Blank Acd 31015 PDF Template

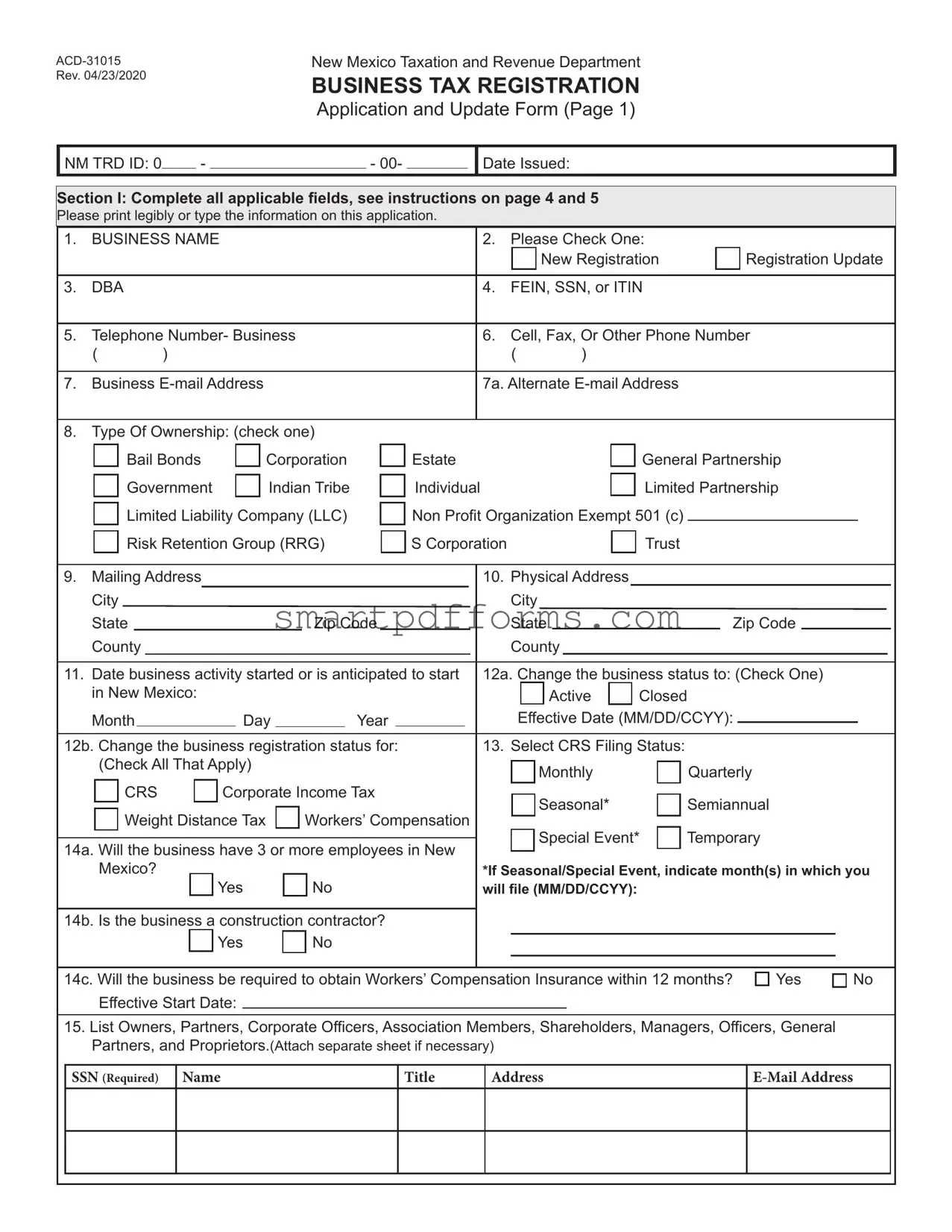

The ACD-31015 form, revised on April 23, 2020, serves as a critical tool for businesses engaging with the New Mexico Taxation and Revenue Department, facilitating both new business tax registrations and updates to existing records. This detailed document requires businesses to provide comprehensive information, including the official business name, type of registration (new or update), details regarding the ownership structure, contact information, and the physical and mailing addresses. Moreover, it delves into specific areas such as the nature of the business activity, tax filing status preferences, and employee-related queries which are essential for identifying the business's tax obligations. Importantly, the form also addresses the need for Worker’s Compensation Insurance and provides a section for listing key company officials and their details, ensuring a full spectrum of the business's operational blueprint is recorded. Additionally, it incorporates questions regarding special tax programs, the presence in the oil and gas sectors, and compliance with health care quality surcharges, highlighting its comprehensive nature in capturing a business's fiscal and operational footprint within New Mexico. Lastly, compliance guidelines underscore the importance of accurate and complete submission of the ACD-31015, directing businesses towards either digital platforms or traditional mailing methods for form submission, underscoring the form's pivotal role in navigating New Mexico’s taxing landscape.

Preview - Acd 31015 Form

New Mexico Taxation and Revenue Department

BUSINESS TAX REGISTRATION

Application and Update Form (Page 1)

NM TRD ID: 0 |

|

- |

|

- 00- |

Date Issued:

Section I: Complete all applicable fields, see instructions on page 4 and 5

Please print legibly or type the information on this application.

