Blank 7001 PDF Template

In the intricate landscape of agricultural and livestock trading, the Form 7001 emerges as a pivotal document, designed with a focus on promoting transparency and accountability in financial transactions. Crafted by the U.S. Department of Agriculture (USDA) Grain Inspection, Packers and Stockyards Administration, this form serves a crucial function in monitoring the status of custodial bank accounts for shippers' proceeds. Its meticulous structure is divided into several sections, each demanding detailed information that encompasses the legal business name, contact details, and an in-depth analysis of the custodial bank account's financial health. Additionally, the form extends its reach to scrutinize proceeds receivable, thus ensuring a comprehensive audit trail of transactions potentially affecting the equitable distribution of funds among consignors of livestock. Penalties for non-compliance or falsification of information are stern, underlining the form's importance in safeguarding the financial interests of stakeholders in the livestock market. With confidential treatment of the submitted information, the USDA reinforces its commitment to upholding the highest standards of privacy and data protection, while mandating this report as a compulsory exercise for relevant entities, thereby facilitating a regime of stringent oversight and increased accountability within the sector.

Preview - 7001 Form

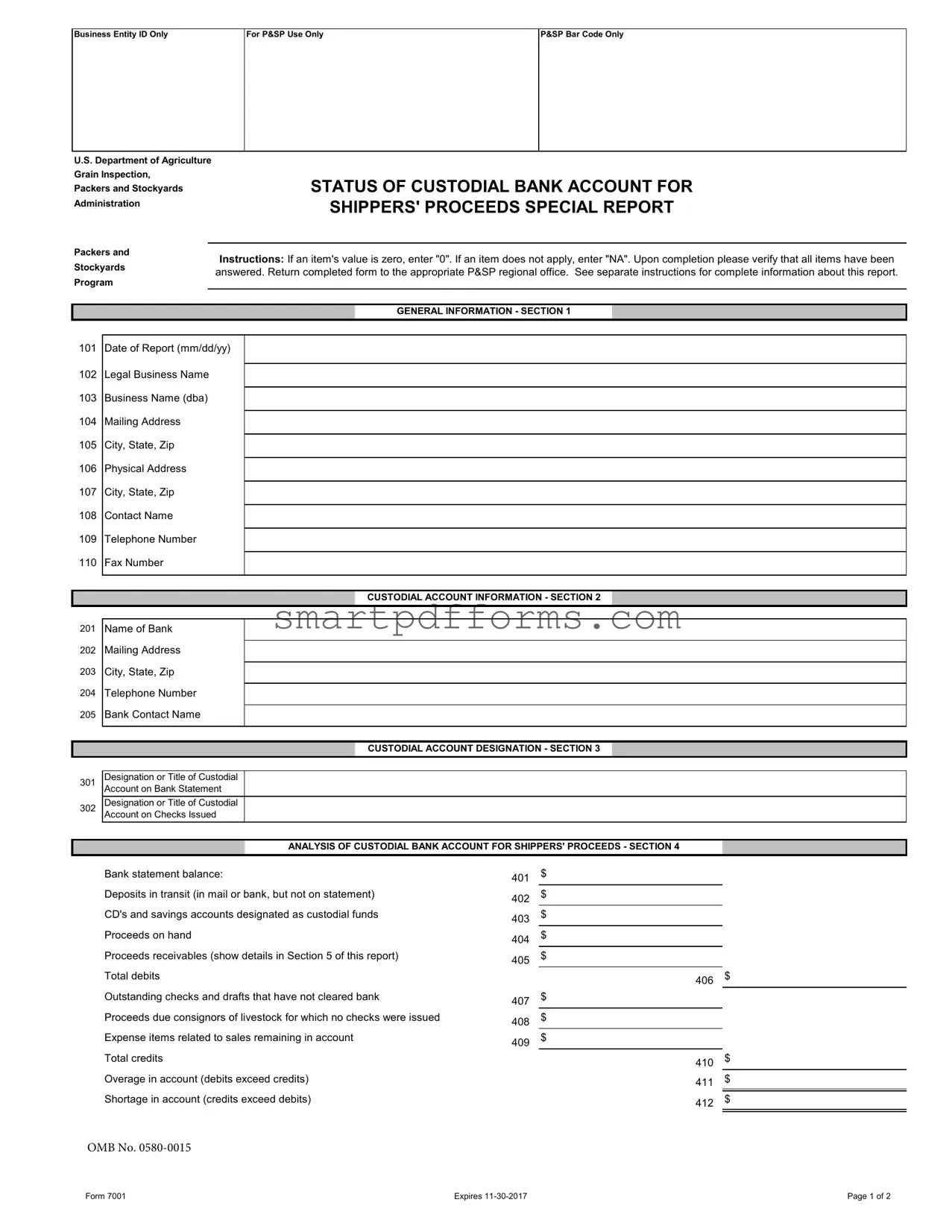

Business Entity ID Only

For P&SP Use Only

P&SP Bar Code Only

U.S. Department of Agriculture Grain Inspection,

Packers and Stockyards Administration

STATUS OF CUSTODIAL BANK ACCOUNT FOR SHIPPERS' PROCEEDS SPECIAL REPORT

