Blank 870 PDF Template

Navigating the intricacies of tax obligations and the Internal Revenue Service (IRS) procedures can be daunting for taxpayers. One facet of this complex system is embodied in Form 870, officially titled "Waiver of Restrictions on Assessment and Collection of Deficiency in Tax and Acceptance of Overassessment," as revised in March 1992. This crucial document plays a pivotal role in the final stages of an audit or tax dispute resolution process with the IRS. By signing Form 870, taxpayers agree to the immediate assessment and collection of any changes in tax and penalties—whether these denote increases or decreases. What sets this form apart is its dual nature; not only does it expedite the adjustment to a taxpayer's account, thereby potentially limiting interest charges, but it also signifies the taxpayer's waiver of the right to contest the findings in the United States Tax Court for those specific years, barring the determination of additional deficiencies. It is crucial for taxpayers to understand that this consent is not all-encompassing, as it leaves room for filing claims for refunds on payments made if they later believe such claims are justified, nor does it preclude the IRS from making future determinations of additional tax owed. Detailed in this form are instructions for who must sign—encompassing individual taxpayers, spouses in joint filings, and corporate officers, along with provisions for attorney or agent signatures under specific conditions. The interplay of federal and state tax assessments, considerations for filing state forms upon changes, and the avenues available for disputing disallowed claims further underscore the significant implications and procedural nuances encapsulated in Form 870.

