Blank Alabama 2100 PDF Template

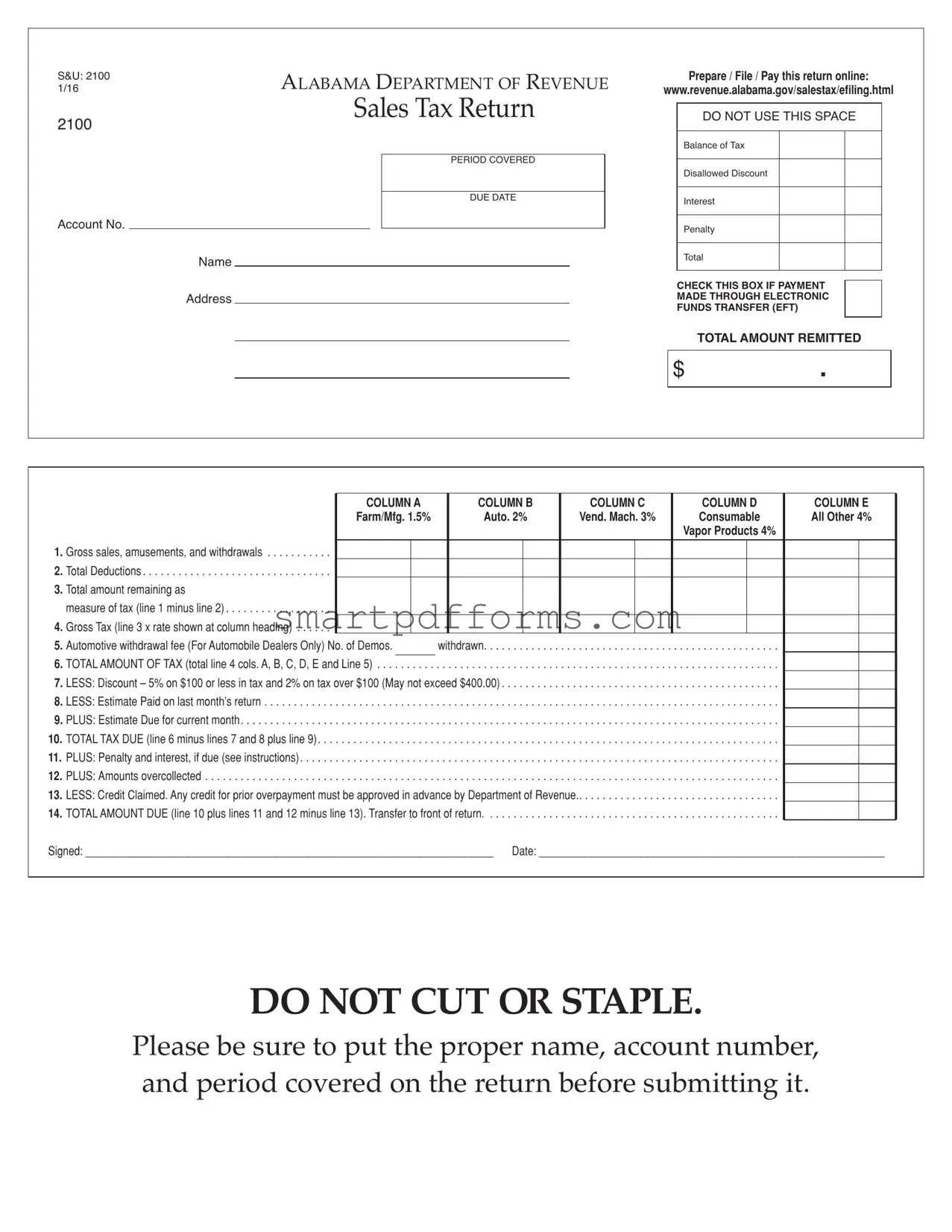

The Alabama 2100 form is a crucial document for businesses within the state, serving as a comprehensive sales tax return that must be meticulously completed and submitted to the Alabama Department of Revenue. Enabling businesses to declare their taxes online through the Department's e-filing system, this form captures a wide array of sales activities, including but not limited to gross sales, amusements, and withdrawals across different tax rates for various categories such as farming, manufacturing, automotive, vending machines, consumables, and even vapor products. These categories are subject to differentiated tax rates, demonstrating the form's versatility in accommodating the diverse economic activities within Alabama. The form also allows for deductions, including discounts for promptly paying taxes and credits for overpaid amounts in previous periods. Additionally, it accounts for the calculation of penalties and interests in cases of overdue payments, ensuring businesses are fully aware of their fiscal responsibilities and the potential consequences of non-compliance. By providing spaces for essential details such as the tax period, business name, and account number, the Alabama 2100 form is a comprehensive tool designed to streamline the tax declaration process, simplifying the complex nature of financial reporting for Alabama's business community.

Preview - Alabama 2100 Form

S&U: 2100 |

AlAbAmA DepArtment of revenue |

|

|

|

Prepare / File / Pay this return online: |

||||||||||||||||||||||

1/16 |

|

|

www.revenue.alabama.gov/salestax/efiling.html |

||||||||||||||||||||||||

|

|

|

|

Sales tax return |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

2100 |

|

|

|

|

|

|

|

|

DO NOT USE THIS SPACE |

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance of Tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PERIOD COVERED |

|

|

|

|

|

|

Disallowed Discount |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DUE DATE |

|

|

|

|

|

|

Interest |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Account No. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Penalty |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CHECKTHISBOXIFPAYMENT |

|

|

|

|

|

||||

|

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MADETHROUGHELECTRONIC |

