Blank 78 014 10 PDF Template

When a vehicle owner passes away without leaving a will, their next of kin face the challenging task of managing the deceased's assets, including the transfer of vehicle ownership. In such situations, Form 78-014-10 becomes an essential document. This form serves as an affidavit for the assignment of a vehicle's title in the absence of a will, probated estate, or appointed personal representative, or widow's allotment. It allows the deceased's kin to legally request the transfer of the vehicle's ownership by stating their relationship to the deceased and their collective desire for whom the vehicle should be passed on to. It’s vital to meticulously fill out this form to ensure all claims are accurately presented and backed by the sworn statements of the next of kin, including details like the vehicle's VIN, make, model, and year, as well as the odometer reading — with specific declarations regarding the mileage's accuracy. Additionally, the form highlights the necessity of honesty in reporting these details, underlining the legal repercussions of falsifying information. Completed under the scrutiny of a notary public, the form fortifies the next of kin's intentions, making it a pivotal step in reassigning ownership while honoring federal and state laws. This process underscores the importance of detailed and truthful documentation in the transition of vehicle ownership under unique circumstances.

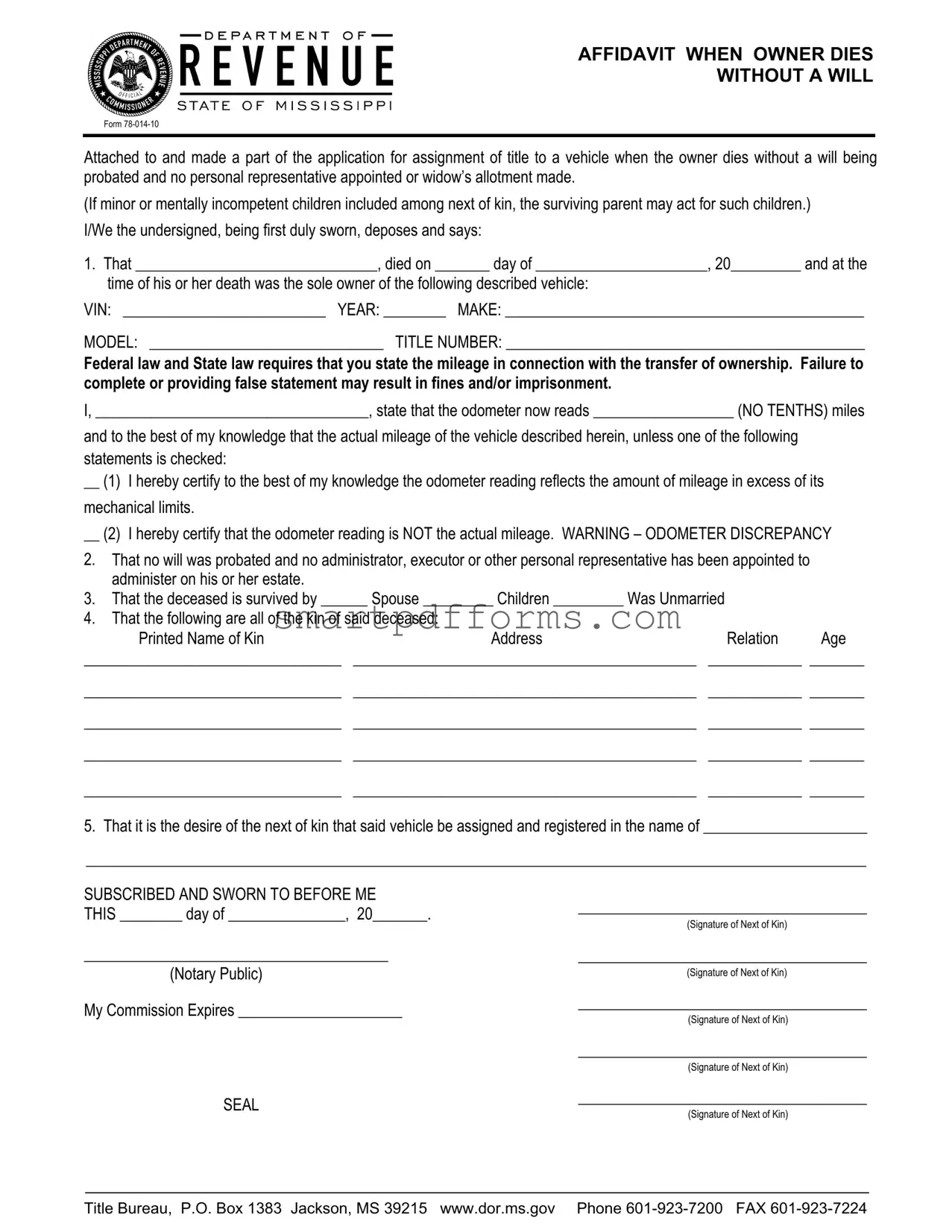

Preview - 78 014 10 Form

AFFIDAVIT WHEN OWNER DIES

WITHOUT A WILL

Form

Attached to and made a part of the application for assignment of title to a vehicle when the owner dies without a will being probated and no personal representative appointed or widow’s allotment made.