Packers and |

Instructions: If an item's value is zero, enter "0". If an item does not apply, enter "NA". Upon completion please verify that all items have been |

|||

Stockyards |

||||

answered. Return completed form to the appropriate P&SP regional office. See separate instructions for complete information about this report. |

||||

Program |

||||

|

|

|

||

|

|

|

|

|

|

|

GENERAL INFORMATION - SECTION 1 |

|

|

|

|

|

|

|

101Date of Report (mm/dd/yy)

102Legal Business Name

103Business Name (dba)

104Mailing Address

105City, State, Zip

106Physical Address

107City, State, Zip

108Contact Name

109Telephone Number

110Fax Number

CUSTODIAL ACCOUNT INFORMATION - SECTION 2

201

202

203

204

205

Name of Bank

Mailing Address

City, State, Zip

Telephone Number

Bank Contact Name

CUSTODIAL ACCOUNT DESIGNATION - SECTION 3

301

302

Designation or Title of Custodial Account on Bank Statement

Designation or Title of Custodial Account on Checks Issued

ANALYSIS OF CUSTODIAL BANK ACCOUNT FOR SHIPPERS' PROCEEDS - SECTION 4

Bank statement balance:

Deposits in transit (in mail or bank, but not on statement) CD's and savings accounts designated as custodial funds Proceeds on hand

Proceeds receivables (show details in Section 5 of this report) Total debits

Outstanding checks and drafts that have not cleared bank

Proceeds due consignors of livestock for which no checks were issued Expense items related to sales remaining in account

Total credits

Overage in account (debits exceed credits) Shortage in account (credits exceed debits)

401$

402$

403$

404$

405$

406 $

407$

408$

409$

410 $

411 $

412 $

OMB No.

