Blank Appraisal Hvcc PDF Template

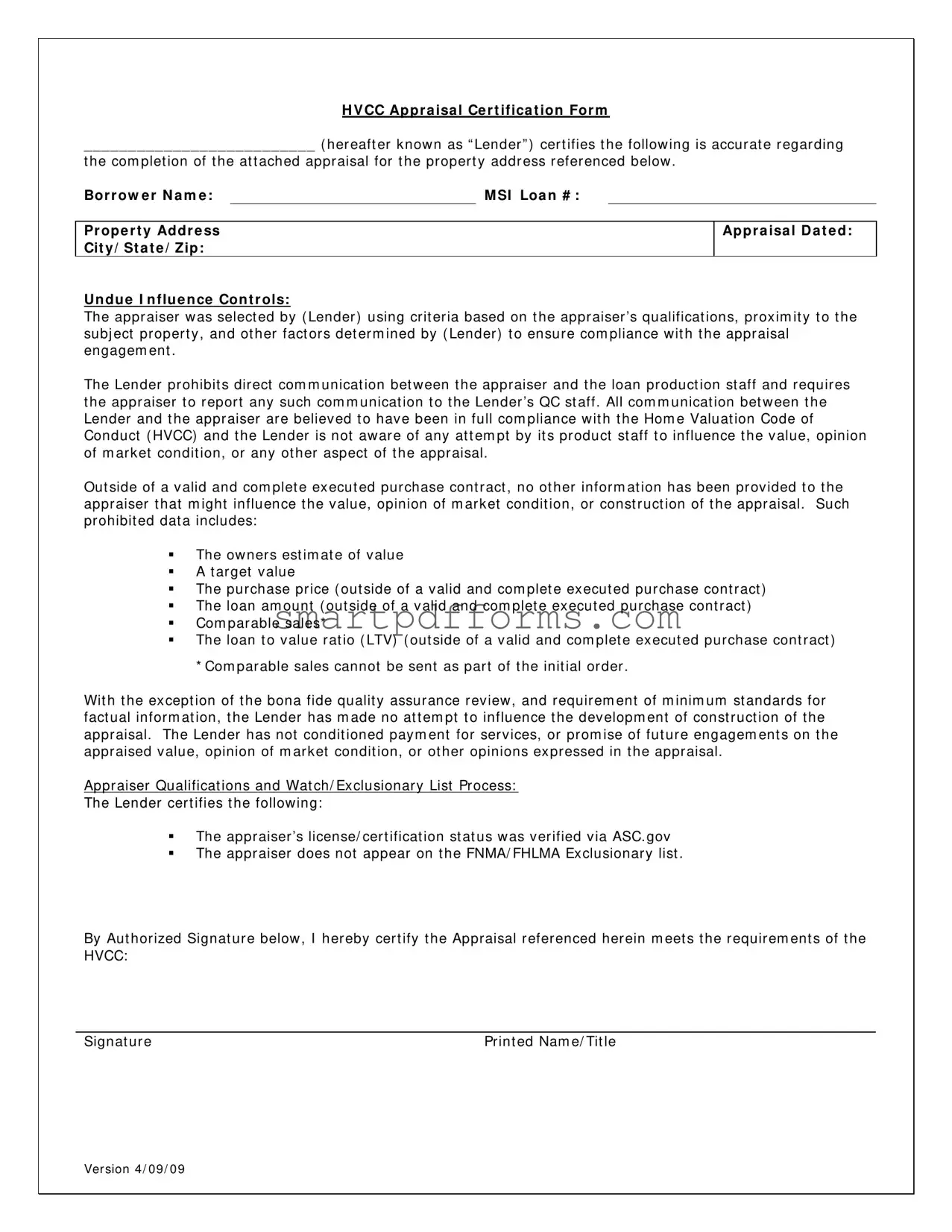

In the complex landscape of real estate transactions, the appraisal process serves as a crucial checkpoint in determining the fair market value of a property. A fundamental component of maintaining the integrity and impartiality of this process is the Home Valuation Code of Conduct (HVCC), which seeks to ensure that appraisals are conducted independently and without undue influence from interested parties. Within this framework lies the Appraisal HVCC Certification Form, a document that certifies a lender's compliance with specific guidelines during the appraisal process. This form records important details such as the borrower's name, loan number, property address, and the date of the appraisal. It emphasizes controls against undue influence, ensuring the appraiser was selected based on qualification criteria without direct communication with loan production staff. The form further stipulates that no information likely to influence the appraiser's valuation, such as an owner's estimated value or a target value, has been provided, barring a complete and executed purchase contract. Moreover, the certification requires the lender to verify the appraiser's qualifications, including license or certification status and that they are not listed on any exclusionary lists. By requiring an authorized signature, the form underscores the lender's adherence to the HVCC, underscoring a commitment to unbiased and fair valuation practices in the real estate market.

Preview - Appraisal Hvcc Form

H V CC Ap p r a isa l Ce r t if ica t ion For m

__________________________ ( her eaft er k now n as “ Lender ” ) cer t ifies t he follow ing is accur at e r egar ding

t he com plet ion of t he at t ached appr aisal for t he pr oper t y addr ess r efer enced below .

Bor r ow e r N a m e : |

|

M SI Loa n # : |

Pr op e r t y Ad d r e ss Cit y / St a t e / Z ip :

Ap p r a isa l D a t e d :

U n d u e I n f lu e n ce Con t r ols:

