Blank Ach Vendor Payment PDF Template

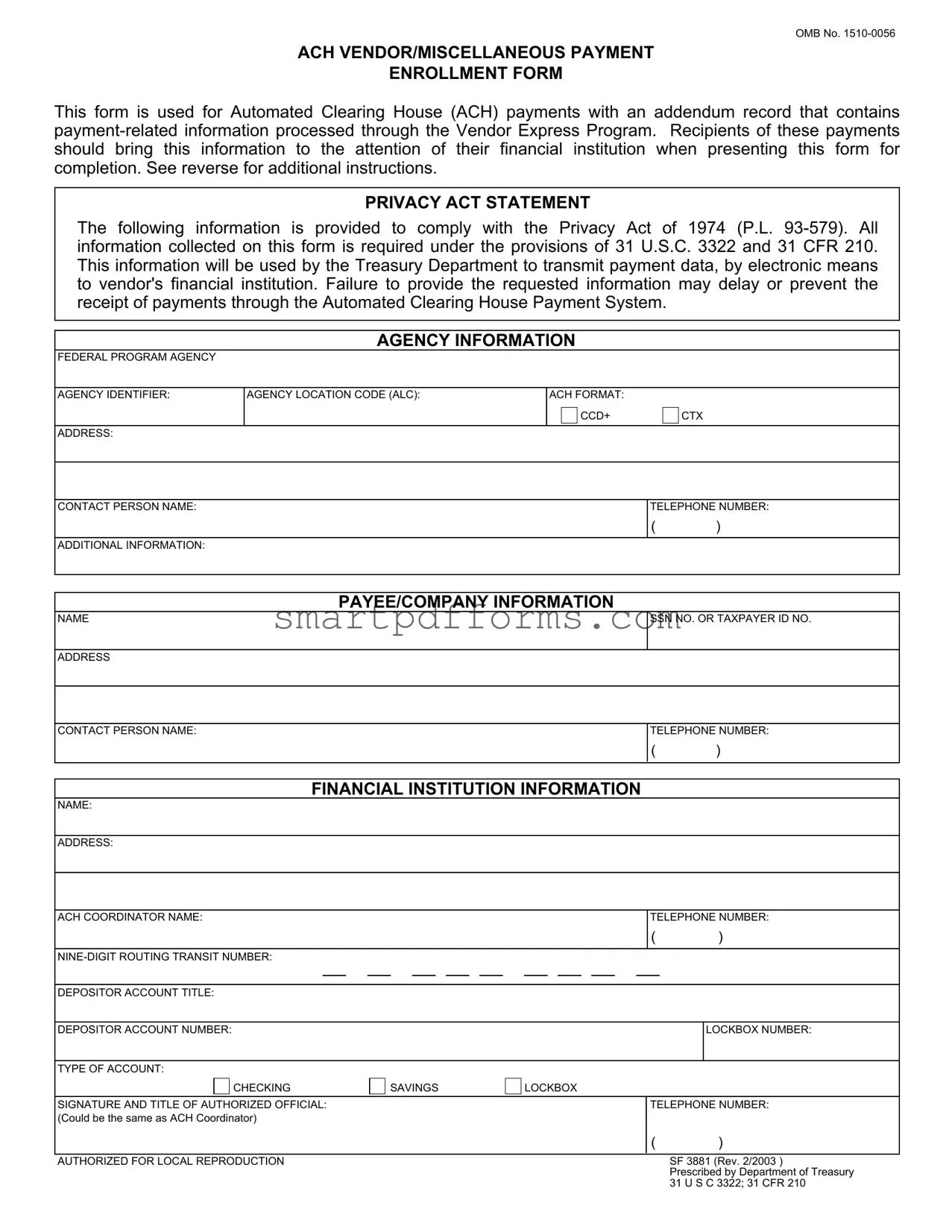

The Automated Clearing House (ACH) Vendor/Miscellaneous Payment Enrollment Form, overseen by the Office of Management and Budget (OMB No. 1510-0056), plays a significant role in the streamlining and enhancement of electronic transaction processes for vendors engaging with federal agencies. It is designed specifically for ACH payments accompanied by an addendum record, which houses pertinent payment-related information, under the Vendor Express Program. Entities receiving these payments are encouraged to share the form's details with their financial institutions to ensure accurate and efficient processing. The form includes a Privacy Act Statement in compliance with the Privacy Act of 1974, highlighting the necessity of the information it gathers for the Treasury Department to facilitate electronic payment transmissions to vendors' financial institutions. Furthermore, it incorporates sections for agency information, payee or company details, and financial institution data – each requiring specific inputs such as identifying codes, contact information, account details, and routing numbers. Additionally, instructions for completing the form and a duplication directive emphasize its operational importance, while a Burden Estimate Statement addresses the expected time investment for respondents. The structure and requirements outlined on this form underscore the Federal government's commitment to efficient transaction processes, securing privacy, and ensuring compliance within electronic financial operations.

