Blank Alabama Ppt PDF Template

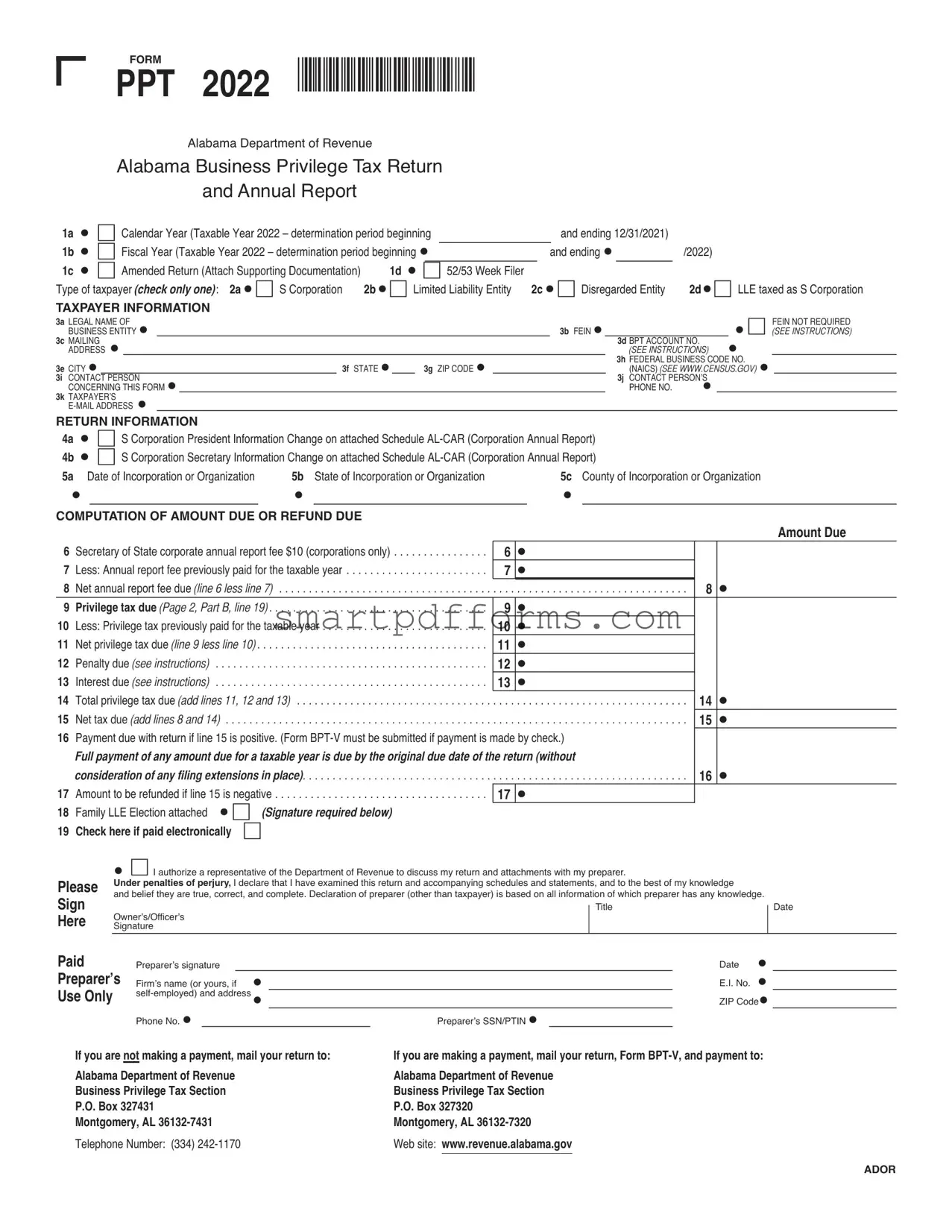

The Alabama PPT form, formally known as the Alabama Business Privilege Tax Return and Annual Report for the tax year 2021, serves as a critical document for businesses operating within the state. It is designed to calculate and report the privilege tax due, which is a tax imposed on entities for the privilege of conducting business in Alabama. This comprehensive form caters to various types of entities including S Corporations, Limited Liability Entities (LLEs), Disregarded Entities, and LLEs taxed as S Corporations by covering specific taxpayer information and requiring details such as legal names, Federal Employer Identification Numbers (FEINs), and contact information. Furthermore, it incorporates sections for computing the amount of tax or refund due, and it details the calculation involved in determining the net worth of a business and applicable exclusions and deductions. The form also requires information on federal taxable income apportioned to Alabama and takes into account payments made towards the Secretary of State corporate annual report fee, specific to corporations. The meticulous structuring of this form underscores the importance of accuracy and completeness in fulfilling state tax obligations, while also highlighting the various considerations businesses must account for when calculating their privilege tax due to Alabama.

Preview - Alabama Ppt Form

FORM

PPT 2022 *220001PP*

Alabama Department of Revenue

Alabama Business Privilege Tax Return

and Annual Report

1a |