The appr aiser w as select ed by ( Lender ) using crit er ia based on t he appr aiser ’s qualificat ions, pr ox im it y t o t he subj ect pr oper t y , and ot her fact or s det er m ined by ( Lender ) t o ensur e com pliance w it h t he appr aisal engagem ent .

The Lender pr ohibit s dir ect com m unicat ion bet w een t he appr aiser and t he loan pr oduct ion st aff and r equir es t he appr aiser t o r epor t any such com m unicat ion t o t he Lender ’s QC st aff . All com m unicat ion bet w een t he Lender and t he appr aiser ar e believ ed t o hav e been in full com pliance w it h t he Hom e Valuat ion Code of Conduct ( HVCC) and t he Lender is not aw ar e of any at t em pt by it s pr oduct st aff t o influence t he v alue, opinion of m ar k et condit ion, or any ot her aspect of t he appr aisal.

Out side of a v alid and com plet e ex ecut ed pur chase cont r act , no ot her infor m at ion has been pr ov ided t o t he appr aiser t hat m ight influence t he v alue, opinion of m ar k et condit ion, or const r uct ion of t he appr aisal. Such pr ohibit ed dat a includes:

The ow ner s est im at e of v alue

A t ar get v alue

|

The pur chase pr ice ( out side of a v alid and com plet e ex ecut ed pur chase cont r act ) |

|

The loan am ount ( out side of a v alid and com plet e ex ecut ed pur chase cont r act ) |

Com par able sales*

The loan t o v alue r at io ( LTV) ( out side of a v alid and com plet e ex ecut ed pur chase cont r act )

* Com par able sales cannot be sent as par t of t he init ial or der .

Wit h t he ex cept ion of t he bona fide qualit y assur ance r ev iew , and r equir em ent of m inim um st andar ds for fact ual infor m at ion, t he Lender has m ade no at t em pt t o influence t he dev elopm ent of const r uct ion of t he appr aisal. The Lender has not condit ioned pay m ent for ser v ices, or pr om ise of fut ur e engagem ent s on t he appr aised v alue, opinion of m ar k et condit ion, or ot her opinions ex pr essed in t he appr aisal.

Appr aiser Qualificat ions and Wat ch/ Ex clusionar y List Pr ocess:

The Lender cer t ifies t he follow ing:

The appr aiser ’s license/ cer t ificat ion st at us w as v er ified v ia ASC. gov

The appr aiser does not appear on t he FNMA/ FHLMA Ex clusionar y list .

