Blank Alabama Rt 1 PDF Template

In the realm of real estate transactions within Alabama, the Alabama RT-1 form plays a pivotal role, designed to ensure transparency and accountability. Mandated by the Code of Alabama 1975, Section 40-22-1, this Real Estate Sales Validation Form serves as a critical document for both the state and the parties involved in the property conveyance. It captures essential details such as the grantor and grantee's names and mailing addresses, the property address, the date of sale, and the critical financial aspects of the transaction, including the total purchase price or the actual value of the said property. Notably, the form allows for verification of these financials through various means like a bill of sale, appraisal, sales contract, or other closing statements, emphasizing flexibility in compliance. Furthermore, it specifies that if the conveyance document already contains this requisite information, filing the RT-1 form becomes unnecessary. The form also acts as a declaration of the truthfulness of the provided information, under penalty of law for any falsification. This underscores its role not just in record-keeping but also in upholding the integrity of real estate transactions within the state.

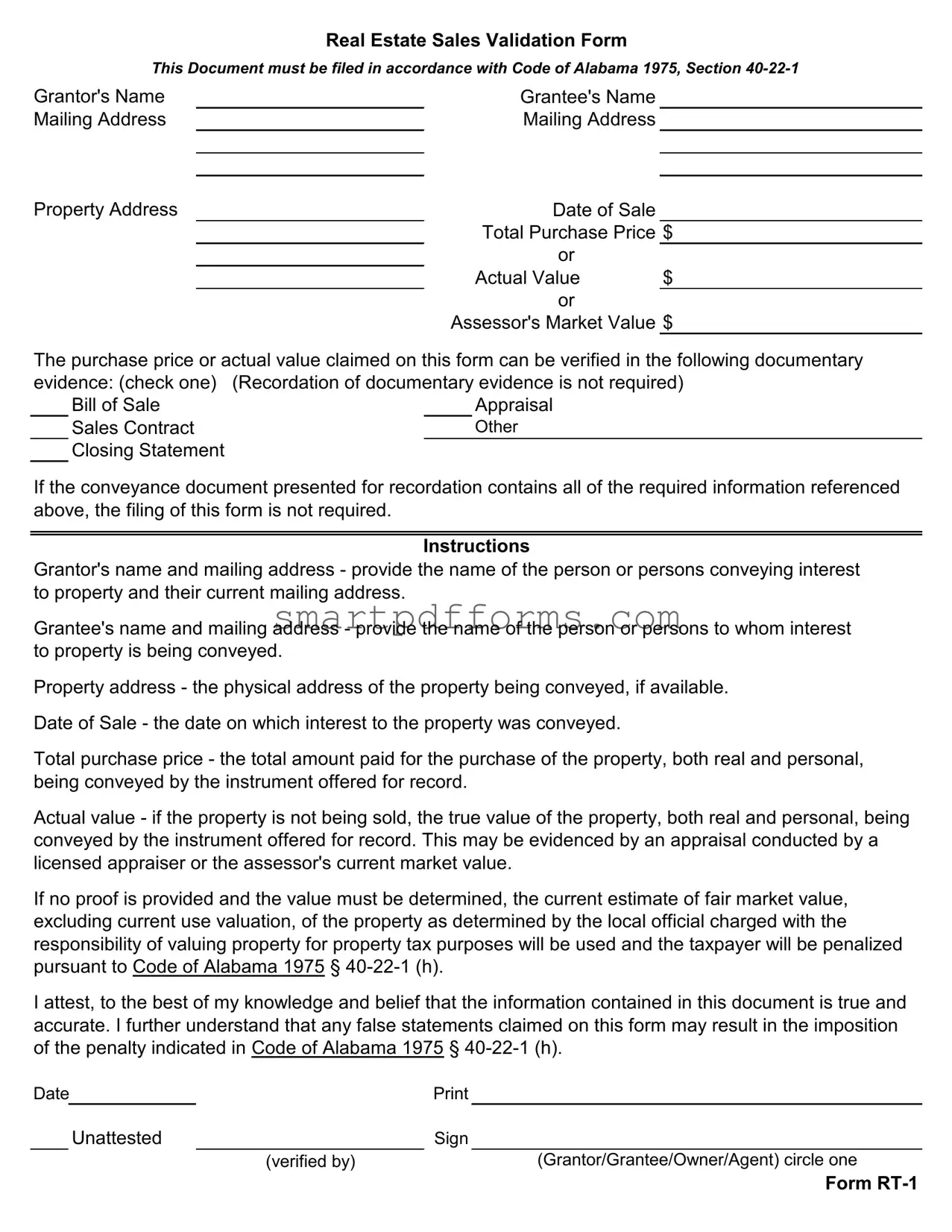

Preview - Alabama Rt 1 Form

REAL ESTATE SALES VALIDATION FORM

THIS DOCUMENT MUST BE FILED IN ACCORDANCE WITH CODE OF ALABAMA 1975, SECTION

Grantor's Name |

|

Grantee's Name |

Mailing Address |

|

Mailing Address |

|

|

|

|

|

|

Property Address |

|

Date of Sale |

|

|

|

Total Purchase Price $ |

|

|

|

or |

|

|

|

Actual Value |

$ |

|

|

or |

|

|

|

Assessor's Market Value $ |

|

|

|

|

|

The purchase price or actual value claimed on this form can be verified in the following documentary

evidence: (check one) |

(Recordation of documentary evidence is not required) |

|||

|

Bill of Sale |

|

|

Appraisal |

|

Sales Contract |

|

|

Other |

|

Closing Statement |

|

|

|

If the conveyance document presented for recordation contains all of the required information referenced above, the filing of this form is not required.

INSTRUCTIONS

Grantor's name and mailing address - provide the name of the person or persons conveying interest to property and their current mailing address.

Grantee's name and mailing address - provide the name of the person or persons to whom interest to property is being conveyed.

Property address - the physical address of the property being conveyed, if available.

Date of Sale - the date on which interest to the property was conveyed.

Total purchase price - the total amount paid for the purchase of the property, both real and personal, being conveyed by the instrument offered for record.

