Blank Ach Transfer Bank Of America PDF Template

When dealing with finances, encountering an unauthorized transaction can be distressing. Bank of America provides a structured way to address this through their Unauthorized ACH Return Form. This form serves a vital purpose for both corporate and small business clients who discover unwelcome ACH transactions on their accounts. By promptly emailing or faxing this form to Bank of America's ACH Services, clients initiate the process of rectifying an unauthorized transaction. It's crucial that the form be submitted no later than one business day after the transaction posts, and by 7:00 p.m. Eastern Time, to ensure it is processed effectively. Completeness and accuracy in filling out this document, from providing correct date formats to ensuring all required information is present, cannot be overstated. Such precision averts delays and complications in resolving the claim. Additionally, the form mandates an authorized account signer to declare the statement’s truthfulness while explaining how to adequately identify the unauthorized transaction based on specific scenarios outlined in the NACHA Rules Subsection. This underscores the importance of understanding the form thoroughly to advocate successfully for the return of unauthorized ACH transactions. Bank of America emphasizes the need for timely, correct, and comprehensive submissions, acknowledging that deviations may impede the request's fulfillment.

Preview - Ach Transfer Bank Of America Form

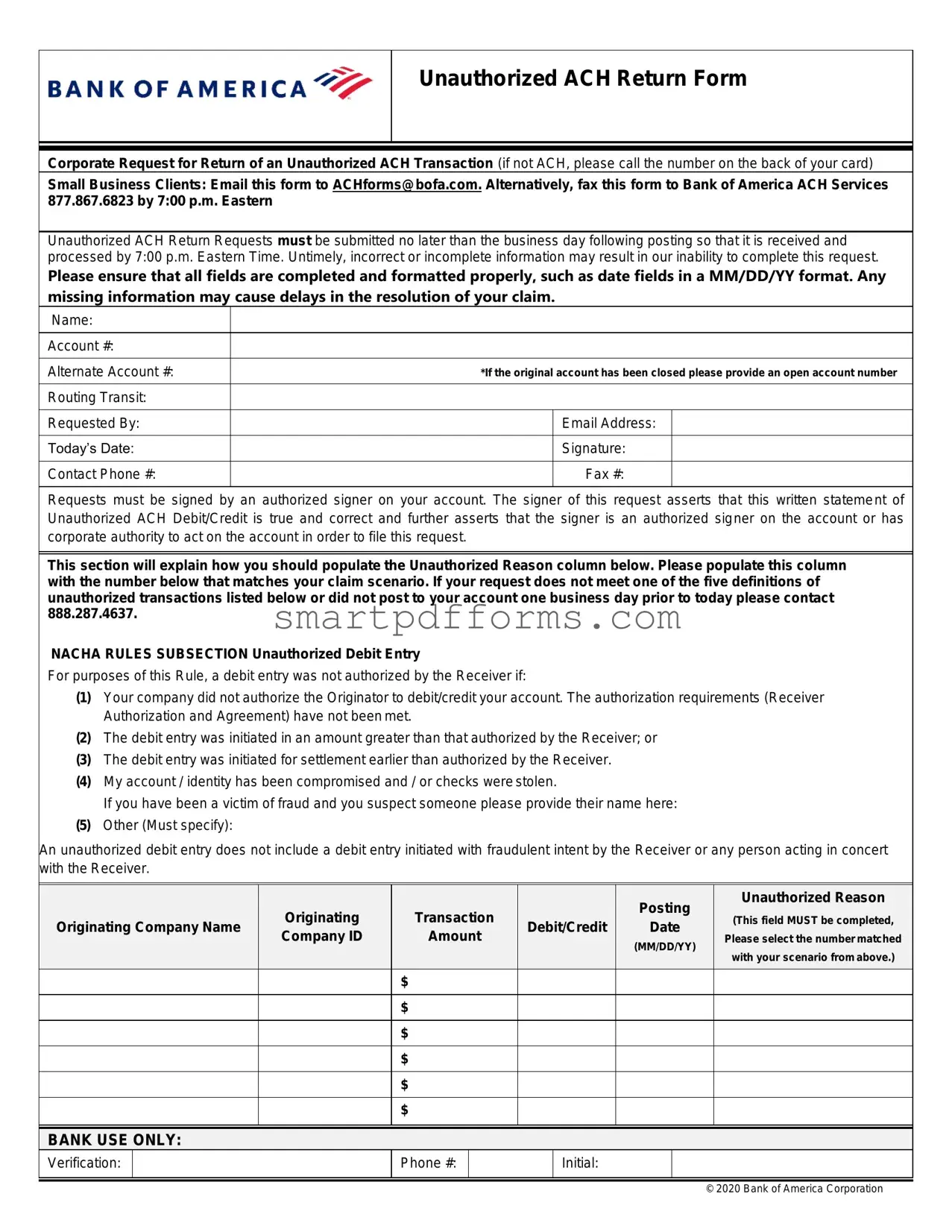

Unauthorized ACH Return Form

Corporate Request for Return of an Unauthorized ACH Transaction (if not ACH, please call the number on the back of your card)

