Blank 543A PDF Template

When businesses undergo changes or updates, it's crucial to formalize those changes in an official capacity with the state. In Ohio, the Form 543A serves as a critical document for domestic limited liability companies (LLCs) that wish to amend or restate their Articles of Organization. This form covers various scenarios, including changes to the company's name, the duration of the company's existence, or any other material information initially filed. Available through the Ohio Secretary of State's office, it offers options for regular and expedited processing, each with its own set fee structure, ensuring that businesses can choose a service speed that matches their needs. The expedited service especially caters to those requiring swift processing, offering options for two-business-day processing, one-business-day processing, or even a four-hour turnaround for walk-in customers. Additionally, the form provides a preclearance service for advising on the acceptability of the proposed filing before the actual submission, adding another layer of convenience and certainty for businesses. Moreover, the form mandates that any change must be accurately represented and authorized by the individual or business entity, underscoring the importance of accurate documentation in maintaining the legal standing of an LLC within Ohio.

Preview - 543A Form

Toll Free: 877.767.3453 | Central Ohio: 614.466.3910

OhioSoS.gov | business@OhioSoS.gov

File online or for more information: OhioBusinessCentral.gov

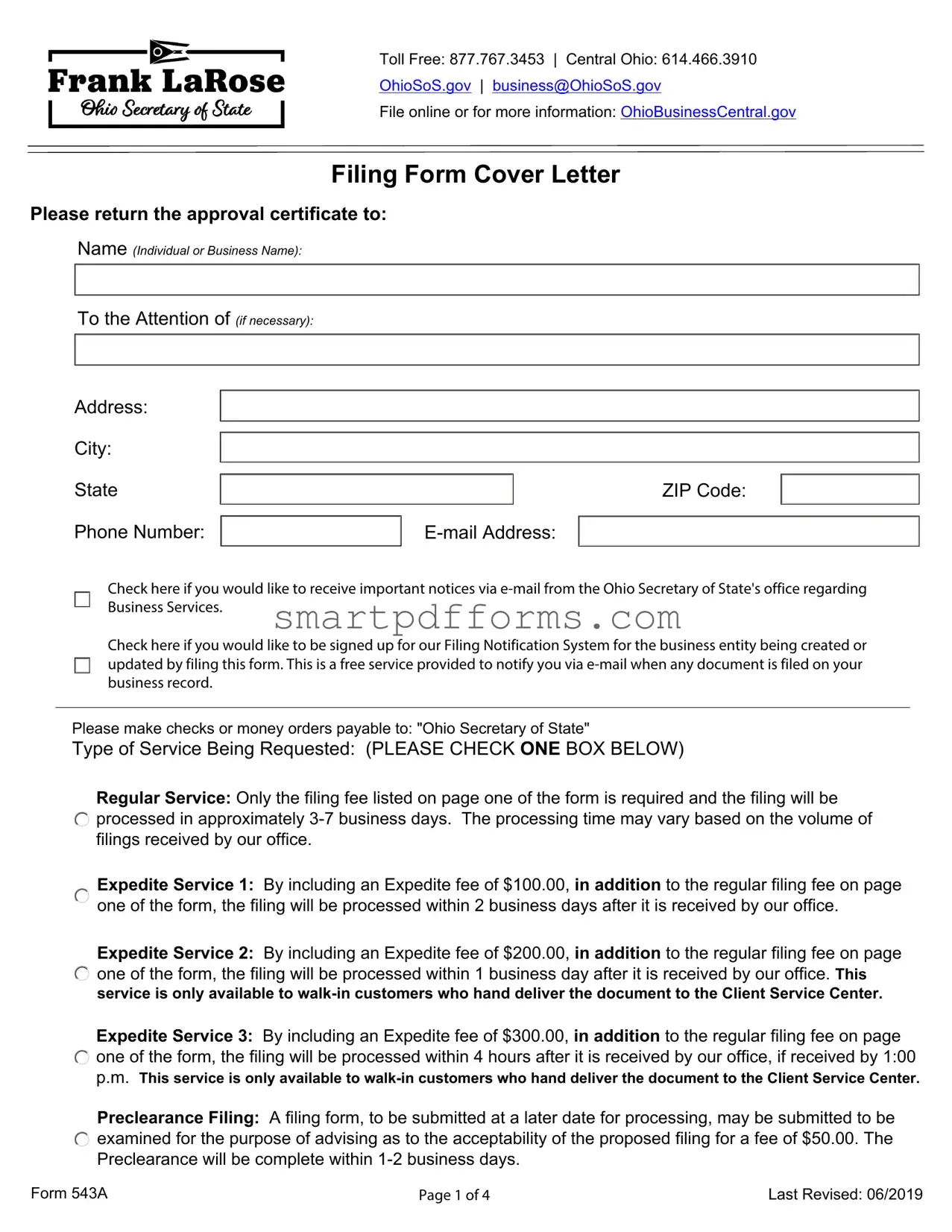

Filing Form Cover Letter

Please return the approval certificate to:

Name (Individual or Business Name):

To the Attention of (if necessary):

Address: |

|

City: |

|

State |

ZIP Code: |

Phone Number: |

