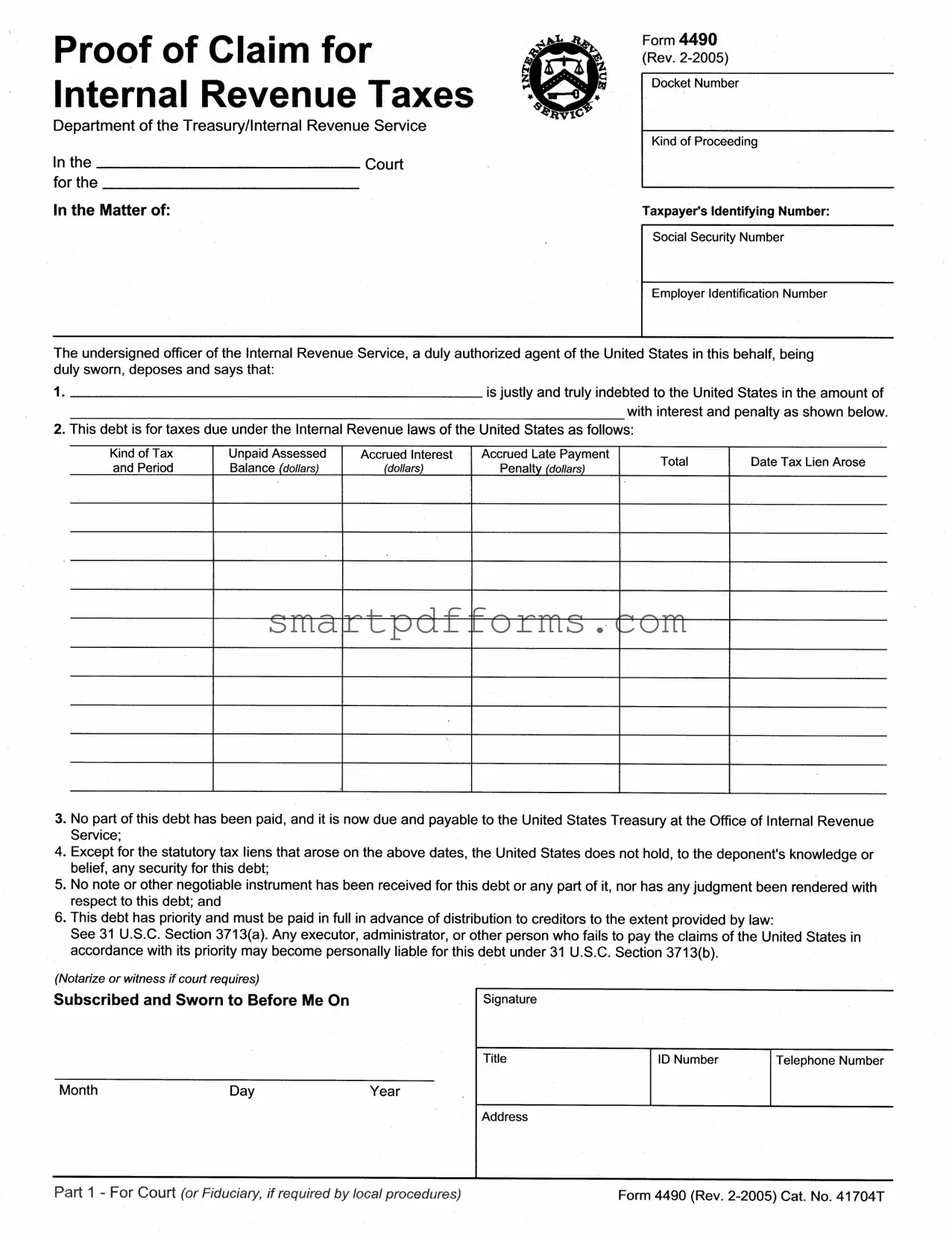

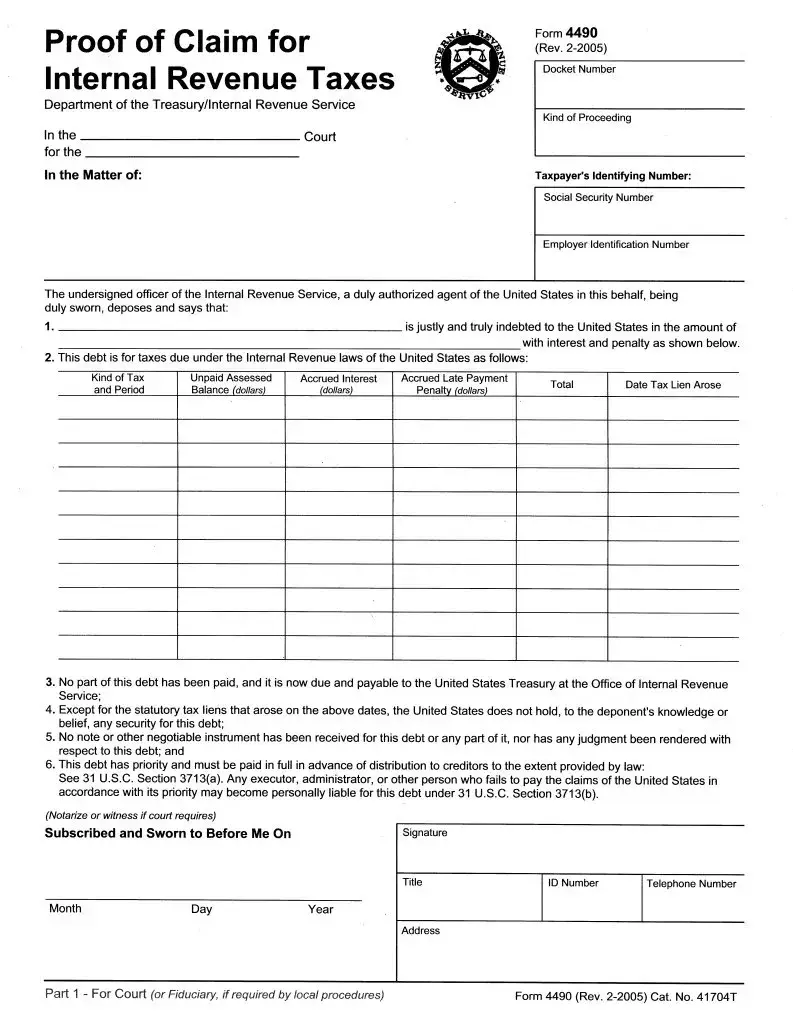

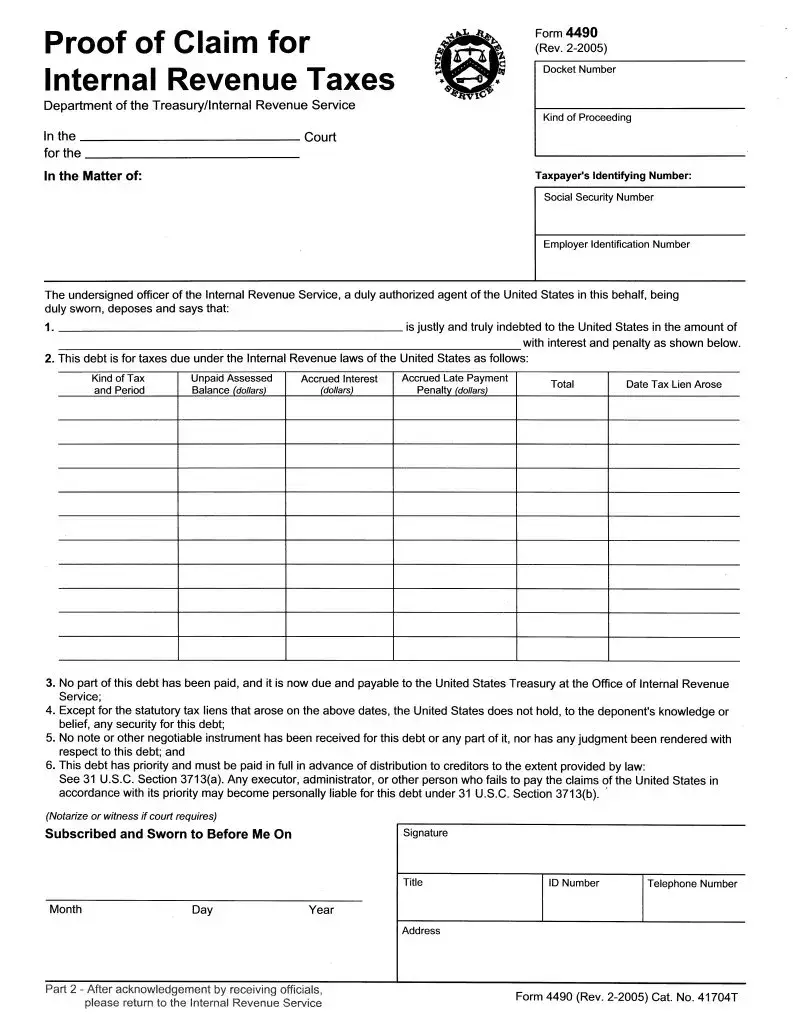

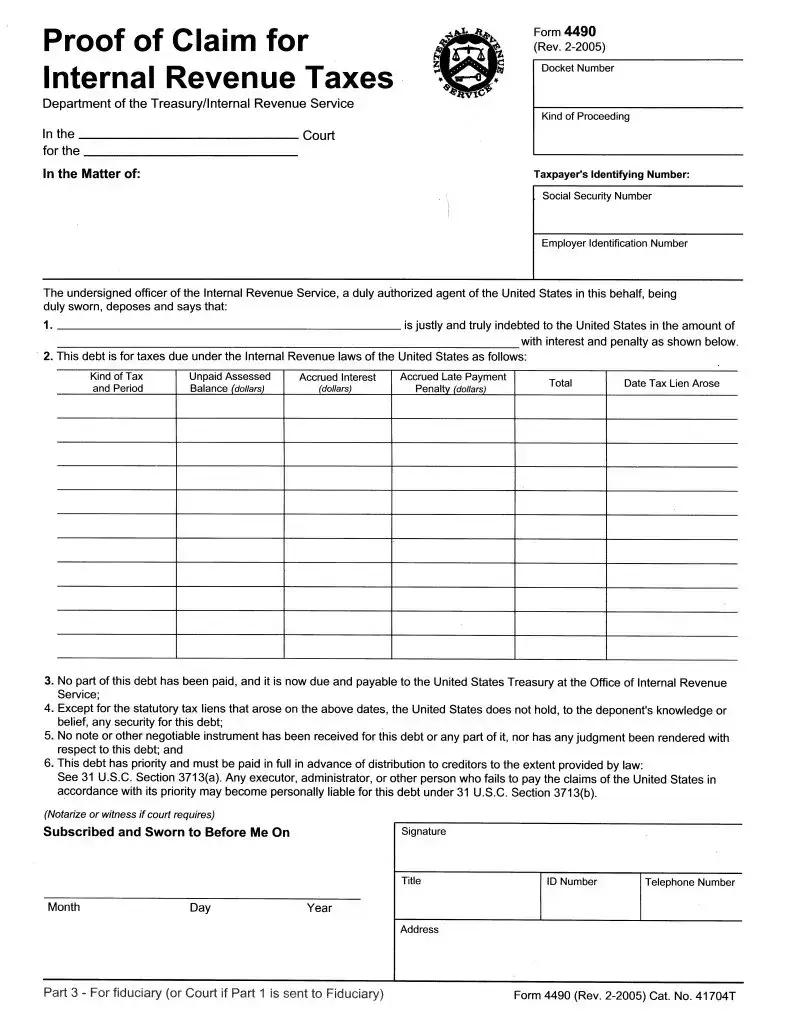

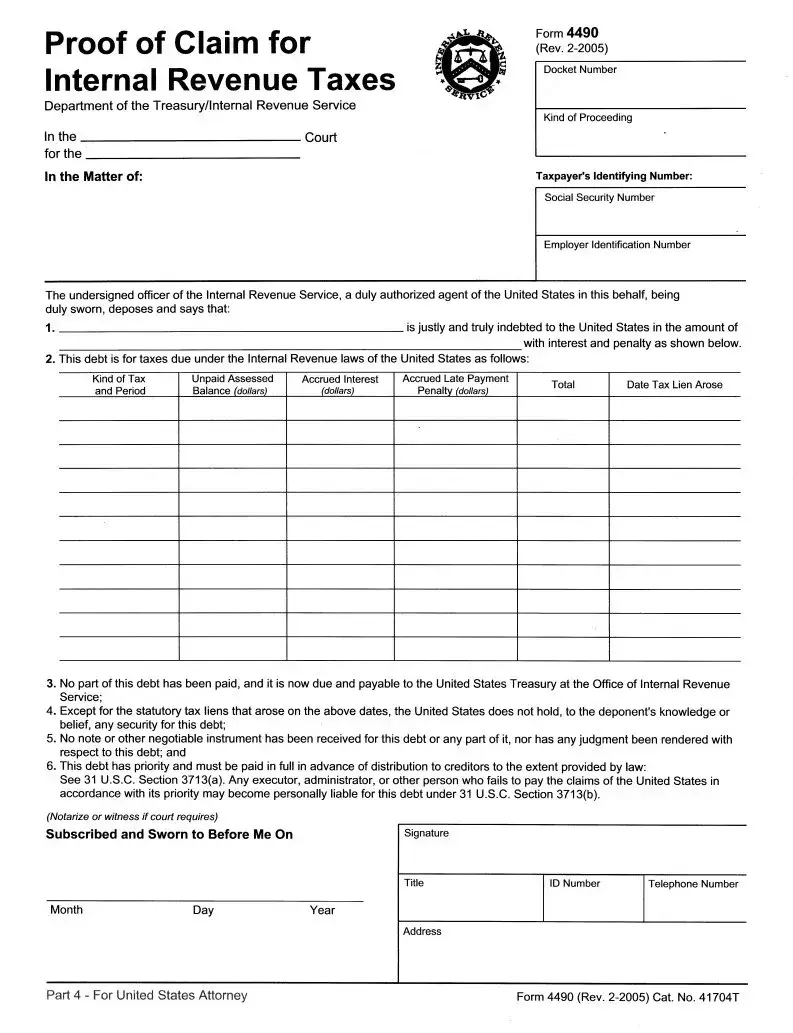

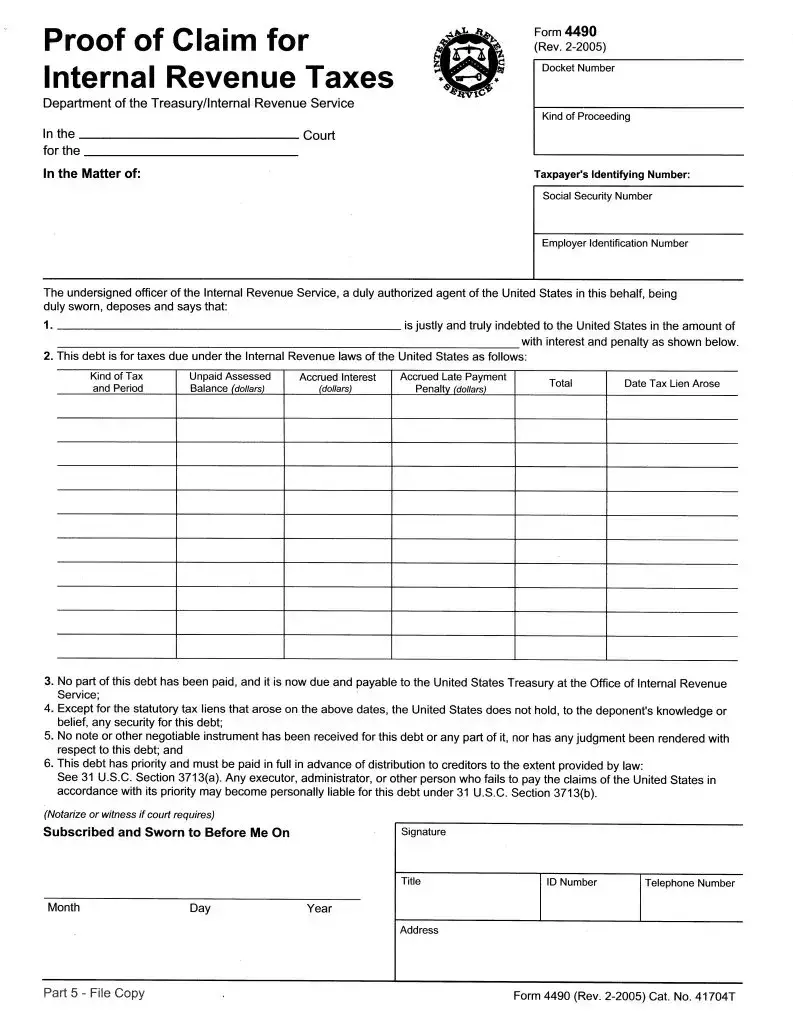

Blank 4490 PDF Template

In the realm of financial obligations to the United States, especially in matters concerning internal revenue taxes, the Form 4490 stands as a crucial document issued by the Department of the Treasury/Internal Revenue Service. This form, formally titled "Proof of Claim for Internal Revenue Taxes," serves as a declaration by a duly authorized agent of the United States, typically an officer of the Internal Revenue Service, asserting that an individual or entity is indebted to the United States for unpaid taxes, inclusive of any interest and penalties accrued over time. The form meticulously details the type of tax, the period for which taxes were assessed but remained unpaid, and the total amount due—including specific breakdowns of the unpaid tax, assessed interest, and late payment penalties. Importantly, it highlights the government's