Blank 82993 PDF Template

In the realm of vehicle transactions, the accurate reporting of a vehicle's mileage is not just a matter of good practice but a legal requirement as well. The State of Florida takes this seriously, with the Department of Highway Safety and Motor Vehicles Division of Motorist Services offering Form HSMV 82993, a crucial document for vehicle buyers and sellers alike. This separate odometer disclosure statement and acknowledgment serves as a vital tool in ensuring transparency during the sale or purchase of a motor vehicle. It requires that the mileage be stated in connection with an application for a Certificate of Title, a process safeguarded by both federal and state laws to prevent and penalize fraud. With strict warnings against providing false statements, potential fines, and even imprisonment, the form underscores the importance of honesty in odometer readings. Whether the odometer reflects the actual mileage, exceeds its mechanical limits, or does not show the actual mileage due to certain discrepancies, Form HSMV 82993 facilitates a clear declaration from both the seller and the buyer. Furthermore, detailed guidance about who should complete the form, when it should be utilized, and the specific instances when it would not be appropriate, ensures that the process remains streamlined, yet comprehensive. In essence, Form HSMV 82993 not only promotes ethical sales practices but also protects the interests of all parties involved in the vehicle transaction process within the state of Florida.

Preview - 82993 Form

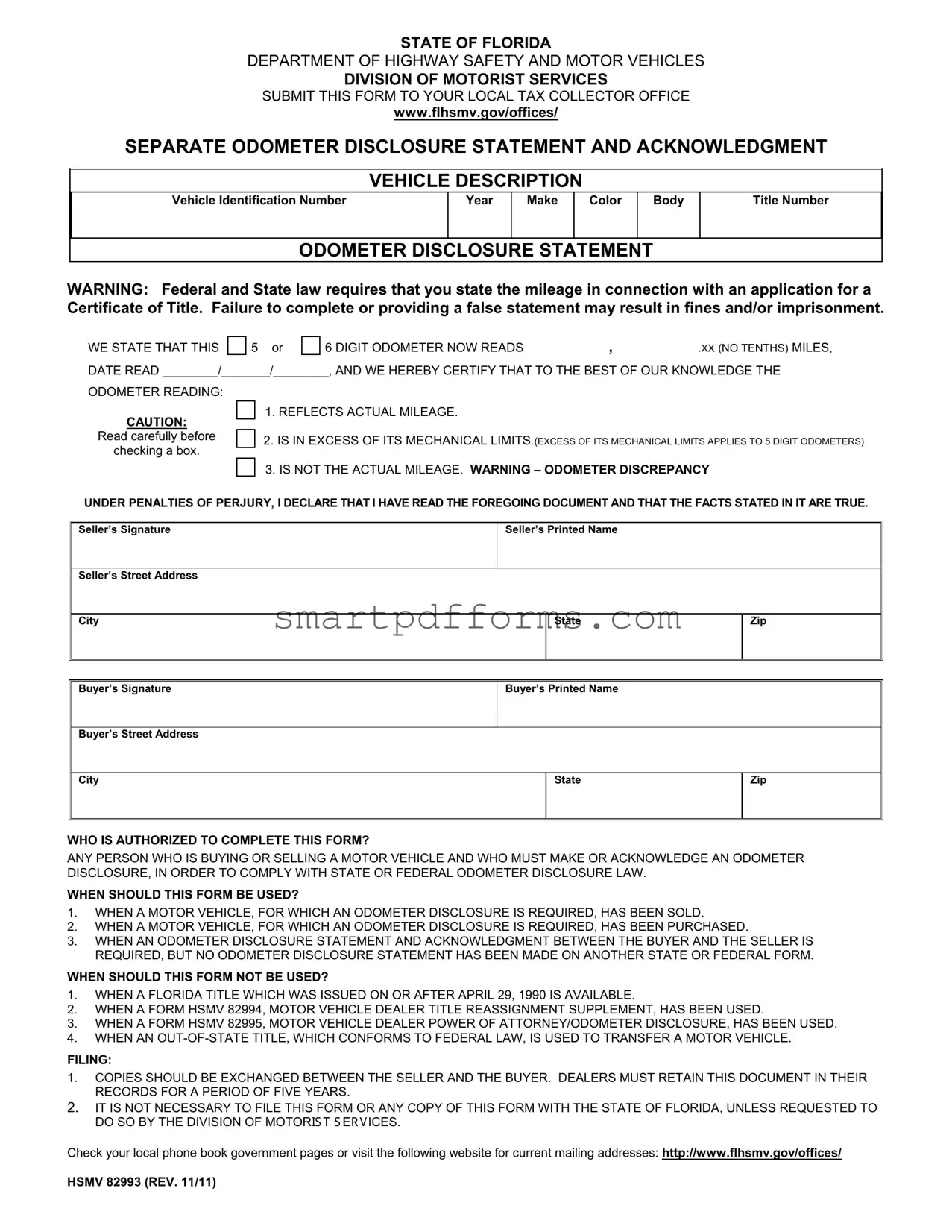

STATE OF FLORIDA

DEPARTMENT OF HIGHWAY SAFETY AND MOTOR VEHICLES

DIVISION OF MOTORIST SERVICES

SUBMIT THIS FORM TO YOUR LOCAL TAX COLLECTOR OFFICE

www.flhsmv.gov/offices/

SEPARATE ODOMETER DISCLOSURE STATEMENT AND ACKNOWLEDGMENT

