Blank Af 1745 PDF Template

In today’s interconnected world, managing personal information and ensuring its accuracy across various systems is more critical than ever, especially for those serving in the military or associated civilian roles. The AF 1745 form serves a vital function in this regard, acting as a bridge for individuals needing to update their address across a range of pay-related systems within the military and civilian pay frameworks. Recognizing the paramount importance of privacy, the form is underscored by the Privacy Act of 1974, ensuring that personal information is collected with transparency and respect for the individual’s privacy. It authorizes address changes not just for the Joint Uniform Military Pay System (JUMPS), but also for Retired Pay Systems, the Reserve component pay systems, and civilian pay systems, covering a broad spectrum of needs from pay and bonds to other remunerations related to service. The form thoroughly outlines the process for changing mailing or organizational addresses to maintain up-to-date records crucial for receiving funds, statements, and other pay-related documents efficiently. Furthermore, a separate section is devoted exclusively to addressing changes specifically for payroll deduction U.S. Savings Bonds, accommodating both military and civilian personnel, albeit with specific instructions for each. By completing the AF 1745 form, individuals take a proactive step in ensuring their personal data is current across relevant systems, thereby avoiding potential delays in payments or the delivery of critical information, highlighting the form’s essential role in the administrative framework of military and associated civilian operations.

