Blank Additional Insured Vendors PDF Template

The Additional Insured Vendors form, designated as CG 20 15 04 13, signifies a critical amendment to the Commercial General Liability policies, especially affecting coverage related to products and completed operations. By extending coverage to specified vendors, this endorsement allows vendors to be protected under the policyholder's commercial general liability coverage, specifically for issues arising from the distribution or sale of the policyholder’s products. It is tailored to cover bodily injury or property damage that may arise from such products, subject to significant limitations and exclusions. Notably, the coverage is only as broad as legally permitted or as narrowly required by any contractual agreement between the vendor and the policyholder. Moreover, the endorsement outlines specific situations where the vendor's protection does not apply, such as when the vendor has altered the product or is found solely at fault for damages due to negligence. Additionally, the form stipulates that the insurance will not exceed limits laid out by a contractual agreement or the policy itself, declaring unequivocally that the vendor's inclusion as an additional insured does not extend the policy's overall coverage limits. Comprehending the intricacies of this form is essential for vendors and policyholders alike, ensuring both parties understand the scope, limitations, and the operational impacts of this coverage on their business relations and liability exposures.

Preview - Additional Insured Vendors Form

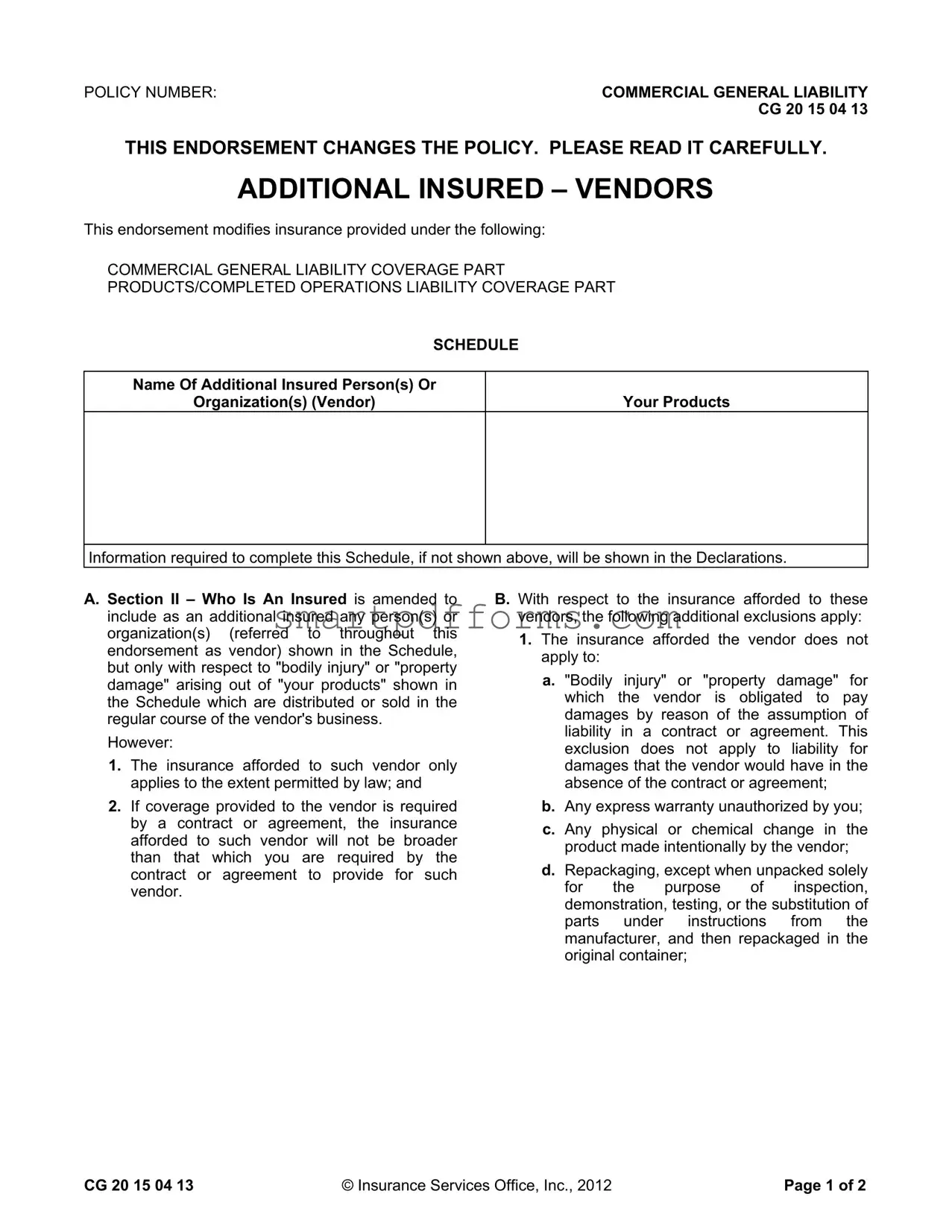

POLICY NUMBER: |

COMMERCIAL GENERAL LIABILITY |

|

CG 20 15 04 13 |

THIS ENDORSEMENT CHANGES THE POLICY. PLEASE READ IT CAREFULLY.

ADDITIONAL INSURED – VENDORS

This endorsement modifies insurance provided under the following:

COMMERCIAL GENERAL LIABILITY COVERAGE PART

PRODUCTS/COMPLETED OPERATIONS LIABILITY COVERAGE PART

SCHEDULE

Name Of Additional Insured Person(s) Or

Organization(s) (Vendor)

Your Products

Information required to complete this Schedule, if not shown above, will be shown in the Declarations.

A. Section II – Who Is An Insured is amended to include as an additional insured any person(s) or organization(s) (referred to throughout this endorsement as vendor) shown in the Schedule, but only with respect to "bodily injury" or "property damage" arising out of "your products" shown in the Schedule which are distributed or sold in the regular course of the vendor's business.

However:

1.The insurance afforded to such vendor only applies to the extent permitted by law; and

2.If coverage provided to the vendor is required by a contract or agreement, the insurance afforded to such vendor will not be broader than that which you are required by the contract or agreement to provide for such vendor.

