Blank 8863 Credit Limit Worksheet PDF Template

Navigating the complexities of education-related tax benefits can be a challenging but rewarding process for individuals seeking to maximize their returns. The Credit Limit Worksheet, associated with Form 8863, plays a crucial role in this endeavor by helping taxpayers calculate the correct amount of education credits, specifically the American Opportunity Credit and the Lifetime Learning Credit, to claim on their tax returns. This worksheet guides individuals through a detailed calculation that considers various amounts from Form 8863 and their wider tax return, particularly Form 1040 or 1040-SR, in addition to credits noted in Schedule 3. The worksheet is structured to ensure that taxpayers do not claim more than the allowable limit by considering their total education expenses, adjustments for tax-free educational assistance, and refunds of qualified education expenses. By meticulously completing this worksheet, taxpayers can determine the smaller amount between their calculated education expenses and the limit set by their income and other claimed credits, ensuring compliance and optimizing their potential tax benefits. Additionally, the requirement to complete a separate worksheet for each student and for each academic period underscores the tailored approach the IRS has designed to cater to the diverse educational journeys of taxpayers and their dependents.

Preview - 8863 Credit Limit Worksheet Form

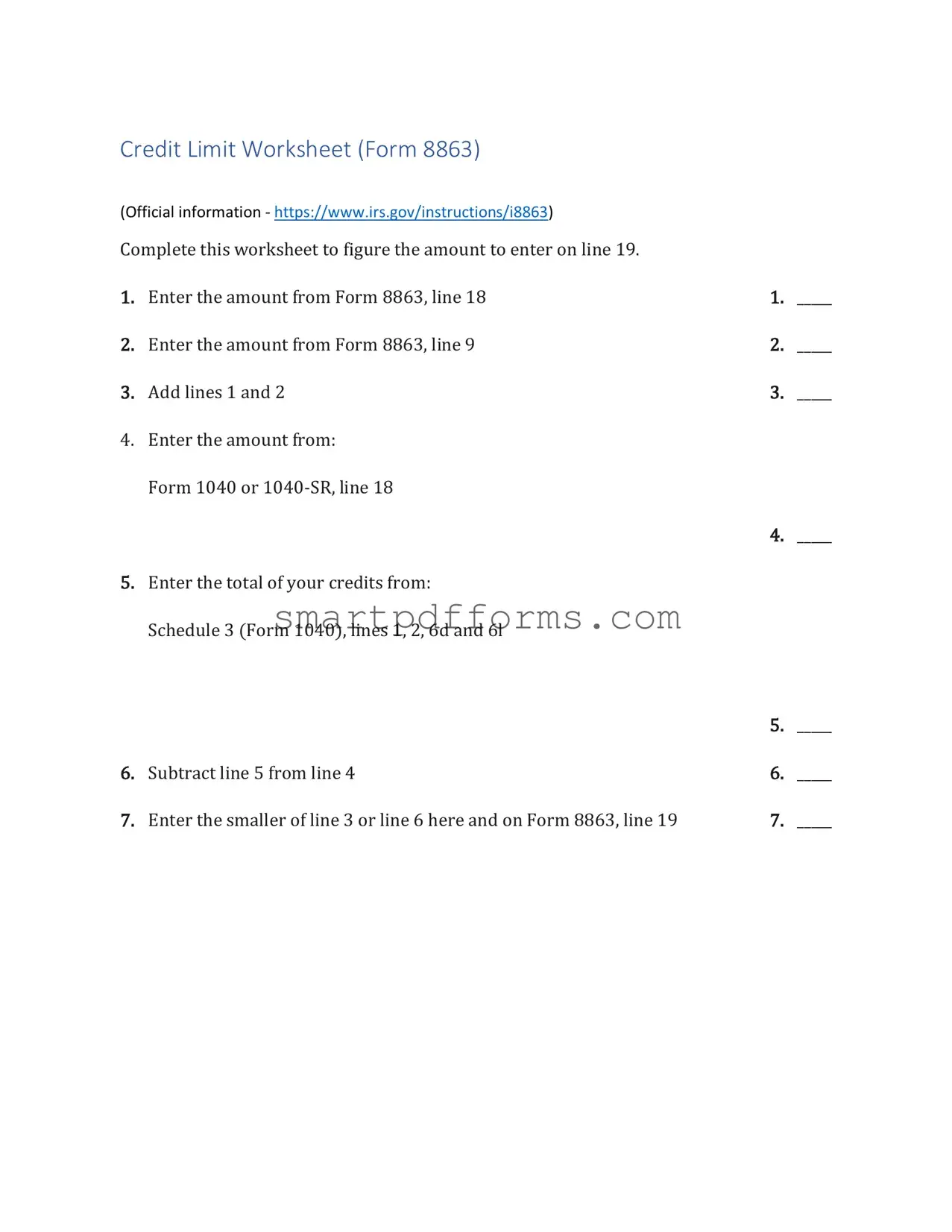

Credit Limit Worksheet (Form 8863)

(Official information - https://www.irs.gov/instructions/i8863) |

|

|

|

Complete this worksheet to figure the amount to enter on line 19. |

|

|

|

1. |

Enter the amount from Form 8863, line 18 |

1. |

_____ |

2. |

Enter the amount from Form 8863, line 9 |

2. |

_____ |

3. |

Add lines 1 and 2 |

3. |

_____ |

4.Enter the amount from:

Form 1040 or

4. _____

5.Enter the total of your credits from: Schedule 3 (Form 1040), lines 1, 2, 6d and 6l

|

|

5. |

_____ |

6. |

Subtract line 5 from line 4 |

6. |

_____ |

7. |

Enter the smaller of line 3 or line 6 here and on Form 8863, line 19 |

7. |

_____ |

Line 31

Complete a separate worksheet for each student for each academic period beginning or treated as beginning (see below) in 2022 for which you paid (or are treated as having paid) qualified education expenses in 2022.

1. |

Total qualified education expenses paid for or on behalf of the |

_____ |

|

|

student in 2022 for the academic period |

|

|

2. |

Less adjustments: |

|