Actual value - if the property is not being sold, the true value of the property, both real and personal, being conveyed by the instrument offered for record. This may be evidenced by an appraisal conducted by a licensed appraiser or the assessor's current market value.

If no proof is provided and the value must be determined, the current estimate of fair market value, excluding current use valuation, of the property as determined by the local official charged with the responsibility of valuing property for property tax purposes will be used and the taxpayer will be penalized pursuant to Code of Alabama 1975 §

I attest, to the best of my knowledge and belief that the information contained in this document is true and accurate. I further understand that any false statements claimed on this form may result in the imposition of the penalty indicated in Code of Alabama 1975 §

DatePrint

Unattested |

Sign |

||

|

(verified by) |

|

(Grantor/Grantee/Owner/Agent) circle one |

FORM

Form Data

| Fact Number | Detail |

|---|---|

| 1 | The form is known as the Real Estate Sales Validation Form, or Form RT-1. |

| 2 | Governing law for this form is the Code of Alabama 1975, Section 40-22-1. |

| 3 | Details required include both the grantor's and grantee's names and mailing addresses. |

| 4 | Property address, date of sale, and total purchase price or actual value are necessary fields on the form. |

| 5 | The form allows for verification of the purchase price or actual value through documentary evidence such as a bill of sale, appraisal, sales contract, other closing statement, but does not require recordation of this evidence. |

| 6 | Completion of this form is not required if the conveyance document presented for recordation contains all mentioned information. |

| 7 | Attesting to the form's accuracy is mandatory, and making false statements can lead to penalties under Code of Alabama 1975 § 40-22-1 (h). |

| 8 | The form is verified by the signature of the grantor, grantee, owner, or an authorized agent, as indicated by circling one of the mentioned roles. |

Instructions on Utilizing Alabama Rt 1

When you're involved in the sale of real estate property in Alabama, accurately completing the Real Estate Sales Validation Form, otherwise known as the Alabama RT-1, becomes a crucial part of the process. This form helps in ensuring that all transactions are transparent and in compliance with Alabama law, specifically under the Code of Alabama 1975, Section 40-22-1. Filling out this form needs attention to detail and an understanding of the transaction specifics. It's vital to ensure that all provided information is accurate to avoid any potential penalties for false statements. Let's walk through the steps necessary to complete this form properly.

