Blank 5000 En PDF Template

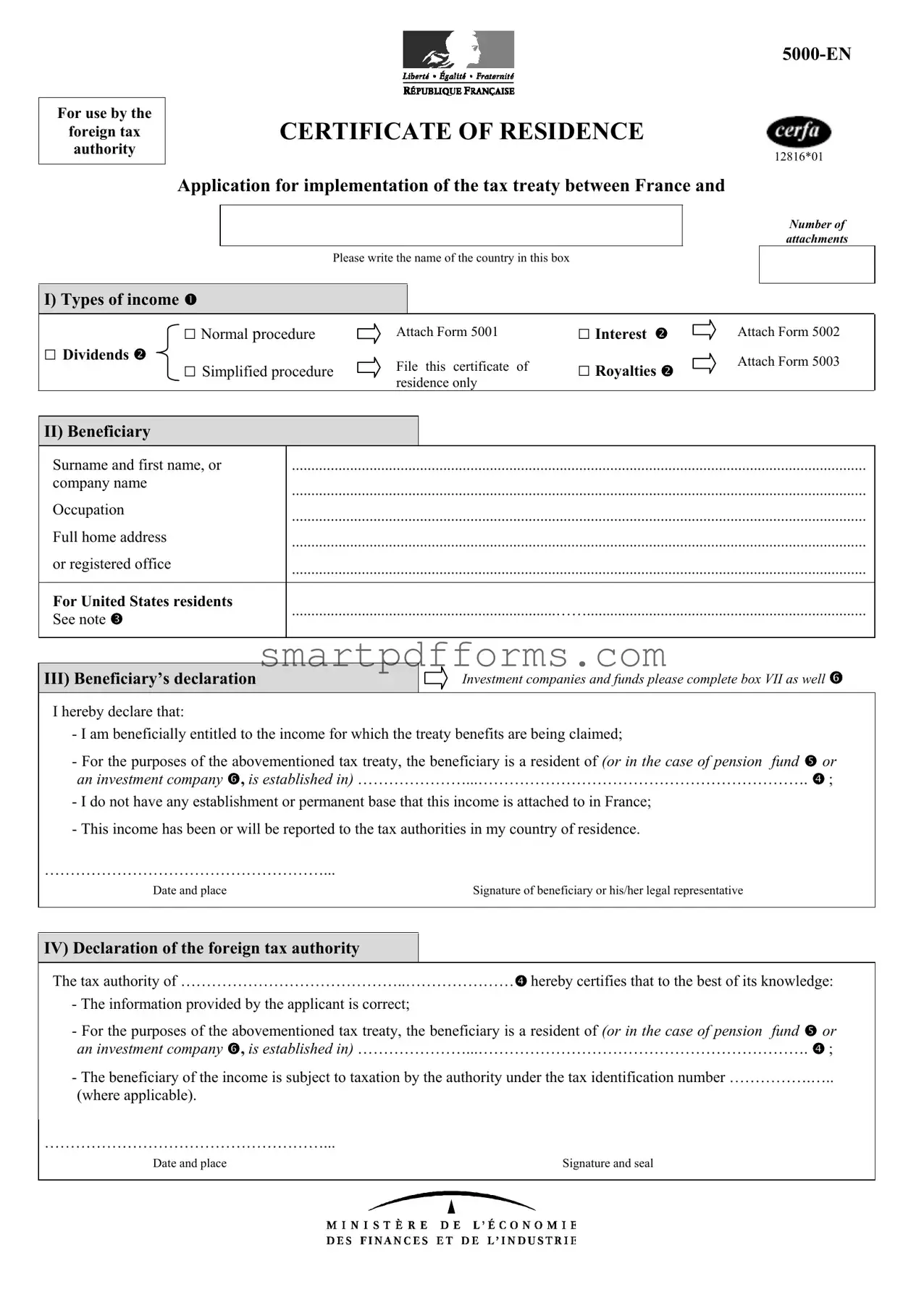

The 5000-EN Certificate of Residence form serves as a crucial document for executing tax treaties between France and other countries, providing a structured means for individuals or entities to claim tax treaty benefits. Specifically designed for use by foreign tax authorities, this form encompasses a wide array of sections aimed at identifying the beneficiary's eligibility for tax relief under the applicable treaty. Key sections include detailed instructions for declaring various types of income such as dividends, interest, and royalties, and stipulations for the beneficiary to assert their right to the income and their residence status for tax purposes. Furthermore, the form outlines the necessity for the declaration from the paying institution and, in the case of U.S. residents, a declaration from the U.S. financial institution. It also caters to investment companies or funds, providing space for additional information pertinent to these entities. Crucial to both the individual or entity applying for treaty benefits and the tax authorities processing these applications, the comprehensive nature of the 5000-EN form facilitates the accurate and efficient application of tax treaty benefits, thereby preventing double taxation and fostering international economic activities.

