Blank 8082 PDF Template

When taxpayers find discrepancies in how their investments in partnerships, S corporations, or other pass-through entities have been reported, they have a specific recourse: Form 8082, Notice of Inconsistent Treatment or Administrative Adjustment Request (AAR). This form, which the Internal Revenue Service (IRS) revised in December 2018, serves a critical function for partners, S corporation shareholders, estate and trust beneficiaries, and others entangled in the complexities of pass-through taxation. It provides a standardized way to communicate with the IRS about inconsistencies between how income, deductions, credits, or other financial data have been reported by the entity and how the taxpayer is reporting them on their personal tax returns. Additionally, for entities and their representatives, it outlines a process for making administrative adjustments in the aftermath of audits or reviews. As regulations have evolved, especially with the Bipartisan Budget Act (BBA) adjustments for partnership tax years beginning after December 31, 2017, the significance of correctly understanding and utilizing Form 8082 has only intensified. This form embodies the intersection of rigorous compliance requirements and the taxpayer's right to accurate and fair tax treatment, underscored by the potential for penalties if discrepancies are not properly disclosed and corrected.

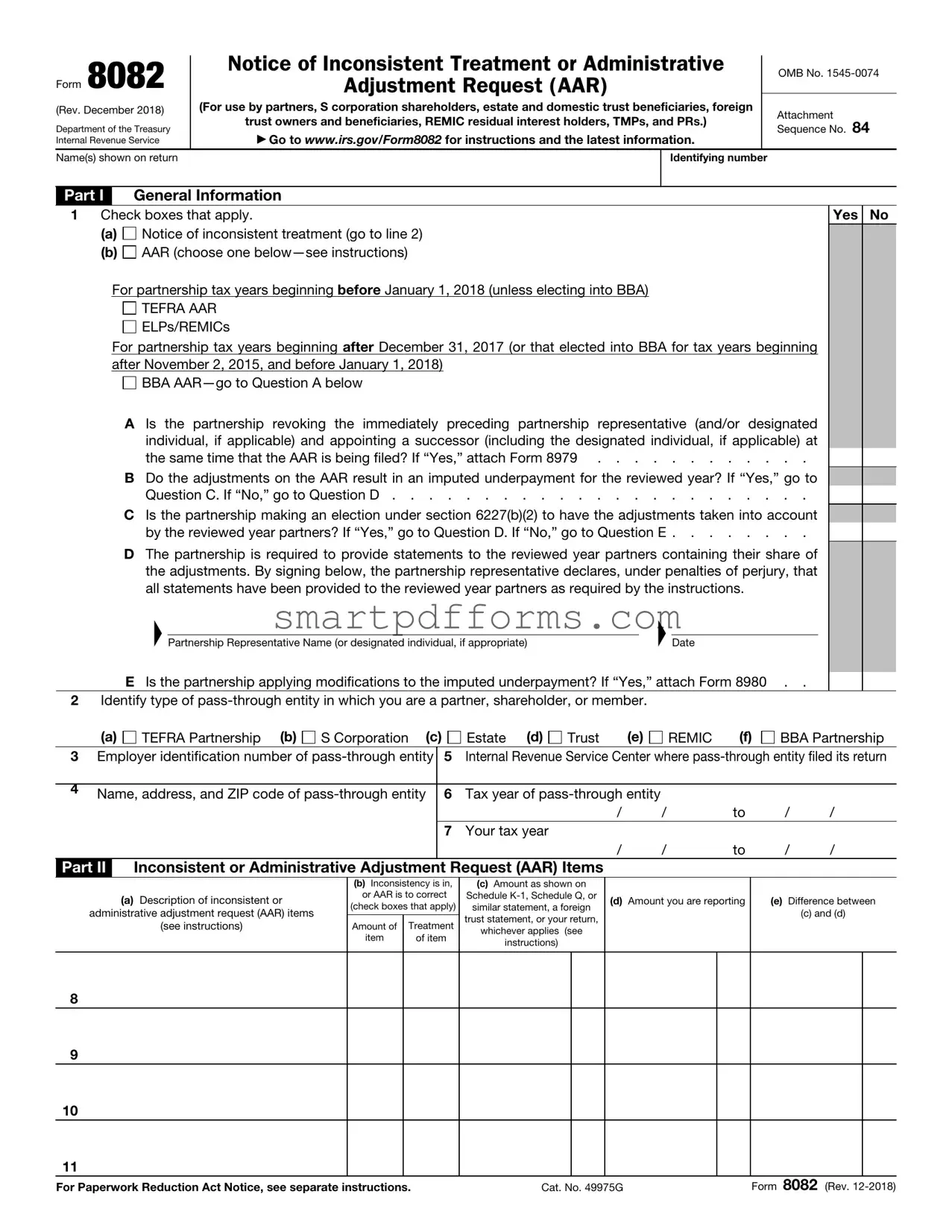

Preview - 8082 Form

Form 8082 |

Notice of Inconsistent Treatment or Administrative |

|

OMB No. |

||

Adjustment Request (AAR) |

|

||||

|

|

|

|||

|

|

|

|

||

(Rev. December 2018) |

(For use by partners, S corporation shareholders, estate and domestic trust beneficiaries, foreign |

|

Attachment |

||

|

|

trust owners and beneficiaries, REMIC residual interest holders, TMPs, and PRs.) |

|

||

Department of the Treasury |

|

Sequence No. 84 |

|||