claim to priority payment over other creditors, a principle supported by law under 31 U.S.C. Section 3713(a), which mandates that debts owed to the United States are to be paid before others. This provision ensures that, in the instance of insolvency or the distribution of an estate, the government's claim is given precedence. Moreover, a warning is underlined that any executor, administrator, or similar party who neglects or fails to satisfy these claims as per their statutory priority risks personal liability as per 31 U.S.C. Section 3713(b). The form, which is to be notarized or witnessed if required by court procedures, emboldens the seriousness of these claims and outlines a structured path for acknowledgment and processing by various judicial and administrative bodies, thereby safeguarding the fiscal interests of the United States with rigor and precision.

Preview - 4490 Form

Form Data

| Fact Name | Description |

|---|---|

| Form Identification | Form 4490 (Rev. 2-2005), Proof of Claim for Internal Revenue Taxes |

| Purpose | Used by the Internal Revenue Service to claim taxes owed by a debtor in proceedings. |

| Prioritization of Debt | Debts outlined in this form have priority and must be paid before distribution to other creditors as mandated by 31 U.S.C. Section 3713(a). |

| Liability for Non-Payment | Executors, administrators, or others failing to pay as per the form's stipulations may become personally liable under 31 U.S.C. Section 3713(b). |

Instructions on Utilizing 4490

Filling out the Form 4490, Proof of Claim for Internal Revenue Taxes, is a crucial step in ensuring compliance with the United States' Internal Revenue laws in particular legal proceedings. This document, once completed, serves as a formal claim filed by the Internal Revenue Service (IRS) to detail and assert the U.S. government's priority to collect unpaid taxes from a debtor. Accurately completing this form is essential for the process to move forward efficiently and lawfully. The following steps are designed to guide individuals through the necessary parts of the form, ensuring clarity and compliance with IRS requirements.

- Start by entering the name of the court where the claim is being filed in the provided space at the top of the form.