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FUNDSTRANSFER(EFT) |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTALAMOUNTREMITTED |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

. |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

COLUMN A |

COLUMN B |

|

COLUMN C |

|

|

|

COLUMN D |

|

COLUMN E |

|

||||||||||||

|

|

|

|

|

Farm/Mfg. 1.5% |

Auto. 2% |

|

Vend. Mach. 3% |

|

|

|

Consumable |

|

All Other 4% |

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Vapor Products 4% |

|

|

|

|

|

|

|

||

1. |

. .Gross sales, amusements, and withdrawals |

. . . . . . . . . |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

2. |

. . . . . . . . . . . . . . . . . . . . . . .Total Deductions |

. . . . . . . . . |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

3. |

Total amount remaining as |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

measure of tax (line 1 minus line 2) |

. . . . . . . . . |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

4. |

. . . . . .Gross Tax (line 3 x rate shown at column heading) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

5. |

Automotive withdrawal fee (For Automobile Dealers Only) No. of Demos. _______ withdrawn |

. . . . |

. |

. |

. |

. . . . . . . . . . . . |

. . . . . |

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

6. |

TOTAL AMOUNT OF TAX (total line 4 cols. A, B, C, D, E and Line 5) |

. . . . . . . . . . . . . |

. . . . . . |

. . . . . . . . |

. . . . . |

. . . . |

. |

. |

. |

. . . . . . . . . . . . |

. . . . . |

|

|

|

|

|

|

|

|

||||||||

7. |

. . . . . . . . . . . . . . . . . . . . . . .LESS: Discount – 5% on $100 or less in tax and 2% on tax over $100 (May not exceed $400.00) |

. . . . |

. |

. |

. |

. . . . . . . . . . . . |

. . . . . |

|

|

|

|

|

|

|

|

||||||||||||

8. |

. . .LESS: Estimate Paid on last month’s return |

. . . . . . . . . |

. . . . . . |

. . |

. . . . . |

. . . . . . |

. . . . . . . . . . . . . |

. . . . . . |

. . . . . . . . |

. . . . . |

. . . . |

. |

. |

. |

. . . . . . . . . . . . |

. . . . . |

|

|

|

|

|

|

|

|

|||

9. |

. . . . . . .PLUS: Estimate Due for current month |

. . . . . . . . . |

. . . . . . |

. . |

. . . . . |

. . . . . . |

. . . . . . . . . . . . . |

. . . . . . |

. . . . . . . . |

. . . . . |

. . . . |

. |

. |

. |

. . . . . . . . . . . . |

. . . . . |

|

|

|

|

|

|

|

|

|||

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .10. TOTAL TAX DUE (line 6 minus lines 7 and 8 plus line 9) |