▶ Go to WWW.IRS.GOV/FORM8082 for instructions and the latest information. |

|

||||

Internal Revenue Service |

|

|

|||

Name(s) shown on return |

|

Identifying number |

|

||

|

|

|

|

||

Part I |

General Information |

|

|||

1 Check boxes that apply. |

Yes No |

||||

(a)

Notice of inconsistent treatment (go to line 2)

Notice of inconsistent treatment (go to line 2)

(b)

AAR (choose one

AAR (choose one

For partnership tax years beginning before January 1, 2018 (unless electing into BBA)

TEFRA AAR

ELPs/REMICs

For partnership tax years beginning after December 31, 2017 (or that elected into BBA for tax years beginning after November 2, 2015, and before January 1, 2018)

BBA

AIs the partnership revoking the immediately preceding partnership representative (and/or designated individual, if applicable) and appointing a successor (including the designated individual, if applicable) at

the same time that the AAR is being filed? If “Yes,” attach Form 8979 . . . . . . . . . . . .

BDo the adjustments on the AAR result in an imputed underpayment for the reviewed year? If “Yes,” go to

Question C. If “No,” go to Question D . . . . . . . . . . . . . . . . . . . . . . .

CIs the partnership making an election under section 6227(b)(2) to have the adjustments taken into account by the reviewed year partners? If “Yes,” go to Question D. If “No,” go to Question E . . . . . . . .

DThe partnership is required to provide statements to the reviewed year partners containing their share of the adjustments. By signing below, the partnership representative declares, under penalties of perjury, that all statements have been provided to the reviewed year partners as required by the instructions.

▲ |

|

▲ |

|

Partnership Representative Name (or designated individual, if appropriate) |

Date |

E Is the partnership applying modifications to the imputed underpayment? If “Yes,” attach Form 8980 . .