6 Calendar Year (Taxable Year 2022 – determination period beginning |

and ending 12/31/2021) |

|

||

1b |

6 Fiscal Year (Taxable Year 2022 – determination period beginning |

|

and ending |

/2022) |

|

1c |

6 Amended Return (Attach Supporting Documentation) |

1d |

6 52/53 Week Filer |

|

|

Type of taxpayer (check only one): 2a |

6 S Corporation |

2b |

6 Limited Liability Entity |

2c 6 Disregarded Entity |

2d |

6 LLE taxed as S Corporation |

|||

TAXPAYER INFORMATION |

|

|

|

|

|

|

|

|

|

3a LEGAL NAME OF |

|

|

|

|

|

|

6 |

FEIN NOT REQUIRED |

|

BUSINESS ENTITY |

|

|

|

|

3b FEIN |

|

(SEE INSTRUCTIONS) |

||

3c MAILING |

|

|

|

|

3d BPT ACCOUNT NO. |

|

|

||

ADDRESS |

|

|

|

|

(SEE INSTRUCTIONS) |

|

|

||

|

|

|

|

|

|

3h FEDERAL BUSINESS CODE NO. |

|

||

3e CITY |

3f |

STATE |

3g ZIP CODE |

|

(NAICS) (SEE WWW.CENSUS.GOV) |

|

|||

3i CONTACT PERSON |

|

|

|

|

3j CONTACT PERSON’S |

|

|

||

CONCERNING THIS FORM |

|

|

|

|

PHONE NO. |

|

|

|

|

3k TAXPAYER’S |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

RETURN INFORMATION |

|

|

|

|

|

|

|

|

|

4a |

6 S Corporation President Information Change on attached Schedule |

|

|

|

|||||

4b |

6 S Corporation Secretary Information Change on attached Schedule |

|

|

|

|||||

5a |

Date of Incorporation or Organization |

5b State of Incorporation or Organization |

|

5c County of Incorporation or Organization |

|

||||

COMPUTATION OF AMOUNT DUE OR REFUND DUE |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