|

|

a. |

_____ |

|

|

allocable to the academic period |

|

|

|

b. |

_____ |

|

|

(and before you file your 2022 tax return) allocable |

|

|

|

to the academic period |

|

|

|

c. Refunds of qualified education expenses paid in |

_____ |

|

|

2022 if the refund is received in 2022 or in 2023 |

|

|

|

before you file your 2022 tax return |

|

|

3. |

Total adjustments (add lines 2a, 2b, and 2c) |

|

_____ |

4. |

Adjusted qualified education expenses. Subtract line 3 from line |

_____ |

|

|

1. If zero or less, enter |

|

|

Form Data

| Fact Name | Description |

|---|---|

| Purpose of Form 8863 | Used to calculate and claim education credits, specifically the American Opportunity Credit and Lifetime Learning Credit. |

| Line 19 Calculation | Requires completion of the Credit Limit Worksheet to figure the amount to enter on Form 8863, line 19. |

| Link to Official Instructions | Comprehensive instructions can be found at https://www.irs.gov/instructions/i8863. |

| Adjustments for Qualified Education Expenses | Accounting for tax-free educational assistance, refunds, and adjustments is necessary to arrive at adjusted qualified education expenses. |

| Academic Period Considerations | A separate worksheet must be completed for each student for each academic period beginning or treated as beginning in the tax year. |

| Governing Laws | The calculation and eligibility criteria are governed by U.S. federal tax law, specifically the Internal Revenue Code (IRC). |

| Role of Form 1040 in Calculation | The Credit Limit Worksheet utilizes information from Form 1040 or 1040-SR, specifically line 18, as part of its calculation process. |

Instructions on Utilizing 8863 Credit Limit Worksheet

Filling out the Credit Limit Worksheet for Form 8863 is an essential step in the process of determining your eligibility for education credits on your tax return. This worksheet helps you calculate the maximum amount of credit you can claim by factoring in various credits and deductions you may also be eligible for. Following these steps accurately will ensure you correctly determine the amount to enter on line 19 of Form 8863, which could significantly affect your tax liability or refund.

- Start by entering the amount from Form 8863, line 18 in the first blank space.

- Next, input the amount from Form 8863, line 9 in the space for the second line.

- Add the amounts entered in steps 1 and 2 together and write the total on the third line.

- On the fourth line, note the amount from your Form 1040 or 1040-SR, line 18.