2Identify type of

(a)

TEFRA Partnership (b)

S Corporation (c)

Estate (d)

Trust (e)

REMIC (f)

BBA Partnership

3 |

Employer identification number of |

5 |

Internal Revenue Service Center where |

||||

|

|

|

|

|

|

|

|

4 |

Name, address, and ZIP code of |

6 |

Tax year of |

|

|

|

|

|

|

|

|

|

|||

|

|

|

/ |

/ |

to |

/ |

/ |

|

|

7 |

Your tax year |

|

|

|

|

|

|

|

/ |

/ |

to |

/ |

/ |

Part II Inconsistent or Administrative Adjustment Request (AAR) Items

(a)Description of inconsistent or administrative adjustment request (AAR) items

(see instructions)

(b)Inconsistency is in, or AAR is to correct

(check boxes that apply)

Amount of |

Treatment |

item |

of item |

(c)Amount as shown on Schedule

similar statement, a foreign

trust statement, or your return,

whichever applies (see

instructions)

(d)Amount you are reporting

(e)Difference between

(c)and (d)

8

9

10

11

For Paperwork Reduction Act Notice, see separate instructions. |

Cat. No. 49975G |

Form 8082 (Rev. |

Form 8082 (Rev. |

Page 2 |

Part III

Form 8082 (Rev.

Form Data

| Fact Name | Description |

|---|---|

| Form Number and Title | Form 8082, Notice of Inconsistent Treatment or Administrative Adjustment Request (AAR) |

| Revision Date | December 2018 |

| OMB Number | 1545-0074 |

| Applicability | For use by partners, S corporation shareholders, estate and domestic trust beneficiaries, foreign trust owners and beneficiaries, REMIC residual interest holders, TMPs, and PRs. |

| Governing Law | Internal Revenue Code and related regulations, specific sections may vary based on the nature of the inconsistency or adjustment. |

| Form Sequence Number | Sequence No. 84 |

Instructions on Utilizing 8082

Completing Form 8082, "Notice of Inconsistent Treatment or Administrative Adjustment Request (AAR)," is crucial for partners, S corporation shareholders, and others to report discrepancies or adjustments in their tax treatment. This process ensures accurate tax reporting and compliance. Follow these steps meticulously to fill out the form correctly.

- Visit the IRS website at WWW.IRS.GOV/FORM8082 to access the latest version of Form 8082 and its instructions.

- Enter the Name(s) shown on return and the Identifying number at the top of the form.

- In Part I, select the applicable checkbox for either Notice of inconsistent treatment or AAR, depending on your situation.

- If selecting AAR, determine if your partnership tax year began before or after January 1, 2018, and then choose the appropriate AAR type based on the instructions. Answer questions A to E as they apply.

- In the section requiring the Partnership Representative’s Name and Date, ensure the partnership representative signs and dates the form, attesting to the accuracy of the information provided under penalty of perjury.

- Under Part II, Identify the type of pass-through entity in which you are a partner, shareholder, or member. Check the appropriate box (TEFRA Partnership, S Corporation, etc.).

- Provide the Employer Identification Number (EIN), Name, address, and ZIP code of your pass-through entity.

- Indicate the IRS Service Center where the pass-through entity filed its return.

- Provide the Tax year of the pass-through entity and your own tax year dates.

- For each inconsistent or AAR item in Part II, describe the adjustment or inconsistency in detail, check whether the inconsistency is in the amount or treatment of the item, and then provide the amounts as shown on the relevant statements versus the amounts you are reporting, along with the difference.

- In Part III, enter the Part II item number for each explanation of inconsistency or adjustment. If you need more space, continue your explanations on the back of the form. Also include imputed underpayment calculations and how modifications were applied, if applicable.

- Review the form carefully to ensure that all information is correct and complete. Attach any required documents, such as Form 8979 or Form 8980 if indicated in your responses to questions in Part I.

- Mail the completed form to the IRS, following the mailing instructions provided on the form and in the instructions booklet for Form 8082.

Completion and submission of Form 8082 require attention to detail and careful adherence to the IRS guidelines. Ensure all required information is present and accurate before submission to avoid processing delays or IRS inquiries.

Obtain Answers on 8082

What is Form 8082 used for?