Small Business Clients: Email this form to ACHforms@bofa.com. Alternatively, fax this form to Bank of America ACH Services 877.867.6823 by 7:00 p.m. Eastern

Unauthorized ACH Return Requests must be submitted no later than the business day following posting so that it is received and processed by 7:00 p.m. Eastern Time. Untimely, incorrect or incomplete information may result in our inability to complete this request.

Please ensure that all fields are completed and formatted properly, such as date fields in a MM/DD/YY format. Any missing information may cause delays in the resolution of your claim.

Name:

Account #:

Alternate Account #:

Routing Transit:

Requested By:

Today’s Date:

Contact Phone #:

*If the original account has been closed please provide an open account number

Email Address:

Signature:

Fax #:

Requests must be signed by an authorized signer on your account. The signer of this request asserts that this written statement of Unauthorized ACH Debit/Credit is true and correct and further asserts that the signer is an authorized signer on the account or has corporate authority to act on the account in order to file this request.

This section will explain how you should populate the Unauthorized Reason column below. Please populate this column with the number below that matches your claim scenario. If your request does not meet one of the five definitions of unauthorized transactions listed below or did not post to your account one business day prior to today please contact 888.287.4637.

NACHA RULES SUBSECTION Unauthorized Debit Entry

For purposes of this Rule, a debit entry was not authorized by the Receiver if:

(1)Your company did not authorize the Originator to debit/credit your account. The authorization requirements (Receiver Authorization and Agreement) have not been met.

(2)The debit entry was initiated in an amount greater than that authorized by the Receiver; or

(3)The debit entry was initiated for settlement earlier than authorized by the Receiver.

(4)My account / identity has been compromised and / or checks were stolen.

If you have been a victim of fraud and you suspect someone please provide their name here:

(5)Other (Must specify):

An unauthorized debit entry does not include a debit entry initiated with fraudulent intent by the Receiver or any person acting in concert with the Receiver.

|

Originating |

Transaction |

|

Posting |

Unauthorized Reason |

|

|

|

|||||

|

|

(This field MUST be completed, |

||||

Originating Company Name |

Debit/Credit |

Date |

||||

Company ID |

Amount |

Please select the number matched |

||||

|

|

(MM/DD/YY) |

||||

|

|

|

|

with your scenario from above.) |

||

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BANK USE ONLY:

Verification:

Phone #:

Initial:

© 2020 Bank of America Corporation

Form Data

| Fact Name | Description |

|---|---|

| Usage Purpose | This form is used exclusively for the return of unauthorized ACH transactions. |

| Target Audience | Corporate and small business clients of Bank of America are the primary users. |

| Submission Methods | Clients can submit the form via email to ACHforms(Q)bofa.com or fax it to Bank of America ACH Services at 877.867.6823. |

| Deadline for Submission | Requests must be submitted no later than the business day following the posting date, received and processed by 7:00 p.m. Eastern Time. |

| Information Accuracy | Incomplete or incorrect information may prevent the request from being completed. |

| Required Signatory | The request must be signed by an individual authorized to make claims on the account in question. |

| Governing Rules | The form adheres to NACHA rules for determining the authorization status of an ACH debit entry. |

Instructions on Utilizing Ach Transfer Bank Of America

Filling out the Unauthorized ACH Return Form for Bank of America is an essential step in disputing a transaction you did not authorize. This form, used specifically for ACH transactions, requires attention to detail and accuracy to ensure that the bank can process your request promptly. It's crucial to submit the form by the specified deadline and provide complete and correctly formatted information to avoid any delays in resolving your claim. The steps outlined below guide you through completing the form, helping you to reclaim control over your financial situation.

- Start by entering your Name as it appears on the bank account in question.

- Input your Account # where the unauthorized ACH transaction was posted.

- For the Alternate Account #, provide a different account number if the original has been closed. This is where any recovered funds should be redirected.

- Enter the Routing Transit number, which identifies your Bank of America branch.

- In the Requested By field, write your name to indicate who is making the request.

