Blank 33H PDF Template

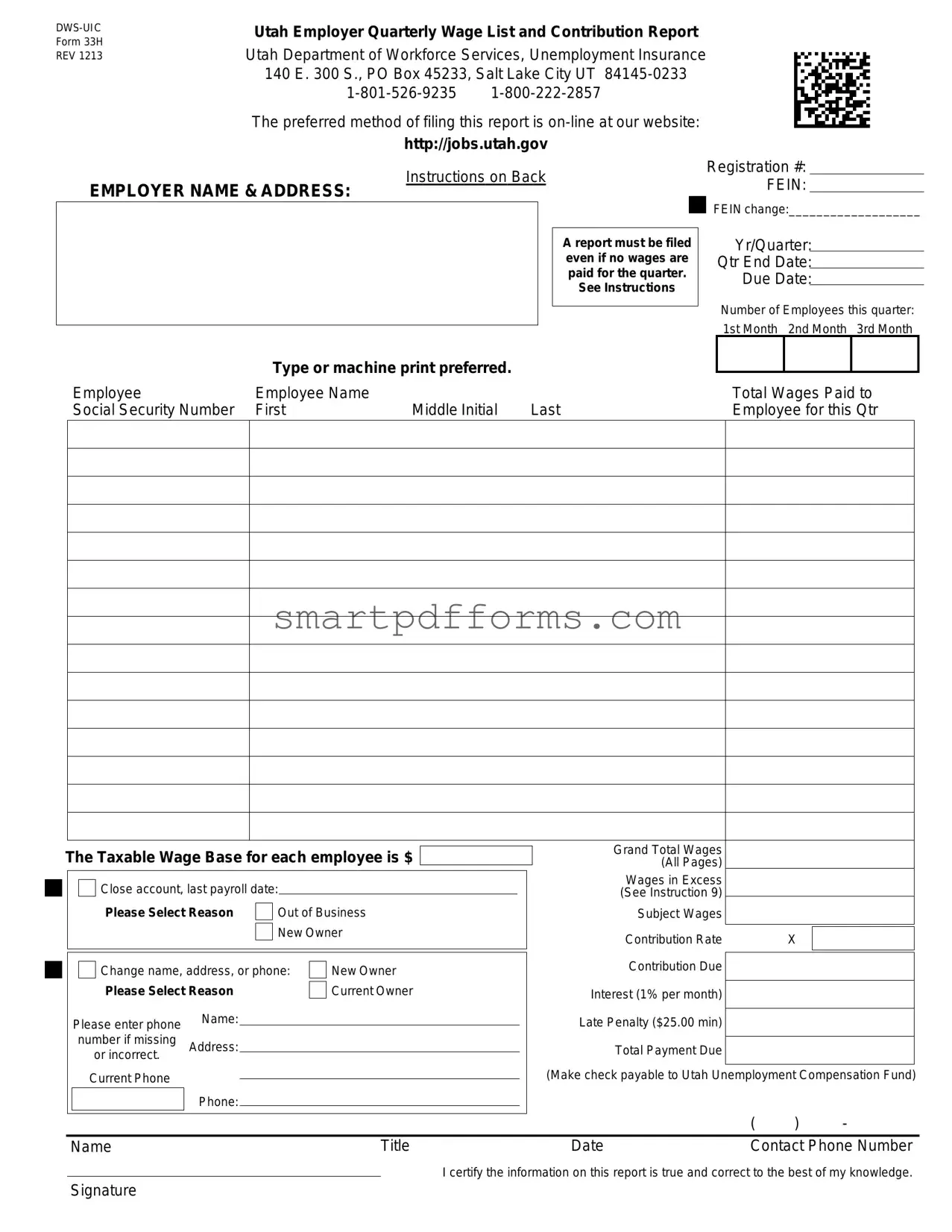

The DWS-UIC Utah Employer Quarterly Wage List and Contribution Report, known as Form 33H, serves as a critical document for employers within the state of Utah. This form, issued by the Utah Department of Workforce Services, Unemployment Insurance, undergoes revisions to ensure accuracy and efficiency in reporting, as indicated by its revision number, REV 1213. Located at 140 E. 300 S., PO Box 45233, Salt Lake City UT 84145-0233, the department facilitates both phone and online support for employers who need assistance with the filing process, highlighting the preferred online filing method available at their website. Form 33H mandates that employers report their quarterly wages paid to employees, providing details such as the employer's name and address, the Federal Employer Identification Number (FEIN), and the total wages paid. This form plays a vital role in the state's unemployment insurance system, requiring employers to calculate and report their contributions based on the taxable wage base applicable to each employee. Additionally, it includes sections for reporting changes in the business, such as closure, ownership transfer, or amendments to business details. The companion document, Form 33HA, serves as a continuation sheet for employers who need to report additional employees beyond the initial form's capacity. Filing this form accurately and on time is imperative for employers to comply with state regulations, avoid penalties, and contribute to the unemployment insurance fund. The inclusion of penalties for late filings underscores the urgency and importance of timely and accurate submissions.

Preview - 33H Form

Utah Employer Quarterly Wage List and Contribution Report

Form 33H |

Utah Department of Workforce Services, Unemployment Insurance |

||||||

REV 1213 |

|||||||