Amount Due |

6 Secretary of State corporate annual report fee $10 (corporations only) |

6 |

|

|

|

|

||||

7 Less: Annual report fee previously paid for the taxable year . |

. . . . . . |

. . . . . . . . . . . . . . . . . |

7 |

|

|

|

|

||

8 Net annual report fee due (line 6 less line 7) |

. . . . . . |

. . . . . . . . . . . . . . . . . . . |

. . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . |

8 |

|

|

||

9 |

Privilege tax due (Page 2, Part B, line 19) |

. . . . . . |

. . . . . . . . . . . . . . . . . |

9 |

|

|

|

|

|

10 |

Less: Privilege tax previously paid for the taxable year |

. . . . . . |

. . . . . . . . . . . . . . . . . |

10 |

|

|

|

|

|

11 |

Net privilege tax due (line 9 less line 10) |

. . . . . . |

. . . . . . . . . . . . . . . . . |

11 |

|

|

|

|

|

12 |

Penalty due (see instructions) |

. . . . . . . . . . . . . . . . |

. . . . . . |

. . . . . . . . . . . . . . . . . |

12 |

|

|

|

|

13 |

Interest due (see instructions) |

. . . . . . . . . . . . . . . . |

. . . . . . |

. . . . . . . . . . . . . . . . . |

13 |

|

|

|

|

14 |

Total privilege tax due (add lines 11, 12 and 13) |

. . . . . . |

. . . . . . . . . . . . . . . . . . . |

. . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . |

14 |

|

|

|

15 |

Net tax due (add lines 8 and 14) |

. . . . . . . . . . . . . . . . |

. . . . . . |

. . . . . . . . . . . . . . . . . . . |

. . . . . |

. . . . . . . . . . . . . . . . . . . . . . . . . . . |

15 |

|

|

16Payment due with return if line 15 is positive. (Form

Full payment of any amount due for a taxable year is due by the original due date of the return (without

|

consideration of any filing extensions in place) |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16 |

|

17 |

Amount to be refunded if line 15 is negative |

17 |

|

18 |

Family LLE Election attached |

6 (Signature required below) |

|

19 |

Check here if paid electronically |

6 |

|

Please

Sign

Here

6I authorize a representative of the Department of Revenue to discuss my return and attachments with my preparer.

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge

and belief they are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Title |

Date |

Ownerʼs/Officerʼs |

|

Signature |

|

Paid |

Preparerʼs signature |

|

|

Date |

Preparer’s |

Firmʼs name (or yours, if |

|

|

E.I. No. |

Use Only |

|

|

ZIP Code |

|

|

|

|

||

|

|

|

|

|

|

Phone No. |

Preparerʼs SSN/PTIN |

||

If you are not making a payment, mail your return to: |

If you are making a payment, mail your return, Form |

|||

Alabama Department of Revenue |

Alabama Department of Revenue |

|||

Business Privilege Tax Section |

Business Privilege Tax Section |

|||

P.O. Box 327431 |

P.O. Box 327320 |

|||

Montgomery, AL |

Montgomery, AL |

|||

Telephone Number: (334) |

Web site: www.revenue.alabama.gov |

|||

|

|

|

|

|

ADOR

|

FORM |

BUSINESS PRIVILEGE |

*220002PP* |

Alabama Department of Revenue |

|

PPT |

TAXABLE/FORM YEAR |

Alabama Business Privilege Tax |

|

|

PAGE 2 |

2022 |

|

Privilege Tax Computation Schedule |

1a. |

FEIN |

1b. LEGAL NAME OF BUSINESS ENTITY |

1c. DETERMINATION PERIOD END DATE (BALANCE SHEET DATE) |

|

V |

|

|

(MM/DD/YYYY) |

|

PART A – NET WORTH COMPUTATION |

|

|

||

I. |

|

|

|

|

1 |

Issued capital stock and additional paid in capital (without reduction for treasury stock) |

|

||

|

but not less than zero |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

1 |

|

2 |

Retained earnings, but not less than zero, including dividends payable |

2 |

||

3 |

Gross amount of related party debt exceeding the sums of line 1 and 2 |

3 |

||

4 |

All payments for compensation, distributions, or similar amounts in excess of $500,000. . . . |

4 |

||

5 |

Total net worth (add lines |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5 |

||

II. Limited Liability Entities (LLE's) |

|

|

||

6 |

Sum of the partners’/members’ capital accounts, but not less than zero |

6 |

||

7All compensation, distributions, or similar amounts paid to a partner/member in

|

excess of $500,000 |

7 |

8 |

Gross amount of related party debt exceeding the amount on line 6 |

8 |

9 |

Total net worth (add lines 6, 7 and 8). Go to Part B, line 1 |

9 |

III. Disregarded Entities |

|

|

10 |

Single Member Name: |

FEIN/SSN: |

11If a disregarded entity has as its single member a taxpayer that is subject to the privilege tax, then the disregarded entity pays the minimum tax. (Go to Part B, line 19.)

