Blank 886 H Dep PDF Template

Navigating the complexities of tax obligations can often feel like traversing a labyrinth, but understanding the specifics of certain forms can provide a clear path forward. The Form 886-H-DEP, a document emanating from the Department of the Treasury and the Internal Revenue Service, serves as a critical tool for taxpayers seeking to claim dependents. It outlines the necessary supporting documents required to substantiate claims for dependents on a tax return. This particular form is crucial for different groups of taxpayers, including those who are divorced, legally separated, living apart, or those with a qualifying child or relative. Requirements vary greatly based on the taxpayer’s situation, demanding anything from divorce decrees and custody orders to birth certificates and proof of residency together. For children, proving that they lived with the taxpayer for more than half of the tax year and did not provide more than half of their own support is essential, further complicated by specific age and student status criteria for eligibility for tax credits. Providing detailed documentation is key, including everything from school records and medical bills to statements of account from child support agencies. Understanding the 886-H-DEP form's requisites can significantly impact eligibility for tax benefits related to dependents, thereby underlining the importance of meticulously gathering and submitting the right documentation.

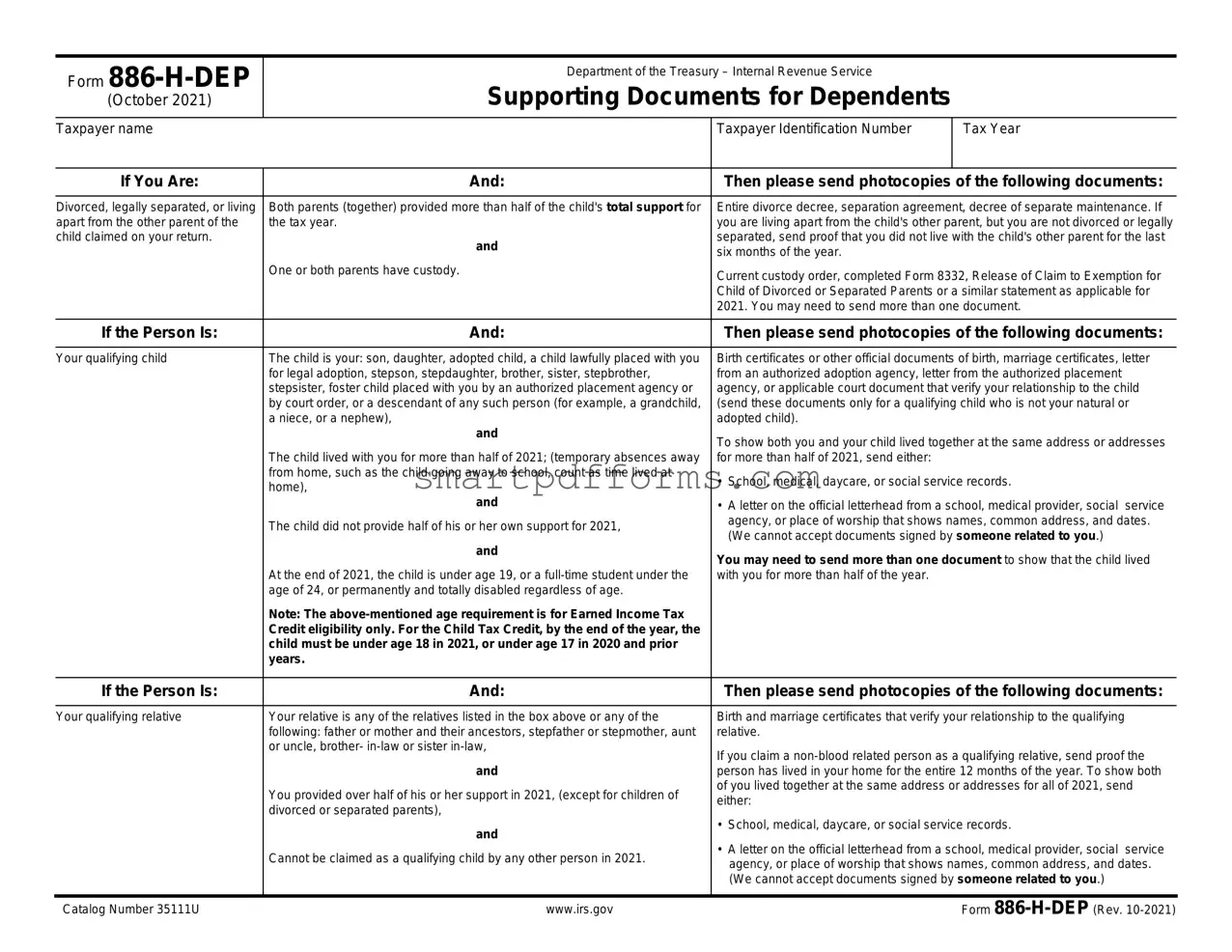

Preview - 886 H Dep Form

Form

(October 2021)

Department of the Treasury – Internal Revenue Service

Supporting Documents for Dependents

Taxpayer name |

Taxpayer Identification Number |

Tax Year |

|

|

|

If You Are: |

And: |

|

Then please send photocopies of the following documents: |

|

|

|

|

Divorced, legally separated, or living |

Both parents (together) provided more than half of the child's total support for |

Entire divorce decree, separation agreement, decree of separate maintenance. If |

|

apart from the other parent of the |

the tax year. |

you are living apart from the child's other parent, but you are not divorced or legally |

|

child claimed on your return. |

and |

separated, send proof that you did not live with the child's other parent for the last |

|

|

six months of the year. |

||

|

|

||

|

One or both parents have custody. |

Current custody order, completed Form 8332, Release of Claim to Exemption for |

|

|

|

||

|

|

