Blank Account Closing PDF Template

The initiation of closing a bank account might often seem like a straightforward task, yet it encapsulates a range of steps and a significant level of precision to ensure that the process is smooth and error-free. When a customer decides to terminate their relationship with a bank for either a checking or savings account, the Account Closing Form becomes an essential document. This form, serving as a direct communication tool with the bank, requires the account holder to provide critical information such as the type of account they wish to close, the account's name, and the unique account number. Remarkably, the form also mandates instructions on how the remaining balance in the account should be handled, requesting details of an address where the bank can send the remaining funds. Furthermore, it includes space for the account holder's contact information, ensuring a channel for the bank to address any inquiries related to the closure request. The formal tone of the document is underscored by the closing salutations and the necessity for the account holder's signature, underscoring the legal and official nature of the account termination. Notably, references to JPMorgan Chase Bank, N.A., and its regulatory status as a Member FDIC, highlight the standardized and regulated framework within which account closures occur, providing a structured approach to ending banking services. This document not only facilitates a significant financial decision but also delineates the formalities involved in dissolving a banking relationship, framed within the procedural and regulatory requirements of the banking sector.

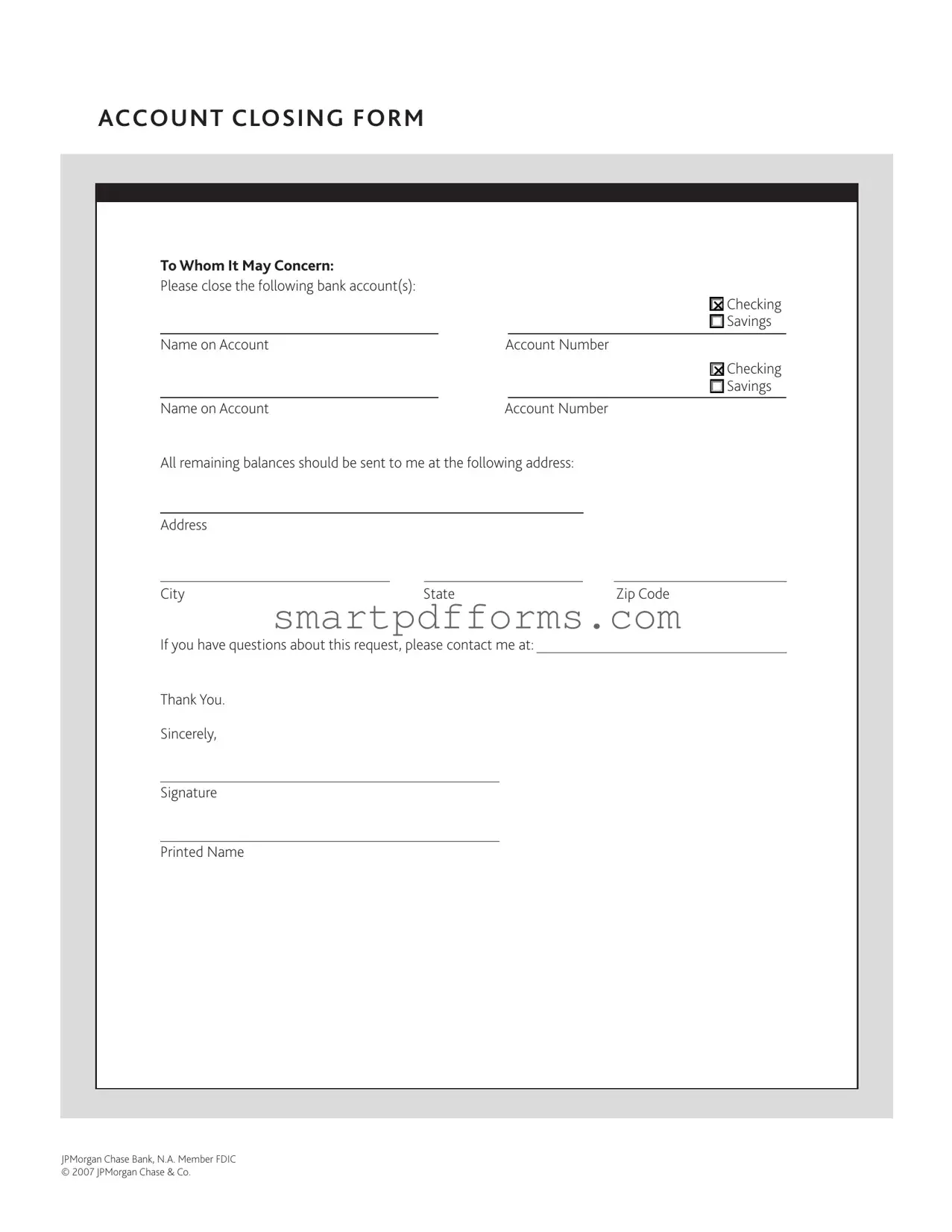

Preview - Account Closing Form

ACCOUNT CLOSING FORM

To Whom It May Concern: |

|

|

|

|

|

|

|

Please close the following bank account(s): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

oChecking |

|

|

|

|

|

|

|

oSavings |

|

|

|

|

|

|

|

|

Name on Account |

|

|

Account Number |

||||

|

|

|

|

|

|

|

oChecking |

|

|

|

|

|

|

|

oSavings |

|

|

|

|

|

|

|

|

Name on Account |

|

|

Account Number |

||||

All remaining balances should be sent to me at the following address: |

|||||||

|

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

State |

|

|

|

Zip Code |

||

If you have questions about this request, please contact me at:

Thank You.

Sincerely,

Signature

Printed Name

JPMorgan Chase Bank, N.A. Member FDIC © 2007 JPMorgan Chase & Co.

Form Data

| Fact Name | Detail |

|---|---|

| Form Purpose | The form is designed for the purpose of closing either a checking or a savings bank account. |

