Blank 14654 PDF Template

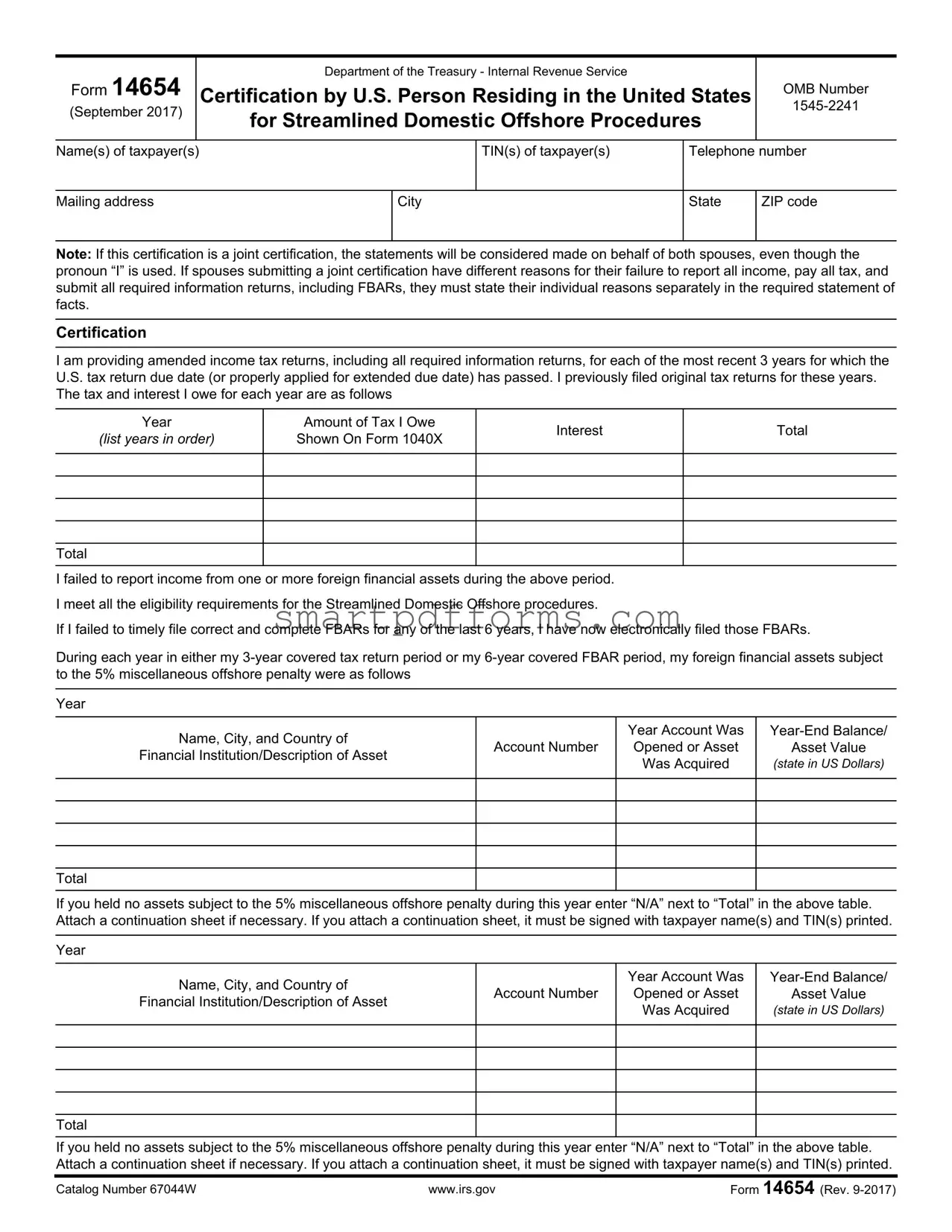

Navigating tax obligations can be daunting, especially when it involves foreign financial assets. The IRS Form 14654 serves as a beacon for U.S. persons residing within the country who have inadvertently overlooked reporting income from offshore assets. Officially known as the Certification by U.S. Person Residing in the United States for Streamlined Domestic Offshore Procedures, this form is a critical component of the IRS’s efforts to simplify the process of rectifying past omissions. It is used to declare amended tax returns for the most recent three years and reveal any previously unreported income from foreign financial assets during that period. Additionally, it touches on the requirements for filing Foreign Bank and Financial Accounts Reports (FBAR) for the last six years if such filings were missed or incomplete. The form outlines the computation of taxes and interest owed, alongside a miscellaneous offshore penalty calculated as a percentage of the highest balance or value of the foreign financial assets. It calls for complete transparency, requiring detailed explanations for the failure to report, as well as a declaration of all foreign financial assets subjected to penalties. Importantly, submitting Form 14654 is a declaration of non-willful conduct, relying on a good faith misunderstanding of tax requirements. This submission not only aids in bringing taxpayers into compliance but also shields them from more severe penalties that could arise from willful neglect of tax obligations.