Preview - 5000 En Form

For use by the

foreign tax

authority

CERTIFICATE OF RESIDENCE

12816*01

Application for implementation of the tax treaty between France and

NUMBER OF

ATTACHMENTS

Please write the name of the country in this box

I) Types of income

□ Dividends |

□ Normal procedure |

Attach Form 5001 |

|

□ Interest |

Attach Form 5002 |

||

□ Simplified procedure |

File this certificate |

of |

□ Royalties |

Attach Form 5003 |

|||

|

|

||||||

|

residence only |

|

|

||||

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

II) Beneficiary |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Surname and first name, or |

.................................................................................................................................................... |

|

|

|

|

||

company name |

|

.................................................................................................................................................... |

|||||

|

|

||||||

Occupation |

|

.................................................................................................................................................... |

|||||

|

|

||||||

Full home address |

|

.................................................................................................................................................... |

|||||

|

|

||||||

or registered office |

|

.................................................................................................................................................... |

|||||

|

|

||||||

|

|

|

|

|

|

|

|

For United States residents |

....................................................................…… |

||||||

See note |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

III) Beneficiary’s declaration

Investment companies and funds please complete box VII as well

I hereby declare that: |

|

|

- I am beneficially entitled to the income for which the treaty benefits are being claimed; |

|

|

- For the purposes of the abovementioned tax treaty, the beneficiary is a resident of (or in the case of pension fund |

or |

|

an investment company , is established in) …………………...………………………………………………………. |

; |

|

- I do not have any establishment or permanent base that this income is attached to in France; |

|

|

- This income has been or will be reported to the tax authorities in my country of residence. |

|

|

………………………………………………... |

|

|

Date and place |

Signature of beneficiary or his/her legal representative |

|

IV) Declaration of the foreign tax authority

The tax authority of ……………………………………..………………… hereby certifies that to the best of its knowledge:

- The information provided by the applicant is correct; |

|

- For the purposes of the abovementioned tax treaty, the beneficiary is a resident of (or in the case of pension fund |

or |

an investment company , is established in) …………………...………………………………………………………. |

; |

-The beneficiary of the income is subject to taxation by the authority under the tax identification number …………….…..

(where applicable).

………………………………………………...

Date and place |

Signature and seal |

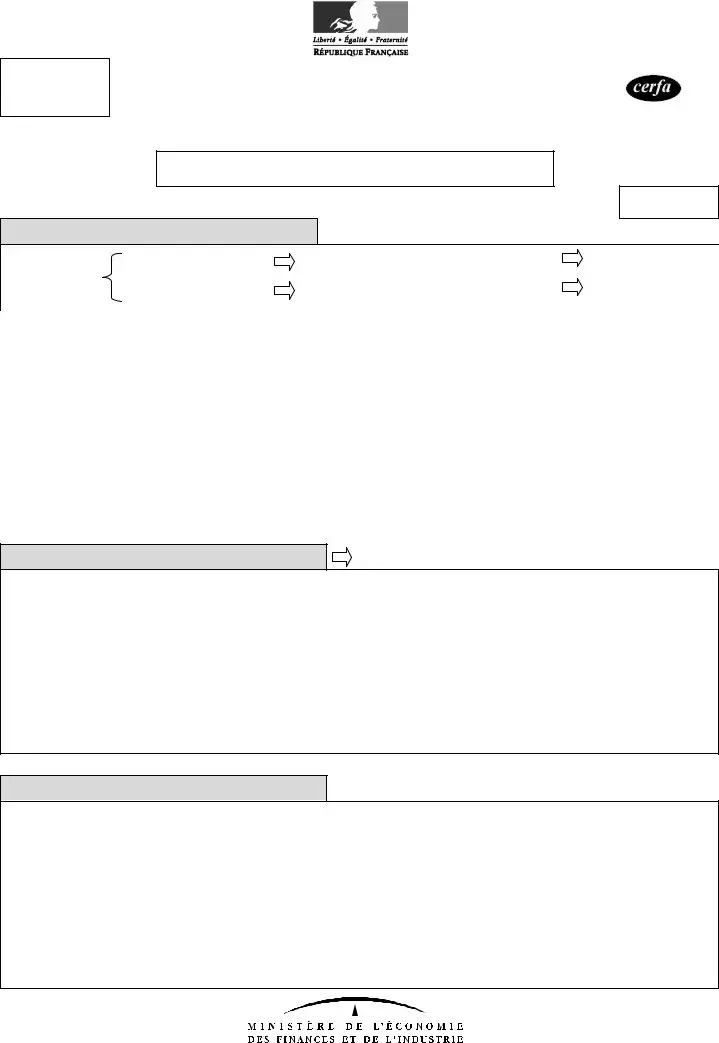

V) Declaration of the paying institution

Name

Address

SIREN number

...........................................................................................................................................................................