12Assets minus liabilities for all disregarded entities that have as a single member an entity that is not subject to the privilege tax, but not less than zero (supporting

documentation required). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

13 Gross amount of related party debt exceeding the amount on line 12 . . . . . . . . . . . . . . . . . 13

14For disregarded entities, all compensation, distributions,

|

or similar amounts paid to a member in excess of $500,000 |

14 |

|

|

15 Total net worth (sum of lines 12, 13 and 14). Go to Part B, line 1 |

. . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . |

. . 15 |

|

PART B – PRIVILEGE TAX EXCLUSIONS AND DEDUCTIONS |

|

|

|

|

Exclusions (Attach supporting documentation) (SEE INSTRUCTIONS) |

|

|

|

|

1 |

Total net worth from Part A – line 5, 9, or 15 |

. . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . |

. . 1 |

2 |

Book value of the investments by the taxpayer in the equity of other taxpayers |

2 |

|

|

3 |

Unamortized portion of goodwill resulting from a direct purchase |

3 |

|

|

4 |

Unamortized balance of properly elected |

4 |

|

|

5 |

Total exclusions (sum of lines |

. . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . |

. . 5 |

6 |

Net worth subject to apportionment (line 1 less line 5) |

. . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . |

. . 6 |

7 |

Apportionment factor (see instructions) |

7 |

. |

% |

8 |

Total Alabama net worth (multiply line 6 by line 7) |

. . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . |

. . 8 |

Deductions (Attach supporting documentation) (SEE INSTRUCTIONS)

9Net investment in bonds and securities issued by the State of Alabama or

political subdivision thereof, when issued prior to January 1, 2000. . . . . . . . . . . . . . . . . . . .

10 Net investment in all air, ground, or water pollution control devices in Alabama. . . . . . . . . .

11Reserves for reclamation, storage, disposal, decontamination, or retirement

|

associated with a plant, facility, mine or site in Alabama |

11 |

|

|

12 |

Book value of amount invested in qualifying low income housing projects (see instructions) |

12 |

|

|

13 |

30 percent of federal taxable income apportioned to Alabama, but not less than zero |

13 |

|

|

14 |

Total deductions (add lines |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . 14 |

15 |

Taxable Alabama net worth (line 8 less line 14) |

. . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . 15 |

|

16a |

Federal Taxable Income Apportioned to AL . . |

16a |

|

|

16b |

Tax rate (see instructions) |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

16b |

. |

17 |

Gross privilege tax calculated (multiply line 15 by line 16b) |

. . . . . . . . . . . . . . . . . . . . . . . |

. . . . . . . . . . 17 |

|

18 |

Alabama enterprise zone credit (see instructions) |

18 |

|

|

19Privilege Tax Due (line 17 less line 18) (minimum $100, for maximum see instructions)

Enter also on Form PPT, page 1, line 9, Privilege Tax Due (must be paid by the original due date of the return) . . . . . . . . . . . . . . . . 19

|

|

Other (noncorporate) |

|

are not required to file an Alabama Schedule |

ADOR |

|

Form Data

| Fact Name | Description |

|---|---|

| Form Purpose | The Alabama PPT form is used for filing the Alabama Business Privilege Tax Return and Annual Report. |

| Taxable Year | The form applies to both the Calendar Year (specifically, taxable year 2021 with the determination period beginning and ending in 2020) and Fiscal Year filers. |

| Amended Return Option | There is an option for filing an Amended Return by attaching supporting documentation. |

| Taxpayer Types | The form categorizes taxpayers into S Corporation, Limited Liability Entity, Disregarded Entity, and LLE taxed as S Corporation. |

| Annual Report Fee | S-corporations must attach an Alabama Schedule AL-CAR and note a $10 fee for the corporate annual report (line 6, page 1). |

| Computing Privilege Tax | The form includes sections for calculating amounts due or refunds due, including net privilege tax due, penalties, and interests. |

| Minimum Tax Requirement | There is a specified minimum privilege tax due, with variations applying under certain conditions as detailed in the instructions. |

| Governing Law | The Alabama Business Privilege Tax is governed by state tax laws, specifically as administered by the Alabama Department of Revenue. |

Instructions on Utilizing Alabama Ppt

Filling out the Alabama PPT form, officially known as the Alabama Business Privilege Tax Return and Annual Report, requires careful attention to detail and a thorough read of the instructions provided by the Alabama Department of Revenue. This form is essential for businesses operating within the state, as it combines the reporting of annual data with the calculation and payment of the business privilege tax. The process involves selecting the right fiscal year, determining the type of taxpayer, entering taxpayer information, completing return information, and accurately computing the amount due or refund. The following steps will guide you through filling out the form to ensure compliance and accuracy in your submission.

