Blank Abl 920 PDF Template

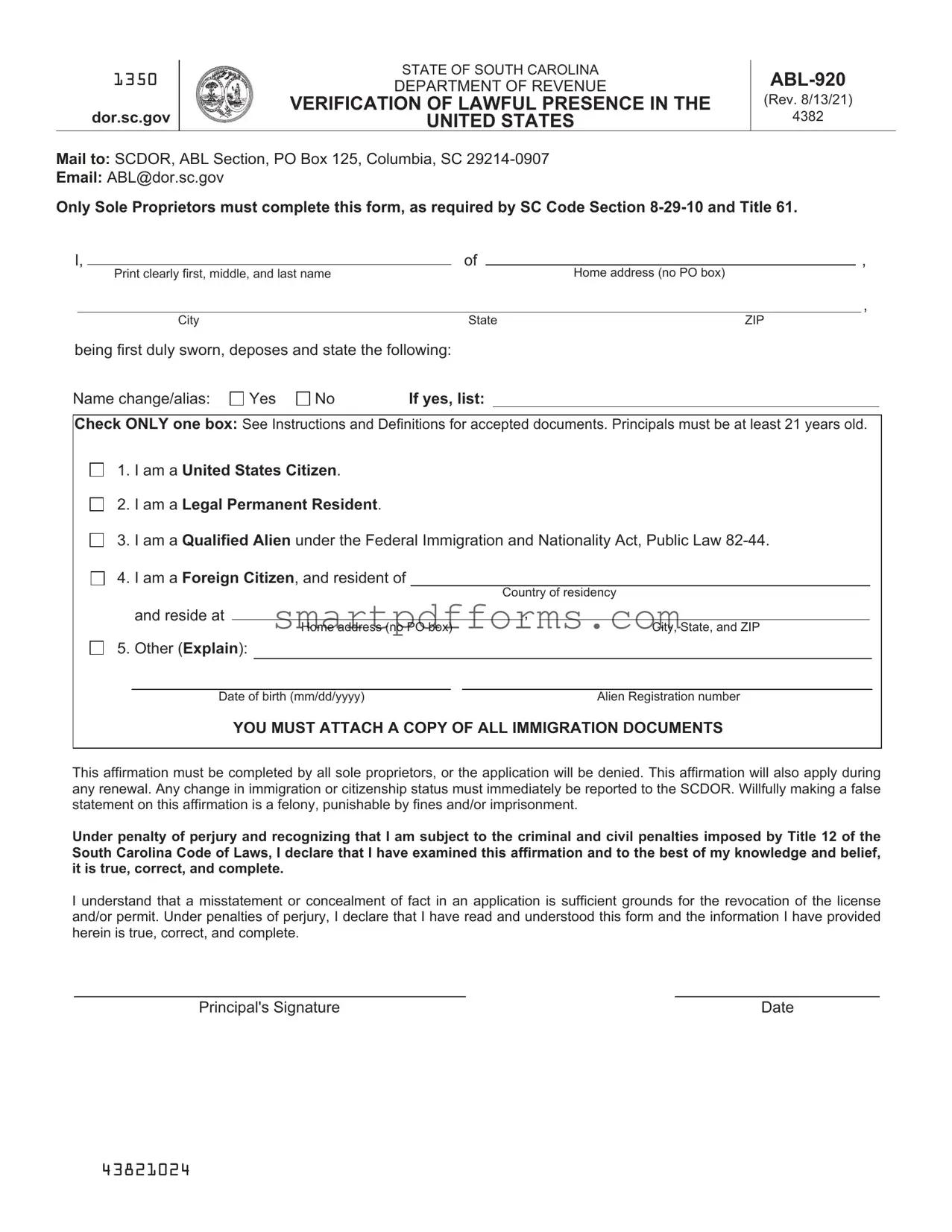

The ABL-920 form, a critical document issued by the State of South Carolina's Department of Revenue, serves as a verification of lawful presence in the United States, specifically tailored for sole proprietors operating within the state. Mandated by SC Code Section 8-29-10 and Title 61, this form requires individuals to affirm their immigration or citizenship status as part of the business licensing process, ensuring compliance with state regulations. Participants are presented with multiple declarations to attest to their status, ranging from U.S. citizenship to various categories of alien status under the Federal Immigration and Nationality Act. Alongside providing personal details like name, address, and date of birth, it emphasizes the importance of attaching all pertinent immigration documents to avoid application denial. The form strictly warns against false statements, highlighting the severe consequences of perjury, which includes potential fines and imprisonment. In addition to initial applications, this affirmation extends to any renewal periods, requiring prompt updates on any changes in immigration or citizenship status to the South Carolina Department of Revenue (SCDOR). This comprehensive process underscores the state's diligence in affirming the legal eligibility of sole proprietors to conduct business, aligning with wider legal and regulatory frameworks.

Preview - Abl 920 Form

1350

dor.sc.gov

STATE OF SOUTH CAROLINA

DEPARTMENT OF REVENUE

VERIFICATION OF LAWFUL PRESENCE IN THE

UNITED STATES

(Rev. 8/13/21)

4382

Mail to: SCDOR, ABL Section, PO Box 125, Columbia, SC

Email: ABL@dor.sc.gov

Only Sole Proprietors must complete this form, as required by SC Code Section

I, |

|

|

|

|

of |

|

|

|

, |

||

|

|

|

|

|

|

|

|||||

|

|

Print clearly first, middle, and last name |

|

|

|

|

Home address (no PO box) |

||||

|

|

|

|

|

|

|

|

|

|

, |

|

|

|

City |

|

|

|

State |

ZIP |

||||

being first duly sworn, deposes and state the following: |

|

|

|

||||||||

Name change/alias: |

Yes |

No |

If yes, list: |

|

|

|

|

||||

Check ONLY one box: See Instructions and Definitions for accepted documents. Principals must be at least 21 years old.

1. I am a United States Citizen.

2. I am a Legal Permanent Resident.

3. I am a Qualified Alien under the Federal Immigration and Nationality Act, Public Law

4. I am a Foreign Citizen, and resident of