|

140 E. 300 S., PO Box 45233, Salt Lake City UT |

||||||

|

|

|

|||||

|

The preferred method of filing this report is |

||||||

|

http://jobs.utah.gov |

||||||

|

Instructions on Back |

||||||

EMPLOYER NAME & ADDRESS: |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A report must be filed |

|

|

|

|

|

|

|

even if no wages are |

|

|

|

|

|

|

|

paid for the quarter. |

|

|

|

|

|

|

|

See Instructions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Registration #:

FEIN:

FEIN change:___________________

Yr/Quarter:

Qtr End Date:

Due Date:

Number of Employees this quarter: 1st Month 2nd Month 3rd Month

Type or machine print preferred.

Employee |

Employee Name |

|

|

Total Wages Paid to |

Social Security Number |

First |

Middle Initial |

Last |

Employee for this Qtr |

|

|

|

|

|

|

|

|

|

|

The Taxable Wage Base for each employee is $

Close account, last payroll date:

Close account, last payroll date:

|

|

Please Select Reason |

|

Out of Business |

||

|

|

|

|

New Owner |

||

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Change name, address, or phone: |

|

New Owner |

||

|

|

|

||||

|

|

Please Select Reason |

|

|

|

Current Owner |

|

|

|

|

|

||

Please enter phone |

Name: |

|

|

||

number if missing |

Address: |

|

or incorrect. |

||

|

||

Current Phone |

|

|

|

Phone: |

Grand Total Wages

(All Pages)

Wages in Excess

(See Instruction 9)

Subject Wages

Contribution RateX

Contribution Due

Interest (1% per month)

Late Penalty ($25.00 min)

Total Payment Due  (Make check payable to Utah Unemployment Compensation Fund)

(Make check payable to Utah Unemployment Compensation Fund)

|

|

|

( |

) |

- |

Name |

Title |

Date |

Contact Phone Number |

||

I certify the information on this report is true and correct to the best of my knowledge.

