Blank Aoc E 204 PDF Template

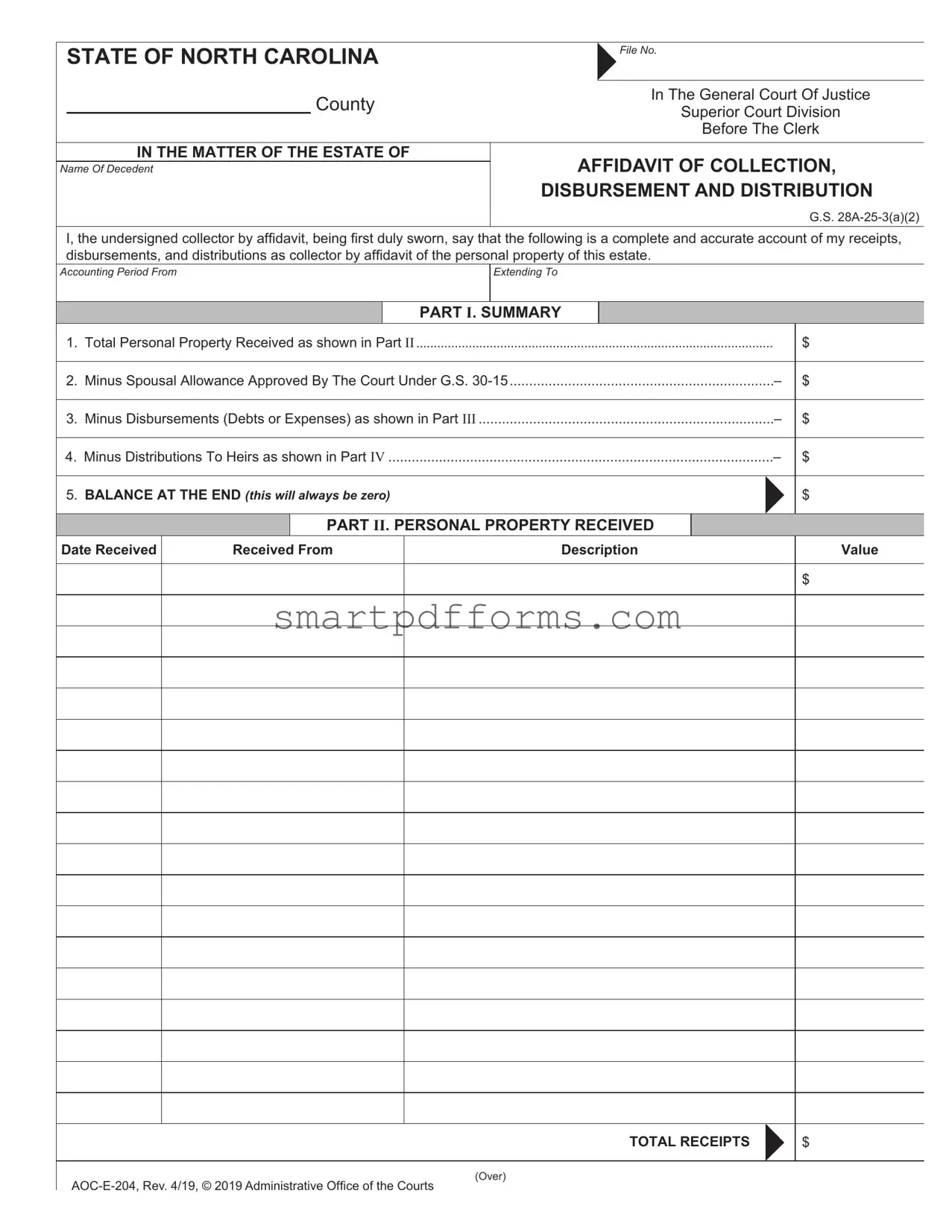

In the legal landscape of North Carolina, handling the estate of a deceased individual involves meticulous processes and documentation, one of which is the AOC-E-204 form, under the auspices of the General Court of Justice Superior Court Division. This affidavit is a critical tool used for the collection, disbursement, and distribution of the personal property within an estate, pursuant to G.S. 28A-25-3(a)(2). The form requires the collector by affidavit, typically a close relative or legal representative of the deceased, to meticulously record all transactions related to the estate’s personal property. From detailing every item of personal property received, to itemizing allowances, disbursements, and eventually, distributions to heirs, the AOC-E-204 ensures transparency and accountability throughout the process. Notably, the form includes sections that guide the affiant through summarizing the total personal property received, subtracting any spousal allowance approved by the court, and listing disbursements made for debts or expenses, before concluding with the balance distributed to heirs, which, by the form’s design, should always net to zero. This careful accounting is sworn to under oath before an official authorized to administer oaths, ensuring its accuracy and reliability. The formulation of the AOC-E-204 form, thus, plays a pivotal role in the streamlined administration of estates, safeguarding the interests of all parties involved and adhering to North Carolina’s legal standards.

