Blank 3567 PDF Template

When facing tax liabilities that cannot be settled in a lump sum, California residents might seek relief through the State of California Franchise Tax Board Installment Agreement, a detailed process facilitated by form FTB 3567. This arrangement allows individuals who cannot immediately pay their tax debt in full an opportunity to make payments over time. Eligibility for such an agreement is subject to certain conditions, such as owing less than $25,000 and being able to pay off the liability within 60 months, on top of having all required personal income tax returns filed and not currently being under another installment plan. Applicants must adhere to the agreement's terms, including making monthly payments, maintaining sufficient funds for payments, filing future returns on time, and paying future taxes promptly. A nominal fee is introduced into the debt amount for utilizing the installment plan, with the obligation to certify financial hardship if the debt or payment period exceeds specified thresholds. This plan also introduces the potential for electronic funds withdrawal, providing a streamlined payment process, while outlining penalties for insufficient funds, and addressing the state's right to file a lien against the debtor as a protective measure. Furthermore, the document outlines procedures for applying online, via mail, or phone, and stresses the importance of complete information for processing and the consequences of agreement default or rejection, including the potential for administrative review and continued collection actions.

Preview - 3567 Form

Form Data

| Fact Name | Description |

|---|---|

| Eligibility Criteria | Taxpayers can apply for an installment agreement if their tax liability does not exceed $25,000, the installment period does not exceed 60 months, they have filed all required tax returns, and they are not currently in another installment agreement. |

| Financial Hardship Consideration | If the owed amount exceeds $10,000, or the payment period exceeds 36 months, taxpayers must certify financial hardship. This may subject the agreement to periodic reviews. |

| Electronic Funds Transfer (EFT) Authorization | Taxpayers must complete and sign EFT Authorization on PAGE 3 of FTB 3567 for automatic monthly withdrawals. They need to choose a withdrawal date no later than the 28th of each month. |

| Governing Laws | The installment agreement is governed by the State of California laws, specifically Government Code Sections 7170-7173 concerning state tax liens. Additionally, California Revenue and Taxation Code Section 19011.5 mandates electronic payments for taxpayers meeting certain criteria. |

Instructions on Utilizing 3567

Filling out the Form 3567 involves a series of steps designed to establish an installment agreement with the State of California Franchise Tax Board. This process aids individuals who are unable to pay their tax liability in full, allowing for payments over time. Pay close attention to the details required and follow every step diligently to ensure accurate submission. The completion of this form is critical for those seeking financial relief through an installment plan.

- Read through PAGE 1 of FTB 3567 carefully to understand the taxpayer installment agreement conditions.

- Ensure you meet the eligibility criteria outlined in the form.

- Head to PAGE 3 of FTB 3567 to the section titled "State of California Franchise Tax Board Installment Agreement Request."