(If minor or mentally incompetent children included among next of kin, the surviving parent may act for such children.)

I/We the undersigned, being first duly sworn, deposes and says:

1.That _______________________________, died on _______ day of ______________________, 20_________ and at the time of his or her death was the sole owner of the following described vehicle:

VIN: __________________________ YEAR: ________ MAKE: ______________________________________________

MODEL: ______________________________ TITLE NUMBER: ______________________________________________

Federal law and State law requires that you state the mileage in connection with the transfer of ownership. Failure to complete or providing false statement may result in fines and/or imprisonment.

I, ___________________________________, state that the odometer now reads __________________ (NO TENTHS) miles

and to the best of my knowledge that the actual mileage of the vehicle described herein, unless one of the following statements is checked:

__ (1) I hereby certify to the best of my knowledge the odometer reading reflects the amount of mileage in excess of its

mechanical limits.

__ (2) I hereby certify that the odometer reading is NOT the actual mileage. WARNING – ODOMETER DISCREPANCY

2.That no will was probated and no administrator, executor or other personal representative has been appointed to administer on his or her estate.

3.That the deceased is survived by ______ Spouse _________ Children _________ Was Unmarried

4.That the following are all of the kin of said deceased:

Printed Name of Kin |

Address |

Relation |

Age |

_________________________________ |

____________________________________________ |

____________ _______ |

|

_________________________________ |

____________________________________________ |

____________ _______ |

|

_________________________________ |

____________________________________________ |

____________ _______ |

|

_________________________________ |

____________________________________________ |

____________ _______ |

|

_________________________________ |

____________________________________________ |

____________ _______ |

|

5.That it is the desire of the next of kin that said vehicle be assigned and registered in the name of _____________________

____________________________________________________________________________________________________

SUBSCRIBED AND SWORN TO BEFORE ME

THIS ________ day of _______________, 20_______.

_______________________________________

(Notary Public)

My Commission Expires _____________________

SEAL

_____________________________________

(Signature of Next of Kin)

_____________________________________

(Signature of Next of Kin)

_____________________________________

(Signature of Next of Kin)

_____________________________________

(Signature of Next of Kin)

_____________________________________

(Signature of Next of Kin)

Title Bureau, P.O. Box 1383 Jackson, MS 39215 www.dor.ms.gov Phone

Form Data

| Fact Number | Detail |

|---|---|

| 1 | Purpose of Form 78-014-10 is for the assignment of a vehicle's title when the vehicle's owner dies intestate (without a will). |

| 2 | This form is specifically used when a vehicle owner dies without a will being probated, and no personal representative has been appointed, nor a widow's allotment made. |

| 3 | If the deceased has minor or mentally incompetent children, the surviving parent can act on behalf of these children in submitting this form. |

| 4 | Mileage declaration is a mandatory requirement on this form. Failing to accurately declare the odometer reading, or providing false information, may result in penalties including fines or imprisonment. |

| 5 | Applicants must disclose any discrepancies in the odometer reading by indicating whether the mileage exceeds mechanical limits or is not the actual mileage. |

| 6 | This form requires the notarization of the next of kin's signature, attesting to the truthfulness of the presented information. |

| 7 | This form is pertinent to the laws and requirements of the state of Mississippi, governed by the Mississippi Department of Revenue. |

| 8 | Contact information for the Title Bureau of Mississippi is provided on the form, enabling individuals to seek assistance or clarification regarding the application process. |

Instructions on Utilizing 78 014 10

Dealing with the affairs of a loved one who has passed away can be a difficult and emotional process. When it comes to transferring ownership of a vehicle without a will, the Form 78-014-10 becomes necessary. This form, titled "AFFIDAVIT WHEN OWNER DIES WITHOUT A WILL," is essential for those seeking to reassign the title of a vehicle under these specific circumstances. By carefully following step-by-step instructions, you can ensure that you complete the form accurately and comply with the legal requirements, making this part of the process as smooth as possible.