- Choose your taxable year type by checking the appropriate box: Calendar Year (1a), Fiscal Year (1b), Amended Return (1c), or 52/53 Week Filer (1d).

- Identify the type of taxpayer by selecting the right category: S Corporation (2a), Limited Liability Entity (2b), Disregarded Entity (2c), or LLE taxed as S Corporation (2d).

- Enter the legal name of the business entity in the space provided (3a).

- If required, provide the Federal Employer Identification Number (FEIN) in the space provided (3b).

- Fill in the mailing address, city, state, and zip code of the business in the respective fields (3c-3g).

- Include the Federal Business Code Number as per the North American Industry Classification System (NAICS) in the space provided (3h).

- Write down the contact person's name (3i), phone number (3j), and email address (3k).

- If applicable, check the boxes to indicate information changes on attached Schedule AL-CAR for S Corporation President and Secretary (4a and 4b).

- Fill in the Date of Incorporation or Organization (5a), State of Incorporation or Organization (5b), and County of Incorporation or Organization (5c).

- Compute your Amount Due, including the Secretary of State corporate annual report fee and privilege tax due, then subtract any payments previously made (lines 6 to 15).

- Indicate your payment method and attach Form BPT-V if paying by check (line 16).

- If expecting a refund, enter the amount in the refund space provided (line 17).

- Check the applicable boxes if the Family LLE Election is attached, and if payment was made electronically (lines 18 and 19).

- Sign the form, indicating authorization for a representative to discuss the return. Include the title, date, and preparer information if applicable.

- Mail your completed form to the correct address based on whether a payment is included, as provided at the bottom of the form instructions.

After the form is completed and submitted, it's crucial to monitor any correspondence from the Alabama Department of Revenue for confirmations or additional requests. Keeping a copy of the submitted form and all related documentation is advisable for your records and future reference. This step-by-step guide aims to simplify the process, making sure businesses can fulfill their tax obligations without undue stress.

Obtain Answers on Alabama Ppt

FAQs About the Alabama PPT Form

- What is the Alabama PPT Form?

The Alabama PPT Form, officially known as the Alabama Business Privilege Tax Return and Annual Report, is a document that must be filed by certain business entities operating within Alabama. It is used to calculate and report the amount of business privilege tax owed to the state, based on the entity's net worth and other factors during the taxable year.

- Who needs to file the Alabama PPT Form?

Entities such as S Corporations, Limited Liability Entities (LLEs), Disregarded Entities, and LLEs taxed as S Corporations are required to file this form. It's essential for these entities to determine their obligation based on their structure and operation within Alabama.

- When is the Alabama PPT Form due?

The form is due by the original due date of the return without consideration of any filing extensions. For most entities operating on a calendar year basis, the due date is March 15th of the following year. Entities on a fiscal year basis must adjust their due date accordingly.

- How is the Business Privilege Tax calculated?

The tax is primarily calculated based on the entity's net worth, as determined through specific computations outlined in the PPT form. The calculation involves deductions and exclusions, apportioned income, and specific tax rates provided by the Alabama Department of Revenue.

- What if I need to amend a previously filed Alabama PPT Form?

If you need to amend a previously filed form, you should check the "Amended Return" box on the form and attach supporting documentation that explains the changes. Make sure to clearly outline the reasons for the amendments and provide accurate recalculations of the tax owed or refund due.

- What penalties exist for late filing or payment?