1. |

BUSINESS NAME |

2. |

Please Check One: |

|

|

|||

|

|

|

|

|

|

New Registration |

|

Registration Update |

|

|

|

|

|

|

|

||

3. |

DBA |

|

4. |

FEIN, SSN, or ITIN |

|

|

||

|

|

|

|

|||||

5. |

Telephone Number- Business |

6. |

Cell, Fax, Or Other Phone Number |

|||||

|

( |

) |

|

( |

) |

|

|

|

|

|

|

|

|

||||

7. |

Business |

7a. Alternate |

|

|

||||

|

|

|

|

|

|

|

|

|

8. Type Of Ownership: (check one)

Bail Bonds |

|

Corporation |

Government |

|

Indian Tribe |

|

Estate Individual

General Partnership Limited Partnership

Limited Liability Company (LLC)

Non Profit Organization Exempt 501 (c)

|

|

Risk Retention Group (RRG) |

|

|

S Corporation |

|

|

|

|

Trust |

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9. Mailing Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10. Physical Address |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

City |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

State |

|

|

|

|

|

|

|

|

Zip Code |

|

|

|

|

|

State |

|

|

|

|

|

Zip Code |

|

|

|

|

|

|||||||||||||||||||||||

County |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

County |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11. Date business activity started or is anticipated to start |

12a. Change the business status to: (Check One) |

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||

in New Mexico: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Active |

|

|

Closed |

|

|

|

|

|

|

||||||||||||||||||||

Month |

|

|

|

Day |

|

|

|

Year |

|

|

|

|

|

Effective Date (MM/DD/CCYY): |

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12b. Change the business registration status for: |

|

|

|

13. Select CRS Filing Status: |

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||

|

(Check All That Apply) |

|

|

|

|

|

|

|

|

|

|

|

|

Monthly |

|

|

|

Quarterly |

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

CRS |

|

|

|

Corporate Income Tax |

|

|

|

|

|

|

Seasonal* |

|

|

|

Semiannual |

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

Weight Distance Tax |

|

|

|

|

Workers’ Compensation |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

Special Event* |

|

|

Temporary |

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

14a. Will the business have 3 or more employees in New |

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

*If Seasonal/Special Event, indicate month(s) in which you |

|||||||||||||||||||||||||||||||||||||||||||||||||

|

Mexico? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

Yes |

|

|

No |

|

|

|

will file (MM/DD/CCYY): |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14b. Is the business a construction contractor? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

Yes |

|

|

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14c. Will the business be required to obtain Workers’ Compensation Insurance within 12 months? |

Yes |

No |

|||||||||||||||||||||||||||||||||||||||||||||||

|

Effective Start Date: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

15.List Owners, Partners, Corporate Officers, Association Members, Shareholders, Managers, Officers, General

Partners, and Proprietors.(Attach separate sheet if necessary)

SSN (Required)

Name

Title

Address

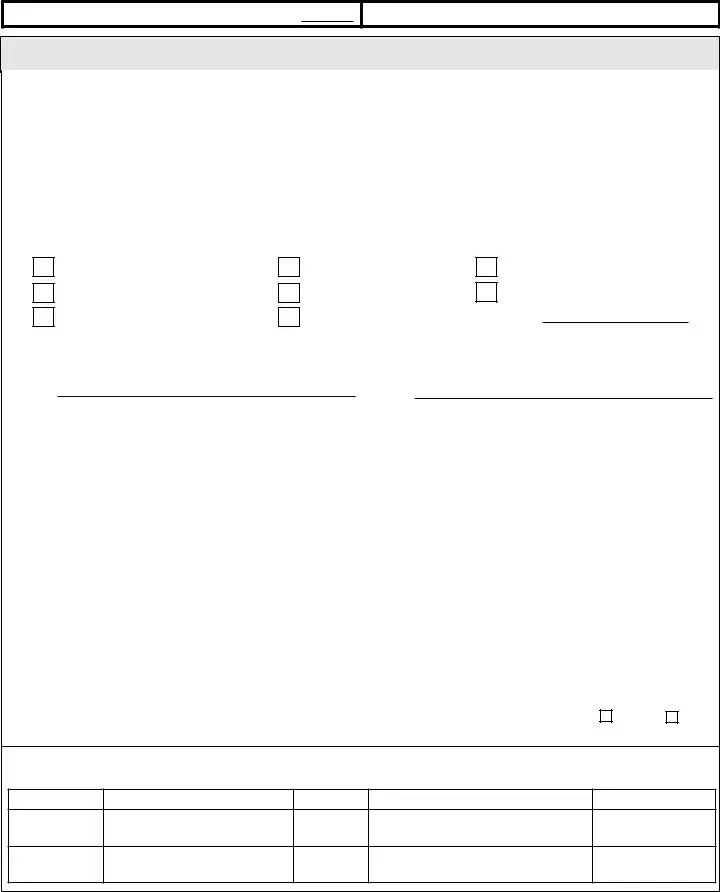

New Mexico Taxation and Revenue Department

BUSINESS TAX REGISTRATION

Application and Update Form (Page 2)