- Begin by reading the form thoroughly to understand all the information required. It's crucial to gather all necessary documents and details about the vehicle and the deceased owner beforehand.

- Fill in the details of the deceased owner, including their name and the date of death, in the designated spaces.

- Enter the specific details about the vehicle, such as the VIN (Vehicle Identification Number), year of manufacture, make, model, and title number in the corresponding fields.

- State the current odometer reading of the vehicle, making sure not to include any tenths of miles. Check the appropriate box below this section if the odometer reading does not reflect the actual mileage or if it exceeds its mechanical limits.

- Fill in the section confirming that no will was probated and no personal representative has been appointed for the estate of the deceased. This is crucial as it outlines the legal standing of the vehicle's ownership.

- Detail the surviving relatives of the deceased, including their printed names, addresses, relation to the deceased, and ages. This information is essential to establish the next of kin.

- Specify the name(s) of the next of kin who desire the vehicle to be assigned and registered in their name. This demonstrates consensus among the relatives regarding the ownership of the vehicle.

- The form must then be signed by all the next of kin mentioned in the affidavit in the presence of a notary public. Ensure that everyone signs the form to validate the information provided.

- Affirm the affidavit in front of a notary public. The notary will fill in the date, seal the document, and sign it, finalizing the official recognition of the form.

- Finally, send the completed and notarized form to the Title Bureau at the address provided at the bottom of the form, making sure to include any additional required documents or information as specified by your state's vehicle authority.

Filling out Form 78-014-10 is a crucial step in the process of transferring vehicle ownership when the original owner has passed away without leaving a will. By following these steps carefully, you can help ensure that this process is handled correctly and respect the wishes of your loved one.

Obtain Answers on 78 014 10

What is Form 78-014-10 used for?

Form 78-014-10 is an affidavit used specifically for transferring the title of a vehicle when the owner has passed away without leaving a will, an act known as dying 'intestate.' It's required when there is no probated will, no appointed personal representative, executor, or administrator, and no widow's allotment has been made. This form serves to legally document the transfer of vehicle ownership under these circumstances.

Who can file Form 78-014-10?

The form is filed by the next of kin of the deceased vehicle owner. This may include the spouse, children, or other relatives as specified by state law. In cases where there are minor or mentally incompetent children among the next of kin, the surviving parent is authorized to act on their behalf. The key requirement is that the individuals filing must be the legal next of kin and have a desire for the vehicle to be assigned and registered in a specific name.

What information is required on Form 78-014-10?

- The full name and death date of the deceased owner.

- Details of the vehicle: VIN (Vehicle Identification Number), year, make, model, and title number.

- An odometer reading and an acknowledgment of the mileage accuracy or discrepancy.

- A statement confirming no will was probated and no estate administrator has been appointed.

- Information about the deceased's surviving kin: names, addresses, relation, and age.

- Details of the desired assignee of the vehicle title.

All this information is essential to process the transfer of ownership and must be accurately provided in the form.

Are there any legal warnings involved with filling out Form 78-014-10?

Yes, there are significant legal obligations and warnings associated with this form, particularly regarding the vehicle's odometer reading. The affidavit demands an accurate odometer reading to prevent fraud. Falsifying this information or failing to provide a truthful reading may result in legal penalties, including fines and imprisonment. This highlights the importance of honesty in the transfer process and ensures transparency in the vehicle's history.

Common mistakes

One common mistake people make is failing to accurately fill in the date of the deceased's death, which is crucial for processing the form.

Individuals often overlook the importance of listing the exact Vehicle Identification Number (VIN), leading to inconsistencies in the vehicle's identification.

There's a tendency to inaccurately report the odometer reading or to leave it blank, forgetting that federal and state laws require accurate mileage reporting to prevent fraud.

People frequently make errors by not checking one of the odometer accuracy statements when applicable, which can lead to potential legal issues regarding odometer fraud.

Another mistake is not fully listing all next of kin, including their relationship and age, which is necessary for establishing rightful ownership and ensuring that all potential heirs are accounted for.

Applicants often neglect specifying the desire of the next of kin regarding the assignment and registration of the vehicle, which clarifies who should rightfully assume ownership.

Finally, failing to properly execute the document in front of a Notary Public and acquiring the necessary signatures from all next of kin contributes to its invalidation, delaying the title transfer process.

Avoiding these common mistakes can help ensure that the application for assignment of title to a vehicle, when the owner dies without a will, is processed smoothly and without unnecessary delay.