. . . . . . |

. . . . . . . . |

. . . . . |

. . . . |

. |

. |

. |

. . . . . . . . . . . . |

. . . . . |

|

|

|

|

|

|

|

|

||||||||||

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .11. PLUS: Penalty and interest, if due (see instructions) |

. . . . . . |

. . . . . . . . |

. . . . . |

. . . . |

. |

. |

. |

. . . . . . . . . . . . |

. . . . . |

|

|

|

|

|

|

|

|

||||||||||

. . . . . . . . . . . . . . . . . . . . . .12. PLUS: Amounts overcollected |

. . . . . . |

. . |

. . . . . |

. . . . . . |

. . . . . . . . . . . . . |

. . . . . . |

. . . . . . . . |

. . . . . |

. . . . |

. |

. |

. |

. . . . . . . . . . . . |

. . . . . |

|

|

|

|

|

|

|

|

|||||

13. LESS: Credit Claimed. Any credit for prior overpayment must be approved in advance by Department of Revenue |

|

|

|

|

|

|

|

||||||||||||||||||||

. . . . . . . . . . . . . . . . . . . . . . . . . .14. TOTAL AMOUNT DUE (line 10 plus lines 11 and 12 minus line 13). Transfer to front of return |

. . . . |

. |

. |

. |

. . . . . . . . . . . . |

. . . . . |

|

|

|

|

|

|

|

|

|||||||||||||

Signed: ________________________________________________________________________ |

Date: _____________________________________________________________ |

DO NOT CUT OR STAPLE.

please be sure to put the proper name, account number, and period covered on the return before submitting it.

Form Data

| Fact | Description |

|---|---|

| Form Name | Alabama 2100 |

| Department | Alabama Department of Revenue |

| Purpose | To file and pay sales tax |

| Governing Law | Alabama State Tax Law |

Instructions on Utilizing Alabama 2100

Filing a sales tax return in Alabama is crucial for businesses to comply with state tax laws. The Alabama 2100 form is designed for this purpose, enabling businesses to report and pay sales taxes they've collected. It's important to fill out this form accurately to avoid any penalties or issues with the Alabama Department of Revenue. Here’s a step-by-step guide on how to complete the Alabama 2100 form to ensure your business stays in good standing.

- Start by visiting www.revenue.alabama.gov/salestax/efiling.html if you prefer to prepare, file, and pay for this return online.

- Enter your Account No. in the designated space.

- Fill in your business’s Name as registered with the Alabama Department of Revenue.

- Provide the Address of your business accurately to ensure any communication related to this form reaches you.

- If you’re making a payment through Electronic Funds Transfer (EFT), make sure to CHECKTHEBOX indicating that option.

- Under the section titled "Balance of Tax," proceed to fill in the PERIOD COVERED and DUE DATE as specified for the reporting period.

- In columns A through E, provide detailed information for each tax category:

- Column A – Enter amounts related to Farm/Mfg. at 1.5%.

- Column B – Input data for Auto. at 2%.

- Column C – Fill in Vend. Mach. at 3%.

- Column D – Enter Consumable at 4%.

- Column E – Provide information for Vapor Products at 4%.

- Deduct the Total Deductions from the Gross sales, amusements, and withdrawals to find the Total amount remaining as measure of tax.

- Calculate the Gross Tax by multiplying the total amount remaining by the rate shown at the column heading for each category.

- For Automobile Dealers only, enter the Automotive withdrawal fee and the number of Demos withdrawn.

- Sum up the TOTAL AMOUNT OF TAX for all columns and enter it along with the automotive withdrawal fee if applicable.