Preview - Af 1745 Form

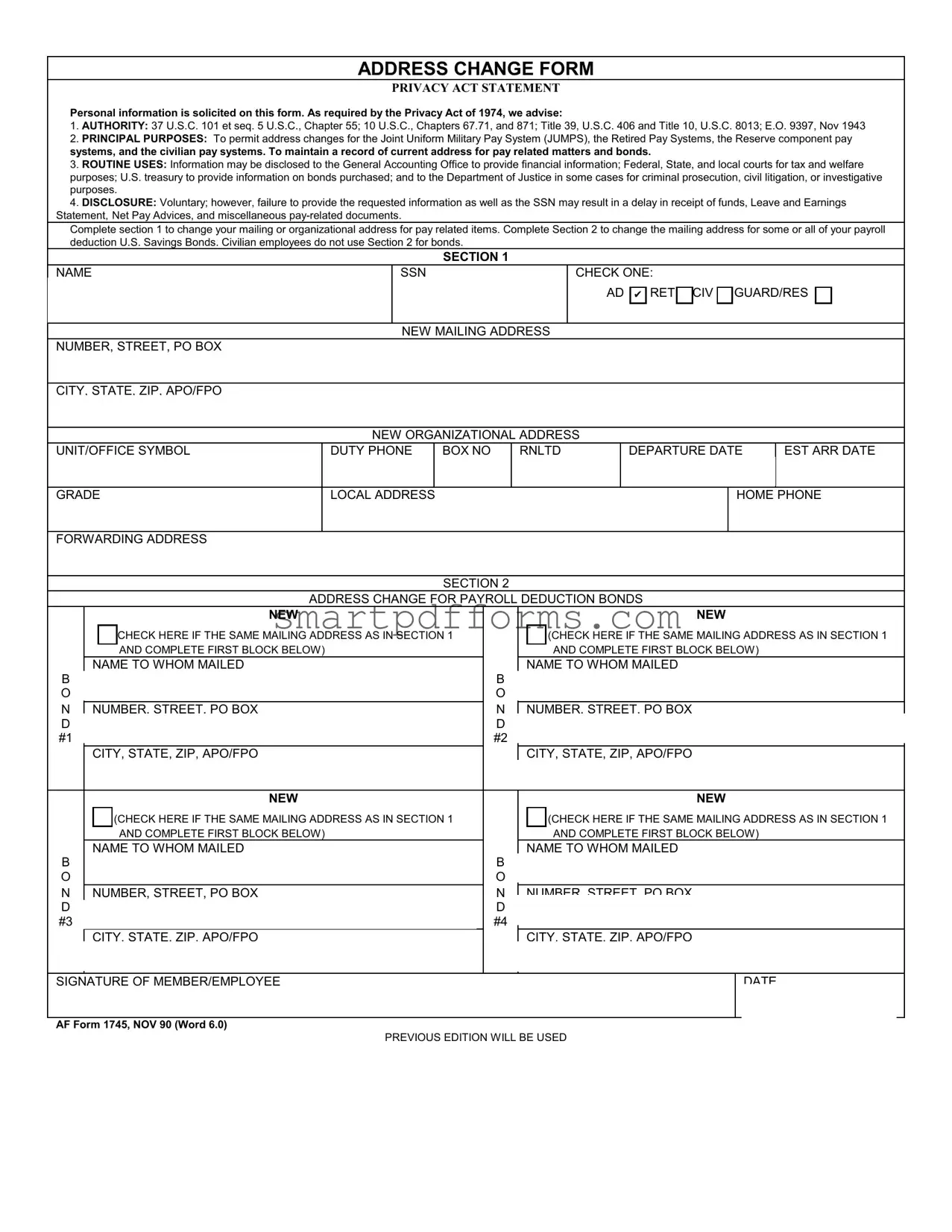

ADDRESS CHANGE FORM

PRIVACY ACT STATEMENT

Personal information is solicited on this form. As required by the Privacy Act of 1974, we advise:

1.AUTHORITY: 37 U.S.C. 101 et seq. 5 U.S.C., Chapter 55; 10 U.S.C., Chapters 67.71, and 871; Title 39, U.S.C. 406 and Title 10, U.S.C. 8013; E.O. 9397, Nov 1943

2.PRINCIPAL PURPOSES: To permit address changes for the Joint Uniform Military Pay System (JUMPS), the Retired Pay Systems, the Reserve component pay systems, and the civilian pay systems. To maintain a record of current address for pay related matters and bonds.

3.ROUTINE USES: Information may be disclosed to the General Accounting Office to provide financial information; Federal, State, and local courts for tax and welfare purposes; U.S. treasury to provide information on bonds purchased; and to the Department of Justice in some cases for criminal prosecution, civil litigation, or investigative purposes.

4.DISCLOSURE: Voluntary; however, failure to provide the requested information as well as the SSN may result in a delay in receipt of funds, Leave and Earnings Statement, Net Pay Advices, and miscellaneous

Complete section 1 to change your mailing or organizational address for pay related items. Complete Section 2 to change the mailing address for some or all of your payroll deduction U.S. Savings Bonds. Civilian employees do not use Section 2 for bonds.

NAME

|

SECTION 1 |

|

SSN |

|

CHECK ONE: |

|

|

AD RET CIV GUARD/RES |

|

|

|

NEW MAILING ADDRESS

NUMBER, STREET, PO BOX

CITY, STATE, ZIP, APO/FPO

UNIT/OFFICE SYMBOL

NEW ORGANIZATIONAL ADDRESS

DUTY PHONE |

BOX NO |

RNLTD |

|

|

|

DEPARTURE DATE

EST ARR DATE

GRADE

LOCAL ADDRESS

HOME PHONE

FORWARDING ADDRESS

SECTION 2

ADDRESS CHANGE FOR PAYROLL DEDUCTION BONDS

|

NEW |

|

NEW |

|

|

ž (CHECK HERE IF THE SAME MAILING ADDRESS AS IN SECTION 1 |

|

ž (CHECK HERE IF THE SAME MAILING ADDRESS AS IN SECTION 1 |

|

|

AND COMPLETE FIRST BLOCK BELOW) |

|

AND COMPLETE FIRST BLOCK BELOW) |

|

|

NAME TO WHOM MAILED |

|

NAME TO WHOM MAILED |

|

B |

|

|

B |

|

O |

|

|

O |

|

N |

|

|

|

|

NUMBER, STREET, PO BOX |

N |

NUMBER, STREET, PO BOX |

||

D |

|

|

D |

|

#1 |

|

|

#2 |

|

|

CITY, STATE, ZIP, APO/FPO |

|

CITY, STATE, ZIP, APO/FPO |

|

|

|

|

|

|

|

NEW |

|

NEW |

|

|

ž (CHECK HERE IF THE SAME MAILING ADDRESS AS IN SECTION 1 |

|

ž (CHECK HERE IF THE SAME MAILING ADDRESS AS IN SECTION 1 |

|

|

AND COMPLETE FIRST BLOCK BELOW) |

|

AND COMPLETE FIRST BLOCK BELOW) |

|

|

NAME TO WHOM MAILED |

|

NAME TO WHOM MAILED |

|

B |

|

|

B |

|

O |

|

|

O |

|

N |

NUMBER, STREET, PO BOX |

N |

NUMBER, STREET, PO BOX |

|

D |

|

|

D |

|

#3 |

|

|

#4 |

|

|

CITY, STATE, ZIP, APO/FPO |

|

CITY, STATE, ZIP, APO/FPO |

|

|

|

|

|

|

SIGNATURE OF MEMBER/EMPLOYEE

DATE

AF Form 1745, NOV 90 (Word 6.0)

