Blank 116M PDF Template

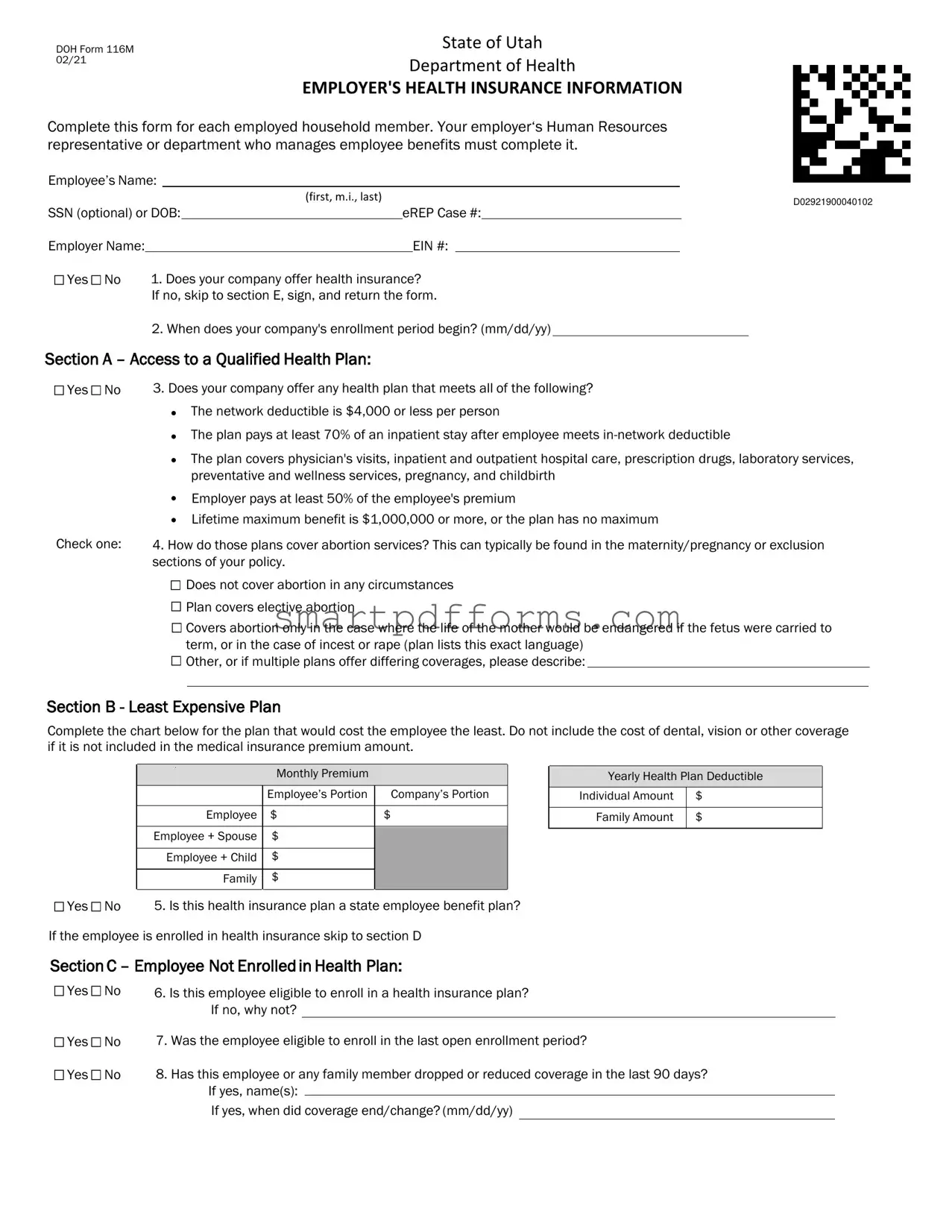

In an era where healthcare accessibility and affordability continue to dominate public discourse, the Department of Health's Form 116M from the State of Utah emerges as a critical instrument designed to streamline the assessment and provision of employer-sponsored health insurance. This comprehensive form obliges employers, through their Human Resources departments or representatives managing employee benefits, to furnish detailed information about the health insurance options available to their employees. The information sought ranges from the fundamental query of whether the company offers health insurance, to more nuanced details such as the nature of the plans offered—covering aspects such as deductible amounts, the proportion of inpatient stay costs covered post-deductible, coverage of various healthcare services, and the employer's contribution towards the employee's premium. Importantly, the form ventures into specifics regarding the least expensive plan available to employees and delves into the policy's approach to abortion services, offering insights into the inclusivity and comprehensiveness of the covered healthcare services. Information on the enrollment options, reasons for non-enrollment, and details regarding the coverage in place are also sought, shedding light on the healthcare support extended by employers to their workforce. By mandating the completion and return of this form, the initiative aims to promote transparency and facilitate informed decisions about healthcare coverage within employed households in Utah.

Preview - 116M Form

DOH Form 116M 02/21

State of Utah

Department of Health

EMPLOYER'S HEALTH INSURANCE INFORMATION

Complete this form for each employed household member. Your employer‘s Human Resources representative or department who manages employee benefits must complete it.

Employee’s Name:

|

|

|

(first, m.i., last) |

eREP Case #: |

|

|

D02921900040102 |

||

SSN (optional) or DOB: |

|

|

|

||||||

Employer Name: |

|

|

|

|

EIN #: |

|

|

|

|

Yes No |

1. Does your company offer health insurance? |

|

|

||||||

|

If no, skip to section E, sign, and return the form. |

|

|

||||||

2. When does your company's enrollment period begin? (mm/dd/yy)

Section A – Access to a Qualified Health Plan:

Yes No

Check one:

3.Does your company offer any health plan that meets all of the following?

•The network deductible is $4,000 or less per person