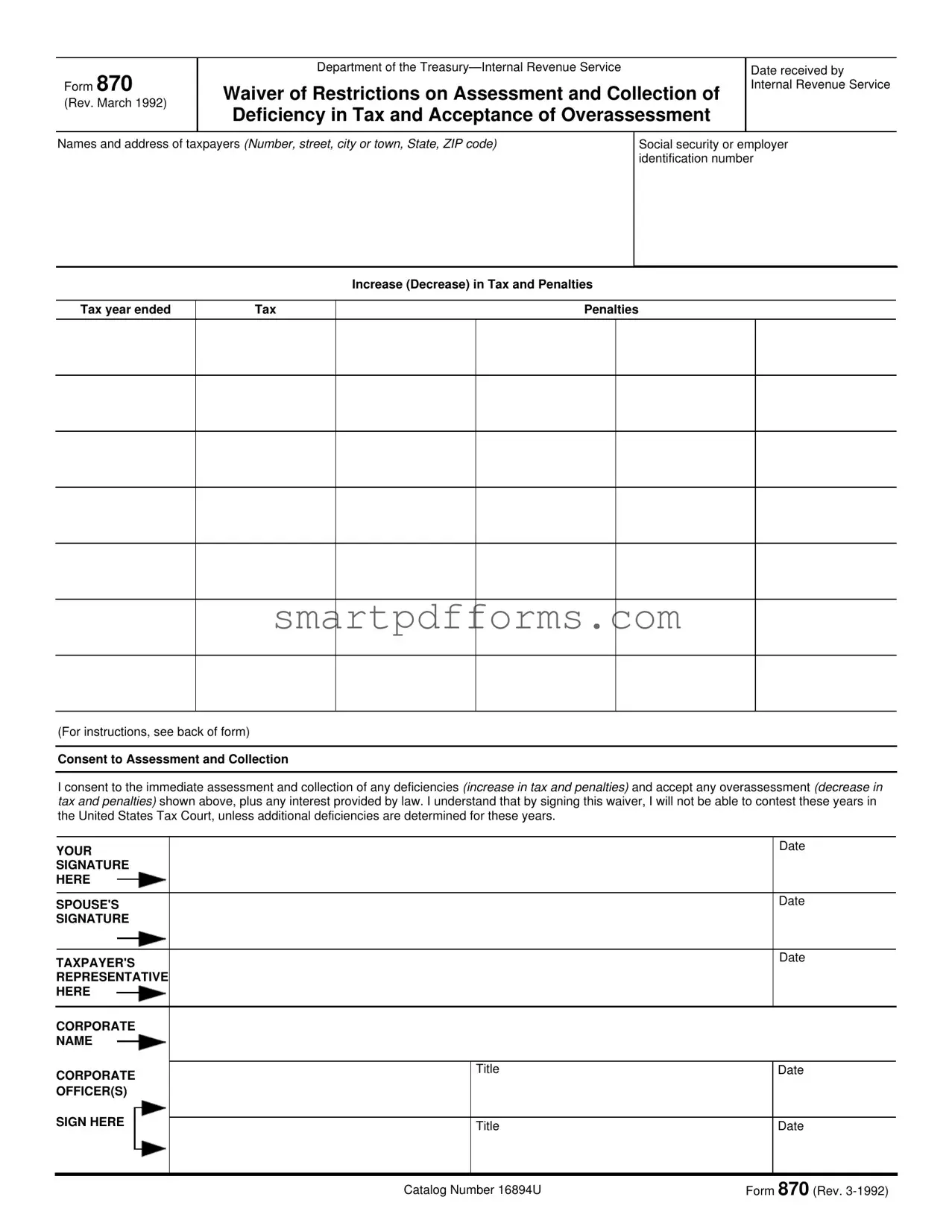

Preview - 870 Form

Form 870

(Rev. March 1992)

Department of the

Waiver of Restrictions on Assessment and Collection of Deficiency in Tax and Acceptance of Overassessment

Date received by

Internal Revenue Service

Names and address of taxpayers (Number, street, city or town, State, ZIP code)

Social security or employer identification number

Increase (Decrease) in Tax and Penalties

Tax year ended |

Tax |

|

Penalties |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(For instructions, see back of form)

Consent to Assessment and Collection

I consent to the immediate assessment and collection of any deficiencies (increase in tax and penalties) and accept any overassessment (decrease in tax and penalties) shown above, plus any interest provided by law. I understand that by signing this waiver, I will not be able to contest these years in the United States Tax Court, unless additional deficiencies are determined for these years.

YOUR SIGNATURE HERE

SPOUSE'S

SIGNATURE

TAXPAYER'S REPRESENTATIVE HERE

CORPORATE

NAME

CORPORATE

OFFICER(S)

SIGN HERE

Title

Title

Date

Date

Date

Date

Date

Catalog Number 16894U |

Form 870 (Rev. |

Name of Taxpayer:

Identification Number:

Form 870 page 2 |

Instructions |

General Information

If you consent to the assessment of the deficiencies shown in this waiver, please sign and return the form in order to limit any interest charge and expedite the adjustment to your account. Your consent will not prevent you from filing a claim for refund (after you have paid the tax) if you later believe you are so entitled. It will not prevent us from later determining, if necessary, that you owe additional tax; nor extend the time provided by law for either action.

We have agreements with State tax agencies under which information about Federal tax, including increases or decreases, is exchanged with the States. If this change affects the amount of your State income tax, you should file the required State form.

If you later file a claim and the Service disallows it, you may file suit for refund in a district court or in the United States Claims Court, but you may not file a petition with the United States Tax Court.

We will consider this waiver a valid claim for refund or credit of any overpayment due you resulting from any decrease in tax and penalties shown above, provided you sign and file it within the period established by law for making such a claim.

Who Must Sign

If you filed jointly, both you and your spouse must sign. If this waiver is for a corporation, it should be signed with the corporation name, followed by the signatures and titles of the corporate officers authorized to sign. An attorney or agent may sign this waiver provided such action is specifically authorized by a power of attorney which, if not previously filed, must accompany this form.

If this waiver is signed by a person acting in a fiduciary capacity (for example, an executor, administrator, or a trustee) Form 56, Notice Concerning Fiduciary Relationship, should, unless previously filed, accompany this form.

Catalog Number 16894U |

Form 870 (Rev. |

Form Data

| Fact Name | Description |

|---|---|

| Purpose of Form 870 | This form serves as a waiver allowing the Internal Revenue Service (IRS) to immediately assess and collect any tax deficiencies or apply any overassessments to a taxpayer's account, without the taxpayer's right to contest the years in question in the United States Tax Court, barring additional deficiencies. |

| Key Components | It includes sections for taxpayer identification, a detailed account of the increase or decrease in tax and penalties, and the tax year(s) involved. |

| Consent Clause | By signing the form, taxpayers consent to the immediate assessment and collection of taxes and penalties as specified, along with related interest, while also accepting any noted overassessments. |

| Impact on Legal Rights | Signing this waiver limits the taxpayer's options to contest adjustments in U.S. Tax Court, though it leaves open the possibility of seeking a refund through other legal means after payment. |

| Signing Requirements | Different parties are required to sign based on the taxpayer's status, including individual taxpayers, corporate officers, and authorized representatives, with specific stipulations for each category. |

| State Tax Implications | Information about federal tax changes under this waiver may be shared with state tax agencies, potentially affecting state income tax calculations and necessitating the filing of state-specific forms under governing laws. |