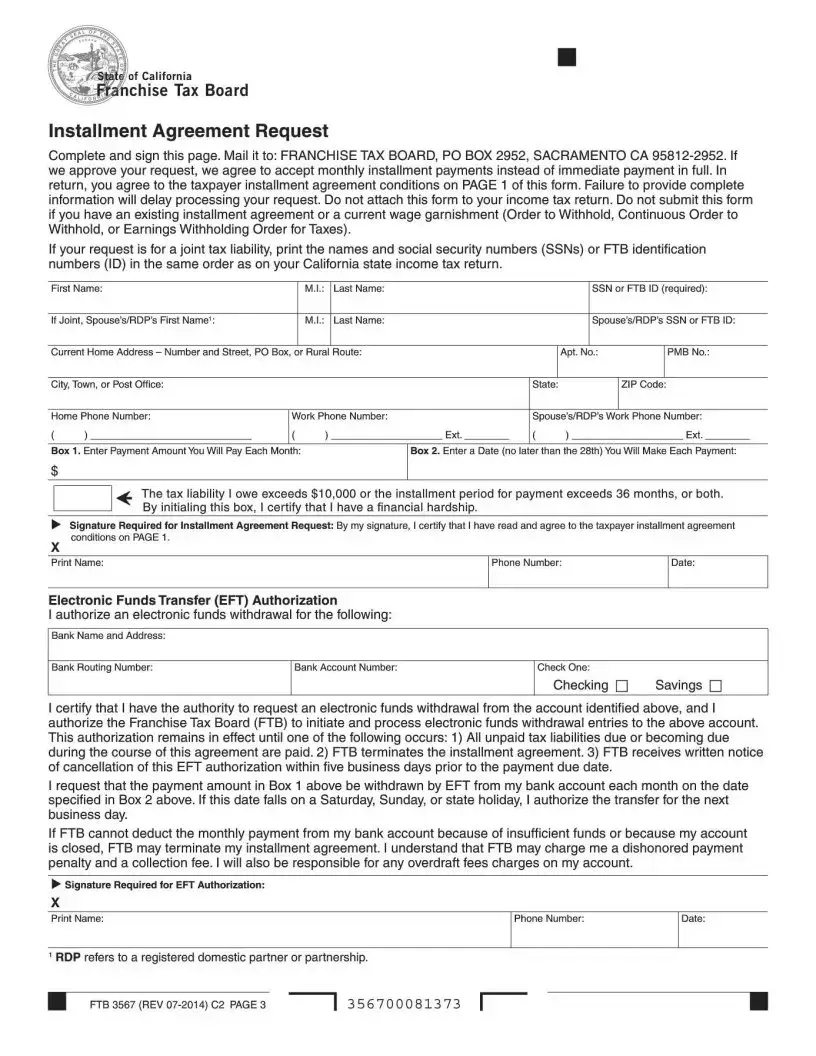

- Provide the taxpayer's information:

- First Name, M.I. (Middle Initial), Last Name

- If filing jointly, add the Spouse's/RDP’s First Name, M.I., and Last Name

- Fill in your current home address, including the City, Town, or Post Office, State, and ZIP Code.

- Enter both the taxpayer's and if applicable, the spouse/RDP's Social Security Numbers (SSNs) or Franchise Tax Board Identification Numbers (FTB IDs).

- Include contact information - home phone number, work phone number, and if applicable, spouse’s/RDP's work phone number.

- In Box 1, specify the monthly payment amount you commit to paying.

- In Box 2, enter the date (no later than the 28th) each month that you will make the payment.

- If applicable, initial the box indicating that your tax liability exceeds $10,000 or the installment period for payment exceeds 36 months, or both, signifying financial hardship.

- Sign and date the form to certify your commitment to the installment agreement conditions mentioned on PAGE 1.

- For EFT Authorization (if you choose to enable automatic withdrawals):

- Provide the Bank Name and Address, Bank Routing Number, and Bank Account Number.

- Check the appropriate box to indicate whether it’s a Checking or Savings account.

- Sign and date the EFT Authorization section to permit the FTB to initiate monthly withdrawals.

- Mail the completed and signed PAGE 3 to: STATE OF CALIFORNIA, FRANCHISE TAX BOARD, PO BOX 2952, SACRAMENTO CA 95812-2952.

Following the submission of Form 3567, anticipate communication from the Franchise Tax Board. If the installment agreement request is accepted, you will receive a notice detailing your monthly payment amount, due dates, and when the first payment must be made. Conversely, if the request is rejected, you have the right to appeal in writing within 30 days. It’s important to maintain compliance with all installment agreement conditions to avoid termination of the plan.

Obtain Answers on 3567

FAQs about the 3567 Form - State of California Franchise Tax Board Installment Agreement Request

What is the purpose of the 3567 form?

The 3567 form is used to request an installment agreement with the State of California Franchise Tax Board if you are unable to pay your full tax liability immediately. It allows eligible taxpayers to make payments over time.

Who is eligible for an installment agreement?

You may be eligible if your tax liability does not exceed $25,000, the installment period does not exceed 60 months, you have filed all required personal income tax returns, and you are not currently in an installment agreement.

What conditions must I agree to for an installment agreement?

You must agree to make timely monthly payments, maintain sufficient funds for payments, file future tax returns on time, pay all future taxes when due, and pay a $34 installment agreement fee that will be added to your tax liability. Additional conditions apply for liabilities over $10,000 or agreements exceeding 36 months, including certifying financial hardship.

How can I request an installment agreement?

You can request an agreement online by searching "installment agreement" on the ftb.ca.gov website, by mail using page 3 of the FTB 3567 form, or by phone at 800.689.4776.

What happens if I don't select an EFT withdrawal date or select a date after the 28th?

If you don't select a withdrawal date, or if the date is after the 28th of the month, the FTB will automatically withdraw the funds on the 28th of each month. Failure to select a date may delay the processing of your request.