16.Method of accounting

Cash

Cash

Accrual

Accrual

17. Please check all that apply: |

Yes No |

a. Does the business have a physical presence in New Mexico? |

|

b. Is the business a marketplace provider? |

|

c. Is the business a marketplace seller? |

|

18.Give a brief description of nature of business:

19.I declare that the information reported on this form and any attached supplement(s) are true and correct:

Print Name |

Signature |

Title |

Date |

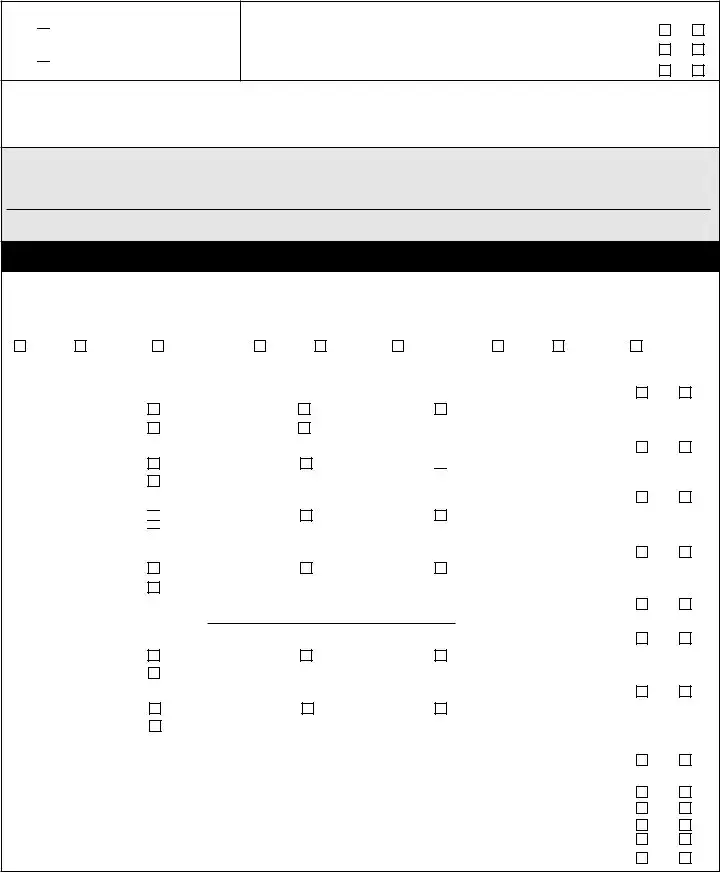

SECTION II: Complete this section if you answered question 13 as a monthly, quarterly, or

20. Liquor License Type/Number |

21. Secretary of State Business ID |

22. Contractor’s License Number |

|||||||||||

|

|

|

|

|

Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Add |

Delete |

Change |

Add |

Delete |

Change |

Add |

Delete |

Change |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Special Tax Programs: |

|

|

|

|

|

|

|

|

|

Yes No |

|||

23. Will business sell Gasoline? Note: Bond may be required. |

|

|

|

|

|

|

|

||||||

If yes, is business: |

Distributor |

Indian Tribal |

|

Retailer |

Wholesaler |

24. Will business sell Special Fuels? Note: Bond may be required.

If yes, is business: |

Supplier |

Wholesaler |

Retailer

25. Will business sell Cigarettes?

Rack Operator

Rack Operator

Rack Operator

If yes, is business:

Distributor

Distributor

Wholesaler

Wholesaler

26. Will business sell Tobacco Products?

Manufacturer |

Retailer |

If yes, is business: |

Distributor |

Manufacturer |

Retailer |

Wholesaler

27.Will business be a Water Producer? If yes, Type of Water System:

28.Will business be involved in Gaming Activities?

|

If yes, is business: |

Bingo and Raffle |

Distributor |

Gaming Operator |

|

|

Manufacturer |

|

|

29. |

Will business sell Liquor? |

|

|

|

|

If yes, if business: |

Direct Shipper |

Manufacturer |

Retailer |

|

|

Wholesaler |

|

|

30. |

Will business sell Prepaid Wireless Communication, Landline, or Wireless Services? |

|||

|

If yes, |

|

|

|

Oil and Gas: |

|

|

|

|

31.Will business engage in Serving Natural Resources?

32.Will business engage in Processing Natural Resources?

33.Will business be a Natural Gas Processor?

34.Will business be an Oil and Gas Taxes Filer?

35.Will business be a Master Operator (Equipment tax)?