- For the fifth line, tally up your credits from Schedule 3 (Form 1040), which are summed from lines 1, 2, 6d, and 6l, and enter the total amount.

- Subtract the total credits calculated in step 5 from the amount noted in step 4 and record this number on the sixth line.

- Finally, compare the figures obtained in steps 3 and 6. Enter the smaller of these two figures on the seventh line, and also on line 19 of Form 8863.

Further instructions are provided for completing a separate worksheet for each student for each academic period starting or treated as starting within the relevant year for which qualified education expenses were paid.

- Write the total qualified education expenses paid in the year for the student for the academic period.

- Calculate adjustments by subtracting any:

- Tax-free educational assistance received in the year allocable to the academic period.

- Tax-free educational assistance received in the following year (before you file your tax return) allocable to the academic period.

- Refunds of qualified education expenses paid in the year if the refund is received either in the same year or in the following year before you file your tax return.

- Add up the amounts from steps 2a, 2b, and 2c for the total adjustments and input this number.

- Subtract the total adjustments calculated in step 3 from the total qualified education expenses paid, noted in step 1. If the result is zero or less, enter "-0-".

By meticulously following these guidelines, you will accurately complete the Credit Limit Worksheet, ensuring the correct calculation of your education credits.

Obtain Answers on 8863 Credit Limit Worksheet

- What is the purpose of the Credit Limit Worksheet (Form 8863)?

- How do I know if I need to complete the Credit Limit Worksheet for Form 8863?

- What are qualified education expenses, and how do they affect the worksheet?

- Can I fill out a separate worksheet for each student?

- What are the "tax-free educational assistance" adjustments mentioned in the worksheet?

- What should I do if the total adjustments are greater than my qualified education expenses?

- How do I figure out the amount to enter on line 19 of Form 8863?

- What information from my Form 1040 is necessary for completing the Credit Limit Worksheet?

- How do the total credits from Schedule 3 (Form 1040) impact the worksheet?

- What happens if I receive a refund of qualified education expenses?

The Credit Limit Worksheet helps you calculate the amount you can claim on line 19 of Form 8863, which is used to figure out the education credits you're eligible for, specifically the American Opportunity Credit and the Lifetime Learning Credit. These credits aim to reduce your tax bill based on the qualified education expenses you've paid.

You need to complete this worksheet if you're planning to claim education credits and you've filled out Form 8863, line 18. This worksheet ensures that the credits you claim do not exceed the limit set by your tax liability.

Qualified education expenses include tuition and certain related expenses required for enrollment or attendance at an eligible educational institution. These expenses are crucial for calculating your education credits, as they determine the amount you can enter on lines 1 and 2 of the worksheet, which ultimately influence the credit amount you're eligible for.

Yes, you must complete a separate worksheet for each student for each academic period they are claiming the credit for. This ensures that the expenses and adjustments are accurately calculated and applied to each student's eligible credits.

"Tax-free educational assistance" refers to any scholarships, grants, or tuition reductions that don’t need to be included in taxable income. These amounts need to be subtracted from your total qualified education expenses because you cannot claim a credit for expenses that were not out-of-pocket.

If the total adjustments exceed your qualified education expenses, you enter "0" for your adjusted qualified education expenses on the worksheet. This means you cannot claim an education credit for that student for that academic period since there were no out-of-pocket expenses.

After completing the required lines on the Credit Limit Worksheet, you compare the sum of your education credits with your allowable tax liability to determine the smaller amount. This amount is what you enter on line 19, representing the maximum education credits you're eligible for after adjustments.

You need to know the amount from line 18 of your Form 1040 or 1040-SR. This figure represents your tax liability before credits, which is used to ensure your education credits do not exceed the tax you owe.

The total of your credits from Schedule 3 affects how much you can claim for education credits. These amounts are subtracted from your tax liability to ascertain the maximum allowable education credit, ensuring that the sum of your credits does not result in a negative tax liability.

If you receive a refund of your qualified education expenses in 2022 or before you file your tax return in 2023, you must subtract this refund amount from your total education expenses on the worksheet. This adjustment ensures that you only claim credits for net expenses that were really out-of-pocket.