- Grantor's Name and Mailing Address: Start by entering the full name and current mailing address of the person or persons conveying the property.

- Grantee's Name and Mailing Address: Next, specify the full name and current mailing address of the person or persons receiving the property interest.

- Property Address: Write down the physical address of the property being conveyed. If the property does not have a specific address, provide a detailed description that clearly identifies the property's location.

- Date of Sale: Enter the date on which the property interest was officially conveyed.

- Total Purchase Price: If the property was sold, specify the total amount paid for the property. This includes both real and personal property being transferred.

- Actual Value: If the transaction isn't a sale, you must provide the true value of the property being conveyed. This can be supported through an appraisal by a licensed appraiser or by the assessor's market value. If no evidence is provided and a value determination is required, the form specifies that the local official responsible for property valuation will estimate the property's fair market value, excluding any current use valuation.

- Select the type of documentary evidence provided to support the purchase price or actual value claimed. This can be a bill of sale, appraisal, sales contract, other closing statement, or if no document is presented because the conveyance document contains all the required information, acknowledge that the filing of this form is not required.

- Confirm the accuracy of the information provided by dating and signing the form. Specify your relationship to the transaction (Grantor, Grantee, Owner, or Agent) by circling the appropriate designation.

After completing these steps, review the form to ensure all provided information is correct and complete. Accurate completion and submission of the Alabama RT-1 form are critical in adhering to state laws and avoiding any possible penalties. Remember, this form plays a key role in the property sale process, acting as a formal declaration of the transaction's details to the appropriate Alabama state department.

Obtain Answers on Alabama Rt 1

- What is the Alabama Rt 1 form?

- When do I need to file the Alabama Rt 1 form?

- What information do I need to provide on the Alabama Rt 1 form?

- The names and mailing addresses of both the grantor (seller) and the grantee (buyer).

- The physical address of the property being conveyed.

- The date of the sale.

- The total purchase price, actual value, or assessor's market value of the property.

- How can the purchase price or actual value be verified?

- What happens if the conveyance document already contains the required information?

- What are the consequences of providing false statements on the form?

- Is it mandatory to have the form attested or verified?

- Can the value of the property be determined by the local official if no proof is provided?

- Where can I find the Alabama Rt 1 form?

The Alabama Rt 1 form, also known as the Real Estate Sales Validation Form, is a document that must be filed to record a real estate transaction in the state of Alabama. It provides details about the sale, including the grantor's and grantee's information, property address, date of sale, and total purchase price or the property's actual value. This form helps in maintaining accurate public records of property transactions.

You need to file the Alabama Rt 1 form anytime you are involved in a real estate transaction, whether buying or selling property, and the conveyance document does not contain all the required information. If the conveyance document, such as a deed, includes all necessary details about the transaction, filing this form may not be required.

The form requires specific information, including:

The form allows you to verify the purchase price or actual value through documentary evidence. This can include a bill of sale, an appraisal by a licensed appraiser, a sales contract, a closing statement, or other relevant documents. Although the recordation of this documentary evidence is not required, it should be available if requested to substantiate the values claimed.

If the conveyance document presented for recordation, such as a deed or title, includes all the required information that the Alabama Rt 1 form asks for, then filing the Rt 1 form is not necessary. This provision ensures efficiency and avoids redundancy in the recording process.

Providing false statements on the Alabama Rt 1 form can lead to penalties as indicated in Code of Alabama 1975 § 40-22-1 (h). This underscores the importance of ensuring that all the information provided on the form is true and accurate to the best of your knowledge and belief.

Yes, the bottom part of the form requires attestation or verification by the grantor, grantee, owner, or their agent, highlighting the responsibility to ensure the information's accuracy. This serves as a formal declaration of the truthfulness and accuracy of the information provided on the form.