- Fill in the matter or case name in the next field titled "In the Matter of:".

- Proceed to enter the docket number and the kind of proceeding in their respective fields.

- Identify the taxpayer by filling in the taxpayer's identifying number. Use the Social Security Number (SSN) field for individuals or the Employer Identification Number (EIN) field for businesses.

- In the section that begins with "The undersigned officer of the Internal Revenue Service..," print your name if you are authorized to act on behalf of the IRS.

- Detail the debt owed by the taxpayer to the United States, including the amount of tax due, interest, penalties, kinds of tax (such as income tax, employment tax, etc.), and total amount due. Use the table provided to itemize these specifics clearly.

- Make a declaration that no part of the debt has been paid, it is due and payable, any security the United States holds, the receipt of any negotiable instrument for the debt, and the priority of this debt. Each of these declarations corresponds to numbered statements on the form.

- For the statement regarding the priority of the debt and potential personal liability under 31 U.S.C. Section 3713(b), re-read and ensure understanding before proceeding.

- The form must be notarized or witnessed, as required by court rules. Fill in the date of submission, and have the form notarized, including the ID number of the notary, the notary's signature, title, address, and telephone number.

- Finally, ensure that all parts of the form are filled out as required by local procedures, including any sections specifically designated for court use, fiduciary use, or other designations indicated in the form's various parts.

After completing and notarizing the Form 4490, it should be submitted to the appropriate court or entity as directed by local procedures. This step is crucial in the process of claiming the government's right to collect unpaid taxes. Timely and accurate submission of Form 4490 ensures that the claim is recognized and processed according to the law, thereby facilitating a fair resolution in accordance with the United States' Internal Revenue laws.

Obtain Answers on 4490

What is Form 4490?

