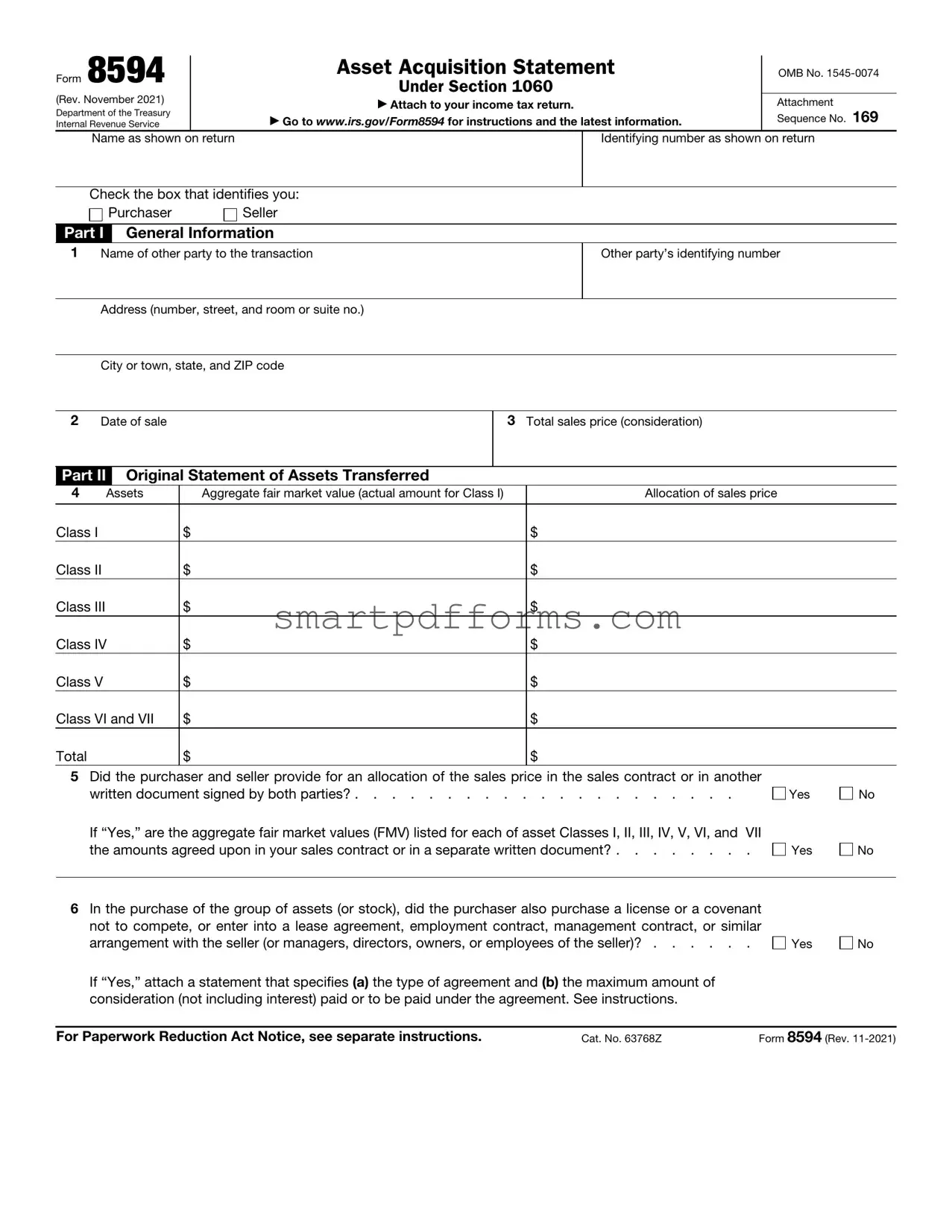

Blank 8594 PDF Template

When parties engage in the purchase and sale of a business, the Form 8594, Asset Acquisition Statement, plays a pivotal role in the process, providing a structured format for declaring the sale to the Internal Revenue Service (IRS). This form, updated in November 2021, is a requirement under Section 1060 of the Internal Revenue Code (IRC), designed to ensure both the purchaser and seller accurately report the financial details of the transaction. Key aspects include identifying both parties, detailing the date of sale, and allocating the total sales price among various asset classes, from tangible goods to intangible assets like licenses and non-compete agreements. Moreover, the form asks whether the purchaser and seller agreed on the asset sale price allocation in their sales contract or another signed document, ensuring clarity and agreement on the value of assets transferred. Form 8594 must be attached to the income tax returns of both the buyer and seller, making it a critical document for correctly finalizing the asset acquisition process. To assist filers, the Department of the Treasury also provides instructions and updates on their official website, making compliance a more straightforward task. Beyond its primary function, the form allows for amendments through Part III, accommodating for adjustments in consideration post-transaction, reflecting the dynamic nature of business sales. The introduction of Form 8594 underscores the IRS's commitment to transparency and accuracy in financial reporting, promoting fair and clear transactions in the business world.

Preview - 8594 Form

Form 8594 |

|

Asset Acquisition Statement |

OMB No. |

||||||

|

|

|

|

||||||

|

|

|

|

Under Section 1060 |

|

||||

(Rev. November 2021) |

|

▶ Attach to your income tax return. |

Attachment |

||||||

Department of the Treasury |

|

||||||||

|

▶ Go to WWW.IRS.GOV/FORM8594 for instructions and the latest information. |

Sequence No. 169 |

|||||||

Internal Revenue Service |

|

||||||||

|

Name as shown on return |

|

|

Identifying number as shown on return |

|||||

|

|

|

|

|

|

|

|

|

|

|

Check the box that identifies you: |

|

|

|

|

||||

|

Purchaser |

|

Seller |

|

|

|

|

||

|

|

|

|

|

|

|

|||

Part I |

General Information |

|

|

|

|

||||

1 Name of other party to the transaction |

|

|

Other party’s identifying number |

||||||

|

|

|

|

|

|

|

|