Form 7001 |

Expires |

Page 1 of 2 |

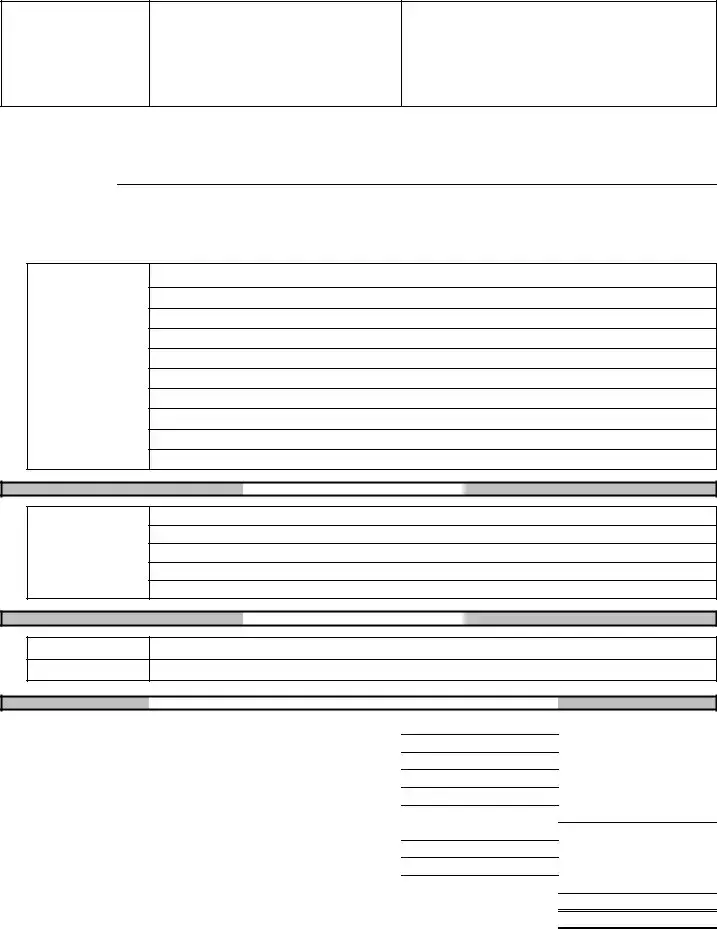

PROCEEDS RECEIVABLE - SECTION 5

“Proceeds Receivables” vary based on the livestock buyer. For most buyers when conducting the custodial analysis any uncollected funds during the time period including the analysis date and the 6 days before the analysis are proceeds receivables. For livestock purchases made by the market, its owner, officers, employers, and credit buyers the time period is limited to include only the analysis date and the previous business day.

|

Date of Sale |

Name of Buyer |

Amount of Proceeds Receivable |

501 |

|

|

|

|

|

$ |

|

|

|

|

|

502 |

|

|

$ |

|

|

|

|

503 |

|

|

$ |

|

|

|

|

504 |

|

|

$ |

|

|

|

|

505 |

|

|

$ |

|

|

|

|

506 |

|

|

$ |

|

|

|

|

507 |

|

|

$ |

|

|

|

|

508 |

|

|

$ |

|

|

|

|

509 |

|

|

$ |

|

|

|

|

510 |

|

|

$ |

|

|

|

|

511 |

|

|

$ |

|

|

|

|

512 |

|

|

$ |

|

|

|

|

513 |

|

|

$ |

|

|

|

|

514 |

|

|

$ |

|

|

|

|

515 |

|

|

$ |

|

|

|

|

516 |

|

|

$ |

|

|

|

|

517 |

|

|

$ |

|

|

|

|

518 |

|

|

$ |

|

|

|

|

519 |

|

|

$ |

|

|

|

|

520 |

|

|

$ |

|

|

|

|

521 |

|

|

$ |

|

|

|

|

522 |

|

|

$ |

|

|

|

|

523 |

|

|

$ |

|

|

|

|

524 |

|

|

$ |

|

|

|

|

525 |

|

|

$ |

|

|

|

|

526 |

|

|

$ |

|

|

|

|

527 |

|

|

$ |

|

|

|

|

528 |

|

|

$ |

|

|

|

|

529 |

|

|

$ |

|

|

|

|

530 |

|

|

$ |

|

|

|

|

531 |

|

|

$ |

|

|

|

|

532 |

|

|

$ |

|

|

|

|

533 |

|

Total from Additional Pages (enter 0 if no other pages used) |

$ |

|

|

||

534 |

|

Total Proceeds Receivable (enter on line 405) |

$ |

CERTIFICATION - SECTION 6

Under the Packers and Stockyards Act any person who willfully makes, or causes any false entry or statement of fact in this report shall be deemed guilty of offense against

the United States, and be subject to a fine of $1,000 to $5,000, or to imprisonment for a term of not more than 3 years, or to both fine and imprisonment.

I certify that this report has been prepared by me or under my direction, and to the best of my knowledge and belief correctly reflects reporting entity operations.

701 Print Name |

702 Signature (Must be signed by a person listed on |

703 Phone Number

704 Date

705 Title

Submitted information is confidential (9 CFR 201.96). Failure to report will result in forfeiture to the United States $110 per day until report receipt 7 (U.S.C. 222). Response is required in order to determine establishment, maintenance and status of custodial account (9 CFR 201.97). According to the Paperwork Reduction Act of 1995, an agency may not conduct or sponsor, and a person is not required to respond to, a collection of information unless it displays a valid OMB control number. The valid OMB control number for this information is

The U.S. Department of Agriculture (USDA) prohibits discrimination in all its programs and activities on the basis of race, color, national origin, age, disability, and where applicable, sex, marital status, familial status, parental status, religion, sexual orientation, genetic information, political beliefs, reprisal, or because all or part of an individual’s income is derived from any public assistance program. (Not all prohibited bases apply to all programs.) Persons with disabilities who require alternative means for communication of program information (Braille, large print, audiotape, etc.) should contact USDA’s TARGET Center at (202)