Signature

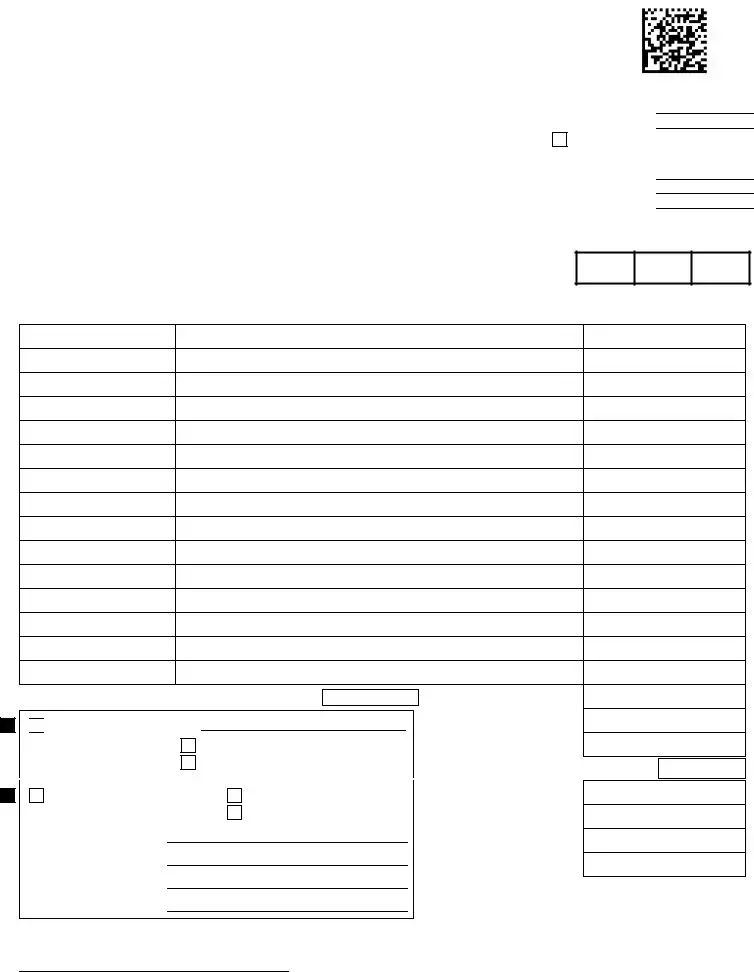

Form 33HA

REV 0813

Utah Employer Quarterly Wage List Continuation Sheet

Utah Department of Workforce Services, Unemployment Insurance

140 E. 300 S., PO Box 45233, Salt Lake City UT

The preferred method of filing this report is

http://jobs.utah.gov

Registration #:

EMPLOYER NAME & ADDRESS:

Yr/Quarter:

Qtr End Date:

Due Date:

|

|

Type or machine print this report. |

|

|

Employee |

Employee Name |

|

Total Wages Paid to |

|

Social Security Number |

First |

Middle Initial |

Last |

Employee for this Qtr |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form Data

| Fact | Detail |

|---|---|

| Form Name | Utah Employer Quarterly Wage List and Contribution Report |

| Form Number | 33H |

| Revision | REV 1213 |

| Administered by | Utah Department of Workforce Services, Unemployment Insurance |

| Location | 140 E. 300 S., PO Box 45233, Salt Lake City UT 84145-0233 |

| Contact Numbers | 1-801-526-9235 / 1-800-222-2857 |

| Preferred Filing Method | Online at http://jobs.utah.gov |

| Filing Requirement | Must file even if no wages were paid for the quarter |

| Governing Law | Utah Unemployment Insurance Laws |

| Info Included in Report | Employer information, number of employees, total wages paid, taxable wages, contribution rate, total payment due |

| Additional Form | Form 33HA - Continuation Sheet for additional employees |

Instructions on Utilizing 33H

After completing the DWS-UIC Utah Employer Quarterly Wage List and Contribution Report Form 33H, the next steps involve submitting the form to the Utah Department of Workforce Services either online, which is preferred, or by mail to the provided address. This submission is crucial for complying with state unemployment insurance regulations. It ensures that your business maintains good standing and your employees can access benefits if they become unemployed. Timely and accurate submission of this form is essential to avoid penalties, including interest and late charges. Upon submission, keep a copy for your records and monitor your account for any additional instructions or confirmations sent by the Department.

- Access the form online at the specified website or obtain a physical copy.

- Complete the "Employer Name & Address" section with your business information.