Form 8082, titled "Notice of Inconsistent Treatment or Administrative Adjustment Request (AAR)," is utilized by partners, S corporation shareholders, beneficiaries of estates and trusts, foreign trust owners and beneficiaries, REMIC residual interest holders, among others, to notify the IRS of inconsistencies between the information reported to them by pass-through entities and what they are reporting on their personal tax returns. Additionally, this form is used to request administrative adjustments to previously filed returns.

When should I file Form 8082?

You should file Form 8082 if you notice discrepancies between the information provided to you on Schedule K-1, Schedule Q, or a similar statement by a pass-through entity, and the information you report on your own tax return. Also, if you are an affected person needing to make administrative adjustments to your reported share of items from a pass-through entity, filing this form is necessary.

Are there different types of AARs referenced in Form 8082?

Yes, Form 8082 references different types of Administrative Adjustment Requests (AARs) depending on the tax years of the partnership. For partnership tax years beginning before January 1, 2018, TEFRA AAR and ELPs/REMICs apply, unless the partnership elected into the Bipartisan Budget Act (BBA) rules. For partnership tax years beginning after December 31, 2017, or those that elected into BBA for tax years after November 2, 2015, and before January 1, 2018, BBA AAR is applicable.

What happens if the adjustments on the AAR result in an imputed underpayment?

If the adjustments made through an Administrative Adjustment Request result in an imputed underpayment, the partnership must either pay the imputed underpayment or make an election under section 6227(b)(2) to have the adjustments taken into account by the reviewed year partners. Depending on this decision, different steps follow, detailed in the instructions of the form.

Is there a need to appoint a new partnership representative when filing a BBA AAR?

As per the Form 8082 instructions, if a partnership is filing a BBA AAR and is revoking the appointment of the current partnership representative while designating a successor at the same time, Form 8979 must be attached, indicating such changes.

What information is required to complete Form 8082?

To properly complete Form 8082, you need to identify the type of pass-through entity involved, provide the employer identification number of the pass-through entity, and detail the tax year of the entity and the inconsistency or adjustment being requested. Specific amounts as reported and as adjusted are necessary, along with a comprehensive explanation for each item listed in Part II of the form.

Where do I file Form 8082?

Form 8082 should be filed with the Internal Revenue Service Center where the pass-through entity filed its return. The form can also be attached to your personal tax return if it pertains to inconsistencies you're reporting with your own tax filing.

Common mistakes

Filing Form 8082, "Notice of Inconsistent Treatment or Administrative Adjustment Request (AAR)," is crucial for taxpayers who need to notify the IRS of inconsistent treatment or to request an administrative adjustment. However, mistakes can occur during its completion, potentially leading to processing delays or other issues. Here are six common mistakes:

- Not checking the correct boxes in Part I regarding the notice of inconsistent treatment or the type of AAR being requested. This section is essential for guiding the IRS on how to process the form and misunderstanding the options can lead to incorrect handling of the case.

- Failing to accurately identify the type of pass-through entity (such as TEFRA Partnership, S Corporation, Estate, Trust, REMIC, or BBA Partnership) in which the filer is a partner, shareholder, or member. This information, requested in item 2, is crucial for processing the form within the context of the correct entity type.

- Incorrectly reporting the amounts in Part II, specifically the inconsistency or AAR items including the amount as shown on Schedules K-1, Q, or similar statements, and the amount the filer is reporting. The discrepancy between these amounts requires precise reporting for accurate IRS assessment.

- Omitting required attachments, such as Form 8979 when revoking and appointing a partnership representative simultaneously with the AAR filing, or Form 8980 when applying modifications to the imputed underpayment. These documents are vital for the IRS to fully understand and process the requested adjustments.

- Not providing detailed explanations in Part III for each reported inconsistency or AAR item. The IRS needs comprehensive details and justifications for the adjustments being requested or the inconsistent treatment reported.

- Ignoring the requirement to supply statements to the reviewed year partners if the adjustments result in an imputed underpayment, as noted in the instructions for Part I, question D. Ensuring that all affected parties are informed is a critical component of the reporting process.