If no proof of the property's value is provided, the current estimate of the fair market value, excluding current use valuation, as determined by the local official responsible for valuing property for property tax purposes, will be used. This determination may result in penalties if it is found that the value declared is inaccurate.

The Alabama Rt 1 form is typically available through the county's office where the property is located or on their official website. It's important to obtain the most current version of the form to ensure compliance with the latest requirements and guidelines.

Common mistakes

Filling out the Alabama RT-1, or Real Estate Sales Validation Form, correctly is essential for a smooth property transaction. However, certain common mistakes can lead to delays or penalties. Here are ten of the most prevalent errors:

- Incorrect or incomplete names: Failing to provide the full legal names of the grantor and grantee can lead to confusion or misidentification of parties involved.

- Address errors: Providing incorrect mailing addresses for either the grantor or grantee, or failing to include the full property address, can significantly delay the transaction.

- Omitting the sale date: The date of sale is crucial for legal and tax purposes. Leaving this blank can invalidate the form.

- Incorrect total purchase price: Entering an inaccurate purchase price, or not including all components of the sale, might result in tax discrepancies.

- Actual value misunderstandings: For transactions not involving a sale, incorrectly reporting the property's actual value, or failing to support it with proper appraisal or assessor's market value, could lead to penalties.

- Failing to select documentary evidence: Not indicating the type of documentation used to verify the purchase price or actual value can cause processing delays.

- Incomplete attestation: Skipping the attestation part or failing to sign the document invalidates the submission.

- Not specifying the right party: Failing to clearly identify whether the grantor, grantee, owner, or agent is the one attesting and signing the document can lead to legal ambiguities.

- Assuming filing isn't required: Misinterpreting the instructions and assuming the form need not be filed because the conveyance document includes the required information. This misstep can result in non-compliance with the Alabama Code.

- Penalties of false statements: Overlooking the warning about penalties pursuant to Code of Alabama 1975 § 40-22-1 (h) for false statements, thereby risking financial and legal repercussions.

Avoiding these mistakes can help in the timely and successful processing of real estate transactions in Alabama. Attention to detail and a thorough review of the form before submission can prevent these common errors.

Documents used along the form

When dealing with property transactions in Alabama, particularly the use of the Alabama RT-1 form, several other forms and documents often accompany the process. These documents are crucial for ensuring that all aspects of the transaction are legally sound and properly recorded. Listed below are documents commonly used alongside the Alabama RT-1 form, each serving a unique purpose in the real estate transaction process.

- Warranty Deed: A document that guarantees the grantor (seller) holds clear title to a piece of real estate and has a right to sell it to the grantee (buyer).

- Quitclaim Deed: A legal instrument that transfers the grantor's rights, title, and interest in a property to the grantee without providing any warranty on the title.

- Mortgage Agreement: This contract outlines the terms under which the lender agrees to loan money to the borrower for purchasing real estate, detailing the loan’s repayment schedule and interest rate.

- Property Tax Records: These documents provide a history of property tax payments and assessments, ensuring the property is free from tax liens.

- Title Insurance Policy: This policy safeguards the buyer (and the lender) against potential losses due to defects in the title that were not discovered during the title search.

- Closing Statement (HUD-1): A detailed list of all the transactions, including the fees both the buyer and seller pay at the closing of a real estate transaction.

- Home Inspection Report: A comprehensive report detailing the condition of the property, including its systems and structures, to identify any existing or potential problems.

- Appraisal Report: An expert's estimation of the property’s market value based on a comparison of similar properties and an examination of the property itself.

- Flood Zone Statement: A document establishing whether the property is located in a flood zone, which would require the purchaser to obtain flood insurance.

Each document plays a vital role in the conveyance process, providing transparency, compliance, and legal protection for both parties involved. Whether you're buying or selling real estate in Alabama, familiarity with these forms and their purposes will aid in a smoother transaction and help you understand the legal and financial responsibilities involved.