Child of Divorced or Separated Parents or a similar statement as applicable for |

|

|

|

2021. You may need to send more than one document. |

|

|

|

|

|

If the Person Is: |

And: |

|

Then please send photocopies of the following documents: |

|

|

|

|

Your qualifying child |

The child is your: son, daughter, adopted child, a child lawfully placed with you |

Birth certificates or other official documents of birth, marriage certificates, letter |

|

|

for legal adoption, stepson, stepdaughter, brother, sister, stepbrother, |

from an authorized adoption agency, letter from the authorized placement |

|

|

stepsister, foster child placed with you by an authorized placement agency or |

agency, or applicable court document that verify your relationship to the child |

|

|

by court order, or a descendant of any such person (for example, a grandchild, |

(send these documents only for a qualifying child who is not your natural or |

|

|

a niece, or a nephew), |

adopted child). |

|

|

and |

To show both you and your child lived together at the same address or addresses |

|

|

|

||

|

The child lived with you for more than half of 2021; (temporary absences away |

for more than half of 2021, send either: |

|

|

from home, such as the child going away to school, count as time lived at |

• |

School, medical, daycare, or social service records. |

|

home), |

||

|

|

|

|

|

and |

• |

A letter on the official letterhead from a school, medical provider, social service |

|

The child did not provide half of his or her own support for 2021, |

|

agency, or place of worship that shows names, common address, and dates. |

|

|

(We cannot accept documents signed by someone related to you.) |

|

|

and |

|

|

|

You may need to send more than one document to show that the child lived |

||

|

At the end of 2021, the child is under age 19, or a |

||

|

with you for more than half of the year. |

||

|

age of 24, or permanently and totally disabled regardless of age. |

|

|

|

Note: The |

|

|

|

Credit eligibility only. For the Child Tax Credit, by the end of the year, the |

|

|

|

child must be under age 18 in 2021, or under age 17 in 2020 and prior |

|

|

|

years. |

|

|

|

|

|

|

If the Person Is: |

And: |

|

Then please send photocopies of the following documents: |

|

|

|

|

Your qualifying relative |

Your relative is any of the relatives listed in the box above or any of the |

Birth and marriage certificates that verify your relationship to the qualifying |