B. With respect to the insurance afforded to these vendors, the following additional exclusions apply:

1.The insurance afforded the vendor does not apply to:

a."Bodily injury" or "property damage" for which the vendor is obligated to pay damages by reason of the assumption of liability in a contract or agreement. This exclusion does not apply to liability for damages that the vendor would have in the absence of the contract or agreement;

b.Any express warranty unauthorized by you;

c.Any physical or chemical change in the product made intentionally by the vendor;

d.Repackaging, except when unpacked solely for the purpose of inspection, demonstration, testing, or the substitution of parts under instructions from the manufacturer, and then repackaged in the original container;

CG 20 15 04 13 |

© Insurance Services Office, Inc., 2012 |

Page 1 of 2 |

e. Any failure to make such inspections, adjustments, tests or servicing as the vendor has agreed to make or normally undertakes to make in the usual course of business, in connection with the distribution or sale of the products;

f. Demonstration, installation, servicing or repair operations, except such operations performed at the vendor's premises in connection with the sale of the product;

g.Products which, after distribution or sale by you, have been labeled or relabeled or used as a container, part or ingredient of any other thing or substance by or for the vendor; or

h."Bodily injury" or "property damage" arising out of the sole negligence of the vendor for its own acts or omissions or those of its employees or anyone else acting on its behalf. However, this exclusion does not apply to:

(1)The exceptions contained in Sub- paragraphs d. or f.; or

(2)Such inspections, adjustments, tests or servicing as the vendor has agreed to make or normally undertakes to make in the usual course of business, in connection with the distribution or sale of the products.

2.This insurance does not apply to any insured person or organization, from whom you have acquired such products, or any ingredient, part or container, entering into, accompanying or containing such products.

C.With respect to the insurance afforded to these vendors, the following is added to Section III – Limits Of Insurance:

If coverage provided to the vendor is required by a contract or agreement, the most we will pay on behalf of the vendor is the amount of insurance:

1.Required by the contract or agreement; or

2.Available under the applicable Limits of Insurance shown in the Declarations;

whichever is less.

This endorsement shall not increase the applicable Limits of Insurance shown in the Declarations.