Preview - 14654 Form

Form 14654

(September 2017)

Department of the Treasury - Internal Revenue Service

Certification by U.S. Person Residing in the United States

for Streamlined Domestic Offshore Procedures

OMB Number

Name(s) of taxpayer(s)

TIN(s) of taxpayer(s)

Telephone number

Mailing address

City

State

ZIP code

Note: If this certification is a joint certification, the statements will be considered made on behalf of both spouses, even though the pronoun “I” is used. If spouses submitting a joint certification have different reasons for their failure to report all income, pay all tax, and submit all required information returns, including FBARs, they must state their individual reasons separately in the required statement of facts.

Certification

I am providing amended income tax returns, including all required information returns, for each of the most recent 3 years for which the U.S. tax return due date (or properly applied for extended due date) has passed. I previously filed original tax returns for these years. The tax and interest I owe for each year are as follows

Year

(list years in order)

Amount of Tax I Owe

Shown On Form 1040X

Interest

Total

Total

I failed to report income from one or more foreign financial assets during the above period.

I meet all the eligibility requirements for the Streamlined Domestic Offshore procedures.

If I failed to timely file correct and complete FBARs for any of the last 6 years, I have now electronically filed those FBARs.

During each year in either my

Year

Name, City, and Country of |

|

Year Account Was |

||

Account Number |

Opened or Asset |

Asset Value |

||

Financial Institution/Description of Asset |

||||

|

Was Acquired |

(state in US Dollars) |

||

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

|

|

|

|

|

|

|

If you held no assets subject to the 5% miscellaneous offshore penalty during this year enter “N/A” next to “Total” in the above table. Attach a continuation sheet if necessary. If you attach a continuation sheet, it must be signed with taxpayer name(s) and TIN(s) printed.

Year

Name, City, and Country of |

|

Year Account Was |

||

Account Number |

Opened or Asset |

Asset Value |

||

Financial Institution/Description of Asset |

||||

|

Was Acquired |

(state in US Dollars) |

||

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

|

|

|

|

|

|

|

If you held no assets subject to the 5% miscellaneous offshore penalty during this year enter “N/A” next to “Total” in the above table. Attach a continuation sheet if necessary. If you attach a continuation sheet, it must be signed with taxpayer name(s) and TIN(s) printed.

Catalog Number 67044W |

www.irs.gov |

Form 14654 (Rev. |

|

|

|

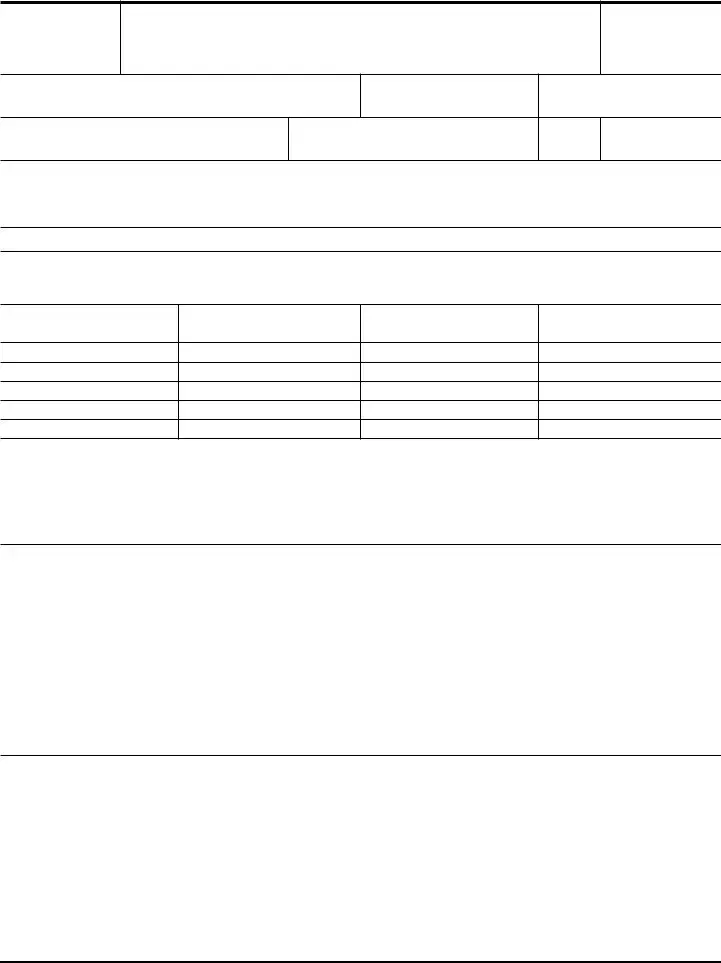

Page of |

|

|

|

|

|

|

Year |

|

|

|

|

|

|

|

|

|

Name, City, and Country of |

|

Year Account Was |

||

Account Number |

Opened or Asset |

Asset Value |

||

Financial Institution/Description of Asset |

||||

|

Was Acquired |

(state in US Dollars) |

||

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

|

|

|

|

|

|

|

If you held no assets subject to the 5% miscellaneous offshore penalty during this year enter “N/A” next to “Total” in the above table. Attach a continuation sheet if necessary. If you attach a continuation sheet, it must be signed with taxpayer name(s) and TIN(s) printed.