Form 4490, titled "Proof of Claim for Internal Revenue Taxes," is a document issued by the Department of the Treasury/Internal Revenue Service. It's used to officially assert the United States government's claim for unpaid taxes, including interest and penalties, from an entity or individual in legal or bankruptcy proceedings. An authorized IRS officer must duly sign and swear to the form, declaring the taxpayer's debt to the United States as outlined under Internal Revenue laws.

When is Form 4490 used?

Form 4490 comes into play during legal or bankruptcy proceedings when there's a need to establish a record of claim against a taxpayer for unpaid taxes. It serves to notify the court and involved parties of the government's claim priority on the debtor's assets for taxes owed. It's especially relevant in situations where the distribution of an estate or bankruptcy assets is being decided, ensuring that tax debts are recognized and prioritized according to law.

What information is required on Form 4490?

To complete Form 4490, specific details concerning the tax debt must be provided. This includes the taxpayer's identifying number (Social Security Number or Employer Identification Number), the type of taxes owed, the periods for which taxes haven't been paid, the amounts of unpaid taxes, assessed interest, late payment penalties, and the total debt. Additionally, the form must indicate the date when tax liens arose and affirm that no security holds or payments have been made towards settling the debt.

What happens if someone fails to satisfy the claims made on Form 4490?

If an executor, administrator, or any individual responsible for managing a debtor's estate fails to prioritize the payment of claims made by the United States on Form 4490, they may become personally liable for the debt. This is regulated under 31 U.S.C. Section 3713(b), emphasizing the legal mandate to settle government claims for unpaid taxes before distributing assets to other creditors.

Does Form 4490 need to be notarized or witnessed?

The requirement for notarization or witnessing of Form 4490 varies depending on court requirements. Typically, the court or legal procedure governing the bankruptcy or estate case will dictate whether the form needs to be formally notarized or simply signed in the presence of witnesses. It's crucial to adhere to the specific instructions given to ensure the form's validity.

Who is authorized to sign Form 4490?

Form 4490 must be signed by an officer of the Internal Revenue Service who is duly authorized to act on behalf of the United States in tax matters. This ensures that the claim for unpaid taxes is formally recognized and carries the weight of the government's authority in the legal proceedings.

Where should Form 4490 be submitted?

After being properly filled out and signed, Form 4490 should be submitted to the applicable court handling the legal or bankruptcy proceedings of the debtor. Additionally, a copy of the form needs to be returned to the Internal Revenue Service, ensuring that the agency is aware of the ongoing claim process and can track the status of its tax claim against the taxpayer.

Common mistakes

Filling out Form 4490, Proof of Claim for Internal Revenue Taxes, can be a meticulous process. It’s essential to approach this task with care to ensure accuracy and compliance. Unfortunately, people often make errors during this process. Avoiding these common mistakes can help streamline the process and avoid potential issues.

- Incorrect Taxpayer Identifying Number: Mistyping or omitting Social Security Numbers (SSN) or Employer Identification Numbers (EIN) can lead to the misprocessing of the form.

- Failing to Detail the Kind of Tax and Periods: It’s crucial to specify the types of taxes due (e.g., income, employment) and the periods they cover. Generalizations or inaccuracies here can lead to confusion or incorrect assessments.

- Omitting Interest and Penalty Amounts: Not including the specific interest and penalty amounts, as accrued up to the submission date, is a common oversight that can result in underreported liabilities.

- Miscalculating Total Amount Owed: Simple mathematical errors in adding the unpaid balance, interest, and penalties can lead to incorrect total claims.

- Failure to Acknowledge Payments Made: If any part of the debt has been paid prior to the submission, failing to indicate this can result in overstating the amount due.

- Neglecting to Notarize or Witness the Form if Required: Depending on court requirements, some forms need to be notarized or witnessed, and overlooking this step can delay processing.

- Incorrect or Incomplete Contact Information: Providing wrong or incomplete contact details makes it difficult for the IRS or the court to follow up, potentially causing delays.

- Assuming Priority of Debt Without Verification: Illegitimately assuming or misstating the priority of the debt according to 31 U.S.C. Section 3713(a) without proper legal basis can lead to legal complications.

Accurately addressing these areas on Form 4490 requires attention to detail and a comprehensive understanding of the debt obligations owed to the United States Treasury. Proper diligence ensures claims are processed efficiently, reducing the risk of delays or legal challenges. When in doubt, consulting with a legal or tax professional can provide valuable assistance and peace of mind during this process.