PREVIOUS EDITION WILL BE USED

Form Data

| Fact Name | Description |

|---|---|

| Form Designation | AF Form 1745 |

| Form Title | Address Change Form |

| Privacy Act of 1974 Notice | Personal information is solicited under the authority of the Privacy Act of 1974. |

| Authority Cited | 37 U.S.C. 101 et seq., 5 U.S.C., Chapter 55; 10 U.S.C., Chapters 67, 71, and 871; Title 39, U.S.C. 406 and Title 10, U.S.C. 8013; E.O. 9397, Nov 1943 |

| Principal Purpose | To facilitate address changes for various military and civilian pay systems, and to maintain current records for pay-related matters and bonds. |

| Routine Uses | Sharing information with entities like the General Accounting Office, federal court systems, U.S. treasury, and the Department of Justice for specific operational purposes. |

| Voluntary Disclosure | Providing information is voluntary, but failure to do so may result in delays in receiving funds and pay-related documents. |

Instructions on Utilizing Af 1745

Once you receive the AF 1745 form, you're tasked with updating either your mailing or organizational address for various pay-related matters or your address related to payroll deduction for U.S. Savings Bonds. It's crucial to provide accurate information to prevent any delays in the receipt of funds or important pay-related documents. Follow the steps detailed below to complete the form properly.

- Start by reading the PRIVACY ACT STATEMENT to understand the use of your personal information.

- In SECTION 1:

- Enter your NAME and SOCIAL SECURITY NUMBER (SSN) in the designated fields.

- For CHECK ONE, mark the appropriate box that describes your status (AD, RET, CIV, GUARD/RES).

- Under NEW MAILING ADDRESS, fill in your number, street, PO box, city, state, zip, and APO/FPO as applicable.

- In NEW ORGANIZATIONAL ADDRESS, provide the unit or office symbol details.

- Enter your DUTY PHONE, BOX NO, RNLTD (Report No Later Than Date), DEPARTURE DATE, EST ARR DATE (Estimated Arrival Date), GRADE, LOCAL ADDRESS, and HOME PHONE where indicated.

- If applicable, provide a FORWARDING ADDRESS.

- For SECTION 2 (Address Change for Payroll Deduction Bonds):

- If your mailing address for bonds is the same as in SECTION 1, check the corresponding box and proceed to the signature line. Civilian employees may skip this section.

- Otherwise, for each bond (labeled as BOND #1, #2, #3, #4), fill in the NAME TO WHOM MAILED and address details, including number, street, PO box, city, state, ZIP, and APO/FPO.

- Sign and date the form at the bottom in the SIGNATURE OF MEMBER/EMPLOYEE and DATE fields, respectively.

- Review the completed form for accuracy before submission to ensure all details are correctly filled out.

Once the form is submitted, it's processed to update your address information for pay-related activities or U.S. Savings Bonds, depending on the sections completed. Ensure all information is accurate and complete to avoid any potential delays in receiving funds or important documents.

Obtain Answers on Af 1745

-

What is the AF Form 1745 used for?

The AF Form 1745 is utilized for updating address information pertaining to the Joint Uniform Military Pay System (JUMPS), the Retired Pay Systems, the Reserve component pay systems, and the civilian pay systems. This ensures that individuals receive their pay-related documents, Leave and Earnings Statements, Net Pay Advices, and miscellaneous pay-related documents at the right address. Additionally, it allows for the update of addresses for payroll deduction U.S. Savings Bonds for eligible participants.

-

Who should complete the AF Form 1745?

This form should be completed by members of the Armed Forces (including Active Duty, Retirees, Guard/Reserve members) and civilian employees wishing to update their mailing or organizational address for pay-related items or payroll deduction U.S. Savings Bonds. Civilian employees, however, are advised not to use Section 2 for bonds.

-

Under what authority is personal information solicited on the AF Form 1745?