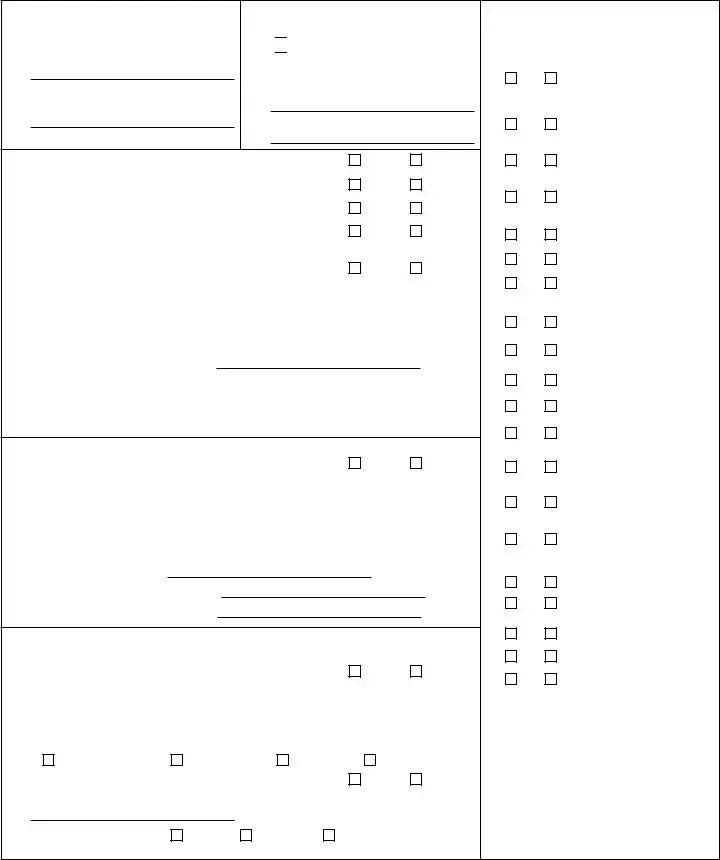

New Mexico Taxation and Revenue Department

BUSINESS TAX REGISTRATION

Application and Update Form (Page 3)

36.If applicable, provide former owner’s:

NM TRD ID No.:

Business Name:

37.Are you operating any other business(es) in New Mexico?  Yes

Yes

No

No

If yes, provide: NM TRD ID No.

Business Name:

38.Primary type of business in NM (Check all that apply)

Add Delete

Accommodation, Food

Services, and Drinking

Places

Administrative and Sup- port Services

39. |

Is the business a Government Entity? |

Yes |

No |

40. |

Is the business a Government Hospital? |

Yes |

No |

41. |

Is the business a |

Yes |

No |

42. |

Is the business a Retail Food Store? |

Yes |

No |

43. |

Is the business a Health Care Practitioner who will deduct receipts under |

||

|

Section |

Yes |

No |

If yes, please briefly explain the type of health care services provided.

Effective date (MM/DD/CCYY):

Explain where the payments that will be deducted are coming from:

44. Health Care Quality Surcharge: SEE INSTRUCTIONS |

|

|

||||

|

Is this business a health care facility? |

Yes |

No |

|||

|

If yes, provide: |

|

|

|||

|

New Mexico Department of Health License Number |

|

|

|||

|

|

|

|

|

|

|

|

List the following: |

|

|

|||

|

DBA: |

|

|

|

|

|

Administrator Name:

Administrator Phone Number:

Administrator Email Address:

45.Insurance Premium Tax:

Is this business licensed through the Office of the Superintendent of

Insurance? |

|

|

|

Yes |

No |

If yes, provide: |

|

|

|

|

|

National Association of Insurance Commissions (NAIC) Number: |

|

||||

|

|

|

|

|

|

Check all that apply: |

|

|

|

|

|

Life and Health |

Property |

Casualty |

Vehicle |

||

Surplus Lines? |

|

|

|

Yes |

No |

If yes, provide National Producer Number (NPN)

Agriculture, Forestry, Fishing and Hunting

Arts, Entertainment and Recreation Management

Construction

Educational Services

Extraction of Natural Resources

Finance and Insurance

Health Care and

Social Assistance

Information

Manufacturing

Oil and Gas Extraction and Processing

Professional, Scientific

and Technical Services

Real Estate and Leasing of Real Property

Rental and Leasing

of Tangible Personal

Property

Retail Trade

Transportation and Warehousing

Utilities

Wholesale Trade

Other Services

Check all that apply: |

Agency |

Agent |

Broker |

New Mexico Taxation and Revenue Department

BUSINESS TAX REGISTRATION

Instructions (Page 4)

Who is required to submit

This Business Tax Registration Application & Update Form is for the following tax programs: Cigarette, Compensating, E911 Service, Gaming Taxes, Gasoline, Gross Receipts, Special Fuels, Tobacco Products, Withholding, Workers Compensation Fee, Master of Operations, Natural Gas, Resources, Severance, Special Fuels, Tobacco Products, Telecommunications Relay Service, and Water Producer. Registration is required by New Mexico Statute, Section

Should you need assistance completing this application, please contact the Department:

Once the completed forms and attachments have been reviewed and processed a registration certificate will be

mailed to the address provided.

New Applications:

Please complete the form in full. Provide completed pag- es 1 through 3 to the: NM Taxation and Revenue Depart- ment, Attn: Compliance Registration Unit, PO Box 8485,

Albuquerque, NM 87198 . All attachments must contain the business name. Mark questions which do not apply with n/a

(not applicable).

3.If entity operates under a different name than the busi- ness name, list the name the business is “doing busi- ness as” (DBA).

4.Enter Federal ID Number (FEIN), Social Security Num- ber (SSN), or Individual Taxpayer Identification Number

(ITIN).

5.Enter the business telephone number.

