Blank 8606 PDF Template

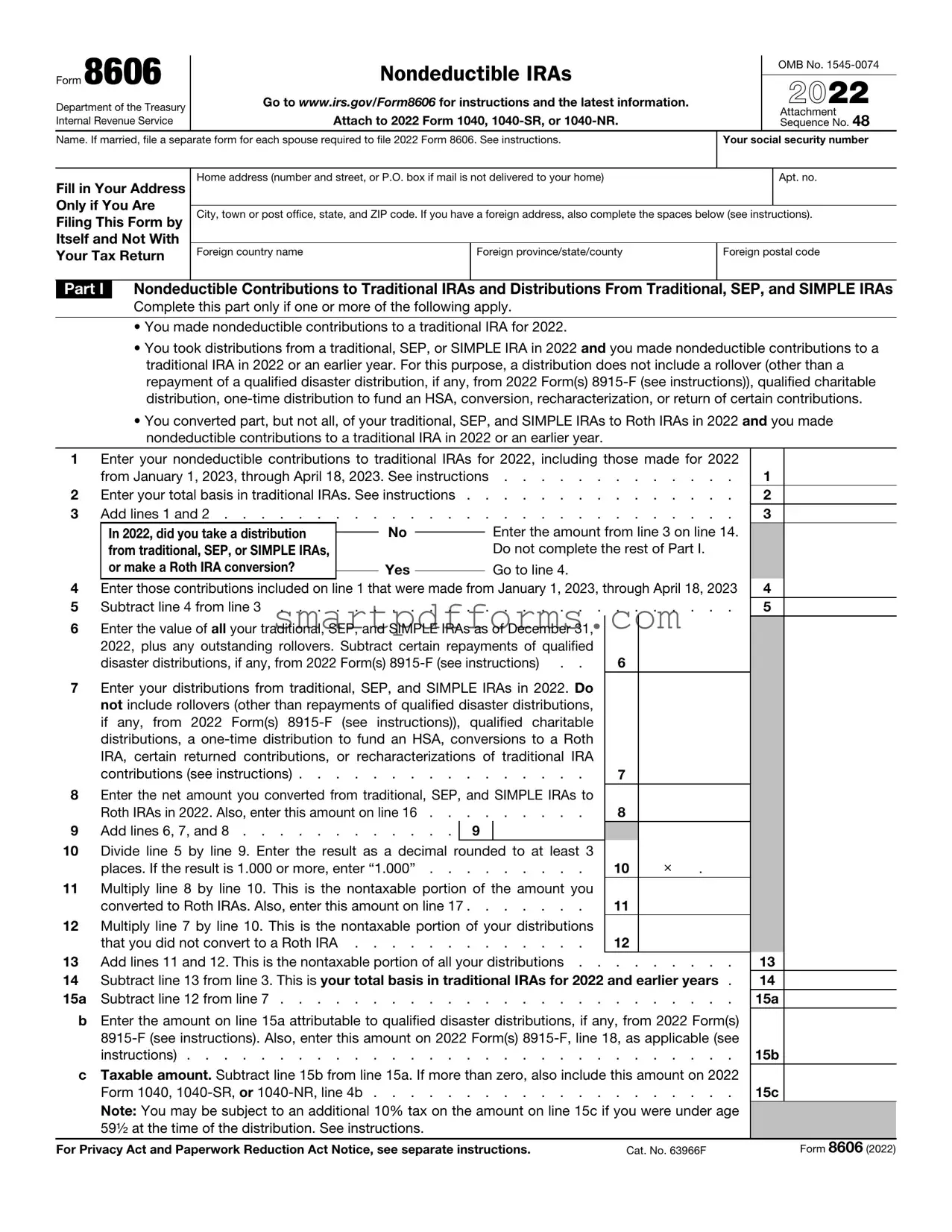

The journey to understanding and managing individual retirement account (IRA) contributions and distributions is often punctuated by the completion of Form 8606, a critical document for taxpayers navigating the nuances of nondeductible contributions to their IRAs. Issued by the Department of the Treasury's Internal Revenue Service, this form serves multiple purposes, helping to clarify contributions that are not tax-deductible and managing the taxation of distributions from traditional, SEP, and SIMPLE IRAs. Particularly, in circumstances where an individual has made nondeductible contributions to a traditional IRA or converted part of their IRAs to Roth IRAs within a tax year, the Form 8606 becomes indispensable for calculating the taxable and nontaxable portions of IRA distributions and conversions. Moreover, it addresses distributions from Roth IRAs, ensuring that individuals correctly report any taxable amount, thus avoiding potential penalties. The form, detailed with sections for calculating a taxpayer's basis in traditional IRAs and delineating the amounts converted to Roth IRAs, proves to be a vital tool for preserving the tax-advantaged status of retirement savings while complying with tax regulations. For married individuals filing separately, a separate Form 8606 is required for each spouse, underscoring the need for meticulous record-keeping and reporting. Through accurate completion and submission attached to the individual's tax return, Form 8606 plays a fundamental role in the transparent accountancy of nondeductible IRA contributions and the strategic planning for retirement distributions, carving a path toward financial security in retirement.

Preview - 8606 Form

Form 8606 |

|

Nondeductible IRAs |

|

|

OMB No. |

|

|

|

|

|

|||

|

|

2022 |

||||

Department of the Treasury |

Go to www.irs.gov/Form8606 for instructions and the latest information. |

|

||||

|

|

Attach to 2022 Form 1040, |

|

|

Attachment |

|

Internal Revenue Service |

|

|

|

Sequence No. 48 |

||

Name. If married, file a separate form for each spouse required to file 2022 Form 8606. See instructions. |

Your social security number |

|||||

|

|

|

|

|

||

Fill in Your Address |

Home address (number and street, or P.O. box if mail is not delivered to your home) |

|

|

Apt. no. |

||

Only if You Are |

|

|

|

|

