Blank 130U PDF Template

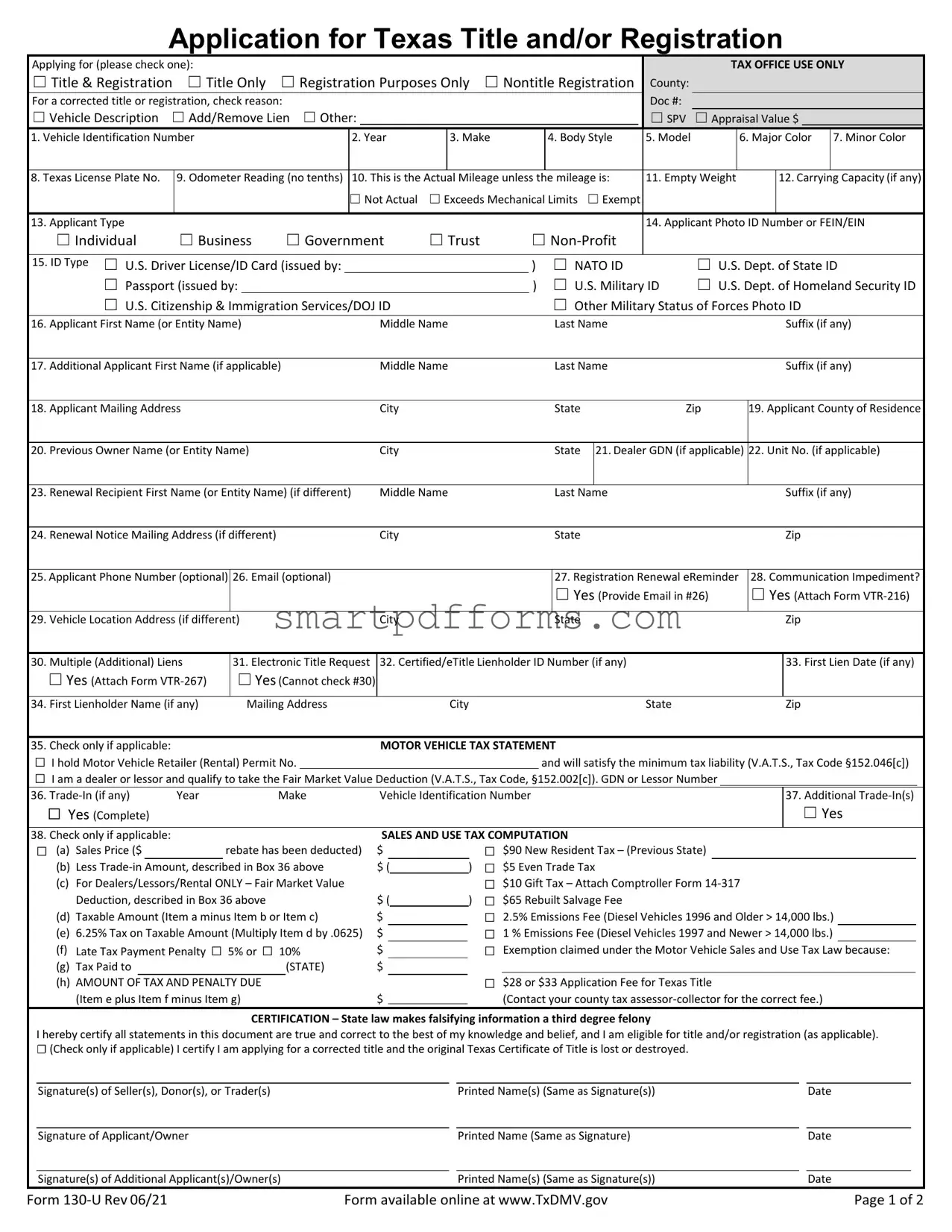

When the time comes to formalize the ownership and usage of a vehicle in Texas, the Application for Texas Title and/or Registration, better known as Form 130U, becomes an indispensable document. This form serves a multitude of purposes, from the initial application for a title and registration to specific needs such as correcting information on an existing title or registration, adding or removing a lien, or even applying for a title with no intention of registering the vehicle for road use. It meticulously collects detailed information about the vehicle, including its identification number, year, make, model, and body style, along with the applicant's personal details, ensuring both the vehicle and its owner are accurately identified and registered within the state's system. Additionally, it addresses financial aspects, guiding applicants through the calculation of taxes and fees associated with vehicle acquisition and ownership, and integrates measures for tax compliance specific to different circumstances, such as new residents or transactions deemed as gifts. Importantly, the form also acknowledges different types of applicants, from individuals to businesses and government entities, reflecting the diversity of vehicle users and owners. The process of submission is carefully designed to include both physical and electronic documentation, underscoring the importance of original signatures in affirming the veracity of the information provided, thereby safeguarding the interests of all parties involved and maintaining the integrity of the motor vehicle registry system in Texas.

Preview - 130U Form

Application for Texas Title and/or Registration

Applying for (please check one): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TAX OFFICE USE ONLY |

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

☐ Title & Registration |

☐ Title Only |

☐ Registration Purposes Only |

☐ Nontitle Registration |

|

County |

: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

For a corrected title or registration, check reason: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Doc #: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

☐ Vehicle Description ☐ Add/Remove Lien ☐ Other: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