6.Enter a cell phone contact number for the business.

7.Enter business

8.Check the type of ownership for the business you are registering (choose only one). If the entity type has

changed, the ID must be closed and a new registration must be completed for the new entity type. If

9.Enter the address at which the business will receive mail from the Department (registration certificate, CRS

Filer’s Kits, etc.).

10.Specify the physical location address of the business. (Not a PO Box). If you have multiple locations, please attach an additional sheet.

11.Enter the date you initially derived receipts from per- forming services, selling property in New Mexico or leasing property employed in New Mexico; or the date you anticipate deriving such receipts; or the period in which the taxable event occurs. Enter month, day and year.

12.a) Enter the date business will close if you check TEM-

PORARY or SPECIAL EVENT on filing status in box 13.

If closing a business, request a Letter of Good Standing or a Certificate of No Tax Due.

Apply for a Business Tax ID Online:

You can apply for a Combined Reporting System (CRS)

number online using the Departments website,Taxpayer Access Point (TAP) https://tap.state.nm.us. From the TAP homepage, under Businesses select Apply for a CRS ID.

Follow the steps to complete the business registration.

Updating Business Registration:

If this is an update to an existing registration, answer ques- tions 1 through 4 and then any additional fields where

changes are being made.

Line Instructions:

SECTION I

1.Enter business name of the entity. If business name is an individual’s name, enter first name, middle initial, and last name.

2.Please mark the appropriate box indicating if this is a new registration or an update to an existing registra- tion. NOTE: If updating existing registration provide the NM TRD ID and Date Issued at the top of page 1 in the space provided.

b) Specify the tax program the business status refers to in 12a.

13.Filing status: Please select the appropriate filing sta- tus for reporting, submitting and paying the business’s

combined gross receipts, compensating and withhold- ing taxes.

a) Monthly - due by the 25th of the following month

if combined taxes due average more than $200 per month, or if you wish to file monthly regardless of the

amount due.

b)Quarterly – due by the 25th of the month following the end of the quarter if combined taxes due for the quarter are less than $600 or an average of less than $200 per month in the quarter. Quarters are January - March; April - June; July - September; October - December.

c)Semiannually – due by the 25th of the month follow- ing the end of the

d)Seasonal – indicate month(s) for which you will be filing.

New Mexico Taxation and Revenue Department

BUSINESS TAX REGISTRATION

Instructions (Page 5)

e)Temporary – enter close date on # 12. The month in which the business files must be a period in which the registration is active.

f)Special event – enter close date on # 12. The month in which the business files must be a period in which the registration is active.

14.a) Indicate whether or not you will have 3 or more em- ployees in New Mexico.

b)Indicate whether the business is a construction con- tractor.

c)Indicate whether or not you will be required to pay the Workers’ Compensation fee to New Mexico. Every

employer who is covered by the Workers’ Compensa- tion Act, whether by requirement or election must file and pay the assessment fee and file form

Workers’ Compensation Fee Form

information contact the Workers’ Compensation Ad- ministration at (505)

nm.gov.

15.Required: Enter the Social Security Number (SSN) or

Individual Tax Identification Number (ITIN) for individu-

als; Name and Title, Address, Phone #, and

General Partners, and Proprietors. This information is required. Attached additional pages if necessary.

16.Check the method of accounting used by the business.

a)Cash - report all cash and other consideration re- ceived but exclude any sales on account (charge sales) until payment is received.

b)Accrual - report all sales transactions, including cash sales and sales on account (charge sales) but exclude cash received on payment of accounts receivable.

17.a) Indicate if the business has physical presence in New Mexico.

b)Indicate if the business is a marketplace provider, meaning a person who facilitates the sale, lease or license of tangible personal property or services or li- cense for use of real property on a marketplace seller’s behalf, or on the marketplace provider’s own behalf by listing or advertising the sale, or collecting payment from the customer and transmitting payment to the seller.

c)Indicate if the business is a marketplace seller, mean- ing a person who sells, leases or licenses tangible per-

sonal property or services or licenses the use of real property through a marketplace provider.

18.Briefly describe the nature of the type(s) of business in which you will be engaging.

19.The application should be signed by an Owner, Partner,

Corporate Officer, Association Member, Shareholder, or Authorized Representative.

SECTION II:

Complete this section if you answered question 13 as a monthly, quarterly, or

20.If applicable, provide your Liquor License Type and Number assigned by the Alcohol and Gaming Division

21.If applicable, provide your Secretary of State Business ID Number. They may be contacted at www.sos.state. nm.us or by phone at

22.If applicable, provide your Contractor’s License Num- ber assigned by the Construction Industries Division.

considered Special Tax Programs. Many of these pro- grams are required to file monthly. Please contact the

Special Tax Programs Unit at (505)

36.If this is not a new business, enter the former owner’s New Mexico Taxation and Revenue Department CRS ID Number (NM TRD ID Number) and business name. You may want to complete a form

37.Specify whether you are operating or have operated any other businesses in New Mexico. If so, enter NM TRD ID number and business name.

38.Select the primary type(s) of business in which you will engage. You may select more than one if necessary.

43.Answer the questions regarding activities as health care practitioner, if applicable.