Preview - Aoc E 204 Form

STATE OF NORTH CAROLINA

County

File No.

In The General Court Of Justice

Superior Court Division

Before The Clerk

IN THE MATTER OF THE ESTATE OF

Name Of Decedent

AFFIDAVIT OF COLLECTION,

DISBURSEMENT AND DISTRIBUTION

G.S.

I, the undersigned collector by affidavit, being first duly sworn, say that the following is a complete and accurate account of my receipts, disbursements, and distributions as collector by affidavit of the personal property of this estate.

Accounting Period From

Extending To

PART I. SUMMARY

1. |

.......................................................................................................Total Personal Property Received as shown in Part II |

|

$ |

||||

|

|

|

|

|

|

|

|

2. |

Minus Spousal Allowance Approved By The Court Under G.S. |

– |

$ |

||||

|

|

|

|

|

|

|

|

3. |

Minus Disbursements (Debts or Expenses) as shown in Part III |

– |

$ |

||||

|

|

|

|

|

|

||

4. Minus Distributions To Heirs as shown in Part IV |

– |

$ |

|||||

|

|

|

|

|

|

|

|

5. |

BALANCE AT THE END (this will always be zero) |

|

|

$ |

|||

|

|

|

|

|

|

|

|

|

|

|

PART II. PERSONAL PROPERTY RECEIVED |

|

|

||

Date Received |

Received From |

|

Description |

|

Value |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL RECEIPTS

$

(Over)

