Blank Additional Insured PDF Template

In the complex terrain of commercial general liability insurance, the Additional Insured – Owners, Lessees or Contractors – Completed Operations form, or CG 20 37 04 13, emerges as a critical modification to the standard policy landscape. This endorsement, carefully tailored by the Insurance Services Office, Inc. in 2012, plays a pivotal role in extending coverage to additional insureds, typically involving the likes of owners, lessees, or contractors, but specifically in relation to completed operations. It delineates the parameters under which these additional insureds gain protection, centering on liabilities arising from bodily injury or property damage tied to the insured's work completed at a specified location. Key to understanding and applying this endorsement is the recognition of its exclusivity: coverage for additional insureds is contingent upon the compliance with legal boundaries and the specifics of contractual agreements that necessitate such coverage. Furthermore, it imposes limitations correlating to the insurance limits stated in the agreement or the policy's declarations, thereby ensuring that the protection afforded does not exceed stipulated bounds. This structured approach to extending liability coverage underscores the nuanced negotiation of risk management in commercial operations, balancing contractual necessities with legal constraints.

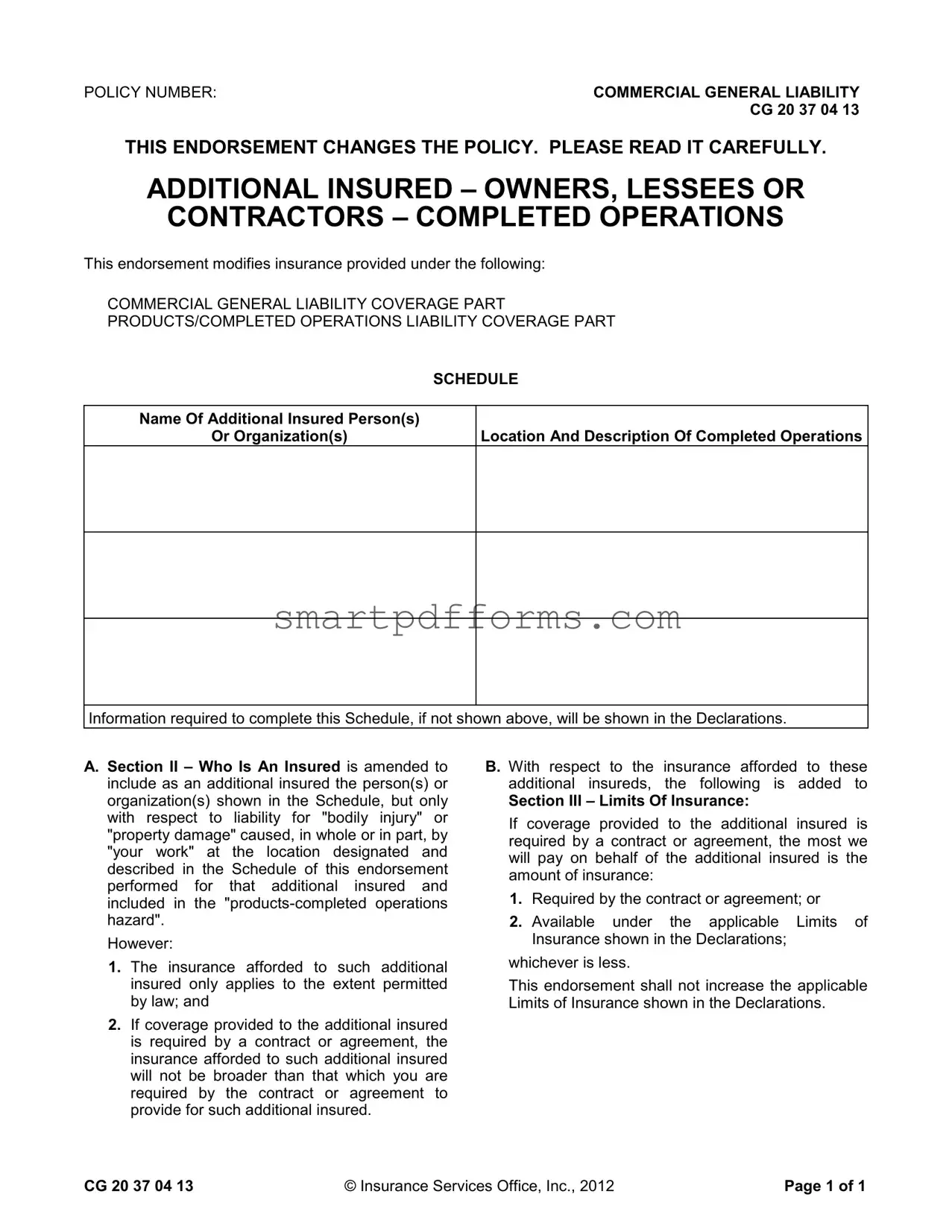

Preview - Additional Insured Form

POLICY NUMBER: |

COMMERCIAL GENERAL LIABILITY |

|

CG 20 37 04 13 |

THIS ENDORSEMENT CHANGES THE POLICY. PLEASE READ IT CAREFULLY.

ADDITIONAL INSURED – OWNERS, LESSEES OR CONTRACTORS – COMPLETED OPERATIONS

This endorsement modifies insurance provided under the following:

COMMERCIAL GENERAL LIABILITY COVERAGE PART

PRODUCTS/COMPLETED OPERATIONS LIABILITY COVERAGE PART

SCHEDULE

Name Of Additional Insured Person(s)

Or Organization(s)

Location And Description Of Completed Operations

Information required to complete this Schedule, if not shown above, will be shown in the Declarations.

A.Section II – Who Is An Insured is amended to include as an additional insured the person(s) or organization(s) shown in the Schedule, but only with respect to liability for "bodily injury" or "property damage" caused, in whole or in part, by "your work" at the location designated and described in the Schedule of this endorsement performed for that additional insured and included in the

However:

1.The insurance afforded to such additional insured only applies to the extent permitted by law; and

2.If coverage provided to the additional insured is required by a contract or agreement, the insurance afforded to such additional insured will not be broader than that which you are required by the contract or agreement to provide for such additional insured.