...........................................................................................................................................................................

...........................................................................................................................................................................

...........................................................................................................................................................................

We hereby declare that we have paid the beneficiary the income referred to in this application, net of the withholding tax at the rate provided for in French domestic law.

………………………………………………...

Date and place |

Seal |

VI) Declaration of the US financial institution

(For beneficiaries who are United States residents only)

Name

Address

...........................................................................................................................................................................

...........................................................................................................................................................................

...........................................................................................................................................................................

The abovenamed institution hereby certifies that, to the best of its knowledge, the applicant is a resident of the United States and that the information provided on this form is correct.

………………………………………………...

Date and placeSeal

VII) Investment company or fund |

|

|

|

|

|

|

|

- Financial year from………...………… to…………………; |

- Number of unit holders or shareholders in fund: |

|

|

- In the case of German funds, if the French authorities |

...................................………………………… |

||

have issued an authorisation: authorisation date and number: |

- Percentage of unit holders or shareholders who are |

|

|

|

|

||

authorisation number ……………… date ………………..…….. |

residents of: |

: |

% |

|

|

|

|

VIII) In case of direct refund by the tax authority

Where should the repayment be sent (bank, post office, account) ?

..................................................................................................................................................................................................................

..................................................................................................................................................................................................................

..................................................................................................................................................................................................................

To be kept by the beneficiary

CERTIFICATE OF RESIDENCE

12816*01

Application for implementation of the tax treaty between France and

NUMBER OF

ATTACHMENTS

Please write the name of the country in this box

I) Types of income

□ Dividends |

□ Normal procedure |

Attach Form 5001 |

|

□ Interest |

Attach Form 5002 |

||

□ Simplified procedure |

File this certificate |

of |

□ Royalties |

Attach Form 5003 |

|||

|

|

||||||

|

residence only |

|

|

||||

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

II) Beneficiary |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Surname and first name, or |

.................................................................................................................................................... |

|

|

|

|

||

company name |

|

.................................................................................................................................................... |

|||||

|

|

||||||

Occupation |

|

.................................................................................................................................................... |

|||||

|

|

||||||

Full home address |

|

.................................................................................................................................................... |

|||||

|

|

||||||

or registered office |

|

.................................................................................................................................................... |

|||||

|

|

||||||

|

|

|

|

|

|

|

|

For United States residents |

....................................................................…… |

||||||

See note |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

III) Beneficiary’s declaration

Investment companies and funds please complete box VII as well

I hereby declare that: |

|

|

- I am beneficially entitled to the income for which the treaty benefits are being claimed; |

|

|

- For the purposes of the abovementioned tax treaty, the beneficiary is a resident of (or in the case of pension fund |

or |

|

an investment company , is established in) …………………………………………………………………………… |

; |

|

- I do not have any establishment or permanent base that this income is attached to in France; |

|

|

- This income has been or will be reported to the tax authorities in my country of residence. |

|

|

………………………………………………... |

|

|

Date and place |

Signature of beneficiary or his/her legal representative |

|

IV) Declaration of the foreign tax authority

The tax authority of ……………………………………..………………… hereby certifies that to the best of its knowledge:

- The information provided by the applicant is correct; |

|

- For the purposes of the abovementioned tax treaty, the beneficiary is a resident of (or in the case of pension fund |

or |

an investment company , is established in) …………………...………………………………………………………. |

; |

-The beneficiary of the income is subject to taxation by the authority under the tax identification number …………….…..

(where applicable).

………………………………………………...

Date and place |

Signature and seal |

V) Declaration of the paying institution

Name

Address

SIREN number

...........................................................................................................................................................................

...........................................................................................................................................................................

...........................................................................................................................................................................

...........................................................................................................................................................................

We hereby declare that we have paid the beneficiary the income referred to in this application, net of the withholding tax at the rate provided for in French domestic law.

………………………………………………...

Date and place |

Seal |

VI) Declaration of the US financial institution

(For beneficiaries who are United States residents only)

Name

Address

...........................................................................................................................................................................