Understanding and carefully navigating these potential pitfalls when completing Form 8082 can enhance the precision of the filing and facilitate smoother processing by the IRS.

Documents used along the form

When dealing with tax matters, especially when inconsistencies arise or adjustments are necessary, understanding which documents to use alongside Form 8082 is essential. Despite Form 8082's specific purpose for reporting inconsistencies or administrative adjustment requests in relation to partnership, S corporation, or trust tax treatments, several other forms and documents play crucial roles in ensuring accurate and compliant tax reporting for entities and individuals affected by these adjustments.

- Form 8979, Partnership Representative Revocation, Designation, and Resignation. This form is used to notify the IRS about changes in the partnership representative. It's necessary when a partnership wants to revoke a previously designated representative and appoint a new one in conjunction with filing an AAR.

- Form 8980, Partnership Adjustment Tracking Report. Form 8980 is attached when modifications are applied to an imputed underpayment. It helps in tracking the adjustments made to a partnership's reported items and their tax impacts.

- Form 1065, U.S. Return of Partnership Income. Often, inconsistencies or the need for adjustments arise during the review of the partnership's annual tax return. This form may need to be referenced or amended accordingly.

- Form 1120S, U.S. Income Tax Return for an S Corporation. Similar to Form 1065 for partnerships, any inconsistency or adjustment request for S corporations may necessitate reviewing or amending the S corporation's tax return reported on Form 1120S.

- Form 1041, U.S. Income Tax Return for Estates and Trusts. For estates and trusts involved in filing Form 8082, referencing or amending Form 1041 may be necessary to address inconsistencies or adjustments.

- Schedule K-1, Partner's Share of Income, Deductions, Credits, etc. This schedule is used by partnerships, S corporations, and trusts to report each partner’s or shareholder's share of income, losses, deductions, and credits. Any inconsistency or adjustment often needs to be reflected in an amended Schedule K-1.

- Form 1040, U.S. Individual Income Tax Return. Individuals affected by adjustments or inconsistencies reported on Form 8082 may need to amend their personal tax returns, using Form 1040, to reflect changes in their income, deductions, or credits.

- Form 8809, Application for Extension of Time to File Information Returns. If inconsistencies or adjustments result in the need for more time to file other required forms or schedules accurately, Form 8809 can be used to request an extension.

- Form 2848, Power of Attorney and Declaration of Representative. To effectively deal with inconsistencies and adjustments, individuals or entities may need to authorize a tax professional to act on their behalf. This form grants that authority.

Handling tax matters, especially those requiring adjustments or reporting inconsistencies, requires careful attention to detail and understanding of various IRS forms and documents. Whether you're dealing with changes in partnership investments, S corporation shares, estate incomes, or trust distributions, knowing how and when to use these forms in conjunction with Form 8082 ensures compliance with IRS regulations and helps maintain the accuracy of reported tax information.

Similar forms

Form 1040, U.S. Individual Income Tax Return: Like Form 8082, Form 1040 is used by individuals to report their annual income to the IRS and calculate taxes owed or refund due. Both forms are integral to the U.S. tax system, ensuring that the appropriate tax liabilities are assessed and that any inconsistencies or adjustments in declared income are accurately reported and rectified.

Form 1065, U.S. Return of Partnership Income: Similarly, Form 1065 and Form 8082 are connected through the reporting requirements of partnerships. While Form 1065 is used by partnerships to report their income, deductions, gains, losses, etc., Form 8082 may be filed by partners if they notice inconsistencies or need adjustments in the treatment of items reported on their Schedule K-1s, which are derived from Form 1065.

Form 1120S, U.S. Income Tax Return for an S Corporation: Comparable to Form 8082, Form 1120S is filed by S Corporations to report income, losses, and dividends. Shareholders who receive a Schedule K-1 from the S Corporation and identify discrepancies in their reported share of income, deductions, or credits would use Form 8082 to notify the IRS of these inconsistencies or to request administrative adjustments.