Form 7001 |

Expires |

Page 2 of 2 |

Form Data

| Fact Number | Description |

|---|---|

| 1 | The form's official title is "STATUS OF CUSTODIAL BANK ACCOUNT FOR SHIPPERS' PROCEEDS SPECIAL REPORT". |

| 2 | It is governed by the Packers and Stockyards Act under the U.S. Department of Agriculture Grain Inspection, Packers and Stockyards Administration. |

| 3 | The form is utilized to report the status of a custodial bank account specifically for shippers' proceeds. |

| 4 | Form 7001 requires the legal business name, business name doing business as (dba), addresses, and contact information of the reporting entity. |

| 5 | The custodial account information section asks for details about the bank holding the custodial account, including the name of the bank, its address, and the name of a bank contact. |

| 6 | Sections on the form require detailed financial information, such as bank statement balance, deposits in transit, designated CDs and savings accounts, among others. |

| 7 | The form mandates disclosure of "Proceeds Receivable" from livestock buyers within a specified timeframe. |

| 8 | Completion of the form includes a certification section where the preparer asserts the veracity of the information provided, subject to penalties for false statements. |

| 9 | The form's expiration date was 11-30-2017, indicating the need for a current version for compliance. |

| 10 | Non-compliance or failure to accurately report can result in fines or even imprisonment, highlighting the importance of accurate and timely submission. |

Instructions on Utilizing 7001

Completing the 7001 form is an essential step for entities required to report on the status of custodial bank accounts for shippers' proceeds. This process involves providing detailed information about the business, the custodial bank account, and conducting an analysis of the account for a specified period. Ensure all sections are filled out accurately to comply with regulations under the Packers and Stockyards Act. The form aims to foster transparency and accountability, safeguarding the interests of all parties involved.

- Start by entering the Date of Report in the format (mm/dd/yy) in section 101.

- Fill in the Legal Business Name in section 102 and, if applicable, the business name used in daily operations (dba) in section 103.

- Provide the Mailing Address in section 104, including City, State, Zip in sections 105 for mailing purposes and repeat the process for the Physical Address in sections 106 and 107.

- Enter the primary Contact Name, Telephone Number, and Fax Number in sections 108, 109, and 110 respectively.

- In Section 2, fill in the Name of Bank, Mailing Address, City, State, Zip, Telephone Number, and Bank Contact Name in fields 201-205 respectively to provide details about the custodial account.

- For Section 3, enter the Designation or Title of Custodial Account as it appears on bank statements and checks in fields 301 and 302.

- In Section 4, conduct and report the analysis of custodial bank account. This includes filling in amounts for Bank statement balance, Deposits in transit, custodial CD's and savings accounts, Proceeds on hand, and Proceeds receivables in fields 401-405. Also, report Total debits, Outstanding checks and drafts, Proceeds due, Expense items, Total credits, and any Overage or Shortage in account in fields 406-412.

- For Section 5, list all Proceeds Receivables with details such as Date of Sale, Name of Buyer, and Amount of Proceeds Receivable in fields 501-533. Ensure to enter the total of additional pages if used in field 534.

- In the final section, Section 6, Certification, the report must be certified to be true and correct. Print the name of the individual completing the report in field 701, provide a signature in field 702, enter a phone number in field 703, the date of signing in field 704, and the title of the signing individual in field 705.

Once all sections are filled out accurately, review the form to ensure compliance and correctness. The completed form should then be submitted to the appropriate P&SP regional office as indicated in the form's instructions. Timely and accurate submission of this form is crucial to fulfilling legal obligations and maintaining operational transparency.

Obtain Answers on 7001

What is the Form 7001 and who should complete it?

Form 7001, known as the "Status of Custodial Bank Account for Shippers' Proceeds Special Report," is a document used by the U.S. Department of Agriculture, particularly within the Grain Inspection, Packers and Stockyards Administration. This form is required to be filled out by businesses that deal with the shipment of livestock, grain, and other related commodities. The form serves to report the status of custodial bank accounts used to hold shippers' proceeds. Entities required to complete this form include those operating within the agricultural sector who manage finances related to livestock, grain, and similar commodities. The purpose is to ensure compliance with financial management guidelines and to prevent fraudulent activities.

What kind of information is required on the Form 7001?

Form 7001 requires comprehensive information regarding the custodial bank accounts that a business uses to manage the proceeds from shippers. Basic information about the business, such as legal name, doing business as (DBA) name, addresses, and contact details, needs to be provided in section 1. Section 2 collects details about the custodial bank account, including the name of the bank, contact information, and mailing address. In section 3, the designation or title of the custodial account as reflected on bank statements and checks is reported. Section 4 focuses on analyzing the custodial bank account's status, including balances, deposits, funds in transit, and any outstanding checks or drafts. Additionally, section 5 gathers data on “Proceeds Receivable” dependent on the livestock buyer, detailing the amount due from sales not yet collected. Finally, section 6 serves as a certification by the person completing the report, confirming the accuracy of the information provided and warning of the legal penalties for willful misstatements.