. |

☐ SPV |

☐ Appraisal Value $ |

|

|

|

|

|

|

||||||||||||||||||||||||

1. Vehicle Identification Number |

|

|

|

|

|

|

|

|

2. Year |

|

3. Make |

|

|

|

4. Body Style |

|

5. Model |

|

|

|

|

6. Major Color |

|

7. Minor Color |

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

8. Texas License Plate No. |

9. Odometer Reading (no tenths) |

10. This is the Actual Mileage unless the mileage is: |

|

11. Empty Weight |

|

|

12. Carrying Capacity (if any) |

|

||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

☐ Not Actual ☐ Exceeds Mechanical Limits |

☐ Exempt |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

13. Applicant Type |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14. Applicant Photo ID Number or FEIN/EIN |

|

|||||||||||||||||||

|

☐ Individual |

☐ Business |

☐ Government |

☐ Trust |

|

|

☐ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

15. ID Type ☐ U.S. Driver License/ID Card (issued by: |

|

|

|

|

|

|

|

|

|

|

) |

|

|

☐ NATO ID |

|

|

|

☐ U.S. Dept. of State ID |

|

|||||||||||||||||||||||||||||

|

|

☐ Passport (issued by: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

) |

|

|

☐ U.S. Military ID |

☐ U.S. Dept. of Homeland Security ID |

|

||||||||||||||||||||||||

|

|

☐ U.S. Citizenship & Immigration Services/DOJ ID |

|

|

|

|

|

|

|

|

|

☐ Other Military Status of Forces Photo ID |

|

|

|

|

|

|||||||||||||||||||||||||||||||

16. |

Applicant First Name (or Entity Name) |

|

|

|

|

|

|

Middle Name |

|

|

|

|

|

Last Name |

|

|

|

|

|

|

|

|

|

|

Suffix (if any) |

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

17. |

Additional Applicant First Name (if applicable) |

Middle Name |

|

|

|

|

|

Last Name |

|

|

|

|

|

|

|

|

|

|

Suffix (if any) |

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

18. |

Applicant Mailing Address |

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

|

|

|

|

State |

|

|

|

|

Zip |

|

19. Applicant County of Residence |

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

20. |

Previous Owner Name (or Entity Name) |

|

|

|

|

|

|

City |

|

|

|

|

|

|

|

|

|

State |

|

21. Dealer GDN (if applicable) |

22. Unit No. (if applicable) |

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

23. |

Renewal Recipient First Name (or Entity Name) (if different) |

Middle Name |

|

|

|

|

|

Last Name |

|

|

|

|

|

|

|

|

|

|

Suffix (if any) |

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

24. |

Renewal Notice Mailing Address (if different) |

|

|

|

|

|

|

City |

|

|

|

|

|

|

|

|

|

State |

|

|

|

|

|

|

|

|

|

|

|

|

Zip |

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

25. Applicant Phone Number (optional) |

26. Email (optional) |

|

|

|

|

|

|

|

|

|

|

|

|

27. Registration Renewal eReminder |

|

28. Communication Impediment? |

|

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

☐ Yes (Provide Email in #26) |

|

☐ Yes (Attach Form |

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

29. |

Vehicle Location Address (if different) |

|

|

|

|

|

|

|

City |

|

|

|

|

|

|

|

|

|

State |

|

|

|

|

|

|

|

|

|

|

|

|

Zip |

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

30. |

Multiple (Additional) Liens |

|

|

31. Electronic Title Request |

32. Certified/eTitle Lienholder ID Number (if any) |

|

|

|

|

|

|

|

|

|

|

33. First Lien Date (if any) |