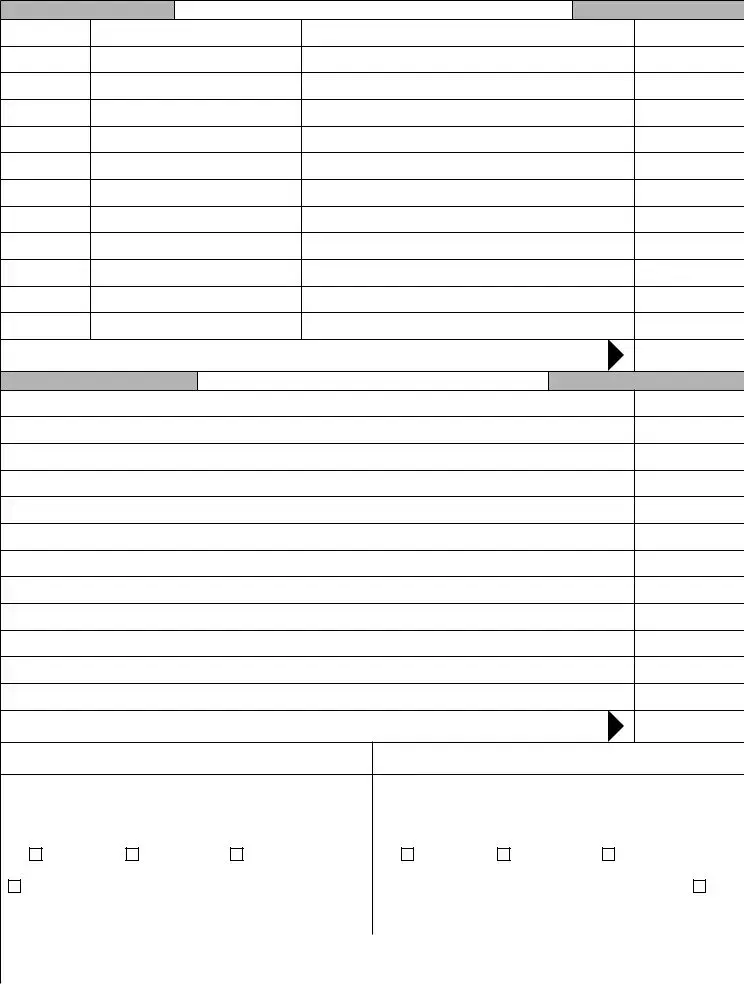

PART III. DISBURSEMENTS (DEBTS OR EXPENSES)

Date Paid |

To |

For |

Amount |

$

TOTAL DISBURSEMENTS

$

PART IV. BALANCE DISTRIBUTED TO HEIRS

Heirs

Amount

$

TOTAL BALANCE

$

Signature Of Affiant 1 |

Signature Of Affiant 2 |

SWORN/AFFIRMED AND SUBSCRIBED TO BEFORE ME |

SWORN/AFFIRMED AND SUBSCRIBED TO BEFORE ME |

||||||

|

|

|

|

|

|

||

Date |

|

Signature Of Person Authorized To Administer Oaths |

Date |

Signature Of Person Authorized To Administer Oaths |

|||

|

|

|

|

|

|

|

|

Deputy CSC |

Assistant CSC |

Clerk Of Superior Court |

Deputy CSC |

Assistant CSC |

Clerk Of Superior Court |

||

|

|

|

|

|

|

|

|

Notary |

Date Commission Expires |

|

Date Commission Expires |

|

|

Notary |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

SEAL |

County Where Notarized |

|

County Where Notarized |

|

|

SEAL |

|

|

|

|

|

|

|

|

|

© 2019 Administrative Office of the Courts

Form Data

| Fact Name | Description |

|---|---|

| Form Title | Affidavit of Collection, Disbursement, and Distribution |

| State | North Carolina |

| Governing Law | G.S. 28A-25-3(a)(2) |

| Use of Form | For reporting the collection, disbursement, and distribution of the personal property of a decedent's estate |

| Accounting Period | Specifies the period from which the affidavit accounts for the estate’s activities |

| Sections | Includes summaries of Personal Property Received, Disbursements, and Distributions to Heirs |

| Final Balance | Must always be zero, indicating all funds have been accounted for |

| Approval of Spousal Allowance | Must be approved by the court under G.S. 30-15 |

| Validation | Requires affidavit signatures to be sworn or affirmed and subscribed before a person authorized to administer oaths |

Instructions on Utilizing Aoc E 204

After completing the necessary paperwork, including the AOC E-204 form, the journey through the probate process takes its next steps towards finality. This process involves a detailed accounting of the estate of a decedent, aimed at ensuring that all assets are accounted for, and liabilities settled, before distribution to rightful heirs. Filling out the AOC E-204 form is crucial in this phase, as it provides a summary of collections, disbursements, and distributions related to the estate. Here's how you can accurately complete the form:

- Start by entering the county and file number in the space provided at the top of the form to ensure the form is filed under the correct estate case.

- In the section titled "In The Matter Of The Estate Of," fill in the full legal name of the decedent to establish whose estate is being referred to.

- Under the affidavit section, input your full name as the collector by affidavit, confirming your role in managing the estate's personal property.

