part of the company's official tax documentation, highlighting the compensation of its key officers. As such, maintaining a copy for records is recommended, ensuring all information is on hand for any future needs or inquiries.

Obtain Answers on 1125E

Frequently Asked Questions about Form 1125-E

- What is Form 1125-E and who is required to file it?

Form 1125-E, titled "Compensation of Officers," is a tax document required by the United States Internal Revenue Service (IRS). It is designed for use by corporations that need to report compensation paid to their officers. Specifically, it must be attached to Form 1120, 1120-C, 1120-F, 1120-REIT, 1120-RIC, or 1120S. A corporation is required to complete Form 1125-E if its total receipts are $500,000 or more. This requirement helps ensure transparency in the compensation practices of businesses.

- What information is needed to complete Form 1125-E?

To accurately complete Form 1125-E, information on the compensation of each officer of the corporation is required. This includes the officer's name, social security number, percentage of common and preferred stock owned, amount of compensation, and the portion of time devoted to the business. Collecting this information in advance will streamline the process of filling out the form.

- Where can I find instructions for completing Form 1125-E?

Instructions for completing Form 1125-E can be found on the IRS website at www.irs.gov/form1125e. The instructions provide detailed guidance on how to accurately report the required information, including definitions of terms used in the form and step-by-step instructions on completing each section. It's crucial to follow these instructions carefully to ensure compliance with IRS requirements.

- Can compensation of officers be claimed elsewhere on the return?

Yes, compensation of officers reported on Form 1125-E may also be claimed elsewhere on the tax return. If any officer's compensation is claimed on Form 1125-A or in another section of the tax return, it should be noted on Form 1125-E. The form includes a specific section to report any compensation amounts claimed elsewhere. This ensures that the total compensation of officers is accurately calculated and reported without duplication.

- How is the total compensation of officers calculated on Form 1125-E?

The total compensation of officers is calculated by summing the compensation amounts for all officers listed on Form 1125-E. If any compensation has been claimed on Form 1125-A or elsewhere on the tax return, these amounts should be subtracted from the total calculation. The resulting figure is then entered on Form 1120, page 1, line 12, or the appropriate line of the relevant tax return. This calculation ensures that the compensation of officers is accurately reflected in the corporation's overall financial statements.

Common mistakes

When it comes to filling out IRS Form 1125-E, which is all about reporting compensation of officers, people often stumble over similar hurdles. This form is vital for businesses that have gross receipts of $500,000 or more, as it attaches to your corporation’s tax return. Keeping an eye out for common mistakes can save a lot of headaches. Here's what to watch out for:

- Not reading the instructions carefully: The IRS provides extensive instructions for Form 1125-E. Skipping this step might lead to misunderstandings about what information is needed, possibly causing errors in reporting.

- Failing to report all compensation: Some might forget to include every form of compensation officers receive, such as bonuses or benefits, leading to inaccuracies in the total compensation reported.

- Incorrect Social Security numbers: A surprisingly common error is entering incorrect Social Security numbers for officers. This mistake can lead to processing delays or mismatches in IRS records.

- Neglecting the percent of time devoted to business: This section requires careful thought, as inaccurately reporting the amount of time officers dedicate to the business could question the compensation reported.

- Miscalculating stock ownership percentages: Both common and preferred stocks need exact percentage calculations. Misestimating these figures can affect the perceived ownership and control of the company.

- Forgetting to total the compensation: The form requires a sum of all officers' compensation before adjustments. Missing this step could result in reporting discrepancies.

- Omitting compensation reported elsewhere: If you've listed officer compensation on Form 1125-A or another part of your tax return, you must deduct this from the total on Form 1125-E. Overlooking this can lead to double counting.

To sidestep these pitfalls, a detailed review of both the instructions and completed form is essential. An accurate and compliant submission helps avoid unnecessary questions from the IRS. Remember, it's all about precise details and full disclosure.

Documents used along the form

Form 1125-E, known as the Compensation of Officers form, is essential for businesses with total receipts of $500,000 or more, as it details the compensation provided to its officers. This form is typically attached to a variety of corporate income tax returns. Understanding and preparing this form accurately requires careful attention to detail and often necessitates supplementary forms and documents to ensure compliance and thorough reporting. Below is a list of other forms and documents frequently used alongside Form 1125-E, each serving a unique purpose within the broader context of corporate tax preparation.

- Form 1120 - U.S. Corporation Income Tax Return: This is the primary form for domestic corporations to report their income, gains, losses, deductions, credits, and to figure out their income tax liability.

