Blank 51A126 PDF Template

Understanding the nuances of the 51A126 form is pivotal for certain entities in Kentucky desiring to make tax-exempt purchases. This specialized certificate grants qualifying Kentucky-based nonprofit educational, charitable, or religious institutions, as well as historical sites, the ability to procure tangible personal property, digital property, or services without the burden of sales tax—provided these goods or services are used within their exempt functions. Delineating between “Blanket” and “Single Purchase” exemptions, the form necessitates the full disclosure of the purchasing institution's details, alongside the vendor's information, ensuring a transparent transaction. It is critical for both the buyer and the seller to adhere strictly to the stipulated guidelines, as misuse of this exemption could result in serious penalties under Kentucky law. Moreover, construction contractors are explicitly excluded from using this certificate for tax-exempt purchases related to contract fulfillment with an exempt institution. This measure protects against potential abuses, ensuring that the exemption serves its intended purpose to support the work of non-profit and historical entities within the state.

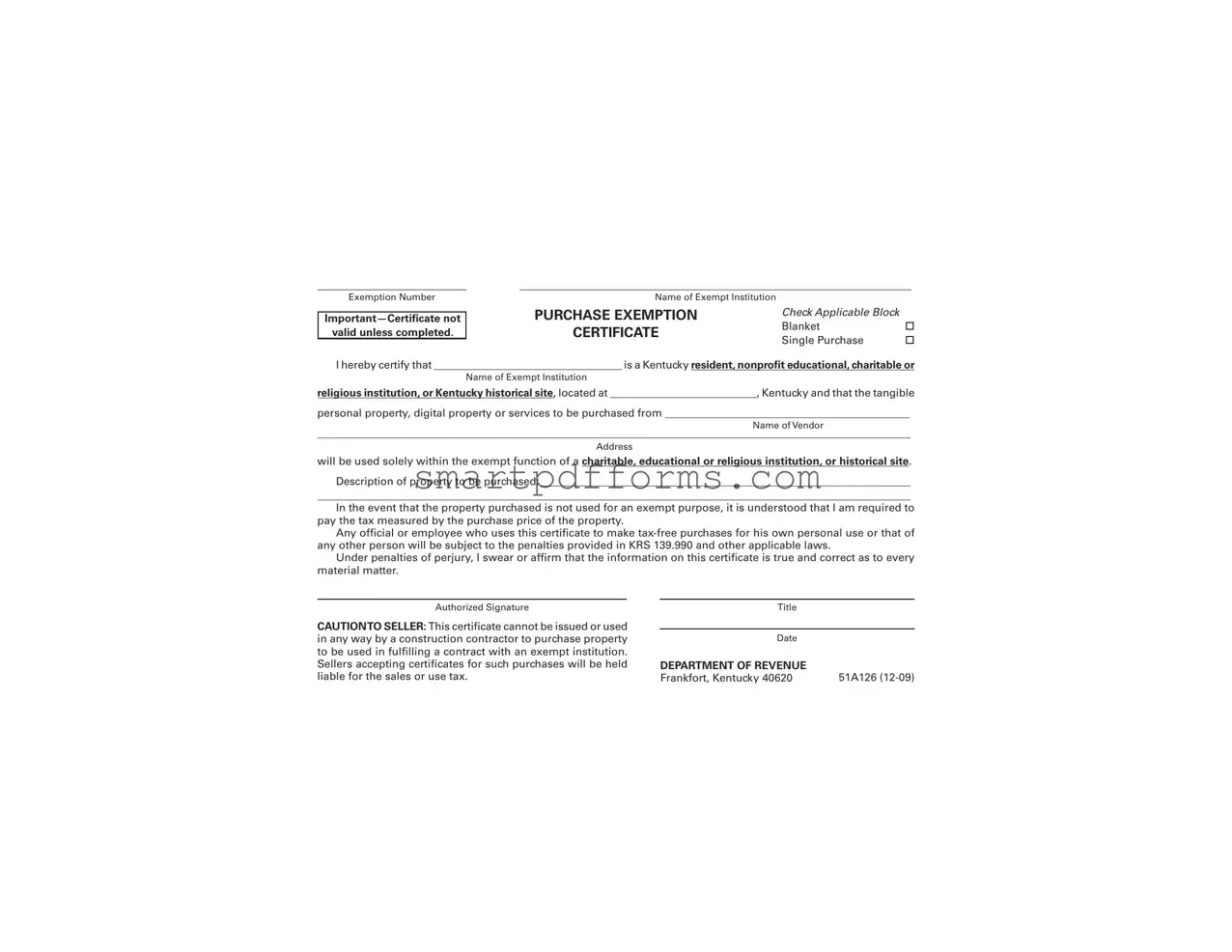

Preview - 51A126 Form

Exemption Number

valid unless completed.