||

|

Address (number, street, and room or suite no.) |

|

|

|

|

||||

|

|

|

|

|

|

|

|

||

|

City or town, state, and ZIP code |

|

|

|

|

||||

|

|

|

|

|

|

|

|

||

2 |

Date of sale |

|

|

|

3 Total sales price (consideration) |

|

|||

|

|

|

|

|

|

|

|||

Part II |

Original Statement of Assets Transferred |

|

|

|

|

||||

4 |

Assets |

|

Aggregate fair market value (actual amount for Class I) |

|

|

Allocation of sales price |

|||

|

|

|

|

|

|

|

|

||

Class I |

$ |

|

|

|

$ |

|

|

||

Class II |

$ |

|

|

|

$ |

|

|

||

Class III |

$ |

|

|

|

$ |

|

|

||

Class IV |

$ |

|

|

|

$ |

|

|

||

Class V |

$ |

|

|

|

$ |

|

|

||

Class VI and VII |

$ |

|

|

|

$ |

|

|

||

Total |

|

|

$ |

|

|

|

$ |

|

|

5Did the purchaser and seller provide for an allocation of the sales price in the sales contract or in another

written document signed by both parties? . . . . . . . . . . . . . . . . . . . . .

If “Yes,” are the aggregate fair market values (FMV) listed for each of asset Classes I, II, III, IV, V, VI, and VII the amounts agreed upon in your sales contract or in a separate written document? . . . . . . . .

Yes

Yes

No

No

6In the purchase of the group of assets (or stock), did the purchaser also purchase a license or a covenant

not to compete, or enter into a lease agreement, employment contract, management contract, or similar arrangement with the seller (or managers, directors, owners, or employees of the seller)? . . . . . .

If “Yes,” attach a statement that specifies (a) the type of agreement and (b) the maximum amount of consideration (not including interest) paid or to be paid under the agreement. See instructions.

Yes

No

For Paperwork Reduction Act Notice, see separate instructions. |

Cat. No. 63768Z |

Form 8594 (Rev. |

Form 8594 (Rev. |

Page 2 |

Part III Supplemental

7Tax year and tax return form number with which the original Form 8594 and any supplemental statements were filed.

8 |

Assets |

|

Allocation of sales price as previously reported |

Increase or (decrease) |

Redetermined allocation of sales price |

|

|

|

|

|

|

Class I |

|

$ |

|

$ |

$ |

Class II |

|

$ |

|

$ |

$ |

Class III |

$ |

|

$ |

$ |

|

Class IV |

$ |

|

$ |

$ |

|

Class V |

$ |

|

$ |

$ |

|

Class VI and VII |

$ |

|

$ |

$ |

|

Total |

|

$ |

|

|

$ |

9Reason(s) for increase or decrease. Attach additional sheets if more space is needed.