- Provide your Email Address to receive confirmations and further communication regarding your request.

- Today’s Date: Fill this with the current date, ensuring it's in the format MM/DD/YY.

- Under the Contact Phone #, list a number where you can be reached for any follow-up questions.

- If applicable, include a Fax # though it's optional.

- The form needs to be signed by an authorized signer on the account, verifying the truthfulness of the request.

- In the Unauthorized Reason column, select the number that corresponds with your specific unauthorized transaction scenario. Reference the NACHA RULES SUBSECTION provided for accurate selection.

- List the Originating Company Name and Originating Company ID to identify who initiated the transaction.

- Fill in the Transaction Amount, specifying how much was debited or credited without authorization.

- Enter the Debit/Credit notation based on whether the transaction was a charge (debit) or a refund/credit.

- Indicate the Posting Date of the unauthorized transaction, again using the MM/DD/YY format.

After filling out the form with the necessary information, review your entries carefully to ensure accuracy. Once satisfied, submit the form via email to ACHforms@bofa.com or fax it to 877.867.6823 no later than 7:00 p.m. Eastern Time on the next business day following the posting date of the unauthorized transaction. Timely and precise submission is crucial for the bank to process your request efficiently, aiming to rectify the unauthorized transaction and secure your account against future discrepancies.

Obtain Answers on Ach Transfer Bank Of America

What is an Unauthorized ACH Return Form from Bank of America?

This form is used by corporate or small business clients of Bank of America to request a return of an Automated Clearing House (ACH) transaction that was not authorized. When a company or individual claims that an ACH debit or credit to their account was made without their permission, they can use this form to initiate the process of getting the amount returned.

How do I submit an Unauthorized ACH Return Form to Bank of America?

Small business clients can submit the form either by emailing it to ACHforms@bofa.com or by faxing it to Bank of America ACH Services at 877.867.6823. The form must be submitted by 7:00 p.m. Eastern Time the business day following the posting date of the transaction in question. It's important to fill out all fields completely and correctly to avoid delays.

What deadlines apply for submitting the Unauthorized ACH Return Form?

Unauthorized ACH Return Requests must be submitted no later than the business day following the transaction posting day. They must be received and processed by Bank of America by 7:00 p.m. Eastern Time. Failing to meet this deadline may hinder the ability to complete the request successfully.

What information is required on the Unauthorized ACH Return Form?

The form requires several pieces of information, including the name on the account, account number, an alternate account number (if the original has been closed), the routing transit number, contact details (email, phone number, fax number), today’s date, and the signature of an authorized signer on the account. Additionally, specific details about the unauthorized transaction, such as the originating company name, ID, transaction amount, type (debit/credit), and posting date, must be completed accurately.

What are the definitions of unauthorized transactions according to the Unauthorized ACH Return Form?

The form lists five scenarios that qualify as unauthorized transactions under the NACHA Rules subsection. These include: transactions not authorized by the company, transactions in amounts greater than what was authorized, transactions settled earlier than authorized, accounts or identities that have been compromised or involve stolen checks, and a category for 'other' that requires specification. It's crucial for the filer to select the number that matches their claim scenario and provide adequate details.

What if my ACH transaction issue does not match the unauthorized transaction definitions on the form?

If the issue with the ACH transaction does not fit one of the five unauthorized transaction definitions provided, or if the transaction did not post to your account one business day prior to today, you are encouraged to contact Bank of America directly at 888.287.4637 for further assistance. They can provide guidance on how to proceed based on the specifics of your situation.

Common mistakes

Filling out the form without checking the authorization status of the transaction can lead to errors. Every person completing the form should verify whether the transaction was indeed unauthorized or if there might have been a misunderstanding or forgotten approval for the transaction. It is important to confirm this before proceeding to ensure that the claim is valid.

Neglecting to sign the form renders it incomplete. The form specifically requires a signature from an authorized signer of the account. This signature is crucial as it verifies the identity of the complainant and grants the request legitimacy. Without this signature, Bank of America may not proceed with the unauthorized ACH return request.

Incorrectly formatting the date fields, such as not adhering to the MM/DD/YY format, can cause delays. Date format adherence is vital because it ensures clarity and prevents confusion during the processing of the form. Mistakes in date formatting can lead to misunderstandings regarding the timeline of events, which is critical in unauthorized transaction claims.

Not providing complete information can hinder the process. The form explicitly mentions that untimely, incorrect, or incomplete information may result in an inability to complete the request. It is crucial to review each field and ensure all relevant information is supplied and accurately reflects the situation.