Name of Exempt Institution |

|

|

PURCHASE EXEMPTION |

Check Applicable Block |

|

CERTIFICATE |

Blanket |

|

Single Purchase |

||

|

I hereby certify that ___________________________________ is a Kentucky resident, nonprofit educational, charitable or

Name of Exempt Institution

religious institution, or Kentucky historical site, located at ___________________________, Kentucky and that the tangible

personal property, digital property or services to be purchased from _____________________________________________

Name of Vendor

_____________________________________________________________________________________________________________

Address

will be used solely within the exempt function of a charitable, educational or religious institution, or historical site.

Description of property to be purchased: ____________________________________________________________________

_____________________________________________________________________________________________________________

In the event that the property purchased is not used for an exempt purpose, it is understood that I am required to pay the tax measured by the purchase price of the property.

Any official or employee who uses this certificate to make

Under penalties of perjury, I swear or affirm that the information on this certificate is true and correct as to every material matter.

Authorized Signature

CAUTIONTO SELLER: This certificate cannot be issued or used in any way by a construction contractor to purchase property to be used in fulfilling a contract with an exempt institution. Sellers accepting certificates for such purchases will be held liable for the sales or use tax.

Title

Date |

|

DEPARTMENT OF REVENUE |

|

Frankfort, Kentucky 40620 |

51A126 |

Form Data

| Fact Number | Fact Detail |

|---|---|

| 1 | The 51A126 form is an exemption certificate used in Kentucky. |

| 2 | It is designed for use by nonprofit educational, charitable, religious institutions, or Kentucky historical sites. |

| 3 | This certificate allows for the purchase of tangible personal property, digital property, or services without paying sales tax, provided they are used solely within the institution's exempt functions. |

| 4 | If the purchased property is not used for an exempt purpose, the purchaser is required to pay the sales tax based on the purchase price of the property. |

| 5 | Using this certificate for tax-free purchases for personal use subjects the user to penalties under KRS 139.990 and other applicable laws. |

| 6 | Construction contractors cannot use this certificate to purchase property for contract work with an exempt institution. Sellers accepting such certificates for contractor purchases will be held liable for the sales or use tax. |

Instructions on Utilizing 51A126

Filling out the 51A126 Purchase Exemption Certificate correctly is crucial for institutions that qualify for tax exemption on purchases in Kentucky. This form ensures that eligible entities like educational, charitable, religious institutions, and Kentucky historical sites can buy goods and services without paying tax, provided these purchases directly support their exempt functions. However, misuse of this certificate can lead to legal penalties. Here's a straightforward guide on how to complete this form.

- Begin by writing down the name of the exempt institution making the purchase in the space provided after "Name of Exempt Institution".

- Choose the type of exemption certificate needed by checking either "Blanket" or "Single Purchase". A "Blanket" exemption applies to all qualifying purchases made by the institution, whereas a "Single Purchase" exemption applies to a specific transaction only.

- Enter the full address of the exempt institution, ensuring it is located in Kentucky.

- In the "Name of Vendor" field, write the name of the company or individual from whom the exempt institution is purchasing goods or services.

- Fill out the vendor’s address as completely as possible.

- Provide a detailed description of the property or services being purchased. Include enough detail to clearly show that the purchases qualify for tax exemption based on their use within the exempt functions of the institution.

- If there's a risk the purchased items might not be used for an exempt purpose, acknowledge the obligation to pay tax on these purchases by understanding the statement given.

- The certificate must be signed by an authorized official or employee of the exempt institution. Include the signature under "Authorized Signature".

- Add the title of the person signing the form next to "Title", indicating their position in the institution.

- The date of signing must be entered next to "Date" to indicate when the certificate was completed.

Once the form is filled out, it's essential to double-check all the provided information for accuracy. Misrepresentations can lead to penalties under the law. The completed form should be given to the vendor at the time of purchase to ensure the exemption is applied. Keep in mind, while sellers are required to accept this certificate in good faith, they are warned against its misuse, especially concerning construction contracts for exempt entities.

Obtain Answers on 51A126

Frequently Asked Questions about the 51A126 Form

- What is the 51A126 form?

The 51A126 form is a Purchase Exemption Certificate used in Kentucky. It allows qualifying non-profit educational, charitable, religious institutions, and Kentucky historical sites to make purchases without paying sales tax. This form validates that the goods or services purchased are used solely for exempt functions related to their charitable, educational, religious, or historical status.