...........................................................................................................................................................................

...........................................................................................................................................................................

The abovenamed institution hereby certifies that, to the best of its knowledge, the applicant is a resident of the United States and that the information provided on this form is correct.

………………………………………………...

Date and placeSeal

VII) Investment company or fund |

|

|

|

|

|

|

|

- Financial year from………...………… to…………………; |

- Number of unit holders or shareholders in fund: |

|

|

- In the case of German funds, if the French authorities |

...................................………………………… |

||

have issued an authorisation: authorisation date and number: |

- Percentage of unit holders or shareholders who are |

|

|

|

|

||

authorisation number ……………… date ………………..…….. |

residents of: |

: |

% |

|

|

|

|

VIII) In case of direct refund by the tax authority

Where should the repayment be sent (bank, post office, account) ?

..................................................................................................................................................................................................................

..................................................................................................................................................................................................................

..................................................................................................................................................................................................................

For use by the

French tax

authority

ATTESTATION DE RESIDENCE

12816*01

Demande d’application de la convention fiscale entre la France et

NOMBRE D’ANNEXES

Inscrire dans cette case le nom de l’Etat contractant

I) Nature des revenus

□

□ Dividendes |

□ |

|

Procédure normale |

Joindre |

un formulaire |

□ Intérêts |

Joindre un formulaire |

|

|

annexe n° 5001 |

□ Redevances |

annexe n° 5002 |

||

Procédure simplifiée |

File this |

certificate of |

Joindre un formulaire |

||

residence only |

annexe n° 5003 |

||||

|

|

||||

II) Désignation du bénéficiaire des revenus

Nom et prénom ou raison sociale |

.................................................................................................................................................... |

|

|

.................................................................................................................................................... |

|

Profession |

.................................................................................................................................................... |

|

Adresse complète du domicile |

.................................................................................................................................................... |

|

ou du siège social |

.................................................................................................................................................... |

|

Pour les résidents des |

....................................................................…… |

|

cf. notice |

||

|

||

|

|

III) Déclaration du bénéficiaire des revenus |

Fonds et sociétés d’investissement : compléter aussi le cadre VII |

|

|

|

|

|

|

Le soussigné certifie : |

|

|

|

- |

être le bénéficiaire effectif des revenus pour lesquels le bénéfice de la convention est demandé ; |

|

|

- |

avoir, au sens de la convention fiscale susvisée, la qualité de résident de (ou s’agissant d’un fonds de pension ou d’un |

||

|

fonds ou d’ une société d’investissement être établi à) …………………………………………...………………….. |

; |

|

- ne pas posséder en France d’établissement ou de base fixe auxquels se rattachent les revenus ; |

|

||

- que ces revenus ont été ou seront déclarés à l’administration des impôts de l’Etat de résidence. |

|

||

………………………………………………... |

|

|

|

|

Date et lieu |

Signature du bénéficiaire ou de son représentant légal |

|

|

|

|

|

IV) Déclaration de l’administration étrangère

L’administration fiscale de ……………………………………………………..……………. certifie qu’à sa connaissance :

-les indications portées par le déclarant sur la présente demande sont exactes ;

-au sens de la convention fiscale susvisée le bénéficiaire a bien la qualité de résident de (ou s’agissant d’un fonds de

pension ou d’un fonds ou d’une société d’investissement être établi à) …………………………...……...……. ;

-le bénéficiaire des revenus relève de son ressort sous le numéro fiscal …………………...…………………………….…..

(si un tel numéro existe).

………………………………………………...

Date et lieu |

Signature et tampon |

V) Déclaration de l’établissement payeur

Nom / Dénomination

Adresse

Numéro SIREN

...........................................................................................................................................................................

...........................................................................................................................................................................

...........................................................................................................................................................................

...........................................................................................................................................................................

Nous certifions avoir payé au bénéficiaire les revenus compris dans la présente demande pour leur montant net c’est à dire déduction faite de l’impôt à la source au taux prévu par le droit interne français.

………………………………………………...

Date et lieu |

Cachet |

VI) Déclaration de l’établissement financier américain

(pour les seuls bénéficiaires résidents des

Nom / Dénomination

Adresse

...........................................................................................................................................................................

...........................................................................................................................................................................

...........................................................................................................................................................................

L’établissement désigné

………………………………………………...