|

|

City, town or post office, state, and ZIP code. If you have a foreign address, also complete the spaces below (see instructions). |

||||||

Filing This Form by |

||||||

Itself and Not With |

|

|

|

|

|

|

Foreign country name |

Foreign province/state/county |

Foreign postal code |

||||

Your Tax Return |

||||||

Part I Nondeductible Contributions to Traditional IRAs and Distributions From Traditional, SEP, and SIMPLE IRAs

Complete this part only if one or more of the following apply.

• You made nondeductible contributions to a traditional IRA for 2022.

• You took distributions from a traditional, SEP, or SIMPLE IRA in 2022 and you made nondeductible contributions to a traditional IRA in 2022 or an earlier year. For this purpose, a distribution does not include a rollover (other than a repayment of a qualified disaster distribution, if any, from 2022 Form(s)

• You converted part, but not all, of your traditional, SEP, and SIMPLE IRAs to Roth IRAs in 2022 and you made nondeductible contributions to a traditional IRA in 2022 or an earlier year.

1 |

Enter your nondeductible contributions to traditional IRAs for 2022, including those made for 2022 |

|

|

|||||

|

from January 1, 2023, through April 18, 2023. See instructions |

. . . . . . . . . . . . . |

1 |

|

||||

2 |

Enter your total basis in traditional IRAs. See instructions . . |

. . . . . . . . . . . . . |

2 |

|

||||

3 |

Add lines 1 and 2 |

. . . . . . . . . . . . . |

3 |

|

||||

|

In 2022, did you take a distribution |

|

No |

|

|

Enter the amount from line 3 on line 14. |

|

|

|

|

|

|

|

||||

|

from traditional, SEP, or SIMPLE IRAs, |

|

|

|

|

Do not complete the rest of Part I. |

|

|

4 |

or make a Roth IRA conversion? |

|

Yes |

|

|

Go to line 4. |

|

|

|

|

|

|

|||||

Enter those contributions included on line 1 that were made from January 1, 2023, through April 18, 2023 |

4 |

|

||||||

5 |

Subtract line 4 from line 3 |

. . . . . . . . . . . . . |

5 |

|

||||

6Enter the value of all your traditional, SEP, and SIMPLE IRAs as of December 31, 2022, plus any outstanding rollovers. Subtract certain repayments of qualified

disaster distributions, if any, from 2022 Form(s) |

6 |

7Enter your distributions from traditional, SEP, and SIMPLE IRAs in 2022. Do not include rollovers (other than repayments of qualified disaster distributions, if any, from 2022 Form(s)