Check here if you would like to receive important notices via

Check here if you would like to be signed up for our Filing Notification System for the business entity being created or updated by filing this form. This is a free service provided to notify you via

Please make checks or money orders payable to: "Ohio Secretary of State"

Type of Service Being Requested: (PLEASE CHECK ONE BOX BELOW)

Regular Service: Only the filing fee listed on page one of the form is required and the filing will be  processed in approximately

processed in approximately

Expedite Service 1: By including an Expedite fee of $100.00, in addition to the regular filing fee on page one of the form, the filing will be processed within 2 business days after it is received by our office.

Expedite Service 2: By including an Expedite fee of $200.00, in addition to the regular filing fee on page  one of the form, the filing will be processed within 1 business day after it is received by our office. This

one of the form, the filing will be processed within 1 business day after it is received by our office. This

service is only available to

Expedite Service 3: By including an Expedite fee of $300.00, in addition to the regular filing fee on page  one of the form, the filing will be processed within 4 hours after it is received by our office, if received by 1:00

one of the form, the filing will be processed within 4 hours after it is received by our office, if received by 1:00

p.m. This service is only available to

Preclearance Filing: A filing form, to be submitted at a later date for processing, may be submitted to be  examined for the purpose of advising as to the acceptability of the proposed filing for a fee of $50.00. The

examined for the purpose of advising as to the acceptability of the proposed filing for a fee of $50.00. The