|

|||||||||||||||||||||||||||||||

|

☐Yes (Attach Form |

|

|

☐Yes (Cannot check #30) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

34. |

First Lienholder Name (if any) |

|

|

|

Mailing Address |

|

|

|

|

City |

|

|

|

|

|

|

|

|

|

State |

|

|

|

|

|

|

|

Zip |

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

35. |

Check only if applicable: |

|

|

|

|

|

|

|

|

|

|

|

MOTOR VEHICLE TAX STATEMENT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

☐ |

I hold Motor Vehicle Retailer (Rental) Permit No. |

|

|

|

|

|

|

|

|

|

|

|

and will satisfy the minimum tax liability (V.A.T.S., Tax Code §152.046[c]) |

|

||||||||||||||||||||||||||||||||||

☐ |

I am a dealer or lessor and qualify to take the Fair Market Value Deduction (V.A.T.S., Tax Code, §152.002[c]). GDN or Lessor Number |

|

|

|

|

|

|

|

|

|

|

. |

|

|||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

36. |

Year |

|

|

|

|

Make |

Vehicle Identification Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

37. Additional |

|

||||||||||||||||||||||||

|

☐ Yes (Complete) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

☐ Yes |

|

||||||||

38. |

Check only if applicable: |

|

|

|

|

|

|

|

|

|

|

|

SALES AND USE TAX COMPUTATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

☐ |

(a) Sales Price ($ |

|

|

|

rebate has been deducted) |

$ |

|

|

|

|

|

|

☐ |

$90 New Resident Tax – (Previous State) |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

(b) Less |

Amount, described in Box 36 above |

$ ( |

|

|

) |

☐ |

$5 Even Trade Tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

(c) For Dealers/Lessors/Rental ONLY – Fair Market Value |

|

|

|

|

|

|

|

☐ |

$10 Gift Tax – Attach Comptroller Form |

|

|

|

|

|

|||||||||||||||||||||||||||||||||

|

|

Deduction, described in Box 36 above |

|

|

|

|

|

|

$ ( |

) |

☐ |

$65 Rebuilt Salvage Fee |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

(d) Taxable Amount (Item a minus Item b or Item c) |

$ |

|

|

|

|

|

|

☐ |

2.5% Emissions Fee (Diesel Vehicles 1996 and Older > 14,000 lbs.) |

|

|||||||||||||||||||||||||||||||||||||

|

(e) |

6.25% Tax on Taxable Amount (Multiply Item d by .0625) |

$ |

|

|

|

|

|

|

☐ |

1 % Emissions Fee (Diesel Vehicles 1997 and Newer > 14,000 lbs.) |

|

|

|

|

|

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

|

(f) |

|

|

☐ 5% or ☐ |

|

|

|

|

|

$ |

|

|

|

|

|

|

☐ |

Exemption claimed under the Motor Vehicle Sales and Use Tax Law |

|

|

|

|||||||||||||||||||||||||||

|

Late Tax Payment Penalty |

10% |

|

|

|

|

|

|

|

|

|

because: |

|

|

||||||||||||||||||||||||||||||||||

|

(g) |

Tax Paid to |

|

|

|

|

|

|

(STATE) |

$ |

|

|

|

|

|

|

☐ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

(h) AMOUNT OF |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$28 or $33 Application Fee for Texas Title |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

TAX AND PENALTY DUE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

(Item e plus Item f minus Item g) |

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

(Contact your county tax |

|

|

|

|

|

||||||||||||||||||||||||||

CERTIFICATION – State law makes falsifying information a third degree felony

I hereby certify all statements in this document are true and correct to the best of my knowledge and belief, and I am eligible for title and/or registration (as applicable).