Year

Name, City, and Country of |

|

Year Account Was |

||

Account Number |

Opened or Asset |

Asset Value |

||

Financial Institution/Description of Asset |

||||

|

Was Acquired |

(state in US Dollars) |

||

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

|

|

|

|

|

|

|

If you held no assets subject to the 5% miscellaneous offshore penalty during this year enter “N/A” next to “Total” in the above table. Attach a continuation sheet if necessary. If you attach a continuation sheet, it must be signed with taxpayer name(s) and TIN(s) printed.

Year

Name, City, and Country of |

|

Year Account Was |

||

Account Number |

Opened or Asset |

Asset Value |

||

Financial Institution/Description of Asset |

||||

|

Was Acquired |

(state in US Dollars) |

||

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

|

|

|

|

|

|

|

If you held no assets subject to the 5% miscellaneous offshore penalty during this year enter “N/A” next to “Total” in the above table. Attach a continuation sheet if necessary. If you attach a continuation sheet, it must be signed with taxpayer name(s) and TIN(s) printed.

Year

Name, City, and Country of |

|

Year Account Was |

||

Account Number |

Opened or Asset |

Asset Value |

||

Financial Institution/Description of Asset |

||||

|

Was Acquired |

(state in US Dollars) |

||

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

|

|

|

|

|

|

|

If you held no assets subject to the 5% miscellaneous offshore penalty during this year enter “N/A” next to “Total” in the above table. Attach a continuation sheet if necessary. If you attach a continuation sheet, it must be signed with taxpayer name(s) and TIN(s) printed.

Note: Use this seventh year only if your

Catalog Number 67044W |

www.irs.gov |

Form 14654 (Rev. |

|

|

|

Page of |

|

|

|

|

|

|

Year |

|

|

|

|

|

|

|

|

|

Name, City, and Country of |

|

Year Account Was |

||

Account Number |

Opened or Asset |

Asset Value |

||

Financial Institution/Description of Asset |

||||

|

Was Acquired |

(state in US Dollars) |

||

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

|

|

|

|

|

|

|

If you held no assets subject to the 5% miscellaneous offshore penalty during this year enter “N/A” next to “Total” in the above table. Attach a continuation sheet if necessary. If you attach a continuation sheet, it must be signed with taxpayer name(s) and TIN(s) printed.

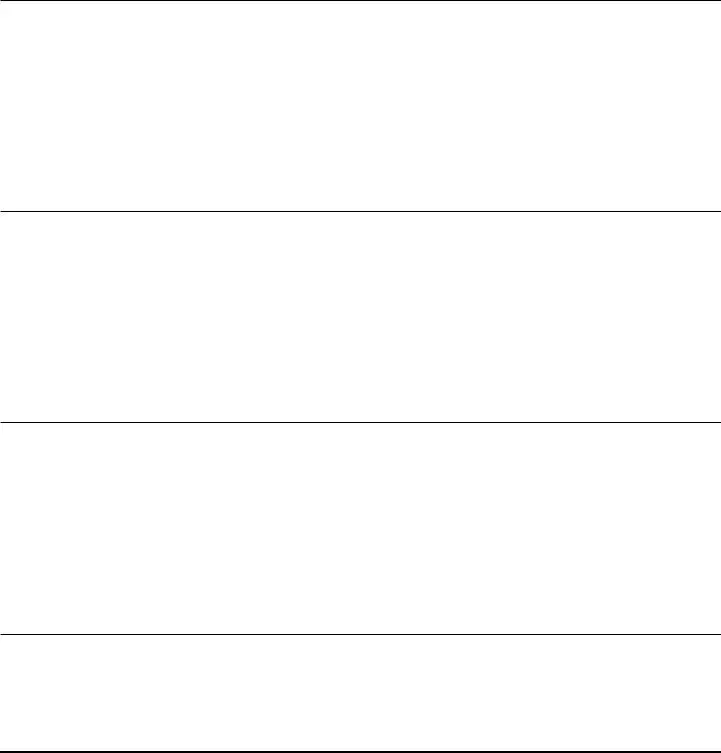

The assets listed in this certification are my only foreign financial assets subject to the 5% miscellaneous offshore penalty.

My penalty computation is as follows

Highest Account Balance/Asset Value (enter the highest total balance/

asset value among the years listed above)

Miscellaneous Offshore Penalty (Highest Account Balance/Asset Value from above multiplied by 5%)

My payment information is as follows

Total Tax and Interest Due

Miscellaneous Offshore Penalty

Total Payment

Note: Your payment should equal the total tax and interest due for all three years, plus the miscellaneous offshore penalty. You may receive a balance due notice or a refund if the tax, interest, or penalty is not calculated correctly.