Preclearance will be complete within

Form 543A |

Page 1 of 4 |

Last Revised: 06/2019 |

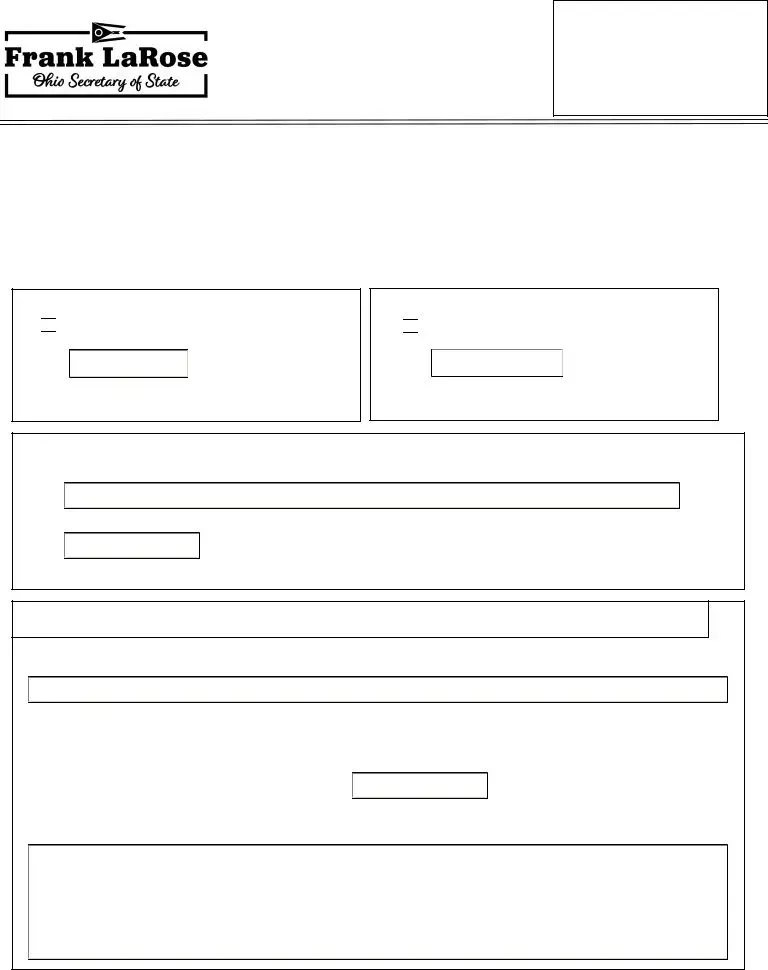

Form 543A Prescribed by:

Toll Free: 877.767.3453

Central Ohio: 614.466.3910

OhioSoS.gov

business@OhioSoS.gov

File online or for more information: OhioBusinessCentral.gov

For screen readers, follow instructions located at this path.

Mail this form to one of the following:

Regular Filing (non expedite)

P.O. Box 1329

Columbus, OH 43216

Expedite Filing (Two business day processing time. Requires an additional $100.00)

P.O. Box 1390

Columbus, OH 43216

Domestic Limited Liability Company Certificate of

Amendment or Restatement

Filing Fee: $50

Form Must Be Typed

(CHECK ONLY ONE (1) BOX)

(1)Domestic Limited Liability Company

Amendment

Amendment

Date of Formation

(MM/DD/YYYY)

(2)Domestic Limited Liability Company

Restatement

Restatement

Date of Formation

(MM/DD/YYYY)

The undersigned authorized representative of:

Name of Limited Liability Company

Registration Number

If box (1) Amendment is checked, only complete sections that apply. If box (2) Restatement is checked, all sections below must be completed.

The name of said limited liability company shall be:

Name must include one of the following words or abbreviations: "limited liability company," "limited," "LLC," "L.L.C.," "ltd." or "ltd"

This limited liability company shall exist for a period of:

Purpose

Form 543A |

Page 2 of 4 |

Last Revised: 06/2019 |

By signing and submitting this form to the Ohio Secretary of State, the undersigned hereby certifies that he or she has the requisite authority to execute this document.

Required

Must be signed by a member, manager or other representative.

If authorized representative is an individual, then they must sign in the "signature" box and print their name in the "Print Name" box.

If authorized representative is a business entity, not an individual, then please print the business name in the "signature" box, an authorized representative of the business entity must sign in the "By" box and print their name in the "Print Name" box.

Signature

By (if applicable)

Print Name

Signature

By (if applicable)

Print Name

Signature

By (if applicable)

Print Name

Form 543A |

Page 3 of 4 |

Last Revised: 06/2019 |

Instructions for Limited Liability Company Certificate of Amendment or

Restatement

This form should be used if you wish to file an amendment or restatement to the articles of organization for a domestic limited liability company.

Pursuant to Ohio Revised Code §1705.08, the articles of organization of a limited liability company may be amended at any time, but a certificate of amendment amending the articles of organization shall be filed within thirty days after the occurrence of any of the following: (1) the name of the limited liability company is changed; (2) the period of the limited liability company's duration is changed; or (3) any other information that is set forth in the articles of organization is changed. An authorized representative of the limited liability company must file an amendment upon discovering that a statement in the articles of organization was materially false when made or that any other information set forth in the articles of organization has changed making the articles materially inaccurate.

The articles of organization of a limited liability company may be restated at any time by filing a restatement of the articles of organization.

If you wish to file an amendment, please select box 1. If you wish to file a restatement, please select box 2. As required by Ohio Revised Code §1705.08 (C)(1)(b), indicate the date of the filing of the limited liability company's articles of organization that are being amended.