By Aut hor ized Signat ur e below , I her eby cer t ify t he Appraisal r efer enced her ein m eet s t he r equir em ent s of t he HVCC:

Signat ur e |

Pr int ed Nam e/ Tit le |

Ver sion 4/ 09/ 0 9

Form Data

| Fact Name | Description |

|---|---|

| Appraisal HVCC Certification | The form is a certification by the lender regarding the accuracy and compliance of the appraisal with the Home Valuation Code of Conduct (HVCC). |

| Appraiser Selection Process | The appraiser is selected based on their qualifications, proximity to the subject property, and other lender-determined criteria to ensure HVCC compliance. |

| Communication Control | Direct communication between the appraiser and loan production staff is prohibited by the lender to prevent undue influence. |

| Appraisal Influence Prevention | All communications between the lender and appraiser are in compliance with HVCC, ensuring no attempt by loan production staff to influence the appraisal. |

| Prohibited Data Provision | The lender ensures that no information that could influence the appraisal's value, market condition, or construction is provided outside of a valid, executed purchase contract. |

| Exclusion of Comparable Sales | Comparable sales data cannot be sent as part of the initial order, adhering to HVCC requirements. |

| Non-Conditioning of Payment | The lender does not condition payment for services or promise of future engagements on the appraised value, market condition, or opinions expressed in the appraisal. |

| Appraiser Qualifications Verification | The lender verifies the appraiser's license/certification status via ASC.gov and ensures they do not appear on the FNMA/FHLMC Exclusionary list. |

| Certification by Lender | The lender certifies that the appraisal meets the requirements of the HVCC through an authorized signature on the form. |

| Form Version | The form version mentioned is dated 4/09/09, indicating when it was last revised or created. |

Instructions on Utilizing Appraisal Hvcc

When preparing to complete the Appraisal HVCC Form, it is essential to proceed meticulously to ensure all information is accurate and in full compliance with the Home Valuation Code of Conduct (HVCC). This form serves a critical role in certifying that the appraisal process was conducted without undue influence, adhering strictly to the HVCC guidelines. The steps below guide you through each section of the form, emphasizing the importance of validating the appraiser's qualifications, ensuring transparency in the appraisal process, and confirming the absence of prohibited data influencing the appraisal report. By following these instructions, lenders can affirm their commitment to honest and fair appraisal practices.

- Start by entering the name of the lender in the space provided at the very top of the form, immediately following "HVCC Appraisal Certification Form." This should be the legal name of the institution or individual acting as the lender.

- Under "Borrower Name," insert the full legal name of the individual or entity that is receiving the loan.

- For "MSI Loan #," enter the unique identifier or loan number associated with the mortgage service.

- In the "Property Address City / State / Zip" section, provide the complete address of the property being appraised, including the city, state, and ZIP code.

- The "Appraisal Dated" field should contain the date when the appraisal report was finalized. Ensure this date is accurate and formatted correctly.

- Under "Undue Influence Controls," verify that the statement provided reflects your procedures for selecting the appraiser. This verifies that the lender used objective criteria, such as the appraiser's qualifications and proximity to the subject property, while adhering to HVCC guidelines that prohibit direct communication between the appraiser and the loan production staff.

- Confirm that all communication with the appraiser complied with the HVCC to ensure no influence was exerted over the appraisal's value, market condition opinions, or any other aspects.

- Ensure that no prohibited data was provided to the appraiser that could influence the appraisal's outcome, as listed in the form.

- Under "Appraiser Qualifications and Watch/Exclusionary List Process," affirm the two points by checking that the appraiser's license status was verified through ASC.gov and that they do not appear on the FNMA/FHLMA Exclusionary list.

- Finally, at the bottom of the form, the authorized signer must provide their signature and print their name and title to certify that the appraisal meets all requirements set forth by the HVCC. Ensure this section is completed fully, with a legible signature and clear printing of the name and title.

By completing the Appraisal HVCC Form following these steps, lenders effectively certify the integrity of the appraisal process, adherence to HVCC guidelines, and the qualification of the appraiser. It acts as a safeguard against undue influence and promotes the fairness and accuracy of the property valuation process. This certification is pivotal in maintaining trust in the appraisal's conclusions and supporting the stability of the mortgage lending system.

Obtain Answers on Appraisal Hvcc

-

What is the HVCC Appraisal Certification Form?

The HVCC Appraisal Certification Form is a document that verifies specific details regarding the appraisal of a property for a lender. It confirms that the appraisal process followed the Home Valuation Code of Conduct (HVCC) guidelines, emphasizing the selection of the appraiser based on qualifications and proximity to the property, ensuring no undue influence affected the appraisal's integrity.

-

How is the appraiser selected according to the HVCC?