Common mistakes

Filling out tax forms can often feel like navigating a maze. The Form 8863 Credit Limit Worksheet, crucial for those claiming education credits, is no exception. Here are six common pitfalls people encounter when completing this form:

- Incorrectly reporting expenses: It's vital to accurately report qualified education expenses. Errors here can lead to miscalculations affecting the credit amount.

- Overlooking adjustments for tax-free educational assistance: Tax-free educational assistance must be subtracted from your total qualified education expenses, a step that’s frequently missed.

- Neglecting the correct lines from other forms: The worksheet requires inputs from Form 1040 and Schedule 3, where mistakes in transcribing numbers or referencing the wrong lines can throw off the entire calculation.

- Failure to complete a separate worksheet for each student: If you're claiming expenses for more than one student, each requires a separate worksheet. Mixing expenses for multiple students on one form is a common error.

- Misunderstanding the time frame for tax-free educational assistance and refunds: Assistance received in 2023 before filing your 2022 tax return must be considered, as should refunds of qualified expenses. This temporal detail often trips people up.

- Entering the wrong amount on line 19 of Form 8863: The final step—entering the smaller of line 3 or line 6 on line 19—is crucial yet frequently botched either through a calculation error or misunderstanding which number is actually smaller.

Avoiding these mistakes not only ensures accuracy on your tax return but can also maximize your eligible education credits. Paying close attention to each step and double-checking figures against official instructions can significantly minimize errors.

Documents used along the form

When filing taxes and calculating educational tax credits, individuals are required to submit various forms and documents to the Internal Revenue Service (IRS). Among these, the Credit Limit Worksheet (Form 8863) plays a crucial role in determining the amount of credit an individual is eligible for. However, this form does not stand alone. To complete the process accurately, several additional forms and documents are often utilized in conjunction with Form 8863. Understanding these documents can simplify the tax filing process and ensure individuals maximize their potential educational credits.

- Form 1040 or 1040-SR: This is the U.S. Individual Income Tax Return form. It is the primary form used by individuals to file their annual income tax returns. Information from this form is essential for completing the Credit Limit Worksheet, specifically line 18.

- Schedule 3 (Form 1040): This schedule is used to claim various credits and payments, including the nonrefundable education credits. The total of your credits from lines 1, 2, and the foreign tax credit, childcare credit, among others, are required to accurately calculate the education credit limit.

- Form 8863: This is the form specifically related to Education Credits (American Opportunity and Lifetime Learning Credits). It requires detailed information about the taxpayer, the student, and the educational institution. The completed Credit Limit Worksheet is used to fill out parts of Form 8863.

- Form 1098-T: Issued by educational institutions, this Tuition Statement form provides information about qualified tuition and related expenses paid during the tax year. It is crucial for completing Form 8863 and accurately claiming education credits.

- Form 1098-E: For those paying interest on student loans, this Student Loan Interest Statement form shows the amount of interest paid over the year. While not directly linked to the Credit Limit Worksheet, it is important for claiming possible deductions related to higher education expenses.

- Receipts and Records: These include receipts for tuition, books, supplies, and equipment required for enrollment or attendance at an educational institution. These documents support the amounts entered on Form 8863 and related worksheets.

- Financial Aid Statements: Statements detailing any scholarships, grants, or fellowships received. This information is necessary to adjust the qualified educational expenses accordingly on the Credit Limit Worksheet and Form 8863.

To navigate the complexities of education tax benefits effectively, taxpayers are advised to gather all pertinent documents well before preparing their tax returns. This not only facilitates the accurate computation of credits and deductions but also helps in substantiating claims made on the tax return, should the IRS request more information or clarification. Understanding and having easy access to these forms and documents simplifies the process of filing for educational credits, ensuring taxpayers can fully benefit from the tax incentives designed to make education more affordable.

Similar forms

The Credit Limit Worksheet (Form 8863) plays a crucial role in calculating the education credits that taxpayers are eligible to claim on their federal income tax returns. Understanding its purpose and relevance, it is beneficial to explore other documents that share similarities in terms of tax calculations or educational benefits. Here are eight forms that bear resemblance to the Credit Limit Worksheet in one way or another:

- Form 1040: This is the U.S. Individual Income Tax Return form. It is similar to the Credit Limit Worksheet because taxpayers must report information from Form 8863 on their Form 1040, specifically regarding education credits which are calculated using the worksheet.

