Blank Aarp Life Insurance PDF Template

The intricacies of managing life insurance benefits underscore the significance of the AARP Life Insurance form, serving as a critical tool for individuals wishing to update their beneficiary designations under the Group Membership Association, specifically within the confines of policies held by the Collegiate Alumni Trust. This document not only facilitates the modification of beneficiaries for either term life or accidental death benefits but also underscores the need for providing detailed identifying information for each designated beneficiary. This requirement is born out of an effort to expedite claim payments and to comply with state insurance regulations designed to prevent unclaimed life insurance benefits from being transferred to the state due to unlocatable beneficiaries. Moreover, the form acts as a revocation of any prior beneficiary designations, making it paramount for policyholders to accurately denote their desired recipients, whether primary or contingent, and the proportional benefits if applicable. Additionally, it features provisions for specifying beneficiary arrangements that might involve trusts or minors, offering guidance on designating a minor as a beneficiary or establishing testamentary trusts under a last will and testament. Crucially, it highlights the potential legal and financial implications of naming someone other than the non-insured owner as a beneficiary, hinting at the complexity and the need for careful consideration when making such decisions. The document, therefore, stands as a testament to the multifaceted nature of life insurance planning, blending the need for personal foresight with regulatory compliance and legal advisement.

Preview - Aarp Life Insurance Form

The Company You Keep®

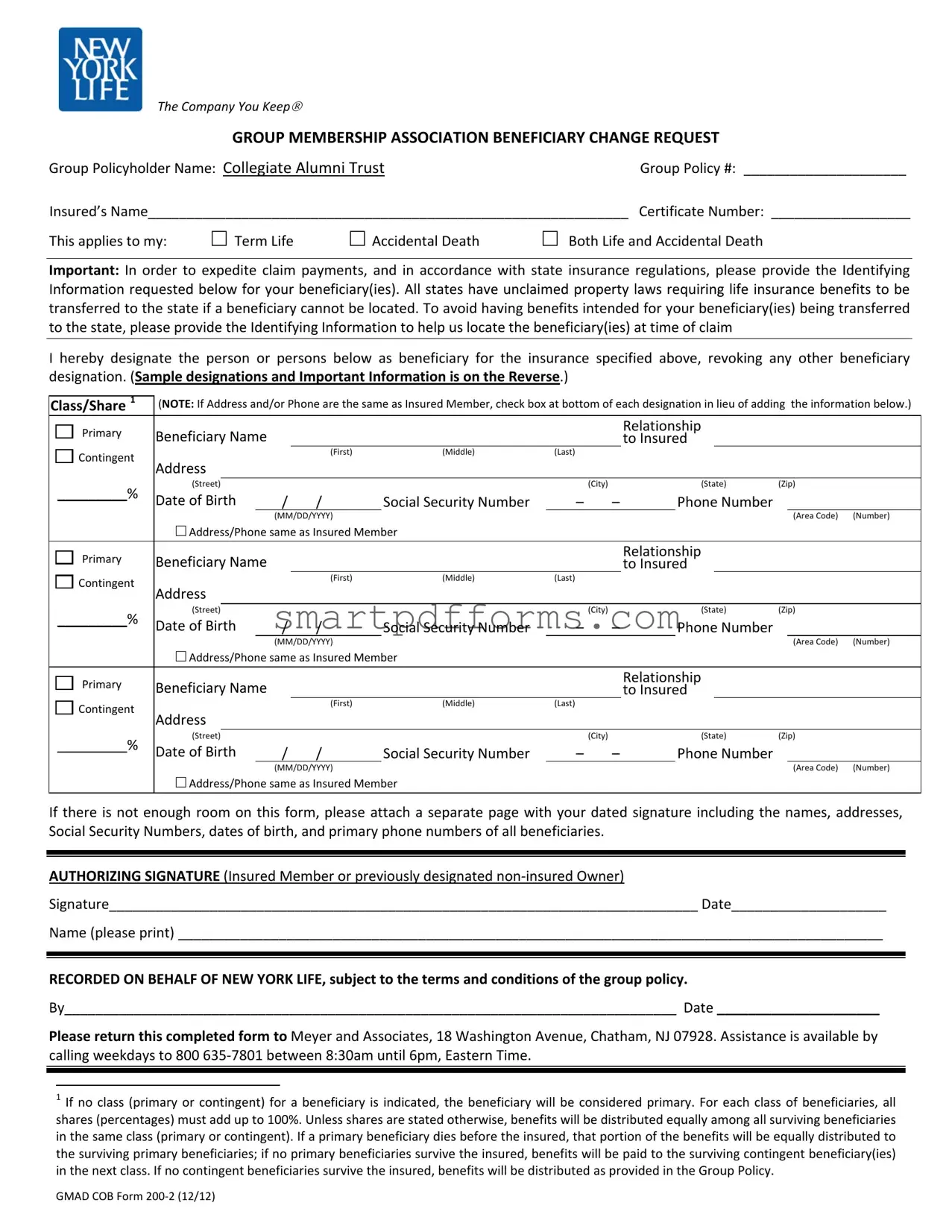

GROUP MEMBERSHIP ASSOCIATION BENEFICIARY CHANGE REQUEST

Group Policyholder Name: Collegiate Alumni TrustGroup Policy #: _____________________

Insured’s Name______________________________________________________________ Certificate Number: __________________

This applieS to my: |

□ Term Life |

□ Accidental Death |

□ Both Life and Accidental Death |

Important: In order to expedite claim payments, and in accordance with state insurance regulations, please provide the Identifying Information requested below for your beneficiary(ies). All states have unclaimed property laws requiring life insurance benefits to be transferred to the state if a beneficiary cannot be located. To avoid having benefits intended for your beneficiary(ies) being transferred to the state, please provide the Identifying Information to help us locate the beneficiary(ies) at time of claim