Country of residency

and reside at

5. Other (Explain):

|

, |

Home address (no PO box) |

City, State, and ZIP |

Date of birth (mm/dd/yyyy) |

Alien Registration number |

YOU MUST ATTACH A COPY OF ALL IMMIGRATION DOCUMENTS

This affirmation must be completed by all sole proprietors, or the application will be denied. This affirmation will also apply during any renewal. Any change in immigration or citizenship status must immediately be reported to the SCDOR. Willfully making a false statement on this affirmation is a felony, punishable by fines and/or imprisonment.

Under penalty of perjury and recognizing that I am subject to the criminal and civil penalties imposed by Title 12 of the South Carolina Code of Laws, I declare that I have examined this affirmation and to the best of my knowledge and belief, it is true, correct, and complete.

I understand that a misstatement or concealment of fact in an application is sufficient grounds for the revocation of the license and/or permit. Under penalties of perjury, I declare that I have read and understood this form and the information I have provided herein is true, correct, and complete.

Principal's Signature |

Date |

43821024

Instructions and Definitions

Check box 1 –

If you are a US Citizen by birth or naturalization.

Check box 2 –

If you are a legal permanent resident and you are not a US citizen, but are residing in the US under legally recognized and lawfully recorded permanent residence as an immigrant.

PROVIDE A COPY OF ALL IMMIGRATION DOCUMENTS.

Check box 3 –

If you are a qualified alien. You are a qualified alien if you are:

•an alien who is lawfully admitted for permanent residence under the INA;

•an alien who is granted asylum under Section 208 of the INA;

•a refugee who is admitted to the United States under Section 207 of the INA;

•an alien who is paroled into the United States under Section 212(d)(5) of the INA for a period of at least 1 year;

•an alien whose deportation is being withheld under Section 243(h) of the INA (as in effect prior to April 1, 1977) or whose removal has been withheld under Section 241(b)(3);

•an alien who is granted conditional entry pursuant to Section 203(a)(7) of the INA as in effect prior to April 1, 1980;

•an alien who is a Cuban/Haitian Entrant as defined by Section 501(e) of the Refugee Education Assistance Act of 1980;

•an alien who has been battered or subjected to extreme cruelty, or whose child or parent has been battered or subject to extreme cruelty.

