Blank 114A PDF Template

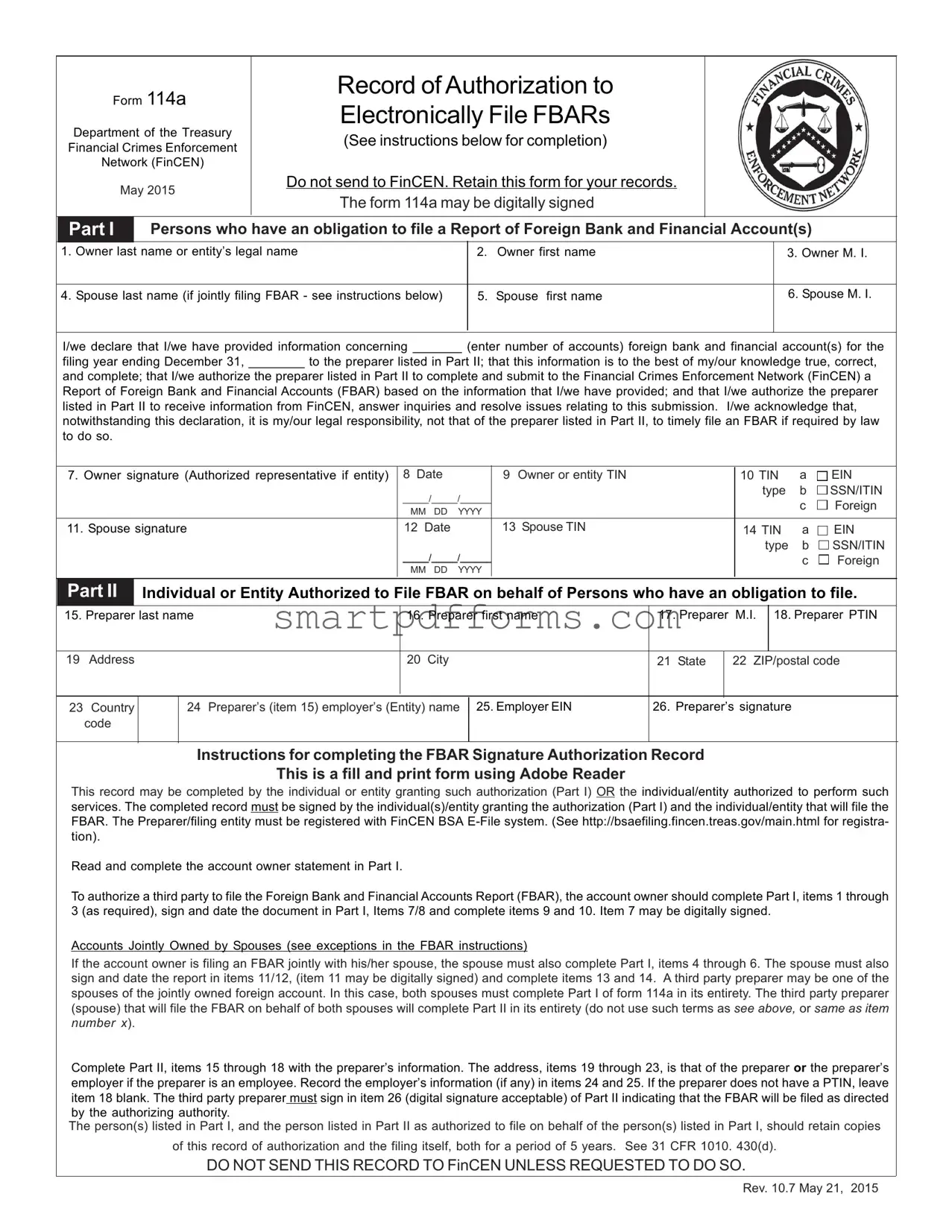

In the realm of international finance and tax compliance, the Form 114a plays a crucial role for individuals and entities with foreign bank and financial accounts. Issued by the Department of the Treasury's Financial Crimes Enforcement Network (FinCEN) as of May 2015, this form serves as a Record of Authorization to Electronically File FBARs (Foreign Bank and Financial Accounts Reports). Central to its purpose is the facilitation of authorization for third parties to file FBARs on behalf of account owners, thereby ensuring compliance with reporting obligations under United States law. Specifically, Form 114a outlines the necessary information from account owners for FBAR filing, including legal names, account numbers, and taxpayer identification numbers, alongside provisions for the digital signature of the document. Spouses jointly filing must also provide detailed information and sign the form if they are co-owners of the foreign account. The form is clear in stating that while third-party preparers can complete and submit the FBAR based on the provided information, the legal responsibility of timely filing falls on the account owner. Notably, this form is to be retained by the individuals or entities involved and not sent to FinCEN unless explicitly requested, with a strict instruction to keep the document for record-keeping purposes for five years. This protocol ensures a streamlined process for FBAR filing, emphasizing accountability and accurate financial reporting, while also offering a measure of convenience through third-party filing capacities.