Date et lieuCachet

VII) Société ou fonds d’investissement |

|

|

|

|

|

- Exercice social du ………...………… au …………………; |

- Nombre de porteurs de parts du fonds : |

|

|

|

|

- Pour les OPCVM d’Allemagne, si l’administration française |

.........................................………………………… |

|

|

|

|

a délivré une autorisation : date et numéro de l’autorisation : |

- Pourcentage de porteurs de parts résidents de |

|

|

|

|

autorisation n° …………………….. du ……………………… |

....................................................... : |

% |

|

|

|

VIII) En cas de remboursement direct par l’administration au créancier

Où le montant à rembourser

..................................................................................................................................................................................................................

..................................................................................................................................................................................................................

..................................................................................................................................................................................................................

Form Data

| Fact Name | Description |

|---|---|

| Purpose of the Form | The 5000-EN form serves as a certificate of residence, used for claiming tax treaty benefits between France and the beneficiary's country of residence. |

| Sections of Importance | It includes selections for types of income (dividends, interest, royalties), beneficiary information, a beneficiary declaration, declarations by the foreign tax authority and financial institutions, and additional details for investment companies or funds. |

| Specific Attachments | Depending on the type of income, forms 5001 (dividends), 5002 (interest), or 5003 (royalties) need to be attached. |

| Governing Law | It is governed by the tax treaty agreements between France and the beneficiary's country of residence. For United States residents, it involves the France-U.S. tax treaty. |

Instructions on Utilizing 5000 En

Once individuals or entities are ready to leverage the tax treaty benefits between France and their country of residence, filing the 5000-EN form becomes a crucial step. Completing this form meticulously ensures that the applicants articulate their eligibility for the tax treaty advantages properly. This involves providing comprehensive details about their income type, personal or company information, and affirming their tax residency. Below are the outlined steps to fill out the form efficiently, ensuring a seamless process toward claiming treaty benefits.

- Start by writing the name of the applicant's country of residence in the box provided at the very beginning of the form to indicate whose tax authority will use this certificate.

- Under section I "Types of income," check the applicable box(es) for the type of income for which you are applying for treaty benefits (e.g., Dividends, Interest, or Royalties). Attach the respective form (5001, 5002, or 5003) as indicated, if applicable.

- In section II "Beneficiary," enter the full name (surname and first name) or company name of the beneficiary. Also, provide the occupation, full home address or registered office of the beneficiary. For United States residents, note any specific instructions provided.

- Section III "Beneficiary’s declaration" requires the beneficiary to declare by checking appropriate boxes and filling in blanks that they are the rightful owner of the income, a resident (or in the case of pension funds or investment companies, established) in the stated country for tax treaty purposes, have no establishment or permanent base in France to which the income could be attributed, and that this income has or will be reported to their home country's tax authority. Sign and date in the provided spaces.

- In Section IV "Declaration of the foreign tax authority," the form must be taken to the relevant tax authority in your country of residence. They need to certify the correctness of your information, your residency status under the tax treaty, and if applicable, your tax identification number. The authority must then sign, date, and apply their official seal.

- The V Section "Declaration of the paying institution" should be filled out and signed by the institution that has paid you the income, confirming the amount paid and the withholding tax applied as per French law.

- For individuals who are United States residents, Section VI "Declaration of the US financial institution" requires the signature, date, and seal from the financial institution certifying the residency of the applicant.

- If applicable, investment companies or funds must complete Section VII, providing details about the financial year, number of unit holders or shareholders, any authorization from French authorities (for German funds), and the percentage of unit holders or shareholders who are residents of the specified country.

- Lastly, in Section VIII, if a direct refund is pursued, specify the details of where the refund should be sent, including the type of account and address.

After carefully completing each section of the 5000-EN form, it's vital to review the document for accuracy to ensure all information provided is correct and fulfills the requirements as laid out by the form's instructions. Once completed, the form along with necessary attachments should be submitted as directed by the relevant authorities to initiate the process of applying for tax treaty benefits. It is advisable to keep a copy of the form for your records.

Obtain Answers on 5000 En

What is the purpose of the 5000-EN form?

The 5000-EN form, also known as the Certificate of Residence, is designed for use by the foreign tax authority to certify the residency of a beneficiary for tax purposes. Its primary goal is to facilitate the application of tax treaties between France and the beneficiary's country of residence, potentially allowing for reduced withholding taxes on various types of income such as dividends, interests, and royalties. By providing proof of residence, beneficiaries can claim treaty benefits for income received from France, ensuring that they are taxed appropriately and possibly benefiting from lower tax rates stipulated by the treaty.

Who needs to fill out the 5000-EN form?