PROVIDE A COPY OF ALL IMMIGRATION DOCUMENTS.

Check box 4 –

If you are a

•foreign government officials,

•visitors for business and for pleasure,

•aliens in transit through the US,

•treaty traders and investors, students,

•international representatives,

•temporary workers and trainees,

•representatives of foreign information media,

•exchange visitors, fiancé(e)s of US citizens,

•intracompany transferees,

•NATO officials,

•religious workers, and some others.

Most nonimmigrants can be accompanied or joined by spouses and unmarried minors (or dependent) children.

PROVIDE A COPY OF ALL IMMIGRATION DOCUMENTS.

Accepted Immigration Documents:

•Unexpired Foreign passport with

•Alien Registration Receipt Card with photograph (INS Form

•Unexpired Temporary Resident Card (INS Form

•Unexpired Employment Authorization Card (INS Form

•Unexpired Reentry Permit (INS Form

•Unexpired Refugee Travel Document (INS Form

•Unexpired Employment Authorization Document issued by the INS which contains a photograph (INS Form

43822022

Form Data

| Fact | Description |

|---|---|

| Form Number | ABL-920 |

| Revision Date | August 13, 2021 |

| Applicable To | Only Sole Proprietors must complete this form |

| Governing Law | SC Code Section 8-29-10 and Title 61 |

| Submission Method | Mail or Email |

| Submission Address | SCDOR, ABL Section, PO Box 125, Columbia, SC 29214-0907 |

| Email Address | ABL@dor.sc.gov |

| Age Requirement | Principals must be at least 21 years old. |

| Documentation Requirement | A copy of all immigration documents must be attached. |

| Penalty for False Statement | Considered a felony, punishable by fines and/or imprisonment. |

Instructions on Utilizing Abl 920

The ABL-920 form is a necessary step for sole proprietors in South Carolina to verify their lawful presence in the United States in accordance with local laws. This document must be accurately completed and submitted to ensure compliance and avoid potential penalties. Please follow the step-by-step instructions below to complete the ABL-920 form properly. Remember to attach a copy of all relevant immigration documents before submission.

- Print your full name clearly — Enter your first, middle, and last name as requested on the form.

- Provide your home address — Fill in your current home address. Note that PO box addresses are not acceptable for this field.

- Indicate any name change or alias — If applicable, check "Yes" and list any name changes or aliases. Otherwise, check "No".

- Check the appropriate box for your status — Select one of the provided options that best describes your legal status in the United States:

- US Citizen

- Legal Permanent Resident

- Qualified Alien under the Federal Immigration and Nationality Act

- Foreign Citizen, providing country of residency

- Other, with an explanation required

- Enter your date of birth in the format (mm/dd/yyyy).

- Provide your Alien Registration number, if applicable.

- Attach a copy of all immigration documents supporting your status. This step is crucial for all applicants regardless of the status selected.

- Review the form to ensure all information is true, correct, and complete. By signing the form, you declare under penalty of perjury that all provided information and documents are accurate.

- Sign and date the form at the bottom, thereby affirming the accuracy of all information and your understanding of the legal implications associated with the form.

After completing the form and attaching all necessary documents, you should mail the form to the South Carolina Department of Revenue at the address provided on the form or email it to the provided email address. It's important to keep in mind that submitting false information can result in severe penalties, including fines or imprisonment. Ensuring the form is filled out accurately and completely is essential for compliance with South Carolina law.

Obtain Answers on Abl 920

Frequently Asked Questions about the ABL-920 Form:

Who is required to complete the ABL-920 form?

Sole proprietors are the only individuals required to complete this form, as mandated by SC Code Section 8-29-10 and Title 61. This requirement ensures the verification of lawful presence in the United States for those seeking to engage in business activities under this status in South Carolina.What is the purpose of the ABL-920 form?

The ABL-920 form serves as a verification tool for the lawful presence of sole proprietors in the United States, in compliance with state laws. It is used by the South Carolina Department of Revenue to confirm the immigration or citizenship status of individuals applying for or renewing business licenses or permits.What documents are accepted for the verification process?