Form 8594 (Rev.

Form Data

| Fact Number | Fact Detail |

|---|---|

| 1 | The form number is 8594. |

| 2 | Title: Asset Acquisition Statement. |

| 3 | OMB Number: 1545-0074. |

| 4 | Under Section 1060 of the Internal Revenue Code. |

| 5 | Revision date: November 2021. |

| 6 | Mandatory attachment to income tax return for both purchaser and seller in an asset acquisition. |

| 7 | Available on the IRS website for instructions and updates. |

| 8 | Includes allocation of sales price across various asset classes (I to VII). |

| 9 | Requires specifics if there's an agreement involving a covenant not to compete, license purchase, or similar arrangements. |

| 10 | Part III allows for amendments to previously filed statements due to changes in consideration. |

Instructions on Utilizing 8594

Successfully completing the 8594 form is a straightforward process that requires attention to detail. This form, often attached to income tax returns, plays a crucial role in transactions involving asset acquisitions. It is used for reporting the sale and purchase of assets to the Internal Revenue Service (IRS), ensuring that both parties involved in the transaction have properly allocated the sales price to the acquired assets. The process involves reporting general information about the transaction, detailing the assets transferred, and, if necessary, correcting any previously reported information. By following the allocated steps, one can fill out this form accurately and efficiently.

- Begin by providing general information about the transaction. Enter your name and identifying number as they appear on your return into the appropriate fields.

- Check the box that identifies you as either the purchaser or the seller.

- Fill out Part I with the name, identifying number, and address of the other party involved in the transaction.

- Enter the date of sale and the total sales price (consideration) in the respective fields of Part I.

- Proceed to Part II, the Original Statement of Assets Transferred. Input the aggregate fair market value and the allocated sales price for each asset class, from I through VII.

- Answer whether the purchaser and seller agreed on an allocation of the sales price in the contract or another written document. Check "Yes" or "No".

- If "Yes" was checked for the previous step, confirm if the listed aggregate fair market values match those agreed upon. Again, check "Yes" or "No".

- Indicate whether the transaction also included other agreements like licenses, non-compete clauses, or employment contracts. If "Yes", you must attach a detailed statement regarding these additional agreements.

- If you need to amend information on an originally filed form 8594 or a supplemental statement due to changes in the consideration, move to Part III for the Supplemental Statement.

- In Part III, specify the tax year and the form number of the original submission.

- For each asset class, report any increase or decrease in consideration since the original filing, and provide the re-determined allocation of sales price.

- Explain the reason(s) for any amendment in consideration, attaching additional sheets if more space is required.

After completing these steps, review the form for accuracy. Attach the completed Form 8594 to your income tax return before submission. Ensuring accurate and complete information on this form is essential for properly reporting asset acquisitions and complying with tax regulations.

Obtain Answers on 8594

Frequently Asked Questions About Form 8594

What is Form 8594 and who needs to file it?

Form 8594, Asset Acquisition Statement, is used by both buyers and sellers to report the sale and purchase of a group of assets that constitute a business. The IRS requires this form when the sale's total consideration exceeds $600. Both parties involved in the transaction must attach this form to their income tax returns for the year in which the transaction took place.

What is the purpose of Form 8594?

The primary purpose of Form 8594 is to report to the Internal Revenue Service (IRS) the allocation of the sales price among various asset classes as agreed upon by the buyer and seller. This allocation affects how the buyer and seller will be taxed on the transaction.

How are assets classified on Form 8594?

Assets are classified into seven different classes on Form 8594, ranging from Class I to Class VII. These classes include various types of assets such as cash, accounts receivable, inventory, and intangible assets. Each class has specific types of assets grouped together for the purposes of allocation and taxation.

What happens if the buyer and seller do not agree on the allocation of the sales price?

Form 8594 includes a section for the buyer and seller to indicate whether an allocation of the sales price was agreed upon in the sales contract or in another written document. If the parties did not agree on an allocation, the IRS can determine the allocation of sales price according to the fair market values of the assets, which may not be beneficial to both parties. Therefore, it is recommended that the buyer and seller agree on the allocation before filing.