Preview - 114A Form

Form 114a

Department of the Treasury

Financial Crimes Enforcement

Network (FinCEN)

May 2015

Record of Authorization to

Electronically File FBARs

(See instructions below for completion)

Do not send to FinCEN. Retain this form for your records. The form 114a may be digitally signed

Part I

Persons who have an obligation to file a Report of Foreign Bank and Financial Account(s)

1. Owner last name or entity’s legal name

2. Owner first name

3. Owner M. I.

4. Spouse last name (if jointly filing FBAR - see instructions below)

5. Spouse first name

6. Spouse M. I.

I/we declare that I/we have provided information concerning _______ (enter number of accounts) foreign bank and financial account(s) for the

filing year ending December 31, ________ to the preparer listed in Part II; that this information is to the best of my/our knowledge true, correct,

and complete; that I/we authorize the preparer listed in Part II to complete and submit to the Financial Crimes Enforcement Network (FinCEN) a Report of Foreign Bank and Financial Accounts (FBAR) based on the information that I/we have provided; and that I/we authorize the preparer listed in Part II to receive information from FinCEN, answer inquiries and resolve issues relating to this submission. I/we acknowledge that, notwithstanding this declaration, it is my/our legal responsibility, not that of the preparer listed in Part II, to timely file an FBAR if required by law to do so.

7. Owner signature (Authorized representative if entity) |

8 Date |

|

9 Owner or entity TIN |

10 TIN |

a |

EIN |

|

_____/_____/______ |

|

type |

b |

SSN/ITIN |

|

|

|

|

c |

Foreign |

||

|

MM DD |

YYYY |

|

|

||

|

|

|

|

|

||

11. Spouse signature |

12 Date |

|

13 Spouse TIN |

14 TIN |

a |

EIN |

|

|

|

|

type |

b |

SSN/ITIN |

|

_____/_____/______ |

|

|

c |

Foreign |

|

|

MM DD |

YYYY |

|

|

||

|

|

|

|

|

||

Part II

Individual or Entity Authorized to File FBAR on behalf of Persons who have an obligation to file.

15. Preparer last name |

|

16. Preparer first name |

17. Preparer |

M.I. |

18. Preparer PTIN |

|||||

|

|

|

|

|

|

|

|

|

|

|

19 |

Address |

|

|

|

20 City |

21 State |

|

22 ZIP/postal code |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

23 |

Country |

|

24 |

Preparer’s (item 15) employer’s (Entity) name |

25. Employer EIN |

26. Preparer’s signature |

||||

|

code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Instructions for completing the FBAR Signature Authorization Record

This is a fill and print form using Adobe Reader

This record may be completed by the individual or entity granting such authorization (Part I) OR the individual/entity authorized to perform such services. The completed record must be signed by the individual(s)/entity granting the authorization (Part I) and the individual/entity that will file the FBAR. The Preparer/filing entity must be registered with FinCEN BSA

Read and complete the account owner statement in Part I.

To authorize a third party to file the Foreign Bank and Financial Accounts Report (FBAR), the account owner should complete Part I, items 1 through 3 (as required), sign and date the document in Part I, Items 7/8 and complete items 9 and 10. Item 7 may be digitally signed.

Accounts Jointly Owned by Spouses (see exceptions in the FBAR instructions)

If the account owner is filing an FBAR jointly with his/her spouse, the spouse must also complete Part I, items 4 through 6. The spouse must also sign and date the report in items 11/12, (item 11 may be digitally signed) and complete items 13 and 14. A third party preparer may be one of the spouses of the jointly owned foreign account. In this case, both spouses must complete Part I of form 114a in its entirety. The third party preparer (spouse) that will file the FBAR on behalf of both spouses will complete Part II in its entirety (do not use such terms as SEE ABOVE, or SAME AS ITEM NUMBER X).