In consideration of the Internal Revenue Service’s agreement not to assert other penalties with respect to my failure to report foreign financial assets as required on FBARs or Forms 8938 or my failure to report income from foreign financial assets, I consent to the immediate assessment and collection of a Title 26 miscellaneous offshore penalty for the most recent of the three tax years for which I am providing amended income tax returns. I waive all defenses against and restrictions on the assessment and collection of the miscellaneous offshore penalty, including any defense based on the expiration of the period of limitations on assessment or collection. I waive the right to seek a refund or abatement of the miscellaneous offshore penalty.

I agree to retain all records (including, but not limited to, account statements) related to my assets subject to the 5% miscellaneous offshore penalty until six years from the date of this certification. I also agree to retain all records related to my income and assets during the period covered by my amended income tax returns until three years from the date of this certification. Upon request, I agree to provide all such records to the Internal Revenue Service.

My failure to report all income, pay all tax, and submit all required information returns, including FBARs, was due to

I acknowledge the possibility that amended income tax returns I am submitting under the Streamlined Domestic Offshore Procedures may report income for tax years beyond the

I recognize that if the Internal Revenue Service receives or discovers evidence of willfulness, fraud, or criminal conduct, it may open an examination or investigation that could lead to civil fraud penalties, FBAR penalties, information return penalties, or even referral to Criminal Investigation.

Note: You must provide specific facts on this form or on a signed attachment explaining your failure to report all income, pay all tax, and submit all required information returns, including FBARs. Any submission that does not contain a narrative statement of facts will be considered incomplete and will not qualify for the streamlined penalty relief.

Catalog Number 67044W |

www.irs.gov |

Form 14654 (Rev. |

Page of

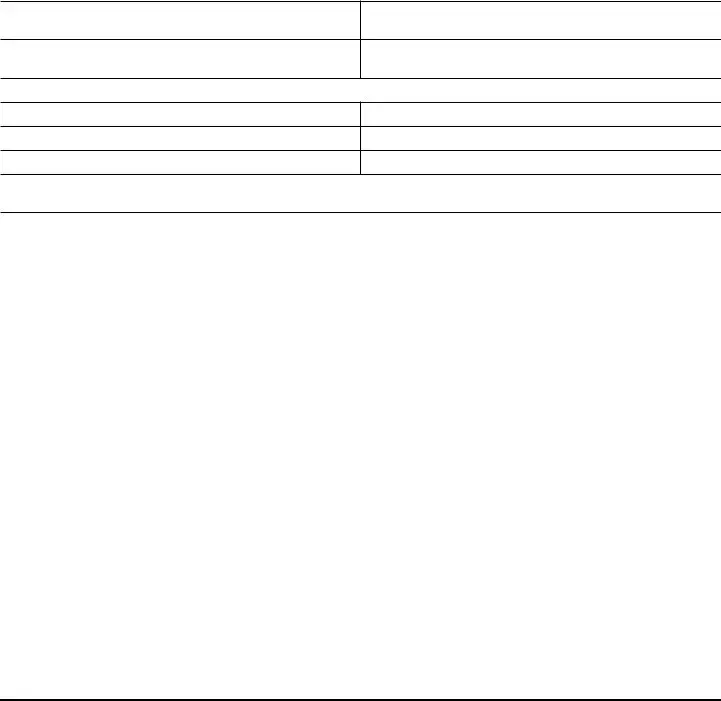

Provide specific reasons for your failure to report all income, pay all tax, and submit all required information returns, including FBARs. Include the whole story including favorable and unfavorable facts. Specific reasons, whether favorable or unfavorable to you, should include your personal background, financial background, and anything else you believe is relevant to your failure to report all income, pay all tax, and submit all required information returns, including FBARs. Additionally, explain the source of funds in all of your foreign financial accounts/assets. For example, explain whether you inherited the account/asset, whether you opened it while residing in a foreign country, or whether you had a business reason to open or use it. And explain your contacts with the account/asset including withdrawals, deposits, and investment/ management decisions. Provide a complete story about your foreign financial account/asset. If you relied on a professional advisor, provide the name, address, and telephone number of the advisor and a summary of the advice. If married taxpayers submitting a joint certification have different reasons, provide the individual reasons for each spouse separately in the statement of facts. The field below will automatically expand to accommodate your statement of facts.

Under penalties of perjury, I declare that I have examined this certification and all accompanying schedules and statements, and to the best of my knowledge and belief, they are true, correct, and complete.