- Schedule 3 (Form 1040): This schedule, part of Form 1040, is used to claim nonrefundable tax credits, including the education credits that are calculated on Form 8863. The similarity lies in the aggregation of credits that affect the taxpayer’s final tax liability.

- Form 1098-T: Tuition Statement form. Educational institutions provide this form to students, showing the amounts paid for tuition and related expenses. The information on Form 1098-T assists in completing Form 8863, making them directly related.

- Form 8917: Tuition and Fees Deduction form. While this form is for a tax deduction rather than a credit, like the education credits on Form 8863, it still deals with the tax treatment of education expenses, showing a thematic similarity.

- Form 1040-SR: U.S. Tax Return for Seniors, is a variant of the standard Form 1040 tailored for senior taxpayers. It’s referenced within the Credit Limit Worksheet instructions for line 4, highlighting its relevance in the context of calculating certain tax credits.

- Education Savings Account (ESA) and 529 Plan Documents: Though not official IRS forms, documents related to ESA and 529 Plans are relevant because withdrawals from these savings plans may fund the qualified education expenses that are reported on Form 8863.

- Form 5405: First-Time Homebuyer Credit and Repayment of the Credit form. It shares a conceptual similarity with Form 8863 as both involve claiming specific credits that impact one’s tax obligations, though for different purposes.

- Form 2441: Child and Dependent Care Expenses. This form is similar to the Credit Limit Worksheet in its focus on providing tax relief for personal expenses, albeit in the realm of child and dependent care rather than education.

Each of these documents contributes to the financial landscape of individuals by offering avenues for tax savings, reductions, or deferrals related to education, housing, care, and more. Understanding how they interconnect, particularly in the realm of education expenses, can ensure taxpayers maximize their potential benefits.

Dos and Don'ts

When filling out the 8863 Credit Limit Worksheet form, it's essential to approach the task with attention to detail and a careful understanding of what is required. This document plays a crucial part in determining the education credits you may be eligible for. Below are some dos and don'ts to help guide you through the process effectively.

Things You Should Do:

- Ensure you have all necessary documents on hand, such as Form 1040 or 1040-SR, and Schedule 3, before starting.

- Read the instructions provided by the IRS for Form 8863 thoroughly to understand the eligibility criteria for education credits.

- Confirm the accuracy of the amounts from Form 8863, lines 18 and 9, before adding them on line 3 of the Credit Limit Worksheet.

- Refer to your Form 1040 or 1040-SR for the amount to enter on line 4 of the worksheet.

- Take your time to properly calculate the total of your credits on Schedule 3 (Form 1040) that are to be entered on line 5.

- Double-check your math, especially when subtracting line 5 from line 4 and comparing line 3 with line 6 to determine the smaller amount for line 7.

- Keep a copy of all the supporting documents in case the IRS requires verification of the information provided.

- Use a calculator or tax preparation software to reduce errors in calculation.

- Consult a tax professional if you encounter difficulties or have questions about your eligibility for education credits.

- Ensure all information is current and reflects the tax year for which you are filing.

Things You Shouldn't Do:

- Avoid guessing amounts or entering information you are not sure about.

- Do not overlook the instructions for each line, as they provide critical guidance on what amounts to include and where to find them.

- Don’t ignore the specific requirements for educational expenses and adjustments as outlined on lines 1 through 4 of the Line 31 worksheet section.

- Refrain from using outdated forms or information from previous tax years, as tax laws and forms may have changed.

- Avoid rushing through the worksheet without verifying each amount entered against your documentation.

- Don’t forget to sign and date Form 8863 after completing the Credit Limit Worksheet.

- Do not submit the form without ensuring that all necessary lines and schedules are completed and attached.

- Avoid discarding records of qualified education expenses and relevant calculations after filing, as they may be needed for future reference.

- Don’t hesitate to ask for help from a qualified tax advisor if the process becomes confusing or overwhelming.

- Do not underestimate the importance of this form—incorrect or incomplete information can delay processing and affect your tax liability or refund.