- Who can use the 51A126 form?

Only Kentucky residents representing non-profit educational, charitable, religious institutions, or Kentucky historical sites are eligible to use this form. The exemption is only applicable if the purchases made are directly related to the exempt functions of these entities.

- What types of purchases can be made tax-free with this exemption?

Tangible personal property, digital property, or services that are used within the exempt functions of charitable, educational, religious institutions, or historical sites qualify for tax-free purchases. Examples include educational materials for a nonprofit school or religious supplies for a church.

- Is there a difference between “Blanket” and “Single Purchase” on the form?

Yes, the form distinguishes between Blanket and Single Purchase exemptions. A "Blanket" exemption applies to all future purchases from a vendor, simplifying the process for repeated transactions. "Single Purchase" is a one-time exemption for a specific transaction with a designated vendor.

- What are the implications if the exempted purchases are not used as declared?

If the property purchased tax-free is not used for an exempt purpose, the purchaser is responsible for paying the sales tax based on the purchase price. Misuse of this exemption can also lead to penalties under KRS 139.990 and other applicable laws.

- Can construction contractors use this certificate for tax-free purchases?

No, construction contractors cannot use the 51A126 certificate to buy materials tax-free for projects involving exempt institutions. If such purchases are made, sellers will be held liable for the sales or use tax.

- What responsibilities does the seller have when accepting a 51A126 form?

Sellers need to ensure that the exemption certificate is fully completed and valid before processing tax-free transactions. They must also be aware that accepting certificates from construction contractors for exempt-institution projects is prohibited and results in liability for any unpaid taxes.

Common mistakes

Filling out the 51A126 form, or Purchase Exemption Certificate, requires careful attention to detail to ensure it's valid and accurately reflects the transaction details. Common mistakes can lead to complications or the rejection of the form. Below are seven mistakes people often make when completing this form:

Not completing all required fields: Every section of the form needs to be filled out to validate the exemption certificate. Leaving fields blank can result in the form being considered incomplete, and thus, invalid.

Incorrect exemption number: It is crucial to provide the correct exemption number to identify the exempt status properly. Misstating or omitting this number can lead to rejection of the exemption.

Failing to specify the exemption type by not checking either the 'Blanket' or 'Single Purchase' box. This indication is necessary to define the scope of the exemption.

Providing inaccurate or vague descriptions of the property to be purchased. It is important to be clear and precise about what is being bought to ensure it falls within the permitted use of the exemption.

Incorrectly stating the institution’s relationship to the exemption: The form must clearly show that the purchase is made by a Kentucky resident, nonprofit educational, charitable, or religious institution, or Kentucky historical site. Any inaccuracies can void the certificate.

Forgetting to sign and date the form. An authorized signature and date are mandatory for the document to be legally binding and recognized. Missing these can lead to automatic disqualification.

Misuse of the certificate for personal purchases or incorrect application of the exemption. Misinterpretation of what qualifies for exemption can not only invalidate the certificate but also expose individuals to legal penalties.

Addressing these common mistakes can significantly enhance the accuracy and validity of the 51A126 form, ensuring that exemptions are applied correctly and in compliance with Kentucky laws.

Documents used along the form

When navigating the intricate landscape of tax exemptions in Kentucky, particularly for nonprofit, educational, charitable, religious institutions, or historical sites, the 51A126 form serves as a cornerstone document. However, to ensure compliance and to fully leverage tax exemption status, various other forms and documents often accompany the 51A126 form. Each of these plays a pivotal role in the seamless execution of tax-exempt purchases or activities, ensuring that institutions stay within the bounds of the law while benefiting from their entitled exemptions.

- 51A260 – Sales and Use Tax Resale Certificate: This document allows businesses to purchase goods tax-free that will be resold in the ordinary course of operations. It's crucial for organizations that sell items as part of fundraising efforts.

- 51A262 – Utility Gross Receipts License Tax Exemption Certificate: This form is used by organizations to certify that they are exempt from taxes on utility services, lowering operational costs significantly for eligible entities.

- 45A227 – Certificate of Exemption for Machinery for New and Expanded Industry: Entities that are expanding or establishing new facilities may use this form to purchase or lease machinery and equipment without paying sales tax, fostering growth and development.

- Form ST-105 – General Sales Tax Exemption Certificate: Although it’s more broadly used across various states, this certificate functions similarly to exempt purchases from sales tax, depending on the nature of the purchase and the buyer's qualification.