Complete Part II, items 15 through 18 with the preparer’s information. The address, items 19 through 23, is that of the preparer or the preparer’s employer if the preparer is an employee. Record the employer’s information (if any) in items 24 and 25. If the preparer does not have a PTIN, leave item 18 blank. The third party preparer must sign in item 26 (digital signature acceptable) of Part II indicating that the FBAR will be filed as directed by the authorizing authority.

The person(s) listed in Part I, and the person listed in Part II as authorized to file on behalf of the person(s) listed in Part I, should retain copies

of this record of authorization and the filing itself, both for a period of 5 years. See 31 CFR 1010. 430(d).

DO NOT SEND THIS RECORD TO FinCEN UNLESS REQUESTED TO DO SO.

Rev. 10.7 May 21, 2015

Form Data

| # | Fact Name | Description |

|---|---|---|

| 1 | Document Title | Form 114a: Record of Authorization to Electronically File FBARs |

| 2 | Issuer | Department of the Treasury Financial Crimes Enforcement Network (FinCEN) |

| 3 | Date of Revision | May 2015 |

| 4 | Primary Purpose | Authorizes a third party to file Report of Foreign Bank and Financial Accounts (FBAR) electronically on behalf of the account owner. |

| 5 | Digital Signature | The form allows for digital signatures from both the account owner and the preparer. |

| 6 | Taxpayer Identification Numbers (TINs) | Requires TINs which can include an EIN, SSN/ITIN, or a Foreign TIN. |

| 7 | Joint Filing Provision | Joint FBAR filing for spouses is allowed under specific conditions outlined in the form. |

| 8 | Record Retention | Both the authorizing individual/entity and the authorized filer must retain copies of the form for 5 years. |

| 9 | Form Submission | The completed form should not be sent to FinCEN unless specifically requested. |

| 10 | Preparer Registration Requirement | The preparer/filing entity must be registered with the FinCEN BSA E-File system. |

Instructions on Utilizing 114A

Filling out the Form 114a is an essential step for individuals or entities who wish to authorize a third party to file the Report of Foreign Bank and Financial Accounts (FBAR) on their behalf. This form serves as a record of such authorization and is not to be submitted to the Financial Crimes Enforcement Network (FinCEN) but retained for the record. The process involves providing detailed personal information, account specifics, and an acknowledgment of responsibility to comply with FBAR filing requirements. Following the instructions below will guide you through completing Form 114a efficiently and accurately.

- Part I - Grantor of Authorization:

- Enter the last name or entity’s legal name, first name, and middle initial (if applicable) of the account owner.

- If filing jointly with a spouse, fill in the spouse’s last name, first name, and middle initial (if applicable).

- Declare the number of foreign bank and financial accounts being reported and the filing year ending December 31, alongside your authorization for the preparer to file the FBAR on your behalf. This includes allowing the preparer to receive information from FinCEN, answer inquiries, and resolve issues related to the submission.

- Sign and date the form to indicate your agreement. If the owner is an entity, an authorized representative should sign. Remember, digital signatures are accepted for this form.

- Provide the Owner or Entity’s TIN, selecting the appropriate type (EIN, SSN/ITIN, or Foreign) and fill in the date accordingly.

- If applicable, have the Spouse sign and date the form. Then, provide the Spouse’s TIN, selecting the appropriate type and fill in the date accordingly.

- Part II - Individual or Entity Authorized to File FBAR:

- Input the preparer’s last name, first name, and middle initial.

- Fill in the Preparer’s PTIN (Preparer Tax Identification Number). Leave blank if not available.

- Provide the preparer or preparer’s employer’s address, including city, state, ZIP/postal code, and country.

- Record the preparer’s (item 15) employer’s name if applicable, and the Employer EIN.

- The preparer must sign in item 26 to indicate that the FBAR will be filed as authorized. Digital signatures are also acceptable for this section.

Once completed, both the individuals/entities listed in Part I and the individual/entity in Part II should keep a copy of Form 114a along with the FBAR filings for a period of 5 years, as mandated by regulation. It's important to remember not to send this form to FinCEN unless specifically requested. Completing Form 114a with accurate and comprehensive information is crucial in meeting your FBAR reporting obligations while ensuring that your chosen preparer is fully authorized to act on your behalf.