Form 1041, U.S. Income Tax Return for Estates and Trusts: This form is used by estates and trusts to report income, deductions, and gains. Beneficiaries of these entities, similar to partners and shareholders, use Form 8082 if they identify inconsistencies in the treatment of items reported on their received Schedules K-1, Q, or similar statements, compared to what is reported on Form 1041.

Form 1066, U.S. Real Estate Mortgage Investment Conduit (REMIC) Income Tax Return: Form 1066 is filed by REMICs to report their income and allocated share to holders of residual interests. Should these holders notice disparities in their reported share of REMIC income or deductions, they would file Form 8082, analogous to how other pass-through entity beneficiaries report adjustments and inconsistencies.

Form 8979, Partnership Representative Revocation, Designation, and Resignation: Specifically linked through the BBA AAR procedures mentioned in Form 8082, Form 8979 is used within the context of adjusting partnership-related items under the Bipartisan Budget Act (BBA) rules. If a partnership files an AAR and also wishes to change its partnership representative concurrently, Form 8979 must be attached, highlighting the direct connection between administrative adjustment actions and representative management in partnerships.

Dos and Don'ts

When filling out the Form 8082, it's crucial to handle the process with care to ensure accurate reporting and compliance with Internal Revenue Service (IRS) requirements. Here are some helpful dos and don'ts:

Do:- Review the instructions available on the IRS website carefully before you start filling out the form. This will help you understand each part of Form 8082 and its requirements.

- Check the appropriate boxes in Part I that apply to your situation, such as whether you're filing a Notice of Inconsistent Treatment or an Administrative Adjustment Request (AAR), and accurately provide all required general information.

- Clearly describe each item of inconsistent treatment or AAR in Part II and how it differs from the information provided by the pass-through entity, ensuring you include specific amounts and details.

- Provide thorough explanations in Part III for each item listed in Part II, including the relevant item number for clarity. If more space is needed, use the back of the form as indicated or attach additional pages if necessary.

- Leave sections incomplete. Make sure you provide all the required information for both the taxpayer and the pass-through entity. Incomplete forms may result in processing delays or inquiries from the IRS.

- Estimate or guess values. Report the accurate amounts as shown on your Schedule K-1, Schedule Q, or similar statement, and the amount you are reporting, along with the difference between the two.

- Overlook signatures. Ensure that the partnership representative (or designated individual) signs the form where required, acknowledging the penalty of perjury statement. An unsigned Form 8082 may not be processed.

- Ignore attachment requirements. If the form requires you to attach other documents, such as Form 8979 or Form 8980, make sure these are completed and attached before submission. Failing to attach required documents can lead to incomplete filing status.

Misconceptions

Understanding the IRS Form 8082, "Notice of Inconsistent Treatment or Administrative Adjustment Request (AAR)," can often be complicated due to misconceptions. Here's a breakdown of some common misunderstandings and the facts to clarify them.

- Misconception 1: Form 8082 is only for partnerships.

- Misconception 2: Form 8082 should be filed for any discrepancy in tax documents.

- Misconception 3: Only one type of AAR can be reported on Form 8082.

- Misconception 4: Filing Form 8082 results in immediate tax adjustments or refunds.

- Misconception 5: Form 8082 is only for corrections that benefit the taxpayer.

- Misconception 6: Partnerships can file Form 8082 at any time.

While Form 8082 is frequently associated with partnerships, it's not exclusive to them. This form is used by partners, S corporation shareholders, estate and domestic trust beneficiaries, foreign trust owners and beneficiaries, REMIC residual interest holders, Tax Matters Partners (TMPs), and Partnership Representatives (PRs). Its purpose extends beyond partnerships to include various entities and individuals involved in pass-through entities.

Form 8082 is specifically designed for situations where there's an inconsistency in treatment between what's reported by the pass-through entity and the information provided on the taxpayer's return. It’s also used to request an administrative adjustment. It's not intended for general discrepancies or errors found in tax documents.