Can Form 8594 be amended?

Yes, if there is an increase or decrease in consideration or any other reason that changes the information provided on the original Form 8594, both the purchaser and seller can file a supplemental statement as part of their tax return for the year in which the change occurred. This supplemental statement must explain the reasons for the adjustment.

What should be attached to Form 8594?

If the purchase agreement involves additional agreements such as licenses, covenants not to compete, or employment contracts, a statement specifying the type of agreement and the maximum amount of consideration paid under these agreements must be attached to Form 8594.

Where can more information about Form 8594 be found?

More details and instructions regarding Form 8594 can be found on the IRS website. It is advisable to consult these resources or a tax professional to ensure that Form 8594 is filled out correctly and completely, adhering to the IRS guidelines and regulations.

Common mistakes

Not attaching the form to the income tax return: One common mistake made is forgetting to attach Form 8594 to the income tax return. This form is essential for reporting the sale of business assets and must be included with the tax return to comply with IRS requirements.

Incorrect or incomplete identifying information: Often, people fill out their identifying information or the other party's details incorrectly. This includes name, identifying number, and address. Precise information is critical for the IRS to process the form correctly.

Omitting details of asset classes: It's crucial to correctly list and allocate the sales price across the different asset classes (I through VII). Neglecting to detail the aggregate fair market value for each asset class, or incorrectly allocating the sales price, can lead to issues with the IRS.

Not specifying agreements related to the transaction: If the purchase includes a license, covenant not to compete, or similar agreements, these need to be explicitly mentioned along with the consideration paid. Failure to attach a statement detailing these aspects can result in incomplete reporting.

Misunderstanding the role of the supplemental statement: A supplemental statement should only be filed if there is a need to amend an original statement due to an increase or decrease in consideration. Not correctly understanding when to use this part of the form leads to unnecessary amendments or errors in reporting.

When filling out Form 8594, attention to detail is paramount. Ensuring accurate and complete information not only facilitates smooth processing by the IRS but also helps to avoid potential audits or penalties. Consulting the form's instructions or seeking professional advice can be beneficial in navigating these complexities.

Documents used along the form

When businesses change hands, the process isn't just a handshake deal; it involves a series of complex transactions and a significant amount of paperwork to ensure everything is legally sound and properly documented. The Form 8594, Asset Acquisition Statement, is a critical piece of this paperwork puzzle for both buyers and sellers, detailing the sale and purchase of business assets for tax purposes. However, this form doesn't operate in isolation. Several other documents typically accompany Form 8594 to complete a thorough record of the transaction, each playing its unique role in the process.

- Bill of Sale: This document outlines the specifics of the transaction between the buyer and seller, acting as a receipt for the transaction. It lists the assets purchased and provides proof that ownership has been transferred.

- Purchase Agreement: A more detailed contract than the Bill of Sale, the Purchase Agreement contains the terms and conditions of the sale, including payment terms, asset descriptions, warranties, and contingencies.

- Non-Compete Agreement: Often included in business sales to prevent the seller from starting a competing business within a specified period and geographical area.

- Employment Agreement: If the buyer plans to retain the seller or the business's current employees, this contract outlines the terms of their employment post-transaction.

- Lease Agreements: If the business location is leased, new lease agreements or assignment of the existing lease to the buyer may be necessary.

- Allocation Schedule: A detailed breakdown of how the total purchase price is allocated among the various asset classes, integral for Form 8594 preparation.

- Escrow Agreement: Used when part of the purchase price is held in escrow to ensure certain terms are met before full payment is released to the seller.

- IRS Form 8824, Like-Kind Exchanges: If the transaction involves a like-kind exchange that defers capital gain taxes, this form must be filled out.

Together, these documents create a comprehensive legal and financial blueprint of the business transaction. Not only do they provide the groundwork for completing Form 8594, but they also protect both parties' interests, ensuring all aspects of the sale are clearly documented and agreed upon. Navigating these documents can be complex, but each serves a vital function in the tapestry of a business sale, ensuring a transparent, fair, and legally sound transition from one owner to the next.