Documents used along the form

When an individual passes away without a will and leaves behind a vehicle, the process to transfer the vehicle's title to the rightful inheritors involves more than just the Form 78-014-10 "Affidavit When Owner Dies Without A Will." Here's a list of other forms and documents typically required or associated with such a scenario:

- Certificate of Vehicle Title: This is the original document proving ownership of the vehicle. It needs to be submitted along with the affidavit to process the title transfer.

- Death Certificate: A certified copy of the death certificate of the deceased vehicle owner is required to confirm their passing and facilitate the transfer of assets.

- DMV Form for Title Transfer: While Form 78-014-10 acts as an affidavit, most states require a specific Department of Motor Vehicles form to be completed for the actual title transfer process.

- Odometer Disclosure Statement: This document is necessary if the vehicle is less than ten years old, providing official mileage at the time of transfer to prevent odometer fraud.

- Bill of Sale: Though not always required, a bill of sale may be requested to document the transaction. It generally includes information about the buyer, seller, and the sale price.

- Proof of Insurance: The new owner may need to provide proof of insurance for the vehicle to complete the title transfer and registration.

- Vehicle Inspection Report: Some states require a vehicle inspection report that verifies the safety and emissions standards of the vehicle before it can be registered under a new owner.

- Release of Lien: If there was a lien on the vehicle, a document confirming the lien has been satisfied and released must be provided.

- Power of Attorney: If another individual is handling the title transfer on behalf of the next of kin, a power of attorney document might be necessary to authorize this process.

Each of these documents plays a crucial role in ensuring the legal and hassle-free transfer of vehicle ownership following the death of the original owner without a will. It's imperative to check with the local Department of Motor Vehicles or similar authority to confirm the specific requirements, as they can vary by state.

Similar forms

Small Estate Affidavit: Similar to the Form 78-014-10, a Small Estate Affidavit is used when a decedent dies without a will, and the estate falls beneath a certain value threshold. Both documents allow for the transfer of assets without formal probate proceedings.

Affidavit for Transfer of Personal Property Without Probate: This document, like Form 78-014-10, facilitates the transfer of personal property, including vehicles, when the owner dies intestate (without a will). Both require personal attestations regarding the deceased and their heirs.

Affidavit of Heirship: Used to establish ownership of a decedent's property among the heirs when no will exists, an Affidavit of Heirship closely resembles Form 78-014-10 in its objective to delineate the rightful heirs and assist in the transfer of assets.

VIN Verification Form: While primarily focused on vehicle identification, the VIN Verification Form bears similarity to Form 78-014-10 in its requirement to accurately describe a vehicle’s make, model, year, and VIN for official purposes.

Odometer Disclosure Statement: This document is required during the transfer of a vehicle to certify the accuracy of the vehicle's mileage, similar to a section within Form 78-014-10. Both ensure lawful compliance during the transfer of ownership.

Vehicle Title Application: Closely related to Form 78-014-10, this application is necessary for establishing a vehicle’s new legal owner. While the context may differ, both documents are critical in the process of transferring vehicle titles.

Statement of Facts: Often used in various legal and administrative contexts to clarify circumstances or provide evidence, a Statement of Facts shares its core utility with Form 78-014-10 by requiring sworn, factual declarations related to specific situations.

Dos and Don'ts

When filling out the Form 78-014-10, an Affidavit When Owner Dies Without a Will, there are several important dos and don'ts to keep in mind to ensure the process is completed accurately and efficiently. Below are five key points in each category to help guide you through this process.

Do:

- Verify all the vehicle information (VIN, year, make, model, title number) is accurate and matches the vehicle’s documentation.

- Clearly state the mileage of the vehicle without including tenths, and mark the appropriate odometer statement if applicable.

- Provide complete and accurate information about the deceased's next of kin, including printed names, addresses, relationships, and ages.

- Ensure that all next of kin who are required to sign the form do so in the presence of a Notary Public, and their signatures are duly notarized.

- Double-check that the form is completely filled out before submission, including any attachments, and submit it to the Title Bureau with the correct contact information provided.

Don't:

- Do not leave any fields blank. If a section does not apply, mark it as N/A (Not Applicable) to indicate that it was not overlooked.

- Do not guess the mileage. Make sure the odometer reading is correct and reflects the vehicle’s actual mileage, unless declaring an odometer discrepancy.

- Do not forget to check one of the odometer statements if the vehicle's actual mileage is not being certified as accurate.

- Do not neglect to have the form notarized. The affidavit requires notarization to be valid and accepted by the Title Bureau.