Documents used along the form

When dealing with the Form 4490, Proof of Claim for Internal Revenue Taxes, it's important to understand that this document is just one piece of a larger puzzle in managing and resolving tax obligations with the U.S. government. Various other forms and documents often accompany or tie into the processing of Form 4490, each serving its unique role in ensuring comprehensive management of a taxpayer's account or estate's financial responsibilities to the Treasury.

- Form 1040: U.S. Individual Income Tax Return. This is the basic form used by individuals to file their annual income tax returns with the IRS. It's crucial for calculating the taxpayer's total taxable income, tax due, and any refunds owed.

- Form 706: United States Estate (and Generation-Skipping Transfer) Tax Return. This form is used by the executor of an estate to report the estate’s tax liability. It’s essential when the decedent’s property transfer includes amounts subject to federal estate taxation.

- Form 433-A: Collection Information Statement for Wage Earners and Self-Employed Individuals. This document provides the IRS details about the taxpayer's financial situation, helping to determine payment plans for outstanding tax debts.

- Form 2848: Power of Attorney and Declaration of Representative. This form allows taxpayers to grant a qualified individual the authority to represent them before the IRS, handling matters related to tax debts and obligations.

- Notice of Federal Tax Lien: A legal claim against a taxpayer's property when they neglect or fail to pay a tax debt. The lien protects the government’s interest in all your property, including real estate, personal property, and financial assets.

Together, these documents contribute to a thorough approach in managing one’s tax affairs, especially when complex issues such as tax debts, liens, or estate taxes are concerned. Understanding each document's purpose aids in navigating the occasionally tricky waters of tax obligation fulfillment, ensuring compliance and minimizing potential legal complications with the IRS.

Similar forms

The IRS Form 1040, which is the U.S. Individual Income Tax Return, is similar to Form 4490 in that it addresses tax obligations to the United States, although it is used by individuals to file their annual income taxes.

IRS Form 941, the Employer's Quarterly Federal Tax Return, shares similarities with Form 4490 as it involves reporting taxes owed by employers, including social security and Medicare taxes.

The W-2 Form, also known as the Wage and Tax Statement, is given to employees and the IRS by employers. It’s similar to Form 4490 because it deals with taxes withheld from employees' wages for income, social security, or Medicare tax.

Form 1065, U.S. Return of Partnership Income, is akin to Form 4490 as it involves reporting the income, gains, losses, deductions, and credits of a business partnership to the IRS.

The Bankruptcy Proof of Claim Form (Official Form 410) has parallels to Form 4490 because it is used to claim a right to receive a payment from a bankruptcy estate, including tax debts owed to the creditor.

IRS Form 1120, the U.S. Corporation Income Tax Return, is similar to Form 4490 because it involves reporting the income, losses, and taxes of corporations.

IRS Form 990, Return of Organization Exempt from Income Tax, relates to Form 4490 in its aim to disclose financial information and ensure non-profits comply with tax laws.

The Offer in Compromise Form (IRS Form 656) differs in purpose but is related to Form 4490 in dealing with tax liabilities, by allowing taxpayers to settle their debt for less than the full amount.

IRS Form 433-A, Collection Information Statement for Wage Earners and Self-Employed Individuals, is associated with Form 4490 by its focus on the financial information of individuals to determine tax liabilities.

IRS Form 8821, Tax Information Authorization, is not a direct counterpart but relates to Form 4490 by allowing individuals or entities to authorize others to review and discuss their tax information with the IRS.

Dos and Don'ts

When dealing with the Form 4490 for the Proof of Claim for Internal Revenue Taxes, it's crucial to approach the task with attention to detail and accuracy. Below is a list of dos and don'ts that will guide you through the process efficiently and effectively.

Do:- Verify the accuracy of all taxpayer identification numbers, such as Social Security Number or Employer Identification Number, before submission.

- Ensure that the kind of tax, period, unpaid balance, assessed interest, and penalties are clearly and accurately stated.

- Confirm that the total debt amount, including interest and penalties, is correctly calculated.

- Double-check that no payments have been made towards the debt that haven’t been accounted for in the form.

- Make sure to have the form notarized or witnessed if required by the court.

- Overlook the importance of stating the date when the tax lien arose; this information is critical.