Preview - Ach Vendor Payment Form

OMB No.

ACH VENDOR/MISCELLANEOUS PAYMENT

ENROLLMENT FORM

This form is used for Automated Clearing House (ACH) payments with an addendum record that contains

PRIVACY ACT STATEMENT

The following information is provided to comply with the Privacy Act of 1974 (P.L.

AGENCY INFORMATION

FEDERAL PROGRAM AGENCY

AGENCY IDENTIFIER: |

AGENCY LOCATION CODE (ALC): |

ACH FORMAT: |

|

|

||

|

|

|

|

CCD+ |

|

CTX |

|

|

|

|

|

||

|

|

|

|

|

|

|

ADDRESS: |

|

|

|

|

|

|

CONTACT PERSON NAME:

ADDITIONAL INFORMATION:

TELEPHONE NUMBER:

( )

PAYEE/COMPANY INFORMATION

NAME

ADDRESS

CONTACT PERSON NAME:

SSN NO. OR TAXPAYER ID NO.

TELEPHONE NUMBER:

( )

FINANCIAL INSTITUTION INFORMATION

NAME:

ADDRESS:

ACH COORDINATOR NAME:

TELEPHONE NUMBER:

( )

DEPOSITOR ACCOUNT TITLE:

DEPOSITOR ACCOUNT NUMBER: |

|

|

|

|

|

LOCKBOX NUMBER: |

||

|

|

|

|

|

|

|

|

|

TYPE OF ACCOUNT: |

|

|

|

|

|

|

||

|

|

CHECKING |

|

SAVINGS |

|

LOCKBOX |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

SIGNATURE AND TITLE OF AUTHORIZED OFFICIAL: |

|

|

|

|

TELEPHONE NUMBER: |

|||

(Could be the same as ACH Coordinator) |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

( |

) |

AUTHORIZED FOR LOCAL REPRODUCTION |

SF 3881 (Rev. 2/2003 ) |

|

Prescribed by Department of Treasury |

|

31 U S C 3322; 31 CFR 210 |

Instructions for Completing SF 3881 Form

Make three copies of form after completing. Copy 1 is the Agency Copy; copy 2 is the Payee/ Company Copy; and copy 3 is the Financial Institution Copy.

1.Agency Information Section - Federal agency prints or types the name and address of the Federal program agency originating the vendor/miscellaneous payment, agency identifier, agency location code, contact person name and telephone number of the agency. Also, the appropriate box for ACH format is checked.

2.Payee/Company Information Section - Payee prints or types the name of the payee/company and address that will receive ACH vendor/miscellaneous payments, social security or taxpayer ID number, and contact person name and telephone number of the payee/company. Payee also verifies depositor account number, account title, and type of account entered by your financial institution in the Financial Institution Information Section.

3.Financial Institution Information Section - Financial institution prints or types the name and address of the payee/company's financial institution who will receive the ACH payment, ACH coordinator name and telephone number,

Burden Estimate Statement

The estimated average burden associated with this collection of information is 15 minutes per respondent or recordkeeper, depending on individual circumstances. Comments concerning the accuracy of this burden estimate and suggestions for reducing this burden should be directed to the Financial Management Service, Facilities Management Division, Property and Supply Branch, Room

Form Data

| Fact Name | Description |

|---|---|

| Purpose of Form | Used for Automated Clearing House (ACH) payments to vendors, including an addendum record with payment-related information. |

| Program Under Which It Operates | Vendor Express Program. |

| Privacy Act Compliance | Collection of information complies with the Privacy Act of 1974 to transmit payment data to vendor's financial institution. |

| Legal Basis | Required under the provisions of 31 U.S.C. 3322 and 31 CFR 210. |

| Sections of the Form | Includes Agency Information, Payee/Company Information, and Financial Institution Information sections. |

| Instructions for Completion | Three copies of the form should be made after completing: Agency Copy, Payee/Company Copy, Financial Institution Copy. |

| Burden Estimate | Estimated average burden is 15 minutes per respondent or recordkeeper. |

Instructions on Utilizing Ach Vendor Payment

The process of filling out the ACH Vendor/Miscellaneous Payment Enrollment Form is a crucial step in ensuring the smooth and efficient transfer of payments through the Automated Clearing House (ACH) system. This form is typically utilized by vendors who wish to receive payments from federal agencies electronically, thereby expediting the payment process and reducing the reliance on physical checks. Understanding how to properly complete this form not only facilitates timely payment receipt but also helps in maintaining accurate and up-to-date financial records.