Similar forms

The Form 8594, Asset Acquisition Statement, shares similarities with a range of other documents in terms of purpose, structure, and requirements. Each document, while unique in its application, intersects with Form 8594 in facilitating the reporting, valuation, or allocation of assets and transactions in different contexts. Here is a detailed comparison:

- Form 4562, Depreciation and Amortization Report: Similar to Form 8594, Form 4562 is used to report specific financial information to the IRS, specifically the depreciation and amortization of assets. Both forms require detailed information about the assets involved, including their value and how this impacts financial records.

- Form 8824, Like-Kind Exchanges: This form is used when a taxpayer is involved in a like-kind exchange. It parallels the Form 8594 in its requirement to detail the specifics of asset exchanges, focusing on the fair market value and character of the assets exchanged, similar to the asset classes and allocations required on Form 8594.

- Schedule D (Form 1040), Capital Gains and Losses: Schedule D is integral to reporting capital gains and losses from the sale or exchange of capital assets. It shares a function with Form 8594 in documenting the transactional details and outcomes that affect a taxpayer's financial responsibilities.

- Form 6252, Installment Sale Income: This form documents income from sales made over time, requiring detailed information similar to what Form 8594 demands, specifically the sale's financial structure and how it's recognized for tax purposes.

- Form 8300, Report of Cash Payments Over $10,000: Form 8300 is required when a business transaction exceeds $10,000 in cash, necessitating detailed reporting of the transaction parties, similar to the purchaser and seller information on Form 8594.

- Form 8949, Sales and other Dispositions of Capital Assets: Form 8949 works in tandem with Schedule D to report sales and exchanges of capital assets. It complements Form 8594 by providing a detailed account of individual transactions, including the date and proceeds, mimicking the detailed asset and sale consideration reporting on Form 8594.

- Form 706, United States Estate (and Generation-Skipping Transfer) Tax Return: Though primarily geared toward estate valuation and tax, Form 706 intersects with Form 8594 in its detailed accounting of asset values and distribution, albeit in the context of an estate rather than a business acquisition.

Each of these documents, while serving their unique purposes, share the fundamental aspect of detailing asset values and transactions for accurate tax and financial reporting, echoing the core function of Form 8594.

Dos and Don'ts

Filling out IRS Form 8594, the Asset Acquisition Statement, is a critical step in documenting the sale or purchase of business assets for tax purposes. This form helps both buyer and seller report the transaction to the IRS correctly. To ensure accuracy and compliance, here are some dos and don'ts to consider:

- Do review the instructions on the IRS website before filling out the form. This ensures you’re up-to-date with any changes or specific requirements.

- Do accurately allocate the purchase price among the asset classes listed on the form. This allocation should reflect the agreement between the buyer and seller.

- Do ensure that both the purchaser and seller sign any separate written document that allocates the sales price, if applicable.

- Do attach any required additional statements, especially if the transaction includes agreements for licenses, non-compete clauses, or similar arrangements.

- Do keep a copy of the completed Form 8594 with your tax records. It's essential for future reference and for substantiating the transaction’s tax implications.

- Do consult with a tax professional if you’re uncertain about how to complete the form, especially regarding complex transactions.

- Don't guess the fair market value of assets. Use appraisals or other objective measures to determine accurate values for each class.

- Don't forget to update the form (using Part III) if there’s an adjustment to the consideration paid or received after the initial filing.

- Don't overlook the requirement to attach the form to your income tax return if you’re involved in the sale or purchase of business assets.

- Don't miss deadlines. The timing of this filing is tied to your income tax return deadlines.

- Don't mix personal assets with business assets in the transaction without clearly documenting and valuing each separately.

- Don't attempt to evade taxes by misclassifying assets or adjusting values without a substantiated basis. This could lead to penalties or audits.

Following these guidelines can help smooth the process of filing Form 8594 and ensure that you accurately report the details of your business asset transaction to the IRS. Remember, the goal is to provide a transparent and fair allocation of the sales price to the appropriate asset classes, reflecting the true nature of the transaction for tax purposes.

Misconceptions

Form 8594 is only used for the sale of business assets. This misconception overlooks that Form 8594 is also required in transactions that involve both the sale of business assets and, in certain cases, the transfer of liabilities. It is a critical tool for reporting details of the sale to the IRS.

Any change in the allocation of sales price does not require an updated Form 8594. In reality, if there is an increase or decrease in the consideration paid for the assets after the original form has been filed, a supplemental statement must be completed and attached. This ensures the IRS is updated with the most accurate information.