I hereby designate the person or persons below as beneficiary for the insurance specified above, revoking any other beneficiary designation. (Sample designations and Important Information is on the Reverse.)

Class/Share 1 |

(NOTE: If Address and/or Phone are the same as Insured Member, check box at bottom of each designation in lieu of adding the information below.) |

|||||||||||||

Primary |

Beneficiary Name |

|

|

|

|

|

Relationship |

|

|

|

||||

|

|

|

|

|

to Insured |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

||||||

Contingent |

|

|

|

|

(First) |

(Middle) |

(Last) |

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|||

_________% |

(Street) |

|

|

|

|

(City) |

|

(State) |

(Zip) |

|

||||

Date of Birth |

/ |

/ |

Social Security Number |

– |

– |

|

Phone Number |

|

|

|

||||

|

|

|

|

|

||||||||||

|

|

|

|

(MM/DD/YYYY) |

|

|

|

|

|

|

|

(Area Code) |

(Number) |

|

|

□ Address/Phone same as Insured Member |

|

|

|

|

|

|

|

|

|||||

Primary |

Beneficiary Name |

|

|

|

|

|

Relationship |

|

|

|

||||

|

|

|

|

|

to Insured |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

||||||

Contingent |

|

|

|

|

(First) |

(Middle) |

(Last) |

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|||

_________% |

(Street) |

|

|

|

|

(City) |

|

(State) |

(Zip) |

|

||||

Date of Birth |

/ |

/ |

Social Security Number |

– |

– |

|

Phone Number |

|

|

|

||||

|

|

|

|

|

||||||||||

|

|

|

|

(MM/DD/YYYY) |

|

|

|

|

|

|

|

(Area Code) |

(Number) |

|

|

□ Address/Phone same as Insured Member |

|

|

|

|

|

|

|

|

|||||

Primary |

Beneficiary Name |

|

|

|

|

|

Relationship |

|

|

|

||||

|

|

|

|

|

to Insured |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

||||||

Contingent |

|

|

|

|

(First) |

(Middle) |

(Last) |

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|||

_________% |

(Street) |

|

|

|

|

(City) |

|

(State) |

(Zip) |

|

||||

Date of Birth |

/ |

/ |

Social Security Number |

– |

– |

|

Phone Number |

|

|

|

||||

|

|

|

|

|

||||||||||

|

|

|

|

(MM/DD/YYYY) |

|

|

|

|

|

|

|

(Area Code) |

(Number) |

|

|

□ Address/Phone same as Insured Member |

|

|

|

|

|

|

|

|

|||||

If there is not enough room on this form, please attach a separate page with your dated signature including the names, addresses, Social Security Numbers, dates of birth, and primary phone numbers of all beneficiaries.