- Agency Information Section:

- Print or type the name and address of the Federal program agency originating the vendor/miscellaneous payment.

- Enter the specific agency identifier and agency location code (ALC).

- Type the contact person’s name and provide their telephone number.

- Check the appropriate box to indicate the ACH format being used, either CCD+ or CTX.

- Include any additional information that might be relevant for the processing of payments.

- Payee/Company Information Section:

- Print or type the name of the payee/company and its address, which will be used to receive ACH vendor/miscellaneous payments.

- Enter the social security or taxpayer ID number of the payee/company.

- Type the contact person’s name for the payee/company and provide their telephone number.

- Verify the depositor account number, account title, and type of account as entered by your financial institution in the Financial Institution Information Section. If any information is incorrect, it should be updated accordingly to ensure correct payment processing.

- Financial Institution Information Section:

- Print or type the name and address of the payee/company's financial institution, which will receive the ACH payment.

- Enter the name and telephone number of the ACH coordinator at the financial institution.

- Provide the nine-digit routing transit number, which is crucial for directing the payment to the correct institution.

- Check the appropriate box to indicate the type of account—either checking or savings—into which the payment will be deposited.

- Include the signature, title, and telephone number of the authorized official from the financial institution. This is an essential step for verifying the authenticity of the information and the authorization to process payments to the account.

Upon completing the form, ensure that three copies are made. Label them accordingly: one for the Agency Copy, one for the Payee/Company Copy, and one for the Financial Institution Copy. Distributing these copies appropriately ensures all parties have the necessary documentation for reference and record-keeping. This meticulous approach to document management aids in the prevention of discrepancies or misunderstandings that could potentially delay the processing of payments.

Obtain Answers on Ach Vendor Payment

- What is the ACH Vendor/Miscellaneous Payment Enrollment Form?

- Why is providing the requested information on this form important?

- What specific information is needed on the form?

- Agency Information Section: includes the federal program agency's details, such as name, address, contact information, and ACH format.

- Payee/Company Information Section: captures the payee's or company's name, address, social security or taxpayer ID number, and contact details, along with verifying account information.

- Financial Institution Information Section: requires information about the payee's financial institution, including the name, address, ACH coordinator's details, routing number, account title and number, and type of account.

- How many copies of the form are needed, and who receives them?

- Copy 1 is the Agency Copy.

- Copy 2 is the Payee/Company Copy.

- Copy 3 is the Financial Institution Copy.

- Are there instructions for filling out this form?

- Where can comments or suggestions about the form be directed?

This form is designed for use in the Automated Clearing House (ACH) payments system. It allows vendors to receive payments electronically through the Vendor Express Program. The form includes sections to be filled out by the federal agency making the payment, the payee or company receiving the payment, and the financial institution handling the transaction. It ensures payment-related information is correctly processed and transmitted.

Providing the requested information is crucial because it enables the Treasury Department to transmit payment data electronically to the vendor's financial institution. If the needed information is not supplied, it could delay or even prevent the receipt of payments through the ACH Payment System. This information must be accurate to ensure smooth and timely transactions.

Three main sections need to be completed:

After completing the form, three copies should be made:

Yes, the form includes detailed instructions on how to complete each section, ensuring that agencies, payees, and financial institutions provide the correct information. These instructions are vital for avoiding errors that could lead to payment delays.

If you have concerns about the time it takes to complete the form or suggestions for making the process more efficient, comments can be sent to two places: the Financial Management Service, Facilities Management Division, at their Property and Supply Branch in Hyattsville, MD, and the Office of Management and Budget's Paperwork Reduction Project in Washington, DC. These organizations collect feedback to improve the burden estimate and the overall process.