- Fill in your Registration Number and Federal Employer Identification Number (FEIN) in the designated fields.

- Indicate any FEIN change in the provided space.

- Enter the Year/Quarter, Quarter End Date, and Due Date appropriately.

- Specify the Number of Employees for each month of the quarter.

- Type or print clearly the employee information including Name, Social Security Number, and Total Wages Paid this Quarter.

- For businesses ending operation, select the reason under the "Close account" section and provide the last payroll date.

- If there are changes in ownership, name, address, or phone number, select the appropriate reason and fill in the new details.

- Calculate and enter the Grand Total Wages, Wages in Excess, Subject Wages, Contribution Rate, Contribution Due, any Interest, Late Penalty, and Total Payment Due.

- If necessary, use the Continuation Sheet (Form 33HA) for additional employee listings.

- Make a check payable to Utah Unemployment Compensation Fund for the amount in "Total Payment Due."

- Sign and date the form at the bottom, providing your Name, Title, and Contact Phone Number.

- Submit the completed form and any attachments online or mail them to the provided address.

Obtain Answers on 33H

Welcome! Below are answers to several frequently asked questions regarding the 33H form, otherwise known as the Utah Employer Quarterly Wage List and Contribution Report Form. This vital form is issued by the Utah Department of Workforce Services, Unemployment Insurance. Our aim is to make this information accessible and understandable, ensuring employers have the knowledge they need to comply with reporting requirements.

- What is the 33H form?

- Who is required to file the 33H form?

- How can I file the 33H form?

- What information do I need to complete the 33H form?

- What is the due date for the 33H form?

- What if I have no wages to report for a quarter?

- Are there penalties for filing the 33H form late?

- Can I close my account using the 33H form?

The 33H form is a document that Utah employers must complete and submit quarterly. It's designed to report wages paid to employees and unemployment insurance contributions due. This form plays a crucial role in maintaining the accuracy of unemployment insurance benefit payments.

All employers in Utah who have registered with the Utah Department of Workforce Services and have employees are required to file the 33H form every quarter, regardless of whether wages were paid during that period.

The Utah Department of Workforce Services prefers that employers file this form online via their website, http://jobs.utah.gov. However, for those who choose not to file online, it's possible to complete the form manually and mail it to the provided address.

To accurately complete the 33H form, you'll need the following information: employer's name and address, registration number, Federal Employer Identification Number (FEIN), the total number of employees per month in the quarter, total wages paid to each employee during the quarter, and any changes in business ownership or contact information.

The 33H form must be submitted by the last day of the month following the end of the quarter. For example, for the first quarter (January-March), the form is due by April 30th.

Even if you did not pay wages during a given quarter, you are still required to file the 33H form. This ensures your account stays up-to-date and avoids potential penalties for non-compliance.

Yes, employers who file the 33H form late may be subject to penalties including interest charges (1% per month) and a minimum late penalty of $25.00. It's important to file on time to avoid these additional costs.

Yes, if you're closing your business or if there has been a change in ownership, you can indicate this on the 33H form. You will need to select the appropriate reason for account closure and provide the last payroll date.

This FAQ aims to provide a comprehensive overview of the 33H form and its requirements. For additional information or specific inquiries, the Utah Department of Workforce Services offers resources and contact numbers to assist employers. Remember, timely and accurate filing is key to compliance and ensures the proper functioning of the unemployment insurance system.

Common mistakes

When it comes to completing the DWS-UIC Utah Employer Quarterly Wage List and Contribution Report Form 33H, carefully ensuring all fields are accurately filled is crucial for the Utah Department of Workforce Services. Unfortunately, some common errors can lead to significant complications. Here is a list of mistakes people often make:

Not filing a report even when no wages have been paid during the quarter. It is essential to understand that a report must be submitted for every quarter, regardless of the business's payroll activities.