44.If you are unsure if you are subject to the Healthcare Quality Surcharge please contact our Special Tax Pro- grams Unit at (505)

45.Answer the questions regarding Insurance Premium Tax, if applicable.

Form submission:

You can apply for and update your Business Registration online using TAP, https://tap.state.nm.us.

You can also mail or email your application to the Depart- ment: Important: Please return completed pages 1, 2, and 3 of the

& Update form.

Mail: NM Taxation and Revenue Department

Attn: Compliance Registration Unit

PO Box 8485

Albuquerque, NM 87198

Form Data

| Fact Name | Detail |

|---|---|

| Form Purpose | The ACD-31015 form is used for the registration and update of business tax for the New Mexico Taxation and Revenue Department. |

| Revision Date | The form was last revised on April 23, 2020. |

| Applicable Entities | This form is applicable to a wide range of business types including corporations, partnerships, LLCs, non-profits, and more within New Mexico. |

| Governing Law | The registration requirement is pursuant to New Mexico Statute, Section 7-1-12 NMSA 1978. |

Instructions on Utilizing Acd 31015

Filling out the ACD 31015 form is an important step for businesses in New Mexico for tax registration or updates. The following steps guide you through the process of completing this form clearly and accurately, ensuring that all necessary information is provided.

- Enter the business name in the space provided.

- Check the appropriate box to indicate if it's a new registration or an update to an existing registration.

- If operating under a DBA ("doing business as"), list that name.

- Provide the Federal ID Number (FEIN), Social Security Number (SSN), or Individual Taxpayer Identification Number (ITIN).

- Input the business telephone number, including the area code.

- Enter a cell phone, fax, or other phone number for additional contact.

- Write down the business e-mail address and an alternate e-mail address if available.

- Check the box that represents the type of ownership of the business. If your entity type has changed, remember to close the previous ID and complete a registration for the new entity type.

- For the mailing address, include where the business will receive mail from the Department.

- Specify the physical address of the business. Use an additional sheet if there are multiple locations.

- Fill in the date your business activity started or is anticipated to start in New Mexico.

- For changes in business status, mark as active or closed and provide the effective dates.

- Select your CRS Filing Status appropriately and indicate any special cases like seasonal or temporary filing.

- Answer questions about employees, construction contractor status, and Workers’ Compensation requirements.

- List all relevant individuals associated with the business (owners, partners, etc.) along with their SSN or ITIN, name, title, address, and email address.

- Choose the method of accounting for the business—cash or accrual.

- Answer yes or no to whether the business has a physical presence in New Mexico, if it's a marketplace provider, or a marketplace seller.

- Provide a brief description of the nature of your business.

- The application must be signed and dated by an authorized individual (Owner, Partner, etc.), attesting the information is correct.

Upon completing these steps, you should review the application to ensure all information is accurate and complete. Your next steps involve submission. The form allows for digital applications through the TAP website, email, or traditional mail. Whichever method you choose, ensure that all pages of the form and any necessary attachments are included. The focused attention to detail in this initial phase will simplify the rest of the process, bringing you closer to achieving your business objectives in New Mexico.

Obtain Answers on Acd 31015

What is the ACD-31015 form used for?

The ACD-31015 form, issued by the New Mexico Taxation and Revenue Department, serves as a Business Tax Registration Application and Update Form. This form is essential for businesses to either register for a new tax entity or update their current registration details with the department. It covers various tax programs, including Cigarette, Compensating, E911 Service, Gaming Taxes, Gasoline, Gross Receipts, Special Fuels, Tobacco Products, Withholding, Workers Compensation Fee, and others. Businesses must fill out this form when they start a new operation in New Mexico, when there are changes in their business details, or when they are required by New Mexico Statute, Section 7-1-12 NMSA 1978.

How do I complete the ACD-31015 form?

To properly fill in the ACD-31015 form, businesses must provide detailed information across various sections of the form, including business name, type of ownership, addresses, and specifics about the nature of the business. The form also requires details about the tax filing status, such as if the business will file monthly, quarterly, or semi-annually, and whether it involves special tax programs. Accurate contact information for owners, partners, and corporate officers must be provided, along with choosing the appropriate method of accounting. If the application is for updating existing registration information, only sections requiring update and initial registration details need completion.

Where can I submit the ACD-31015 form?

The completed ACD-31015 form can be submitted online using the Taxpayer Access Point (TAP) platform at https://tap.state.nm.us, which allows for easy application and updating of business registration details. Alternatively, businesses can mail or email the completed form and necessary attachments to the New Mexico Taxation and Revenue Department at the addresses provided in the form's instructions. It's crucial to include all required pages and documents to ensure the application or update is processed without delays.

What happens after I submit the form?

Once the ACD-31015 form and any attachments are reviewed and processed by the New Mexico Taxation and Revenue Department, the department will issue a registration certificate to the business. This certificate is mailed to the address provided on the form. The certificate serves as confirmation of the business's registration for taxation purposes in New Mexico. It's important for businesses to review the certificate upon receipt to ensure all details are accurate and reflect their current operation status.

Who is required to submit the ACD-31015 form?