|

|

following: father or mother and their ancestors, stepfather or stepmother, aunt |

relative. |

|

|

or uncle, brother- |

If you claim a |

|

|

and |

||

|

person has lived in your home for the entire 12 months of the year. To show both |

||

|

You provided over half of his or her support in 2021, (except for children of |

of you lived together at the same address or addresses for all of 2021, send |

|

|

either: |

||

|

divorced or separated parents), |

||

|

• |

School, medical, daycare, or social service records. |

|

|

and |

||

|

• |

A letter on the official letterhead from a school, medical provider, social service |

|

|

Cannot be claimed as a qualifying child by any other person in 2021. |

||

|

|

agency, or place of worship that shows names, common address, and dates. |

|

|

|

|

|

|

|

|

(We cannot accept documents signed by someone related to you.) |

|

|

|

|

Catalog Number 35111U |

www.irs.gov |

|

Form |

*** Note - Send Us Copies of the Following Documents as Proof You Provided More Than Half of Your Dependent's Total Support: ***

•A statement of account from a child support agency.

•A statement from any government agency verifying the amount and type of benefits you and/or your dependent received for the year.

•Rental agreements or a statement showing the fair rental value of your residence (proof of lodging cost).

•Utility and repair bills (proof of household expenses) with canceled checks or receipts.

•Daycare, school, medical records, or bills (proof of child's support) with canceled checks or receipts.

•Clothing bills (proof of child's support) with canceled checks or receipts.

Catalog Number 35111U |

www.irs.gov |

Form |

Form Data

| Fact Name | Description |

|---|---|

| Purpose of Form | The Form 886-H-DEP is used by individuals to provide supporting documents for dependents claimed on their tax return. |

| Required Documents for Divorced or Separated Parents | If both parents together provided more than half of the child's total support for the tax year, necessary documents include the entire divorce decree, separation agreement, or decree of separate maintenance, depending on the situation. |

| Verification for Qualifying Child | To meet the criteria for a qualifying child, individuals must submit birth certificates or other official documents to prove the child's relationship to them and documentation showing they lived with the child for more than half of 2021. |

| Documentation for a Qualifying Relative | For claiming a qualifying relative, required documents include proof of residency for the entire 12 months if not related by blood and evidence of providing over half of the relative's support in 2021. |

Instructions on Utilizing 886 H Dep

Filling out the Form 886-H-DEP correctly is an important step in ensuring that the Internal Revenue Service (IRS) acknowledges and accepts the dependents you claim on your tax return. This form is used to provide the necessary documentation proving the dependency criteria are met according to IRS guidelines. Detailed information clarifies the relationship between the taxpayer and the dependent(s), in addition to showing that the living situation and financial support requirements are fulfilled. Carefully following the steps to complete this form will aid in avoiding delays or complications with your tax return.

- Collect all necessary documents based on your specific situation as outlined in the form instructions. This may include divorce decrees, custody orders, birth certificates, school records, financial documents, and any other relevant documentation that proves your relationship to the dependent and that you meet the support and residency requirements.

- Identify the taxpayer's name and Taxpayer Identification Number (TIN) at the top of the form, as well as the tax year for which you are providing documentation.

- Choose the appropriate section that matches your situation, whether you are claiming a qualifying child or relative. Each section clearly outlines what documents are needed based on different circumstances such as divorce, legal separation, custody arrangements, or living situations.

- For those claiming a qualifying child, ensure you have documents that verify your relationship to the child (such as birth certificates or adoption documents), proof of residency (such as school or medical records), and evidence that the child did not provide more than half of their own support.

- If you are claiming a qualifying relative, gather documents that establish your relationship to the relative (like birth and marriage certificates), proof of residency for the entire year, and documentation showing you provided more than half of the person's support for the year.