Entering incorrect Employer Registration Numbers or Federal Employer Identification Numbers (FEIN). These unique identifiers are crucial for tracking and must be accurately provided.

Failure to update FEIN when changes occur within the business structure, such as a change in ownership or company name changes. This could lead to misfiling or other legal complications.

Not accurately reporting the total number of employees for each month of the quarter. This can lead to incorrect contribution calculations and potential underpayment or overpayment of dues.

Omitting or inaccurately entering employee information, including Social Security Numbers and the total wages paid during the quarter. Precision in this step is vital for the proper calculation of contributions.

Miscalculating wages in excess of the Taxable Wage Base, leading to incorrect contributions. It's paramount to understand and apply the current Taxable Wage Base correctly.

Incorrectly calculating the total payment due, including contributions, interest, and late penalties. Misunderstandings or miscalculations in this step can result in financial discrepancies.

Neglecting to certify the report with a signature, name, title, and contact phone number. This certification is a legal affirmation that the information provided is accurate to the best of the filer's knowledge.

Here are additional tips to avoid these mistakes:

Always double-check the form for any updates or changes in reporting requirements before submission.

Ensure that all numerical entries, especially those involving finances and Social Security Numbers, are double-checked for accuracy.

Keep a record of all submissions and correspondence with the Department to quickly resolve any issues that may arise.

Consider using the recommended online filing system, as it may have built-in checks that help avoid some of these common errors.

By paying close attention to these details, employers can significantly reduce the risk of potential errors and the complications that might follow. Remember, the goal is not just compliance, but also contributing accurately to the unemployment insurance system, benefiting both employees and the broader community.

Documents used along the form

When businesses in Utah manage their responsibilities related to unemployment insurance, the DWS-UIC Form 33H, or the Utah Employer Quarterly Wage List and Contribution Report, is a primary document used to report wages and calculate contributions. However, managing unemployment insurance obligations often requires several other forms and documents to ensure compliance and accurate reporting. Here is a look at some of these essential documents and a brief description of each.

- Form 33HA: Known as the Utah Employer Quarterly Wage List Continuation Sheet, this form accompanies Form 33H for employers who need to report additional employees beyond what the primary form can accommodate.

- New Hire Reporting Form: Employers are required to report new or rehired employees to a state directory, helping in the detection of unemployment insurance fraud and ensuring compliance with child support enforcement.

- Unemployment Insurance Employee Separation Report: When an employee leaves, this report is used to provide the reasons for separation, helping the state determine eligibility for unemployment benefits.

- Employer Registration Form: Before submitting unemployment contributions, businesses must register with the Utah Department of Workforce Services, using this form to provide business and contact details.

- Wage and Tax Statement (W-2 Form): This IRS form reports an employee's annual wages and the amount of taxes withheld from their paycheck, crucial for verifying income and tax withholding.

- Quarterly Federal Tax Return (Form 941): Used by employers to report income taxes, social security tax, or Medicare tax withheld from employees' paychecks and to pay the employer's portion of social security or Medicare tax.

- Employment Eligibility Verification (Form I-9): Federal law requires employers to verify that all newly hired employees present documentary proof of their identity and eligibility to work in the United States.

- Worker Adjustment and Retraining Notification (WARN) Notice: If a business is closing or laying off a large number of employees, this notice must be provided in advance to the affected employees or their representatives.

- Request for Tax Rate Transfer (UI Form): If there is a change in business ownership, this form allows for the transfer of the unemployment insurance tax rate from one employer to another.

- Power of Attorney (POA) Form: Authorizes a representative to handle tax and unemployment insurance matters on behalf of the employer, including filing forms and making payments.

The landscape of employer responsibilities can be complex, particularly when navigating the nuances of unemployment insurance reporting and contributions. It's crucial for businesses to familiarize themselves with these forms and documents to maintain regulatory compliance and ensure the correct handling of any situation that arises. Proper use and understanding of these documents not only help in fulfilling legal obligations but also in supporting and managing the workforce effectively.