- Compute and deduct the Discount (5% on $100 or less in tax and 2% on tax over $100, May not exceed $400.00).

- Deduct the Estimate Paid on last month’s return, and add the Estimate Due for the current month to determine the TOTAL TAX DUE.

- Include any due Penalty and interest in the next line as instructed on the form.

- Adjust for any Amounts overcollected in the following section.

- If you have a pre-approved Credit Claimed for prior overpayment, deduct it from the total.

- Finally, calculate the TOTAL AMOUNT DUE, which is the sum of the TOTAL TAX DUE, plus any penalties and interest, plus any amounts overcollected, minus any credit claimed. Transfer this amount to the front of the return.

- Sign and date the bottom of the form confirming the accuracy of the information provided.

- Double-check that you have entered the proper name, account number, and period covered on the return before submitting it. Remember, do not cut or staple the form.

Proper completion and timely submission of the Alabama 2100 form help ensure that businesses adequately meet their sales tax obligations, thereby avoiding potential pitfalls with tax authorities. Should you have any questions or concerns while filling out the form, seeking advice from a tax professional or contacting the Alabama Department of Revenue directly may be beneficial.

Obtain Answers on Alabama 2100

What is the Alabama 2100 form used for?

The Alabama 2100 form is a sales tax return document required by the Alabama Department of Revenue. It is utilized by businesses to report and remit the sales taxes they have collected during a given tax period. The form covers various tax rates corresponding to different categories such as farm equipment, automobiles, vending machines, consumable items, other general sales, and vapor products. By accurately completing and submitting this form, businesses ensure compliance with state tax regulations.

How can a business file the Alabama 2100 form?

The Alabama Department of Revenue facilitates the filing of the 2100 form both online and manually. Businesses are encouraged to prepare, file, and pay for their sales tax returns online through the official website (www.revenue.alabama.gov/salestax/efiling.html). This not only enhances efficiency but also ensures accuracy and timely compliance. For businesses that opt for manual filing, it's critical to complete the form with the correct information, including the tax period covered, gross sales for each category, deductions, and the total tax due.

When is the Alabama 2100 form due?

The due date for the Alabama 2100 sales tax return is typically set by the Alabama Department of Revenue. It is imperative for businesses to note the specific due date for their filing to avoid any penalties for late submissions. Generally, sales tax returns are due monthly, but the exact deadline can vary based on the tax period or any extensions granted by the Department. Businesses should consult the Department of Revenue's website or their tax advisor to ensure they meet their filing obligations on time.

What kinds of sales are subject to the taxes reported on the 2100 form?

Sales subject to the taxes reported on the 2100 form include a wide range of categories specified by the Alabama Department of Revenue. These categories cover the sale of tangible personal property and certain services. The specifics can vary but generally include farm and manufacturing equipment, automobiles, vending machine sales, consumable items, other general sales, and vapor products. Each category is subject to its specific tax rate, as outlined in the form. It's essential for businesses to accurately categorize their sales to comply with state tax laws fully.

Can businesses take any deductions or discounts on the Alabama 2100 form?

Yes, businesses are allowed to take certain deductions and discounts on the Alabama 2100 form, which can reduce the total amount of sales tax due. For instance, a discount of 5% on $100 or less in tax and a 2% discount on the tax over $100 may be applied, but the discount cannot exceed $400.00. Additionally, businesses can deduct estimated payments made on the last month's return. It's crucial for businesses to carefully review the form's instructions to ensure the appropriate calculations and to follow the specific guidelines for deductions and discounts as provided by the Alabama Department of Revenue.

Common mistakes

Not putting the correct name and account number at the top of the form can lead to processing delays or errors in your tax records. Always double-check these details for accuracy.

Omitting the period covered can result in the Alabama Department of Revenue being unable to apply your payment to the correct tax period. Clearly indicate the tax period on your form.

Failure to properly calculate gross sales, amusements, and withdrawals in the spaces provided can affect your tax liability. Make sure you accurately report these amounts.