All businesses that need to register for tax programs in New Mexico or update their existing business tax registration details are required to submit the ACD-31015 form. This includes entities engaging in activities such as selling tangible personal property, leasing property, providing services within the state, or those subject to special tax programs detailed in the form. Whether starting a new business, changing business information, or complying with statutory requirements, the submission of this form is a mandatory step in the business tax registration process in New Mexico.

Common mistakes

-

Not confirming the type of registration needed: People often skip over checking whether they are filling out the form for a new registration or an update. This step is crucial to ensure your application is processed correctly.

-

Omitting the DBA (Doing Business As) name: If your business operates under a different name than its legal name, failing to list this can lead to confusion and misfiled documentation.

-

Incorrectly entering identification numbers: Whether it's the FEIN, SSN, or ITIN, entering these numbers incorrectly can lead to significant delays and possibly even the rejection of the application.

-

Leaving contact information fields blank: Not providing a business email, telephone number, or cell, fax, or other phone numbers limits the department's ability to contact you for further information or clarification.

-

Selection errors in the type of ownership: Misidentifying your business type—such as Corporation, LLC, or Individual—can affect not just your tax status but also how your business is legally perceived.

-

Failure to accurately list owners or officers: Skipping or incorrectly listing information under item 15 can cause problems. Every individual associated with your business must be accounted for accurately.

-

Incorrectly reporting the method of accounting: Choosing the wrong accounting method (cash or accrual) under item 16 can lead to inaccurate tax filings and potential legal implications.

When completing the ACD-31015 form, ensuring accuracy in every section prevents unnecessary delays. It's also important to consult the instructions on pages 4 and 5 of the form to avoid common pitfalls.

- Always check whether the form is for a new registration or an update.

- Include your business's DBA name if applicable.

- Double-check the FEIN, SSN, or ITIN for accuracy.

- Do not leave contact information fields empty.

- Correctly identify your business's type of ownership.

- Accurately list all owners, partners, and officers with complete information.

- Choose the correct method of accounting specific to your business operations.

Adhering to these guidelines ensures a smoother application process for your business tax registration with the New Mexico Taxation and Revenue Department.

Documents used along the form

In the realm of business operations and compliance, the ACD-31015 form is a pivotal document for businesses operating within New Mexico. However, this form does not stand alone. Several other documents and forms often accompany it to ensure comprehensive registration, reporting, and adherence to New Mexico's taxation and revenue requirements. Understanding these additional forms can simplify the process for businesses seeking to maintain compliance.

- Certificate of Good Standing: This document, issued by the New Mexico Secretary of State, certifies that a business is legally registered and compliant with state regulations. It's crucial for businesses looking to affirm their legitimacy and compliance status.

- Form RPD-41054 (Workers’ Compensation Fee Form): Required for employers covered by the Workers’ Compensation Act in New Mexico. It details the assessment fee for workers’ compensation insurance.

- Form ACD-31096 (Tax Clearance Request): Utilized by businesses needing to prove that they have no outstanding tax liabilities. This is particularly important for transactions such as selling a business or applying for specific licenses.

- Form CRS-1 (Combined Reporting System Form): Used for reporting Gross Receipts Tax, Compensating Tax, and Withholding Tax. Vital for businesses to report their taxable activities in New Mexico accurately.

- Form NTTC (Non-Taxable Transaction Certificates): Allows businesses to purchase goods or services for resale without paying gross receipts tax. It's essential for retailers and wholesalers to reduce tax liabilities.

- Licensure Applications: Depending on the nature of the business, specific licensure forms from the New Mexico Regulation & Licensing Department may be necessary. For example, construction contractors, alcohol retailers, or health care facilities require respective licenses to operate legally.

Having these forms and documents in order alongside the ACD-31015 can significantly streamline business operations, ensuring all regulatory requirements are met swiftly. For businesses navigating the intricate landscape of state compliance, understanding the function and necessity of each of these documents is imperative. By doing so, businesses can ensure they are fully prepared to meet New Mexico's legal and regulatory standards.

Similar forms

The ACD-31015 form is a New Mexico Taxation and Revenue Department document for business tax registration and updates. It closely resembles other forms that facilitate business identification, tax registration, and operational updates in various contexts. Here are six similar documents:

- IRS Form SS-4: This document is used to apply for an Employer Identification Number (EIN). Similar to the ACD-31015 form, it collects information about the business's type, ownership, and operational status for tax purposes.

- State Business License Application: Many states require businesses to obtain a general business license. These applications often require information about the business's name, type, owner(s), and contact details, much like the ACD-31015 form.

- Form 2553 (Election by a Small Business Corporation): Used by businesses to elect S Corporation status with the IRS, requiring details about business organization and ownership. It parallels ACD-31015’s focus on business structure and tax reporting preferences.

- Workers' Compensation Insurance Registration Forms: These forms, required for businesses that have employees, gather data on the company’s size, type, and start date, overlapping with Sections 14a-c of the ACD-31015 regarding employee information.

- Local Tax Registration Forms: Local municipalities often require businesses to register for tax purposes. These forms share similarities with the ACD-31015 in requiring business identification, operational details, and tax filing schedules.