| Account Types Covered | It covers two types of accounts: Checking and Savings. |

| Required Information | Account holder needs to provide the name on the account and the account number for each account they wish to close. |

| Balance Disbursement | Instructions are provided for disbursing any remaining balances to the account holder's specified address. |

| Contact Information | The form requires the account holder's contact information for any questions regarding the closure request. |

| Bank Affiliation | The form is associated with JPMorgan Chase Bank, N.A., which is a member of the FDIC. |

| Governing Law | While not explicitly stated in the provided contents, typically, such forms and account relationships are governed by the laws of the state where the bank account was opened and federal banking regulations. |

Instructions on Utilizing Account Closing

Filling out an Account Closing form is a straightforward process, but it's crucial to provide accurate and clear information to ensure the timely and proper closure of your banking accounts. Once submitted, this form communicates to the bank your intent to close your specified bank account(s) and requests the remaining balance to be sent to your address. Following the step-by-step instructions will make this task easier and help avoid any potential misunderstandings or delays.

- Start by clearly marking whether the account you wish to close is a Checking or Savings account. Do this by placing a checkmark or X in the appropriate box next to the account type.

- Proceed to fill in the Name on Account. Ensure the name provided matches exactly with the name the bank has on file for the account.

- Enter the Account Number for the account being closed. Double-check this number for accuracy to prevent any issues with the closure process.

- If you are closing more than one account, repeat steps 1 through 3 for the second account type, whether it's another Checking or Savings account.

- Under the section marked for your address, fill in your Address where you would like the remaining balances sent. This includes filling out the specific City, State, and Zip Code fields accurately.

- Provide a contact number or email where you can be reached should there be any questions about this request. This ensures any queries regarding the closure can be promptly addressed.

- Finally, sign your name at the bottom of the form under the “Signature” line to validate the request. Your Printed Name should also be clearly written near your signature to confirm the identity of the account holder making the request.