•The plan pays at least 70% of an inpatient stay after employee meets

•The plan covers physician's visits, inpatient and outpatient hospital care, prescription drugs, laboratory services, preventative and wellness services, pregnancy, and childbirth

•Employer pays at least 50% of the employee's premium

•Lifetime maximum benefit is $1,000,000 or more, or the plan has no maximum

4.How do those plans cover abortion services? This can typically be found in the maternity/pregnancy or exclusion sections of your policy.

Does not cover abortion in any circumstances Plan covers elective abortion

Covers abortion only in the case where the life of the mother would be endangered if the fetus were carried to term, or in the case of incest or rape (plan lists this exact language)

Other, or if multiple plans offer differing coverages, please describe:

Section B - Least Expensive Plan

Complete the chart below for the plan that would cost the employee the least. Do not include the cost of dental, vision or other coverage if it is not included in the medical insurance premium amount.

|

|

Monthly Premium |

|

|

|

|

Employee’s Portion |

Company’s Portion |

|

|

|

|

|

|

|

Employee |

$ |

$ |

|

|

|

|

|

|

|

Employee + Spouse |

$ |

|

|

|

|

|

|

|

|

Employee + Child |

$ |

|

|

|

|

|

|

|

|

Family |

$ |

|

|

|

|

|

|

|

Yes No |

5. Is this health insurance plan a state employee benefit plan? |

|||

Yearly Health Plan Deductible

Individual Amount |

$ |

|

|

Family Amount |

$ |

|

|

If the employee is enrolled in health insurance skip to section D

Section C – Employee Not Enrolled in Health Plan:

Yes No |

6. Is this employee eligible to enroll in a health insurance plan? |

|

|

If no, why not? |

|

Yes No Yes No

7.Was the employee eligible to enroll in the last open enrollment period?

8.Has this employee or any family member dropped or reduced coverage in the last 90 days? If yes, name(s):

If yes, when did coverage end/change? (mm/dd/yy)

Section D - Employee's Health Plan Information:

Yes No

Yes No

Check one:

9.Is this employee or any family member enrolled in any insurance plan offered? If no, skip to section E

If yes, name(s) of person(s) enrolled:

When did coverage begin? (mm/dd/yy)

Insurance company and plan name: |

|

|

|

|

|

D02921900040202 |

|

|

|

|

|

|

|||

Policy number: |

|

|

Group number: |

||||

|

|

|

|

|

|

|

|

What is the check date for the first premium deduction?