Obtain Answers on 114A

-

What is the Form 114a and why is it important?

The Form 114a, officially known as the Record of Authorization to Electronically File FBARs, is a document used by individuals or entities to grant permission to a third party to file the Report of Foreign Bank and Financial Accounts (FBAR) on their behalf. It's critical because it legally documents the authorization given to the preparer, ensuring that the FBAR is submitted correctly and on time by someone who has the knowledge and registration required by the Financial Crimes Enforcement Network (FinCEN). Keeping this form is essential as it serves as proof of the authorization and compliance with the regulations.

-

Who needs to complete the Form 114a?

Anyone with a foreign bank or financial account who prefers to have a third party, such as a tax preparer, file their FBAR must complete the Form 114a. This includes both individuals and entities with foreign financial interests or signature authority over these accounts and who meet the reporting threshold. If an individual is filing an FBAR jointly with a spouse, both must complete and sign the form to authorize a preparer. Similarly, if a third-party preparer is one of the spouses for the jointly owned account, the form must be filled out in its entirety by both spouses.

-

How should the Form 114a be submitted?

Form 114a should not be submitted to FinCEN. Instead, after completion and signing, it must be retained by both the account owner(s) and the authorized filer for a period of five years. This record will serve as evidence of the permissions granted to the third-party preparer. It is crucial to have this form readily available if requested by authorities to verify the authorization to file the FBAR electronically on the account owner's behalf.

-

Can the Form 114a be digitally signed?

Yes, digital signatures are accepted on the Form 114a. Both the account owner(s) authorizing the third-party to file the FBAR and the third-party preparer completing the form can use digital signatures. This feature facilitates easier and faster completion and helps in maintaining records electronically, thus ensuring a more efficient process in compliance with the legal requirements for the electronic filing of FBARs.

-

What information is required to complete Form 114a?

- Owner’s name or entity’s legal name

- Spouse’s information if filing jointly

- Tax Identification Numbers (TIN) for the owner, spouse (if applicable), and the preparer

- Number of foreign accounts being reported

- Authorization statement signed and dated by the account owner(s)

- Preparer’s information, including name, PTIN, and signature

Accurately completing all these items is necessary for legally authorizing someone to file an FBAR on your behalf. It confirms the preparer is equipped with all necessary information to accurately report foreign bank and financial accounts to FinCEN.

Common mistakes

Failing to properly complete the owner and/or entity information in Part I, items 1-6, can lead to confusion about who is responsible for the FBAR filing. This includes not providing last names, first names, and middle initials for owners or entities, or inaccurately entering the information.

Incorrectly entering the number of accounts and filing year in the declaration statement. It is crucial that filers accurately report the total number of foreign bank and financial accounts and the correct filing year to ensure the FBAR reflects all required information for the respective period.

Not properly authorizing the preparer by failing to sign and date Part I of the form. Both the account owner’s signature (Item 7) and the date (Item 8) are mandatory fields that confirm the authorizer has delegated the responsibility to the preparer listed in Part II.

Omitting or incorrectly providing the Tax Identification Number (TIN) for both the owner or entity and spouse (if applicable) in items 9, 10, 13, and 14. The appropriate TIN, whether it’s an EIN, SSN, or a foreign TIN, must be correctly filled to ensure proper identification and compliance.

When filing jointly with a spouse, overlooking the requirement to complete items 4-6 for the spouse and to obtain the spouse’s signature and date in items 11 and 12. This mistake can invalidate the joint filing status if not properly executed.

Incorrectly filling out or skipping information in Part II for the preparer’s details, including the Preparer Tax Identification Number (PTIN) in item 18, is a common error. This section must be filled accurately to ensure that the preparer is correctly identified and authorized in the FinCEN BSA E-File system.

Failure to retain copies of the form for the required period of five years. Owners and preparers often forget that both need to keep copies of the form 114a record and the FBAR filing itself, which might be needed for future reference or in case requested by FinCEN.

Documents used along the form

When handling finances, especially with an international reach, several forms and documents work alongside Form 114a, the Record of Authorization to Electronically File FBARs. Each assists in ensuring that individuals and entities meet their reporting obligations fully and accurately, within legal guidelines. Here’s a look at some of these crucial documents.

- Form 8938 (Statement of Specified Foreign Financial Assets): This form is required for taxpayers with specified foreign financial assets that exceed certain thresholds. It’s part of the tax return and helps report foreign assets and investments.