IRA, certain returned contributions, or recharacterizations of traditional |

IRA |

|

contributions (see instructions) |

. |

7 |

8Enter the net amount you converted from traditional, SEP, and SIMPLE IRAs to

Roth IRAs in 2022. Also, enter this amount on line 16 . . |

. . . . . . . |

8 |

|

|

9 Add lines 6, 7, and 8 |

9 |

|

|

|

10Divide line 5 by line 9. Enter the result as a decimal rounded to at least 3

places. If the result is 1.000 or more, enter “1.000” |

10 |

× |

. |

11Multiply line 8 by line 10. This is the nontaxable portion of the amount you

converted to Roth IRAs. Also, enter this amount on line 17 |

11 |

12Multiply line 7 by line 10. This is the nontaxable portion of your distributions

|

that you did not convert to a Roth IRA |

12 |

|

|

13 |

Add lines 11 and 12. This is the nontaxable portion of all your distributions |

|

13 |

|

14 |

Subtract line 13 from line 3. This is your total basis in traditional IRAs for 2022 and earlier years . |

|

14 |

|

15a |

Subtract line 12 from line 7 |

15a |

||

bEnter the amount on line 15a attributable to qualified disaster distributions, if any, from 2022 Form(s)

instructions) |

15b |

cTaxable amount. Subtract line 15b from line 15a. If more than zero, also include this amount on 2022 Form 1040,

For Privacy Act and Paperwork Reduction Act Notice, see separate instructions. |

Cat. No. 63966F |

Form 8606 (2022) |

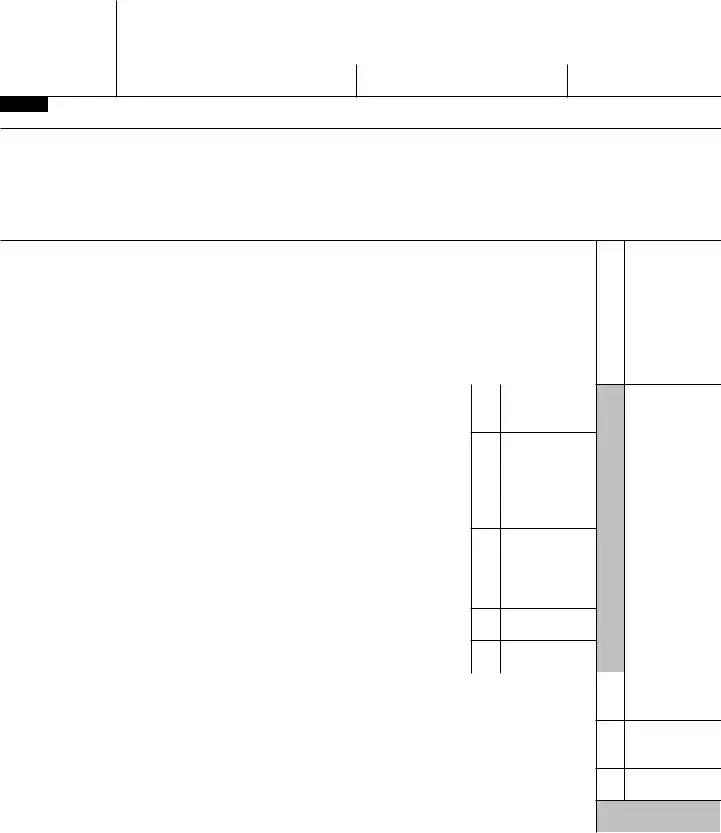

Form 8606 (2022) |

Page 2 |

Part II 2022 Conversions From Traditional, SEP, or SIMPLE IRAs to Roth IRAs

Complete this part if you converted part or all of your traditional, SEP, and SIMPLE IRAs to a Roth IRA in 2022.

16If you completed Part I, enter the amount from line 8. Otherwise, enter the net amount you converted

from traditional, SEP, and SIMPLE IRAs to Roth IRAs in 2022 . . . . . . . . . . . . .

17If you completed Part I, enter the amount from line 11. Otherwise, enter your basis in the amount on

line 16 (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . .

18Taxable amount. Subtract line 17 from line 16. If more than zero, also include this amount on 2022 Form 1040,

Part III Distributions From Roth IRAs

16

17

18

Complete this part only if you took a distribution from a Roth IRA in 2022. For this purpose, a distribution does not include a rollover (other than a repayment of a qualified disaster distribution (from 2022 Form(s)

19 |

Enter your total nonqualified distributions from Roth IRAs in 2022, including any qualified |

|

|

|||||||||

|

homebuyer distributions, and any qualified disaster distributions from 2022 Form(s) |

|

|

|||||||||

|

instructions) |

. . . . |

19 |

|

||||||||

20 |

Qualified |

|

|

|||||||||

|

by the total of all your prior qualified |

. . . . |

20 |

|

||||||||

21 |

Subtract line 20 from line 19. If zero or less, enter |

. . . . |

21 |

|

||||||||

22 |

Enter your basis in Roth IRA contributions (see instructions). If line 21 is zero, stop here . |

. . . . |

22 |

|

||||||||

23 |

Subtract line 22 from line 21. If zero or less, enter |

|

|

|||||||||

|

may be subject to an additional tax (see instructions) |

. . . . |

23 |

|

||||||||

24 |

Enter your basis in conversions from traditional, SEP, and SIMPLE IRAs and rollovers from qualified |

|

|

|||||||||

|

retirement plans to a Roth IRA. See instructions |

. . . . |

24 |

|

||||||||

25a |

Subtract line 24 from line 23. If zero or less, enter |

. . . . |

25a |

|

||||||||

b Enter the amount on line 25a attributable to qualified disaster distributions, if any, from 2022 Form(s) |

|

|

||||||||||

|

|

|

||||||||||

|

instructions) |

. . . . |

25b |

|

||||||||

c |

Taxable amount. Subtract line 25b from line 25a. If more than zero, also include this amount on 2022 |

|

|

|||||||||

|

Form 1040, |

. . . . |

25c |

|

||||||||

Sign Here Only if You |

Under penalties of perjury, I declare that I have examined this form, including accompanying attachments, and to the best of my knowledge and |

|||||||||||

Are Filing This Form |

belief, it is true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge. |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|||

by Itself and Not With |

|

|

|

|

|

|

|

|

|

|

||

Your Tax Return |

|

|

|

|

|

|

|

|

|

|

||

|

Your signature |

|

|

|

|

Date |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

Paid |

|

Print/Type preparer’s name |

Preparer’s signature |

Date |

|

|

|

Check |

if |

PTIN |

||

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|||

Preparer |

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

||

Firm’s name |

|

|

|

|

|

|

|

Firm’s EIN |

|

|||

Use Only |

|

|

|

|

|

|

|

|

||||

Firm’s address |

|

|

|

|

|

Phone no. |

|

|||||

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

Form 8606 (2022) |

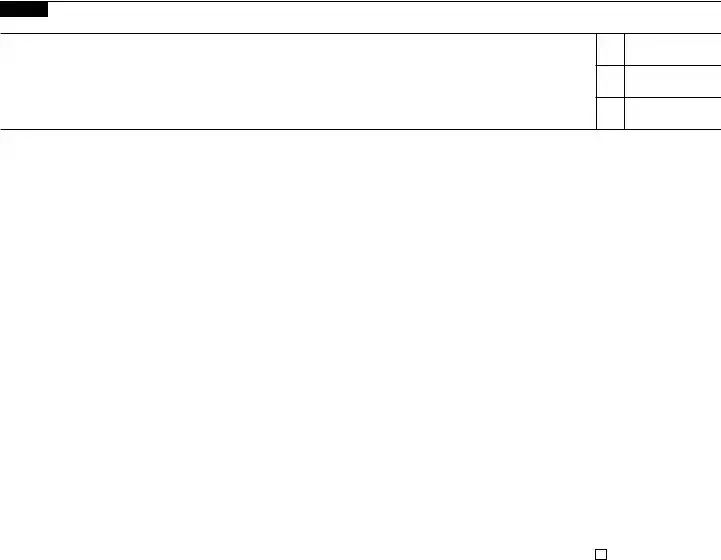

Form Data

| Fact | Description |

|---|---|

| Form Number | 8606 |

| Form Title | Nondeductible IRAs |

| OMB Number | 1545-0074 |

| Year | 2022 |

| Department | Department of the Treasury |

| Website for Instructions | www.irs.gov/Form8606 |

| Attachment Sequence | 48 |

| Special Instructions | If married, file a separate form for each spouse required to file Form 8606. |