Name of Limited Liability Company

Indicate the name of the limited liability company and the registration number. If you choose to change the name of the limited liability company, the name must include one of the following: “limited liability company,” “limited,” “LLC,” “L.L.C.,” “ltd.” or “ltd”, pursuant to Ohio Revised Code §1705.05.

Period of Existence

A period of existence may be provided but is not required. Pursuant to Ohio Revised Code §1705.04 (B), if a period of existence is not provided in the articles the limited liability company's period of existence is perpetual.

Purpose Clause

A purpose clause may be provided but is not required. As stated in Ohio Revised Code §1705.02, a limited liability company may generally “be formed for any purpose or purposes for which individuals lawfully may associate themselves.”

Additional Provisions

If the information you wish to provide for the record does not fit on the form, please attach additional provisions on a

Signature(s)

After completing all information on the filing form, please make sure that page 2 is signed by at least one authorized representative of the limited liability company.

**Note: Our office cannot file or record a document that contains a social security number or tax identification number. Please do not enter a social security number or tax identification number, in any format, on this form.

Form 543A |

Page 4 of 4 |

Last Revised: 06/2019 |

Form Data

| Facts | Details |

|---|---|

| Form Number | 543A |

| Form Title | Domestic Limited Liability Company Certificate of Amendment or Restatement |

| Governing Law | Ohio Revised Code §1705 |

| Filing Fee | $50 |

| Last Revised | June 2019 |

| Services Offered | Regular Service, Expedite Service (1, 2, 3), Preclearance Filing |

Instructions on Utilizing 543A

After deciding whether an amendment or restatement of the articles of organization is necessary for a domestic limited liability company (LLC) in Ohio, the Form 543A is required to be filled out and submitted to the Ohio Secretary of State. This process enables the registration of changes like the company name, period of the company's duration, or any other pertinent information initially established in the articles of organization. The steps outlined below guide through filling out the form accurately to ensure compliance and timely processing.

- Select the type of filing: Indicate whether the form is for an Amendment (129-LAM) or a Restatement (142-LRA) by checking the appropriate box at the top of the form.

- Provide the date of formation: Enter the date the LLC was originally formed in the format MM/DD/YYYY.

- Enter the name and registration number of the LLC: Write the current name of the limited liability company and its registration number provided by the Ohio Secretary of State.

- If changing the company name, include the new name ensuring it complies with Ohio naming requirements (must include "limited liability company", "limited", "LLC", "L.L.C.", "ltd.", or "ltd").

- Specify the period of existence if applicable, although this is not a mandatory field unless you are altering the current period of existence.

- Include a purpose clause if the purpose of the LLC is being added or changed. This is not required if the purpose remains as previously submitted.

- For additional provisions that do not fit on the form, attach extra sheet(s) with the necessary information on a single-sided, 8 ½ x 11 sheet of paper.

- Sign and date the form: The form must be signed by at least one authorized representative of the LLC. If the representative is an individual, they should sign and print their name in the designated areas. If a business entity is the authorized representative, print the business name in the "signature" box, and an authorized individual must sign in the "By" box and print their name in the "Print Name" box.

- Finally, choose the type of service being requested (Regular, Expedite Service 1, 2, or 3, Preclearance Filing) and include the appropriate fee with the submission.

Once the form is fully completed and the filing fee is attached, mail the document to the corresponding address depending on the selected service speed. Regular filings should be sent to the P.O. Box for non-expedite filings, while expedited filings have a separate P.O. Box. Ensure that no social security numbers or tax identification numbers are included on the form to comply with privacy regulations. Following these steps will facilitate a smooth process in amending or restating your LLC’s articles of organization.

Obtain Answers on 543A

-

What is the purpose of the Form 543A?

Form 543A is designed for domestic limited liability companies (LLCs) in Ohio looking to amend or restate their articles of organization. Whether there's a change in the company name, duration, or any other significant information originally filed, this form helps in updating those details. It outlines the necessary steps and documentation required to either amend existing articles (with selective updates) or to completely restate (comprehensively update) the LLC's foundational document. This process is crucial for maintaining the accuracy and legality of the company's official records with the Ohio Secretary of State.

-

Who is required to sign the Form 543A?