☐(Check only if applicable) I certify I am applying for a corrected title and the original Texas Certificate of Title is lost or destroyed.

Signature(s) of Seller(s), Donor(s), or Trader(s) |

Printed Name(s) (Same as Signature(s)) |

Date |

Signature of Applicant/Owner |

Printed Name (Same as Signature) |

Date |

Signature(s) of Additional Applicant(s)/Owner(s) |

Printed Name(s) (Same as Signature(s)) |

Date |

Form |

Form available online at www.TxDMV.gov |

Page 1 of 2 |

Application for Texas Title and/or Registration

General Instructions

With a few exceptions, you are entitled to be informed about the information the department collects about you. The Texas Government Code entitles you to receive and review the information and to request that the department correct any information about you that is incorrect. Please contact the Texas Department of Motor Vehicles at

This form must be completed and submitted to your county tax

AVAILABLE HELP

•For assistance in completing this form, contact your county tax

•For information about motor vehicle sales and use tax or emission fees, contact the Texas Comptroller of Public Accounts, Tax Assistance Section, at

•For title or registration information, contact your county tax

Additional Details

Title Only: License plates and registration insignia previously issued for this motor vehicle must be surrendered in accordance with Transportation Code §501.0275, if applicable, unless this vehicle displays a license plate under an applicable status of forces agreement. The following types of vehicles are not eligible for Title Only: construction machinery (unconventional vehicles), water well drilling units, machinery used exclusively for drilling water wells, construction machinery not designed to transport persons or property, implements of husbandry, farm equipment (including combines), golf carts, slow moving vehicles, or any vehicle with a suspended or revoked title. Registration Purposes Only: Do not surrender an original out of state title with this application. A Texas title will NOT be issued for a vehicle applying for Registration Purposes Only. The receipt issued upon filing this application will serve as the registration receipt and proof of application for Registration Purposes Only.

•Foreign Vehicles: Foreign vehicles applying for Registration Purposes Only must attach DOT Form

indicate the vehicle is: 1) over 25 years old, or 2) complies with Federal Motor Vehicle Safety Standards, or 3) is being imported in the United States for a temporary period by a nonresident or a member of the armed forces of a foreign country on assignment in the U.S., and does not conform to the Federal Motor Vehicle Standards and cannot be sold in the U.S.

Nontitle Registration: Certain trailers, farm equipment, construction machinery, oil well servicing machinery, water well drilling units, etc. are either exempt from, or not eligible for title, but are eligible for, or required to, obtain registration or a specialty plate in order to operate on the highway. Applicants should mark this box only when applicable. Note: A lien cannot be recorded on this type of application.

Out of State Vehicles: If the applicant certifies the vehicle is located out of state,

Notice

•The sales and use tax must be paid to the county tax

•A $2.50 transfer fee is paid to transfer current registration to the new owner in addition to the title application fee and other applicable fees. If the registration is not current, full registration fees are due unless applying for Title Only.

•A 6.25 percent motor vehicle sales and use tax is imposed on the sales price (less

•Standard Presumptive Value (SPV) applies to

•New Texas residents are subject to a $90 use tax on a vehicle brought into this state that was previously registered to the new resident in another state or foreign country. This is in lieu of the 6.25 percent use tax imposed on a Texas resident.

•A $10 gift tax is due when a person receives a motor vehicle as a gift from an immediate family member, guardian, or a decedent's estate. A vehicle donated to, or given by, a

•A transaction in which a motor vehicle is transferred to another person without payment of consideration and one that does not qualify as a gift described above is a sale and will be subject to tax calculated on the vehicle's standard presumptive value.

•A late penalty equal to 5 percent of the tax will be charged if the tax or surcharge is paid from 1 to 30 calendar days late. If more than 30 calendar days late, the penalty will be 10 percent of the tax; minimum penalty is $1.

•In addition to the late tax payment penalty, Texas Transportation Code provides for an escalating delinquent transfer penalty of up to $250 for failure to apply for title within 30 days from the date of title assignment. Submit this application along with proper evidence of ownership and appropriate valid proof of financial responsibility such as a liability insurance card or policy.