AUTHORIZING SIGNATURE (Insured Member or previously designated non‐insured Owner)

Signature____________________________________________________________________________ Date____________________

Name (please print) ___________________________________________________________________________________________

RECORDED ON BEHALF OF NEW YORK LIFE, subject to the terms and conditions of the group policy.

By_______________________________________________________________________________ Date _____________________

Please return this completed form to Meyer and Associates, 18 Washington Avenue, Chatham, NJ 07928. Assistance is available by calling weekdays to 800 635‐7801 between 8:30am until 6pm, Eastern Time.

1If no class (primary or contingent) for a beneficiary is indicated, the beneficiary will be considered primary. For each class of beneficiaries, all shares (percentages) must add up to 100%. Unless shares are stated otherwise, benefits will be distributed equally among all surviving beneficiaries in the same class (primary or contingent). If a primary beneficiary dies before the insured, that portion of the benefits will be equally distributed to the surviving primary beneficiaries; if no primary beneficiaries survive the insured, benefits will be paid to the surviving contingent beneficiary(ies) in the next class. If no contingent beneficiaries survive the insured, benefits will be distributed as provided in the Group Policy.

GMAD COB Form 200‐2 (12/12)

SAMPLES OF BENEFICIARY DESIGNATIONS: Below are examples of some common beneficiary designations that may be helpful as you complete this form.

1. Specific unequal shares (NOTE: Insert “Per Stirpes” after % to have any Benefits due any deceased beneficiary payable to his/her descendents)

|

Class/Share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

Primary |

Beneficiary Name |

|

|

|

|

|

Relationship |

|

|

|

|

|||||

|

|

|

John |

J. |

|

Smith |

to Insured |

Brother |

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contingent |

Address |

|

|

|

|

(First) |

(Middle) |

|

(Last) |

|

99999‐1111 |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

15 Bay Ridge Boulevard |

Smithville |

AK |

|

|

|||||||||||

__60%___ |

|

|

(Street) |

|

|

|

|

|

(City) |

|

(State) |

(Zip) |

|||||||

|

Per stirpes |

Date of Birth |

|

11 / 15 / 1974 |

|

Social Security Number |

123 – 45 – 6789 |

Phone Number |

(111) 234‐5678 |

||||||||||

|

|

|

|

|

|

|

(MM/DD/YYYY) |

|

|

|

|

|

|

|

(Area Code) |

(Number) |

|||

|

|

|

|

□ Address/Phone same as Insured Member |

|

|

|

|

|

|

|

|

|

||||||

|

|

|

Primary |

Beneficiary Name |

|

|

|

|

|

Relationship |

|

|

|

|

|||||

|

|

|

Antoinette |

Dubois |

|

Jones |

to Insured |

Sister |

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contingent |

|

|

|

|

|

(First) |

(Middle) |

|

(Last) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

Address |

2201‐1870 Southwest Third Avenue |

|

|

Ocean City |

KS |

11111‐2222 |

||||||||||

|

|

|

|

|

|

||||||||||||||

__40%___ |

|

|

(Street) |

|

|

|

|

|

(City) |

|

(State) |

(Zip) |

|||||||

|

Per stirpes |

Date of Birth |

|

5 / |

7 / 1979 |

|

Social Security Number |

987 – 65 – 4321 |

Phone Number |

|

(999) 876‐5432 |

||||||||

|

|

|

|

|

|

|

(MM/DD/YYYY) |

|

|

|

|

|

|

|

(Area Code) |

(Number) |

|||

|

|

|

|

□ Address/Phone same as Insured Member |

|

|

|

|

|

|

|

|

|

||||||

2. Trust as Beneficiary:

“John Smith and Mary Jones as Trustees of the Jones Family Trust under the Trust document dated December 1, 2012.” [Please provide Identifying Information for all Trustees.]