Instructions on Utilizing 870

Filling out the Form 870 is a necessary step in the process of managing your tax records with the Internal Revenue Service. This form plays a crucial role in the waiver of restrictions on assessment and collection of tax deficiencies and acceptance of overassessment. Whether you're acknowledging an increase or decrease in your taxes and penalties, it's essential to complete this form accurately. Follow these step-by-step instructions to ensure your Form 870 is correctly filled out and submitted.

- Start with the Date received by Internal Revenue Service at the top of the form, entering the current date.

- Proceed to Names and address of taxpayers section. Fill in your full name(s), address, including number, street, city or town, state, and ZIP code.

- Enter your Social security or employer identification number in the designated space.

- In the Increase (Decrease) in Tax and Penalties section, list the details of your tax year ended, including any adjustments to tax and penalties.

- Under Consent to Assessment and Collection, read the declaration carefully. By signing, you consent to the immediate assessment and collection of any deficiencies or accept any overassessment, acknowledging the terms laid out.

- Sign the form in the YOUR SIGNATURE HERE space provided. If you're filing jointly, ensure your spouse also signs in the SPOUSE'S SIGNATURE space.

- If applicable, a taxpayer's representative should sign in the TAXPAYER'S REPRESENTATIVE HERE area.

- For corporations, enter the CORPORATE NAME and have an authorized corporate officer sign with his or her title in the designated space. Repeat for each necessary officer.

- Make sure all signatories fill out the Date next to their signatures.

- Review the form for accuracy and completeness before submitting it to the IRS.

Upon completion and submission, your Form 870 will be processed by the IRS. This will expedite adjustments to your account and limit any potential interest charges. Remember, if you believe you are owed a refund after filing this form, you retain the right to file a claim for refund once the tax is paid, albeit with certain limitations as outlined in the form's instructions. By filling out Form 870 correctly, you ensure a smoother process in managing your tax records.

Obtain Answers on 870

What is Form 870 and why is it used?

Form 870 is a document issued by the Department of the Treasury—Internal Revenue Service. It serves a very specific purpose: it is a waiver that allows for the immediate assessment and collection of any tax deficiencies, which means increases in tax and penalties, as well as the acceptance of overassessments (decreases in tax and penalties), for a particular tax year. By signing Form 870, taxpayers agree not to challenge these assessments in the United States Tax Court, with the exception of any additional deficiencies that may be determined later. This form helps in speeding up the tax adjustment process on the taxpayer's account and in limiting any potential interest charges.

Can signing Form 870 affect my right to file a refund claim?

No, signing Form 870 does not affect your right to file a claim for a refund after you have paid the tax, in case you believe you are entitled to it. However, if your claim is later disallowed by the IRS, your option to take legal action shifts from the United States Tax Court to either a district court or the United States Claims Court.

Does Form 870 affect the information shared with State tax agencies?

The IRS has agreements for information sharing with State tax agencies, meaning that any increase or decrease in federal tax, as documented in Form 870, may be shared. This could affect your State income tax, so you may need to file the appropriate State tax form if there's a change in the amount of your State income tax.

Who needs to sign Form 870?

For individuals filing jointly, both spouses must sign the form. For corporations, the form must be signed in the corporation's name by corporate officers authorized to do so. If the form is signed by an attorney or agent, a power of attorney must accompany the form if it hasn’t been previously filed. Fiduciaries, such as executors, administrators, or trustees, must accompany the form with Form 56 unless it has been filed already.

What happens after Form 870 is signed?

Once Form 870 is signed, it allows the IRS to promptly assess and collect any increase or decrease in tax and penalties for the specified tax year. It also serves as a valid claim for refund or credit in cases of overpayment due to a decrease in tax and penalties, as long as it is signed and filed within the legally established period for making such a claim. The form ultimately expedites the adjustment to your account and limits any additional interest charges.