•All new residents applying for a Texas title and registration for a motor vehicle must file at the county tax

Form |

Form available online at www.TxDMV.gov |

Page 2 of 2 |

Form Data

| Fact Name | Description |

|---|---|

| Primary Purpose | The 130U form is used for applying for Texas title and/or registration of a vehicle. |

| Application Options | Applicants can check options for Title & Registration, Title Only, Registration Purposes Only, or Nontitle Registration. |

| Governing Law | This form is governed by the Texas Transportation Code and other relevant state laws regarding vehicle registration and titling. |

| Requirements | All title applications must include a government-issued photo ID as specified in the form. |

| Special Conditions | Contains sections for corrected title or registration, additional trade-ins, motor vehicle tax statement, and sales and use tax computation. |

Instructions on Utilizing 130U

Filling out the Form 130-U, the Application for Texas Title and/or Registration, is a critical step in legally transferring a vehicle's title or updating its registration in Texas. Whether you're applying for a new title, making changes to an existing vehicle's registration, or need to correct information on a title or registration, this document is essential. Understanding and accurately completing this form ensures your vehicle transactions comply with Texas state laws. Below are step-by-step instructions to guide you through each section of the form.

- Check the appropriate box to specify whether you are applying for Title & Registration, Title Only, Registration Purposes Only, or Nontitle Registration.

- For corrected titles or registrations, indicate the reason by checking the appropriate box next to Vehicle Description, Add/Remove Lien, or specify under Other.

- Complete the Vehicle Description section with the Vehicle Identification Number, Year, Make, Body Style, Model, Major and Minor Color, Texas License Plate Number (if applicable), and Odometer Reading.

- Mark the appropriate indicator for the odometer reading, whether it is Actual Mileage, Not Actual, Exceeds Mechanical Limits, or Exempt.

- Fill out the Empty Weight and Carrying Capacity of the vehicle, if applicable.

- Identify the Applicant Type (Individual, Business, Government, Trust, Non-Profit) and provide the Applicant Photo ID Number or FEIN/EIN.

- Select the ID Type from the given options that correspond to the applicant’s identification.

- Enter the Applicant's Full Name or Entity Name, including Middle Name and Last Name with Suffix if any.

- If there is an Additional Applicant, provide their Full Name including Middle Name, Last Name, and Suffix if any.

- Provide the Mailing Address for the Applicant, including City, State, and Zip code.

- Indicate the Applicant County of Residence.

- Fill in the Previous Owner's Name or Entity Name and their City and State.

- If bought from a dealer, include the Dealer GDN and Unit No., if applicable.

- For Renewal Recipient information (if different), fill in the First Name, Middle Name, Last Name, Suffix, and Renewal Notice Mailing Address.

- Optionally, you can provide the Applicant's Phone Number and Email.

- If you want to sign up for Registration Renewal eReminder and if there's a Communication Impediment, check the appropriate box and provide the Email in #26 or attach Form VTR-216 as needed.

- If the Vehicle Location Address is different from the applicant's address, enter it completely.

- For Multiple (Additional) Liens, Electronic Title Request, and details about the First Lienholder, accurately fill in the necessary fields.

- Check the applicable boxes under the Motor Vehicle Tax Statement and provide additional details if you're claiming specific tax exemptions or deductions.

- Complete the Sales and Use Tax Computation section with the details of your transaction, applying tax rates and deductions appropriately.

- Read the Certification statement, acknowledging understanding and truthfulness of the information provided. Sign and date the form along with any Additional Applicant(s).

After accurately filling out and signing Form 130-U, you should submit it to your local county tax assessor-collector's office, along with any required fees, valid identification, evidence of ownership, and financial responsibility proof. Completing this form is a fundamental step in ensuring your vehicle is legally registered and titled in the state of Texas.

Obtain Answers on 130U

What is a 130U form?

The 130U form, also known as the Application for Texas Title and/or Registration, is a required document in Texas for obtaining a vehicle title, registration, or both. This form can be used for various circumstances including new purchases, title corrections, and adding or removing a lien.

Who needs to complete the 130U form?