The Form 543A must be signed by an authorized representative of the limited liability company. According to the instructions provided with the form, if the representative is an individual, they must sign in the designated "signature" box and print their name. If the representative is a business entity rather than an individual, the business name should be printed in the "signature" box, and an authorized individual must sign in the "By" box and print their name. This ensures that the form is duly authorized according to the LLC's governing structure.

-

What are the different services available for processing Form 543A, and how long do they take?

There are multiple processing services available for Form 543A, each varying in cost and processing time. Here's a quick overview:

- Regular Service: Requires only the form's filing fee and takes approximately 3-7 business days, varying with filing volume.

- Expedite Service 1: For an additional $100.00, filings are processed within 2 business days.

- Expedite Service 2: For an extra $200.00, and exclusive to walk-in customers, processing occurs within 1 business day.

- Expedite Service 3: For a $300.00 fee, and again only for walk-ins, filings are processed within 4 hours if received by 1:00 p.m.

- Preclearance Filing: For a $50.00 fee, a form can be pre-examined within 1-2 business days for later submission.

Choosing the right service depends on the required timeline and whether the filing can be delivered in person.

-

How should payments be made for filing Form 543A, and to whom?

Payments for filing Form 543A, either for the regular filing fee or including an additional expedite service fee, should be made by check or money order. These payments must be payable to the "Ohio Secretary of State." This ensures the proper handling and allocation of your filing fees, directly supporting the processing of your submitted form. Always include the form and payment in the same submission to avoid delays or processing issues.

Common mistakes

Filling out the 543A form is an important process for limited liability companies in Ohio looking to amend or restate their articles of organization. Here are seven common mistakes to avoid when completing this form:

Not checking the appropriate service type box: Regular, Expedite Service 1, Expedite Service 2, Expedite Service 3, or Preclearance Filing. This oversight might lead to delays in processing.

Omitting the return address details in the Filing Form Cover Letter. The Secretary of State’s office needs this information to return the approval certificate.

Forgetting to indicate the type of filing on the form: Domestic Limited Liability Company Amendment or Restatement. This is crucial for the form to be processed correctly.

Incorrectly or incompletely filling out the name of the limited liability company and the registration number. This can cause confusion and result in the document being returned.

Not including one of the required words or abbreviations ("limited liability company," "limited," "LLC," "L.L.C.," "ltd." or "ltd") in the name of the limited liability company if changing the name.

Leaving the period of existence blank when a specific term is intended, contrary to the perpetual default assumption as per Ohio law.

Failing to sign the form by an authorized representative, which is mandatory for the filing to be accepted and processed. If the form is signed by a business entity, not following the correct format for business entity signatures.

Being attentive to these details can make the filing process smoother and help avoid unnecessary delays or rejections from the Ohio Secretary of State's office.

Documents used along the form

When businesses undergo changes or updates, such as those detailed in Form 543A for amending or restating articles of organization of a domestic limited liability company, they often need to complete additional forms and documents to ensure all aspects of the transition are legally documented and properly filed. These documents can range from changes in company structure to tax registrations. Below is a list of documents frequently used in conjunction with Form 543A, each with a brief description:

- Articles of Incorporation: This document formally establishes a corporation's existence under state law and includes details like the company’s name, purpose, and the distribution of shares.

- Operating Agreement: Especially for LLCs, this document outlines the business's financial and functional decisions including rules, regulations, and provisions. The purpose is to govern the internal operations of the business in a way that suits the specific needs of the business owners.

- Employer Identification Number (EIN) Application: When a business changes its structure, it may need to apply for a new EIN or update its existing EIN with the IRS. This is essential for tax purposes.

- DBA Registration Form: If a business operates under a name different from its legal name, a "Doing Business As" (DBA) registration form must be filed with the state or local government.

- Shareholders' Agreement: This is relevant for corporations and details the rights, responsibilities, and obligations of shareholders, including how shares can be bought, sold, or transferred.

- Business License Application: Depending on the nature of the change and the local requirements, businesses may need to apply for a new business license or update their existing license.

- Sales Tax Permit Application: For businesses that sell goods or services subject to sales tax, updating or applying for a new sales tax permit may be necessary.