Form 8082 caters to different types of Administrative Adjustment Requests (AARs). Depending on the timing and specific circumstances, a filer may indicate a Tax Equity and Fiscal Responsibility Act (TEFRA) AAR, an Electing Large Partnership (ELP) / Real Estate Mortgage Investment Conduit (REMIC) AAR, or a Bipartisan Budget Act (BBA) AAR. The form is adaptable to various regulatory frameworks and legislative changes over time.

Submitting Form 8082 is the beginning of a process. It notifies the IRS of inconsistencies or requests an adjustment. The resolution and any resulting tax adjustments, including refunds, depend on further IRS review and are not immediate.

While filing Form 8082 can sometimes lead to a favorable adjustment for the taxpayer, its primary role is to correct inconsistencies, whether they result in an increased tax liability or a reduction. The form ensures accurate tax reporting and compliance, regardless of the outcome's direction.

The timing for filing Form 8082 is subject to specific rules and deadlines, especially when it's part of the Administrative Adjustment Request process under the Bipartisan Budget Act (BBA) rules. The ability to file and the specific requirements depend on the tax year and the applicable regulatory framework. It's not a form that can be submitted at any discretion without regard to timing and procedural rules.

Clarifying these misconceptions is crucial for taxpayers and advisors dealing with Form 8082 to ensure compliance and the correct reporting of inconsistencies or administrative adjustment requests.

Key takeaways

The Form 8082, officially titled "Notice of Inconsistent Treatment or Administrative Adjustment Request (AAR)," plays a crucial role for taxpayers who need to report inconsistencies or adjustments in their tax filings associated with pass-through entities. Understanding when and how to use this form is vital for compliance with tax regulations and to avoid potential penalties. Here are several key takeaways about filling out and using Form 8082:

- Form 8082 is used by partners, S corporation shareholders, estate and domestic trust beneficiaries, foreign trust owners and beneficiaries, REMIC residual interest holders, and others involved with pass-through entities to notify the IRS about inconsistencies between their tax return and the information reported to them by the entity.

- The form is necessary for situations where taxpayers need to report an inconsistent treatment of items on their tax returns compared to how these items were reported by the pass-through entity on Schedule K-1, Schedule Q, or similar statements. This includes reporting lesser or greater amounts, or completely omitted items.

- Those filing Form 8082 must check the appropriate boxes in Part I to indicate whether they are filing for a notice of inconsistent treatment or an Administrative Adjustment Request (AAR) and specify the type of pass-through entity involved.

- If the AAR is being filed, filers should be ready to answer additional questions regarding the partnership's actions, like appointing a successor, the result of adjustments leading to an imputed underpayment, or making elections under specific tax sections.

- Accurate identification of the pass-through entity, including its name, employer identification number, and the tax year of the entity as well as the taxpayer's own tax year, is crucial for ensuring that the IRS can process the form correctly.

- In Part II, the taxpayer must describe each item for which inconsistent treatment or adjustment is being requested, list the amount as reported by the pass-through entity, the amount the taxpayer is reporting, and the difference between these two amounts.

- Explanations for each inconsistent or AAR item must be provided in Part III, including the item number from Part II to which the explanation relates. If additional space is required, filers are encouraged to continue their explanations on the back of the form or attach additional sheets if necessary.

Given its complexity and the precision required in reporting, taxpayers are encouraged to consult with a tax professional or advisor when completing Form 8082. This ensures accuracy and compliance with tax laws, potentially avoiding challenges or disputes with the Internal Revenue Service.

Popular PDF Forms

Florida Corporate Tax - The Florida F-1120 requires the corporation's Federal Employer Identification Number (FEIN) for identification.

Deadline to File Notice of Appeal California - It includes sections to indicate the case title, originating court details, and the appellate division case type, highlighting the need for specific details.