Similar forms

The Alabama RT-1 form, known as the Real Estate Sales Validation Form, plays a crucial role in the process of real estate transactions. Its main function is to capture key details about the sale of property, including information on the grantor and grantee, the property address, the date of sale, and the sale's financial specifics. This form bears similarities to various other documents used across different contexts, each aimed at facilitating, recording, or validating transactions or agreements between parties. Below is a list of eight documents similar to the Alabama RT-1 form and a description of how they are alike:

- Deed of Sale: A Deed of Sale officially records the transfer of property from one party to another. Like the Alabama RT-1 form, it includes details such as the identities of the buyer and seller, the property's location, and the transaction's financial terms, ensuring the lawful transfer of ownership.

- Warranty Deed: This document guarantees that the grantor holds clear title to a property and has the right to sell it, similar to how the RT-1 form records a transaction’s validity. Both documents play a part in affirming the legitimacy of the sale and the transfer of clear property titles.

- Mortgage Agreement: A mortgage agreement outlines the terms under which a lender provides a loan for the purchase of real estate. While serving different functions, both this agreement and the RT-1 form involve the recording of significant financial details pertinent to real estate transactions.

- Quitclaim Deed: This transfer document is used to convey whatever interest the grantor has in a property without any warranty regarding the title’s validity. Like the RT-1, it includes information on the parties involved and the property but differs in the level of warranty provided about the title.

- Closing Disclosure: This is a detailed financial statement provided to homebuyers before closing on a mortgage. It shares similarities with the RT-1 form by listing the details of the transaction, including the sale price and other financial terms agreed upon by both parties.

- Bill of Sale: Commonly used in the sale of personal property, a Bill of Sale documents the transaction between a buyer and a seller. It mirrors the RT-1 form in its function to provide evidence of a transfer, capturing critical information such as the parties’ details and the sale price.

- Appraisal Report: An appraisal report assesses a property's market value and is often required in sales and lending transactions. While it focuses on valuing the property rather than recording the sale, it resembles the RT-1 form in its use as a document to validate financial aspects of real estate transactions.

- Title Insurance Policy: This policy protects real estate owners and lenders against loss from defects in titles. Both this policy and the RT-1 form are integral to the real estate sales process, ensuring the legitimacy and security of property transactions.

Each of these documents, like the Alabama RT-1 form, plays an essential role in the facilitation, recording, or validation of property transactions, protecting the interests of all parties involved and ensuring the legality and transparency of the process.

Dos and Don'ts

To ensure the accurate and lawful completion of the Alabama RT-1 Real Estate Sales Validation Form, it is critical to follow specific guidelines. Here are four dos and don'ts to assist you:

Do:- Verify all information for accuracy: Before submitting, double-check all entered information including names, addresses, and the total purchase price to ensure accuracy.

- Use the correct form of documentation: Depending on whether the property was sold or not, provide the appropriate documentary evidence such as a bill of sale, sales contract, appraisal, or other closing statements as specified.

- Sign and date the form appropriately: Ensure that the form is signed and dated by the correct party (Grantor/Grantee/Owner/Agent) as indicated at the end of the form. An appropriate verification signals compliance and acknowledgment of the contents.

- Comply with legal requirements: Adhere to the Code of Alabama 1975, Section 40-22-1, especially in accurately reporting the purchase price or actual value of the property to avoid penalties.

- Leave fields blank: It is important to fill out all required fields to avoid delays in processing. Missing information can lead to the rejection of the form.

- Misrepresent information: Falsifying information not only leads to legal penalties as indicated in Code of Alabama 1975 § 40-22-1 (h) but also damages the integrity of the transaction.

- Forget to check the appropriate boxes: Make sure to indicate the type of documentary evidence being provided by checking the corresponding box. This step is crucial for validating the information supplied.

- Ignore the need for witness or notarization, if required: Although the form does not explicitly mention it, understanding the nuances of local real estate law might necessitate a notarized document or witnessed signatures in certain cases.