B. With respect to the insurance afforded to these additional insureds, the following is added to

Section III – Limits Of Insurance:

If coverage provided to the additional insured is required by a contract or agreement, the most we will pay on behalf of the additional insured is the amount of insurance:

1.Required by the contract or agreement; or

2.Available under the applicable Limits of Insurance shown in the Declarations;

whichever is less.

This endorsement shall not increase the applicable Limits of Insurance shown in the Declarations.

CG 20 37 04 13 |

© Insurance Services Office, Inc., 2012 |

Page 1 of 1 |

Form Data

| Fact Number | Fact Detail |

|---|---|

| 1 | The endorsement is identified as CG 20 37 04 13. |

| 2 | This endorsement modifies the Commercial General Liability Coverage Part and the Products/Completed Operations Liability Coverage Part. |

| 3 | The purpose of this endorsement is to include additional insureds for liability arising from the named insured's completed operations. |

| 4 | Coverage is provided under this endorsement only for bodily injury or property damage caused in whole or in part by the named insured's work at a designated location. |

| 5 | Insurance coverage for the additional insureds is conditioned to be within the extent permitted by law. |

| 6 | If required by a contract or agreement, the coverage will not exceed the scope mandated by that contract or agreement. |

| 7 | For contractual requirements, the maximum payable amount on behalf of an additional insured is the lesser of the amount required by contract or the limit of insurance available under the policy. |

| 8 | This endorsement does not increase the overall limits of insurance provided under the policy. |

| 9 | Information about the additional insured person(s) or organization(s) and the location/description of completed operations is provided in the schedule attached to the endorsement or in the Declarations. |

| 10 | This endorsement was copyrighted in 2012 by the Insurance Services Office, Inc. |

Instructions on Utilizing Additional Insured

Completing the Additional Insured form is a critical step in modifying your commercial general liability coverage. It involves designating additional insured persons or organizations, specifying their connection to your operations, and detailing the completed operations covered. This process ensures that your policy accurately reflects the extended coverage to additional insureds as per your agreement with them. By following the steps below, you can accurately complete the form and ensure all necessary information is communicated to your insurance provider.