Incorrect deductions reporting in Column B can either inflate or deflate the actual amount you owe. Deductions must be accurately calculated and properly documented.

Not applying the correct tax rates (Farm/Mfg. 1.5%, Auto. 2%, Vend. Mach. 3%, Consumable and All Other 4%, and Vapor Products 4%) to the total amount remaining as the measure of tax can significantly impact your tax due. Each category has its specific rate which should be applied correctly.

Automobile dealers failing to report the automotive withdrawal fee correctly can face discrepancies in their tax obligations. If applicable, this fee must be reported with accuracy.

Miscalculating the total amount of tax by not adding up all columns correctly or forgetting to include the automotive withdrawal fee (if applicable) can lead to under or overpayment of taxes.

Not claiming the allowed discount correctly, or attempting to claim more than the maximum allowed $400.00, can result in errors in tax computation. Understand the discount rules and apply them correctly.

Forgetting to account for penalties and interest if due by not including these amounts in the total tax due can result in further penalties. Always include any additional charges when they apply.

Each of these mistakes can lead to complications with your tax return, including potential fines and delays. It's important to take your time, review each section of the form carefully, and ensure all information is complete and correct before submission. Using the department's online resources for e-filing can also help prevent some of these common errors.

Documents used along the form

For individuals and businesses in Alabama preparing to submit the 2100 sales tax return, it's essential to recognize that this document often constitutes just one part of a broader collection of filings within a comprehensive tax compliance framework. Understanding the array of additional documents that might accompany or be necessary in conjunction with the Alabama 2100 form will ensure thorough preparedness and compliance with state tax regulations.

- Form BPT-IN: Also known as the Initial Business Privilege Tax Return, this document is required for new businesses in Alabama. It establishes initial tax obligations under the state's business privilege tax.

- Form BPT-V: This is a payment voucher for the Alabama Business Privilege Tax, aimed at businesses operating within the state, facilitating the payment process associated with the business privilege tax.

- Form 65: Required for partnerships, Limited Liability Companies (LLCs) taxed as partnerships, and S Corporations, this form addresses income and adjustments from both federal and state perspectives.

- Form PPT: The Alabama Business Privilege Tax Return and Annual Report, needed by LLCs, S Corporations, Partnerships, and Limited Liability Partnerships (LLPs), examines the privilege of doing business in the state.

- ACH Credit Authorization Form: For those opting to make tax payments via electronic fund transfer, this form authorizes the Alabama Department of Revenue to debit the indicated bank account.

- Sales Tax Exemption Certificate: Required for businesses that purchase goods for resale, manufacturing, or other tax-exempt purposes, this certificate prevents the collection of sales tax at the point of purchase.

- Consumer Use Tax Return: For purchases made outside of Alabama for use within the state, this return covers tax liabilities when sales tax was not collected at the time of sale.

- Form 40: The Alabama Individual Income Tax Return, necessary for all state residents with income above a certain threshold, addressing personal income tax obligations.

- Form A-3: Required annually, this form reconciles the total amount of state income tax withheld from employees' paychecks with the taxes actually remitted to the state.

- Form COM-101: This form designates a responsible party or parties for communication with the Alabama Department of Revenue regarding the sales tax account, ensuring that crucial tax-related correspondence is directed appropriately.

Each document serves a distinct role within the broader context of Alabama's tax administration, addressing various facets of tax liability and compliance for individuals and businesses alike. Proper preparation and submission of these forms, in accordance with the unique demands of Alabama's tax codes and regulations, are crucial steps in maintaining good legal standing, avoiding penalties, and ensuring the smooth operation of one's financial responsibilities within the state.

Similar forms

The California Sales and Use Tax Return shares similarities with the Alabama 2100 form in terms of structure and purpose. Both documents are designed for businesses to report and remit sales tax collected during a specific period. They feature sections for gross sales, deductions, taxable sales, and calculate the tax owed, including applicable discounts, penalties, and interest.