Signature of Taxpayer

Name of Taxpayer

Date

Signature of Taxpayer (if joint certification)

Name of Taxpayer (if joint certification)

Date

Catalog Number 67044W |

www.irs.gov |

Form 14654 (Rev. |

Page of

For Estates Only

Signature of Fiduciary

Date

Title of Fiduciary (e.g., executor or administrator)

Name of Fiduciary

For Paid Preparer Use Only (the signature of taxpayer(s) or fiduciary is required even if this form is signed by a paid preparer)

Signature of Preparer |

Name of Preparer |

|

|

Date |

|

|

|

|

|

Firm’s name |

|

|

|

Firm’s EIN |

|

|

|

|

|

Firm’s address |

City |

|

State |

ZIP code |

|

|

|

|

|

Telephone number |

PTIN |

|

|

Check if |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Do you want to allow another person to discuss this form with the IRS |

Yes (complete information below) |

No |

||

|

|

|

|

|

Designee’s name |

|

|

Telephone number |

|

|

|

|

|

|

Privacy Act and Paperwork Reduction Notice

We ask for the information on this certification by U.S. person residing in the United States for streamlined domestic offshore procedures to carry out the Internal Revenue laws of the United States. Our authority to ask for information is sections 6001, 6109, 7801, 7803 and the regulations thereunder. This information will be used to determine and collect the correct amount of tax under the terms of the streamlined filing compliance program. You are not required to apply for participation in the streamlined filing compliance program. If you choose to apply, however, you are required to provide all the information requested on the streamlined certification. You are not required to provide the information requested on a document that is subject to the Paperwork Reduction Act unless the document displays a valid OMB control number. Books or records relating to a document or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law. Generally, tax returns and return information are confidential, as required by section 6103. Section 6103, however, allows or requires the Internal Revenue Service to disclose or give this information to others as described in the Internal Revenue Code. For example, we may disclose this information to the Department of Justice to enforce the tax laws, both civil and criminal, and to cities, states, the District of Columbia, and U.S. commonwealths or possessions to carry out their tax laws. We may also disclose this information to other countries under a tax treaty, to federal and state agencies to enforce federal nontax criminal laws, or to federal law enforcement and intelligence agencies to combat terrorism. Failure to provide this information may delay or prevent processing your application. Providing false information may subject you to penalties. The time needed to complete and submit the streamlined certification will vary depending on individual circumstances. The estimated average time is: 8 hours

Catalog Number 67044W |

www.irs.gov |

Form 14654 (Rev. |

Form Data

| Fact | Detail |

|---|---|

| Form Number | 14654 |

| Revision Date | September 2017 |

| Issuing Authority | Department of the Treasury - Internal Revenue Service |

| Title | Certification by U.S. Person Residing in the United States for Streamlined Domestic Offshore Procedures |

| OMB Number | 1545-2241 |

| Purpose | Used to certify compliance for the streamlined domestic offshore procedures, including amended tax returns and FBAR filings. |

| Eligibility | U.S. persons (including individuals and estates) residing in the United States who have failed to report foreign financial assets and pay all tax due in respect of those assets. |

| Joint Filings | Allows joint certifications, but requires that spouses state their individual reasons for noncompliance if they differ. |

| Required Attachments | Amended income tax returns for the most recent 3 years and FBARs for the last 6 years where applicable. |

| Offshore Penalty | Applicants must calculate a 5% miscellaneous offshore penalty based on the highest aggregate balance/value of foreign financial assets. |

| Consent Provisions | Applicants must consent to the immediate assessment and collection of the miscellaneous offshore penalty and waive defenses against its assessment and collection. |

| Catalog Number | 67044W |

| Governing Law | Form 14654 is governed by federal law, specifically the Internal Revenue Code and regulations issued by the IRS. |

Instructions on Utilizing 14654

Filling out Form 14654 is a step you're taking towards compliance with IRS regulations, specifically if you've had issues with foreign financial assets. It’s a clear process but requires your attention to detail. This guide will help you complete the form accurately. Make sure you have all necessary documents, such as amended tax returns and information on foreign financial assets, at hand before you start.

- Start by entering the Name(s) of taxpayer(s) at the top of the form. If it’s a joint certification, remember that the statements will apply to both taxpayers.

- Fill in the TIN(s) of taxpayer(s) – these are your Taxpayer Identification Numbers.

- Provide your Telephone number and Mailing address including City, State, and ZIP code.

- Under the Certification section, list the most recent 3 years for which you are providing amended income tax returns. Include the Amount of Tax and Interest you owe for each year.

- Detail the failure to report income from foreign financial assets in the specified period and confirm that you meet the eligibility requirements for the Streamlined Domestic Offshore procedures.

- If applicable, confirm that you've now electronically filed the FBARs for any of the last 6 years.

- For each year, provide information about your foreign financial assets subject to the 5% miscellaneous offshore penalty, including the Year, Name, City, and Country of the Financial Institution, Account Number, Year-End Balance/Asset Value, and Total. If you had no assets in a given year, enter “N/A” next to “Total”.

- If additional space is needed for your assets, use a continuation sheet and ensure it is signed with taxpayer name(s) and TIN(s).