How often must Form 7001 be submitted?

The frequency at which Form 7001 must be submitted depends on the regulatory requirements set forth by the Grain Inspection, Packers and Stockyards Administration of the U.S. Department of Agriculture or any other relevant guidelines applicable to the entity's specific industry sector. Entities should refer to the separate instructions provided with the Form 7001 or consult directly with the Packers and Stockyards Program (P&SP) regional office to determine their specific reporting requirements. However, it’s important to regularly monitor and update the custodial account information to ensure ongoing compliance and to be prepared for periodic reporting.

What could happen if you fail to submit Form 7001 or submit it inaccurately?

Failure to submit Form 7001 or submitting it with false or inaccurate information can result in significant legal and financial consequences as outlined under the Packers and Stockyards Act. Individuals who willfully make false entries or statements in the report may face fines ranging from $1,000 to $5,000, imprisonment for a term of up to three years, or both. Additionally, there is a daily penalty of $110 until the report is received, emphasizing the importance of timely and accurate submission. These measures underline the critical nature of the form in maintaining the integrity of financial operations related to shippers' proceeds and the government's role in overseeing these activities to protect against fraud and mismanagement.

Common mistakes

Filling out the Form 7001, which plays a crucial role in reporting the status of custodial bank accounts for shippers' proceeds, requires attention to detail and a thorough understanding of the instructions. Mistakes made during this process can lead to confusion, delays, or even compliance issues. Here are five common mistakes people often make when completing this form:

- Entering Incorrect Dates: The Date of Report (101) must reflect the current reporting period in the format mm/dd/yy. Mistyping the year, month, or day can cause significant confusion and may even render the report invalid.

- Failure to Specify "NA" or "0": For any item that does not apply or where the value is zero, it is essential to enter "NA" (Not Applicable) or "0" (Zero), respectively. Omitting this information can lead to an incomplete understanding of the custodial account's status.

- Mismatch in Custodial Account Designation: The titles designated on bank statements (301) and checks issued (302) for the custodial account must match precisely. Any discrepancy here can raise questions about the integrity and accuracy of the custodial account's records.

- Inaccurate or Incomplete Analysis of Custodial Bank Account: The analysis section (Section 4) requires careful input of the balances, deposits, proceeds, and expenses related to the custodial bank account. Errors in this section can affect the overall assessment of funds available versus outstanding obligations.

- Omission of Proceeds Receivable Details: In Section 5, "Proceeds Receivable," it’s critical to accurately record the details of uncollected funds, including the date of sale and the name of the buyer. Failure to provide comprehensive details can lead to an incorrect calculation of total proceeds receivable.

By avoiding these common mistakes, individuals can ensure that the Form 7001 is accurately and effectively completed, thereby fulfilling their reporting obligations under the Packers and Stockyards Act with confidence.

Documents used along the form

When businesses engage in operations that involve the management of funds on behalf of others, stringent reporting and documentation are required. Form 7001 is a crucial document for entities handling custodial bank accounts for shippers' proceeds, ensuring compliance with the Packers and Stockyards Act. However, this form doesn't stand alone. Several other documents often complement it to provide a comprehensive overview of an entity's financial stewardship, each serving its unique purpose in the broader regulatory framework.

- Form 1030 - Bond Coverage Certification: This form certifies that a business has the necessary bond coverage as required by the Packers and Stockyards Act. It provides assurance to both the government and other stakeholders that the entity is financially backed to cover potential losses.

- Annual Financial Statement: A detailed report that outlines the company's financial status over the last fiscal year. It includes income statements, balance sheets, and cash flow statements, giving a comprehensive view of the entity's financial health.

- Market Agency or Dealer Trust Agreement: This document establishes a trust account for the benefit of the individuals or entities from whom the livestock are purchased, ensuring that proceeds from sales are properly handled and directed.

- Ownership and Custody of Livestock Document: It details the ownership status and custody chain of the livestock involved in transactions, providing clear evidence of legal possession and responsibility.

- Power of Attorney Documents: If the Form 7001 is signed by an individual other than the entity’s principal, this document grants the signer the authority to act on behalf of the entity in legal and financial matters.