Page 2 of 2 |

© Insurance Services Office, Inc., 2012 |

CG 20 15 04 13 |

Form Data

| Fact Name | Description |

|---|---|

| Endorsement Title | Additional Insured – Vendors |

| Policy Modification | This endorsement modifies the Commercial General Liability Coverage and Products/Completed Operations Liability Coverage parts. |

| Coverage Scope | Coverage is provided to vendors as additional insureds, but only for bodily injury or property damage arising out of the vendor's distribution or sale of the insured's products. |

| Exclusions and Limits | The endorsement details specific exclusions and limits the insurance coverage extended to vendors, highlighting the cases where vendors are not covered, such as for their sole negligence or for contractual liabilities unrelated to the product's inherent faults. |

Instructions on Utilizing Additional Insured Vendors

Filling out the Additional Insured Vendors form is a crucial step for businesses to ensure their vendors are covered under their commercial general liability policy, especially when it comes to products and completed operations. This process requires attention to detail and a clear understanding of the terms stipulated in the policy. Following the correct steps not only facilitates compliance with contractual agreements but also helps in establishing a clear framework for liability and protection. Here's how to accurately complete the form:

- Locate the POLICY NUMBER at the top of the form and ensure it matches the policy number on your commercial general liability documentation.

- In the SCHEDULE section, write the full legal name of the vendor you wish to add as an additional insured. If you are adding more than one vendor, ensure each name is clearly listed.

- Under Your Products, specify the products distributed or sold by the vendor that you are seeking to cover. Be as detailed as necessary to avoid any ambiguity regarding the coverage.

- Review Section A to understand the extent of coverage provided to the vendor. This includes who is covered, in what circumstances, and the limitations set by law or contract.

- Pay close attention to the additional exclusions listed under Section B. These outline what the insurance does not cover for the vendor, including any liabilities assumed under contract or arising from modifications to the product by the vendor.

- Read the added stipulations in Section C carefully. These relate to the limits of insurance and serve to clarify the maximum amount payable on behalf of the vendor, as dictated by the contract or the policy declarations.

- Once all relevant sections of the form have been completed, double-check for accuracy. Any incorrect or missing information can lead to issues with coverage later on.

- Submit the completed form to your insurance provider according to their submission guidelines. This may involve mailing a physical copy, submitting it online, or through email.

After submission, your insurance provider will process the Additional Insured Vendors form and, if everything is in order, formally add the specified vendors to your policy. It's recommended to follow up with your insurer to confirm the addition and request a copy of the endorsement for your records. By taking these steps, businesses can ensure that their vendors are properly protected and minimize potential legal and financial risks associated with their products or operations.

Obtain Answers on Additional Insured Vendors

What is an Additional Insured Vendors form?

The Additional Insured Vendors form is an endorsement to a commercial general liability insurance policy. It modifies the policy to include certain vendors as additional insureds. This coverage is specific to "bodily injury" and "property damage" arising out of products distributed or sold by the vendor in the normal course of their business.

Who can be added as an additional insured under this form?

Any person(s) or organization(s) acting as a vendor of the insured's products, as shown in the Schedule of the endorsement, can be added as an additional insured. This is subject to the products being distributed or sold in the regular course of the vendor's business.

Are there any exclusions under the Additional Insured Vendors form?

Yes, there are specific exclusions. The insurance does not cover:

- "Bodily injury" or "property damage" for which the vendor is obligated to pay damages due to a contractual assumption of liability.

- Any unauthorized express warranty given by the vendor.

- Physical or chemical changes to the product made intentionally by the vendor.

- Issues related to repackaging, except under certain circumstances.

- The vendor's failure to conduct necessary inspections, adjustments, tests, or servicing.

- Demonstration, installation, servicing, or repair operations not performed at the vendor's premises in connection with the sale.

- Products that have been altered post-sale by the vendor.

- Bodily injury or property damage caused solely by the negligence of the vendor.

Does this endorsement affect the policy's Limits of Insurance?

No, the endorsement specifies that it does not increase the Limits of Insurance of the existing policy. The maximum amount paid on behalf of the vendor will be the lesser of the amount required by a contract or the Limits of Insurance stated in the Declarations.

What happens if the coverage required for a vendor is broader than the policy provides?