- Form 1120S - U.S. Income Tax Return for an S Corporation: S Corporations use this form to report their income, deductions, gains, losses, etc. It’s necessary for corporations that have elected the S Corporation status, distinguishing itself from Form 1120 by the pass-through tax structure it offers.

- Form 1120-C - U.S. Income Tax Return for Cooperative Associations: This form is designed for cooperatives to file their income tax return, reporting income, deductions, and credits specific to their operations.

- Form 1120-F - U.S. Income Tax Return of a Foreign Corporation: Foreign corporations use this form to report their income, gains, losses, deductions, and to calculate their income tax liability while operating in the United States.

- Form 1120-REIT - U.S. Income Tax Return for Real Estate Investment Trusts: This form is specifically for Real Estate Investment Trusts (REITs) to report their income, deductions, and to calculate their income tax liability in accordance with their specific tax structure.

Each of these documents plays an essential role in corporate tax preparation, either by providing detailed information about the company's financial activities or by structuring the company's tax liabilities according to its unique business model. When preparing Form 1125-E, it's crucial to have a comprehensive understanding of the accompanying forms relevant to the specific business entity. Integrating these forms accurately helps ensure that corporations are in compliance with IRS reporting requirements. Moreover, these documents collectively offer a comprehensive view of a corporation's fiscal responsibilities and contribute to its financial accountability and integrity.

Similar forms

Form 1120 (U.S. Corporation Income Tax Return): This form is alike to Form 1125-E in its pertinence to corporations, providing a detailed account of the corporation's income, gains, losses, deductions, credits, and income tax liability. Form 1125-E supplements Form 1120 by detailing compensation to officers, which is a requisite part of calculating the corporation's taxable income.

Form 1120-C (U.S. Income Tax Return for Cooperative Associations): Similar to Form 1125-E, Form 1120-C is used by cooperatives to report their income, deductions, and credits. The requirement to attach Form 1125-E if total receipts are $500,000 or more implies that officers' compensation is a significant factor for cooperatives in their tax reporting and accounting practices.

Form 1120-F (U.S. Income Tax Return of a Foreign Corporation): This form, used by foreign corporations to report their income tax liabilities and transactions in the United States, parallels Form 1125-E in its incorporation into the broader calculation of tax obligations, including the compensation of U.S.-based officers of foreign corporations.

Form 1120-REIT (U.S. Income Tax Return for Real Estate Investment Trusts): Like Form 1125-E, Form 1120-REIT applies to specialized corporate entities; specifically, Real Estate Investment Trusts. Reporting compensation of officers on Form 1125-E provides crucial information for determining the correct amount of tax owed by these trusts, emphasizing the role of leadership compensation in tax considerations.

Form 1120-RIC (U.S. Income Tax Return for Regulated Investment Companies): This form is designed for regulated investment companies (RICs), such as mutual funds, to declare their income and taxes. Form 1125-E's requirement reflects the importance of transparency in reporting officer compensation within these financial entities, contributing to their regulatory compliance and fiscal responsibility.

Form 1120S (U.S. Income Tax Return for an S Corporation): S Corporations use Form 1120S to report income, losses, and dividends. Attaching Form 1125-E for compensation detail is similar because it ensures that S Corporations account for payment to their officers in their income reporting, affecting their tax liability and adherence to tax laws.

Form 1125-A (Cost of Goods Sold): Though primarily focused on the costs associated with producing or purchasing goods sold by a business, Form 1125-A is connected to Form 1125-E through their mutual role in the comprehensive tax reporting process. Compensation of officers, as reported on Form 1125-E, alongside the cost of goods sold on Form 1125-A, contributes to a complete picture of a corporation's financial activities and taxable income.

Dos and Don'ts

When filling out Form 1125-E, Compensation of Officers, it's important to pay attention to both the instructions and the details you provide. Here are tips on what you should and shouldn't do:

Things You Should Do

- Ensure total receipts are $500,000 or more: Only complete Form 1125-E if your business's total receipts meet or exceed this threshold. This requirement is clearly stated in the form's instructions.

- Provide accurate information: Fill in all required details accurately, including the name and social security number of each officer, their percentage of stock ownership, the amount of time they devote to the business, and their compensation.

- Check stock ownership percentages: Carefully report the percent of stock owned, both common and preferred, as per the instructions. This involves understanding the definitions related to stock ownership in your company's context.

- Review and confirm the total compensation: Calculate the total compensation of officers correctly. This involves adding up all the compensation figures accurately before entering the total amount in the designated space on the form.

Things You Shouldn't Do

- Leave fields blank: Don't skip any fields. If a particular item doesn't apply, consider entering "N/A" or "0," as appropriate, instead of leaving it blank. Blank fields may lead to unnecessary queries from the IRS.