- Form 1040 (U.S. Individual Income Tax Return): The standard form used by individuals to file their annual income tax returns. It’s essential for reporting income, deductions, and credits to the IRS.

- Schedule B (Interest and Ordinary Dividends): Attached to Form 1040, Schedule B is necessary when a taxpayer receives income from interest or dividends that exceed a certain amount, including those from foreign accounts.

- FinCEN 105 (Report of International Transportation of Currency or Monetary Instruments): This report is required if an individual physically transports or ships currency or monetary instruments in excess of $10,000 into or out of the U.S. It ensures transparency with cash movements.

- Form TD F 90-22.1 (Report of Foreign Bank and Financial Accounts, FBAR): Although superseded by FinCEN Form 114 for electronic filings, this was the previous paper filing option for reporting foreign bank and financial accounts.

Aligning these documents with Form 114a ensures a comprehensive approach to financial reporting, covering various aspects of international financial engagements. This combination of forms helps individuals and entities comply with U.S. laws, avoid penalties, and maintain accurate records for financial integrity.

Similar forms

Form 2848, Power of Attorney and Declaration of Representative: Both Form 114a and Form 2848 enable individuals or entities to authorize a third party to take specific actions on their behalf. Form 114a allows for authorization to file FBARs electronically, while Form 2848 is broader, permitting a third party to represent the taxpayer before the IRS and perform acts like signing agreements or accessing confidential tax information.

Form 8821, Tax Information Authorization: Similar to Form 114a, Form 8821 authorizes a third party to access tax information, but it does not permit representation before the IRS or the ability to act on the taxpayer's behalf. Form 114a specifically relates to the filing and handling of information regarding foreign bank accounts.

Form 8879, IRS e-file Signature Authorization: This form, like Form 114a, involves digital authorizations. Form 8879 is used to authorize the e-filing of a tax return by an electronic return originator, much like Form 114a authorizes a third party to file FBARs electronically.

Form 706, United States Estate (and Generation-Skipping Transfer) Tax Return: Although focused on estate taxes, Form 706 can require the disclosure of foreign accounts, akin to the disclosures mandated by FBAR requirements. Both forms may involve complex international financial information.

Form TD F 90-22.1, Report of Foreign Bank and Financial Accounts: Before being replaced by FinCEN Form 114 (FBAR) filed electronically via the BSA E-File System, TD F 90-22.1 served a similar purpose to Form 114a by requiring U.S. persons to report foreign accounts. The 114a form facilitates authorization for electronic filing of what TD F 90-22.1 used to cover in paper form.

Form 8938, Statement of Specified Foreign Financial Assets: Form 8938 and Form 114a both deal with foreign financial information but serve different purposes under the law. Form 8938 is filed with the IRS and requires more extensive disclosure of foreign assets than FBAR, suggesting a potential overlap in the information authorized under Form 114a.

Form SS-4, Application for Employer Identification Number (EIN): While Form SS-4's purpose is to obtain an EIN, both this form and Form 114a require detailed identification information. Entities might need to use information from Form SS-4 to accurately complete Form 114a when authorizing a third party for FBAR filing.

Form W-8BEN, Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding: Form W-8BEN is used by foreign individuals to assert their status and avoid withholding, akin to how Form 114a identifies foreign accounts to comply with U.S. reporting requirements.

Form W-9, Request for Taxpayer Identification Number and Certification: Like Form 114a, Form W-9 is used to provide necessary taxpayer identification information. Form 114a might require information typically found on a W-9 to ensure the correct reporting of foreign financial accounts.

Dos and Don'ts

Filling out Form 114a, the Record of Authorization to Electronically File FBARs (Foreign Bank and Financial Accounts Report), is an important legal step for those who have foreign financial accounts. Here are essential dos and don'ts to keep in mind:

- DO thoroughly review the instructions for completing the FBAR Signature Authorization Record provided by FinCEN to ensure accuracy.

- DO ensure that all information is complete and accurate, including names, dates, and account numbers, to the best of your knowledge.

- DO digitally sign the form if such an option is available and acceptable in the context of your filing process.

- DO retain copies of the completed form for your records, as well as the actual filed FBAR, for at least five years, as required by law.

- DO register the preparer or the filing entity with the FinCEN BSA E-File system in advance if they are responsible for filing the FBAR on your behalf.