Submitting the form after the deadline can result in the request being voided. The instructions state that the Unauthorized ACH Return Requests must be submitted no later than the business day following posting, and received and processed by 7:00 p.m. Eastern Time. Timeliness is key, as failing to meet this deadline may lead to the inability of Bank of America to act on your request.

Ensure all fields are completed and accurately filled out to prevent unnecessary delays in the resolution of your claim.

Verify the authorization status of the transaction carefully before proceeding with the claim.

Adhering strictly to the required date format (MM/DD/YY) eliminates potential processing delays.

Remember, the signature of an authorized account signer is mandatory for the form's validity.

Keep the timing in mind; submitting your form on time is crucial for it to be considered.

Documents used along the form

When dealing with electronic transactions, especially Automated Clearing House (ACH) transfers with Bank of America, it's crucial to understand the associated forms and documentation that frequently accompany or complement the ACH Transfer Bank of America form. This knowledge ensures a smooth process, whether it's to resolve unauthorized transactions, facilitate transfers, or guarantee compliance with banking regulations. The documents listed below are often used alongside the Unauthorized ACH Return Form to provide a comprehensive framework for managing electronic payments and disputes.

- Account Opening Forms: Before initiating any ACH transfers, individuals or businesses must open an account with Bank of America. These forms collect essential information such as personal identification, business details (for corporate accounts), and legal agreements between the account holder and the bank.

- Direct Deposit Authorization Form: This form is used by individuals who wish to have their payroll or other recurring payments deposited directly into a Bank of America account. It requires the account holder's authorization and typically includes the employer's information, routing, and account numbers.

- Wire Transfer Request Form: While not directly related to ACH transfers, this form is used for requesting wire transfers, which are another form of electronic funds transfer. It's crucial for transactions that need to be completed more quickly than ACH transfers, requiring detailed beneficiary and banking information.

- Business Online Banking Enrollment Form: For businesses that wish to manage their accounts online, including initiating ACH transfers digitally, this enrollment form is essential. It gathers information needed to set up online banking capabilities and outlines the terms and services offered.

- Dispute Resolution Form: Aside from the Unauthorized ACH Return Form, there are circumstances where additional dispute resolution forms may be required. These documents are used to formally dispute transactions that were incorrectly processed, including but not limited to ACH transfers, wire transfers, and unauthorized card transactions.

Understanding and using these documents in conjunction with the ACH Transfer Bank of America form ensures that individuals and businesses can effectively manage their finances with greater security and efficiency. Whether opening a new account, setting up direct deposits, requesting wire transfers, enrolling in online banking, or resolving disputes, these forms provide the necessary framework to navigate the complexities of modern banking.

Similar forms

Wire Transfer Request Form: This form also allows individuals or businesses to move funds electronically, but it differs from ACH transfers in speed and cost, often being more expensive but faster.

Direct Deposit Authorization Form: Similar to ACH transfers for depositing salaries or other payments directly into bank accounts. The form usually requires bank account information and authorization to send funds directly to the accounts.

Debit Card Dispute Form: This form is used to dispute transactions made with a debit card, akin to disputing unauthorized ACH transactions but specifically for debit card issues.

Credit Card Dispute Form: Similar to the Debit Card Dispute form, this is used for contesting charges on a credit card, covering unauthorized transactions, billing errors, or quality of goods and services.

Bank Account Closure Form: While it serves a different purpose — to close a bank account — it may require similar information regarding the account and transaction details, especially if closing due to unauthorized activities.

Stop Payment Request Form: This form is used to request a bank to stop a check or preauthorized transfer. It is similar in the sense that it deals with preventing unwanted transactions from going through.

Fraudulent Account Activity Report Form: Utilized to report any suspected fraudulent activity on one's account, this form has a similar function in terms of securing the account from unauthorized transactions.

Online Banking Setup Form: While primarily for setting up online banking access, it shares similarities in requiring detailed account and personal identification information.

Bank Account Update Form: Used for updating personal or account details, this form might be needed after resolving issues related to unauthorized ACH transfers to ensure all account details are current.

Customer Complaint Form: Though broader in application, this form is used to report dissatisfaction with banking services, which might include unauthorized transactions or the handling thereof.

Dos and Don'ts

When filling out the ACH Transfer Bank Of America form, it's important to follow certain guidelines to ensure the process is smooth and error-free. Below is a list of things you should and shouldn't do:

Do:- Ensure all fields are completed: Missing information can delay the resolution of your claim. Pay special attention to fields that require dates to be in MM/DD/YY format.