- K-4 Form – Employee’s Withholding Certificate: While not directly related to sales tax, this document is crucial for nonprofit organizations in handling payroll taxes for their employees, ensuring the correct amount of state income tax is withheld.

- Form 990 – Return of Organization Exempt From Income Tax: Essential for tax-exempt organizations, this form reports their income, expenditures, and operational information to the IRS, maintaining their tax-exempt status.

- Organizational By-Laws or Articles of Incorporation: These documents often accompany tax exemption applications and forms like the 51A126 to validate the legal and operational status of the institution claiming an exemption.

- Form SS-4 – Application for Employer Identification Number (EIN): This form is used to apply for an EIN, necessary for tax identification purposes and is often required when opening bank accounts or applying for licenses and permits.

- Annual Financial Report: Providing a detailed account of an institution's financial activities over the year, this report often supports claims for exemptions and is used in conjunction with forms like the 51A126 to ensure financial transparency.

Collectively, these forms and documents create a comprehensive framework supporting the operational, financial, and legal aspects of tax-exempt entities. Proper utilization and understanding of each document ensure that organizations can maximize their benefits while adhering to Kentucky's tax laws, fostering a healthy balance between compliance and support for nonprofit activities and services.

Similar forms

The Form ST-5 Exempt Purchaser Certificate has similarities to the 51A126 form in that it is also used by organizations to certify their tax-exempt status for the purposes of purchasing goods without paying sales tax. The ST-5 form, common in various states, requires the exempt institution to provide details about its exempt status, similar to the 51A126 which asks for the nature of the exemption and the specific use of purchased items.

The Form 13, or Nebraska Resale or Exempt Sale Certificate, shares similarities with the 51A126 form as it is utilized for claiming tax exemption on purchases. Like the 51A126 form, it is used by entities such as non-profit, educational, or religious organizations; however, it also extends to resellers who buy products to sell them further. Both forms necessitate the disclosure of the purpose of the purchase and affirm that the items bought will be used in accordance with the organization’s tax-exempt functions.

The Sales and Use Tax Exemption form in Florida, often referred to as the "Consumer's Certificate of Exemption" or "Form DR-14," serves a purpose parallel to the 51A126 form. It allows tax-exempt entities, including non-profits and educational institutions, to make purchases without paying state sales tax. Applicants must provide details about their exempt status, comparable to the requirements on the 51A126 form, ensuring the use of purchased goods aligns with their exempt purposes.

The Uniform Sales & Use Tax Exemption/Resale Certificate – Multijurisdiction, is a document with a purpose that echoes the 51A126 form. Used by businesses and organizations across multiple states, this certificate allows tax-exempt purchases similar to the 51A126 form's aim for Kentucky-based entities. Both types of forms require the entity making the purchases to certify their eligibility for tax exemption and ensure the goods or services bought are utilized within the scope of their exempt activities.

The Streamlined Sales and Use Tax Agreement Certificate of Exemption is another document comparable to the 51A126 form. This multi-state form allows entities to claim sales tax exemption on purchases made in member states, emphasizing the necessity for goods to be used in a manner that aligns with the purchaser’s exempt status. Like the 51A126, it requires the purchaser to provide a detailed explanation for how the purchased items will be utilized within their exempt functions, ensuring compliance with tax-exempt requirements.

Dos and Don'ts

When filling out the 51A126 form for Purchase Exemption Certificate in Kentucky, it's crucial to follow certain do's and don'ts to ensure the process is seamless and compliant with state regulations. Here's a guide to help you navigate this important task:

Do's:- Verify the institution's eligibility: Ensure that the institution named on the form qualifies as a Kentucky resident, non-profit educational, charitable or religious institution, or Kentucky historical site.

- Provide accurate information: The institution's name, address, and description of the property or services to be purchased must be clearly and accurately stated.

- Specify the type of exemption: Clearly mark whether the certificate is for a "Blanket" or "Single Purchase" exemption.

- Understand the use of purchased items: Confirm that the items or services purchased will be used solely within the exempt functions of the institution.

- Sign and date the form: The form must be signed by an authorized official of the institution, and the date of signing should be clearly indicated.

- Keep a copy for records: Retain a copy of the completed form for the institution’s records as evidence of compliance with Kentucky’s tax laws.

- Leave sections incomplete: Do not submit the form with missing information. Incomplete forms may be considered invalid and can lead to complications.

- Use for personal purchases: The exemption certificate cannot be used for personal gains or purchases outside the scope of the exempt institution’s functions.