Entities that fail to file or pay the Business Privilege Tax by the due date may incur penalties and interest. The specifics of these penalties are detailed in the instructions accompanying the PPT form, and they include a percentage of the unpaid tax and additional interest calculated from the due date until the full payment is made.

- How can I pay the Business Privilege Tax?

Payments can be made electronically or by check. If paying by check, you must also submit Form BPT-V along with your payment and the PPT form to the designated address. Ensure that your payment is made by the due date to avoid penalties and interest.

- What is the minimum and maximum tax due?

The minimum privilege tax due is $100, but the maximum can vary based on the entity's net worth and other factors calculated in the form. Detailed instructions are provided to help determine the exact tax obligation.

- Where can I find more information or get help with my Alabama PPT Form?

For more information or assistance, you can visit the Alabama Department of Revenue website at www.revenue.alabama.gov or contact their Business Privilege Tax Section directly by phone. It's also advisable to consult with a tax professional familiar with Alabama tax laws and regulations for specific guidance.

Common mistakes

When filling out the Alabama Business Privilege Tax Return and Annual Report (Form PPT), individuals and businesses often encounter several common pitfalls. Recognizing and avoiding these mistakes can streamline the filing process and help ensure accuracy and compliance. Here are nine mistakes frequently made:

Not selecting the correct tax year and determination period type at the beginning of the form. This includes oversight between calendar year, fiscal year, amended return, and 52/53 week filer options, leading to inconsistencies in reported data.

Incorrectly identifying the type of taxpayer in question 2 (e.g., S Corporation, Limited Liability Entity, Disregarded Entity, LLE taxed as S Corporation), which can result in the misapplication of tax rates and exemptions.

Omitting or inaccurately filling out taxpayer information, such as the legal name of the business entity, FEIN, and mailing address. This can lead to processing delays or misdirected correspondence.

Failing to include essential details such as the date of incorporation or organization, state of incorporation, and county of incorporation, which are crucial for the proper assessment of the privilege tax.

Overlooking the computation of the amount due or refund, particularly in completing the corporate annual report fee, previously paid annual report fees, and privilege tax calculations, which affects the accuracy of the tax owed or refund due.

Miscalculating net worth in part A of the Privilege Tax Computation Schedule due to incorrect inclusion or exclusion of issued capital stock, retained earnings, and related party debt, among others, thereby affecting the tax base calculation.

Ignoring or incorrectly applying deductions and exclusions such as investments in Alabama government bonds, pollution control devices, reserves for plant reclamation, and low income housing projects, leading to an overstated tax liability.

Misidentifying applicable credits like the Alabama enterprise zone credit, which can result in the failure to reduce the gross privilege tax by eligible amount, thus overstating the privilege tax due.

Errors in signature and payment section, including not authorizing a Department of Revenue representative to discuss the return with the preparer, failing to sign the return, or incorrectly directing the payment can delay processing and potentially result in penalties.

Avoiding these common mistakes requires careful review and adherence to the instructions provided with the form. Attention to detail, alongside thorough verification of the information entered, can ensure a smoother filing process.

Documents used along the form

When filing the Alabama Business Privilege Tax Return and Annual Report (FORM PPT) for a taxable year, entities must often submit additional documents to comply fully with state tax obligations. Understanding these documents helps ensure the accuracy and completeness of your tax filings. Below is a list of documents often used alongside the Alabama PPT form:

- Form BPT-V (Business Privilege Tax Voucher): Utilized for payment if a business chooses to send a check rather than paying electronically. This voucher ensures the payment is correctly applied to the taxpayer's account.

- Alabama Schedule AL-CAR (Corporation Annual Report): Required for S corporations to report changes in president or secretary information. Although non-corporate pass-through entities are not required to file this, it's essential for corporations to stay compliant.

- Articles of Incorporation/Organization: These foundational documents are sometimes requested to confirm the legal status and structure of the entity, providing a baseline for taxation purposes.

- Federal Tax Return: The entity's federal tax return can be required for cross-reference to ensure consistency in reported income and deductions between federal and state filings.

- Bond and Security Investments Documentation: Detailed records of investments in bonds and securities issued by Alabama or its subdivisions, when applicable, for deduction purposes.