3.Minor Beneficiary ‐ Uniform Transfers/Gifts to Minors Act (UTMA/UGMA) Designation:

“[Name of Adult] as Custodian for [Name of Minor] under [Insured Member’s or Minor’s State of Residence] Uniform Transfers/Gifts to Minors Act.” [Please provide Identifying Information for the minor and adult Custodian.]

NOTICE REGARDING DESIGNATING A MINOR BENEFICIARY

Unless a UTMA/UGMA designation is used, or there is an existing court appointed guardian of the minor’s estate who can make financial decisions for the minor, a claims payment to a minor may be delayed until a surviving parent, relative, or other interested party obtains a court appointment as financial guardian of the minor’s estate, for the purpose of receiving the proceeds on behalf of the child.

NOTICE REGARDING TESTAMENTARY TRUST UNDER LAST WILL AND TESTAMENT AS BENEFICIARY

The following is understood and agreed when naming a Testamentary Trust under the Last Will and Testament as beneficiary of a specified decedent (Insured Member or non‐insured owner).

Proceeds shall be paid to the named contingent beneficiary if the decedent dies intestate (without a Last Will and Testament), or with a Last Will and Testament but (1) it does not create a Trust and name a Trustee or (2) no court proceeding has been started to probate the Last Will and Testament or no Trustee qualifies and claims the proceeds within 12 months (18 in Mississippi, New York, Texas; 6 months in Florida and North Carolina) after the decedent’s death. If the named contingent beneficiary is not living, and no further beneficiary is named, payment shall be made in accordance with the Group Policy.

New York Life is not obligated to inquire about the terms of any Trust affecting this policy or its proceeds, and shall not be held responsible for knowing the terms of any such Trust.

Payment to and receipt by said Trustee(s) or any successor Trustee(s), or payment to and receipt by the contingent beneficiary or insured’s estate shall constitute a full discharge and releases the New York Life Insurance Company to the extent of such payment. The full discharge and release of the New York Life Insurance Company’s obligation for payment applies to all persons and fiduciaries having any interest in such proceeds.

NOTICE REGARDING NON‐INSURED OWNER

A non‐insured owner who wishes to name a person other than themselves as beneficiary should do so only after receiving advice from their Counsel as to the possible tax consequences in light of existing decisional law to the effect that, when the proceeds are paid to someone other than the non‐insured owner, the proceeds constitute a taxable gift from the owner to the beneficiary at the time of the insured’s death.

*Per Stirpes means that any interest in a life insurance policy that a deceased beneficiary would have, if living, will be shared equally by all living children of that deceased beneficiary.

GMAD COB Form 200‐2 (12/12)

Form Data

| Fact Name | Description |

|---|---|

| Beneficiary Designation | Allows for the designation of both primary and contingent beneficiaries to receive benefits from the policy. |

| Identification Requirement | Requires detailed identifying information for each beneficiary to expedite claim payments and comply with unclaimed property laws. |

| Shares Allocation | Beneficiaries can be allocated specific percentages of the benefits, and if no percentages are designated, benefits are divided equally amongst all beneficiaries within the same class. |

| Minor Beneficiaries | Designating a minor beneficiary requires adherence to either the UTMA/UGMA designation or the appointment of a financial guardian to manage the funds. |

| Testamentary Trust and Non-Insured Owner Notice | Clarifies the policy regarding the payment of benefits to a testamentary trust or in cases where the policy is owned by a non-insured individual, emphasizing the need for legal advice due to potential tax consequences. |

Instructions on Utilizing Aarp Life Insurance

Filling out an AARP Life Insurance Beneficiary Change Request form is a straightforward process, yet it is a vital step in managing your life insurance policy. This procedure ensures that the benefits of your policy are correctly allocated according to your wishes in the event of your passing. Pay close attention to each section to accurately designate your beneficiaries and to ensure your intentions are clear. The steps below guide you through filling out the form to designate or change beneficiaries for your life insurance policy.