VEHICLE DESCRIPTION

Vehicle Identification Number

Year

Make

Color Body

Title Number

ODOMETER DISCLOSURE STATEMENT

WARNING: Federal and State law requires that you state the mileage in connection with an application for a Certificate of Title. Failure to complete or providing a false statement may result in fines and/or imprisonment.

WE STATE THAT THIS |

5 or |

6 DIGIT ODOMETER NOW READS |

, |

.XX (NO TENTHS) MILES, |

DATE READ ________/_______/________, AND WE HEREBY CERTIFY THAT TO THE BEST OF OUR KNOWLEDGE THE

ODOMETER READING:

1. REFLECTS ACTUAL MILEAGE.

CAUTION:

Read carefully before 2. IS IN EXCESS OF ITS MECHANICAL LIMITS.(EXCESS OF ITS MECHANICAL LIMITS APPLIES TO 5 DIGIT ODOMETERS) checking a box.

3. IS NOT THE ACTUAL MILEAGE. WARNING – ODOMETER DISCREPANCY

UNDER PENALTIES OF PERJURY, I DECLARE THAT I HAVE READ THE FOREGOING DOCUMENT AND THAT THE FACTS STATED IN IT ARE TRUE.

Seller’s Signature |

Seller’s Printed Name |

|

|

|

|

|

|

Seller’s Street Address |

|

|

|

|

|

|

|

City |

|

State |

Zip |

|

|

|

|

|

|

|

|

Buyer’s Signature |

Buyer’s Printed Name |

|

|

|

|

|

|

Buyer’s Street Address |

|

|

|

|

|

|

|

City |

|

State |

Zip |

|

|

|

|

WHO IS AUTHORIZED TO COMPLETE THIS FORM?

ANY PERSON WHO IS BUYING OR SELLING A MOTOR VEHICLE AND WHO MUST MAKE OR ACKNOWLEDGE AN ODOMETER DISCLOSURE, IN ORDER TO COMPLY WITH STATE OR FEDERAL ODOMETER DISCLOSURE LAW.

WHEN SHOULD THIS FORM BE USED?

1.WHEN A MOTOR VEHICLE, FOR WHICH AN ODOMETER DISCLOSURE IS REQUIRED, HAS BEEN SOLD.

2.WHEN A MOTOR VEHICLE, FOR WHICH AN ODOMETER DISCLOSURE IS REQUIRED, HAS BEEN PURCHASED.

3.WHEN AN ODOMETER DISCLOSURE STATEMENT AND ACKNOWLEDGMENT BETWEEN THE BUYER AND THE SELLER IS REQUIRED, BUT NO ODOMETER DISCLOSURE STATEMENT HAS BEEN MADE ON ANOTHER STATE OR FEDERAL FORM.