Misconceptions

When it comes to understanding the Credit Limit Worksheet (Form 8863), there are several misconceptions that people commonly hold. These misunderstandings can potentially affect the accuracy of their tax returns and the amount of credit they claim. Below are nine common misconceptions explained to help clarify how this form should be used:

- Misconception 1: The Credit Limit Worksheet is optional.

Many believe that completing the Credit Limit Worksheet is a matter of choice. However, this worksheet is necessary for accurately calculating the amount to be entered on line 19 of Form 8863, directly impacting the education credits you may be eligible for.

- Misconception 2: You only need to fill out this form for one student.

Each student for whom you paid qualified education expenses requires a separate worksheet. This detail is crucial for families with multiple students, as it affects the overall credit calculation.

- Misconception 3: All education expenses qualify.

It's a common mistake to assume that all education-related expenses can be used in the calculations on this form. However, only certain qualified education expenses are eligible for consideration.

- Misconception 4: The form doesn't account for tax-free educational assistance.

Some taxpayers fail to recognize that the worksheet deducts tax-free educational assistance from the total qualified education expenses. This adjustment is vital for arriving at the correct amount of adjusted qualified education expenses.

- Misconception 5: Refunds don't affect the credit.

There is a belief that refunds of qualified education expenses do not impact the credit. However, the worksheet instructs to subtract these refunds, as they reduce the amount of eligible expenses.

- Misconception 6: The worksheet is the same as Form 8863.

Form 8863 includes the Credit Limit Worksheet, but they serve different functions. The form itself is used to claim education credits, while the worksheet helps calculate the credit limit.

- Misconception 7: It's not necessary to report expenses paid on behalf of the student.

Many taxpayers think that only expenses paid directly by the student qualify. In contrast, qualified education expenses paid by others on behalf of the student also count towards the credit.

- Misconception 8: The amount on line 18 is the final credit amount.

Some individuals mistakenly view the amount from Form 8863, line 18, as the credit amount they’ll receive. In reality, the Credit Limit Worksheet is needed to determine the final amount entered on line 19, which could potentially adjust the credit.

- Misconception 9: Filing this worksheet guarantees the credit.

Completing and submitting the Credit Limit Worksheet does not guarantee that you will receive the education credit. Eligibility for the credit depends on various factors, including the taxpayer's income level and filing status.

Understanding these misconceptions and how the Credit Limit Worksheet functions are fundamental in correctly applying for education credits. Taxpayers are encouraged to thoroughly review their eligibility and the instructions provided by the IRS to ensure accurate credit claims.

Key takeaways

Understanding the Credit Limit Worksheet, part of Form 8863, is crucial for correctly claiming education credits on a federal tax return. This document is used to calculate the amount of education credit that can be claimed and ensures that taxpayers do not exceed the allowable limit. Here are key takeaways for filling out and utilizing the 8863 Credit Limit Worksheet effectively:

- The worksheet helps taxpayers figure the education credits to enter on line 19 of Form 8863, ensuring they claim the correct amount.

- Taxpayers must fill in the amounts from Form 8863, lines 18 and 9, and then add these figures to complete part of the worksheet. This step consolidates information across different parts of Form 8863.

- Calculations require referencing additional tax documents, specifically Form 1040 or 1040-SR, line 18, and the total credits from Schedule 3 (Form 1040) from specified lines. This highlights the interconnected nature of various tax forms.

- The process demands subtraction of the total of specific credits from the amount on Form 1040 or 1040-SR, line 18. This reveals the taxpayer's available credit limit after considering other credits.

- Taxpayers determine the final education credit amount by entering the smaller of two calculated values (the sum of lines 1 and 2 from Form 8863 or the result of the subtraction on the worksheet), ensuring they do not exceed the credit limit.

- A separate Credit Limit Worksheet is required for each student and for each academic period. This level of detail accommodates variations in education expenses and credits eligible across different students and time frames.

The precise following of instructions on the 8863 Credit Limit Worksheet is essential for accurately completing Form 8863. This ensures taxpayers maximize their education credits while adhering to IRS regulations.

Popular PDF Forms

Your Case Is Taking Longer Than Expected to Process I-765 - Provides a pathway for eligible immigrants to present their financial situation in support of their work authorization application.

Ssa-1099 Form 2022 - This statement provides key financial information needed for accurately filing taxes.