- For the accounting period, specify the start and end dates of the timeframe for which the estate's financial activity is being reported.

- In Part I. Summary, itemize the total personal property received. This figure should match the total calculated in Part II.

- Deduct any spousal allowance approved by the court, disbursements for debts or expenses, and distributions to heirs from the total personal property received. Ensure the balance at the end equals zero.

- In Part II. Personal Property Received, list all items of personal property received, including the date received, from whom it was received, a description of each item, and its value. Total these amounts at the end of this section.

- In Part III. Disbursements (Debts or Expenses), detail all payments made from the estate, including the date, payee, purpose, and amount. Sum these figures to provide a total disbursement amount.

- Part IV. Balance Distributed to Heirs requires the names of all heirs who received a distribution, alongside the amount each received. The sum of these distributions is entered at the end of this part.

- Both affiants (if applicable) must sign their names at the bottom of the form to verify the information provided is complete and accurate.

- Finally, ensure that the form is sworn or affirmed in front of a person authorized to administer oaths, such as a Deputy CSC, Assistant CSC, Clerk of Superior Court, or Notary. This individual must sign, date, and affix their seal on the form, confirming the swearing or affirmation of the affiants.

With the completion of the AOC E-204 form, the probate process inches closer towards resolution, ultimately leading to a phase where the estate can be rightfully distributed among the heirs as per the decedent's wishes or state law. Ensuring accuracy and completeness when filling out this form is vital to a smooth estate administration process.

Obtain Answers on Aoc E 204

-

What is the AOC-E-204 form used for in North Carolina?

The AOC-E-204 form, also known as the Affidavit of Collection, Disbursement, and Distribution, is used in the state of North Carolina to provide a detailed account of how the personal property of a deceased person's estate was handled by the collector by affidavit. This includes a complete report of receipts, disbursements, and distributions related to the estate's personal property.

-

Who needs to fill out the AOC-E-204 form?

This form must be completed by an individual acting as the collector by affidavit for an estate. This person is responsible for collecting the personal property, paying any debts or expenses, and distributing what remains to the heirs. The requirement to submit this form arises when handling an estate under the provisions of G.S. 28A-25-3(a)(2).

-

What information is required in Part I of the AOC-E-204 form?

Part I, called the Summary, requires the filer to provide totals that summarize the estate's activity during the accounting period. This includes the total value of personal property received, any spousal allowance approved by the court, disbursements made for debts or expenses, distributions to heirs, and the final balance, which should always be zero.

-

How do I document distributions to heirs in the AOC-E-204 form?

In Part IV of the form, distributions to heirs must be detailed. For each distribution, the heir’s name and the amount distributed to them should be listed. This section ensures that all distributions of the estate’s personal property to heirs are accounted for correctly.

-

Can this form be used for all estates in North Carolina?

No, the AOC-E-204 form is specifically designed for use with estates that can be settled by the affidavit procedure under North Carolina General Statutes. It is not suitable for all estates, particularly those that require formal probate administration due to their size or complexity.

-

What happens after the AOC-E-204 form is completed?

Once the AOC-E-204 form is filled out, it must be signed by the collector by affidavit in front of an individual authorized to administer oaths, such as a Deputy CSC, Assistant CSC, Clerk of Superior Court, or Notary Public. The completed and sworn document is then submitted to the appropriate court as part of the estate settlement process. It becomes a public record of how the estate's personal property was managed, serving as proof of the collector's compliance with the law.

Common mistakes

When filling out the AOC-E-204 form, a critical document for managing an estate in the State of North Carolina, individuals often encounter challenges. This form, crucial for accurate accounting in estate management, can be complex. Ensuring precision is paramount, as any errors can lead to delays or complications in the process. Here are ten common mistakes people make when completing this form:

Not verifying the County and File No. at the beginning of the document to match the estate case, leading to misfiled forms or confusion in the court's administration.

Skipping the Accounting Period section or entering incorrect dates, which could result in discrepancies in the estate's financial period under review.