- Additionally, for both qualifying children and relatives, include any requested supplemental documents that further prove you provided more than half of the dependent’s total support. This can include statements from child support agencies, government agencies, rental agreements, utility bills, and receipts for expenses such as clothing, daycare, and medical bills.

- After gathering all the necessary documents, make photocopies. Do not send original documents to the IRS.

- Review the form and all documentation to ensure completeness and accuracy. Missing or incorrect information can result in processing delays.

- Mail the completed Form 886-H-DEP along with the photocopies of your supporting documents to the address provided by the IRS in your tax correspondence or as directed by an IRS representative.

After submitting the Form 886-H-DEP with the necessary documentation, the next step is to wait for the IRS to process your submission. This process can take some time, depending on the complexity of your situation and the volume of applications the IRS is handling. You may receive additional correspondence from the IRS requesting further information or clarifying certain details. Respond to any requests promptly to avoid further delays. Once your documentation is reviewed and approved, it will support your eligibility to claim the dependent(s) for the tax year in question, potentially impacting your tax liability and refund.

Obtain Answers on 886 H Dep

-

What is the purpose of Form 886-H-DEP?

Form 886-H-DEP assists taxpayers in providing the necessary documentation to the Internal Revenue Service (IRS) to support the claim of dependents on their tax return. It outlines the specific types of supporting documents required for different dependent situations, such as being divorced, legally separated, having custody issues, or claiming qualifying children and relatives.

-

Who needs to submit Form 886-H-DEP?

Any taxpayer who is claiming dependents on their tax return and is requested by the IRS to provide additional documentation to substantiate those claims must submit Form 886-H-DEP. This is especially relevant for individuals navigating divorce, legal separation, custody arrangements, or those claiming individuals other than their natural children as dependents.

-

What documents are required for a dependent who is a qualifying child?

- Birth certificates or other official documents of birth and marriage certificates, adoptive documents, or court orders that verify the taxpayer's relationship to the child.

- Documentation showing that the child lived with the taxpayer for more than half of the tax year, such as school, medical, daycare, or social service records, or letters on official letterhead from these sources.

- Proof that the child did not provide more than half of their own support for the tax year.

- Additional documents based on specific situations, such as proof of age for certain tax credits.

-

What types of proof are accepted to show you provided more than half of your dependent's total support?

Accepted proof includes statements of account from child support agencies, statements from government agencies verifying benefits received, rental agreements, utility and repair bills, daycare or school records, and clothing bills, all accompanied by canceled checks or receipts.

-

What if the dependent is not the taxpayer's natural or adopted child?

If the dependent is not the taxpayer's natural or adopted child, such as a foster child or stepchild, taxpayers must still provide proof of the dependent's relationship to them, documentation showing the dependent lived with them for the required time, and proof of support. For qualifying relatives, proof of living together for the entire year and the inability to be claimed as a qualifying child by another person are required.

-

How should the documents be submitted?

Documents should be submitted as photocopies. Taxpayers should not send original documents to the IRS. It's essential to ensure that all photocopies are clear and legible.

-

What if a taxpayer is divorced or legally separated?

Taxpayers who are divorced, legally separated, or living apart from the other parent of the child must provide the entire divorce decree, separation agreement, decree of separate maintenance, or proof that they lived apart from the child's other parent for the last six months of the tax year. If custody is shared, a current custody order or completed Form 8332, or similar statement is required.

-

Where can more information about Form 886-H-DEP be found?

More information about Form 886-H-DEP can be found on the IRS website at www.irs.gov. It is advisable to review the latest updates and guidelines as tax laws and requirements may change.

Common mistakes

Not providing sufficient documentation: It's crucial to include all the necessary documents listed on the form such as divorce decrees, school records, or statements from social services. Failing to do so may lead to the IRS rejecting the claim for dependents.

Incorrect documentation for living arrangements: When claiming a child that lived with you for over half the year, providing appropriate documents like school, medical, or daycare records proves residency. Often, people submit incomplete information, not covering the entire required timeframe.