Common mistakes

Filling out the ACH Vendor/Miscellaneous Payment Enrollment Form can be daunting, and mistakes are easily made. By knowing what to look out for, individuals can ensure a smoother process. Here are seven common errors to avoid:

Not reviewing the Privacy Act Statement — It's crucial to understand how your information will be used and protected. Ignoring this can lead to misunderstandings about the privacy of your personal details.

Incorrect agency information — Filling in the wrong agency identifier or location code can direct your payment to the wrong place. This section is vital for ensuring your payment is processed properly.

Failing to provide accurate Payee/Company Information — Mismatched or erroneous social security numbers, taxpayer ID numbers, or contact information can delay or prevent payments.

Omitting details in the Financial Institution Information — Every piece of information in this section, from the routing transit number to the type of account (checking or savings), must be accurate to ensure successful transactions.

Skipping the type of account — Not checking the box for the type of account can lead to payments being processed incorrectly, which might result in delays.

Neglecting to verify depositor account information — It's the payee's responsibility to ensure that the account number and title entered match their records. Discrepancies here can cause payments to go awry.

Forgetting to sign the form — A common, yet critical mistake is not signing the form. Without the signature and title of the authorized official, the form is incomplete and will not be processed.

Avoiding these mistakes can greatly enhance the efficiency of your ACH transactions. Diligence and double-checking each section ensures your payments are processed quickly and correctly.

Documents used along the form

When managing vendor payments through the Automated Clearing House (ACH), a variety of documents and forms are often required to ensure seamless transactions and compliance with legal and financial standards. The ACH Vendor/Miscellaneous Payment Enrollment Form is crucial for initiating these electronic transfers. However, companies and financial institutions also rely on several other documents to facilitate and record these transactions accurately.

- W-9 Form: This form is necessary for collecting the correct taxpayer identification number (TIN) and certification to confirm that the payee is not subject to backup withholding taxes. It's a prerequisite for any entity engaging in a financial transaction that generates taxable income.

- Direct Deposit Authorization Form: Though similar to the ACH enrollment form, the Direct Deposit Authorization Form specifically grants permission to deposit funds directly into a bank account. It requires the account holder’s signature, providing an added layer of security.

- Invoice: An invoice is a detailed list of goods or services provided, including prices, terms, dates, and other important transaction details. It serves as a request for payment from the vendor to the company.

- Bank Confirmation Letter: This document from a bank authenticates a company’s or individual's banking details, such as account numbers and balances. It’s crucial for verifying the information provided on the ACH form.

- Vendor Agreement: A legal contract between a vendor and a client that outlines the goods or services to be provided, payment terms, confidentiality policies, and dispute resolution procedures. It sets the foundation for the financial relationship.

- Payment Remittance Advice: Often accompanying a payment, this document details what invoices the payment covers, the method of payment, and any deductions or adjustments made. It helps vendors reconcile their accounts receivable.

Together, these documents form a comprehensive toolkit that supports the ACH payment process. Each plays a vital role in ensuring that payments are processed efficiently, accurately, and in compliance with regulatory requirements. Beyond just facilitating transactions, these forms and documents cement the financial relationship between vendors and companies, aiding in clear communication and mutual understanding.

Similar forms

The Direct Deposit Enrollment Form is similar to the ACH Vendor Payment form in that both are used to arrange the electronic transfer of funds to an account. Like the ACH form, it collects the recipient's bank account and routing numbers, as well as personal identification information, to ensure the funds are accurately deposited.

The IRS W-9 Form shares similarities with the ACH form in its collection of taxpayer identification numbers and the certification of information provided by the payee or vendor. Both forms are integral in the process of reporting and documenting financial transactions for federal tax purposes.

The Electronic Funds Transfer (EFT) Authorization Form is akin to the ACH Vendor Payment form as it permits the transfer of funds from one bank account to another electronically. Both require information about the financial institution receiving the funds, including the routing and account numbers.

A Vendor Setup and Update Form also mirrors the ACH Vendor Payment form by collecting vendor information, such as contact details and bank information, to initiate or update payment arrangements. This form is critical for entities managing a large number of vendors to ensure payments are processed efficiently.

The Payroll Direct Deposit Authorization Form is comparable since it sets up the electronic deposit of an employee's earnings into their bank account, much like the ACH form does for vendor payments. It captures employee banking information and authorization for the deposit.

The Bank Wire Transfer Request Form is similar in its purpose of facilitating the electronic transfer of funds. However, it is typically used for immediate and one-time transactions, unlike the ACH, which can be used for repeated payments. Both forms require detailed information about the sender's and recipient's bank accounts.