- Overlook caution to seller: Be mindful that the form cannot be used by construction contractors buying property for projects with exempt institutions. Sellers must be aware of this limitation.

- Misrepresent information: Avoid providing false information. Misrepresentation can result in penalties under KRS 139.990 and other laws.

- Forget to update blanket certificates: For blanket exemptions, ensure the certificate is updated regularly to reflect any changes in the institution’s eligibility or the nature of exempt purchases.

- Ignore tax obligations: If the purchased property is later used for non-exempt purposes, it's important to comply with the requirement to pay tax on the purchase price.

Adhering to these guidelines will help ensure that your 51A126 form is properly completed and accepted, furthering your institution's mission while remaining compliant with Kentucky's tax regulations.

Misconceptions

Understanding forms and their specific uses in government and taxation can sometimes be tricky. The 51A126 form is a vital document for exempt institutions making certain purchases in Kentucky, but there are a few common misunderstandings about it:

- It's only for educational institutions: While educational institutions can use this form, it's also available to charitable or religious institutions, and Kentucky historical sites that meet specific criteria.

- Any purchase qualifies for exemption: The form is designed for purchases that are directly related to the institution's exempt function. Items not used within these functions do not qualify for exemption.

- Completion guarantees exemption: Simply completing the form doesn't automatically grant exemption. The purchases must align with the usage outlined in the form, and improper use may lead to the requirement to pay tax on the items.

- It can be used by anyone within the institution: The form must be filled out and signed by an authorized individual who can legally represent the institution and affirm that the purchase complies with exempt purposes.

- It allows for personal use: Absolutely no part of this exemption extends to personal use by officials or employees. Misuse of the form for personal benefit is subject to legal penalties.

- It's a one-time use document: The certificate can be either for a single purchase or as a blanket certificate for multiple purchases, as long as all purchases meet the eligibility criteria.

- No follow-up is required: Should the purchased items not be used as intended for exemption, the institution is obligated to pay the sales tax on those items. This indicates a follow-up on the use of purchased goods is essential.

- Any vendor can accept it without consequence: Sellers are cautioned about accepting the certificate, especially for construction contractors purchasing property for contract fulfillment with an exempt institution. Sellers may be held liable for sales or use tax if the purchase does not qualify for the exemption.

- There's no penalty for incorrect use: Use of the certificate for non-exempt purposes or personal gain can lead to penalties under Kentucky Revised Statutes (KRS) 139.990 and other applicable laws.

Correctly understanding and using the 51A126 form ensures that exempt institutions can appropriately benefit from tax exemptions on qualifying purchases, while also maintaining compliance with Kentucky tax laws.

Key takeaways

Filling out and using the 51A126 form, a Purchase Exemption Certificate in Kentucky, involves a detailed understanding of its purpose, guidelines, and implications. This document facilitates tax-exempt purchases by certain entities. Below are eight key takeaways to assist in navigating this process:

- Eligibility Criteria: Only Kentucky residents, nonprofit educational, charitable, religious institutions, or Kentucky historical sites qualify for this exemption.

- Complete Information Required: The certificate is not valid unless it is fully completed with accurate information about the exempt institution and the vendor from whom purchases are made.

- Use Within Exempt Functions: Items purchased using this certificate must be used solely within the exempt function—charitable, educational, religious, or as part of a historical site's operations.

- Type of Exemption: The form allows for either a blanket or single purchase exemption, which should be specified when filling it out.

- Accountability Clause: There is a responsibility to pay taxes on items purchased if they are later used for non-exempt purposes, maintaining the integrity of the exemption’s intent.

- Penalties for Misuse: Misusing this certificate for personal benefits or outside the stated exempt purposes exposes individuals to legal penalties under KRS 139.990 and other applicable laws.

- Verification by Sellers: Sellers must exercise caution and verify the validity of the exemption certificate to avoid being held liable for sales or use tax on the transaction.

- Restriction on Construction Contractors: Construction contractors cannot use this certificate for buying property intended for contracts with exempt institutions, a specific prohibition aimed at preventing misuse.

Proper application and adherence to these guidelines ensure the 51A126 form serves its purpose—supporting the valuable work of exempt organizations within Kentucky without complicating tax obligations. It is imperative that both sellers and exempt institutions understand and respect the legal boundaries this certificate operates within.

Popular PDF Forms

Madison County Al Probate Records - The Alabama Rt 1 form is an essential part of property recordation in Alabama, helping to ensure transparency and accuracy in property transactions.

Dhsmv Forms - The form permits use in legal proceedings, research activities, and by insurers or insurance organizations for specified activities.