What are the consequences of insufficient funds in my bank account?

Insufficient funds can result in dishonored payment penalties and possible termination of your installment agreement. It's important to ensure your bank account has enough funds to cover each payment until the tax liability is paid in full.

Will the Franchise Tax Board file a lien against me?

The Franchise Tax Board may file a state tax lien to protect the state's interest until your tax liability is paid off. This can impact your credit report.

What if I cannot make electronic payments?

If you are not required to make payments electronically, you can pay by check, money order, or through other online options like Web Pay or credit card. Be sure to include your account number on your payment.

What happens if my installment agreement request is accepted or rejected?

If accepted, you will receive a notice confirming your monthly payment amount, due date, and when the first payment is due. If rejected, you may request an independent administrative review within 30 days of the rejection notice.

Can future state or federal refunds be applied to my tax liability?

Yes, the FTB will apply any state tax refunds due to you toward your tax liability. Your account may also be submitted to the Federal Treasury Offset Program, where federal refunds or payments are used to satisfy your tax debt.

Common mistakes

Filling out any official form requires attention to detail, especially when it's related to taxes and financial agreements. When it comes to completing the Form 3567, the Installment Agreement Request for the State of California Franchise Tax Board, there are common pitfalls to avoid. Here are four mistakes people often make:

-

Not providing complete information: Every section of the form needs your attention. Skipping areas or leaving them incomplete can delay the processing of your request. Make sure you double-check each field and provide all the required information.

-

Selecting a payment date incorrectly: The form specifies that the automatic withdrawal date for your payment must be no later than the 28th day of the month. Choosing a date after the 28th or failing to select a date at all can result in processing delays or issues with your payment schedule.

-

Assuming eligibility: Just because you need an installment plan does not automatically mean you qualify for one. The form outlines specific eligibility criteria, such as owing no more than $25,000, being within a 60-month payment period, and having filed all required tax returns. It's essential to review these criteria carefully before submitting your request.

-

Ignoring electronic payment requirements: Depending on the amount you owe or your previous payment history, you might be required to make payments electronically. Not adhering to these requirements, especially the mandatory e-pay stipulations for larger liabilities or estimated tax payments over certain thresholds, can result in penalties. Always verify whether these requirements apply to you.

Avoiding these mistakes not only speeds up the process but also ensures that you remain compliant with the State of California Franchise Tax Board's requirements. Keeping these points in mind while filling out the Form 3567 can make your experience smoother and more efficient.

Documents used along the form

When navigating the complexities of setting up a payment plan with the State of California Franchise Tax Board (FTB) using Form 3567, the Installment Agreement Request, understanding additional forms and documents that may be required or beneficial can help streamline the process. These documents not only support the installment agreement application but also address other aspects of one’s financial situation and obligations to the state.

- Form DE 4: Employment Development Department (EDD) Employee's Withholding Allowance Certificate. This form is used by employees to determine the amount of state income tax to be withheld from their wages. As part of the installment agreement conditions, the FTB requires the taxpayer to ensure that withholding rates are sufficient to cover their state income tax liability.

- IRS Form W-4: Employee’s Withholding Certificate. Like the DE 4, this form is critical for accurately determining federal tax withholdings. Though primarily for federal purposes, adjustments to this form can affect one’s overall tax situation, especially when state and federal tax liabilities intersect.

- FTB 1140: Personal Income Tax Collection Information. This pamphlet provides detailed information about payment options, the collection process, and what actions the Franchise Tax Board may take to collect outstanding debts. It’s a vital resource for understanding the broader implications of entering into an installment agreement.

- Request for Waiver of Penalty Fee and Interest: While not a standardized form, a written request to waive penalty fees and interest due to reasonable cause can be submitted alongside Form 3567. If a taxpayer faces exceptional circumstances that lead to their tax debt, this letter can plead their case.

- Power of Attorney (POA) Declaration: If a taxpayer chooses to have a tax professional represent them in dealings with the FTB, completing a POA declaration is necessary. This form authorizes an individual or organization to receive confidential information and act on behalf of the taxpayer.