- Locate the POLICY NUMBER section at the top of the form and input your current commercial general liability policy number.

- In the SCHEDULE section, write the full name(s) of the person(s) or organization(s) you wish to add as an additional insured. Ensure the names are spelled correctly and match the official documents.

- Under the Location And Description Of Completed Operations, provide a detailed description of the completed operations for which the additional insureds are being covered. This should include the specific location(s) of the operations and any relevant details that describe the scope of work completed.

- Review the declarations section of your policy to see if any required information not specified on the form should be included. If so, include this information in the appropriate sections on the Additional Insured form.

- Read carefully through sections A and B under the endorsement agreement to ensure you understand how the addition of insureds affects the coverage and limits of insurance.

- Verify that the coverage extended to the additional insureds complies with any contractual requirements or agreements, noting the insurance limits and any legal constraints on the form.

- Before finalizing the form, double-check all entered information for accuracy and completeness. Any errors or omissions could affect the validity of the coverage for the additional insureds.

- Once completed, submit the form to your insurance provider according to their submission guidelines. Some providers may require a physical copy, while others might accept digital submissions.

After submission, your insurance provider will process the Additional Insured form. This involves reviewing the information provided and officially modifying your policy to include the additional insureds. It's important to keep a copy of the submitted form for your records and to follow up with the insurance provider if you do not receive confirmation of the change within their specified time frame. Properly adjusting your commercial general liability coverage in this manner helps protect not only your interests but also those of your partners or clients, in alignment with your agreements.

Obtain Answers on Additional Insured

What is the purpose of the CG 20 37 04 13 Additional Insured Endorsement?

The CG 20 37 04 13 Additional Insured Endorsement is designed to extend the coverage of a Commercial General Liability (CGL) policy to include as additional insureds certain individuals or organizations, specifically owners, lessees, or contractors, related to completed operations. This means that if the named insured performs work for these additional insureds, they are protected under the named insured's policy for liability claims arising out of the named insured's completed work. This endorsement is crucial for protecting additional insureds against potential liabilities related to the named insured's work, within the scope defined by the endorsement.

Who can be added as an additional insured under the CG 20 37 04 13 form?

Under the CG 20 37 04 13 form, the individuals or organizations that can be added as additional insureds include owners, lessees, or contractors. These entities are added only with respect to liability for "bodily injury" or "property damage" that arises out of the named insured's work at a location specified and described in the endorsement schedule, and only if the work performed is for the benefit of the additional insured and falls within the "products-completed operations hazard."

Are there any limitations to the coverage provided to additional insureds under this endorsement?

Yes, there are specific limitations to the coverage provided to additional insureds under the CG 20 37 04 13 endorsement. First, the coverage extended to additional insureds is only applicable to the extent permitted by law. Furthermore, if the inclusion of the additional insured is mandated by a contract or agreement, the breadth of coverage provided will not exceed what is required by said contract or agreement. Additionally, the maximum amount payable on behalf of an additional insured cannot surpass the lesser of what is demanded by the contract or what is available under the policy's limits of insurance.

Does the CG 20 37 04 13 endorsement alter the policy's overall Limits of Insurance?

No, the CG 20 37 04 13 endorsement does not increase the overall Limits of Insurance of the policy. Although it extends coverage to additional insureds, it clarifies that the most that will be paid on behalf of an additional insured is the amount required by the contract or the limits available under the policy, whichever is lesser. This provision serves to protect the insurer from exceeding the policy's designed financial limits while still providing coverage to additional insureds as required by agreements or contracts.

Is it mandatory for the additional insured to be named in the policy's declarations?

The additional insured does not necessarily have to be named in the policy's declarations. The endorsement specifies that the required information to complete the schedule of the additional insured(s), if not shown above, will be reflected in the Declarations. This means the individual or organization to be added as an additional insured can be listed in the endorsement schedule or within the policy's Declarations section, ensuring flexibility in how additional insureds are documented and covered under the policy.