After completing these steps, review the form to ensure all provided information is correct and legible. Following the submission of this form, the bank will process your request to close the account(s) as instructed. The remaining balance, if any, will be sent to the address provided. This process can take a few days to several weeks, depending on the bank's policies and procedures. Additionally, it's wise to follow up with the bank if confirmation of the account closure is not received within a reasonable timeframe. Taking these actions will help facilitate a smooth transition and closure of your banking account(s).

Obtain Answers on Account Closing

How do I use the Account Closing Form to close my bank account?

To close your bank account, you need to complete the Account Closing Form with the relevant details, including selecting the type(s) of account(s) you are closing (Checking and/or Savings), providing the name on the account, the account number(s), and your contact information. Make sure you sign the form and write your printed name at the bottom. Once completed, submit the form to your bank.

Can I close more than one account with a single form?

Yes, the form allows you to close multiple accounts. You can indicate on the form whether you are closing a Checking account, Savings account, or both for each account holder listed. Ensure you provide the names on the accounts and the corresponding account numbers.

What happens to the remaining balance in my account?

Your remaining balance will be sent to the address you provide on the Account Closing Form. Double-check your address details to ensure they are accurate to avoid any delays in receiving your funds.

How can I receive assistance if I have questions about the form?

If you have any questions regarding the Account Closing Form or the closing process, you can contact the bank at the phone number provided on the form. Make sure to have your account information handy to receive tailored assistance.

Is the Account Closing Form specific to JPMorgan Chase Bank?

Yes, the form is specifically designed for the account closure procedure at JPMorgan Chase Bank, N.A. If you have accounts at another bank, you will need to obtain their specific account closing form or follow their prescribed procedure.

What should I do after submitting the Account Closing Form?

After submitting the form, monitor your mail for the check containing your remaining balance. Additionally, keep an eye on your account(s) to confirm they have been closed as requested. If you notice any issues or if the account remains open longer than expected, contact the bank promptly.

Am I required to close my account in person?

Typically, submitting the Account Closing Form is sufficient to request the closure of your account. However, requirements can vary based on the bank's policies. It's advisable to follow up with the bank if you have any specific concerns or if they have additional requirements.

Will I receive confirmation my account has been closed?

Banks usually send a written confirmation that your account(s) has been closed. If you do not receive this confirmation within a reasonable time frame, contact the bank to verify the status of your account closure request.

Common mistakes

Failing to thoroughly verify the account details can lead to the closing of the incorrect account. Account holders must cross-check each piece of information, such as account number and the type of account (checking or savings), to ensure accuracy.

Omitting necessary details such as the Name on Account is a common mistake. The name should precisely match the one the bank has on file to avoid any issues with the account closure process.

Incorrectly filling out the address to receive the remaining balance can result in funds being sent to the wrong place. The address must be current and include all relevant information like City, State, and Zip Code.

Not specifying how the remaining balance should be received, such as by check or direct deposit into another account, can cause delays. While this form does not provide a separate field for this preference, including this information in a separate communication is advisable.

Overlooking the signature area is one of the more serious mistakes. A missing Signature can invalidate the entire request, as it is a crucial part of verifying the account holder's identity and intentions.

Printing the name unclearly under the signature can also lead to unnecessary delays. The Printed Name should be legible to ensure the bank can easily match it to their records.

Not contacting the bank if there are outstanding issues or questions about the account closure process can leave unresolved issues. It's always better to reach out proactively using the provided contact details.

Assuming instant closure without confirming with the bank can be a critical mistake. It often takes several days to officially close an account, and following up for confirmation is a step many forget.

When filling out an Account Closing Form, attention to detail is paramount. It is not only about ensuring that the bank processes the closure as requested but also about safeguarding against potential issues that could arise from incorrect or incomplete information. Each step, from verifying personal details to providing clear instructions for the remaining balance, requires careful attention. By sidestepping these common pitfalls, individuals can ensure a smooth and efficient closure of their bank accounts.