The individuals or entities that need to complete the 5000-EN form are those who receive income from France and reside in a country that has a tax treaty with France. This includes, but is not limited to, individual investors, pension funds, and investment companies. The form must be filled out by beneficiaries wishing to claim benefits under the tax treaty, such as reduced withholding tax rates on income types like dividends, interest, and royalties. It is also crucial for investment companies and funds, as they are required to fill out additional sections that pertain specifically to their structure and investor base.

What attachments are required with the 5000-EN form?

The 5000-EN form may require various attachments depending on the type of income for which treaty benefits are being claimed:

- For dividends, attach Form 5001.

- For interest, attach Form 5002.

- For royalties, attach Form 5003.

How does a beneficiary declare their eligibility for treaty benefits on the 5000-EN form?

On the 5000-EN form, the beneficiary declares their eligibility for treaty benefits through a dedicated section where they must affirm that:

- They are the beneficial owner of the income for which treaty benefits are claimed.

- They are a resident of (or, in the case of pension funds or investment companies, established in) their home country for the purposes of the tax treaty with France.

- They do not have any establishment or permanent base in France to which the income is attached.

- The income has been or will be reported to the tax authorities in their country of residence.

What is the role of the US financial institution in the 5000-EN form?

For beneficiaries who are United States residents, the role of the US financial institution is particularly significant. In section VI of the 5000-EN form, the US financial institution must certify that, to the best of its knowledge, the applicant is indeed a resident of the United States and that the information provided on the form is accurate. This certification helps to validate the residency claim of the beneficiary and is crucial for the processing and approval of treaty benefits. The financial institution's declaration adds an additional layer of credibility to the application, assisting in the efficient and effective application of the tax treaty between France and the United States.

Common mistakes

Not specifying the type of income: Applicants often forget to check the box indicating whether their income comes from dividends, interest, or royalties. This clarification is crucial for processing the form correctly.

Missing attachments: When certain types of income are declared, attaching additional forms such as Form 5001 for dividends, Form 5002 for interest, or Form 5003 for royalties is required. Applicants frequently miss this detail.

Incorrect beneficiary information: It's common to see errors in the beneficiary section — either the name and surname or company name is filled out incorrectly, or occupation details are incomplete or missing.

Failing to provide a full address: Many applicants do not provide their full home address or registered office address, which is necessary for identification purposes.

Omitting the declaration section for investment companies and funds: If the beneficiary is an investment company or fund, a specific box needs to be completed. This step is often overlooked.

Incorrect or incomplete beneficiary declarations: Applicants sometimes misunderstand or incorrectly declare their entitlement to income, their residency status, the absence of a permanent establishment in France, or their compliance with reporting this income to their local tax authority.

Declaration of the foreign tax authority not duly filled: This section requires careful completion, as it certifies the accuracy of the provided information, the residency of the beneficiary, and their subjectivity to taxation. Errors or omissions here can lead to processing delays.

Declaration of the paying institution not properly completed: Similar to the declaration by the foreign tax authority, this section necessitates precision and completeness. Missing or incorrect information about the income paid, including the withholding tax rate, can cause inaccuracies.

Forgetting the US financial institution declaration (for US residents): US residents must ensure this section is completed, certifying their residency and the correctness of the form's information. Neglecting this step can invalidate the application.

Direct refund instructions left blank: Applicants seeking a direct refund must specify the destination (bank, post office, account) clearly. Failure to do so may result in refund delays or complications.

Documents used along the form

The 5000-EN form is a critical document for individuals and entities seeking to apply the tax treaty benefits between France and their country of residence, facilitating the correct taxation of various types of income such as dividends, interests, and royalties. When completing and submitting the 5000-EN form, it is often accompanied by additional forms and documents to provide a comprehensive understanding of the individual's or entity's tax situation and ensure compliance with tax laws. These additional documents are essential for a smooth process and adherence to fiscal obligations and treaty benefits.

- Form 5001 - This form is specifically required when declaring dividends under the normal procedure. It provides detailed information about the dividends to be taxed, ensuring that the correct tax treaty benefits are applied based on the specific agreement between France and the country of residence of the dividend's beneficial owner.

- Form 5002 - Attached in cases involving interest income, Form 5002 allows for the detailed declaration of such income. This form helps to clarify the amount of interest income and the rightful tax rate under the tax treaty, ensuring the beneficial owner is taxed appropriately and benefits from the treaty.

- Form 5003 - Required for royalty income declarations, Form 5003 captures specifics about the royalties in question. It ensures that income from intellectual property or other sources that qualify as royalties is accurately reported and taxed according to the stipulations of the tax treaty.