10.Does the employee's chosen health plan meet all of the following?

•The network deductible is $4,000 or less per person

•The plan pays at least 70% of an inpatient stay after employee meets

•The plan covers physician's visits, inpatient and outpatient hospital care, prescription drugs, laboratory services, preventative and wellness services, pregnancy, and childbirth

•Employer pays at least 50% of the employee's premium

•Lifetime maximum is $1,000,000 or more, or the plan has no maximum

11.How does the plan cover abortion services? This can typically be found in the maternity/pregnancy or exclusion sections of your policy

Does not cover abortion in any circumstances

Plan covers elective abortion

Covers abortion only in the case where the life of the mother would be endangered if the fetus were carried to term, or in the case of incest or rape (plan lists this exact language)

Other, please describe:

12. What is the monthly premium cost of this plan for a single employee, not including any family members?

This plan's monthly premium cost for just a single employee

Employee Cost |

Employer Cost |

$ |

$ |

|

|

13.Complete this chart for the benefits the employee is enrolled in. Fill out all applicable boxes

Premium deducted from this employee's check:

How often is the premium deducted? |

|

|

|

|

|

|

|

||

Weekly Every 2 Weeks Twice a month |

Monthly Other (Specify:) |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

Medical (Required) |

|

Dental (Optional) |

Vision (Optional) |

||||

Employee |

$ |

|

|

$ |

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

Employee + Spouse |

$ |

|

|

$ |

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

Employee + Child |

$ |

|

|

$ |

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

Family |

$ |

|

|

$ |

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yearly Health Plan Deductible |

|

|

|

|

|||

|

Individual Amount |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Family Amount |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14. Please list any children who have dental coverage

Section E - Signature:

Name (please print): |

|

|

Title: |

|

||||

Phone #: |

|

|

Email Address: |

|

||||

Signature |

|

|

Date: |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

Please Return Completed Form To: |

|||||

Department of Workforce Services, PO Box 143245, SLC, UT

Fax:

Form Data

| Fact Number | Fact Detail |

|---|---|

| 1 | The form is designated as DOH Form 116M and was updated in February 2021. |

| 2 | It is mandated by the State of Utah Department of Health. |

| 3 | This form must be filled out by the employer's Human Resources representative or department that manages employee benefits. |

| 4 | It is designed to gather health insurance information for each employed household member. |

| 5 | The form inquires whether the company offers health insurance and specifies the coverage details, including deductibles, covered services, and employer contributions. |

| 6 | Employers must disclose how their health plans cover abortion services, providing detail on the circumstances under which it is covered. |

| 7 | There is a section for employers to fill out information about the least expensive plan available to the employee, including monthly premiums and yearly deductibles. |

| 8 | The form includes a section for employee health plan enrollment, detailing insurance company, plan name, policy number, and benefits enrolled in. |

Instructions on Utilizing 116M

Filling out the 116M form is a straightforward process, yet it requires attention to detail to ensure all the necessary information is accurately provided. This form is designed to gather data about the health insurance benefits offered by employers to their employees, including plan details and coverage options. It's essential for Human Resources representatives or those in charge of managing employee benefits to complete it meticulously. Here's a step-by-step guide to help you through the process:

- Start by entering the Employee’s Name, including the first name, middle initial, and last name.

- Fill in the eREP Case # and the employee's Social Security Number (SSN) or Date of Birth (DOB).

- Provide the Employer Name and EIN # (Employer Identification Number).

- Answer Yes or No to whether your company offers health insurance. If the answer is No, proceed directly to section E to sign and return the form.

- Specify the start date of your company's enrollment period for health insurance.

- In Section A, check Yes or No to questions regarding the access to a Qualified Health Plan and provide details as required.

- Complete the chart in Section B concerning the Least Expensive Plan offered to employees, breaking down the monthly premium costs.

- Answer questions in Section C if the employee is not enrolled in a health plan, regarding eligibility and recent changes in coverage.

- In Section D, provide information about any health insurance plan the employee or their family members are currently enrolled in. This includes enrollment details, insurance company, and plan name, among other specifics.

- For the plan the employee is enrolled in, detail the coverage options, especially how it covers abortion services in question 11.