Together, these forms and documents play crucial roles in establishing a compliant and manageable approach to paying off tax liabilities through an installment agreement with the FTB. Ensuring that all requisite forms are accurately completed and submitted, alongside Form 3567, can significantly increase the chances of successfully negotiating a payment arrangement that aligns with the taxpayer's financial capabilities while remaining in good standing with tax obligations.

Similar forms

The IRS Form 9465, Installment Agreement Request, is quite similar to the FTB 3567 form. Both forms serve as requests for payment plans, allowing taxpayers to pay their debt in installments when they cannot afford to pay in full. They outline the conditions under which taxpayers may enter into agreements, such as owing a certain amount and having filed all required tax returns. Furthermore, these forms require personal information, the proposed monthly payment amount, and banking information for electronic fund transfers.

The Form 433-F, Collection Information Statement, shares similarities with the FTB 3567 form in that it is used by taxpayers to provide financial information to the taxing authority when requesting a payment plan or other collection alternative. Although the 433-F focuses more on detailed financial analysis for determining a taxpayer's ability to pay, both forms are integral tools for individuals seeking relief from immediate full payment of tax liabilities.

The Offer in Compromise (OIC) application forms (such as the IRS Form 656 and related documents) bear resemblance to the FTB 3567 form in their objective of tax debt resolution. While the OIC program allows taxpayers to settle their tax debt for less than the full amount owed, the installment agreement request form seeks to arrange a payment plan. Both processes require disclosure of financial status and are designed to help individuals comply with their tax responsibilities in situations of financial hardship.

The Direct Debit Installment Agreement (DDIA) component, incorporated within broader payment plan requests like in the FTB 3567 form, shares a direct similarity by mandating taxpayers to agree to automatic withdrawals from their bank accounts. Although DDIA refers specifically to the mechanism of payment rather than the agreement itself, it’s a common feature in forms like FTB 3567 that stipulate terms for taxpayers to fulfill their liabilities over time, including the provision of bank routing and account numbers for the setup of electronic payments.

Dos and Don'ts

When dealing with the State of California Franchise Tax Board Installment Agreement Request, known as form 3567, it's crucial to pay attention to the details, not only to ensure timely processing but also to avoid potential errors that could delay or invalidate your request. Here's a concise guide on what you should and shouldn't do:

- Do ensure all personal income tax returns are filed before submitting the form. It's a key eligibility requirement for the installment agreement.

- Do decide on and stick to the highest possible monthly payment you can afford. This approach helps reduce the accrued interest and penalties over time.

- Do maintain sufficient funds in your bank account to cover each monthly payment to avoid dishonored payment penalties.

- Do complete and sign the electronic funds transfer (EFT) Authorization if you opt for automatic monthly withdrawals, ensuring you choose a withdrawal date no later than the 28th of each month.

- Do check the eligibility criteria carefully, especially regarding your tax liability amount and the installment period. Your tax liability must not exceed $25,000, and the installment period must not exceed 60 months.

- Do accurately identify your bank routing and account numbers for the EFT Authorization. Avoid using a deposit slip for these details.

- Do carefully review and agree to the taxpayer installment agreement conditions outlined on page 1 of the form, including making timely payments and filing all required returns.

- Don't submit the form if you already have an existing installment agreement or wage garnishment in place. In these cases, contact the tax board directly for guidance.

- Don't leave any required fields incomplete, as this will delay the processing of your request.

- Don't select an automatic withdrawal date for the electronic funds transfer that falls after the 28th day of the month.

- Don't underestimate the importance of certifying financial hardship if your tax liability exceeds $10,000 or your installment period exceeds 36 months.

- Don't forget to sign and date both the Installment Agreement Request and the EFT Authorization sections on page 3.

- Don't ignore the mandatory e-Pay requirements if your estimated tax or extension payment exceeds $20,000, or your tax liability exceeds $80,000 for any taxable year beginning on or after January 1, 2009.

- Don't use the form to change the withholding rates with your employer. If necessary, adjust your Employment Development Department Form DE 4 and Internal Revenue Service W-4 forms separately.

By following these guidelines, you can smoothly navigate the submission of form 3567 and establish an installment agreement with the State of California Franchise Tax Board. This not only aids in managing your tax obligations but also helps maintain good standing with state tax authorities.