- Declaration of the Paying Institution - This document, part of the 5000-EN form process, requires the institution that pays the income (whether dividends, interest, or royalties) to declare that they have done so in compliance with French domestic law. It ensures transparency and allows tax authorities to verify that taxes are withheld correctly.

- Declaration of the US Financial Institution - Specifically for US residents, this declaration confirms that the financial institution is aware of the applicant's residency and tax situation. It corroborates the information provided on the 5000-EN form, adding an additional layer of verification to the application process.

These documents collectively support the 5000-EN Certificate of Residence form in providing a full picture of the applicant's entitlement to tax treaty benefits. Each form and declaration plays a unique role in clarifying the nature of income, the rightful tax treatment under the treaty, and the compliance of the involved parties with their fiscal obligations. Proper completion and submission of these documents facilitate the effective implementation of tax treaties, ensuring both compliance and fairness in the taxation of international income.

Similar forms

The 5000-EN form serves as a crucial document for implementing tax treaties between France and other countries, specifically designed for foreign tax authorities and taxpayers seeking to avoid double taxation on income like dividends, interests, and royalties. This form is part of a broader ecosystem of international tax compliance documents. Here are nine documents that share similarities with the 5000-EN form in terms of purpose, structure, or function:

- W-8BEN Form (Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting (Individuals)): Like the 5000-EN, the W-8BEN is designed for non-U.S. residents to claim tax treaty benefits, primarily to reduce withholding tax rates on income from U.S. sources.

- FORM 6166 (Certification of U.S. Residency for Tax Purposes): Issued by the U.S. Internal Revenue Service, this form serves a similar purpose to the 5000-EN's certification by foreign tax authorities, verifying the residency of taxpayers for claiming benefits under international tax treaties.

- W-8BEN-E Form (Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities)): This is the entity version of the W-8BEN form, used by foreign entities to claim tax treaty benefits, akin to how the 5000-EN is used by individuals and entities to claim similar benefits in France.

- 1042-S Form (Foreign Person's U.S. Source Income Subject to Withholding): While primarily a reporting form for the payer, the information about tax withholding and treaty benefits claimed mirrors the declarations made on 5000-EN regarding income paid and tax withheld according to treaty rates.

- SS-4 Form (Application for Employer Identification Number (EIN)): Though its primary function is for obtaining an EIN, international entities may need an EIN to comply with withholding requirements, linking it to the broader context of international tax compliance akin to the 5000-EN's role.

- 8833 Form (Treaty-Based Return Position Disclosure): U.S. taxpayers use this form to disclose positions taken on their tax return that are based on a tax treaty, similar to how the 5000-EN form is used to claim treaty benefits to avoid double taxation.

- 3520 Form (Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts): Although focused on reporting rather than claiming treaty benefits, this form is part of the international reporting regime, connecting it to the purposes served by the 5000-EN form.

- DA-1 Form (For Claiming Income Tax Treaty Benefits in India): Similar to France's 5000-EN form, the DA-1 form is used by residents of countries that have a tax treaty with India to claim benefits and avoid double taxation.

- Residence Certificate for Tax Purposes: Many countries issue certificates of residence which are used similarly to support claims under tax treaties, functioning in parallel with the 5000-EN's certification by foreign tax authorities of a beneficiary's residency for treaty benefits.

Each of these documents plays a unique role within the context of international tax law and compliance, yet they collectively facilitate the application of tax treaties, help prevent double taxation, and ensure the proper reporting and withholding of taxes on international income.

Dos and Don'ts

When filling out the 5000-EN form for the Certificate of Residence, it's important to follow specific guidelines to ensure the form is completed accurately and effectively. Here are some dos and don'ts to consider:

Do:- Double-check the form for any updates: Before starting, make sure you have the latest version of the form to comply with current requirements.

- Provide accurate information: Fill in all sections with current and accurate information to prevent any delays or issues with processing.

- Include all required attachments: Depending on the types of income, attach Forms 5001, 5002, or 5003 as indicated in the instructions.

- Sign and date the form: Ensure that the beneficiary or their legal representative signs and dates the form to validate the information provided.

- Omit the name of the country: Make sure to write the name of the country in the designated box at the top of the form to specify the applicable tax treaty.

- Ignore specific sections for U.S. residents: If the beneficiary resides in the United States, pay attention to sections specifically marked for U.S. residents and provide the necessary details.

- Forget to declare all types of income: Clearly indicate all relevant types of income for which tax treaty benefits are being claimed by checking the appropriate boxes.

- Leave sections incomplete: Avoid leaving any fields blank. If a section does not apply, consider marking it as "N/A" or "Not Applicable" to indicate that it has been reviewed.