- Fill out the premium costs and deductibles for the employee’s chosen health plan, ensuring to differentiate between the employee's portion and the company's portion.

- Complete the chart for the benefits the employee is enrolled in, including how often premiums are deducted and the costs for medical, dental, and vision coverage.

- List any children who have dental coverage in the space provided.

- In Section E, the form must be signed and dated by the individual completing it. Include the name, title, phone number, and email address for any potential follow-up.

- Lastly, return the completed form to the Department of Workforce Services at the address provided, choosing either to mail or fax the document.

Once this form is fully completed and sent, it will enable the processing of health insurance information accurately, ensuring employees receive the benefits they are entitled to. Make sure all the information is correct and up-to-date to avoid any potential issues or delays.

Obtain Answers on 116M

What is the purpose of DOH Form 116M?

This form collects details about health insurance provided by an employer in Utah. It's mainly for household members who are employed to submit their employer-provided health insurance information.

Who needs to complete DOH Form 116M?

Each employed member of a household, as well as their employer's Human Resources representative or the department managing employee benefits, must fill out this form.

What are the key sections of the form?

- Verification if the company offers health insurance.

- Details about the least expensive health plan available.

- Enrollment eligibility and past enrollment information.

- Information on the employee's current health plan.

- A section for signature, confirming the accuracy of the provided information.

What happens if an employer does not offer health insurance?

If an employer doesn't offer health insurance, you can skip to section E, sign the form, and return it, as instructed.

How should I handle the health plan coverage questions?

Answer all questions truthfully regarding the health plan's coverage, including the deductible, premium, and specific coverages like maternity/pregnancy, abortion services, and maximum benefits.

Is it necessary to fill out the entire form?

Fill out every relevant section. If certain sections or questions do not apply, such as if there's no health insurance offered, you may skip those parts as directed on the form.

What should I do if the health insurance information changes after I submit the form?

Contact the Department of Workforce Services with updated information as soon as possible to ensure the records are accurate.

Where and how do I return the completed form?

The completed form should be returned to the Department of Workforce Services at the provided PO Box address in SLC, Utah, or via the fax numbers listed on the form.

What if I have questions while filling out the form?

For questions, you can contact the Human Resources department of your employer or the Department of Workforce Services directly via phone or email as provided on the form.

Common mistakes

-

Not getting the form completed by the employer's Human Resources representative or the department that manages employee benefits. This oversight can lead to inaccuracies or incomplete information.

-

Skipping the Employer Identification Number (EIN) section. This critical piece of information is necessary for employer identification and can delay processing if omitted.

-

Entering incorrect employee details such as name, eREP Case #, SSN, or DOB. Correct details ensure that the form is attributed to the correct individual and case.

-

Failing to answer all sections applicable, especially neglecting the health plan qualifications in Section A. This can lead to misunderstandings about the health coverage available to the employee.

-

Omitting details of the least expensive plan in Section B. This section helps in understanding the most affordable health insurance option available to the employee.

-

Forgetting to fill out Section D if the employee or any family member is enrolled in an insurance plan. The details of the enrolled plan are crucial for a comprehensive understanding of the coverage in place.

-

Inaccurately reporting the monthly premium costs and the breakdown between what the employee and employer pay. This miscalculation or inaccuracy can affect the assessment of the plan’s affordability.

-

Not providing a signature and date in Section E or failing to return the completed form to the specified address or fax number. This final step is essential for the form's submission and subsequent processing.

To ensure accurate and efficient processing, it's crucial to avoid these common mistakes when filling out the 116M form.

Documents used along the form

When handling the DOH Form 116M for Employer's Health Insurance Information, understanding and gathering related documents can streamline the process of verifying and recording employees' health insurance status. These forms and documents often provide complementary information, enhance data accuracy, and ensure compliance with health insurance regulations. Below is a list of additional forms and documents commonly used in conjunction with the 116M form, each serving a specific purpose in the broader context of health insurance and employee benefits management.

- IRS Form W-4: This form determines the amount of federal income tax to withhold from an employee's paycheck. It's relevant when considering the net income of an employee after tax and insurance deductions.