- Verify the authorization requirements are met: Confirm that the company did not authorize the transaction if claiming an unauthorized debit/credit.

- Match your claim scenario with the correct unauthorized reason number: Select the number that matches your situation from the provided list and fill it in the Unauthorized Reason column.

- Sign the request: The form must be signed by an authorized signer on the account or someone with corporate authority to act on the account.

- Meet the submission deadline: Submit your request no later than the business day following the posting date of the transaction, by 7:00 p.m. Eastern Time.

- Delay your request: A request submitted after the deadline may result in the inability of the bank to process your claim effectively.

- Provide inaccurate or incomplete information: This may result in delays or the bank's inability to complete your request. Check all filled details for correctness before submission.

By following these guidelines, you can help ensure that your ACH Transfer Bank Of America form is filled out correctly and processed in a timely manner.

Misconceptions

When dealing with the Bank of America Unauthorized ACH (Automated Clearing House) Return Form, people often encounter a few common misconceptions. Understanding these aspects correctly is crucial for efficiently managing unauthorized transactions and ensuring one's financial safety.

Misconception #1: Any type of unauthorized transaction can be disputed using this form. Many believe this form is a one-size-fits-all for disputing any unauthorized bank transaction. However, it is specifically designed for ACH transactions. If the issue involves another type of transaction, such as fraud on your debit card, you must contact the bank through different channels.

Misconception #2: The form can be submitted at any time after noticing an unauthorized transaction. Timeliness is crucial. The Bank of America requires this form to be submitted no later than the business day following the posting of the unauthorized ACH transaction. Late submissions may result in the inability of the bank to process your request.

Misconception #3: Partially completed forms are acceptable. It's a common belief that if most of the information is provided, the form will be processed. However, missing details can lead to delays or the rejection of your claim. Every field must be accurately and fully completed.

Misconception #4: Authorization by any account holder is sufficient. The form specifically requires the signature of an authorized signer on the account. This means that the person requesting the return of an unauthorized ACH transaction must have the authority to act on behalf of the account in question.

Misconception #5: The form is complex and requires legal assistance to complete. Some account holders may be intimidated by the formal nature of the request and believe they need legal help to fill it out. In reality, the form is straightforward. By carefully following the instructions and accurately providing all required information, most individuals can complete the process independently.

Understanding these misconceptions can streamline the process of disputing unauthorized ACH transactions with Bank of America, ensuring account holders take the right steps promptly and efficiently.

Key takeaways

Filling out the ACH Transfer Bank of America form correctly is crucial for small business clients looking to report unauthorized ACH transactions efficiently. Below are key takeaways to ensure the process is smooth and successful.

- Identification of Unauthorized Transactions: It's important to correctly determine if the ACH transaction in question is indeed unauthorized, based on the definitions provided in the form and adhering to NACHA Rules Subsection Unauthorized Debit Entry criteria.

- Email or Fax Submission: Small Business Clients should submit the completed form either by email to ACHforms(Q)bofa.com or fax it to Bank of America ACH Services at 877.867.6823.

- Submission Deadline: To ensure timely processing, unauthorized ACH return requests must be submitted no later than the business day following the posting of the transaction and received by 7:00 p.m. Eastern Time.

- Accuracy of Information: Filling out the form with accurate and complete information is crucial. Make sure all fields are filled correctly and that date fields are in MM/DD/YY format to avoid delays in the processing of your claim.

- Authorized Signer's Responsibility: The request must be signed by an individual authorized on the account. They must certify that the claim is accurate and that they hold the necessary authority to act on the account's behalf.

- Selecting the Unauthorized Reason: Carefully choose the unauthorized reason that best matches your scenario from the options provided on the form. This helps in the clear communication and appropriate handling of your claim.

- Immediate Reporting: For a request to be considered, the unauthorized transaction must have posted to your account no later than one business day before submitting the form.

- Verification of Claim Information: Bank of America uses a verification process for the information provided on the form. Timely, correct, and complete submission helps in the swift resolution of your claim.

- Contact Information for Further Assistance: If your request does not meet the specified conditions for unauthorized transactions, or if there is any confusion, direct contact with Bank of America is recommended at 888.287.4637.

Adhering to these guidelines when filing an Unauthorized ACH Return Form with Bank of America can help ensure that your claim is processed efficiently, increasing the likelihood of a satisfactory resolution.

Popular PDF Forms

Dss 5163 - Crucial for documenting the adoptee's consent and understanding of the adult adoption process, ensuring it is a mutual decision.

Wall Water Leakage Detector - Essential facts about the leak adjustment request form for residents dealing with water leaks in Houston.