Misunderstanding the support criteria: For both qualifying children and relatives, the taxpayer needs to prove they provided more than half of the support for the year. This includes submitting all relevant financial support documents such as rent agreements, utility bills, or medical receipts. Skipping or partially providing this information can be problematic.

Confusion over custody arrangements: In the case of divorced or separated parents, the proper documentation must include current custody orders or a completed Form 8332. Some individuals mistakenly believe informal agreements suffice, which is not the case in the eyes of the IRS.

Mixing up the age and relationship requirements: Each dependent type has specific age and relationship criteria that must be met. Ensure that the documentation adequately reflects these requirements, such as birth certificates for qualifying children or marriage certificates for qualifying relatives.

Omitting proof for the entire year for non-blood relatives: When claiming a non-blood related person as a qualifying relative, evidence that they lived in your home for the entire year must be provided. Often, people forget to cover the whole year or provide insufficient proof.

Not double-checking for updates or revisions to Form 886-H-DEP: Lastly, a critical mistake is not verifying if there have been recent updates or revisions to the form or its requirements. Always check the IRS website for the latest version to ensure compliance with current guidelines.

To ensure success when claiming dependents, it's vital to understand and meticulously follow the guidelines provided by Form 886-H-DEP. Avoiding the outlined mistakes significantly increases the likelihood of the IRS accepting your dependent claims, thus providing potential tax benefits.

Documents used along the form

When compiling the necessary paperwork for tax purposes, especially regarding dependents, several documents are typically used in tandem with Form 886-H-DEP to ensure the Internal Revenue Service (IRS) receives a clear and complete picture of the taxpayer's financial support and living arrangements with dependents. Understanding what these documents are and their functions can simplify the process significantly.

- Form 1040, U.S. Individual Income Tax Return: This is the primary federal income tax form for individuals. It's where taxpayers report their income, deductions, and credits to calculate their tax owed or refund due. When attaching Form 886-H-DEP, it directly relates to deductions or credits claimed for dependents.

- Form 8332, Release/Revocation of Release of Claim to Exemption for Child by Custodial Parent: This form is crucial for divorced or separated parents. It allows the custodial parent to release their claim to the child's exemption, enabling the non-custodial parent to claim the exemption and potentially qualify for child-related tax benefits.

- Schedule EIC (Earned Income Credit): For those claiming the Earned Income Tax Credit with a child, this schedule is a necessary addition to Form 1040. It requires detailed information about each qualifying child, which often necessitates the supportive documentation outlined in Form 886-H-DEP.

- Proof of Residency and Relationship Documents: These aren't formal IRS forms but are essential. They can include school, medical, or daycare records and letters on official letterhead from service agencies or places of worship. They prove the child’s relationship and residency, supporting claims made on Form 886-H-DEP.

- Statement of Account from Child Support Agency: While mentioned within Form 886-H-DEP's instructions for supporting documents, it's significant enough to highlight separately. This statement helps prove financial responsibility and support provided, directly influencing the taxpayer's eligibility for credits and deductions related to dependents.

Together, these forms and documents paint a full picture of dependency and support, addressing the IRS's need for thorough verification. The aim is to ensure that all claims related to dependents are accurate and substantiated, minimizing the chances of errors or audits. By gathering these materials in advance, taxpayers can streamline their filing process and confidently claim the credits and deductions to which they are entitled.

Similar forms

The Form 886-H-DEP serves a specific function in the tax preparation process, primarily focusing on providing the necessary documentation to support claims for dependents. Several other documents share similarities with this form in terms of their purpose and the types of information they require. Below is a list of five such documents:

- Form 1040, U.S. Individual Income Tax Return: This is the primary form used by individuals to file their annual income tax returns in the United States. It is similar to Form 886-H-DEP in that both forms require information regarding dependents. Form 1040 requires basic information about dependents to calculate deductions and credits accurately, while Form 886-H-DEP provides detailed supporting documentation.