WHEN SHOULD THIS FORM NOT BE USED?

1.WHEN A FLORIDA TITLE WHICH WAS ISSUED ON OR AFTER APRIL 29, 1990 IS AVAILABLE.

2.WHEN A FORM HSMV 82994, MOTOR VEHICLE DEALER TITLE REASSIGNMENT SUPPLEMENT, HAS BEEN USED.

3.WHEN A FORM HSMV 82995, MOTOR VEHICLE DEALER POWER OF ATTORNEY/ODOMETER DISCLOSURE, HAS BEEN USED.

4.WHEN AN

FILING:

1.COPIES SHOULD BE EXCHANGED BETWEEN THE SELLER AND THE BUYER. DEALERS MUST RETAIN THIS DOCUMENT IN THEIR RECORDS FOR A PERIOD OF FIVE YEARS.

2.IT IS NOT NECESSARY TO FILE THIS FORM OR ANY COPY OF THIS FORM WITH THE STATE OF FLORIDA, UNLESS REQUESTED TO DO SO BY THE DIVISION OF MOTORIS T S ER VICES.

Check your local phone book government pages or visit the following website for current mailing addresses: http://www.flhsmv.gov/offices/

HSMV 82993 (REV. 1 /11)

/11)

Form Data

| Fact Name | Fact Detail |

|---|---|

| Governing Law | The form is governed by both Federal and Florida State laws regarding odometer disclosure. |

| Form Purpose | To disclose odometer readings in the sale or purchase of a motor vehicle. |

| Authorized Users | Any person buying or selling a motor vehicle who must acknowledge an odometer disclosure. |

| When to Use | When selling or purchasing a motor vehicle requiring odometer disclosure, and no other state or federal form has been provided. |

| When Not to Use | If a Florida Title issued after April 29, 1990, is available, or specific forms (HSMV 82994, HSMV 82995) have been used, or an out-of-state title conforming to federal law is being used. |

| Filing Requirements | Copies should be exchanged between the seller and buyer, and dealers must retain this document for five years. It's not necessary to file this form with the state unless requested. |

| Odometer Disclosure Statement | Includes a warning that failure to complete or providing a false statement may result in fines and/or imprisonment. |

| Submission Information | Form is to be submitted to the local Tax Collector's office, with a reference to check the www.flhsmv.gov/offices/ for current mailing addresses. |

Instructions on Utilizing 82993

Filling out the 82993 form is a crucial step for individuals buying or selling a motor vehicle, where an odometer disclosure statement is necessary. This process ensures clear communication between the buyer and the seller regarding the vehicle's odometer reading, helping to comply with state and federal laws. The following instructions are intended to guide you through each section, ensuring that all required information is accurately and completely provided. Once the form is filled out, it's important to exchange copies between the buyer and the seller, with dealers required to retain this document for five years.

- Begin by locating your local tax collector office’s details on www.flhsmv.gov/offices/—this is where the form will be submitted.

- In the VEHICLE DESCRIPTION section, enter the vehicle's identification number, year, make, color, body type, and title number in the respective spaces.

- Under ODOMETER DISCLOSURE STATEMENT, provide the mileage without including tenths. Ensure to write the date the odometer was read.

- Read the options provided carefully, noting that you must select if the odometer reading:

- Reflects actual mileage.

- Is in excess of its mechanical limits—this applies to 5-digit odometers.

- Is not the actual mileage—indicate this if there are discrepancies.

- Both the seller and buyer need to acknowledge the accuracy of the provided information under penalties of perjury. This involves signing and printing names, and also providing respective addresses.

- The document clarifies who is authorized to complete it, alongside specifying occasions when its use is both necessary and unnecessary.

- Lastly, the form indicates the filing process, stating that while it's essential for copies to be exchanged between the seller and the buyer, and for dealers to retain a copy, it does not need to be filed with the state unless requested.

After completing this form with accuracy and ensuring all parties have received their respective copies, you have successfully fulfilled a vital step in the vehicle transfer process. This action promotes transparency and compliance with legal requirements, supporting a smooth transfer of ownership. Remember, retention of this document is crucial for record-keeping and future reference if needed.