Omitting signature(s) at the bottom, where both the Signature Of Affiant and the Signature Of Person Authorized To Administer Oaths are required. This oversight can invalidate the document.

Incorrectly recording transactions in Part II: PERSONAL PROPERTY RECEIVED, like underreporting values or forgetting to list some items, thus affecting the estate’s total asset value.

Forgetting to deduct the Spousal Allowance, approved by the court under G.S. 30-15, which can distort the disbursements and allocations meant for heirs.

Failing to accurately detail Disbursements (Debts or Expenses) in Part III, leading to a misrepresentation of the estate’s liabilities.

Misallocating amounts in Part IV: BALANCE DISTRIBUTED TO HEIRS, which can cause disputes among beneficiaries or further legal challenges.

Not ensuring the BALANCE AT THE END is zero, as required to demonstrate that all assets have been properly accounted for, disbursed, or distributed.

Leaving Date Commission Expires and County Where Notarized fields blank, overlooking key notarization details critical for the form’s validity.

Miscalculating totals in either the receipts, disbursements, or distributions sections, which can throw off the entire estate’s financial report.

Ensuring each section is completed accurately helps avoid possible legal complications.

Double-checking the form for accuracy and completeness before submission is essential.

Consulting a legal professional when in doubt can prevent costly mistakes and delays.

These mistakes, while common, are easily avoidable with careful attention to detail and an understanding of the form's requirements. Accurate completion of the AOC-E-204 form is crucial for the efficient administration of an estate, ultimately helping to honor the decedent's wishes and fairly distribute their assets.

Documents used along the form

In the legal administration of an estate in the State of North Carolina, the AOC-E-204 form, known as the Affidavit of Collection, Disbursement, and Distribution, plays a critical role. Alongside this document, several other forms and documents are often used to ensure a thorough and legally compliant process. Each serves its own purpose in the administration of an estate, reflecting different aspects and requirements of the legal proceedings.

- AOC-E-505: This is the Application for Letters of Administration. It is used when there is no will, and it requests the appointment of an administrator for the estate.

- AOC-E-506: Known as the Application for Probate and Letters Testamentary, this form is employed when there is a will, and it requests the court's recognition of the will and the appointment of the executor named in the will.

- AOC-E-202: This document is the Inventory for Decedent's Estate form. It is used to list all assets of the estate at the time of the decedent’s death.

- AOC-E-410: The Estate Tax Certification form, which is necessary when settling a decedent's estate, indicating whether estate taxes are due at the federal or state level.

- AOC-E-207: Titled as the Annual/Final Account, this form provides a detailed accounting of the estate’s finances from the opening of the estate until its closure.

- AOC-E-505A: The Notice to Creditors, this form requires publishing in a local newspaper and sending directly to known creditors, notifying them of the decedent's death and inviting them to present their claims against the estate.

- AOC-E-204A: This is a supplementary document to the AOC-E-204, providing additional space for listing receipts, disbursements, and distributions, if the initial form lacks sufficient space.

- AOC-E-303: Known as the Petition for Year's Allowance, this form allows the surviving spouse or dependent children to claim an allowance from the estate for their support.

These documents, when used together with the AOC-E-204 form, create a comprehensive legal framework that guides the process of estate administration. They ensure that the estate is managed and distributed in accordance with North Carolina law, protecting the interests of creditors, heirs, and other stakeholders. Understanding and properly utilizing these forms is fundamental for anyone involved in the legal aspects of estate management and distribution.

Similar forms

Small Estate Affidavit: Like the AOC-E-204 form, a Small Estate Affidavit is used to manage and settle smaller estates without a formal probate process. Both documents enable the collection, distribution, and disbursement of the deceased's assets to heirs and beneficiaries, based on the estate's value and the applicable state law requirements.