Personal information on the AF Form 1745 is solicited under the authority of multiple statutes and executive orders, including 37 U.S.C. 101 et seq., 5 U.S.C., Chapter 55; 10 U.S.C., Chapters 67, 71, and 871; Title 39, U.S.C. 406; Title 10, U.S.C. 8013; and Executive Order 9397 of November 1943. These laws regulate the collection of personal data for pay systems within the military and civilian sectors of the Department of Defense.

-

What are the principal purposes of collecting information through the AF Form 1745?

The primary goal is to allow for the processing of address changes within various pay systems, including those for active military members, reservists, retired personnel, and civilian employees. This ensures the accurate delivery of financial documents, pay-related correspondence, and savings bonds (when applicable).

-

How is the information from the AF Form 1745 used?

Information provided on the AF Form 1745 can be disclosed to various entities for legitimate purposes. These include the General Accounting Office for financial information, federal, state, and local courts for tax and welfare purposes, the U.S. Treasury for bond information, and the Department of Justice for potential criminal prosecution, civil litigation, or investigative purposes.

-

Is providing information on the AF Form 1745 voluntary, and what are the implications of not providing requested information?

Yes, providing information on this form is voluntary. However, failing to provide the requested information, including the Social Security Number (SSN), may result in delays in the receipt of funds, Leave and Earnings Statements, Net Pay Advices, and other pay-related documents.

-

How to complete the AF Form 1745?

To complete the AF Form 1745, fill in the name section with your full name and social security number (SSN). Indicate your current status by checking the appropriate box (Active Duty, Retiree, Civilian, Guard/Reserve). Provide your new mailing and/or organizational addresses, including number, street, P.O. Box, city, state, ZIP, and APO/FPO where applicable. For changes related to payroll deduction U.S. Savings Bonds, complete Section 2 with the required details. Remember to sign and date the form upon completion.

Common mistakes

Filling out the AF 1745 form can sometimes be tricky. Avoiding common mistakes ensures your address change goes smoothly. Here are some of the most frequent errors:

- Not providing complete information in the NAME SECTION 1. It's crucial to fill out your full legal name to ensure your records are correctly updated.

- Forgetting to indicate the type of participant by checking one of the boxes: AD (Active Duty), RET (Retiree), CIV (Civilian), or GUARD/RES (Guard/Reserve). This helps to direct your form to the right department.

- Omitting or providing inaccurate information in the NEW MAILING ADDRESS fields. This includes the number, street, PO Box, city, state, ZIP, and APO/FPO details. Accuracy here is vital for receiving important mail.

- Leaving the DUTY PHONE box blank or entering an outdated number. This number is often used for quick, necessary communications about your pay or address changes.

- Failure to complete the NEW ORGANIZATIONAL ADDRESS section if there’s a change. This address is used for organizational correspondence and documents related to your position or role.

- Mixing up the sections for the mailing address and the payroll deduction bonds address. If the mailing address for bonds is the same as your current mailing address, you must check the corresponding box to indicate this and avoid filling out repetitive information.

- Forgetting to sign and date the form at the bottom. The SIGNATURE OF MEMBER/EMPLOYEE and DATE fields are a necessary part of verifying your identity and approving the changes being requested.

Steering clear of these mistakes will not only save you from potential delays but also ensure that all your pay related documents reach you without any hassle. Always double-check your form before submission to keep your information accurate and up-to-date.

Documents used along the form

Filling out the AF Form 1745 is a straightforward step for members wishing to change their address for pay and other related matters. Yet, this form often works in tandem with other documents to ensure all bases are covered when it comes to personal and payment information within the military and associated civilian sectors. Here are some of those documents that are commonly used alongside the AF Form 1745.

- DD Form 93 (Record of Emergency Data): This form is essential for recording emergency contact information and beneficiary details for military personnel. It ensures that the correct individuals are contacted and benefits are properly allocated in the event of a service member's death.

- SD Form 702 (Security Container Check Sheet): Used in secure environments, this document logs the openings and closings of security containers, helping to maintain the integrity of classified information, which could indirectly relate to address changes in secure assignments.

- DA Form 31 (Request and Authority for Leave): Service members fill out this form to request leave from their post. It includes sections detailing the leave address and contact information, which must be updated if there's a change of address.

- Standard Form 1199A (Direct Deposit Sign-Up Form): Essential for setting up or changing direct deposit information for pay. Since the AF Form 1745 includes changes related to pay systems, ensuring bank information is current is critical.

- IRS Form W-4 (Employee's Withholding Certificate): It's vital to update this form with any address changes to ensure accurate tax withholding and communications from the IRS.