- Forget to confirm that, to the best of your knowledge, the United States does not hold any security for the debt outside of statutory tax liens.

- Ignore the requisite to disclose whether any note, negotiable instrument, or judgment has been received or rendered against the debt.

- Submit the form without reviewing the implications of 31 U.S.C. Section 3713(a) and (b) regarding the priority of the debt and potential personal liability for non-payment.

- Fail to provide the contact information and signature of the sworn IRS officer or authorized agent, which validates the submission.

Approaching Form 4490 with thoroughness and care ensures that the claim for the internal revenue taxes is submitted correctly and efficiently, reflecting the due diligence required in tax matters.

Misconceptions

When dealing with the Form 4490, "Proof of Claim for Internal Revenue Taxes," misconceptions can lead to misunderstandings and mistakes in handling tax liabilities. Here are ten common misconceptions about Form 4490 and the facts that clarify these misunderstandings:

Form 4490 is for individual taxpayers to claim refunds. Actually, Form 4490 is used by the IRS to file a claim in bankruptcy proceedings or similar cases, stating that a debtor owes taxes to the U.S. government.

Any IRS officer can fill out and submit Form 4490. In truth, only an authorized IRS officer can complete and submit this form, as it asserts a claim on behalf of the United States for unpaid taxes.

Form 4490 covers all types of debts. This form specifically pertains to taxes due under the Internal Revenue laws, including interest and penalties, not all types of debts.

The form must be notarized. While the form requires a signature from a duly authorized IRS officer, it only needs to be notarized or witnessed if the court or relevant legal body requires it.

Submitting Form 4490 settles the tax debt. Submitting the form is a claim of debt; it does not settle the debt. Settlement occurs once the debt is paid or otherwise resolved.

Form 4490 can be used to dispute a tax lien. The form is actually a statement of claim for taxes owed, not a mechanism for disputing tax liens or other tax-related disputes.

There is a fee to submit Form 4490. There is no fee associated with submitting Form 4490 to the court or other fiduciary body.

Form 4490 is only used in bankruptcy cases. While commonly used in bankruptcy proceedings, Form 4490 can also be used in other legal cases where the government needs to assert its claim for unpaid taxes.

Taxpayers can fill out and submit Form 4490 on their own behalf. This form is specifically for the use of the IRS to claim unpaid taxes from a debtor in legal proceedings and cannot be submitted by individual taxpayers.

Form 4490 claims do not prioritize. According to 31 U.S.C. Section 3713(a), debts to the government, including those claimed through Form 4490, must be paid before most other debts in cases like bankruptcy, giving these claims priority.

Key takeaways

Filling out and using the Form 4490, otherwise known as "Proof of Claim for Internal Revenue Taxes," is a critical process that individuals and entities involved in certain legal proceedings might need to navigate. Here are five key takeaways about this form:

- The Form 4490 is used by an officer of the Internal Revenue Service (IRS) to declare under oath that an individual or entity owes taxes to the United States government. This includes any unpaid taxes, interest, and penalties.

- It outlines the specific kinds of taxes owed, the periods for which these taxes are due, and provides a detailed breakdown of the unpaid tax balance, accrued interest, and any accrued penalties.

- The form indicates that the tax debt has not been secured by any note, negotiable instrument, or judgment. It stresses that to the IRS' knowledge, there is no security held against the declared debt, except for statutory tax liens that may have arisen.

- There is a clear statement regarding the priority of this debt, noting that it must be paid in full before distribution to other creditors as per 31 U.S.C. Section 3713(a). This emphasizes the seriousness with which the tax debt is regarded in the eyes of the law.

- The form also serves as a warning to executors, administrators, or any other individuals handling the debtor's estate or financial matters. If they fail to prioritize the payment of the claims of the United States, they may become personally liable for the debt under 31 U.S.C. Section 3713(b).

Completing and properly handling the Form 4490 is crucial for ensuring that tax liabilities to the government are accurately represented and addressed in court proceedings. It's not just about documenting what is owed; it's about acknowledging the government's priority in repayment and avoiding further legal complications for those responsible for settling an entity's or individual's debts.

Popular PDF Forms

Var Forms - Explains expenses, prorations, and potential rollback taxes, providing a comprehensive view of fiscal obligations at settlement.

Af Form 1297 - By facilitating coordination and planning of healthcare during relocations, the AF Form 4380 significantly reduces the potential for service interruptions.