- Form 8332, Release/Revocation of Release of Claim to Exemption for Child by Custodial Parent: This form is used by divorced or separated parents to transfer the right to claim a child as a dependent to the non-custodial parent. It shares a common purpose with the custody-related sections of Form 886-H-DEP, which require documentation proving which parent provided more than half of the child’s support or had custody for the tax year.

- Schedule EIC (Earned Income Credit): Attached to Form 1040, this schedule is used to document a taxpayer's eligibility for the Earned Income Credit, particularly when they have dependents. Both Schedule EIC and Form 886-H-DEP require detailed information about a dependent's residence and financial support to ensure taxpayer eligibility for tax benefits.

- Form W-7, Application for IRS Individual Taxpayer Identification Number: This form is used to apply for a Taxpayer Identification Number for individuals who are not eligible for a Social Security Number but need to report their financial activity to the IRS, such as dependents in a tax return. Similar to Form 886-H-DEP, it involves providing documentation to verify identities and relationships.

- Form 1040-SS, U.S. Self-Employment Tax Return (Including the Additional Child Tax Credit for Bona Fide Residents of Puerto Rico): This form is for self-employed individuals, including residents of Puerto Rico, to report income and calculate self-employment tax. It also includes sections for claiming the Additional Child Tax Credit. Like Form 886-H-DEP, it requires information on dependents for tax credit purposes.

Each of these documents serves a unique role in the tax filing process but shares the common feature of requiring detailed information on dependents to accurately determine tax obligations, credits, and eligibility for various exemptions. This ensures that taxpayers comply with IRS regulations and receive any tax benefits for which they qualify.

Dos and Don'ts

Filling out Form 886-H-DEP is a crucial step for taxpayers who wish to claim dependents and potentially receive significant tax benefits. However, the process can be nuanced and requires attention to detail. To ensure accuracy and compliance, here are seven do's and don'ts to consider:

Do's:

- Gather all necessary documents before starting: Ensure you have all the required supporting documents listed in the form such as divorce decrees, custody orders, birth certificates, and proof of residence and support.

- Send photocopies, not originals: The IRS requests photocopies of your documents to verify your claims. Keep the originals for your records to avoid any potential loss.

- Pay attention to details: When proving a child lived with you for more than half of the tax year, use the specific types of documents suggested, such as school or medical records, ensuring they clearly show names, common addresses, and dates.

- Understand the specifics: If you're claiming a qualifying child or relative, ensure you fully grasp the criteria, such as the child's age, relationship to you, and the requirement of living together for more than half the year.

- Double-check for age and support requirements: Make sure the dependent meets the age requirements and did not provide more than half of their own support, as these are common areas of confusion and mistakes.

Don'ts:

- Don’t overlook the requirement for detailed proof: Simply stating your relationship and support provided is not enough. The IRS requires specific types of proof, like school records or statements from government agencies, to substantiate your claims.

- Avoid waiting until the last minute: Gathering the comprehensive documentation needed to support your claims on Form 886-H-DEP can take time. Procrastination can lead to errors or omissions that might impact your tax benefits.

By adhering to these guidelines, taxpayers can more effectively navigate the complexities of Form 886-H-DEP, thereby avoiding common pitfalls and ensuring the best possible outcome for their tax situation.

Misconceptions

Understanding tax forms can be a daunting task, and misinformation can lead to unnecessary stress and errors. Specifically, the Form 886-H-DEP, which is used to provide supporting documents for dependents, often comes with misconceptions. Here's a clarification of some common misunderstandings:

Only biological children qualify: Many believe that the Form 886-H-DEP is solely for biological children. However, this form also applies to adopted children, stepchildren, foster children, siblings, and even more distant relatives under certain conditions, as well as non-related dependents living with you for the entire year.

Divorce decrees are the only necessary document for separated parents: While a divorce decree is critical, you may also need to submit a custody order, Form 8332 (Release of Claim to Exemption for Child of Divorced or Separated Parents), or similar statements, especially in cases where custody is shared.