Obtain Answers on 82993

Who is authorized to complete the 82993 form?

Any person involved in buying or selling a motor vehicle that necessitates an odometer disclosure to comply with state or federal law is authorized to fill out the 82993 form. This includes both the buyer and seller in the transaction, ensuring that all parties are making an acknowledgment regarding the odometer reading.When should the 82993 form be used?

The form is necessary in three main scenarios: When a motor vehicle has been sold, when a motor vehicle has been purchased, and when an odometer disclosure statement is required between the buyer and seller, but no such statement has been made on another state or federal form. It ensures transparency about the vehicle's mileage.When should the 82993 form not be used?

The 82993 form should not be used in four specific cases: If a Florida title issued after April 29, 1990, is available; if Form HSMV 82994 or Form HSMV 82995 has been utilized; or if an out-of-state title conforming to federal law is being used to transfer a motor vehicle. These conditions suggest that other forms or documents can or have already served the odometer disclosure purpose.Is it necessary to file the 82993 form with the State of Florida?

It is not mandatory to file the 82993 form or any copy of it with the State of Florida unless specifically requested by the Division of Motorist Services. This detail emphasizes that the form primarily functions as a transaction record between buyer and seller rather than a document for state records.What should be done with the form after completion?

After filling out the 82993 form, copies should be exchanged between the seller and the buyer to ensure both parties have a record of the odometer disclosure. Dealers must retain this document in their records for a period of five years, indicating its importance in maintaining accurate historical information about the vehicle.What are the consequences of failing to complete the 82993 form or providing a false statement?

Federal and state law mandates the disclosure of mileage in connection with an application for a Certificate of Title. Failure to complete the form or providing a false statement can result in fines and/or imprisonment. This underscores the legality and seriousness of accurately reporting odometer readings.How can someone find their local Tax Collector's office to submit the form?

To locate the nearest Tax Collector's office for form submission, individuals can refer to the government pages of their local phone book or visit the website provided (www.flhsmv.gov/offices). This online resource provides the most current mailing addresses and office locations, facilitating the submission process.

Common mistakes

-

Not reading the instructions carefully. Individuals often rush through filling out the form without thoroughly understanding the instructions, leading to errors. Each section has specific requirements, especially regarding the type of odometer disclosure statement needed. For example, mistakes occur when the box selected does not accurately represent the actual mileage situation because the instructions were not followed carefully.

-

Incorrectly stating the mileage. A common mistake is incorrectly stating the vehicle’s mileage, particularly failing to ensure that the mileage entered on the form matches the vehicle's current odometer reading exactly, without including tenths of miles. This error can create significant issues, as the form is a legal document used for titling and registration purposes.

-

Omitting required information. People often overlook sections that require complete information, such as the seller’s and buyer’s printed names, signatures, and complete addresses. Leaving these sections blank or partially filled can render the document invalid or incomplete, potentially delaying the transaction.

-

Not exchanging copies between the seller and the buyer. After completing the form, both parties sometimes forget to exchange copies, which is a crucial step. Dealers must also retain this document in their records for five years. This oversight can lead to difficulties in verifying the authenticity of the odometer reading if disputes arise later.

-

Using the form when it's not necessary. Another mistake is using the form when it’s not required, such as when a Florida title issued on or after April 29, 1990, is available, or when other specific forms have been used. This not only wastes time but can also complicate the vehicle’s documentation unnecessarily.

When filling out the Form HSMV 82993 for odometer disclosure in the state of Florida, attention to detail is paramount. Ensuring accuracy and completeness in every section can help avoid legal complications and ensure smooth transactions between buyers and sellers.

Documents used along the form

When dealing with vehicle transactions, specific forms and documents help ensure compliance with legal requirements and facilitate smooth transfers of ownership or information. The 82993 form is an essential part of vehicle transactions in Florida, particularly for odometer disclosure. However, it often goes hand in hand with other documents to meet various state and federal guidelines. Here's a guide to other forms and documents frequently used alongside the 82993 form, each serving its unique purpose in the broader context of vehicle management and ownership transfer.