The form acknowledges a range of immigration documents for verification, including but not limited to Unexpired Foreign passports with an I-551 stamp or attached INS Form I-94 indicating unexpired employment authorization, Alien Registration Receipt Cards with a photograph (INS Form I-151 or I-551), Unexpired Temporary Resident Card (INS Form I-688), Unexpired Employment Authorization Card (INS Form I-688A/B), Unexpired Reentry Permit (INS Form I-327), Unexpired Refugee Travel Document (INS Form I-571), and Unexpired Employment Authorization Documents issued by the INS with a photograph (INS Form I-688B).What happens if false information is provided on the ABL-920 form?

Willfully making a false statement on this affirmation is considered a felony, punishable by fines and/or imprisonment. It is vital to provide accurate and complete information to avoid severe legal consequences, including the possibility of license or permit revocation.How can a change in immigration or citizenship status be reported?

Any change in immigration or citizenship status must be reported immediately to the South Carolina Department of Revenue. Compliance with this requirement ensures that the business’s legal basis for operation remains current and valid.Where should the ABL-920 form be submitted?

Completed forms along with the required documentation should be mailed to the SCDOR, ABL Section, PO Box 125, Columbia, SC 29214-0907 or can be emailed to ABL@dor.sc.gov. This allows for the systematic processing and verification by the Department of Revenue.Are there any age requirements for the principals completing the form?

Yes, principals must be at least 21 years old to complete the ABL-920 form. This requirement is in place to ensure that individuals meet the legal age for business ownership and accountability within the state.

Common mistakes

Filling out the ABL-920 form, a vital document for sole proprietors in South Carolina to verify their lawful presence in the United States, requires careful attention to detail. However, individuals often make mistakes that can delay the process or affect the outcome of their application. Understanding these common errors can help applicants navigate the complexities of this form more effectively.

Not providing a physical home address: A common oversight is entering a P.O. Box instead of a physical home address. The form requires a physical address to verify the applicant’s residence.

Failure to attach immigration documents: Applicants must attach copies of all immigration documents relevant to their status. Neglecting to include these documents can result in the denial of the application.

Incorrectly selecting citizenship status: Carefully choosing the correct box that accurately reflects your citizenship or immigration status is crucial. Mistakes in this section can lead to unnecessary scrutiny or rejection.

Forgetting to list name changes or aliases: If you've undergone a name change or have used aliases, failing to disclose this information can create discrepancies in your application.

Overlooking the signature and date requirement: The form must be signed and dated to be considered valid. An unsigned or undated form is incomplete and will not be processed.

Providing incorrect date of birth: An accurate date of birth is essential for verifying your identity. Errors here can confuse the verification process.

Unreported changes in immigration or citizenship status: If your immigration or citizenship status changes, it is imperative to report these changes immediately to the SCDOR. Failure to update this information can lead to complications with your application.

By sidestepping these common errors, applicants can smooth the pathway to verifying their lawful presence in the United States, ensuring they meet the legal requirements to operate as sole proprietors in South Carolina.

Documents used along the form

When individuals or sole proprietors in the United States fill out the ABL-920 form for Verification of Lawful Presence, it's often part of a larger packet of forms and documents necessary for regulatory, legal, or administrative purposes. The ABL-920 form is specifically designed for individuals to affirm their immigration status to comply with certain state regulations. However, alongside this form, several other documents are frequently required to paint a full picture of an individual's eligibility for the matters at hand. These forms and documents vary in purpose from verifying identity and immigration status to detailing personal information crucial for various applications.

- Form I-9, Employment Eligibility Verification: Employers use this form to verify the identity and employment authorization of individuals hired for employment in the United States.

- Form W-9, Request for Taxpayer Identification Number and Certification: This form is used to provide the correct taxpayer identification number to persons who are required to file information returns with the IRS.

- Driver’s License or State ID: A government-issued identification card is necessary for proof of identity and age, often required in conjunction with the ABL-920.