Documents used along the form

When managing finances, particularly in relation to closing a bank account, it is crucial to understand not only the importance of an Account Closing Form but also the variety of other documents and forms that may be involved in the process. These documents serve a range of purposes, from ensuring the legality and security of the transaction to facilitating the transfer or safeguarding of assets. Having a comprehensive understanding of these forms can streamline the process, making it more efficient and less prone to errors.

- Account Opening Form: Used to establish a new account, this form captures personal information, the type of account being opened, and any specific instructions or preferences. It often precedes the need for an Account Closing Form when the customer decides to switch banks or consolidate accounts.

- Bank Statement Request Form: Individuals may need to request previous statements for their records, especially before closing an account to ensure all transactions have been accounted for and to assist with financial tracking or reporting.

- Direct Deposit Authorization Form: This form is used to set up electronic deposits to the account from employers or other sources. When closing an account, a new form must be submitted to redirect those deposits to a new account.

- Automatic Payment Cancellation Form: To stop automatic payments from an account that is about to be closed, this form notifies the bank and the service providers to cancel the arrangements, thus preventing missed payments or overdrafts.

- Debit Card Cancellation Form: Similar to closing an account, canceling any associated debit cards is a necessary step to prevent unauthorized use and protect one's finances. This form provides the formal request to deactivate the card.

- Balance Transfer Form: When closing an account, it may be necessary to transfer the remaining balance to a new account. This form outlines the details of the transfer, including the amount and the receiving account information.

- Joint Account Holder Removal Form: If the account being closed is a joint account, this form is used to remove one party’s access and liability before the account closure, ensuring that the process complies with both parties' wishes.

- Personal Identification Update Form: In some cases, updated identification documents need to be submitted before closing an account, especially if there have been changes not previously reported to the bank. This ensures all transactions are legally binding.

- Safe Deposit Box Closing Form: For customers who also rent safe deposit boxes with their bank, this form facilitates the return of keys and termination of the rental agreement in association with the account closing.

- Customer Feedback Form: While not directly related to the financial aspects of closing an account, this form allows customers to provide feedback on their banking experience, offering banks valuable insights into their services and customer satisfaction.

Efficiently navigating the path to closing a bank account requires attention to these accompanying forms and documents, each playing a pivotal role in ensuring the process adheres to both bank policies and legal requirements. By familiarizing oneself with these documents, individuals can ensure that they are fully prepared for a smooth and successful closure of their bank account.

Similar forms

Change of Address Form: Similar to an Account Closing form, a Change of Address Form also deals with updating personal information with a financial institution. Both require the account holder's verification and often ask for a current address to ensure proper forwarding of documents or remaining funds.

Beneficiary Designation Form: This document, like the Account Closing form, is used to indicate the account holder's wishes regarding their account. Instead of closing an account, it designates individuals to receive the account's assets upon the account holder's death. Both forms require detailed identification of the account and clear instructions on handling the account's assets.

Direct Deposit Authorization Form: Both this form and the Account Closing form involve instructions to a bank concerning the account holder's funds. While the Direct Deposit Authorization Form provides information on where to deposit recurring funds, the Account Closing form provides instructions on where to send final balances.

Wire Transfer Request Form: Like the Account Closing form, a Wire Transfer Request Form also involves the transfer of funds from the account holder's bank account. Both require account numbers, personal identification, and the address where funds should be sent or received, albeit for different purposes.

Stop Payment Request: Similar to an Account Closing form, a Stop Payment Request requires the account holder to provide specific account information and authorization to halt a particular transaction. Both forms are mechanisms for account holders to manage and control the activity within their accounts, often requiring similar details such as account numbers and the account holder's signature for verification.

Dos and Don'ts

When you decide to close your bank account, it's paramount to complete the Account Closing Form with accuracy and attention to detail. Here are four things you should do along with four things you should avoid when filling out this form.

Do's

- Verify All Account Information: Ensure the name and account numbers listed match exactly with your bank records. Discrepancies could delay or void your request.

- Check Account Type Boxes: Clearly indicate whether the account(s) you're closing is a checking or savings. If you have both types, make sure to check off each one accordingly.