Instructions on Utilizing 8606

When preparing to navigate your tax obligations, especially concerning contributions to individual retirement accounts (IRAs), Form 8606 becomes essential. This form is utilized by taxpayers to report nondeductible contributions to traditional IRAs, distributions from IRAs for which nondeductible contributions were made, and conversions from traditional, SEP, or SIMPLE IRAs to Roth IRAs. Completing this form accurately ensures that you're taxed correctly on IRA distributions and assists in tracking the basis in your IRAs, which is crucial for determining the taxable portion of distributions. Below, step-by-step guidance is provided to simplify the completion of Form 8606.

- Fill in your full name as it appears on your Social Security card.

- Enter your Social Security Number next to your name.

- Provide your complete home address, including the number and street, apartment number if applicable, city, town or post office, state, and ZIP code. If you have a foreign address, include the foreign country name, province/state/county, and foreign postal code.

- Under Part I, indicate your nondeductible contributions to traditional IRAs for 2022. This includes contributions made for 2022 from January 1, 2023, through April 18, 2023.

- Enter your total basis in traditional IRAs to date, as instructed.

- If you did not take any distributions from traditional, SEP, or SIMPLE IRAs, nor made any conversions to a Roth IRA, skip to line 14 following the instructions. Otherwise, continue to line 4.

- Specify the contributions included on line 1 that were made from January 1, 2023, through April 18, 2023.

- Calculate and note the value of all your traditional, SEP, and SIMPLE IRAs as of December 31, 2022, plus any outstanding rollovers, subtracting certain repayments if applicable.

- Enter any distributions from traditional, SEP, and SIMPLE IRAs received in 2022, following the guidelines for exclusions.

- Document the net amount converted from traditional, SEP, and SIMPLE IRAs to Roth IRAs in 2022.

- Sum the values from lines 6, 7, and 8 to complete line 9.

- Divide the amount on line 5 by the result on line 9 to determine the ratio of nontaxable distributions, rounding to at least three decimal places.

- Multiply the amount converted to Roth IRAs (line 8) by the result from line 10 to calculate the nontaxable portion of your conversions.

- Calculate the nontaxable portion of your distributions that were not converted to Roth IRAs by multiplying the distribution amount (line 7) by the ratio from line 10.

- Combine the nontaxable portions of your conversions and distributions to find the total nontaxable amount.

- Subtract the total nontaxable amount from your total basis in traditional IRAs to update your basis for 2022 and earlier years.

- Provide the taxable amount of your distributions, accounting for any qualified disaster distributions if applicable.

Proceed to Part II and III if they apply to your situation, following similar stepwise instructions to cover conversions to Roth IRAs and distributions from Roth IRAs. Remember to sign and date the form if you are not filing it with your tax return. Diligently reviewing the form before submission ensures that it accurately reflects your IRA contributions and transactions for the year.

Obtain Answers on 8606

What is Form 8606 used for?

Form 8606 is used by individuals to report nondeductible contributions to Traditional IRAs, distributions from Traditional, SEP, and SIMPLE IRAs when nondeductible contributions have been made, and conversions from Traditional, SEP, or SIMPLE IRAs to Roth IRAs. This form helps taxpayers calculate the taxable portion of their IRA distributions and conversions.

Who needs to file Form 8606?

If you made nondeductible contributions to a Traditional IRA in the tax year, took distributions from any IRA when you have nondeductible contributions, or converted assets to a Roth IRA, you'll need to file Form 8606. This applies separately to each spouse, so if you're married, each spouse must file a separate Form 8606 if they meet the filing criteria.

What happens if I don't file Form 8606?

Not filing Form 8606 when required can lead to paying tax twice on the same funds: once when you made the nondeductible contributions and again when you withdraw them. Additionally, the IRS may impose a $50 penalty for not filing the form, and a $100 penalty for overstating the nondeductible contributions unless you have reasonable cause.

Can I file Form 8606 by itself?

Yes, if you are not required to file an income tax return for the year, but need to file Form 8606, you can do so. Just ensure to sign and date the form at the bottom of the final page to declare that, under penalties of perjury, the form is true, correct, and complete.