- Pollution Control Devices Investment Records: Documentation for any investment in air, ground, or water pollution control devices in Alabama, which may qualify for deductions.

- Reclamation and Environmental Compliance Reserves Documentation: Evidence of reserves set aside for environmental compliance related to a plant, facility, mine, or site in Alabama, applicable for deductions.

- Low-Income Housing Investment Documentation: Records of amount invested in qualifying low-income housing projects within Alabama, which are eligible for deductions.

- Enterprise Zone Credit Documentation: Documents supporting the claim for an Alabama enterprise zone credit, which can reduce the privilege tax due.

Each additional document plays a critical role in the accurate filing of the Alabama Business Privilege Tax Return and Annual Report by providing essential details that affect the tax computation, credits, and deductions. Businesses must ensure they collect and accurately prepare these documents in alignment with their PPT filings to meet state tax obligations fully. Staying organized and understanding the requirements can mitigate errors and prevent potential issues with the Alabama Department of Revenue.

Similar forms

The Alabama Ppt form is akin to the IRS Form 1120S, used by S corporations for federal tax return filing. Both documents gather information about the entity's income, deductions, and tax liability. However, the Alabama Ppt form specifically addresses state-level business privilege tax obligations and includes computation schedules tailored to Alabama's tax code requirements, reflecting the state's unique approach to taxing entities based on net worth and other factors.

Similar to the IRS Form 1065, which is used for reporting the income, deductions, gains, and losses of a partnership, the Alabama Ppt form collects detailed financial information for entities taxed as partnerships at the state level. Both forms require disclosures about the entity's financial health but serve different government entities: the Alabama Department of Revenue versus the federal IRS.

Resembling the State of Incorporation Annual Report, required by various states for registered businesses, the Alabama Ppt incorporates elements of reporting changes in critical business details like addresses and officer details. These reports are crucial for keeping business records current with state agencies, ensuring compliance, and maintaining good standing status.

The Alabama Ppt form parallels the functionality of the IRS Schedule K-1 (Form 1065) to some extent, as it includes sections aimed at documenting direct allocations of income, deductions, and credits to the entity's members or partners. These allocations influence individual tax liabilities, linking entity-level reporting with the personal tax obligations of its owners.

The IRS Form 8832 (Entity Classification Election) relates to the Alabama Ppt form by allowing entities to choose their federal tax classification. The Alabama Ppt form's sections for identifying the type of taxpayer echo the choices an entity might make on Form 8832, impacting how they are taxed and what specific state forms they need to complete.

Similar to the IRS Form 2553 (Election by a Small Business Corporation), which S corporations use to elect "S" status for federal tax purposes, the Alabama Ppt form requires S corporations to identify themselves and calculate taxes due in alignment with their chosen tax status. Both forms are essential for entities leveraging specific tax treatment benefits.

Dos and Don'ts

When completing the Alabama PPT (Privilege Tax) form, it's essential to approach the process with care to ensure accuracy and compliance with the state's tax laws. Below are several do's and don'ts to guide you through filling out this form.

- Do carefully review the entire form before starting to fill it out to make sure you understand all the requirements.

- Do check the correct box for your type of taxpayer status, such as S Corporation, Limited Liability Entity, Disregarded Entity, or LLE taxed as S Corporation, to prevent any misclassification.

- Do provide accurate and complete information in every section, including taxpayer information, return information, and computation of the amount due or refund.

- Do attach all required documentation, such as supporting documentation for an amended return or the Alabama Schedule AL-CAR for S Corporations, to ensure your return is processed efficiently.

- Don't forget to sign and date the return. An unsigned return is considered invalid and may result in penalties or delays.

- Don't calculate your amounts due incorrectly. Pay close attention to the computation section, including net worth computation and the privilege tax computation, to avoid errors that could lead to underpayment or overpayment.

- Don't miss the deadline for submission. Ensure your return and any payment due are submitted by the original due date to avoid penalties and interest for late filing and payment.