The insurance afforded to the vendor will not exceed the scope of coverage the insured is obligated to provide under a contract or agreement. Essentially, coverage cannot be broadened to exceed what is contractually required.

Is there any circumstance under which the insurance would not cover bodily injury or property damage related to the vendor's products?

Yes, the insurance would not cover damages linked primarily to the vendor's own negligence or wrongful act or omission, except in cases outlined in the exclusions, such as certain repackaging activities and agreed upon inspections or tests.

Does the Additional Insured Vendors form apply to products acquired from another insured?

No, the coverage does not extend to any insured person or organization from whom the insured's products, or any components or containers of such products, were acquired.

Can the Additional Insured Vendors form be modified?

Modifications to the form would need to be agreed upon by the insurance provider. Typically, endorsements are standard forms but may be subject to negotiation or adjustment based on specific contractual requirements between the insured and the vendor.

Common mistakes

Filling out the Additional Insured Vendors form accurately is crucial for ensuring the proper extension of coverage to vendors under a commercial general liability policy. However, several common mistakes can jeopardize this process, leading to potential gaps in coverage or difficulties in the event of a claim. Awareness and avoidance of these errors are key to maximizing the protection intended by this endorsement.

Not precisely identifying the additional insured: One common error is the failure to accurately name the person(s) or organization(s) intended as an additional insured under the policy. This should exactly match their legal name to ensure proper coverage.

Omission of essential product information: The form requires clear identification of "your products" which trigger the additional insured coverage. Neglecting to provide this information, or providing vague or incomplete descriptions, can lead to confusion about what products are covered.

Overlooking the exclusions: The endorsement contains specific exclusions that limit the coverage extended to the vendor. Not understanding or acknowledging these can lead to mistaken assumptions about the breadth of coverage afforded.

Assuming automatic coverage breadth: It's a mistake to assume that the coverage extended to the additional insured vendor will be as broad as the policyholder's. The coverage is only as extensive as permitted by law and the contract requirements, not exceeding the scope the policyholder is obligated to provide.

Failure to align coverage with contractual requirements: When coverage for an additional insured is necessitated by a contract, the limits of insurance provided to the vendor must comply with those contractual stipulations. Not aligning the coverage limits accordingly can lead to non-compliance with contractual obligations.

Attending to the details and requirements laid out in the Additional Insured Vendors form is essential. A thorough and correct submission not only fulfills contractual obligations but also reinforces the protective measures intended by the commercial general liability policy. By avoiding these common errors, policyholders and vendors alike can enjoy the full benefit of the coverage intended to safeguard against liability arising from the distributed or sold products.

Documents used along the form

When businesses engage with vendors, a variety of forms and documents are often required to ensure both parties are sufficiently protected and that all legal and insurance requirements are met. The Additional Insured Vendors form is a key document, but it usually doesn’t stand alone. Here are six other commonly used forms and documents that accompany this form, each playing a crucial role in managing the vendor relationship and associated liabilities.

- Certificate of Insurance (COI): This document verifies the insurance coverage of a business. It outlines the types of coverage, the limits of liability, and the effective dates of the policy. It’s essential for confirming that a vendor has the necessary insurance protections in place.

- Indemnity Agreement: An indemnity agreement is a contract that outlines financial responsibilities, typically protecting one party from the financial losses or liabilities of another party. This is particularly important in vendor relationships to manage risk.

- Waiver of Subrogation: This waiver is an agreement where an insured party waives the right of their insurance carrier to seek compensation or pursue legal action against a third party for losses covered by the policy. It’s crucial in vendor agreements to avoid complications related to claim recoveries.

- W-9 Form: The Internal Revenue Service (IRS) requires this form to collect correct taxpayer identification number (TIN) information for vendors or contractors for tax reporting purposes. It’s fundamental for the correct filing of taxes and avoiding penalties.

- Vendor Agreement: This is a comprehensive contract that specifies the terms and conditions of the relationship between a business and a vendor. It covers aspects such as delivery of goods or services, payment terms, and confidentiality requirements, providing a clear legal foundation for the partnership.

- Product Liability Release: This form is an agreement that releases a party from being held liable for damages or injuries caused by a product. For vendors, this is particularly relevant if they distribute or sell goods that could potentially cause harm, limiting their liability exposure.