- Title Application (HSMV 82040): This form is used to apply for a Florida title for new purchases, out-of-state vehicles, and when the title has been lost or destroyed. It's a comprehensive document that captures essential information required for titling a vehicle in Florida.

- Billof Sale (HSMV 82050): Often used to document the sale and purchase of a vehicle between private parties, this form provides a record of the transaction details, including the vehicle's selling price, which can be crucial for tax and legal purposes.

- Vehicle Registration Application (HSMV 82042): This application is necessary for registering a vehicle. It requires details about the vehicle and proof of insurance.

- Motor Vehicle Dealer Title Reassignment Supplement (HSMV 82994): Dealers use this form when they need to reassign a title. It's especially useful when the original title doesn't have enough space for dealer reassignments.

- Power of Attorney/Odometer Disclosure (HSMV 82995): Dealers employ this document to disclose odometer readings and grant certain rights to act on behalf of the vehicle's owner.

- Notice of Sale (HSMV 82050): Sellers use this to notify the Department of Highway Safety and Motor Vehicles that a sale has occurred, helping to release them from liability and update the vehicle's record.

- VIN Verification (HSMV 82042): Required for certain transactions, including when registering an out-of-state vehicle in Florida, this form verifies the vehicle's identification number.

- Application for Duplicate or Lost in Transit/Reassignment for a Motor Vehicle, Mobile Home or Vessel Title Certificate (HSMV 82101): This form is used when the original title has been lost, stolen, or destroyed, or to request additional reassignment documents.

- Lien Satisfaction (HSMV 82260): Lienholders use this document to release their interest in the vehicle once a loan has been fully repaid, ensuring clear title transfer to the new owner.

These forms and documents play significant roles in the life cycle of a vehicle's ownership and legal status. Each serves specific purposes, from establishing legal ownership and ensuring the vehicle is legally operated to protecting the interests of sellers, buyers, and lienholders. For smooth vehicle transactions within Florida, understanding and properly utilizing these documents in conjunction with the 82993 form is crucial.

Similar forms

Form HSMV 82994 (Motor Vehicle Dealer Title Reassignment Supplement): Similar to Form 82993, it deals with the transfer of vehicle ownership but is specifically used for dealers to reassign a title. Both ensure compliance with legal requirements for odometer disclosure.

Form HSMV 82995 (Motor Vehicle Dealer Power of Attorney/Odometer Disclosure): Like the 82993 form, it includes provisions for odometer disclosure but also grants power of attorney to enable dealers to complete certain transactions on behalf of the owner. Both forms are essential for accurate and legal disclosure of odometer readings.

Out-of-State Title that complies with Federal Law: This is used in the transfer of a vehicle across state lines and must include odometer disclosure, similar to the 82993 form's objective for in-state transactions. Both forms serve to inform the buyer about the vehicle's mileage.

Florida Title issued after April 29, 1990: This title already includes an odometer disclosure statement, serving a similar purpose to the 82993 form. Both are used to accurately record and disclose the vehicle's mileage at the time of sale, ensuring transparency and compliance with federal and state law.

Dos and Don'ts

Filling out the 82993 form, a necessary step in the process of buying or selling a vehicle and making an odometer disclosure in the state of Florida, requires attention to detail and understanding of the process. Below are essential do's and don'ts to help ensure the process is completed accurately and lawfully.

- Do read the entire form carefully before filling it out. Understanding each section will help prevent mistakes.

- Do ensure that all the information is complete and accurate, especially the vehicle identification number (VIN), make, year, and the odometer reading.

- Do make sure to check the correct box under the odometer disclosure statement to indicate whether the mileage is actual, exceeds mechanical limits, or is not the actual mileage.

- Do exchange copies of the completed form with the other party (buyer or seller), as both parties need proof of the odometer disclosure.

- Do retain a copy of the form for your records, as dealers are required to keep this document for five years.

- Don’t leave any sections blank. If a section doesn’t apply, fill it in with “N/A” (not applicable) to indicate that you didn’t overlook it.