- Start by entering the Group Policyholder Name and your Group Policy Number in the provided spaces at the top of the form.

- Fill in the Insured's Name (your name) and your Certificate Number in the designated areas.

- Select the type of insurance coverage this beneficiary change applies to by checking the appropriate box: Term Life, Accidental Death, or Both Life and Accidental Death.

- For each beneficiary you wish to name or change, provide the requested details:

- Primary Beneficiary Name: Enter their full name (First, Middle, Last).

- Relationship to Insured: Specify how they are related to you (e.g., spouse, child, sibling).

- Address and Percentage of benefits they are to receive. If their address and phone number are the same as yours, check the box provided instead of re-entering this information.

- Enter their Date of Birth, Social Security Number, and Phone Number.

- If you wish to designate more than one beneficiary or add contingent beneficiaries (those who will receive the benefit if the primary beneficiaries are unable to), repeat step 4 for each additional person, indicating their class/share as either primary or contingent and the percentage they should receive. Remember, the total percentage allotted must equal 100%.

- If the provided spaces are insufficient, attach a separate page with the remaining beneficiary information, making sure to include your dated signature on the additional page.

- Review the AUTHORIZING SIGNATURE section, which emphasizes the importance of your signature to validate any changes made. Sign and date the form in the designated spaces.

- Finally, print your name clearly under your signature for clarification and record-keeping purposes.

- Review the completed form for accuracy. Once you are satisfied, return the form to the address provided at the bottom: Meyer and Associates, 18 Washington Avenue, Chatham, NJ 07928. Assistance is available by calling the provided phone number during specified hours if you have any questions or require support.

After you submit the AARP Life Insurance Beneficiary Change Request form, it will be processed according to the terms and conditions stipulated by the group policy. This administrative step is crucial in ensuring that your beneficiaries are up to date, reflecting your current intentions and wishes. It's always a good idea to periodically review and update this information as life circumstances change.

Obtain Answers on Aarp Life Insurance

Frequently Asked Questions about AARP Life Insurance Beneficiary Change Request

How do I change the beneficiary on my AARP life insurance policy?

To change the beneficiary on your AARP life insurance policy, you need to complete the Beneficiary Change Request form. Fill out the Group Policyholder Name, your name as the insured, your certificate number, and specify if the change applies to Term Life, Accidental Death, or both. Then, designate your new beneficiary(ies) by providing their full name, relationship to you, address, percentage of benefits, date of birth, Social Security Number, and phone number. If the address and phone number are the same as yours, simply check the box indicating this. Make sure to sign and date the form before sending it to Meyer and Associates for processing.

What happens if I don't assign a class (primary or contingent) to a beneficiary?

If you do not assign a class to a beneficiary, that beneficiary will be considered primary by default. Keep in mind that for each class of beneficiaries, the shares must add up to 100%. If a primary beneficiary predeceases you, their portion of the benefits will be equally distributed among the surviving primary beneficiaries. If there are no surviving primary beneficiaries, the benefit will then be paid to the surviving contingent beneficiary(ies).

Can I designate a trust or a minor as a beneficiary on my AARP life insurance policy?

Yes, you can designate a trust or a minor as a beneficiary. For a trust, you should state the name of the trust and the trustees, along with the date the trust document was executed. For minors, you can use the Uniform Transfers/Gifts to Minors Act (UTMA/UGMA) designation by naming an adult custodian to manage the proceeds for the minor under the laws of the state of residence. However, if you do not use a UTMA/UGMA designation or if there isn't a court-appointed guardian, the claims payment to a minor may be delayed until a guardian is appointed.

What are the tax implications of changing a beneficiary for non-insured owners?

If you're a non-insured owner of a life insurance policy and wish to name someone other than yourself as the beneficiary, it's important to be aware of potential tax consequences. The proceeds paid out to a beneficiary other than the non-insured owner may be considered a taxable gift at the time of the insured's death. It is advisable to consult with legal counsel to understand the implications fully in light of existing tax laws and decisions.