How do I calculate the taxable portion of my IRA distributions?

To calculate the taxable portion, you first need to determine your total basis in nondeductible contributions. Then, you'll account for the total value of your IRA distributions for the year. Using the formula provided on Form 8606, you can derive the nontaxable portion of your distributions, and by subtracting this from the total distribution amount, you'll find the taxable portion.

Where do I report a Roth IRA conversion on my tax return?

The taxable amount of a Roth IRA conversion is reported on your income tax return for the year of the conversion. Specifically, you'll include this amount on Form 1040 or Form 1040-NR. The calculation for the taxable amount of the conversion is detailed on Form 8606.

What should I do if I have excess contributions to my IRA?

Excess contributions to an IRA can result in additional taxes unless corrected in a timely manner. If you've over-contributed, you should withdraw the excess contributions and any earnings on them before the tax filing deadline (including extensions) for the year of the contribution to avoid a 6% tax for each year the excess remains in the account.

Is there software or a tool to help fill out Form 8606?

Many tax preparation software programs can help fill out Form 8606 correctly based on the information you provide about your IRAs, contributions, distributions, and conversions. These tools can guide you through the process, calculate the taxable portions for you, and ensure your form is complete and accurate.

Common mistakes

When completing IRS Form 8606, which is used for tracking nondeductible contributions to Traditional IRAs and for reporting distributions and conversions, individuals frequently make mistakes that can lead to incorrect tax calculations or problems with the IRS. Understanding these common errors can save taxpayers time and potential penalties. Below are six common mistakes:

- Forgetting to file Form 8606 with the tax return: Filing Form 8606 is crucial if you've made nondeductible contributions to a Traditional IRA or if you've taken distributions or converted Traditional, SEP, or SIMPLE IRAs to a Roth IRA. This form should be attached to your Form 1040 or other tax return forms.

- Misreporting nondeductible contributions: It's important to accurately report the amount of nondeductible contributions to Traditional IRAs for the year being filed and for any previous years. This helps to calculate the taxable portion of distributions correctly.

- Incorrect calculation of the taxable portion of distributions or conversions: Errors in calculating the nontaxable and taxable portions of IRA distributions or Roth IRA conversions can lead to reporting incorrect taxable income. This calculation often involves understanding and applying the pro-rata rule accurately.

- Omitting required information or forms for IRA distributions: If portion of a distribution is attributable to qualified disaster distributions or other specific exceptions, it is critical to include all relevant forms and to detail these exceptions correctly on Form 8606 and other related tax forms as necessary.

- Failure to track and report the basis in traditional IRAs: Taxpayers often fail to accurately track and report their basis in traditional IRAs over the years. This information is crucial for determining the nontaxable portion of any IRA distributions or conversions.

- Miscalculating distributions from Roth IRAs: For those taking distributions from Roth IRAs, properly determining the taxable and nontaxable amounts, especially when considering contributions, conversions, and any qualified distributions, is essential. Misinterpretation can result in incorrect taxation or penalties.

To avoid these and other errors, carefully reviewing the Form 8606 instructions provided by the IRS is advised. This includes understanding the terms and calculations required, especially when dealing with distributions, conversions, and the taxable and nontaxable components of these transactions.

Documents used along the form

When managing individual retirement accounts (IRA) contributions and distributions, taxpayers often encounter the necessity for various forms alongside the Form 8606, Nondeductible IRAs. The understanding of how these documents interplay provides insights into the taxpayer's complete financial picture concerning retirement contributions, conversions, and distributions.

- Form 1040 (U.S. Individual Income Tax Return): This form is foundational for most taxpayers, serving as the primary vehicle for reporting annual income. It encompasses all income types, adjustments to income, tax credits, and deductions. When contributions to a traditional IRA are nondeductible, taxpayers need to complete Form 8606 to accurately report such transactions within their broader tax obligations on Form 1040.

- Form 5498 (IRA Contribution Information): Financial institutions use Form 5498 to report IRA contributions to the IRS and the account holder. This form details the types of IRA contributions made throughout the year, including rollovers, recharacterizations, and conversions. Viewing the information on Form 5498 can help taxpayers verify the accuracy of their reported contributions on Form 8606.