Similar forms

The Form 940 is similar to the 33H form as it is also used by employers to report annual Federal Unemployment Tax Act (FUTA) tax. Both forms are necessary for the calculation and reporting of unemployment taxes, albeit for different levels of government. The 33H form pertains to state unemployment contributions in Utah, while Form 940 is for federal unemployment taxes.

Form 941, the Employer's Quarterly Federal Tax Return, shares similarities with the 33H form as it requires employers to report wages paid, taxes withheld from employees' paychecks, and the employer's portion of Social Security and Medicare taxes. Both forms are filed on a quarterly basis and are essential for compliance with tax obligations.

The W-2 form, or the Wage and Tax Statement, is another document similar to the 33H form. It is issued by employers to report an employee's annual wages and the taxes withheld from their paycheck. The key similarity lies in the requirement to report wage-related information, although the W-2 form is primarily for employee and IRS use.

State-Specific Unemployment Insurance (UI) Tax Forms for other states, like California's DE 9 and DE 9C forms, share a common purpose with Utah's 33H form. They are used to report wages and calculate state unemployment insurance contributions, each tailored to the specific requirements and tax rates of their respective states.

The Form W-3, Transmittal of Wage and Tax Statements, is an annual form that summarizes the information on the W-2 forms an employer issues to their employees. Like the 33H form, it deals with the aggregation and reporting of wage information, but on an annual basis and strictly for federal tax purposes.

The Form W-4, Employee's Withholding Certificate, while primarily used by employees to indicate their tax withholding preferences, indirectly influences the information reported on the 33H form. The allowances claimed on Form W-4 affect the amount of federal income tax withheld, impacting the overall wage and tax calculations employers must report.

The Schedule B (Form 941) is a counterpart to the 33H form for employers who deposit federal employment taxes on a semi-weekly schedule. It details the tax liability associated with each payroll within the quarter. Both documents require detailed, periodic reporting of tax liabilities associated with wages.

Form 1099-NEC, used for reporting non-employee compensation, shares a reporting purpose similar to the 33H form. Though it pertains to contractors as opposed to employees, it requires businesses to report payments made to non-employees, underlining the broader obligation of reporting payments made in the course of business.

Dos and Don'ts

Filling out the DWS-UIC Utah Employer Quarterly Wage List and Contribution Report Form 33H is an essential task for employers within Utah. This form plays a critical role in ensuring accurate reporting for unemployment insurance purposes. Below are important guidelines on what you should and shouldn't do when completing this form:

Things You Should DoAlways ensure that the information provided is accurate and true. This includes verifying the employer name and address, the number of employees each month, employees' names, social security numbers, and total wages paid.

Use the preferred method of filing the report online at the Utah Department of Workforce Services website, as it is typically more efficient and reduces the risk of errors.

Consult the instructions on the back of the form carefully to understand how to calculate and report wages, contributions due, and any applicable interest or penalties.

Double-check that the FEIN (Federal Employer Identification Number) is correctly entered and report any changes in FEIN, business ownership, name, address, or phone number as indicated on the form.

Do not leave any required fields blank. Even if no wages were paid during the quarter, it is important to file the report stating this fact.

Avoid guessing or estimating figures. Ensure all wage and employee information is based on actual payroll records to prevent discrepancies.

Do not ignore the deadlines for submission. Late submissions can result in penalties and interest charges, as stated on the form.

Refrain from using handwriting if possible; type or machine-print the report to ensure clarity and legibility, reducing the chance of errors in processing.

By following these guidelines, employers can fulfill their reporting obligations accurately and efficiently, contributing to the smooth operation of Utah's unemployment insurance system.

Misconceptions

When it comes to the DWS-UIC Form 33H, also known as the Utah Employer Quarterly Wage List and Contribution Report Form, there are several misconceptions that can create confusion for employers. This form is an essential document for reporting wages paid to employees and calculating unemployment insurance contributions in Utah. However, understanding the nuances of the form can be challenging. Here, we clarify seven common misconceptions to assist employers in accurately completing the form.