Common mistakes

Filling out the Additional Insured form, especially the CG 20 37 (04 13) version, is critical for ensuring that certain individuals or organizations are covered under a Commercial General Liability policy for specific liabilities. However, common mistakes can significantly impact the effectiveness of this coverage. Understanding these errors can help in correctly completing the form and securing appropriate insurance coverage.

Not reading the endorsement carefully: Many people fail to read the endorsement thoroughly, missing vital information about what changes are being made to the policy. This can lead to misunderstandings about the coverage extent.

Incorrectly identifying the Additional Insured: Misidentifying the person or organization that should be added as an Additional Insured is a common error. This mistake can void the intended coverage for the wrongly identified party.

Omitting the location and description of completed operations: The form requires details of the location and the completed operations. Failing to provide this information can lead to insufficient coverage.

Assuming broad coverage automatically applies: The endorsement specifies that coverage for the Additional Insured is often only for liabilities directly caused by the policyholder’s work. Some mistakenly believe it covers all liabilities associated with the Additional Insured.

Ignoring the limits of insurance clause: The insurance coverage for the Additional Insured cannot exceed the limits established in the agreement or the policy itself. Overlooking this clause can lead to unrealistic expectations of coverage amount.

Not understanding the legal constraints: Coverage is provided to the extent permitted by law. Ignoring or misunderstanding this can lead to complacency about what protections the endorsement actually offers.

Overlooking the contract’s insurance requirements: When coverage is mandated by a contract or agreement, the Additional Insured form must mirror those requirements. Skipping this step can result in non-compliance and inadequate coverage.

Misinterpreting the ‘completed operations’ provision: This endorsement is specifically for liabilities arising from completed operations. Confusing it with ongoing operations can leave gaps in coverage.

Failure to update the form: If the project scope or involved parties change, the form should be updated to reflect these changes. Failure to do so can leave new operations or parties uncovered.

Properly filling out the Additional Insured form requires attention to detail and an understanding of insurance practices and laws. Avoiding the mistakes listed above can ensure that all parties have the appropriate coverage for the duration of the policy.

Documents used along the form

When managing insurance needs, especially in commercial settings, the Additional Insured form plays a crucial role in extending coverage to other parties involved in a project or operation. However, this document often does not stand alone. It is typically one of several forms and documents needed to ensure comprehensive coverage and compliance with contractual agreements. Here is a list of other forms and documents frequently utilized alongside the Additional Insured form to create a complete insurance package:

- Certificate of Insurance (COI): A document that provides evidence of insurance coverage. It outlines the types and limits of coverage, insurance company name, policy number, and policy effective dates.

- Endorsement Page: This portion of the policy amends or adds certain terms and conditions to the original contract without altering the original agreement's essence.

- Waiver of Subrogation: A waiver that prevents an insurance carrier from seeking compensation from a third party that may have contributed to a loss. This is particularly relevant when multiple parties work together on a project.

- Indemnity Agreement: A contract that outlines one party's agreement to compensate for the loss incurred by another party, often pivotal in contractual relationships to manage risk.

- Policy Declarations Page: The part of the insurance policy that includes detailed information about the insured, the insurer, the coverage limits, and other key details specific to the policy.

- Exclusions Section: An integral part of the policy, listing the damages and events not covered by the insurance policy. Understanding these exclusions is crucial as it defines the policy's limitations.

- Conditions Section: This section outlines the obligations of the insured and the insurer. It includes the procedures for filing a claim, the insurer's promise to settle claims promptly, and other conditions both parties must adhere to.

- Proof of Loss: A formal statement provided by the policyholder to the insurer, detailing the specifics of a claim. This document is necessary for the insurer to begin processing a claim.

- Schedule of Values: Often used in construction insurance, this document lists the materials, labor, and other costs involved in a project. It's essential for underwriting purposes and helps in the accurate valuation of covered items.