Anyone looking to title or register a vehicle in Texas must complete the form. This includes individuals, businesses, government entities, trusts, and non-profits. Whether you've purchased a vehicle, received it as a gift, or need to make changes to your current title or registration, you'll need to fill out this form.

What information do I need to provide in the form?

The 130U form requires detailed information about the vehicle and its owner(s). Mandatory fields include vehicle identification number (VIN), make, model, year, primary and secondary colors, odometer reading, and the type of application (title and/or registration). Additionally, applicant information such as name, photo ID number, and contact details are required.

Can I apply for title only, without registration?

Yes, applicants have the option to apply for a title without registration by selecting the "Title Only" box. It's important to note that license plates and registration insignia previously issued must be surrendered if this option is selected, unless the vehicle displays a license plate under an applicable status of forces agreement.

What documentation is needed alongside the 130U form?

Supporting documentation includes proof of ownership, such as a bill of sale or previous title, a valid form of photo identification (as specified in the form), and any other documents relevant to the specific transaction, like lien release documents if a lien is being removed. Additionally, payment for the application fee, registration fee (if applicable), and any applicable vehicle tax must be submitted with the form.

How do I submit the completed 130U form?

The completed form, along with all required documentation and fees, should be submitted to your county tax assessor-collector's office. It can be delivered in person or mailed, depending on the office's policies.

Is there a deadline for submitting the 130U form after purchasing a vehicle?

Yes, to avoid penalties, the form should be submitted within 30 days from the date of purchase or the date the vehicle is brought into Texas. Late submissions may incur additional fees.

Can I use the 130U form for vehicles purchased out of state?

Absolutely. The 130U form is used for registering vehicles purchased out of state when they are brought into Texas. Make sure to check the "Out of State Vehicles" section and attach any necessary documentation like a Vehicle Inspection Report (VIR).

What are the fees associated with the 130U form?

Fees can vary based on the transaction type and can include an application fee, registration fee, and motor vehicle tax. Specific fee amounts should be verified with your local county tax assessor-collector's office, as they can differ by county.

How can I get help if I have questions about completing the form?

For assistance, you can contact your county tax assessor-collector's office directly. You can also reach out to the Texas Department of Motor Vehicles at 1-888-368-4689 or 512-465-3000 for general inquiries related to title or registration.

Common mistakes

One common mistake involves inaccuracies in the vehicle identification number (VIN). Every digit and letter must be correct to ensure the vehicle is properly identified. Mistakes here can lead to delays or inaccuracies in the title or registration process.

Applicants often check the wrong box in section 13, indicating applicant type. It's essential to clearly identify whether the applicant is an individual, business, government entity, trust, or non-profit. This affects the processing and the applicable requirements.

Incorrect or incomplete lienholder information is another frequent error. If there is a lien on the vehicle, sections 32 through 34 require accurate and comprehensive details. Failure to provide correct lienholder information can invalidate the application.

Failing to sign and date the application is a surprisingly common oversight. The application must contain original signatures from the buyer and, where applicable, the seller. Without these signatures, the document is not considered legally binding and cannot be processed.

Many applicants forget to include necessary supporting documents, such as evidence of vehicle insurance, inspection reports, or proof of sales tax payment. These documents are crucial for validating the information provided on the form and for complying with state legal requirements.

In summary, while filling out the 130U form requires attention to detail, avoiding these common mistakes can streamline the process of obtaining a vehicle's title and/or registration. It is crucial to review the form thoroughly before submission.

Documents used along the form

When it comes to handling vehicle transactions, especially in Texas, the Application for Texas Title and/or Registration, known as Form 130-U, plays a crucial role. However, this form is often just one part of a larger bundle of documents required to properly complete a transaction. Below is an outline of some other forms and documents frequently used alongside Form 130-U to ensure all legal, tax, and regulatory requirements are met.

- Affidavit of Motor Vehicle Gift Transfer (Form 14-317): This form is used when a vehicle is given as a gift between immediate family members, guardians, or from a decedent's estate. Both the giver and receiver must sign to validate the transfer as a gift.

- VIN Verification Form (VTR-270): Necessary for out-of-state vehicles being titled in Texas, this form verifies the Vehicle Identification Number (VIN) and confirms the physical existence and condition of the vehicle.