Online Filing Is Optional: Despite the encouragement towards digital submission, many believe they can choose between online and paper filing based on personal preference. In reality, the Utah Department of Workforce Services (DWS) strongly prefers online filings, as it expedites processing and reduces errors, making it the more efficient option for most employers.

Reporting Zero Wages: A common misunderstanding is the belief that if no wages were paid during a quarter, the form does not need to be filed. On the contrary, the form must be submitted every quarter, regardless of whether wages were paid, ensuring that employer records remain consistent and up-to-date.

Employee Count: Some employers get confused about how to report the number of employees. It's critical to understand that the form requires the number of individuals employed during each month of the quarter, which provides vital data for unemployment insurance purposes and future benefits claims.

Taxable Wage Base: Misinterpretation of the taxable wage base is frequent. Employers should be aware that there is a limit to the wages subject to unemployment insurance contributions for each employee. This can change annually, so it's essential to verify the current taxable wage base to calculate contributions correctly.

Interest and Penalties: Many are unaware that failing to submit the form on time can lead to interest charges and a minimum late penalty. Timely submission is crucial to avoid unexpected costs.

Completeness of Information: The necessity of complete accuracy, including details like employee social security numbers and total wages, is often underestimated. Inaccurate or incomplete forms can lead to processing delays and potential fines.

Form Updates: Lastly, there's a misconception that once familiar with the form, there's no need to review it for updates. The DWS may revise the form or its requirements, hence it's important for employers to check for the latest version before filing each quarter to ensure compliance.

Understanding these misconceptions can greatly assist employers in compiling their quarterly wage reports accurately, thereby ensuring they meet the legal requirements set by the Utah Department of Workforce Services. It helps in avoiding unnecessary fines, penalties, or delays, enhancing the unemployment insurance system's efficiency for both employers and employees.

Key takeaways

When it comes to managing your business's responsibilities, one important task is staying on top of your reporting duties to the government. The DWS-UIC Form 33H, also known as the Utah Employer Quarterly Wage List and Contribution Report, is a critical document for employers in Utah. Here are four key takeaways to guide you through filling out and using this form effectively:

- Online Filing is Preferred: The Utah Department of Workforce Services encourages employers to file this report online. This method is not only environmentally friendly but also efficient, reducing the likelihood of errors and ensuring a faster processing time. The specific website provided for this purpose is http://jobs.utah.gov, which is a hub for various employer-related services and reporting requirements.

- Complete Reporting Even With No Wages Paid: It's mandatory to file the 33H form for each quarter, even if your business hasn't paid wages to employees during that period. This ensures that your records with the Department are up-to-date and reflects your business activity accurately, which is crucial for compliance and potential unemployment insurance purposes.

- Accuracy in Employee Information: The form requires detailed employee information, including social security numbers and total wages paid in the quarter. Ensuring this information is accurate is vital. Mistakes can lead to issues with employee records, potentially affecting their unemployment benefits and leading to penalties for the employer.

- Understanding the Taxable Wage Base: The form mentions a taxable wage base for each employee, which is an important figure for calculating your contributions accurately. This base is the amount of an employee's income that is subject to unemployment insurance taxes. Knowing this figure helps in determining the correct amount of taxes that should be reported and paid, avoiding under or overpayment.

For employers in Utah, staying compliant with the state's reporting requirements is a non-negotiable part of doing business. By paying close attention to the details when filling out the DWS-UIC Form 33H and using the online resources available, employers can ensure they meet their obligations and support their employees' eligibility for benefits, should the need arise.

Popular PDF Forms

De 6 - Employers must check a specific box if reporting solely Voluntary Plan Disability Insurance wages.

Wv Sales Tax Form - It distinguishes between single purchase certificates and blanket certificates to accommodate different buying needs.