- DD Form 214 (Certificate of Release or Discharge from Active Duty): Though not regularly updated like other forms, ensuring that discharge papers have the correct address can be important for veterans accessing benefits and services.

- DD Form 2656 (Data for Payment of Retired Personnel): For service members approaching retirement, this document is vital for initiating retired pay. It must reflect current contact and banking information, closely aligning with the intent behind AF Form 1745.

Together, these documents form a suite that ensures service members' personal and financial information is accurate and secure. Whether it's a simple address change or something more complex like retirement or emergency contacts, correctly managing these forms is vital for a hassle-free experience in both active duty and civilian life post-service.

Similar forms

Several documents share similarities with the AF 1745 form, particularly in their purpose, the type of information collected, and their use in government or organizational processes. These documents are vital for maintaining accurate records, ensuring compliance with regulations, and facilitating communication. Here's a breakdown of these documents:

- IRS Form 8822, Change of Address: Similar to the AF 1745, this form is used to notify the IRS about a change in address to ensure important tax documents are sent to the correct location.

- USPS Change of Address Form: This form notifies the United States Postal Service of a change in address, ensuring mail is forwarded to the new location, much like the AF 1745 informs military or civilian pay systems of an address change.

- DMV Change of Address forms: State-specific, these forms are used to update a person’s address on their driver’s license and vehicle registration, similar to how the AF 1745 updates address information for pay-related matters.

- SSA Change of Address form: Used to update an address with the Social Security Administration, this form ensures continued receipt of social security benefits, paralleling the AF 1745’s function for pay-related documents.

- Employee Record Update forms: Utilized within various organizations to update employee records, including address changes, these forms serve a similar purpose within a civilian employment context as the AF 1745 does within a military or governmental one.

- Voter Registration Update forms: These forms allow voters to update their address to ensure they are registered to vote in the correct precinct, akin to the way the AF 1745 ensures correct address information for official documents.

- Department of Veterans Affairs (VA) Change of Address form: This form is used by veterans to update their address details with the VA, ensuring they receive pertinent information and benefits, similarly to the AF 1745's use in military contexts.

- School Enrollment/Update forms: These forms are used by schools to update student information, including addresses, ensuring communications reach the right destination, just as the AF 1745 does for military and civilian personnel.

- Banking Change of Address forms: Required by financial institutions to update an account holder’s address information, these forms ensure statements and sensitive information are accurately delivered, much like the AF 1745's function for pay and bond information.

Each of these documents, while utilized in different fields and for varying purposes, aligns with the AF 1745 form in its basic function to communicate a change in address. This function is crucial for the smooth operation of services, be they governmental, financial, or personal, and ensures individuals continue to receive important information and documents without interruption.

Dos and Don'ts

Filling out the AF 1745 form, a critical process for address changes within various military and civilian pay systems, requires both attention and diligence. To ensure this form is completed accurately, thereby avoiding delays in pay and other critical communications, here are essential dos and don'ts:

Do:

- Review the Privacy Act Statement: Before filling out the form, understand the purpose behind the collection of personal information, how it will be used, and the consequences of not providing the required details.

- Complete all sections applicable to you: Whether you're active duty, a civilian employee, in the reserves, or retired, make sure to fill out the sections that apply to your status, ensuring all address changes are correctly logged for pay-related items and bonds.

- Verify your information: Double-check all the details you enter, including your Social Security Number (SSN), new mailing, and organizational addresses for accuracy to prevent any misrouting of important documents or payments.

- Sign and Date the Form: Your signature and the date are necessary to validate the form. Make sure these are not overlooked, as an unsigned form may be considered incomplete and lead to processing delays.

Don't:

- Forget to check the applicable boxes: If your new mailing address for payroll deduction bonds is the same as in Section 1, ensure you mark the appropriate checkbox. This tiny, yet vital detail, helps in reducing confusion and processing time.

- Use unclear handwriting: If completing the form by hand, write legibly. Unclear handwriting can result in errors in updating your information, leading possibly to significant delays or misdelivery.

- Leave sections incomplete: Even if some parts of the form do not apply to you, do not just skip them. If a section is not applicable, mark it as such or fill it with "N/A" to indicate that you have reviewed the section but it does not apply.

- Overlook routing and submission instructions: Make sure you understand how and where to submit the completed form. Incorrect submission could delay the processing of your address change request.