The form is only for the purchaser to complete. Both the purchaser and the seller are required to complete Form 8594. Each party must provide details from their perspective, ensuring full disclosure of the transaction to the IRS.

Form 8594 should be filed separately from your income tax return. Contrary to this belief, Form 8594 must be attached to the income tax return of both the buyer and the seller participating in the asset transaction.

There's no need to include agreements such as non-compete clauses on Form 8594. This is incorrect as the form specifically asks if the purchase of a group of assets also included licenses, covenants not to compete, or similar agreements. Details of these agreements are essential and must be attached if applicable.

Only tangible assets need to be reported on Form 8594. This is not true; the form is designed to report both tangible and intangible assets. The allocation of the sales price across various asset classes, including intangibles, is crucial for the appropriate tax treatment of the sale.

Buyers and sellers must agree on the allocation of the sales price for it to be valid. Although the IRS prefers and it’s beneficial for both parties to agree on the sales price allocation, disagreements may occur. The key is that both parties must report the allocation consistently on their respective forms.

Personal assets included in the sale of a business do not need to be listed on Form 8594. If personal assets are part of the transaction, they may need to be reported, depending on how they are classified in the sale. Misclassifying or omitting assets can lead to discrepancies and potential issues with the IRS.

There is no need to report changes in the sales price or asset valuation after the sale is complete. This misunderstanding can lead to compliance issues. Changes that affect the total consideration or the allocation among asset classes require filing a supplemental statement to amend the original Form 8594.

The information provided on Form 8594 does not affect tax liability. The way the sales price is allocated among different asset classes can significantly impact the tax liabilities of both the buyer and the seller. Incorrect allocations or failure to report the sale accurately can lead to audits, penalties, or additional taxes.

Key takeaways

Understanding the IRS Form 8594, the Asset Acquisition Statement, is vital for both buyers and sellers during the sale of a business. This document plays a crucial role in how the sale is reported to the Internal Revenue Service (IRS). Here are key takeaways regarding filling out and using Form 8594.

- Form 8594 is required to be attached to your income tax return if you have acquired or sold assets of a business. This form categorizes the assets into different classes for tax purposes.

- The form is designed to ensure compliance with Section 1060 of the Internal Revenue Code, which specifies how buyers and sellers should report the sale and purchase of business assets.

- Both the buyer and the seller must complete and file Form 8594 with their respective income tax returns for the year in which the transaction occurred.

- The Total Sales Price (consideration) of the assets being bought or sold must be clearly indicated on the form. This figure is essential for determining how the sale affects your tax obligations.

- Part II of the form, "Original Statement of Assets Transferred," requires detailed information about the assets exchanged, including their allocation into specific classes from I to VII, based on their nature and the aggregate fair market value.

- If the purchaser and seller have agreed upon an allocation of the sales price in the sales contract or another written document, this agreement must be reflected in the stated fair market values for each asset class.

- Additional agreements related to the asset purchase, such as licenses, covenants not to compete, or leases, need to be specifically mentioned, and a detailed statement regarding these agreements should be attached.

- For transactions that involve adjustments to the consideration after the initial agreement, Part III, "Supplemental Statement," allows for these changes to be documented and reported to the IRS.

- The reason(s) for any increase or decrease in the consideration post the initial filing must be clearly detailed, possibly necessitating additional sheets for a thorough explanation.

- Both parties involved in the transaction must keep detailed records and documentation related to the sale or purchase of business assets, as this information may be needed for future reference or in the event of an audit.

- Before completing and submitting Form 8594, it is advisable to consult with a tax professional or legal advisor. These professionals can provide guidance to ensure that all information is accurate and that both parties are compliant with tax laws.

Filing Form 8594 accurately is vital for both the buyer and the seller. It not only helps in complying with tax reporting requirements but also ensures that both parties properly account for the asset transfer in their tax filings. As tax laws can be complex and subject to changes, professional advice is key to navigating these responsibilities effectively.

Popular PDF Forms

How to Send Certified Mail With Return Receipt - Outlines the steps for the recipient to waive rights in favor of the sender regarding international claims.

Da 3355 - DA 3355 serves as an official record of a soldier’s achievements and qualifications for promotion within the USAR.