Can I contest additional deficiencies after signing Form 870?

Yes, you can still contest additional deficiencies that are determined after you've signed Form 870. While the form waives your right to contest the specific adjustments (increases or decreases in tax and penalties) stated in the form in the United States Tax Court, it does not apply to any additional deficiencies that might be found later.

Is there a deadline to file Form 870?

While Form 870 itself does not specify a filing deadline, it mentions that it should be signed and filed within the period established by law for making a claim for refund or credit. This period can vary depending on your specific circumstances and tax issues, so it's essential to be mindful of the lawful deadlines to benefit from the potential expediting of your tax account adjustment and the limitation of interest charges.

Common mistakes

Filling out Form 870, which serves as a waiver of restrictions on the assessment and collection of tax deficiencies and acceptance of overassessments, requires careful attention to detail. Common mistakes can lead to unnecessary complications or delays. Below are seven critical areas where errors frequently occur:

Incorrectly filled-out personal information: It is crucial to ensure that names, addresses, social security, or employer identification numbers are accurately entered. These details should match those in previous IRS records to avoid confusion or misidentification.

Failure to report all changes in tax and penalties accurately: Taxpayers often make the mistake of not thoroughly reviewing and correctly entering the increase or decrease in tax and penalties. Each figure should be double-checked for accuracy.

Overlooking the requirement for dual signatures on joint filings: When filing jointly, both individuals must sign the form. Missing the signature of either party can render the waiver incomplete and delay processing.

Not attaching necessary documentation: Sometimes, a power of attorney or Form 56, Notice Concerning Fiduciary Relationship, is required if the form is being signed by an attorney, agent, or someone acting in a fiduciary capacity. Failure to include these documents can lead to the rejection of the form.

Misunderstanding the consent to assessment and collection statement: Some taxpayers do not fully comprehend that, by signing the form, they are waiving their right to contest the assessed years in the United States Tax Court, except under specific conditions. A thorough reading is advised to avoid any unintended waiver of rights.

Incorrectly dating the form: The date is often incorrectly entered or completely overlooked. Correct dating is critical to ensure the form's validity and to meet any applicable deadlines.

Overlooking the impact on state income taxes: Taxpayers sometimes forget to consider how changes in federal tax might affect their state income tax. It’s important to file the necessary state forms promptly to reflect these changes and avoid discrepancies.

By paying careful attention to these areas and ensuring all information is complete and accurate, taxpayers can avoid these common pitfalls when submitting Form 870 to the IRS.

Documents used along the form

When dealing with the 870 Form, which is a waiver of restrictions on the assessment and collection of a tax deficiency and the acceptance of overassessment by the Internal Revenue Service (IRS), several other documents often come into play throughout the process. These documents serve various purposes, from authorizing representation to indicating specific financial situations. Understanding these forms and documents can help taxpayers navigate their interactions with the IRS more effectively.

- Form 2848, Power of Attorney and Declaration of Representative: This document allows taxpayers to grant a specific person or organization the authority to represent them before the IRS. It's crucial for situations where taxpayers cannot handle their tax matters directly and need a professional, such as an attorney or a certified public accountant, to act on their behalf.

- Form 56, Notice Concerning Fiduciary Relationship: Filed to inform the IRS of a fiduciary relationship, this form is used when an individual is acting on behalf of another person or an entity in a fiduciary capacity, such as an estate administrator or trustee. It's especially relevant if such a relationship affects tax obligations or rights.

- Form 1040, U.S. Individual Income Tax Return: The basic form used by individuals to file their annual income tax returns. It is often the source document from which the information regarding deficiencies or overassessments that leads to the use of Form 870 arises.

- Form 1120, U.S. Corporation Income Tax Return: Similar to Form 1040 but specifically designed for corporate entities. It details the income, losses, and taxes of corporations, and discrepancies found here may also necessitate the use of Form 870 for resolving tax issues.

- Form 433-A, Collection Information Statement for Wage Earners and Self-Employed Individuals: This form provides the IRS with information about the taxpayer's financial situation, including income, debts, and assets. It's often used in negotiations of tax liabilities and payment arrangements.