Only one year of documentation is needed: You may be required to provide documentation beyond the tax year in question, particularly if living situations, dependency, or support circumstances have changed.

Personal attestations are sufficient: Although personal attestations about your relationship and support provided to the dependent are important, official documents such as birth certificates, school records, or financial statements are necessary for verification.

Dependents must live with you the entire year: There's a misconception that dependents must live with you for 100% of the year. In reality, temporary absences like school or medical treatment are considered time lived at home, and the requirement is that the dependent lived with you for more than half of the year.

Only children under 18 qualify: While it's true for the Child Tax Credit, for Earned Income Tax Credit, children can qualify up to age 19, or up to age 24 if they are full-time students, or at any age if permanently and totally disabled.

Financial support is the only factor: Although providing more than half of a dependent's support is a key criterion, the relationship and residency requirements must also be met. This means that even if you financially support someone, they may not qualify as a dependent if they do not live with you or they do not fall under the IRS's definition of a qualifying child or relative.

Submitting original documents is required: Taxpayers often worry about sending original documents. However, photocopies of the necessary documents are acceptable. Do not send original birth certificates, marriage certificates, or legal documents to the IRS.

Clearing up these misconceptions can smooth the process of providing the necessary documentation for dependents on Form 886-H-DEP. Understanding these points ensures that taxpayers submit the form correctly and with the appropriate supporting documents, helping to avoid delays or issues with their tax return.

Key takeaways

When filing the 886-H-DEP form, taxpayers should understand several key points to ensure their documentation is complete and accurate. These key takeaways help to streamline the submission process and support claims for dependents effectively.

- Identification of Relationship: Proof of the taxpayer's relationship to the dependent is required. This could include birth certificates, marriage certificates, or court documents for adopted children.

- Residency Requirements: To claim a qualifying child, documents must prove that the child lived with the taxpayer for more than half of the tax year. Acceptable proofs include school, medical, or daycare records, or letters from authoritative sources showing a common address.

- Support Documentation: Evidence that the taxpayer provided more than half of the dependent's support during the tax year is necessary. This includes statements from child support agencies, government benefits, rental agreements, utility bills, and receipts for expenses such as clothing and daycare.

- Special Conditions for Divorced or Separated Parents: Divorced or legally separated parents, or those living apart, must provide specific documents such as a complete divorce decree, a separation agreement, or proof of living apart from the child’s other parent for the last six months of the tax year.

- Custody Documentation: For parents who share custody, a current custody order or completed Form 8332 (Release of Claim to Exemption for Child of Divorced or Separated Parents) is required, along with any other relevant documents that outline the custody arrangement.

- Age and Support for Qualifying Children: Claimants need to verify that by the end of the tax year, their qualifying child was under age 19, or a full-time student under age 24, or permanently and totally disabled, and did not provide more than half of their own support.

- Requirements for Qualifying Relatives: To claim a qualifying relative, taxpayers must provide documentation proving they lived with the dependent all year, provided over half of their support, and that the relative cannot be claimed as a qualifying child by someone else.

- Maintain Photocopies: The form specifically asks for photocopies of supporting documents, not the original documents, to be submitted as proof for the dependent claims.

Adhering to these guidelines when completing and submitting the Form 886-H-DEP can significantly increase the likelihood of a successful claim for dependents on tax returns, thereby potentially enhancing the taxpayer's benefits under the applicable tax laws.

Popular PDF Forms

Dl-90a - An instructor must acknowledge their relationship to the student, asserting they are eligible to provide driver's education as a parent, guardian, or specific family member.

Whats Hvac - It serves as a guide for ensuring compliance with relevant regulations and standards related to HVAC systems and indoor air quality, promoting a safe and compliant building environment.

Irs Form 7200 Instructions - Offers a measure of financial relief to businesses committed to retaining employees through economic uncertainties.