Dos and Don'ts

When filling out the ACH Vendor Payment Enrollment Form, it is important to pay attention to details to ensure accurate and timely processing. Here are three things you should do and three things you shouldn't to help you navigate the process smoothly:

-

Do's:

- Review the form thoroughly before starting. Make sure you understand each section and what information is required. This will save time and minimize errors.

- Verify the accuracy of all information you provide, especially your Social Security or Taxpayer ID number, financial institution's nine-digit routing transit number, and your account number. Errors in these critical pieces of information can delay payment processing.

- Consult with your financial institution, especially regarding the ACH coordinator's name and the correct type of account (checking or savings). They can provide valuable guidance and ensure that your form is completed properly.

-

Don'ts:

- Do not leave any required fields blank. Incomplete forms can lead to processing delays or outright rejection of your enrollment.

- Avoid guessing on any of the details, such as your bank's routing number or the specific type of account. Incorrect information can cause payments to be misrouted or lost.

- Do not fail to make the necessary copies of the form once completed. Remember, you need to keep a copy for your agency, one for yourself (the payee/company), and one for your financial institution.

By following these guidelines, you'll help ensure that your enrollment in the ACH Vendor Payment system is successful and that your payments are processed efficiently and correctly.

Misconceptions

There are several misconceptions about the ACH Vendor/Miscellaneous Payment Enrollment Form that can lead to confusion. Let's clear up some of the most common misunderstandings:

- It's only for big businesses: Individuals and small businesses can also use this form to receive payments via the ACH Network. It's not exclusively for large corporations.

- It's too complicated: While the form contains detailed information, it's designed to ensure accurate and secure payments. With the right information, filling it out is straightforward.

- Information is optional: Compliance with the Privacy Act of 1974 requires all fields to be completed. Missing information can delay or prevent payments.

- Same as direct deposit: Although ACH payments are a form of electronic payment, like direct deposits, this form specifically facilitates vendor and miscellaneous payments, which might carry additional details in the addendum records.

- One-time setup: Changes in bank details, such as account numbers or financial institutions, necessitate submitting a new form. It's not a one-and-done deal.

- No need to notify the bank: It's essential to inform your financial institution of upcoming ACH payments. This can help ensure they are processed smoothly.

- Personal bank accounts are incompatible: You can use personal accounts for receiving ACH payments. However, ensure the account details are correctly provided on the form.

- Security concerns: The ACH Network is a secure method of payment. Furthermore, the form's Privacy Act Statement outlines how personal information is protected.

- Only for U.S. entities: While primarily used within the U.S., international vendors can be paid through the ACH network if their financial institutions can receive ACH payments and are part of the network.

Understanding the ACH Vendor/Miscellaneous Payment Enrollment Form is crucial for ensuring timely and secure transactions. Clearing up these misconceptions can help streamline the payment process for vendors and their clients.

Key takeaways

Filling out the ACH Vendor Payment Enrollment Form correctly is crucial for ensuring smooth and timely payments. Here are key takeaways to remember:

- Gather all necessary information before beginning. This includes agency information, payee/company details, and financial institution data.

- Be precise when filling out the Agency Information Section. This section captures the originating federal program agency details. Incorrect information here can lead to payment delays.

- In the Payee/Company Information Section, double-check the accuracy of the social security or taxpayer ID number and the contact details. Mistakes in this section can directly impact the receipt of payments.

- The Financial Institution Information Section requires careful attention to detail. The correct routing transit number and account information are critical for directing funds to the right destination.

- Checking the type of account correctly—whether checking, savings, or lockbox—is essential. This affects where the funds are deposited.

- Ensure all copies are distributed appropriately after completion: one for the agency, one for the payee/company, and one for the financial institution. Retaining a copy for your records is also a good practice.

By paying attention to these details, you can facilitate a smoother transaction process, avoid common pitfalls, and expedite the receipt of ACH vendor payments. Remember, accuracy and clarity in completing the form play a pivotal role in the success of electronic transactions.

Popular PDF Forms

Pasport - The PPTC 001 form reflects the Canadian government's efforts to meticulously document the citizenship status of those born abroad to Canadian parents.

How Do I Know If My Medical Is Active - This document is crucial for keeping Medi-Cal information updated, reflecting any changes in family size or status.

Jurat Form California 2023 - The Jurat form is imperative in legal settings where the authenticity and veracity of a document's contents are critical, such as in court proceedings.