Common mistakes

When filling out the AARP Life Insurance form, people often commit several common mistakes that can lead to issues during the beneficiary claim process. Recognizing and avoiding these errors can ensure that the intended recipients receive the benefits as smoothly as possible. Here are ten common mistakes:

- Not specifying the class of beneficiary (primary or contingent). This ambiguity can lead to confusion in administering benefits.

- Forgetting to provide complete identifying information for each beneficiary, including their Social Security number and date of birth, which is crucial for locating the beneficiary at the time of a claim.

- Failing to assign specific shares (percentages) for each beneficiary when there’s more than one, which can result in unintended equal distribution.

- Omitting the address and phone number for each beneficiary, assuming it is the same as the insured member without marking the provided checkbox.

- Not using a separate page to add more beneficiaries when the form space is insufficient, which can lead to incomplete beneficiary designation.

- Incorrectly assuming the term “per stirpes” applies automatically without explicitly stating it, which affects how benefits are distributed if a beneficiary is deceased.

- Neglecting to consider the appointment of financial guardianship for minor beneficiaries, which can delay benefits.

- Designating a minor without using the Uniform Transfers/Gifts to Minors Act (UTMA/UGMA) designation or a trust, potentially complicating and delaying the payment process.

- Not understanding the implications of naming a testamentary trust or non-insured owner as a beneficiary, which may have unexpected tax consequences or procedural challenges.

- Overlooking the need for the authorizing signature, which validates the form. A missing signature means the form is not legally binding.

The completion of this form with accuracy and attention to detail is essential. Each field provides crucial information that aids in the efficient and correct disbursement of benefits in accordance with the policyholder's wishes. Avoiding these common mistakes ensures that the benefits go to the intended beneficiaries without unnecessary legal complications or delays.

Documents used along the form

When filling out or updating the AARP Life Insurance form, it's crucial to have all necessary information and documents at hand to ensure the accuracy and completeness of the submission. This process often involves more than just the insurance form itself; several other forms and documents are commonly used in conjunction with it to provide a comprehensive overview of the insured's wishes. Understanding these additional documents can streamline the process and avoid any potential complications.

- Will or Testament: Outlines how the insured's assets should be distributed after their death. This document can specify how life insurance proceeds should be handled, especially if a trust is named as the beneficiary.

- Trust Document: Establishes a trust and outlines its terms. In cases where a trust is named as a beneficiary, the insurance company requires details of the trust to ensure proper payment distribution.

- Power of Attorney (POA): Grants someone the authority to act on the insured's behalf in financial matters. This can include making changes to the life insurance policy if the insured is unable to do so.

- Guardianship Documents: Establish legal guardianship, allowing someone to make decisions for a minor or an incapacitated adult. This is crucial when a minor is named as a beneficiary.

- Birth Certificate: Used to verify the age and identity of the insured or beneficiary. This might be required if there are discrepancies or to fulfill state insurance regulations.

- Social Security Card: Also utilized for identity verification purposes, and to ensure the correct handling of any potential tax implications for the beneficiaries.

- Marriage Certificate or Divorce Decree: Needed to confirm the relationship status of the insured, as it may affect beneficiary designations, especially in states with community property laws.

- Death Certificate: In the event of the insured's death, a death certificate is necessary to process the claim. Additionally, if a beneficiary predeceases the insured, their death certificate may be required to adjust the beneficiary designations.

Each of these documents plays a vital role in the life insurance process, ensuring that the insured's intentions are clearly understood and carried out. Keeping these documents updated and in order simplifies the claims process, providing peace of mind for both the policyholder and their beneficiaries. It's advisable to consult with legal or financial advisors to ensure all paperwork is correctly prepared and submitted, aligning with the insured's final wishes.

Similar forms

Will and Testament: Like the AARP Life Insurance form, a Will and Testament also includes beneficiary designations, specifying who should receive assets upon the individual's death. Both documents can designate individuals, trusts, or other entities as beneficiaries and provide instructions on how the assets or benefits should be distributed, potentially specifying percentages or conditions similar to the life insurance form's class/share allocations.