- Estimate amounts without verification: Avoid guessing values, especially for compensation amounts and percentages of time devoted to the business. Use accurate, up-to-date records to fill in these amounts.

- Ignore the instructions: Don't overlook the specific instructions for Form 1125-E available on the IRS website. These instructions provide crucial details on how to fill out the form correctly.

- Forget to attach the form to the appropriate return: Make sure Form 1125-E is attached to Form 1120, 1120-C, 1120-F, 1120-REIT, 1120-RIC, or 1120S, as applicable. Failing to attach it to the correct tax return can lead to processing delays.

Misconceptions

Understanding Form 1125-E, titled "Compensation of Officers," involves clarifying some common misconceptions. This form, revised in October 2016, is an integral part of the documentation for certain corporations filing specific types of tax returns with the Internal Revenue Service (IRS).

Misconception 1: Form 1125-E is required for all businesses.

This is incorrect. Only corporations with total receipts of $500,000 or more are required to complete Form 1125-E. This threshold is critical because it determines the applicability of the form to a corporation. The form's instructions expressly state that it should be attached to Form 1120, Form 1120-C, Form 1120-F, Form 1120-REIT, Form 1120-RIC, or Form 1120S, depending on the type of corporation filing the return.

Misconception 2: Social Security Numbers (SSNs) of officers are optional.

Each officer's Social Security Number is a mandatory field on the form. This requirement ensures accurate identification and record-keeping for the IRS. It's a common misunderstanding that providing this information is discretionary, but in reality, omitting it can lead to processing delays or requests for additional information.

Misconception 3: The form includes detailed descriptions of compensation types.

Form 1125-E asks for compensation information but does so in a summary format. Detailed compensation breakdowns, such as salary, bonuses, or other types of remuneration, are not explicitly requested on this form. Instead, the form focuses on the total compensation, the officer's percentage of stock owned, and the amount of time devoted to the business. This condensed format aims to streamline the reporting process.

Misconception 4: Filing Form 1125-E is unrelated to other parts of the corporate tax return.

Contrary to this belief, the total compensation of officers reported on Form 1125-E directly affects other parts of a corporation’s tax return. Specifically, the final amount from Form 1125-E is entered on page 1 of Form 1120 (or the corresponding line of other relevant forms) under "Compensation of Officers." This entry is crucial for accurately calculating the corporation's taxable income.

In summary, understanding the specific requirements, purpose, and integration of Form 1125-E into the broader tax filing process can help corporations accurately report compensation of officers. Clarifying these misconceptions ensures compliance and streamlines the reporting process with the IRS.

Key takeaways

Understanding Form 1125-E is crucial for businesses meeting certain criteria. This form, titled Compensation of Officers, must be completed and attached to the tax return forms for corporations and other entities, such as Forms 1120, 1120-C, 1120-F, 1120-REIT, 1120-RIC, or 1120S, if total receipts are $500,000 or more. Its primary use is to report officer compensation.

Specific details about each officer are required. Form 1125-E collects comprehensive information on each officer, including their name, social security number, the percentage of stock owned (both common and preferred), the amount of time devoted to the business, and compensation. This detailed reporting ensures transparency in officer compensation and verifies that it aligns with the company’s declared income and tax obligations.

Calculation of compensation must be precise. To accurately complete the form, one must first sum up the total compensation of officers. Next, if any officer's compensation has been claimed on Form 1125-A or elsewhere on the tax return, this amount should be noted. The net amount of officer compensation—after subtracting claimed compensations—should be calculated and entered on the tax return. This careful calculation is important for accurately determining the business's taxable income.

- Form 1125-E is mandatory for businesses with total receipts of $500,000 or more, making it essential for eligible entities to comply.

- Accurate reporting of each officer’s detailed information, including compensation and stock ownership, is required.

- The form demands precise calculation of total compensation and the distinction between reported and claimed amounts elsewhere on tax returns.

- Failure to complete Form 1125-E when required can lead to inaccurate reporting of taxable income and possibly penalties.

Overall, paying close attention to the completion of Form 1125-E is vital for compliance and accuracy in tax reporting for businesses that meet the specified criteria. Properly documenting and reporting officer compensation contributes to a transparent, fair, and accurate tax process.

Popular PDF Forms

Navsup Form 306 - Equips officers with the necessary documentation to fulfill requisition orders accurately and timely.

Buyer Guide - It serves as a physical reminder of the buyer's rights and the dealer’s obligations, aiming to prevent any post-sale disputes related to vehicle condition or warranty coverage.

What Is a Coc - Suppliers are responsible for ensuring that their products conform to the technical drawings, diagrams, and specifications listed in the contract.