In ensuring a business is sufficiently protected when working with vendors, it's not sufficient to only have the Additional Insured Vendors form in place. A comprehensive approach requires gathering and effectively managing a suite of documents that address various aspects of risk, liability, and compliance. These forms and documents collectively help establish a clear legal framework for the business-vendor relationship, safeguarding against unforeseen liabilities and facilitating smooth business operations.

Similar forms

Certificate of Insurance (COI): Similar to the Additional Insured Vendors form, a Certificate of Insurance provides proof of insurance coverage. Both documents specify particular coverages and limits relevant to the parties involved. The Additional Insured Vendors form extends specific rights and protections to the vendors, much like how a COI evidences existing coverages to third parties. These documents are crucial in business transactions to ensure that all parties have the appropriate levels of insurance protection required by contractual agreements.

Waiver of Subrogation: In contracts where a Waiver of Subrogation is required, parties agree not to seek recovery from each other for any claims paid by insurers. This waiver is similar to the Additional Insured Vendors form in that both modify standard insurance terms to conform to the requirements of a contract or agreement. Specifically, the Additional Insured Vendors form limits the breadth of insurance coverage for vendors to the extent required by law or a contract, akin to how a Waiver of Subrogation relinquishes rights to pursue claims against a co-party.

Indemnity Agreements: Indemnity Agreements, much like the Additional Insured Vendors form, are used to manage risk between parties. Indemnity Agreements are contracts that require one party to compensate the other for certain damages or losses. The Additional Insured Vendors form aligns the interests of the vendor and the primary insured by extending coverage to the vendor, but only for liabilities arising from the products specified, similar to how indemnity agreements may restrict the scope of indemnification to specified liabilities or acts.

Endorsements for Contractors’ Equipment: This form of insurance endorsement modifies the property insurance policy covering contractors’ equipment. It's similar to the Additional Insured Vendors form because both serve to modify the existing coverage in a policy to fit specific needs. While the Contractors’ Equipment endorsement specifically targets the extension of property coverage, the Additional Insured Vendors form focuses on extending liability coverage. Both are critical in adapting standardized insurance policies to meet the nuanced requirements of different business relationships and contracts.

Dos and Don'ts

When dealing with the Additional Insured Vendors form, it's imperative to navigate the process with precision and awareness. This document has significant implications for your business relationships and insurance coverage. To ensure you're completing this form effectively and responsibly, here are five dos and don'ts to consider:

- Do thoroughly review your existing Commercial General Liability (CGL) policy. Understanding your current coverage is essential before making any amendments or additions.

- Do verify the exact name and details of the vendor you intend to add as an additional insured. Mistakes in identifying information can lead to complications in the event of a claim.

- Do understand the scope of coverage extension to your vendors. It’s crucial to know that the coverage is typically limited to "bodily injury" and "property damage" related to your products, and understand exclusions outlined in the form.

- Do consult with a professional insurance advisor or lawyer if you have questions about the form or how its provisions affect your liability and coverage. Legal and insurance guidance can prevent costly mistakes.

- Do confirm whether the additional insured status is required by a contract or agreement, and ensure the coverage provided does not exceed what is mandated by such contracts.

- Don't overlook the additional exclusions section that applies to the vendors. Being aware of what is not covered is as important as knowing what is covered.

- Don't assume that adding a vendor as an additional insured is always necessary or beneficial. Evaluate the need based on contractual requirements and the nature of your relationship with the vendor.

- Don't wait until the last minute to submit this form. Processing and approval can take time, and you'll want the additional insured status in effect before it's needed.

- Don't forget to inform the vendor that they have been added as an additional insured on your policy. They should be aware of their coverage status and any conditions or limitations that apply.

- Don't neglect to review and possibly adjust your policy limits. Adding an additional insured could impact your coverage limits, and it’s critical to ensure that your policy continues to meet your business needs.

Misconceptions

Understanding the Additional Insured Vendors form can be tricky, and there are several common misconceptions about its coverage and limitations. Clarifying these points can help both vendors and policyholders navigate their insurance needs more effectively.