- Beneficiary Designation Form: Used to designate beneficiaries for life insurance or retirement accounts, this document is crucial for employees enrolled in employer-sponsored life insurance plans.

- Proof of Relationship Documents: Required when adding dependents to an insurance policy, such documents include marriage certificates, birth certificates, or domestic partnership affidavits.

- Health Insurance Marketplace Notice: Employers must provide this document to inform employees of the health insurance marketplace's existence as an alternative to employer-sponsored plans.

- Summary of Benefits and Coverage (SBC): This document offers a detailed overview of what the health plan covers and the costs involved, helping employees compare different health insurance options.

- COBRA Election Notice: Required for employers to provide to eligible employees and beneficiaries who lose their group health coverage, detailing their rights to elect COBRA continuation coverage.

- Employee Handbook: Though not a form, the employee handbook often contains essential information about the company's health insurance policies and procedures for enrollment and benefits management.

- Group Health Plan Application: This application is necessary for enrolling in the employer-sponsored group health insurance plan, detailing employee and dependent information.

- Health Insurance Waiver Form: Employees who opt out of employer-sponsored health insurance due to having coverage elsewhere need to complete this form.

- Flexible Spending Account (FSA) Enrollment Form: Useful for employees wanting to allocate pre-tax dollars towards medical expenses not covered by insurance, including deductibles and copayments.

In navigating the intricate landscape of employer health insurance documentation, these forms and documents play a pivotal role. They work collectively to ensure that both employees and employers meet their obligations and make informed decisions regarding health coverage. Efficient handling and comprehension of these documents support a comprehensive approach to managing employee health benefits, a key component of employee well-being and satisfaction.

Similar forms

The DOH Form 116M is a detailed document catering to the health insurance offerings and enrollment of employees. This document parallels several others in purpose and structure, each playing a vital part in the administrative landscape. Understanding these documents can illuminate the broader context of employee benefits administration.

- IRS Form W-4: Similar to the 116M, the W-4 form is filled out by employees to indicate their tax withholdings. Both forms are vital at the onset of employment, focusing on financial planning - the W-4 for taxes and the 116M for health insurance costs.

- Form I-9: Like the 116M, the I-9 is another form completed by new employees. It verifies the employee's identity and eligibility to work in the United States, paralleling the 116M’s purpose of verifying eligibility for health insurance benefits.

- Summary of Benefits and Coverage (SBC): The SBC shares its goals with the 116M by providing essential information about health insurance plans. Both documents aim to clarify the benefits and coverage to help employees make informed decisions.

- Benefits Enrollment Forms: These are directly related to the 116M, as they both deal with the enrollment process in employer-provided benefits. While the 116M collects information about available health insurance, enrollment forms act on this information, allowing employees to select their preferred options.

- COBRA Election Notice: Although dealing with the continuation of health insurance after employment ends, the COBRA Election Notice is similar to the 116M in its focus on informing employees about their health insurance options and rights.

- Flexible Spending Account (FSA) Enrollment Forms: FSA forms and the 116M both involve making pre-tax contributions to account for health expenses, highlighting the broader theme of managing healthcare costs through employment.

- Employee Handbook: While more comprehensive, the employee handbook often contains sections that mirror the information on the 116M, such as details on health insurance benefits, eligibility, and enrollment periods.

- Health Insurance Portability and Accountability Act (HIPAA) Forms: These forms, similar to section D of the 116M, deal with the privacy of health information and the individual’s rights concerning their health information, emphasizing confidentiality and informed consent in health insurance matters.

Together, these documents form a network of resources that guide the administration of employee benefits, ensuring both compliance and clarity in the often-complex world of health insurance and employment.

Dos and Don'ts

When filling out the DOH Form 116M for employer’s health insurance information, it’s crucial to pay close attention to details to ensure accuracy and compliance. Here are some do’s and don’ts to guide you through the process:

- Do have your employer's Human Resources representative or the department responsible for employee benefits complete the form. They have access to the precise information needed.

- Do ensure that all information is accurate and thoroughly checked, especially details like the Employer Identification Number (EIN), insurance plan details, and the portions of premiums paid by both employee and employer.