- Form 433-B, Collection Information Statement for Businesses: The partner form to 433-A but for businesses. It collects detailed information about a business's financial condition, which is vital when addressing matters related to assessments and collections outlined in Form 870.

In essence, these documents each play a specific role in the broader context of managing and resolving tax issues with the IRS. Whether it's authorizing a representative, declaring a fiduciary relationship, reporting individual or corporate income, or providing detailed financial information, these forms collectively support the process initiated by Form 870. Navigating the complexities of tax assessment and collection is a multifaceted process that often requires the support of multiple documents to ensure clarity, accuracy, and the protection of taxpayer rights.

Similar forms

Form 656 - Offer in Compromise: Similar to Form 870, Form 656 is another document used in the tax resolution process. It allows taxpayers to settle their tax liabilities for less than the full amount owed. Both forms are avenues for taxpayers to address and resolve tax obligations with the IRS, albeit through different mechanisms. Form 870 facilitates the immediate assessment and collection of tax liabilities, while Form 656 proposes a compromise to reduce those liabilities.

Form 843 - Claim for Refund and Request for Abatement: This form shares similarities with Form 870 in that it also deals with adjustments to tax liabilities. While Form 870 involves a taxpayer's consent to the assessment and collection of deficiencies or acceptance of overassessments, Form 843 is used to request refunds or abatements of certain taxes, interest, penalties, and fees. Both forms play roles in rectifying taxpayers' accounts, but they serve different functions in the adjustment process.

Form 9423 - Collection Appeal Request: Form 9423 is utilized by taxpayers to request an appeal of certain collection actions. It's similar to Form 870 in the context of dealing with disputes or issues related to tax collection. However, whereas Form 870 waives restrictions on the assessment and collection of tax deficiencies, Form 9423 provides a route for taxpayers to challenge proposed or actual collection actions taken by the IRS.

Form 2848 - Power of Attorney and Declaration of Representative: Both Form 870 and Form 2848 involve authorizing actions on behalf of a taxpayer. Form 870 may require the signature of a representative if the taxpayer has granted such authority, especially in corporate scenarios. Form 2848 is the document that officially grants this authority, allowing representatives to perform certain acts, including signing forms like the 870 on behalf of a taxpayer. While Form 2848 primarily establishes representation, it is indirectly linked to actions taken through forms like the 870.

Form 1040X - Amended U.S. Individual Income Tax Return: Similar to Form 870 in its function of addressing and correcting tax records, Form 1040X is used by individuals to amend previously filed income tax returns. Both forms are integral to the process of rectifying inaccuracies or changes in a taxpayer's account. While Form 870 focuses on consenting to adjustments related to specific tax assessments and collections, Form 1040X allows taxpayers to proactively change information on a return to correct or update tax liability.

Dos and Don'ts

When dealing with Form 870, a waiver of restrictions on the assessment and collection of deficiency in tax and acceptance of overassessment, there are specific do's and don'ts you should follow to ensure the process goes smoothly. Here are nine key points to help guide you:

- Do read through the entire form carefully before filling it out. Understanding all the sections and instructions is crucial.

- Do ensure that both you and your spouse sign the form if you're filing jointly. This is a requirement for processing.

- Do include any relevant power of attorney if someone other than the taxpayer is signing the form.

- Do fill out every required section clearly and accurately to avoid any delays or issues.

- Do consider consulting with a tax professional or lawyer if you have any confusion or concerns about the implications of signing this form.

- Don't sign Form 870 if you are unsure about any increases in tax and penalties or about accepting any overassessment. It’s your right to seek clarification first.

- Don't forget to date your signature. The date is critical for tracking the submission and any relevant timelines thereafter.

- Don't neglect to review the specific conditions under which you can still file a claim for refund, as outlined in the form's instructions.

- Don't hesitate to file the required State form if the changes in your Federal tax affect your State income tax, as this could lead to further complications.

By following these guidelines, you can ensure that you properly complete and submit Form 870, facilitating a smoother interaction with tax authorities.