Misconceptions

Addressing misconceptions about the Alabama Real Estate Sales Validation Form (RT-1) is key to ensuring compliance and understanding among those involved in real estate transactions within the state. Below are nine common misconceptions and their clarifications:

- Filing is always required: The RT-1 form need not be filed if the conveyance document already includes all required information, as specified by the form itself.

- Only for sold properties: Though it primarily concerns the sale of property, the RT-1 form is also applicable when property is transferred without a traditional sale — capturing the "actual value" in such instances.

- Personal property is excluded: The total purchase price or actual value reported should include both real and personal property involved in the conveyance.

- Proof of value is optional: If the value is not evident through the sale price, credible documentation, such as an appraisal or the assessor's market value, must be presented or the local official's estimate will be used, possibly incurring penalties.

- Only the grantee's information is needed: Information for both the grantor and grantee, including names and mailing addresses, is required on the form.

- Any closing documentation is acceptable: While various documents can support the provided values, only specific types of documentary evidence, such as a bill of sale or sales contract, are acknowledged for verifying the information.

- Penalties are rare: False statements on the RT-1 can lead to penalties as outlined in the Code of Alabama 1975 § 40-22-1 (h), emphasizing the importance of accuracy.

- Official valuation is definitive: The assessor's market value is one method to substantiate the property value, but if unprovided, an estimation of the fair market value excluding current use valuation will be employed, which may not always align with the taxpayer's assessment.

- Electronic signatures are acceptable: The form specifies that the signature must be unattested but verified, suggesting a need for a physical signature by the grantor, grantee, owner, or agent. This underlines the formality and traditional documentation practices in real estate transactions.

Understanding these keypoints demystifies the RT-1 form, facilitating smoother real estate transactions and enhancing compliance with Alabama’s legal requirements. Individuals and professionals involved in property conveyance should remain vigilant in deciphering the stipulations of the RT-1 to avoid common pitfalls and ensure accuracy in documentation.

Key takeaways

Understanding and accurately completing the Alabama RT-1 form is essential for any party involved in the conveyance of real estate within the state. Below are key takeaways that can guide individuals through this process:

- Required when exemption criteria are not met: The RT-1 form must be filed whenever a conveyance document, such as a deed, does not contain all the necessary information as prescribed by the Code of Alabama 1975, Section 40-22-1. If the conveyance document includes all the required details, filing this form is not mandatory.

- Completeness is crucial: The form necessitates various details about the transaction, including the names and mailing addresses of both the grantor (seller) and grantee (buyer), the property's physical address, the date of sale, and the total purchase price or the property's actual value. Ensuring accuracy and completeness of this information is paramount to avoid penalties or delays in the conveyance process.

- Verification of property value: Value can be determined through different documents, such as a bill of sale, an appraisal, a sales contract, or other closing statements. In instances where the property is not sold, the actual value must be substantiated, either through an appraisal by a licensed appraiser or the assessor's current market value. Absence of proof may lead to reliance on a fair market value estimate by local officials, potentially incurring penalties for the taxpayer.

- Declaration of accuracy: The form requires an attestation by the individual filing it—whether the grantor, grantee, owner, or an agent—affirming to the best of their knowledge and belief that the information provided is true and accurate. This is a crucial step, as any false statements may lead to penalties under Code of Alabama 1975 § 40-22-1 (h).

- Penalty for false statements: It's important for filers to understand that any inaccuracies or false claims made in the RT-1 form might not just lead to correction requirements but could also result in penalties as indicated by the relevant Alabama Code. Such consequences underscore the importance of diligent verification of all information before submission.

Comprehension and adherence to these points can streamline the real estate transfer process, preventing unnecessary legal complications and ensuring compliance with Alabama state regulations.

Popular PDF Forms

Security Deposit Return Letter Pdf - A user-friendly format for clearly showing tenants what charges have been deducted from their security deposit and why.

Hot Topic Application - Step into a world of opportunities with Hot Topic's application, designed for inclusivity and equal employment opportunities.

Workers Comp Exemption New York - Directors, trustees, homeowners, and other titles have specific requirements under the CE-200 form, underscoring the importance of correctly identifying one's role.