- Social Security Card: This card is pivotal for verifying an individual's Social Security Number (SSN), which is needed for a range of purposes, from employment to tax considerations.

- Birth Certificate: A document required to establish citizenship status for those born in the United States.

- Passport: For non-citizens, a valid passport is often required to verify identity and nationality, particularly when other immigration documents are also involved.

- Immigration Documents: Such as Permanent Resident Card (Green Card), Employment Authorization Document, or visa, these documents support the immigration status declared in the ABL-920 form.

- Business License Application: For individuals seeking to validate their immigration status for business purposes, a copy of their business license application may be required.

- Proof of Residence: Utility bills, lease agreements, or mortgage statements serve as proof of residence within a specific state or territory.

In practice, the completion and submission of the ABL-920 form, alongside these associated documents, facilitate compliance with legal and regulatory frameworks. By comprehensively assembling the required paperwork, individuals can more effectively navigate processes such as business licensing, employment verification, and compliance with state and federal laws. Understanding the context and requirements for each of these documents ensures smoother interactions with governmental and regulatory bodies, paving the way for successful applications and verifications. It is essential for individuals to gather and prepare these documents with care, ensuring that all information provided is accurate and up to date.

Similar forms

The ABL-920 form shares similarities with the I-9 Employment Eligibility Verification form. Both require individuals to provide proof of their identity and eligibility to work or conduct certain activities in the United States legally. The I-9 form must be completed by both employees and employers in the U.S., verifying the employee's authorization to work in the country, akin to how sole proprietors must submit the ABL-920 to prove lawful presence for business purposes.

Another document similar to the ABL-920 is the I-485 Application to Register Permanent Residence or Adjust Status. This form also requires applicants to prove their lawful presence in the U.S., though its purpose is to adjust an individual's status to that of a lawful permanent resident. Both forms necessitate detailed personal information, background checks, and declarations of immigration status, underlining their focus on legal residency and identity verification.

The DS-160, Online Nonimmigrant Visa Application, is closely related to the ABL-920 in that it pertains to individuals seeking temporary status in the U.S. While the DS-160 is for foreign nationals applying for a nonimmigrant visa, the ABL-920 is for sole proprietors validating their lawful status. Each document requires information on the applicant's immigration status, and both ensure that the individual's presence in the U.S. complies with federal law.

Lastly, the ABL-920 form mirrors aspects of the USCIS Form N-400, Application for Naturalization. Applicants of the N-400 must demonstrate their permanent residence status, similar to how the ABL-920 requires proof of legal presence. Although the N-400 is specifically for those seeking U.S. citizenship through naturalization, and the ABL-920 is for business licensing purposes, both critically assess the applicant's eligibility based on their immigration status.

Dos and Don'ts

When filling out the ABL-920 form for verifying lawful presence in the United States, certain dos and don'ts can help ensure the process goes smoothly. It's crucial to pay close attention to detail and provide accurate information to avoid potential legal issues or delays. Here are some essential tips to consider:

What You Should Do:

- Read all instructions carefully before beginning to fill out the form. This can prevent common mistakes and save time.

- Ensure all information is complete and accurate. Double-check details like your name, date of birth, and alien registration number against your official documents.

- Include a copy of all necessary immigration documents as specified in the instructions. This is crucial for verifying your status and supporting your application.

- Sign the affirmation section to declare under penalty of perjury that the information provided is true, correct, and complete. This step is vital for the legitimacy of the application.

What You Shouldn't Do:

- Avoid using a P.O. Box as your home address. The form specifically requires a physical address to ensure accurate and lawful processing.

- Do not leave any sections blank. If a question does not apply to you, write "N/A" (not applicable) to indicate that you have read and acknowledged the question.

- Refrain from submitting the form without attaching the necessary immigration documents. Doing so will result in delays or even denial of your application.

- Avoid making false statements or misrepresenting your immigration status. Remember, willfully making a false statement on this affirmation is a felony with severe consequences.

By following these guidelines, applicants can navigate the verification process more effectively and ensure their application is processed without unnecessary complications.