Misconception 1: Coverage Is Automatic for All Vendors - Many believe that all vendors are automatically covered under the Additional Insured Vendors form, but coverage only applies to vendors specifically listed in the schedule.

Misconception 2: Coverage Extends to All Vendor Activities - The form only provides coverage for "bodily injury" and "property damage" arising out of the products specified in the schedule, not for all activities of the vendor.

Misconception 3: Coverage is Unlimited - Some assume the coverage is without limits, but the endorsement specifies that the insurance for vendors will not exceed the limits shown in the Declarations or as required by contract, whichever is less.

Misconception 4: Coverage Applies to Vendor's Sole Negligence - A common misunderstanding is that the coverage extends to liabilities arising out of the vendor's sole negligence. In reality, exclusions apply for bodily injury or property damage caused by the vendor's sole negligence.

Misconception 5: All Products Sold by the Vendor Are Covered - The endorsement only covers "your products" that cause bodily injury or property damage, not all products sold by the vendor.

Misconception 6: The Vendor’s Assumed Liabilities Are Covered - There’s a belief that liabilities assumed by the vendor under a contract or agreement are covered. However, the endorsement excludes coverage for bodily injury or property damage for which the vendor is obligated to pay by reason of assumed liability.

Misconception 7: The Endorsement Covers Repackaging by the Vendor - Many think any form of repackaging by the vendor is covered. Coverage is actually excluded for repackaging, except under strict conditions mentioned in the endorsement.

Misconception 8: Contractual Requirements Override the Policy - It's often misunderstood that if a contract requires broader coverage, the endorsement will automatically provide it. The endorsement makes clear that insurance afforded will not exceed what is required by contract or the policy limits.

Correctly understanding the Additional Insured Vendors endorsement is crucial for vendors and policyholders alike to ensure they are adequately protected and aware of the coverage's scope and limitations.

Key takeaways

Understanding the Additional Insured Vendors form, specifically the CG 20 15, is crucial for businesses engaged in the distribution or sale of products. This form plays a key role in defining the scope of coverage for vendors under a commercial general liability policy. Here are key takeaways to guide businesses through the process of filling out and utilizing this form effectively:

- Scope of Coverage: The form amends the commercial general liability coverage to include vendors as additional insureds, but only for liabilities arising out of the products specified in the schedule that are sold or distributed in the vendor's regular business operations.

- Permissibility by Law: The coverage extended to the vendor is subject to limitations imposed by law and will only be as broad as legally allowed.

- Contractual Requirements: If the extension of coverage to the vendor is mandated by a contract or agreement, the scope of the insurance coverage will not exceed what is stipulated in that contract or agreement.

- Additional Exclusions: The endorsement outlines specific exclusions for the additional insured vendor, such as liabilities arising from the vendor's assumption of liability in contracts, unauthorized warranties, alterations to the product, and negligence solely attributed to the vendor, among others.

- Liability Coverage Limitations: Any coverage provided to the vendors is capped by the terms outlined in relevant contracts or the limits of insurance shown in the declarations, whichever is lesser. This is to ensure the policy does not extend beyond agreed-upon limits.

- No Increase in Insurance Limits: It is critical to understand that this endorsement does not increase the total amount of insurance available under the policy. The limits of insurance as shown in the declarations remain the upper boundary for claims.

- Importance of Accurate Schedule: The necessity of accurately completing the schedule cannot be overstated. It identifies the specific products and vendors covered, thus ensuring there is no ambiguity in the coverage extension.

- Exclusions for Certain Operations: Special attention should be given to the exclusions related to product alterations by the vendor, repackaging, and the vendor's failure to conduct necessary inspections or tests. These actions by the vendor can void coverage under this endorsement.

In navigating the complexities of adding vendors as additional insureds on a commercial general liability policy, attention to detail and a thorough understanding of the endorsement's provisions are foundational. This ensures that businesses and their vendors have clear expectations of coverage scope and limitations, fostering better risk management and collaborative relationships.

Popular PDF Forms

Employee Emergency Contact Form Template - A detailed form allowing employees to specify emergency contacts and medical preferences to be used in urgent situations.

Florida Proof Loss - A comprehensive approach to filing insurance claims in Florida, highlighting the necessity for truthfulness in reporting losses.