- Provide Correct Forwarding Address: Include the address where any remaining balance should be sent. This ensures that you'll receive your funds promptly and securely.

- Sign and Date the Form: Your signature officially authorizes the bank to close your account. Without it, the form is incomplete and the bank may not proceed with your request.

Don'ts

- Leave Sections Blank: Failing to fill out any part of the form can result in processing delays or the bank being unable to close your account.

- Forget to Include Contact Information: Your phone number or email is crucial in case the bank has questions or needs further confirmation to close your account.

- Rush Through the Process: Taking the time to double-check the details on your form can prevent future issues. Always review all information before submitting.

- Assume Automatic Closure: Just submitting the form doesn't guarantee immediate account closure. Follow up with the bank to ensure the process has been completed.

Misconceptions

When it comes to closing a bank account, it’s essential to use the correct procedure to ensure everything goes smoothly. A particular document, the Account Closing Form, is often required by banks to initiate this process. However, several misconceptions exist about this form, which can lead to confusion and delays. Let’s clear up four common misunderstandings:

- Misconception 1: You can only close accounts in person. While it’s true that some banks may require you to visit a branch in person, the Account Closing Form can typically be sent via mail or, in some cases, submitted online. This form serves as a written request to the bank, instructing them to close your account(s) and send any remaining balances to the address you specify.

- Misconception 2: The form is complicated and requires a lot of information. The Account Closing Form is actually quite straightforward. It simply asks for the types of accounts you’re closing (checking or savings), the name(s) on the account(s), the account number(s), your contact information, and where to send any remaining funds. This simplicity is designed to make the process as smooth as possible for the account holder.

- Misconception 3: Submitting this form immediately closes the account. After the form is received, the bank may still need a few days to process the closure. They will verify the information provided, ensure all pending transactions have cleared, and then officially close the account. It’s important to keep this timeframe in mind and to avoid writing checks or authorizing debits from the account during this period.

- Misconception 4: There’s no need to follow up after submitting the form. Even though it would be ideal if everything worked seamlessly, it’s prudent to follow up with the bank a week or so after submitting your Account Closing Form. This ensures that the process is moving forward as expected and allows you to address any unforeseen issues that may have arisen, ensuring the account is properly closed.

Understanding these misconceptions about the Account Closing Form can help make the process of closing a bank account much less daunting. It’s always a good idea to read the form thoroughly and speak directly with your bank if you have any questions or concerns.

Key takeaways

When you decide to close your bank account, the Account Closing Form is a document that ensures this process is completed properly. Here are some key takeaways about filling out and using this form:

- Identify Your Account Type: Clearly mark whether the account you wish to close is a checking or savings account. If you're closing more than one account, specify each separately.

- Provide Accurate Account Information: The form requires the name on the account and the account number. Make sure these details are correct to avoid any delays.

- Indicate Where to Send Remaining Balances: You need to provide an address where the bank should send any remaining money from the account. This includes your city, state, and zip code.

- Contact Information Is Crucial: Include your contact information, making it easier for the bank to reach you if they have any questions about your request.

- Signature is Mandatory: Your signature is required to validate the request. Without it, the bank may not proceed with closing your account.

- Printed Name for Verification: Besides your signature, print your name as it appears on the account. This is for added verification purposes.

- Understand the Bank’s Process: After submitting this form, the bank may have its own time frame and process for closing the account. It’s advisable to follow up if necessary.

- Check for any Fees or Charges: Be aware of any possible fees or charges associated with closing your account. It’s good practice to ask the bank about this beforehand.

By following these guidelines, you can ensure a smooth process in closing your bank account. Always double-check the details you provide to avoid any complications.

Popular PDF Forms

Va Form 26 1880 - The importance of this form in facilitating homeownership for veterans and their families cannot be overstated.

Business License New Mexico - This Albuquerque-specific business registration form is an essential step for entrepreneurs to legally establish their business in the city.