- Don’t guess the odometer reading. Ensure the mileage is recorded accurately without rounding up or down.

- Don’t use this form if a current Florida title issued after April 29, 1990, is available, or if other specified forms have been used for odometer disclosure.

- Don’t forget to sign and print your name, along with providing your address. Both the buyer and seller must do this to validate the form.

Remember, providing false information on this form can result in fines and/or imprisonment due to the serious nature of odometer disclosures. Always approach this process with honesty and diligence.

Misconceptions

When it comes to the 82993 form used in the State of Florida for odometer disclosure statements in vehicle sales, several misconceptions circulate. Clearing up these misunderstandings can help both buyers and sellers navigate the process more smoothly.

- It's only for use with cars. While the form is primarily associated with automobiles, it's important to recognize its relevance across various types of motor vehicles. Any motor vehicle requiring an odometer disclosure can and should use this form for accurate record-keeping.

- It's a complicated form to fill out. This misconception might stem from unfamiliarity with the form. In truth, the form is straightforward, asking for basic vehicle identification information and the odometer reading at the time of sale. Understanding what each section means and requires beforehand can simplify the process.

- The form must always be filed with the state. Not necessarily. The 82993 form is intended for exchange between the buyer and the seller. Dealers are required to retain the document in their records for five years, but private parties typically do not need to file this form with the state of Florida unless specifically requested.

- Any type of Florida title makes this form redundant. This is not the case. The form is not needed only when a Florida title issued after April 29, 1990, is available or other specific forms are used. This means there are instances where a Florida title exists, but this form still plays a crucial role in the odometer disclosure process.

- The form is optional for private sales. One key aspect of this form is its requirement under both federal and state laws for odometer disclosure. Whether you're a private seller or a dealer, if you're involved in the sale of a motor vehicle requiring odometer disclosure, using this form isn't optional—it's a legal requirement.

Understanding these key points about the 82993 form can greatly ease the process of buying or selling a vehicle in Florida, ensuring that all parties comply with legal requirements and that transactions proceed as smoothly as possible.

Key takeaways

Understanding how to properly complete and use Form 82993 for the State of Florida is crucial for anyone engaged in the process of buying or selling a vehicle where an odometer disclosure is required. Here are six key takeaways to ensure compliance with both federal and state laws regarding odometer disclosure statements:

- Authorized Users: Form 82993 must be used by individuals involved in the selling or buying of a motor vehicle who need to make or acknowledge an odometer disclosure to comply with state or federal laws.

- Appropriate Use Cases: This form is necessary when a vehicle is sold or purchased and an odometer disclosure is mandatory, especially in situations where no other state or federal odometer disclosure statement has been completed.

- Restrictions on Usage: It should not be used if a Florida title issued on or after April 29, 1990 is available, or if other specific forms (Form HSMV 82994 or HSMV 82995) were used, or when an out-of-state title complying with federal law is utilized for transferring a motor vehicle.

- Filing Requirements: Although it's not mandatory to file this form or any of its copies with the state, sellers and buyers must exchange copies. Dealers are required to retain the document in their records for five years.

- Legal Implications: Failing to complete the form or providing false information can lead to fines or imprisonment, as per federal and state laws. Individuals are warned to accurately state the vehicle's mileage to avoid legal consequences.

- Accessing Form 82993: Visit the Florida Department of Highway Safety and Motor Vehicles website or your local tax collector's office to obtain Form 82993. Always ensure to use the most current version of the form to comply with updated laws and regulations.

Being meticulous in how you handle Form 82993 not only ensures legal compliance but also protects all parties involved in the vehicle transaction process. Always double-check the information you provide, especially the odometer reading, and remember that this document plays a critical role in maintaining transparency and honesty in vehicle sales and purchases.

Popular PDF Forms

How to Verify Someone's Military Service - Facilitates the recognition of veterans' service and experiences for honors, medals, or awards eligibility.

Visitation Verification Form - Can be submitted along with other child support documentation to provide a comprehensive view of the child's care.

Direct Deposit Set Up - Solves the common problem of delayed or missed deposits by setting a clear, automated path for funds to reach the account holder's bank account timely.