Final Accounting Form for Estates: Similar to the AOC-E-204, this document provides a detailed account of the financial transactions undertaken by the estate's administrator or executor. It includes receipts, disbursements, and distributions of the estate’s assets, ensuring transparency and accountability in the estate settlement process.

Inventory and Appraisement Form: While primarily used for listing and valuing estate assets at the outset of the probate process, this form shares similarities with the AOC-E-204 in terms of itemizing assets. Both documents require a detailed accounting of the estate’s personal property, albeit for different purposes and stages within the estate management process.

Receipts and Releases Form: This document is used when heirs and beneficiaries receive their inheritance from the estate. It is related to the AOC-E-204 as part of the distribution process, where beneficiaries acknowledge receipt of their inheritance, paralleling the AOC-E-204’s reporting of distributions to heirs.

Executor’s/ Administrator’s Deed: Used to transfer real property from an estate to heirs or new owners, the Executor’s/Administrator’s Deed intersects with the AOC-E-204 in the broader context of administering estate assets. While the AOC-E-204 deals with personal property, both documents facilitate the transfer of assets pursuant to a decedent's will or state succession laws.

Claim Against Estate Form: Creditors use this document to assert claims for debts owed by the deceased. It complements the AOC-E-204 form, which accounts for disbursements made for debts and expenses, indicating both forms play critical roles in addressing the financial obligations of the estate.

Notice to Creditors: This form is issued to inform potential claimants of the decedent’s death and the probate administration’s commencement. It correlates with the AOC-E-204 form by impacting the disbursements section, as it invites creditors to submit their claims, which the estate must settle or dispute.

Waiver of Notice: This document, signed by heirs or beneficiaries, indicates that they consent to certain probate procedures without requiring formal notice. It intersects with the process outlined in the AOC-E-204 through its focus on streamlining procedural steps within estate management, specifically in matters related to asset distribution and account settlements.

Petition for Probate and Administration Form: Required for initiating the probate process, this form requests the court's approval to appoint an executor or administrator for the estate. It connects to the AOC-E-204 form because administering the estate ultimately involves the collection, disbursement, and distribution of assets, activities accounted for in the AOC-E-204.

Notice of Administration: This form notifies interested parties about the commencement of estate administration and the appointed administrator or executor's identity. It is related to the AOC-E-204 form, as both are integral steps in administering an estate, ensuring parties involved are informed and that the estate is settled according to legal requirements.

Dos and Don'ts

When filling out the AOC-E-204 form, an important document for the collection, disbursement, and distribution of an estate in North Carolina, there are specific steps you should follow to ensure clarity, correctness, and compliance with legal requirements. Given the form's significance in the process of estate management, attention to detail cannot be overstated. Here is a list of best practices to adopt, as well as pitfalls to avoid.

Do:

Review the form in its entirety before starting to ensure you understand all the information required. This can prevent errors and save time.

Gather all necessary documents related to the estate’s personal property, including bank statements, bills, and receipts, to accurately report values in Parts II, III, and IV.

Use precise figures when reporting the value of personal property received, disbursements, and distributions. Estimations may lead to inaccuracies and potential legal issues.

Ensure that the spousal allowance, if applicable, is accurately calculated and approved by the court as per G.S. 30-15 before deducting it.

Double-check the form for completeness and correctness before signing it. Remember, signing the form attests to the accuracy of the information provided.

Don’t:

Exclude any personal property received or disbursements made. The law requires a complete accounting, and failing to report all activities could lead to penalties.

Forget to deduct approved spousal allowances before calculating the balance for distribution among heirs. This could result in an incorrect distribution of the estate.

Sign the form without ensuring all involved parties have reviewed it. Collaboration can help catch errors or omissions you might have missed.

Submit the form without having it notarized. The form requires notarization to validate the identity of the affiant(s).

Ignore the instructions regarding the accounting period. The form must accurately reflect the specific time frame for which you are reporting.