Misconceptions

When dealing with international tax forms like the 5000-EN Certificate of Residence, it’s common to come across misconceptions. Understanding these documents correctly is crucial for beneficiaries looking to apply the tax treaty benefits between France and their country of residence. Here are eight common misconceptions about the 5000-EN form:

- It's only for individuals. One common misconception is that the form is exclusively for individual use. In reality, the form also caters to entities such as companies and investment funds, providing a comprehensive avenue for various applicants to claim treaty benefits.

- Submission Leads to Automatic Approval. Simply submitting the form does not guarantee automatic approval of the benefits. The authorities meticulously review the provided information against tax treaty conditions, and only eligible beneficiaries will receive approval.

- Only applicable for dividends income. While dividends are a significant part of the income types covered, the form also applies to interest, royalties, and other income types as specified. Beneficiaries must accurately identify the income type to ensure correct processing.

- Any tax authority can confirm residency. The declaration of residency must be certified by the foreign tax authority of the beneficiary’s country. This is to confirm the beneficiary's claim of residence and eligibility under the specific tax treaty.

- No need to report income in the resident country. Contrary to this belief, the beneficiary must declare that the income for which treaty benefits are being claimed has been or will be reported to the tax authorities in their country of residence. This ensures compliance with international tax obligations.

- The form covers all tax treaties. The 5000-EN form is designed for the implementation of tax treaties specifically between France and another contracting state. Each treaty has its nuances, and the form facilitates the application of these treaty-specific benefits.

- All financial institutions can make the declaration. For United States residents, only the declaration made by a US financial institution is recognized on the form. This institution certifies the applicant’s US residency and the correctness of the provided information.

- Direct refunds are immediate. While the form includes a section for direct refunds, the processing time can vary, and several factors may affect the timeline for receiving the refund. Beneficiaries should prepare for potential waiting periods.

Navigating the complexities of international taxation requires accurate information and understanding. Misconceptions can lead to errors and potential delays in receiving benefits. Therefore, it's essential for beneficiaries to carefully review their eligibility, complete the forms accurately, and understand the process involved in applying for tax treaty benefits.

Key takeaways

Understanding the intricacies of the 5000-EN Certificate of Residence form is critical for ensuring compliance with tax treaties, specifically between France and other countries. Below are some key takeaways to assist users in accurately filling out and utilizing this form:

- The form is designed for use by foreign tax authorities to certify the residence of individuals or entities claiming tax treaty benefits, specifically avoiding double taxation on income such as dividends, interest, and royalties.

- It’s essential to clearly specify the type of income for which treaty benefits are being claimed by checking the appropriate boxes and attaching any necessary forms (5001 for dividends, 5002 for interest, 5003 for royalties) as indicated.

- The beneficiaries, whether individuals or companies, must provide comprehensive details including their full name or company name, occupation or business activity, and their full residential or registered office address. For United States residents, specific notes may apply, highlighting the importance of examining the form closely.

- A critical declaration by the beneficiary affirms their entitlement to the income, residence status as per the relevant tax treaty, the absence of any permanent establishment in France attaching to this income, and the reporting of such income to the tax authorities in their country of residence.

- The form also requires a declaration from the foreign tax authority, certifying the accuracy of the information provided by the applicant, their residency status, and their taxation identification details, ensuring the legitimacy of the claims made.

- Paying institutions and US financial institutions, where applicable, must also declare that they have paid the income to the beneficiary, net of any withholding tax as prescribed by French domestic law, further supporting the application.

- For investment companies or funds, additional specific details are required, including the financial year, number of unit holders or shareholders, and the percentage of those who are residents of the applicable country, amongst other details.

- If a direct refund from the tax authority is sought, the beneficiary must stipulate where the repayment should be directed, including detailed bank or post office information.

- Lastly, it’s imperative for beneficiaries to retain a copy of the 5000-EN Certificate of Residence for their records, as it plays a vital role in ensuring tax compliance and can be referenced in disputes or queries from tax authorities.

Accurately completing and understanding the 5000-EN form is instrumental in leveraging tax treaties effectively, minimizing tax liabilities, and ensuring transparency and compliance in cross-border financial transactions.

Popular PDF Forms

How to Read a Scale Ticket - The Scale Ticket forms’ pin-feed stock design guarantees smooth operation through printers, reducing downtime and increasing productivity in business environments.

Do C Corps Issue K-1 - The form is designed to provide transparency in the taxation process, ensuring that profits and losses are accurately reported and taxed at the individual level, not at the corporate level.