- Form 1099-R (Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc.): This form reports distributions from retirement accounts, including IRAs. When an individual takes a distribution, or converts an IRA to a Roth IRA, the financial institution issues Form 1099-R to both the taxpayer and the IRS. Taxpayers use this information to fill out Form 8606, particularly if the distribution is partly or wholly nontaxable due to previously taxed contributions.

- Form 5329 (Additional Taxes on Qualified Plans (Including IRAs) and Other Tax-Favored Accounts): Sometimes, distributions or failures to take required minimum distributions (RMDs) can incur additional taxes. Form 5329 covers these scenarios, calculating extra taxes owed. If an individual has taken a distribution before the permissible age or failed to take an RMD, this form becomes relevant. While Form 8606 deals with the basis in IRAs for nondeductible contributions, Form 5329 addresses tax implications of specific distribution behaviors.

Each document plays a unique role in ensuring compliance with IRS rules and regulations regarding retirement savings and distributions. Taken together, they form a network of reporting requisites that mirror an individual’s interactions with their retirement accounts across contributions, growth, and eventual distributions. Understanding and accurately completing each form can assist individuals in maximizing the benefits of their retirement strategies while minimizing their tax liabilities.

Similar forms

The Form 8606 is a crucial document for individuals managing their taxes, specifically related to nondeductible contributions to IRAs and the taxation of their distributions. Other tax documents have similar roles or structures, tailored towards specific financial or personal circumstances. Here are nine forms similar to Form 8606:

- Form 1040: The U.S. Individual Income Tax Return is the cornerstone of personal tax filings, into which Form 8606 directly feeds information. Like Form 8606, it deals with the calculation of taxable income and tax owed or refunded, but on a broader scale, including all sources of income, Credits, and deductions.

- Form 5498: IRA Contribution Information reports IRA contributions to the IRS, similar to how Form 8606 tracks nondeductible contributions. It's furnished by financial institutions, helping individuals and the IRS reconcile reported contributions with tax deductions or credits claimed.

- Form 1099-R: Distributions from Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc., similar to Form 8606, is pivotal for reporting distributions taken from retirement accounts, an essential element of calculating taxable parts of distributions on Form 8606.

- Form 5329: Additional Taxes on Qualified Plans (Including IRAs) and Other Tax-Favored Accounts complements Form 8606 by detailing additional taxes due to early withdrawals or insufficient distributions, demonstrating the tax code's intricate rules surrounding retirement savings.

- Form 8880: Credit for Qualified Retirement Savings Contributions bears similarities to Form 8606 in its focus on retirement savings, offering taxpayers a credit for certain contributions, while Form 8606 helps identify taxable and nontaxable portions of IRA distributions.

- Form 8960: Net Investment Income Tax—Individuals, Estates, and Trusts, like Form 8606, deals with the taxation of investments by focusing on the calculation of a Medicare surtax on net investment income, including distributions from retirement accounts that exceed certain thresholds.

- Form 1040-SR: U.S. Tax Return for Seniors, modeled closely on the standard Form 1040 but designed with features to aid older taxpayers, interacts with Form 8606 regarding retirement distributions, ensuring seniors accurately report their IRA distributions and taxes.

- Form 4952: Investment Interest Expense Deduction is used to calculate the deductible amount of investment interest expense, akin to how Form 8606 calculates the nondeductible contributions to IRAs, playing a key role in the management of investment-related deductions.

- Form 8815: Exclusion of Interest from Series EE and I U.S. Savings Bonds Issued After 1989 shares a purpose with Form 8606 in offering tax benefits for certain savings, allowing savings bond interest to be excluded from income if used for educational expenses, akin to the tax-advantaged growth of nondeductible IRA contributions.

Each of these forms interlocks with Form 8606 in the broader tax reporting and planning framework, illustrating how various aspects of an individual's financial life are interconnected through the U.S. tax code. Understanding and effectively utilizing these forms can pave the way for optimized tax outcomes, especially concerning retirement planning and investment strategies.

Dos and Don'ts

Filling out Form 8606 accurately is crucial for managing the tax implications of nondeductible IRAs. Here are some do's and don'ts to help guide you through the process:

- Do ensure you have all the necessary information before starting, including records of nondeductible contributions to traditional IRAs.

- Do use the instructions on the IRS website to help fill out the form correctly. The guidelines provided are invaluable for addressing complex issues.