Trust Agreement: This document shares similarities with the AARP Life Insurance form when it comes to designating beneficiaries for assets held within the trust. Both forms can specify primary and contingent beneficiaries, allocation of shares (in the case of the trust, the distribution of assets), and provide identifying information for the trustees or beneficiaries to ensure proper transfer of benefits or assets.

401(k) or IRA Beneficiary Designation Forms: These retirement account forms, like the life insurance form, require the account holder to designate beneficiaries who will inherit the account's assets upon the account holder’s death. They often require similar information, such as the beneficiary's name, relationship to the insured/account holder, and possibly their social security number and contact information. Both types of forms make provisions for primary and contingent beneficiaries, allowing the designation of who should benefit if the primary beneficiary cannot.

Power of Attorney (POA): Although primarily for granting someone the authority to make decisions on one’s behalf while alive, some aspects are similar to the AARP Life Insurance form, especially in regards to preparing for eventualities. A POA often requires detailed information about the individuals involved (similar to the beneficiary identifying information) and may include instructions that align with the individual’s wishes concerning finances or health, similarly to how a life insurance beneficiary designation secures an individual's wishes for asset distribution after death.

Advance Health Care Directive: While this document primarily deals with medical decisions rather than asset distribution, it is similar to the AARP Life Insurance form in that it requires one to designate individuals (in this case, to make healthcare decisions) and often includes detailed personal information about those individuals. Both documents are preemptive, designed to ensure that an individual’s wishes are known and respected in situations where they cannot express those wishes themselves.

Dos and Don'ts

Filling out the AARP Life Insurance form is an important step to ensuring your beneficiaries are correctly documented. Here are 10 dos and don'ts to guide you through this process effectively:

Do:- Review the entire form before filling it out to understand all the sections and information required.

- Use black or blue ink for better clarity and to ensure that all written information is legible.

- Provide complete information on your primary and contingent beneficiaries, including their full names, addresses, Social Security numbers, and phone numbers.

- Clearly specify the percentage of benefits for each beneficiary if you're dividing the policy among multiple people, ensuring the total adds up to 100%.

- Consider specifying "Per Stirpes" for any beneficiary to ensure their share passes on to their descendants if they predecease you.

- Include complete Identifying Information for trustees if you're naming a trust as a beneficiary.

- Sign and date the form yourself, as the insured member or previously designated non-insured owner, to validate the beneficiary designation.

- Consult with a professional if you're considering designating a minor as a beneficiary to understand the best way to structure this.

- Keep a copy of the completed form for your records before mailing the original to the provided address.

- Ensure the information is accurate and current, especially if there have been any life changes that affect your beneficiary designations.

- Forget to indicate the relationship of each beneficiary to you; this can help clarify your intentions and expedite the claim process.

- Rush through the form without double-checking all the details and spellings, especially for names and Social Security numbers.

- Overlook the importance of designating contingent beneficiaries as backups to your primary beneficiaries.

- Ignore the instructions for designating a minor beneficiary or setting up a trust, as these can have significant legal and tax implications.

- Use pencil or non-permanent writing instruments, as these can smudge or be altered, leading to potential disputes.

- Assume you only need to fill out the form once; review and update your beneficiary information periodically or after major life events.

- Designate a beneficiary without considering the potential tax consequences, especially if you're a non-insured owner naming someone other than yourself.

- Forget to provide detailed contact information for each beneficiary, which is critical for locating them if a claim needs to be processed.

- Leave any sections incomplete, as missing information could delay or complicate the claim process for your beneficiaries.

- Fail to seek advice if you're unsure, especially when it comes to legal distinctions like UTMA/UGMA designations or testamentary trusts.

Misconceptions

When discussing AARP Life Insurance forms and beneficiary designations, there are several common misconceptions that arise. Understanding these can help ensure your life insurance benefits are handled according to your wishes. Here are nine of the most common misconceptions:

Only family members can be named as beneficiaries: It's a common belief that beneficiaries must be blood relatives. However, you can designate anyone as a beneficiary—friends, partners not legally married to you, charities, or trusts.