- Provide details about the Highest Account Balance/Asset Value, calculate the Miscellaneous Offshore Penalty, and detail your payment information including Total Tax and Interest Due along with the Total Payment.

- Consent to immediate assessment and collection of a Title 26 miscellaneous offshore penalty and agree to retain all relevant records for the specified durations.

- Explain the reasons for your failure to report all income, pay all tax, and submit all required information returns, including FBARs on this form or on a signed attachment.

- Sign and date the form. If filing jointly, both taxpayers must sign and date. For estates, the signature of the fiduciary is required.

- If a paid preparer filled the form, their information must be included in the designated section at the bottom of the form.

- If you wish to allow another person to discuss this form with the IRS, provide the Designee’s name and Telephone number in the provided section.

After submitting Form 14654, keep a copy of the form and all related documents for your records. This ensures you're prepared to answer any follow-up questions from the IRS or provide additional documentation if requested.

Obtain Answers on 14654

FAQs on Form 14654: Certification by U.S. Person Residing in the United States for Streamlined Domestic Offshore Procedures

- What is the purpose of Form 14654?

- Who should file Form 14654?

- What information is required on Form 14654?

- How does one file Form 14654, and what are the next steps after filing?

Form 14654 serves a critical role in the IRS's Streamlined Domestic Offshore Procedures. It is designed for individuals residing in the United States who need to certify that their failure to report income, pay taxes, and submit required information returns, including FBARs (Foreign Bank and Financial Accounts Report), regarding foreign financial assets, was due to non-willful conduct. By completing this form, taxpayers present amended tax returns for the most recent three years and FBARs for the last six years, rectifying their reporting based on the eligibility requirements of these streamlined procedures.

This form is for U.S. persons, including individuals, estates, and entities, residing in the United States who have previously filed U.S. tax returns but omitted income from foreign financial assets. It is specifically for those who believe their actions were non-willful—meaning due to negligence, inadvertence, or a misunderstanding of the legal requirements—and wish to correct their previously filed tax returns and FBARs under the streamlined procedures, thereby avoiding larger penalties.

The form requires a comprehensive breakdown of the taxpayer's foreign financial assets that were not fully reported in the past, encompassing details such as the account numbers, financial institutions, and the highest balance or asset value during the covered years. Furthermore, taxpayers must disclose the total tax and interest due for each of the three years being amended, the reason for their non-willful conduct, and the calculation of a 5% miscellaneous offshore penalty on the highest aggregate account balance/value. It also requires a signed declaration under penalties of perjury that the information provided is complete and accurate.

After completing Form 14654, the taxpayer should attach it to their amended tax returns for the last three years and submit the entire package to the IRS as outlined in the streamlined procedures. It's crucial to also electronically file delinquent FBARs for the last six years, if applicable, through the Financial Crimes Enforcement Network's (FinCEN) website. Once the submission is reviewed and accepted by the IRS, the taxpayer may be informed of any additional tax, interest, or penalties due beyond those self-calculated on the form. If the IRS determines the taxpayer's actions were willful, more significant penalties or legal actions could follow. Taxpayers are advised to retain all records related to their foreign financial assets and amended returns for at least six years following the certification.

Common mistakes

When filling out Form 14654, several common errors can significantly impact the processing of the application. It's imperative to fill out this form meticulously to ensure compliance with the streamlined procedures for disclosing offshore assets.

Not Reporting All Income: A frequent oversight is failing to report all income from foreign financial assets for the period covered. Each income source, regardless of its size, must be meticulously documented to avoid discrepancies.

Incomplete FBAR Filings: The requirement to electronically file Foreign Bank and Financial Accounts Reports (FBARs) for the last six years is often misunderstood or overlooked. Ensuring that these are filed correctly and completely is crucial for compliance.

Incorrect Calculation of Penalties: The computation of the 5% miscellaneous offshore penalty can be complex. Errors in calculating the highest account balance or asset value and subsequently the penalty amount can occur, leading to underpayment or overpayment.

Failure to Provide Detailed Narrative: The form mandates a comprehensive narrative of the reasons behind the failure to report all income, pay all tax, and submit all required information returns, including FBARs. A common mistake is providing a statement that is too vague or incomplete, lacking specific facts and circumstances.

Omission of Signature and Date: An application can be deemed incomplete if it lacks the necessary signatures and date, a straightforward but often neglected step. This includes the signature of the taxpayer, and if applicable, the joint taxpayer or fiduciary, and the date of signing.

Avoiding these mistakes requires careful review and comprehensive understanding of both the financial information being reported and the requirements set forth by the Internal Revenue Service (IRS). Accurate and complete submissions are essential for individuals seeking to utilize the streamlined domestic offshore procedures.

Documents used along the form

When taxpayers use Form 14654, Certification by U.S. Person Residing in the United States for Streamlined Domestic Offshore Procedures, they often need to gather additional documents and forms to complete their submission comprehensively. These documents play critical roles in ensuring compliance with the procedures and help streamline the process of rectifying past non-compliance with offshore account reporting.