By following these guiding principles, you can navigate the complexities of the Alabama Business Privilege Tax Return and Annual Report with greater confidence and accuracy, ensuring compliance with tax obligations in Alabama.

Misconceptions

Understanding the nuances of Alabama's Business Privilege Tax return, often referred to as the PPT form, is essential for accurate compliance. However, several misconceptions surround its completion and submission. Below are ten common misunderstandings clarified for better insights.

Fiscal Year Dates: It's mistakenly believed that the fiscal year dates mentioned must align with the calendar year. However, these dates are determined by each business's fiscal year, which might not correspond with the January to December calendar year.

Amended Returns: There's a misconception that filing an amended return is unnecessary. If errors are discovered post-submission, an amended return should be filed with supporting documentation to correct the discrepancies.

FEIN Requirement: Some believe the Federal Employer Identification Number (FEIN) is always required. However, the instructions differentiate scenarios where a FEIN may not be necessary, emphasizing the need to review instructions carefully.

S Corporation Designation: The belief that all Limited Liability Entities (LLEs) should check the S Corporation box if they're taxed as such is incorrect. The form has a separate designation for LLEs taxed as S Corporations, acknowledging their unique tax structure.

Corporate Annual Report Fee: A common misconception is that all entities must pay the corporate annual report fee. In reality, only corporations, including S-corporations, are subjected to this fee, while other non-corporate entities are exempt.

Paying with Check: Many believe that payment can only be made via check. While Form BPT-V is for those making payments by check, electronic payments are encouraged and accepted, offering flexibility in payment methods.

Annual Fee Adjustments: Some assume the annual report fee cannot be adjusted. If the fee has been overpaid in the taxable year, the net annual report fee due can be reduced accordingly on the form.

Penalties and Interest: There's a misconception that penalties and interest are flat rates. They are calculated based on the specifics of the late payment or filing, necessitating a review of instructions for proper calculation.

Minimum Tax Due: Many are under the mistaken impression there's no minimum tax. Regardless of size or income, there's a minimum privilege tax due, ensuring all entities contribute to their ability to operate within Alabama.

Electronic Filing: Lastly, there's a reluctance to file electronically due to the misconception it's more complicated than paper filing. Electronic submission is streamlined, promoting accuracy and efficiency in fulfilling tax obligations.

Careful attention to the Alabama Department of Revenue's guidelines and the specifics outlined in the form can dispel these misconceptions, enabling accurate and timely compliance with state tax laws.

Key takeaways

Understanding and properly completing the Alabama PPT form is essential for businesses operating within the state to ensure compliance with tax obligations and avoid potential penalties. Here are four key takeaways to assist in filling out and using the form effectively:

- The form applies to different types of entities, including S Corporations, Limited Liability Entities, Disregarded Entities, and LLEs taxed as S Corporations, specifying the need to accurately identify the type of taxpayer entity to ensure the correct tax obligations are met.

- It is vital to include comprehensive taxpayer information, such as the legal name of the business entity, Federal Employer Identification Number (FEIN), and contact details, to ensure accurate identification and communication regarding the tax return.

- Calculation of the amount due or refund involves several steps, including determining the net annual report fee, computing the privilege tax due, and accounting for any payments previously made within the taxable year. This meticulous process is crucial for identifying the accurate tax liability of the entity.

- Payment deadlines and methods are clearly outlined, indicating that full payment of any amount due for the taxable year is required by the original due date of the return, with specific mailing addresses provided for returns with and without payment. This underscores the importance of timely compliance to avoid interest and penalties.

Adherence to these guidelines when completing the Alabama PPT form can facilitate a smooth tax filing process, ensuring that business entities remain in good standing with the Alabama Department of Revenue.

Popular PDF Forms

What Is the Par-q - This comprehensive form balances the need for safety with the enthusiasm for participating in fitness activities.

How to Apply at Dollar Tree - The form seeks to gather comprehensive data on applicants’ work history to ensure a good match between the candidate's skills and job requirements.

Can a Part Time Employee Get Unemployment - A digital or physical log for keeping track of job search activities, critical for meeting the Texas Workforce Commission's unemployment insurance criteria.