Minors can directly receive life insurance benefits: While minors can be named as beneficiaries, they cannot directly manage these funds until they reach adulthood. An adult custodian or a trust should be designated to manage the proceeds under UTMA/UGMA or through a testamentary trust.

A will supersedes a life insurance beneficiary designation: Many people think a will has the final say in the distribution of life insurance proceeds. This is not true. The beneficiary form with the insurance company will override any instructions in a will regarding the life insurance payout.

Beneficiary designations don't need regular updating: Life events like marriage, divorce, the birth of children, or the death of a beneficiary necessitate a review and possibly, an update of your beneficiary designations to reflect your current wishes.

The estate must be the beneficiary if no one else is named: While benefits can be paid to the estate if no beneficiary is designated, this is not a requirement. To avoid probate, it’s recommended to always name a specific person, trust, or organization as beneficiary.

Equal distribution is the only option: People often assume that benefits must be shared equally among beneficiaries. In reality, you can specify different percentages for each beneficiary to correspond with your wishes.

Naming a trust as beneficiary is unnecessarily complex: While naming a trust requires additional steps, such as providing the trustee's information, it is a viable option for managing the proceeds, particularly when minors are involved or to address specific financial goals.

Tax consequences don't exist for life insurance proceeds: Generally, life insurance benefits are not subject to income tax. However, naming someone other than yourself as a beneficiary for a policy you own may have gift tax implications.

Specifying a "Per Stirpes" designation is unnecessary: Without a per stirpes designation, if a beneficiary predeceases the insured, their share might not be distributed according to the insured's wishes. A per stirpes designation ensures that the deceased beneficiary's portion goes to their descendants.

Clearing up these misconceptions is crucial for managing your life insurance policy effectively. Accurate beneficiary designations ensure that your assets are distributed in accordance with your wishes, offering peace of mind to both policyholders and their loved ones.

Key takeaways

When dealing with the AARP Life Insurance form, there are several key elements to consider to ensure that the beneficiary information is accurately and effectively recorded. Understanding these aspects can help facilitate a smoother process in the event of a claim and ensure that your intentions are clearly understood. Here are eight key takeaways:

- It's crucial to provide complete identifying information for each beneficiary, including their full name, relationship to the insured, address, date of birth, Social Security number, and primary phone number. This detail helps the insurance company expedite claims and locate beneficiaries when necessary.

- States have unclaimed property laws that could result in life insurance benefits being transferred to the state if a beneficiary cannot be found. Providing detailed beneficiary information helps prevent this.

- You can designate beneficiaries to receive benefits from your term life insurance, accidental death insurance, or both, by indicating your choice on the form.

- Designations can be revised by filling out this form, thereby revoking any previous beneficiary designations.

- If specifying more than one beneficiary, it’s important to indicate the class/share for each. You'll need to decide whether each beneficiary is primary or contingent and assign percentages if not dividing equally.

- Specific designations can include unequal shares, trusts, or minors under the Uniform Transfers/Gifts to Minors Act (UTMA/UGMA). For minors, unless a UTMA/UGMA designation is used, or a guardian is appointed, claim payments could be delayed.

- When a testamentary trust under a Last Will and Testament is named as the beneficiary, the proceeds will be paid to the trust or the contingent beneficiary, depending on the circumstances described in the notice regarding testamentary trust.

- A non-insured owner naming a beneficiary other than themselves should be aware of potential tax consequences. The payment to someone other than the non-insured owner might constitute a taxable gift at the time of the insured's death.

Accurately completing the AARP Life Insurance form not only honors your wishes but also safeguards your beneficiaries' interests, ensuring that they receive the support they need in your absence. It's a significant part of estate planning that demands careful consideration and, where necessary, consultation with a professional to understand all legal and financial implications.

Popular PDF Forms

Da Form 3439 - The form suggests that selection for positions will be significantly influenced by the feedback received.

Dhsmv Forms - The structured process and fees associated with the HSMV 85054 form ensure that requests are handled efficiently and equitably.

What Are the Basic Needs - A robust, detail-oriented document to ensure your family's preparedness for any circumstance.