Misconceptions

Understanding the AF Form 1745 is crucial for anyone in the process of address change, especially within the military and related civilian sectors. However, several misconceptions can complicate this process. Let's clarify six common misconceptions surrounding the AF Form 1745.

- It's for military personnel only. While it's true that the form is primarily used within military contexts, it also applies to civilian employees involved in the Joint Uniform Military Pay System (JUMPS), the Retired Pay Systems, the Reserve component pay systems, and civilian pay systems. This broader scope ensures that all necessary address changes can be made in a streamlined manner.

- Section 2 is for everyone. This section might seem like it should be completed by anyone who wishes to change their address for payroll deduction U.S. Savings Bonds. However, civilian employees are specifically instructed not to use Section 2 for bonds. This distinction ensures that the process adheres to the correct administrative pathways for different groups.

- Providing a Social Security Number (SSN) is optional. The form makes it clear that failure to provide the requested information, including the SSN, may result in delays. This is because the SSN serves as a unique identifier that aids in the accurate processing of address changes and related pay matters.

- Any address change will update all systems. Completing the AF Form 1745 might seem like a one-stop solution for all address-related updates. However, the form distinguishes between mailing and organizational addresses, as well as specific changes for payroll deduction bonds, highlighting the importance of specifying the type of address change to ensure accurate record-keeping across different systems.

- It's a one-time process. Address changes, especially within the military and associated civilian sectors, may occur more than once. Each occurrence requires submission of the AF Form 1745 to ensure that records are up to date. This ongoing requirement underscores the dynamic nature of assignment and employment within these sectors.

- Full completion is required for processing. The form is designed with different sections to address different needs. You only need to complete the sections relevant to your specific address change requirements. For instance, if you are not changing your payroll deduction for U.S. Savings Bonds, Section 2 does not need to be filled out. This design facilitates efficient processing and ensures that relevant details are not overlooked.

By dispelling these misconceptions, individuals can approach the AF Form 1745 with clarity, ensuring their address changes are submitted accurately and processed efficiently.

Key takeaways

When interacting with the AF Form 1745, understanding its structure and the specific information it solicits is critical for ensuring timely and accurate processing. Below are key takeaways intended to streamline the completion and use of this form.

Understanding the Purpose: The primary function of the AF Form 1745 is to facilitate address changes for individuals within various pay systems, including the Joint Uniform Military Pay System (JUMPS), the Retired Pay Systems, the Reserve component pay systems, and civilian pay systems. It ensures that individuals receive pay-related documents and funds without unnecessary delay.

Privacy Act Statement: It’s essential to note that personal information provided on this form is protected under the Privacy Act of 1974. This act mandates informing the submitter about the authority under which the information is collected, the principal purposes for collection, routine uses of this information, and the voluntary nature of disclosure.

Sections of the Form: The AF Form 1745 is divided into two main sections. Section 1 is designed for changes in the mailing or organizational address for pay-related items, while Section 2 is specifically for changes in the mailing address for payroll deduction U.S. Savings Bonds.

Completing Section 1: This section captures essential details such as the submitter’s new mailing and organizational addresses, including phone numbers and estimated dates of relocation. Accurate completion of this section ensures continued receipt of pay statements and related documents.

Address Change for Payroll Deduction Bonds: For individuals who have payroll deductions for U.S. Savings Bonds, Section 2 allows for the update of mailing addresses associated with these bonds. It’s important to specify whether the updated address for the bonds is the same as the mailing address updated in Section 1.

Voluntary Disclosure and Implications: While supplying information on the AF Form 1745 is voluntary, omission of requested details, especially the Social Security Number (SSN), can lead to delays in the processing of pay and receipt of various pay-related documents.

Signature and Date: The form requires the signature and date by the member or employee making the address change. This acts as a confirmation of the accuracy of the information provided and authorizes the implementation of the address change.

In conclusion, the AF Form 1745 serves as a vital tool for efficiently managing address changes within military, reserve, retired, and civilian pay systems. Attention to detail when completing this form ensures that individuals continue to receive necessary payments and documents without interruption.

Popular PDF Forms

Da 3161 Example - Contributes to effective financial tracking by recording unit prices and total cost details.

Florida Proof Loss - Facilitates the submission of detailed and truthful insurance claims in Florida, with legal warnings against dishonesty.