The New York Sales and Use Tax Return closely resembles the Alabama 2100 form in its comprehensive approach to tax calculation. Each form categorizes sales by types and applies different tax rates accordingly. This allows for detailed reporting of diverse sale transactions, from general merchandise to specific items like vehicles or manufactured goods.

The Florida Sales and Use Tax Return also shares a design with the Alabama 2100 form, facilitating the reporting of sales tax by differentiating between various types of sales and applicable tax rates. Both forms provide fields for adjustments, including exemptions and credits, ultimately leading to the calculation of total tax due.

The Texas Sales and Use Tax Return mirrors the Alabama form in its segmentation of sales types and application of corresponding tax rates. Each form includes specific lines for adjustments related to discounts, overpayments, and penalties, ensuring accurate tax liability is calculated and reported.

The Alabama Consumer Use Tax Return parallels the 2100 form but focuses on use tax rather than sales tax. The concept remains the same: taxpayers report purchases subject to tax, calculate the amount due, and subtract any credits. The primary difference lies in the source of the taxable transactions—purchases from out-of-state or untaxed online sales versus in-state sales.

The Michigan Sales, Use, and Withholding Taxes Monthly/Quarterly Return resembles the Alabama 2100 form in its multi-purpose functionality. It allows for the reporting of sales and use tax alongside withholding tax, demonstrating a consolidated approach to tax returns that cater to varied reporting needs of businesses.

The Ohio Commercial Activity Tax (CAT) Return is similar in its aim to report business activities but focuses on gross receipts rather than sales tax. Nevertheless, it shares the Alabama 2100's emphasis on accurate accounting for business transactions, required deductions, and subsequent tax liabilities.

The Colorado Retail Sales Tax Return offers a structure that requires detailed reporting of taxable sales, much like the Alabama 2100 form. In both documents, there's a clear pathway for translating sales data into tax responsibility, adjusting for specific exemptions, and calculating net tax due, inclusive of any penalties and interest for late payments.

Dos and Don'ts

When completing the Alabama 2100 form for sales tax return, there are several critical steps you must adhere to, as well as common pitfalls to avoid. Ensuring accuracy and thoroughness in this process is paramount, as it directly impacts the financial statements and legal standing of your business within the state of Alabama. Here is a guide to help navigate the completion of this form:

- Do:

- Ensure that all information is accurate and up-to-date, especially the business name, account number, and the period covered, to prevent any discrepancies.

- Calculate the gross sales, amusements, and withdrawals carefully in COLUMN A, ensuring that all applicable sales are included to determine the correct tax liability.

- Deduct the total deductions accurately in line 2 to arrive at the correct total amount remaining as the measure of tax. Double-check these calculations to avoid errors.

- Apply the correct tax rate for each category (Farm/Mfg., Auto., Vend. Mach., Consumable, All Other, Vapor Products) as specified in COLUMNS A through E to the gross tax.

- Factor in any automotive withdrawal fees if you are an automobile dealer, as this is a specific requirement that could easily be overlooked.

- Utilize the electronic funds transfer (EFT) option for payment if available and convenient, ensuring to check the designated box on the form to indicate this method of payment.

- Include any applicable Discounts, Estimate Paid on last month’s return, and Plus Estimate Due for the current month as outlined in lines 7 through 9 to accurately determine the total tax due.

- Don't:

- Forget to include penalties and interest, if due, as failing to accommodate these amounts could result in underpayment and further penalties.

- Overlook any amounts overcollected; this must be added as per line 12 to ensure that your tax liability is accurately reflected and to maintain compliance.

- Miscalculate the total amount due by not correctly adding lines 10, 11, and 12, and then subtracting line 13. This total amount is fundamental, as it represents the final tax obligation for the period.

By closely adhering to these guidelines, you will mitigate the risk of errors and ensure that your Alabama 2100 sales tax return is accurately prepared and submitted, maintaining compliance with Alabama Department of Revenue regulations.