Misconceptions

Understanding Form 870 involves dispelling common myths that often confuse taxpayers. Here are 10 misconceptions and the actual facts:

Signing Form 870 completely removes your right to dispute the IRS’s findings. While signing the form does limit your ability to contest the assessment in Tax Court, it doesn't revoke your ability to challenge the decision through other means, such as filing a claim for a refund after payment.

Form 870 is only for individuals. This form is not restricted to individuals; it is also applicable to corporations and other entities required to file tax returns. The key is that the appropriate party—with the authority to do so—must sign the form.

Form 870 guarantees a speedy resolution of your tax issue. Although signing the form can expedite the adjustment to your account, it doesn't ensure an immediate resolution. The IRS’s processing times can vary.

Signing Form 870 means you agree with the IRS’s determination. Consent to assessment and collection doesn’t necessarily mean agreement with the IRS's findings, but rather, it is a procedural step that may expedite case closure.

If you sign Form 870, you can’t file a claim for a refund. Taxpayers retain the right to file a claim for a refund if they believe the assessment was incorrect, even after signing the form.

Form 870 is a final agreement that prevents further IRS action. The IRS can still determine additional tax liabilities after the form is signed. Similarly, you can also contest these new findings or file for a refund if overpayments are identified.

The form is a straightforward acknowledgement of tax overpayment. Form 870 is primarily a waiver concerning the assessment and collection process, not a direct acknowledgment or agreement on tax overassessment amounts.

Once signed, the form takes effect immediately. The form’s effectivity is subject to IRS processing. An immediate effect occurs upon the IRS's acceptance, not merely the taxpayer's signature.

Form 870 serves as a blanket waiver for all tax years. The waiver specifically applies to the tax year and matters outlined on the form. Separate agreements are required for other tax years or distinct issues.

Any party can sign Form 870 on behalf of the taxpayer. Only specific individuals with legal authority to act on the taxpayer’s behalf, such as duly authorized corporate officers or agents with power of attorney, can sign the form. Special documentation may be required to support this authority.

Clearing up these misconceptions is vital for taxpayers to understand their rights and obligations concerning Form 870. Proper comprehension ensures informed decisions can be made in the context of IRS proceedings.

Key takeaways

Understanding the Form 870 is crucial for taxpayers who are considering waiving restrictions on the assessment and collection of potential tax deficiencies and accepting overassessments. Here are key takeaways:

- Waiver of Rights: By signing Form 870, taxpayers agree to the immediate assessment and collection of any additional taxes and penalties. This action also means accepting adjustments that decrease tax and penalties, along with the applicable interest as provided by law.

- Impact on Tax Court Proceedings: Once Form 870 is signed, taxpayers lose the right to contest the agreed years’ tax deficiencies in the United States Tax Court, unless the IRS determines additional deficiencies for those years.

- Refund Claims: Signing the form does not prevent taxpayers from filing a claim for a refund if they believe they are entitled to one after the tax has been paid.

- Future Assessments: The IRS retains the right to assess additional taxes if necessary, and signing the form does not extend the legal timeframe for such actions.

- State Tax Implications: Information on federal tax changes, including increases or decreases, may be shared with state tax agencies. Taxpayers should file the appropriate state forms if their state income tax is affected.

- Refund or Credit Claims: Form 870 serves as a valid claim for refund or credit of any overpayments due to the taxpayer as a result of decreases in tax and penalties, provided it is signed and filed within the legally established period.

- Signature Requirements: If filing jointly, both spouses must sign the form. For corporations, authorized corporate officers must sign, including their titles. Attorneys or agents can sign if they have specific power of attorney, which must accompany the form if not already filed.

- Accompanying Documents: For those signing in a fiduciary capacity, such as an executor or trustee, Form 56, Notice Concerning Fiduciary Relationship, should accompany Form 870 unless it has been previously filed.

Form 870 is a significant document that affects taxpayers' rights and obligations. It is essential for taxpayers to fully understand the consequences of signing this form and consider consulting a tax professional if they have any doubts or questions.

Popular PDF Forms

Communication Attitude Test Pdf - The Communication Attitude Test Form A helps to uncover any negative or positive beliefs a person has about their speaking skills.

Fs Form 1048 - FS Form 1522 includes directives for preparing the form, especially regarding ink usage and clarity in filling out required information.