- Do not send the form to the Title Bureau without making sure that all the required signatures of the next of kin are included and properly notarized.

Misconceptions

Understanding the Form 78-014-10, specifically designed for instances where a vehicle owner dies without a will, can often bring about misconceptions. It's important to clarify these misunderstandings to ensure the process of transferring vehicle ownership goes smoothly.

- Misconception 1: This form is only necessary if the deceased has left behind significant assets other than the vehicle.

Actually, regardless of the deceased’s other assets, this form specifically addresses the transfer of a vehicle’s title when the owner dies intestate, that is, without a will.

- Misconception 2: Completion of this form automatically transfers the vehicle to the next of kin.

Completing the form is a critical step, but it is part of a process that may require additional documentation and steps with the Title Bureau to officially transfer the vehicle.

- Misconception 3: Any family member can sign the form on behalf of the deceased.

Only the next of kin as specified, or a surviving parent acting for minor or mentally incompetent children, can lawfully sign the affidavit.

- Misconception 4: An odometer disclosure is not important if the vehicle is old.

The law requires the statement of mileage as part of the transfer process, regardless of the vehicle's age. Failure to accurately disclose mileage can result in penalties.

- Misconception 5: If there is a surviving spouse, children’s consent is not needed.

The form requires the signatures of all next of kin, which may include the spouse and children, to validate the desire to transfer the vehicle as indicated.

- Misconception 6: A notary public’s validation is optional.

The affidavit must be sworn to and signed before a notary public to be considered legally binding.

- Misconception 7: The form is valid in all states.

This form is specific to certain regulations and may not meet the requirements or be recognized outside of its jurisdiction. Always verify with local laws and requirements.

- Misconception 8: Filing this form with the Title Bureau is the final step.

While crucial, submitting this form to the Title Bureau is part of the initial steps. There may be additional requirements or documentation needed to complete the transfer.

Overall, understanding and accurately completing the Form 78-014-10 is essential for a smooth transfer of vehicle ownership under these specific circumstances. Misinterpretations can lead to delays or legal complications, underscoring the need for clear comprehension and adherence to the outlined procedures.

Key takeaways

The Form 78-014-10, known as the "AFFIDAVIT WHEN OWNER DIES WITHOUT A WILL," plays a critical role in the transfer of vehicle ownership in the event of an owner's death without a will or designated personal representative. This document facilitates the legal process by providing a structured path for the transfer of the title under these circumstances. Understanding its requirements and correct utilization is paramount for those involved in such a situation. Here are six key takeaways regarding the preparation and use of this form:

- Accuracy is Imperative: The form demands accurate information regarding the deceased, the vehicle, and the next of kin. Ensuring the details such as the date of death, vehicle identification number (VIN), year, make, model, and title number are precisely documented is essential to avoid processing delays or legal complications.

- Odometer Disclosure: Federal and state laws require the accurate reporting of the vehicle's mileage at the time of transfer. The declarant must indicate the current odometer reading and certify either its accuracy, that it exceeds mechanical limits, or acknowledge an odometer discrepancy. Falsification of this information can lead to severe penalties.

- Evidence of No Will Probate: This affidavit serves as a declaration that the deceased's estate is being handled without a probated will, nor has any personal representative been appointed. It solidifies the legal basis for transferring the vehicle's ownership under these circumstances.

- Next of Kin Designation: The form requires the listing of all immediate family members and next of kin, detailing their names, addresses, relationship to the deceased, and age. This ensures a comprehensive account of potential claimants or beneficiaries involved in the ownership transfer.

- Unanimous Consent: For a smooth transfer process, it is preferable that all listed next of kin agree on the person to whom the vehicle will be assigned. Disagreements among next of kin can complicate or stall the transfer process.

- Legal Acknowledgment: The submission of this affidavit involves a legal declaration, made under oath before a notary public. The signatures of the next of kin, validated by the notary’s seal, affirm that the statements made in the document are truthful and accurate. This legal endorsement is crucial for the document’s acceptance by the Title Bureau.

Processing the Form 78-014-10 with diligence ensures compliance with the law while facilitating the rightful transfer of a vehicle’s title in the absence of a will. It underscores the legal framework designed to uphold fairness and accuracy in such transactions.

Popular PDF Forms

How to Write a Jury Duty Excuse Letter - The form serves as a channel for jurors to express legitimate constraints, aiming to balance civic duties with personal circumstances.

How to Send Certified Mail With Return Receipt - Includes space for the sender to provide contact information and detailed description of the mailed item.