- Vehicle Inspection Report: A safety and emissions inspection report required for all vehicles being titled in Texas. The inspection ensures the vehicle meets Texas safety and emissions standards.

- Proof of Insurance: A valid Texas liability insurance card or policy must be presented to show that the vehicle meets Texas' minimum insurance requirements.

- Power of Attorney (VTR-271): When someone else is signing documents or making decisions on behalf of the vehicle owner, this form officially grants them the authority to do so.

- Odometer Disclosure Statement (VTR-40): A federal requirement, this form documents the mileage of a vehicle at the time of sale to prevent odometer fraud.

- Release of Lien (VTR-266): This document is needed when a previously financed vehicle has been paid off, and the lienholder is releasing their interest in the vehicle.

- Application for Disabled Veteran License Plates and Parking Placards (VTR-615): Used by disabled veterans to apply for special license plates or parking permits.

- Bill of Sale: Although not a formal state document, a bill of sale serves as a receipt for the transaction between the buyer and seller, detailing the terms of the sale and any warranties.

- Application for Personalized License Plate (VTR-35): Used by individuals who want to obtain a personalized license plate for their vehicle.

Completing a vehicle transaction smoothly involves understanding and accumulating the right set of documents. For a transaction in Texas, starting with Form 130-U is just the beginning. Each supporting document serves a specific purpose, from verifying the vehicle's history and condition to ensuring compliance with state regulations. Always check with your local Tax Assessor-Collector's office for the most current information and requirements.

Similar forms

The Application for Registration and Title (VTR-346) is similar to the 130U form. Both documents are required by the Texas Department of Motor Vehicles for vehicle owners to officially register and title their vehicles in Texas. Each form collects detailed vehicle information, owner identification, and evidence of ownership to ensure that all vehicles on the road are properly documented and their owners are easily identifiable.

The Affidavit of Motor Vehicle Gift Transfer (Form 14-317) shares similarities with the 130U form in that it is used in specific transactions concerning vehicle ownership. While the 130U form can be used for various types of vehicle title and registration applications, Form 14-317 specifically pertains to vehicle transactions made as gifts, excluding monetary exchanges, but still requires detailed vehicle and ownership information similar to that of the 130U.

The Vehicle Transfer Notification (VTR-346) aligns closely with the 130U form's purpose for updating the state registry on changes in vehicle ownership. When a vehicle is sold, the seller uses the VTR-346 to notify the DMV about the change in ownership, paralleling the 130U's function of officially documenting changes in vehicle title and registration but from the buyer or new owner's perspective.

The Application for Disabled Veteran License Plates and Parking Placards (VTR-615) is used by individuals seeking special designation due to disability status, which is somewhat analogous to part of the 130U's function. Both forms require identification and vehicle information to process requests related to vehicle use and benefits in the state of Texas, albeit for different end purposes – with VTR-615 focusing on accessibility and the 130U on broader title and registration needs.

Dos and Don'ts

When you're filling out the Form 130U, which is the Application for Texas Title and/or Registration, there are some important steps you should follow to ensure your application is filled out correctly and completely. Here are the things you should do:

- Double-check all vehicle-related information (like the Vehicle Identification Number, Year, Make, Model, and Odometer Reading) for accuracy.

- Ensure the application form is signed by all required parties. Remember, original signatures are needed from the buyer, while the seller’s signature can be a reproduction or faxed.

- Include any applicable supporting documents, such as proof of insurance, vehicle inspection reports, and payment for fees ad taxes.

- Use one of the government-issued photo IDs listed in Box 15 of the form for the applicant’s identification.

- Make sure to complete sections regarding lien information if your vehicle is financed.

- Check the appropriate boxes that apply to your situation, like whether you are seeking title only, registration, or both.

- Contact your county tax assessor-collector office if you need assistance completing the form.

Just as important, here are the things you shouldn't do:

- Avoid leaving any required fields blank. If a field doesn’t apply to you, make sure to mark it as “N/A” or “None”.

- Don’t guess on vehicle details; ensure all information matches your vehicle documentation.

- Do not submit the application without the required signatures.