In conclusion, while the Additional Insured form is critical in extending coverage to other parties involved in your operations, it is but one piece of the puzzle. Ensuring that all these documents are in place and accurately reflect the scope of the project and the risks involved is essential to maintaining adequate insurance protection and complying with contractual obligations. It's always a good idea to consult with an insurance professional to ensure that your coverage is comprehensive and meets all legal and contractual requirements.

Similar forms

Certificate of Insurance (COI): Like the Additional Insured form, a Certificate of Insurance serves as proof of coverage but does not modify the policy itself. Both documents provide evidence to third parties that specific coverage is in place. The Additional Insured form explicitly modifies the policy to include an additional insured party, while a COI summarizes the insurance policies and coverages already in effect, including any Additional Insured endorsements that have been made.

Indemnity Agreement: Similar to the Additional Insured form, an Indemnity Agreement is used to outline the responsibilities of one party to compensate for losses or damages incurred by another. Both documents are often required in business contracts to manage risks associated with liability claims. Whereas the Additional Insured form provides direct coverage under the policyholder's insurance to another party, an indemnity agreement may require the indemnifying party to cover losses or damages, potentially through their own insurance.

Waiver of Subrogation: This document is akin to the Additional Insured form in that both can alter how claims are handled and paid by insurers. A Waiver of Subrogation prevents an insurance company from seeking recovery from a third party that may have caused an insurance loss to the insured. While the Additional Insured form extends coverage to include other parties as insureds under the policy, a Waiver of Subrogation affects the rights of insurers to pursue claims against third parties, potentially including additional insureds.

Named Insured Endorsement: The Named Insured Endorsement modifies who is protected under an insurance policy, similar to the Additional Insured endorsement. Both endorsements expand the scope of coverage beyond the original policyholder. However, the Named Insured Endorsement typically designates another entity or individual as a primary insured, sharing equal status with the policyholder. In contrast, the Additional Insured form extends coverage to other parties related to specific operations or activities, often with less comprehensive coverage than that provided to the Named Insured.

Dos and Don'ts

When filling out the Additional Insured form, especially the CG 20 37 04 13 related to commercial general liability and completed operations, it's crucial to approach the task with precision and attention to detail. Below are key dos and don'ts to guide you through the process.

Do:- Review the entire form carefully – Ensure you understand every section to avoid any misinterpretation of what is required.

- Provide accurate information – The name of the additional insured person(s) or organization(s), and the location and description of completed operations must be precisely filled in to reflect the actual parties and operations covered.

- Consult with a professional – If there's any doubt or confusion about how to complete the form or its implications, seeking advice from an insurance or legal professional can prevent costly mistakes.

- Verify the coverage requirements – Make sure the coverage you're providing to the additional insured aligns with what is mandated by any contract or agreement, without exceeding the limits.

- Check the applicable laws – Since the endorsement mentions coverage is provided "to the extent permitted by law," ensure that the coverage complies with local, state, or federal regulations.

- Confirm the limits of insurance – Understand the maximum amount payable under the policy to an additional insured, ensuring it meets the contract requirements without surpassing the policy's limits of insurance.

- Overlook the endorsement's specific language – Failing to comprehend the implications of the clauses, especially those related to the scope of coverage and the limits of insurance, can lead to unwarranted expectations.

- Assume all responsibilities – The endorsement specifies that coverage for additional insureds is linked to the work performed for them, so make sure the described operations accurately reflect this scope.

- Forget to update the form – Should there be changes in the operations, contracts, or laws affecting the coverage, the form should be updated accordingly to maintain its accuracy and relevance.

- Ignore contract or agreement specifics – Since the coverage is often tied to contractual requirements, disregarding these specifics can lead to insufficient or inappropriate coverage.

- Provide misleading information – Inaccuracies can nullify the coverage and potentially lead to legal challenges or financial loss.

- Delay submission – Timely submission of the completed form is crucial to ensure coverage is in place when needed. Procrastination can lead to unintended gaps in protection.

Misconceptions

Understanding the Additional Insured endorsement, specifically form CG 20 37 04 13, is crucial for all parties involved in a commercial general liability policy. However, several misconceptions surround its use and implications. Here, we will address and clarify seven common misunderstandings.