- DO fill out the spouse’s section (items 4 to 14) if you are filing jointly with a spouse, ensuring both parties provide their signatures and relevant information.

- DON'T send the completed Form 114a to FinCEN unless specifically requested. Keep it for your records instead.

- DON'T use vague terms like "SEE ABOVE" or "SAME AS ITEM NUMBER X" in any part of the form—each requested item should be filled out comprehensively.

- DON'T leave the PTIN (Preparer Tax Identification Number) blank if you have one. This information is crucial when a third-party preparer is used.

- DON'T forget to complete both Part I and Part II of the form if authorization is being granted to a preparer to file on your behalf.

- DON'T neglect the digital signature where applicable; it's an essential aspect of authorizing electronic filing.

- DON'T underestimate the significance of double-checking all entered information for accuracy before finalizing the form. Errors or omissions can lead to complications in your filing process.

Misconceptions

Understanding the Form 114a, the Record of Authorization to Electronically File FBARs, is crucial for accurately managing your financial reporting responsibilities. However, several misconceptions can lead to confusion. Here, we'll clarify some of the most common misunderstandings.

- Form 114a needs to be submitted to FinCEN. This is a common misconception. In reality, Form 114a should not be sent to FinCEN. Instead, it's meant to be retained by the filer for their records. The form serves as a record of authorization for a third party to file an FBAR on behalf of the account owner, but it is only required to be sent to FinCEN if specifically requested.

- Digital signatures are not acceptable. On the contrary, Form 114a allows for digital signatures. Both the individual granting authorization and the authorized third party preparer can use digital signatures for items 7 and 11, respectively. This flexibility makes it easier for parties to complete and retain the authorization record without the need for physical signatures.

- Spouses must file separate FBARs. Actually, if spouses have joint foreign bank and financial accounts and opt to file a joint FBAR, they can complete a single Form 114a. In this case, both spouses need to provide their information in Part I and sign the form accordingly. This facilitates a more streamlined filing process for married couples managing their foreign accounts together.

- A third-party preparer's Personal Taxpayer Identification Number (PTIN) is always required. While it's true that a preparer's information is crucial, if the third-party preparer does not have a PTIN, the respective field in the form can be left blank. This aspect provides some leeway for authorized preparers who may not have a PTIN to still legally file an FBAR on behalf of the account owner.

Correctly understanding these aspects of Form 114a can greatly simplify the process of complying with the legal requirements for reporting foreign bank and financial accounts. Keeping these clarifications in mind ensures that individuals fulfill their obligations while making efficient use of the available provisions for authorization.

Key takeaways

Filling out the Form 114A is critical for giving someone the authorization to file the Report of Foreign Bank and Financial Accounts (FBAR) on your behalf. Here are seven key takeaways to keep in mind when dealing with this form:

- The Form 114a allows individuals and entities to grant authorization to a third party to file an FBAR electronically with the Financial Crimes Enforcement Network (FinCEN).

- To be valid, both the authorizing individual/entity and the authorized filer must sign the completed form.

- Digital signatures are acceptable for the owner (or the entity’s authorized representative) and for the spouse, if filing jointly, as well as for the preparer.

- If you’re completing this form as a part of a joint filing with a spouse, both you and your spouse need to fill out and sign the form to provide the necessary information and consents.

- The person or entity authorized to file the FBAR on behalf of the owner must be registered with the FinCEN BSA E-File system, ensuring they are recognized and allowed to perform this filing.

- Do not send this form to FinCEN unless specifically requested. Instead, both the authorizing and the authorized parties should keep copies of the completed form for their records for a period of 5 years.

- Every piece of information provided by the account owner(s) to the authorized filer must be true, correct, and complete to the best of their knowledge, as inaccuracies can lead to legal consequences.

Understanding these key points helps ensure that the FBAR filing process is handled correctly and efficiently, maintaining compliance with federal financial reporting requirements.

Popular PDF Forms

Special Olympics Certificate Template - Granted to athletes who distinguish themselves in competitions that embody the spirit of the Olympics.

Ab 1424 - It incorporates a section where families can list medications that have been effective or ineffective, offering valuable insights for current treatment strategies.

Wisconsin Instruction Permit - Commercial Driver License (CDL) applicants find specific sections within the MV3001 form tailored to federal and state regulatory compliance.