- Avoid ignoring the need for a government-issued photo ID. This is crucial for validating the application.

- Don’t use outdated forms. Always verify that you are using the most current version of the 130U form.

- Do not forget to calculate and include the proper amount for fees and taxes due.

- Avoid submitting the form without reviewing all the information for accuracy and completeness.

Taking the time to thoroughly check your Form 130U for accuracy and completeness can save you time and hassle down the road. Ensuring all the necessary information and documentation is correctly presented the first time helps to expedite the process of obtaining your Texas title and/or registration.

Misconceptions

When dealing with the Application for Texas Title and/or Registration, commonly known as Form 130-U, there are several misconceptions that can create confusion. Here is a clarification of eight common misunderstandings:

Form 130-U is only for cars and trucks: This is incorrect. The form is used for various types of vehicles, including motorcycles, trailers, and boats, to apply for a title and/or registration in Texas.

You must go in person to submit Form 130-U: While many prefer to handle their vehicle-related paperwork in person, Form 130-U can be submitted through mail or, in some cases, electronically through county websites. This process can save time and is convenient for many vehicle owners.

Form 130-U is only for new Texas residents: Both new and current Texas residents use Form 130-U for various title and registration purposes, not exclusively for new residents registering a vehicle for the first time in Texas.

The seller must fill out and submit Form 130-U: It is the buyer’s responsibility to complete and submit Form 130-U to their county tax assessor-collector's office. Although the seller's signature is needed on the form, the buyer must ensure that the form is submitted correctly.

No proof of insurance is required for Form 130-U: A valid proof of financial responsibility, typically a liability insurance card or policy, is required to accompany Form 130-U for registration purposes. This proof is crucial and ensures compliance with Texas laws.

Form 130-U requires notarization: This form does not need to be notarized. The crucial aspect is that it contains the original signature of the buyer and, when applicable, the seller’s signature, which can be either original, reproduced, or faxed.

You can use Form 130-U to apply for registration without a title: This is partially true. While Form 130-U is primarily used for title and registration, there's a specific option for applying for registration purposes only, without requesting a title, under certain conditions outlined in the form.

There's no deadline for submitting Form 130-U after purchasing a vehicle: To avoid penalties, Form 130-U along with the payment of sales and use tax must be filed within 30 days from the date of purchasing or bringing a vehicle to Texas. Delays can result in late fees and other penalties.

The Form 130-U is a key component in ensuring that vehicle ownership is correctly recorded by the state of Texas. Understanding these misconceptions can ease the process for many individuals looking to navigate through their title and registration requirements efficiently.

Key takeaways

Filling out and using the Application for Texas Title and/or Registration (Form 130-U) is an essential step when transferring vehicle ownership or adjusting registration details in Texas. Here are four key takeaways to guide you through the process:

- Know the purpose of your application: The form allows for different types of applications, including applying for a title and registration, a title only, registration purposes only, or a nontitle registration. Make sure to check the appropriate option that suits your needs.

- Complete all required fields accurately: Detailed information such as Vehicle Identification Number, year, make, model, and applicant details, including name and mailing address, are vital for processing. Inaccurate or incomplete forms can lead to delays. Remember to signify if the odometer reading represents the actual mileage, unless it is not accurate, exceeds mechanical limits, or is exempt.

- Understand tax and fee implications: Depending on the transaction type, motor vehicle tax, sales and use tax computation, and possible fees, such as the application fee, might be applicable. It’s crucial to assess these financial requirements correctly to avoid any discrepancies.

- Submit supporting documents and fees: Alongside the 130-U form, additional documents and fees are often required. These may include evidence of ownership, proof of insurance, and any relevant tax payments. Make sure to gather all necessary items before submission to ensure a smooth process.

It is always advisable to review the form instructions thoroughly and consult with your county tax assessor-collector’s office or seek guidance if you have any questions. This proactive approach can help minimize errors and expedite the processing of your application.

Popular PDF Forms

Australia Visa Requirements - The inclusion of specific details about family members aims to provide the Australian authorities with a clear picture of the applicant's background.

Buyer Guide - Pointing out the federal law against label removal before sale, the guide reinforces the seriousness with which these disclosures are treated.