Misconceptions

Understanding the ABL-920 form, used for verifying lawful presence in the United States by sole proprietors in South Carolina, involves clarifying common misconceptions. Here are six misconceptions explained to provide clearer insights:

- It's only for new applicants: Many believe that the ABL-920 form is only required during the initial application process. However, this form is also necessary for renewals, and any change in immigration or citizenship status must be reported promptly to the South Carolina Department of Revenue (SCDOR).

- All business owners must complete it: Contrary to this belief, only sole proprietors are required to complete the ABL-920 form. This specification aligns with South Carolina Code Section 8-29-10 and Title 61, focusing on individual proprietors to verify their legal presence in the U.S.

- No need to attach immigration documents: The form explicitly requires sole proprietors to attach copies of all relevant immigration documents. This requirement aids the verification process of the applicant’s status as a United States Citizen, Legal Permanent Resident, Qualified Alien, or other applicable classifications.

- Postal addresses are acceptable: The ABL-920 form specifics that a home address must be provided and explicitly states that P.O. Box addresses are not acceptable. This requirement ensures the provision of a verifiable, physical address for the sole proprietor.

- Any age is eligible to affirm: It's a common misunderstanding that individuals of any age can complete the form. However, the form clearly states that principals must be at least 21 years old, aligning with legal age requirements for business ownership and responsibility in many jurisdictions.

- Filing the form is a one-time requirement: Some may mistakenly think that once the ABL-920 form is filed, no further action is required. In reality, any changes in the sole proprietor's immigration or citizenship status must be immediately reported to the SCDOR. This ongoing requirement ensures that the verification of legal presence is current and accurate.

By addressing these misconceptions, sole proprietors can better understand their obligations under South Carolina law concerning the ABL-920 form, ensuring compliance and avoiding potential legal issues.

Key takeaways

When it comes to navigating legal requirements for business operations in South Carolina, the ABL-920 form stands out for sole proprietors. This document, crucial for verifying lawful presence in the United States, requires careful attention to detail and adherence to specific regulations set forth by the state. Here are some key takeaways to ensure a smooth process:

Sole Proprietor Specific: The ABL-920 form is a necessary step exclusively for sole proprietors operating in South Carolina. It's designed to confirm that the individual running the business is legally allowed to work within the United States.

Legal Requirement: Completing this form is not just paperwork; it's mandated by SC Code Section 8-29-10 and Title 61. Ignoring this requirement can lead to penalties and complications with your business license or permit.

Document Verification: You must provide a copy of all your immigration documents along with the ABL-920 form. This step is crucial for verifying your status and ensures that your application process is not delayed or denied.

Multiple Status Options: The form accommodates various legal statuses including U.S. Citizen, Legal Permanent Resident, Qualified Alien, Foreign Citizen, and other specific designations. Each category has distinct documentation requirements.

Penalty for False Statement: Making a false statement on this affirmation is considered a felony with severe consequences, including fines and/or imprisonment. It's imperative to provide truthful and accurate information.

Importance of Accuracy: When filling out the ABL-920, it's important to examine the affirmation carefully and ensure all information provided is true, correct, and complete to the best of your knowledge.

Update on Status Change: Any change in immigration or citizenship status must be immediately reported to the SCDOR. This ongoing requirement ensures that your business remains in compliance with state laws.

Understanding the Checkboxes: The form outlines specific checkboxes that correspond to different immigration or citizenship statuses. Understanding which box to tick is crucial and depends on your particular legal standing in the U.S.

Comprehensive Instructions: The ABL-920 form comes with detailed instructions and definitions to help guide you through the process. It's important to read these instructions carefully to ensure you fill out the form correctly and include all necessary documents.

Being diligent and thorough in completing the ABL-920 form will help ensure that your business complies with South Carolina's legal requirements. Remember, when in doubt, consulting with a legal professional can provide clarity and peace of mind throughout this process.

Popular PDF Forms

Smc Resident Visa - Your EOI will be reviewed for eligibility to enter the EOI Pool, based on character, health, English language, and other prerequisites.

Call Out Form - Ensures employees are informed of the necessary steps and documentation required for leave approval, including FMLA considerations.

Var Forms - Defines the process for handling post-inspection disputes, ensuring fair resolution before settlement.