- Bank Verification Letter: A document from the bank confirming the existence of the custodial bank account, its account numbers, and the signatories authorized to handle the account. This provides verification of the critical information reported on Form 7001.

- Compliance Certification: A statement or document wherein the entity certifies its compliance with all applicable regulations outlined by the Packers and Stockyards Act, as well as any other relevant federal or state laws.

Together, these documents play a vital role in maintaining transparency, accountability, and regulatory compliance for entities operating within the ambit of the Packers and Stockyards Act. By thoroughly compiling and accurately completing these documents, businesses not only adhere to legal requirements but also build trust with their clients, partners, and regulatory bodies. It's a testament to the importance of diligent record-keeping and reporting in the financial management of custodial accounts.

Similar forms

Form 1120: Similar to Form 7001, Form 1120, which is used by corporations to report their income, gains, losses, deductions, credits, and to figure out their income tax liability, requires comprehensive financial information about the business entity. Both forms necessitate detailed accounting information and are stringent in terms of the accuracy and completeness of the data provided. They also share in common the need for certification by an authorized individual that the information is correct.

Form 1065: This form is used by partnerships for the annual return of income. Like Form 7001, Form 1065 collects detailed financial data, including incomes and losses, which reflect the business operations. Both forms share a similar trait in facilitating financial transparency and accountability within business entities, and both require detailed analysis and reporting of the organization's financial status. They also necessitate a declaration by a signatory that the provided information is accurate to the best of their knowledge.

Form 990: Non-profit organizations use Form 990 to provide the IRS with the information required by section 6033. This form and Form 7001 both collect extensive data about the entity's financial activities and operational status. Each necessitates a high level of detail concerning financial transactions and account statuses, and they require the submission of contact information for responsible individuals. Ensuring accuracy and compliance with regulatory standards is a priority shared by both forms.

Schedule K-1 (Form 1065): This form is a part of Form 1065 and is used to report the share of a partnership's income, deductions, credits, etc., assigned to each partner. Similar to Form 7001, it deals with detailed financial reporting and ensures accountability by providing a breakdown of individual financial contributions and earnings. Both forms are instrumental in maintaining transparent financial records for all parties involved and require detailed reporting and verification of information.

Form 941: Used by employers to report quarterly federal tax returns, Form 941 is akin to Form 7001 in its role of maintaining compliance with federal reporting requirements. Both forms are crucial for reporting accurate financial information to government entities and require regular updates regarding the entity's financial health. Compliance, accuracy, and timely submissions are central themes for both forms, ensuring entities fulfill their legal and financial obligations.

Dos and Don'ts

Filling out the Form 7001 accurately and completely is crucial for complying with the regulations set by the U.S. Department of Agriculture and ensuring that the status of your custodial bank account for shippers' proceeds is transparent and up to date. Below are nine essential do's and don'ts to consider when completing this form:

- Do ensure that every field is completed. If a field is not applicable or the answer is zero, enter "NA" or "0" as instructed to indicate this.

- Do double-check the accuracy of all the information provided, including the legal business name, contact numbers, and addresses to ensure they match your official records.

- Do verify the totals for all monetary fields, especially in Sections 4 and 5, relating to the analysis of custodial bank accounts and proceeds receivable, to prevent any discrepancies.

- Do use the official form provided by the U.S. Department of Agriculture, ensuring it is the most current version to avoid using outdated forms.

- Do submit the form within the required timeframe to avoid possible penalties or fines for late submission.

- Don't leave any sections blank unless specified that it's permissible to do so for fields that do not apply to your situation.

- Don't sign the form without reviewing all entries. The signature certifies that the information provided is correct to the best of your knowledge, and inaccuracies could lead to legal consequences.

- Don't overlook the specific instructions for sections like Proceeds Receivable, which may require detail depending on the type of buyer and transaction dates.

- Don't hesitate to reach out to the appropriate P&SP regional office if you have questions or need clarification on how to complete the form properly. Support is available to ensure compliance and avoid misunderstandings.

Following these guidelines will help to ensure the Form 7001 is filled out accurately and in compliance with USDA requirements, thereby supporting the effective management of custodial accounts for shippers' proceeds.