- Form 1040X (Amended U.S. Individual Income Tax Return): Used by taxpayers to make corrections or amendments to their previously filed Form 1040 forms. It is essential for correcting income, deductions, and tax liability.

- FBAR (FinCEN Form 114, Report of Foreign Bank and Financial Accounts): Required for reporting financial interest in or signature authority over foreign financial accounts. This form is filed separately from income tax returns and is crucial for taxpayers with foreign accounts.

- Form 8938 (Statement of Specified Foreign Financial Assets): Required for taxpayers with specified foreign financial assets exceeding certain thresholds. It provides detailed information on foreign assets, aiding in the compliance process.

- Form 8854 (Initial and Annual Expatriation Statement): Necessary for individuals who have renounced their U.S. citizenship or long-term residents who have ended their residency. This form is part of the process to ensure all tax obligations are met upon expatriation.

- Form 3520 (Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts): Used to report transactions with foreign trusts and receipt of large gifts from foreign entities, crucial for taxpayers involved in these financial interactions.

- Form 5471 (Information Return of U.S. Persons With Respect to Certain Foreign Corporations): Required for certain U.S. citizens and residents who are officers, directors, or shareholders in certain foreign corporations, facilitating information exchange and compliance.

- Form 8621 (Information Return by a Shareholder of a Passive Foreign Investment Company or Qualified Electing Fund): Necessary for taxpayers who hold investments in passive foreign investment companies (PFICs), to calculate and report any earnings and gains.

- Form 926 (Return by a U.S. Transferor of Property to a Foreign Corporation): Used to report transfers of property to foreign corporations, assisting in the enforcement of taxation on such transfers.

Each of these forms and documents plays a pivotal role in ensuring that taxpayers accurately report their foreign financial activities and comply with U.S. tax laws. Properly completing and submitting these forms along with Form 14654 can help taxpayers take advantage of the Streamlined Domestic Offshore Procedures to address and rectify previous reporting oversights or errors.

Similar forms

Form 1040X (Amended U.S. Individual Income Tax Return): Much like Form 14654, Form 1040X requires individuals to provide amended tax return information. Both forms are used when taxpayers need to correct previously filed tax returns. While Form 14654 is specifically for correcting offshore income reporting, Form 1040X covers a broader range of corrections to an individual's tax return.

Form 8938 (Statement of Specified Foreign Financial Assets): This form has similarities to Form 14654 in its focus on foreign financial assets. Both forms require taxpayers to disclose assets held in foreign accounts but are designed for different purposes. Form 8938 is a requirement for taxpayers to report foreign financial assets along with their regular tax return if the total value of those assets exceeds a certain threshold, while Form 14654 relates to the streamlined filing compliance procedures for correcting past non-compliance.

FBAR (Report of Foreign Bank and Financial Accounts, FinCEN Form 114): The FBAR is another document that deals with foreign financial accounts and is referenced in Form 14654. Taxpayers use the FBAR to report foreign bank and financial account holdings. It complements Form 14654 as part of the process to rectify failures in reporting these foreign financial accounts in the past.

Form 8854 (Initial and Annual Expatriation Statement): Form 8854 is utilized by individuals who have renounced their U.S. citizenship or ended their long-term residence status for tax purposes. Although its primary purpose differs from Form 14654, both forms require detailed information about foreign assets. The connection is in the disclosure of financial interests outside the United States, which is crucial for compliance with tax obligations.

Form 926 (Return by a U.S. Transferor of Property to a Foreign Corporation): This form shares a similarity with Form 14654 in terms of its relevance to international financial activities. Form 926 is used to report transfers of property by U.S. persons to foreign corporations, which can involve considerations similar to those disclosed on Form 14654, especially in terms of reporting foreign assets and understanding tax obligations resulting from international dealings.

Dos and Don'ts

When preparing to fill out Form 14654, also known as the Certification by U.S. Person Residing in the United States for Streamlined Domestic Offshore Procedures, certain practices should be embraced while others are to be avoided to ensure accuracy and compliance with IRS requirements. Here's a detailed guide:

- Do review the entire form before starting to understand all the requirements.

- Don't wait until the last minute to begin filling out the form to avoid mistakes due to rushing.

- Do gather all necessary documentation related to foreign financial assets, including account statements and tax returns, before beginning.

- Don't estimate figures; use actual data from your records to report income from foreign financial assets accurately.

- Do disclose all foreign financial assets subject to the 5% miscellaneous offshore penalty, as failure to report could lead to severe penalties.

- Don't ignore the need for a separate statement if filing a joint certification with different reasons for failures to report. Each spouse must provide individual explanations.

- Do ensure that narrative statements are detailed, including the source of funds in foreign accounts and any reliance on professional advice.

- Don't submit without double-checking that all information is complete, accurate, and matches the documentation you have.