- Do clearly indicate the coverage details, including whether your plan covers abortion services and under what circumstances if applicable. This information should be specified in the provided sections accurately.

- Do sign and date the form in Section E before returning it to the specified address or fax number. A signature is necessary for verification and processing.

- Don't leave any required fields blank if they are applicable to your situation. If a question does not apply, indicate as such by marking it ‘N/A’ or ‘No,’ as directed by the form’s instructions.

- Don't guess information. If you are uncertain about any detail, it’s important to verify it with the correct department or documentation to prevent inaccuracies.

- Don't include costs for additional coverages, such as dental or vision, in the premium amounts unless specifically instructed. Section B requires information strictly for the least expensive plan excluding such coverages.

- Don't forget to report any changes in your health insurance enrollment situation in the designated sections. This includes not currently being enrolled in a plan or any changes to coverage in the last 90 days.

Misconceptions

Understanding the DOH Form 116M can sometimes be confusing, leading to several misconceptions. Here are six common misunderstandings cleared up for you:

- It's only for the employee to fill out. This form must be completed by your employer's Human Resources representative or the department that handles employee benefits, not by the employee themselves.

- SSN is a must for the form. While providing a Social Security Number (SSN) can be helpful, it is optional. You can also use the employee's Date of Birth (DOB) for identification.

- All companies must offer a health plan that meets specific criteria. Not every company offers health insurance that checks all the boxes mentioned in Section A, such as in-network deductible limits, payment after deductible, or coverage of specific services. The form is designed to gather information on what is available.

- Every plan covers maternity and abortion services. The coverage for these services can significantly vary between plans. Some might not cover abortion at all, while others cover under specific circumstances. The form seeks to clarify this aspect.

- If an employee isn't enrolled in the plan, section D doesn't need to be filled out. This section is crucial for understanding why an employee might not be enrolled and if they or their family members have recently dropped or reduced coverage. It provides essential context about the employee's current insurance status.

- Listing children for dental coverage isn't necessary if they don't have it. Section D asks for information on dental coverage specifically to understand the benefits the employee's children are receiving under the plan, highlighting the extent of coverage provided by the employer.

Clear communication with your HR department while filling out this form is essential to ensure that the information reflects the health insurance benefits accurately. Remember, this form is an important document that helps in understanding the diverse health insurance offerings available to employees and their families.

Key takeaways

Filling out the DOH Form 116M, a critical document from the State of Utah Department of Health, requires careful attention to detail and thorough understanding. This form, essential for employed household members, captures vital information on employer-provided health insurance. Here are five key takeaways to ensure its accurate completion and optimal use:

- Complete it for each employed household member: This form must be filled out separately for each member of the household who is employed, making it crucial to gather all necessary information for every individual.

- Employer's role is vital: The section of the form detailing the health insurance information needs to be completed by the Human Resources representative or the department managing employee benefits. This emphasizes the importance of employer participation for accurate completion.

- Details on health insurance coverage: The form asks specific questions about the health insurance plan offered by the employer, such as the deductible amount, coverage of inpatient stays, and whether the plan includes essential services like physician's visits, hospital care, and prescription drugs. It is crucial that these details are accurate to ensure compliance with health insurance information requirements.

- Information on abortion services coverage: It includes specific inquiries regarding the coverage of abortion services within the health plan, reflecting the need for comprehensive details about the scope of the insurance policy.

- Employee enrollment information is necessary: Whether or not the employee or any family member is currently enrolled in the offered insurance plan, and details about their enrollment or reasons for non-enrollment must be provided. This part of the form can significantly impact eligibility and benefits, underlining the need for thorough and accurate completion.

This form is a key instrument in managing health insurance information within employed households in Utah. Its completion is not just a mere formal requirement; it plays a significant role in ensuring that employees and their families have access to necessary health coverage. Given its importance, both employers and employees must approach this document with the seriousness and attention to detail it requires.

Popular PDF Forms

Ssa-1099 Form 2022 - Beneficiaries can use this form when preparing their annual tax returns.

Eviction Forms California - Obligates landlords to formally assert the factual and legal basis of their eviction complaint, fostering transparency and efficiency in the judicial process.