- Change of Registered Agent Form: If changing the registered agent or their address, this form notifies the state of who is officially designated to receive legal documents on behalf of the business.

- Certificate of Good Standing Request: After making changes, a business might request this certificate from the state to prove it is compliant with state regulations and legally allowed to do business.

- Annual Report: Depending on the state, businesses may be required to file an annual report detailing current information about the business, such as addresses, directors, and officers. This may be necessary especially if any of this information has changed.

Completing and filing the appropriate forms and documents when making formal changes to a business is crucial for compliance and operational continuity. While Form 543A is a significant step for LLCs amending or restating their organization specifics, the additional documents mentioned play vital roles in fully implementing and registering those changes across various government and legal bodies. Understanding each document’s purpose aids in a smoother transition and ensures legal obligations are met.

Similar forms

The Domestic Limited Liability Company Amendment form (129-LAM) shares similarities with the Form 543A, as both involve changes to the official records of a business entity held by the state. Specifically, they allow for modifications such as the name change of the company, adjustment in the period of existence, or updates to other essential company details.

The Domestic Limited Liability Company Restatement form (142-LRA) is akin to the Form 543A since it also pertains to updating a company's foundational documents. This form goes a step further by enabling an entire restatement of the company's articles of organization, offering a comprehensive update beyond amendments.

Application for Name Reservation is related because it deals with the selection and reservation of a business name. Similar to the name change option in Form 543A, it focuses on the crucial aspect of a company's identity within the state's official records.

Forms related to Annual Reports for maintaining compliance also share similarities. These forms ensure that a company's current information is accurately reflected in the state's database, comparable to updates made through the Form 543A for specific changes.

The Change of Registered Agent form parallels the Form 543A in its purpose to update official records with the state. It specifically allows a business to change its registered agent details, akin to how Form 543A might be used to update business details.

Foreign Entity Registration forms, which allow an out-of-state business to operate within another state, have shared intentions with the Form 543A. Both sets of forms ensure a business's operations are recognized and properly recorded by state authorities.

The Articles of Dissolution are connected in function to Form 543A, as they both pertain to significant changes in a company's status. While the Form 543A might amend or restate business details, the Articles of Dissolution formally end a company's legal existence.

Finally, Merger and Consolidation Forms are akin to Form 543A, as they also address alterations in a business's structure or ownership. Similar to amendments or restatements, these forms are used when companies undergo major transformations that affect their state records.

Dos and Don'ts

When filling out the Form 543A for filing an amendment or restatement with the Ohio Secretary of State, there are several dos and don'ts to consider to ensure that your submission is processed smoothly and accurately.

Dos:

- Read the instructions carefully before beginning to fill out the form. This will save time and help avoid mistakes.

- Ensure that the form is typed, as handwritten forms may not be accepted.

- Check the appropriate box at the top of the form to indicate whether you are filing an amendment or a restatement of your limited liability company’s articles of organization.

- Include the name and the registration number of the Limited Liability Company accurately as registered with the Ohio Secretary of State.

- Choose an expedite service if you need the filing to be processed faster than the standard processing time and include the additional fee with your payment.

- Sign the form with the authorized representative's signature. If the signee is an individual, remember to print their name in the designated box.

- If attaching additional provisions, ensure they are on a single-sided, 8 ½ x 11 sheet(s) of paper.

- Double-check that all required fields have been completed and that information is accurate before submitting the form.

Don'ts:

- Don't skip providing an email address if you want to receive important notices via email from the Ohio Secretary of State's office concerning Business Services.

- Don't enter a social security number or tax identification number anywhere on the form, as the document cannot be filed or recorded with such information.

- Don't overlook the choice of service type. If you require faster processing, be sure to select the correct Expedite Service option and include the appropriate fee.

- Don't forget to make your check or money order payable to the "Ohio Secretary of State."

- Don't send the form without making sure it’s signed by an authorized representative. Unsigned forms will not be processed.

- Don't file the form without verifying the name inclusion meets Ohio Revised Code requirements, including permissible abbreviations.

- Don't ignore the attachment requirement if additional space is needed for provisions not fitting on the form.