- Do double-check your social security number and other personal information to prevent delays or issues with your filing.

- Do attach the form to your tax return if required. Form 8606 should be submitted as part of your tax documents if it applies to you for the year.

- Do report any distributions from traditional, SEP, or SIMPLE IRAs accurately, excluding rollovers and certain other distributions as instructed.

- Don't forget to sign and date the form if you are filing it by itself. This is a common oversight that can invalidate your submission.

- Don't include details about rollovers or recharacterizations in parts not designated for them. Place information in the correct section to ensure accurate processing.

- Don't ignore instructions regarding conversions from traditional, SEP, or SIMPLE IRAs to Roth IRAs. This could lead to mistakes in calculating the taxable amount.

- Don't overlook the need to complete different parts of the form based on your specific financial actions during the year. Each section addresses different scenarios.

Misconceptions

Many people have misconceptions about the IRS Form 8606, which deals with nondeductible IRAs. Clarifying these misunderstandings is essential for accurate tax filing.

- Only for Roth IRAs: A common misconception is that Form 8606 is only for Roth IRA transactions. However, this form is also necessary for reporting nondeductible contributions to traditional IRAs, distributions from these accounts, and conversions to Roth IRAs.

- Filing is unnecessary if no contributions are made: Even if no nondeductible contributions were made in a given year, individuals might still need to file Form 8606. This necessity arises if they have any previous nondeductible contributions in their traditional IRAs and took distributions or made conversions.

- Married couples can file jointly: Another incorrect assumption is that married couples can file a joint Form 8606. If both spouses need to file this form—due to making nondeductible contributions or completing certain transactions—they must each file separately, even if they file a joint income tax return.

- It's only for reporting purposes: Some may believe that Form 8606 is purely for informational purposes and has no real impact on taxes. However, this form plays a crucial role in determining the taxable portion of IRA distributions and conversions. Incorrectly filed or omitted forms can lead to paying taxes unnecessarily or facing IRS penalties.

Correcting these misunderstandings can help taxpayers comply with IRS regulations and possibly save on taxes. Using Form 8606 accurately ensures that nondeductible contributions are properly tracked and that taxpayers avoid paying tax twice on the same income.

Key takeaways

Understanding the Form 8606 and its implications can significantly affect how you manage your Individual Retirement Accounts (IRAs), especially when it comes to nondeductible contributions and conversions. Here are four key takeaways that should guide you through filling out and using this form:

- Filling Out For Nondeductible Contributions: If you make nondeductible contributions to your traditional IRA, the Form 8606 must be completed. This is crucial for tracking the tax basis in your IRA and ensuring that when you withdraw funds, you won’t be taxed again on these contributions. Remember, failing to file Form 8606 can lead to penalties.

- Reporting Roth Conversions: When you convert a portion or all of your traditional, SEP, or SIMPLE IRAs to a Roth IRA, Form 8606 helps you calculate the taxable portion of the converted amount. This ensures that you only pay taxes once on your contributions, complying with the IRS rules on IRA conversions.

- Determining the Taxable Amount of Distributions: The form is used to determine the nontaxable and taxable portions of distributions taken from IRAs if you have previously made nondeductible contributions. This step is essential to avoid double taxation on the same money.

- For Roth IRA Distributions: If you are taking distributions from a Roth IRA, part III of Form 8606 will help you determine the taxable part of your distribution, if any. Given that Roth IRAs offer tax-free growth, understanding the conditions under which distributions are tax-free versus those that are taxable is critical for tax planning.

The above takeaways underscore the importance of accurately completing and filing Form 8606. Whether you are making nondeductible contributions, converting a traditional IRA to a Roth IRA, or taking distributions, the form serves as a key document for tracking and reporting your IRA contributions and taxes. Ensure that you consult the instructions for Form 8606 or seek guidance from a tax professional to avoid any potential mistakes that could affect your tax obligations.

Popular PDF Forms

Rd 3560 10 - Enables better informed decision-making regarding approvals, renewals, and funding adjustments.

IRS W-2 - Box 1 of the W-2 shows the total taxable wages, tips, and other compensation an employee received.

Topgrading Career History Form - Space for elaboration on professional licenses or other certifications, highlighting qualifications and specialized skills relevant to the job role.