Misconceptions

Misconceptions about the 7001 form, officially known as the Status of Custodial Bank Account for Shippers' Proceeds Special Report, can lead to confusion and errors in compliance. Here is a clearer understanding of what it involves:

- Misconception 1: The 7001 form is relevant for all businesses. In truth, this form is specific to entities under the oversight of the U.S. Department of Agriculture's Grain Inspection, Packers and Stockyards Administration. It is designed for reporting the status of custodial bank accounts related to shippers' proceeds.

- Misconception 2: Completing the 7001 form is optional. On the contrary, the submission of this form is mandatory for entities that are required to maintain a custodial account for shippers' proceeds, as failure to report can result in significant daily fines.

- Misconception 3: The form is complex and requires extensive financial details. Although the form requires comprehensive information about custodial accounts, the provided instructions aim to guide the preparer through each step, making it manageable to complete accurately.

- Misconception 4: Any bank account details can be used for the custodial account. The form specifies that the account must be designated for the specific use of holding shippers' proceeds, indicating that not just any account will suffice for this purpose.

- Misconception 5: "Proceeds Receivable" refers to all outstanding payments. In reality, it specifically relates to uncollected funds during a certain time frame relevant to the livestock buyer, as defined in the form.

- Misconception 6: There's no penalty for inaccurate reporting on the form. Submitting false information can result in severe penalties, including fines and imprisonment, underscoring the need for careful and accurate completion.

- Misconception 7: Any person can sign the certification section. Actually, the form must be signed by a person listed in the custodial account information section, ensuring accountability and verification of the report’s accuracy.

- Misconception 8: Submitted information is made public. The information provided on the 7001 form is confidential, intended solely for the purpose of verifying the establishment and status of a custodial bank account as per regulatory requirements.

- Misconception 9: There's no compliance assistance available for those unfamiliar with the form. The USDA and its Packers and Stockyards Division are available to provide guidance, ensuring entities can comply correctly and efficiently with the reporting requirements.

Understanding the specifics of the 7001 form is crucial for entities that are subjected to its requirements, ensuring compliance and avoiding potential penalties. Should questions arise, it's imperative to seek clarity from the U.S. Department of Agriculture or qualified legal advisors.

Key takeaways

Filling out the Form 7001, issued by the U.S. Department of Agriculture Grain Inspection, Packers and Stockyards Administration, demands meticulous attention to detail due to its significant role in the financial operations of agricultural businesses. Here are key takeaways to ensure accurate and compliant submissions:

- Every field in the form must have an entry, even if the appropriate value is "0" or "NA" for items that are not applicable, ensuring completeness of the information provided.

- Section 1 covers general information about the business, including legal names, addresses, and contact information, laying the foundation for the identification and communication process.

- In Section 2, detailed information about the custodial bank account must be entered, including the name and contact details of the bank, which is crucial for the monitoring of shippers' proceeds.

- The form requires the designation or title of the custodial account as seen on the bank statement and checks, under Section 3, to accurately link financial activities to this account.

- Section 4 provides an analysis of the custodial bank account, requiring a thorough financial breakdown that includes bank statement balance, deposits, CDs, proceeds on hand, and outstanding checks, among others.

- “Proceeds Receivables” detailed in Section 5 vary depending on the livestock buyer and include specific timelines for accounting, highlighting the need for timely and accurate record-keeping.

- The certification section underscores the legal obligation of the signer to ensure the accuracy of the report, with penalties for false statements, emphasizing the seriousness of the document.

- Data privacy is addressed, with submitted information labeled as confidential, pointing to the safeguards in place to protect business information.

- A failure to report or submitting late can incur a fine, incentivizing timely compliance.

- It’s important to note the expiration date of Form 7001 to ensure the version being filled out is current and valid. For the provided sample, the expiration date was 11-30-2017.

- The legal warning against discrimination in the final paragraph of the form reinforces the USDA’s commitment to equality in its programs and services, affirming the right to equal opportunity for all who interact with this form.

Accurate and conscientious completion of Form 7001 is essential for compliance with U.S. agricultural regulations, financial accountability, and the promotion of fair practices within the industry. The detailed instructions and legal notices embedded within the form serve to guide and protect both the filing entity and the broader agricultural community.

Popular PDF Forms

Colorado Accidents - How Colorado Springs individuals can report accidents that occur at railroad crossings or construction zones.

Ab 1424 - Its development involved a wide array of stakeholders from Alameda County, highlighting the form’s comprehensive nature designed to address various aspects of mental health treatment.

Health and Safety Induction - Serves to record the assessment of environmental risks like chemicals, dust, and pollution, and the measures to control them.