- Do sign and date the form (and any continuation sheets) to certify that, to the best of your knowledge, the information is true, correct, and complete.

Adhering to these dos and don'ts when completing Form 14654 will help facilitate a smoother process with the IRS and ensure compliance with the Streamlined Domestic Offshore Procedures. Always remember, when in doubt, seeking advice from a tax professional well-versed in offshore tax matters can provide clarity and direction.

Misconceptions

When it comes to Form 14654, "Certification by U.S. Person Residing in the United States for Streamlined Domestic Offshore Procedures", several misconceptions commonly arise. These misunderstandings can complicate the process for taxpayers trying to comply with the IRS regulations regarding foreign financial assets. Below are four common misconceptions about this form and clarifications to help better understand its requirements and purpose.

- Only for those with intentionally undeclared offshore assets. A common misconception is that Form 14654 is strictly for taxpayers who have intentionally avoided reporting foreign financial assets. However, this form is intended for U.S. taxpayers residing in the country who have not willfully failed to report income from foreign financial assets, pay the required tax, and submit all necessary information returns, including FBARs. It's designed for those whose failure to comply was non-willful, stemming from negligence, inadvertence, mistake, or a good faith misunderstanding of the law.

- Automatically results in penalties. Another misunderstanding is that submitting Form 14654 guarantees the imposition of significant penalties. While taxpayers must calculate a miscellaneous offshore penalty, the streamlined procedures are designed to offer a way for taxpayers who meet the non-willful criteria to correct past mistakes with reduced or, in some instances, no penalties for failure to file the FBAR, outside of the miscellaneous offshore penalty.

- Only for correcting the previous year's tax returns. Some people incorrectly believe that this form is only used to amend the immediately preceding tax year. In reality, Form 14654 requires taxpayers to provide amended income tax returns, including all required information returns, for the most recent three years for which the U.S. tax return due date (or properly applied for extended due date) has passed, along with electronically filed FBARs for the last six years if applicable. This requirement ensures that taxpayers correct a broader range of compliance issues than just those from the last fiscal year.

- Joint filers must have identical reasons for previous non-compliance. It is often mistakenly thought that if a married couple is filing this certification jointly, they must have the same reasons for failing to report all income, pay all tax, and submit all required information returns, including FBARs. The form explicitly states, however, that if spouses submitting a joint certification have different reasons for their failures, they must state their individual reasons separately in the required statement of facts. This allowance acknowledges that each spouse may have different circumstances leading to their non-compliance.

Understanding these misconceptions surrounding Form 14654 can significantly help U.S. residents navigate the complexities of complying with tax obligations related to foreign financial assets. Properly addressing these misunderstandings can facilitate a smoother process in utilizing the Streamlined Domestic Offshore Procedures.

Key takeaways

When preparing Form 14654, also known as the Certification by U.S. Person Residing in the United States for Streamlined Domestic Offshore Procedures, it’s essential to include accurate information for a smooth process. Here are key takeaways to guide you in filling out and using this form:

- Individuals must provide amended income tax returns for the last three years for which the U.S. tax return due date (including extensions) has passed. It’s important to ensure that these returns include all required information returns.

- For joint certifications, spouses must indicate their reasons for not reporting income or filing information returns separately if their reasons differ. This distinction highlights the necessity of clear communication and transparency between spouses when handling joint financial disclosures.

- Accuracy in reporting the amount of tax and interest owed for each year is crucial. The form requires listing these amounts for each relevant year, emphasizing the need for thorough review and correct calculation.

- Form 14654 necessitates the disclosure of foreign financial assets, including the year-end balance or asset value stated in U.S. dollars. If no assets are subject to the 5% miscellaneous offshore penalty for a given year, the taxpayer should enter “N/A” in the total column for that year. This specification underlines the importance of detailed record-keeping for all foreign assets.

- All assets subject to the 5% miscellaneous offshore penalty must be disclosed, including the highest account balance or asset value. Taxpayers must also calculate and report the total payment due, which includes the sum of the tax, interest, and penalties due. This highlights the significance of accurate asset valuation and penalty calculation in compliance with IRS regulations.

- By signing the form, taxpayers waive the right to contest the assessment and collection of the miscellaneous offshore penalty and agree to retain all records related to their foreign assets and income for the specified periods. This agreement underscores taxpayers' commitment to comply fully with IRS requirements, including the potential future provision of these documents to the IRS upon request.

Understanding these key aspects of Form 14654 can help taxpayers accurately report their foreign financial assets and navigate the streamlined filing compliance procedures with more confidence.

Popular PDF Forms

Devry University Transcript Request - Highlight your commitment to education by using this form to request your official academic transcript from Keller.

B2b State Farm Claims - A vehicle repair supplemental request form designed for efficient communication with State Farm, minimizing delays in insurance claim adjustments.

How Do You Pay Back Unemployment - This document is a requisite for recording the effective date and specifics of a business sale, purchase, or transfer.