- Department of Health Licensure Applications: For businesses involved in health care, these applications require details on business activities, owners, and locations, akin to the ACD-31015 form’s requirements for businesses with specific operational focuses.

These documents serve parallel functions in the business ecosystem, ensuring that businesses are properly registered for taxation, operational legality, and compliance with local and federal regulations.

Dos and Don'ts

When filling out the ACD-31015 form for the New Mexico Taxation and Revenue Department, it's important to approach it with attention to detail to ensure your business tax registration application or update goes smoothly. Here are seven do's and don'ts to keep in mind:

- Do ensure that all applicable fields in Section I and II, if applicable, are completed according to the instructions provided on pages 4 and 5 of the form.

- Do print legibly or type the information to avoid any confusion or errors in processing the form.

- Do check the type of ownership accurately in section eight, indicating the correct category that applies to your business structure.

- Do include comprehensive details for all Owners, Partners, Corporate Officers, Association Members, Shareholders, Managers, Officers, General Partners, and Proprietors as required in section fifteen.

- Don't leave any section that applies to your business blank. If a question does not apply, mark it with n/a (not applicable) to indicate you have reviewed the question.

- Don't use a P.O. Box address for the physical location of the business in section ten; always provide the actual physical address.

- Don't forget to sign and date the application in section nineteen, as the application needs to be completed by an Owner, Partner, Corporate Officer, Association Member, Shareholder, or Authorized Representative for submission.

Remember, an accurate and complete form ensures a smoother registration process for your business with the New Mexico Taxation and Revenue Department.

Misconceptions

When dealing with the ACD-31015 form in New Mexico, businesses and individuals often face misconceptions. Understanding these misconceptions is crucial for accurate and timely compliance with state requirements for business tax registration and updates.

It's only for new businesses: A common misunderstanding is that the ACD-31015 form is solely for new business registrations. In reality, this form serves dual purposes—it is used both for registering a new business with the New Mexico Taxation and Revenue Department and for updating information about an existing business. Whether there's a change in address, ownership type, name, or the need to update filing status, businesses must submit this form.

Physical presence is not important: Another misconception is that only businesses with a physical presence in New Mexico need to complete this form. However, the form requires all businesses, whether or not they have a physical presence in New Mexico, to disclose their situation. This information is crucial for determining tax obligations under state law, especially for marketplace providers and sellers.

Business type doesn't affect filing: The belief that the type of business does not influence the form's completion is incorrect. The ACD-31015 form encompasses various business types—including corporations, partnerships, sole proprietorships, and more—each with its specific sections to complete. The form tailors the registration process to the business type, ensuring accurate taxation and compliance with state laws.

One submission fits all purposes: Some might think that submitting the ACD-31015 form is a one-time event that covers all tax purposes. This is not true. While the form does register a business for multiple tax programs, certain tax liabilities or incentives—ranging from gross receipts tax to workers' compensation fee requirements— might necessitate additional registrations or filings outside this form.

No need for updates after initial submission: Lastly, there's a misconception that once the ACD-31015 form is submitted initially, no further action is required unless the business closes. On the contrary, the form explicitly serves for both initial registration and subsequent updates. Businesses are required to submit updates for any changes in information provided in their initial registration to ensure continued compliance with New Mexico’s tax laws.

Understanding these aspects of the ACD-31015 form is vital for business owners in New Mexico. Clearing up these misconceptions can promote better compliance with state requirements and help avoid potential penalties or complications in business operations.

Key takeaways

When engaging with the ACD-31015 form, associated with New Mexico Taxation and Revenue Department for Business Tax Registration, careful attention to detail is essential. Here are key takeaways to ensure accurate and efficient submission:

- Ensure that all sections applicable to your business are completed fully. Refer to the instructions provided on pages 4 and 5 for comprehensive guidance.

- If you are registering a new business or updating an existing registration, indicate this clearly by checking the appropriate box at the top of the form.

- It is vital to list the business name exactly as it is known legally. If operating under a different name, the "doing business as" (DBA) name must also be provided.

- Provide the correct Federal Employer Identification Number (FEIN), Social Security Number (SSN), or Individual Taxpayer Identification Number (ITIN) to avoid processing delays.

- Accurate contact information, including a primary business email and alternate email address, facilitates timely communication with the Department.

- Select the right type of ownership from the provided list. This choice affects the processing and requirements of your application.

- Determine your filing status based on the tax obligations of your business, including special considerations if operating on a seasonal or temporary basis.

- For businesses with a physical presence in New Mexico, specific questions relating to the nature of the business, marketplace provider status, and special tax programs must be addressed accurately.

Remember, the ACD-31015 form is not just a formality but a critical step in ensuring your business is properly registered and compliant with New Mexico tax laws. Accurate completion and timely submission will help avoid potential issues or delays in your business operations. For further assistance, the contact details for phone and email support provided in the form's instructions can be invaluable resources.

Popular PDF Forms

Dot Long Form - Ensures that the former employer confirms the applicant's completion of DOT return-to-duty requirements if any violations were reported.

Department Of Corrections Visitation Florida - Emphasizing the importance of truthful and complete responses, this form serves as a gateway for establishing visitation rights under the Florida Department of Corrections.