- Misconception 1: The additional insured endorsement provides unlimited coverage. In reality, the coverage is explicitly limited to liability for bodily injury or property damage caused by the named insured's work for the additional insured, within the scope described in the schedule.

- Misconception 2: Adding an additional insured provides coverage for all types of liabilities. This specific endorsement only covers the completed operations of the named insured and does not extend to all potential liabilities the additional insured might face.

- Misconception 3: The coverage for additional insureds is broader than that for the named insured. The endorsement clarifies that the insurance afforded will not be broader than what is required by contract or agreement and is subject to the policy's terms and limits.

- Misconception 4: The additional insured endorsement extends the policy’s aggregate limits. The endorsement expressly states that it does not increase the Limits of Insurance shown in the Declarations.

- Misconception 5: All additional insureds have the same coverage. Coverage varies based on the requirements outlined in the contract or agreement and can only be activated with respect to liability directly related to the named insured's work for the additional insured as specified.

- Misconception 6: The named insured's policy's duties to defend are extended to additional insureds without limitation. In practice, the duty to defend additional insureds is limited to claims that fall within the coverage scope outlined in the endorsement and subject to the terms of the insurance policy.

- Misconception 7: Completing the schedule fully outlines the additional insured's coverage. Essential coverage details for additional insureds are dictated not just by what is filled out in the schedule but also by the underlying contract or agreement requirements and the applicable law.

Clarifying these misconceptions is essential for both named and additional insureds to fully understand their rights, obligations, and the extent of their coverage under a commercial general liability policy. It helps in setting accurate expectations and promotes smoother relationships between contractual parties.

Key takeaways

Understanding the Additional Insured endorsement, specifically form CG 20 37 04 13, is critical for ensuring proper coverage in commercial general liability policies. This form plays a pivotal role in defining who is covered and under what circumstances, especially for owners, lessees, or contractors after a project has been completed. Here are key takeaways to guide through accurately filling out and utilizing this form:

- Identification of Additional Insureds: It's essential to clearly identify the person(s) or organization(s) being added as additional insureds on the schedule. This includes specifying the location and description of the completed operations covered. Accuracy in this step ensures that the intended parties receive coverage and helps avoid disputes over who is insured under the policy.

- Scope of Coverage: The coverage extended to additional insureds is specifically related to liability arising from “bodily injury” or “property damage” connected to the work performed for the additional insured at the designated location. It's important to understand that this coverage is inherently limited to incidents stemming from the named insured's completed operations.

- Compliance with Law and Contracts: Coverage for additional insureds is contingent upon compliance with applicable laws and the requirements of any contract or agreement in place. This implies that the insurance will not provide broader coverage for additional insureds than what the law allows or what has been contractually agreed upon. Ensuring that the coverage meets legal and contractual obligations is paramount.

- Limits of Insurance: An important aspect to note is that the endorsement specifies limits on the amount of coverage available to additional insureds. The maximum payable is the lesser of the amount required by a contract or the limits shown in the policy declarations. This limitation highlights the need to closely review and understand the limits of insurance to ensure they align with contractual requirements and risk exposures.

In summary, when dealing with the Additional Insured endorsement CG 20 37 04 13, attention to detail is vital. From accurately designating additional insureds to understanding the extent and limits of coverage, each element requires careful consideration to ensure comprehensive protection is in place for all parties involved. This endorsement is a valuable tool for managing risk in commercial relationships, particularly when it comes to completed projects, but it demands a thorough understanding and meticulous handling to be fully effective.

Popular PDF Forms

Examples of Intake Forms - Questions are designed to understand the home environment, including relationships, communication styles, rules, and consequences within the family unit.

Free Diabetic Log Book by Mail - The comment section of the logbook offers space for notes on diet changes, exercise habits, and any other factors that might impact blood sugar, fostering a comprehensive health overview.

What's an Employer Statement - This document is not just a formality but a crucial step in affirming the employee’s role in safeguarding the ethical standards of the Department of Correction.