- Don't send the form to the wrong office; use the correct mailing address for either regular or expedite filing as stated on the form instructions.

Misconceptions

Many misunderstandings surround the 543A form, which can lead to confusion and errors in filing. Here, we aim to clarify the most common misconceptions:

- The 543A form applies only to amendments.

Contrary to this belief, the 543A form is utilized for both amendments and restatements of the articles of organization for a domestic limited liability company in Ohio.

- It’s optional to file an amendment using form 543A when changes occur.

This is inaccurate. If there are material changes to the articles of organization, such as a name change or duration change, the LLC is required to file an amendment within thirty days of such changes.

- Email notifications are automatic.

Actually, to receive email notifications from the Ohio Secretary of State's office, one must expressly opt-in on the 543A form by checking the appropriate box.

- The filing fee is the same for all services.

There are different filing fees and additional expedite fees depending on the speed of processing required, with regular, expedite, and preclearance options having varying costs.

- A signature from an individual is always required.

While a signature is mandatory, it can come from either an individual or an authorized representative of a business entity, as stipulated by the form’s instructions.

- Preclearance is only for expedited services.

Actually, preclearance is a separate service designed to review a filing form for accuracy and completeness before the actual filing, and it is not limited to expedited processing.

- Formatting requirements are flexible.

The form must be typed, adhering to strict formatting guidelines, contrary to the assumption that handwritten submissions are acceptable.

- Any additional information can be included on the form itself.

For information that does not fit on the form, additional provisions must be attached on single-sided, 8 ½ x 11 sheet(s) of paper, rather than trying to cram all information directly onto the form.

- Expedite Service 3 is the fastest option for anyone.

This expedited service is only available to walk-in customers who deliver their documents by hand to the Client Service Center, making it inaccessible for those unable to visit in person.

- The form requires inclusion of social security or tax identification numbers.

The form explicitly instructs not to enter social security numbers or tax identification numbers, debunking the myth that these are necessary for the filing.

Understanding these aspects of the 543A form is crucial for correct and efficient processing, ensuring that the necessary legal requirements are met without unnecessary delay or rejection.

Key takeaways

Understanding the intricacies of the 543A form, especially for amendments or restatements of domestic limited liability companies in Ohio, is crucial for maintaining compliance and ensuring the proper management of business entities. Here are several key takeaways for anyone navigating this process:

- Before initiating the filing process, it's essential to decide whether you're filing for an amendment or a restatement of the articles of organization, as the form accommodates both but requires a choice.

- The form mandates that any changes to the business name, period of existence, or correction of materially false or inaccurate statements in the articles of organization must be officially amended within thirty days.

- Expedite Service Options are available for those who need their filings processed more quickly than the standard 3-7 business days. Fees for these services range from $100 to $300, depending on the turnaround time desired.

- A Preclearance Filing option is offered for a fee of $50.00, allowing for a preliminary examination of the proposed filing to advise on its acceptability. This process is completed within 1-2 business days.

- When changing the name of a limited liability company, the new name must include specific designations such as "limited liability company," "limited," or abbreviations like "LLC" to comply with Ohio Revised Code §1705.05.

- Although providing a period of existence and a purpose clause is optional, these can be included in the filing to specify the duration of the company’s existence and the nature of its business activities.

- The form must be typed, ensuring clarity and preventing processing delays that handwritten documents may cause.

- It is vital that the form is signed by an authorized representative of the limited liability company, indicating their capacity to bind the company. If the representative is a business entity, both the entity name and the signing individual’s name must be included.

- For effective record-keeping and to avoid identity theft or fraud, social security numbers or tax identification numbers should not be included on the form.

Completing Form 543A accurately and understanding the available options for processing are fundamental steps in managing the legal documentation for limited liability companies in Ohio. These key points provide a comprehensive overview of how to navigate the amendment and restatement process, ensuring adherence to state requirements and promoting successful business operations.

Popular PDF Forms

Haccp Template - Structured to support food establishments in ensuring compliance with food safety regulations and standards, promoting consumer health and safety.

How to Write a Construction Bid - Designed to improve transparency and accuracy in construction project planning and budgeting.