Misconceptions

There are several common misconceptions about the State of California Franchise Tax Board Installment Agreement Request, form number 3567. Understanding what the form entails and how it operates can help individuals and households navigate their tax liabilities more effectively. Here are nine common misunderstandings:

- All taxpayers are eligible for the installment agreement. In reality, eligibility is limited. Taxpayers must owe $25,000 or less, and the installment period cannot exceed 60 months. Additionally, all required valid personal income tax returns must have been filed, and the taxpayer cannot already be in an installment agreement.

- The installment agreement pauses interest and penalties on the tax owed. This is incorrect. Interest and applicable penalties continue to accrue on the unpaid tax liability until it is paid in full, emphasizing the importance of making the largest monthly payment feasible.

- There's a one-time fee for setting up an installment agreement. While there is a setup fee of $34, it's added to the tax liability rather than being a separate, upfront payment. Moreover, the amount is subject to change without notice.

- Taxpayers don't need to certify financial hardship for every installment agreement. If the owed amount exceeds $10,000 or the installment period is longer than 36 months, the taxpayer must indeed certify financial hardship.

- Once approved, the installment agreement terms are fixed and cannot be reviewed or altered. Installment agreements, especially in cases of financial hardship, are subject to periodic review. The conditions can change based on financial circumstances or compliance with tax laws.

- Completing an EFT Authorization is optional for all taxpayers. For those who choose the convenience of Electronic Funds Transfer (EFT), completing and signing the EFT Authorization on PAGE 3 of FTB 3567 is mandatory. This authorizes automatic monthly withdrawals from the taxpayer's bank account.

- Any bank account can be used for EFT Authorization. Taxpayers must use a regular checking or savings account for EFT and ensure the bank routing and account numbers are correctly entered. Deposit slips should not be used to find this information.

- Failure to make electronic payments doesn’t incur penalties. If a taxpayer is required to make payments electronically due to either estimated tax or extension payments exceeding $20,000, or their tax liability exceeds $80,000 for any taxable year beginning on or after January 1, 2009, failure to comply results in a penalty of 1% of the amount paid.

- State tax liens are an option, not a requirement, for the Franchise Tax Board when dealing with delinquent taxpayers. The truth is, the state may file a tax lien to protect its interest until the full tax liability is paid off. This action can significantly affect an individual's credit report.

Correcting these misconceptions can provide clarity and ease the stress associated with managing outstanding tax liabilities with the State of California. Being well-informed about the nuances of Form 3567 and the associated processes enables taxpayers to make better decisions for their financial health.

Key takeaways

When you find yourself unable to pay your tax liability to the State of California in full, the Form 3567, Installment Agreement Request, becomes an invaluable option. Here are five key takeaways about this process:

- An installment agreement allows you to make monthly payments over time if you owe $25,000 or less and can pay off the liability within 60 months, provided you've filed all required valid personal income tax returns and are not currently in an installment agreement.

- To maintain your installment agreement, you must make your payments on time each month, ensure your bank account has sufficient funds, file all future tax returns on time, and pay all future tax liabilities promptly. Additionally, a $34 fee will be added to your tax balance.

- You must complete and sign the Electronic Funds Transfer (EFT) Authorization on the form if you intend to make payments directly from your bank account. This enables the Franchise Tax Board (FTB) to automatically withdraw your payment monthly. Always ensure there are enough funds in your account to cover the monthly payment to avoid penalties or termination of the installment agreement.

- If your tax liability or installment payment period surpasses certain thresholds, you may be required to prove financial hardship, and your agreement could be subject to periodic review. This ensures that you are still in a position where continuing the payment plan is necessary due to your financial condition.

- The Franchise Tax Board provides several ways to apply for an installment agreement, including online, by mail, or by phone. Once submitted, the FTB will approve or reject your request based on your ability to pay and your compliance history. In case of a rejection, you have the right to request an administrative review.

Filling out Form 3567 accurately and submitting it on time is crucial for setting up a manageable installment plan with the California Franchise Tax Board. This formality not only helps in structurally organizing your tax payments but also in maintaining good standing with tax authorities by showing your commitment to resolving your tax liabilities.

Popular PDF Forms

Dfas Notification Of Death - Structured to provide clear instruction for reporting the death of a military retiree, mitigating against overpayment risks.

Inspection Palpation Percussion and Auscultation - Aids in the assessment of sensory losses, directing attention to aids and adaptations that can improve the resident's functional independence.

Air National Guard Retirement - Submission instructions and contact information for relevant Armed Forces headquarters provided.