Misconceptions

When it comes to the Alabama 2100 form, several misconceptions can lead to confusion among taxpayers. Here, we debunk some of the most common misunderstandings:

- Misconception 1: The Alabama 2100 form is only for businesses that sell tangible goods.

This is incorrect. While the form primarily deals with sales tax, which is often associated with the sale of physical goods, it also applies to certain services that may be taxed, such as amusements. Therefore, both goods and applicable services are relevant for this form.

- Misconception 2: You can only file the form by mail.

Many people are unaware that the Alabama Department of Revenue encourages electronic filing. The Alabama 2100 form can, and in many cases should, be prepared, filed, and paid online, which is more efficient and secure.

- Misconception 3: The discount applied to taxes is fixed.

The form outlines a sliding scale for discounts: 5% on $100 or less in tax and 2% on tax over $100, with a maximum of $400. It’s a misconception that this discount is a fixed percentage or amount unrelated to the actual tax due.

- Misconception 4: All businesses pay the same tax rate.

Depending on what is being sold, businesses may be subject to different tax rates. The form lists rates for farm/mfg. products (1.5%), automobiles (2%), vending machine items (3%), consumable goods and vapor products (4%). Each category has its tax rate, acknowledging the diversity of business types.

- Misconception 5: Credits for overpayment are automatically applied.

If a business overpays their tax, they may believe that the credit is automatically applied to their next payment. However, any credit for prior overpayment must be approved in advance by the Department of Revenue. This approval process is essential to ensure that the claimed credits are legitimate and accurately reflected.

- Misconception 6: Penalties are only for late payments.

While late payments are a common reason for penalties, inaccuracies or omissions on the Alabama 2100 form can also result in penalties. It's vital to fill out the form carefully and ensure all information is accurate and complete to avoid unnecessary penalties.

- Misconception 7: Personal information is unnecessary if you have an account number.

Even if you provide your account number, it's crucial to also include the proper business name and the period covered by the return. This detailed information helps the Department of Revenue process each return efficiently and reduces the risk of misapplication of funds.

Understanding the Alabama 2100 form thoroughly can help taxpayers avoid common pitfalls and ensure that their sales tax is filed correctly and efficiently. Remember, when in doubt, consulting with a tax professional or the Department of Revenue directly can provide clarity and peace of mind.

Key takeaways

Filling out the Alabama 2100 form is a straightforward process, but attention to detail is crucial. Below are key takeaways to ensure the form is completed accurately and efficiently:

- Preparation is key: Before starting, gather all necessary sales data, including gross sales, deductions, and any applicable automotive withdrawal fees. This preparation ensures accuracy and helps in completing the form more efficiently.

- Understand the sections: The form is divided into specific sections that calculate the tax due based on different rates for various categories such as Farm/Mfg., Auto, Vend. Mach., Consumable, All Other, and Vapor Products. Correct assignment of sales to these categories is essential for an accurate tax calculation.

- Discounts and Deductions: Pay close attention to the Discounts section. A discount is allowed at 5% on tax up to $100 and 2% on tax over $100, with a maximum of $400. This can significantly impact the total tax due, so make sure you apply this correctly to take full advantage of potential savings.

- Electronic Filing and Payment: The form encourages electronic filing and payment. If payment is made through Electronic Funds Transfer (EFT), check the appropriate box on the form. Electronic submissions can expedite processing and reduce errors, making it a convenient option for most taxpayers.

Completing the Alabama 2100 form accurately ensures compliance with the state's sales tax requirements. It helps in avoiding penalties and interest for incorrect or late submissions. Always double-check calculations and the completeness of information before submission.

Popular PDF Forms

Bp-a0629 - Applicants must acknowledge the potential for emergency situations that could suspend visitation as part of their agreement.

Cup Fund - Discover the Caring Unites Partners Fund, a safety net for Starbucks partners facing financial hardship due to unforeseen events.

Fmla Paperwork - Offers a section for healthcare providers to indicate if the returning employee’s restrictions are temporary or permanent.