Correctly handling the AOC-E-204 form is a critical step in the estate management process. Being thorough and attentive to the details can help facilitate a smoother execution of your duties as collector by affidavit, ensuring that all legal obligations are met and that the estate is managed and distributed in accordance with North Carolina law.

Misconceptions

Understanding the AOC-E-204 form, used within the North Carolina court system for handling the estate of a deceased person, can often be confusing. Here, we're addressing six common misconceptions about this form to clarify its purpose and use.

Only Lawyers Can Complete the AOC-E-204 Form: Many people believe this form is strictly in the domain of legal professionals. However, the form is designed to be filled out by the collector by affidavit, who is not required to be a lawyer. This individual is responsible for managing the estate’s assets and must accurately report receipts, disbursements, and distributions.

The Form Always Results in a Balance: A common misconception is that completing this form will always show funds remaining to be distributed. However, the aim is to report that the estate’s personal property assets, after allowable deductions and distributions to heirs, results in a zero balance. This demonstrates that the estate has been properly settled.

It Covers All Types of Assets: Some individuals mistakenly think the AOC-E-204 form covers the distribution of all types of assets. In truth, it only pertains to personal property and not real estate or other non-personal assets.

Approval by the Court is Not Necessary: There's a belief that once the AOC-E-204 is filled out, no further court action is required. This is incorrect. The form includes a section for spousal allowance approved by the court, indicating that court involvement and approval are indeed necessary components of the process.

There is No Need for an Accounting Period: Another misunderstanding is the idea that the form doesn't require a specific accounting period. The form clearly outlines the need to record an accounting period, helping to organize and detail transactions within a set timeframe.

One Affiant is Sufficient: It’s often believed that only one person needs to sign the form. While it might be common for a single individual to manage the estate, the form provides space for two affiants to sign, indicating that there can be circumstances where more than one person is managing the estate together.

Dispelling these misconceptions helps in understanding the purpose and correct usage of the AOC-E-204 form, ensuring that the estate of a deceased person is managed and distributed accurately and legally.

Key takeaways

Understanding the AOC E-204 form is crucial for those involved in handling the estate of a deceased individual in North Carolina. This form, titled "Affidavit of Collection, Disbursement, and Distribution," serves as a detailed account of how an estate's personal property has been managed. Below are key takeaways to guide users through filling out and utilizing this form effectively.

- The form is designed to provide a comprehensive overview of the estate's financial activities, including the collection, disbursement, and distribution of assets within the estate.

- Personal property received is documented in Part II, necessitating accurate and complete records of all assets received by the estate. These include the date received, the source, a description of the property, and its value.

- Deductions from the estate include the Spousal Allowance (if approved by the court) and any debts or expenses paid out, which are detailed in Part III. This section requires information on the payments made, including to whom, the reason for the payment, and the amount.

- In Part IV, the form entails the distribution of the balance to heirs, requiring a list of heirs and the amounts distributed to each. This part concludes the estate's financial activities relating to the distribution of assets.

- It's critical to note that the balance at the end of the accounting period should always be zero, signifying that all received assets have been accounted for through disbursements and distributions.

- The form must be signed by the collector by affidavit in the presence of a notary or other official authorized to administer oaths. The signatures of the affiant(s) and the notary official, along with the dates and notary seal, are essential for the form's validity.

- This document, once completed and properly executed, serves as a legal affidavit that can be used to demonstrate the lawful handling of the estate's personal property. It's vital for estate administrators or executors to keep this document for records and potential future legal reference.

Filling out the AOC E-204 form accurately is imperative for ensuring transparency and accountability in estate management, thereby avoiding potential disputes among heirs or with creditors. It's also a step towards finalizing the estate's obligations and distributing the assets according to the decedent's wishes or the law.

Popular PDF Forms

What Is a Dvir - Allows for clear communication between inspectors and vehicle operators regarding the condition and safety of the vehicle.

Dmv Reg 138 - Proper completion and recording of the REG 138 by the DMV shifts liability for future violations or litigation to the new owner.