Under the HVCC, the lender selects the appraiser based on a set of criteria that includes the appraiser's qualifications and proximity to the subject property. The process is designed to prevent undue influence by prohibiting direct communication between the appraiser and the loan production staff. Any communication must be in compliance with HVCC regulations, ensuring an impartial and accurate appraisal.

-

What information is prohibited from being provided to the appraiser under HVCC?

To maintain the integrity of the appraisal process under HVCC, certain information is not allowed to be shared with the appraiser. Prohibited data include the owner's estimate of value, a target value, the purchase price (outside of a fully executed purchase contract), loan amount (outside of a fully executed purchase contract), comparable sales initially, and the loan to value ratio (LTV) outside of a purchase contract. This ensures that appraisals are conducted impartially and based on factual market conditions.

-

Can the lender attempt to influence the appraisal?

No, the lender is expressly prohibited from attempting to influence the outcome of the appraisal. This includes conditions such as payment for services, promise of future engagements based on the appraised value, opinions of market condition, or any other aspect of the appraisal. The focus is to warrant that the appraisal process is conducted fairly and with integrity, based on factual data and the appraiser's professional judgment.

-

What are the qualifications for an appraiser under HVCC?

An appraiser must meet specific qualifications to be considered under HVCC guidelines. The lender must verify that the appraiser’s license or certification status is current via ASC.gov and ensure that the appraiser does not appear on the FNMA/FHLMA Exclusionary List. These steps are crucial for maintaining the credibility and reliability of the appraisal process.

-

What happens if there are violations of the HVCC?

If there are violations of the HVCC, penalties may be imposed on the involved parties. These can include fines or other disciplinary actions. Additionally, the appraisal may be considered invalid, which could impact the loan process. It is imperative for all parties to adhere strictly to HVCC guidelines to ensure a fair and efficient appraisal process.

Common mistakes

Filling out the Appraisal HVCC (Home Valuation Code of Conduct) form correctly is crucial for lenders to ensure compliance and the integrity of the appraisal process. However, several common mistakes can compromise the form’s accuracy and effectiveness. Here’s a look at six frequent errors:

Failure to Verify Appraiser Credentials: Neglecting to check the appraiser’s license or certification status via the Appraisal Subcommittee (ASC.gov) or ensuring they do not appear on the FHLMC/FNMA Exclusionary Lists can lead to employing an unqualified appraiser, jeopardizing the appraisal’s compliance and reliability.

Omitting Borrower’s Information: Failing to include comprehensive details of the borrower, such as their name or the loan number, can result in a lack of traceability and accountability in the appraisal process.

Inaccurate Property Address: Entering the property address, city, state, or ZIP code incorrectly can cause significant confusion, potentially leading to the appraisal of the wrong property.

Overlooking the Appraisal Date: Not specifying the date of the appraisal can create issues with timing and relevance, creating potential discrepancies in market value assessments.

Allowing Undue Influence: Failing to enforce restrictions on direct communication between the appraiser and loan production staff, as well as not documenting attempts to influence the appraisal process, can result in a compromised valuation that does not comply with HVCC guidelines.

Incomplete Certification: Neglecting to have the authorized signature, printed name/title, and date at the bottom of the form can result in an incomplete certification, rendering the appraisal non-compliant with HVCC requirements.

Addressing these mistakes requires careful attention to detail and a thorough understanding of the HVCC regulations to ensure fair, accurate, and compliant appraisals.

Documents used along the form

When dealing with real estate transactions, especially in the context of obtaining a mortgage or refinancing, multiple documents besides the Appraisal HVCC (Home Valuation Code of Conduct) Certification Form are usually required. These documents serve various purposes, from verifying the information provided in the appraisal to ensuring all parties are legally protected. Below is a list of other forms and documents that are often used alongside the Appraisal HVCC form, each serving its critical role in the process.

- Loan Application: This document is the initial step in the lending process where the borrower provides financial, employment, and personal information to the lender to assess creditworthiness.

- Loan Estimate: Provided by the lender within three days of application submission, this document outlines the estimated interest rates, monthly payments, and closing costs associated with the loan.

- Closing Disclosure: This is a final statement of loan terms and closing costs, given to the borrower at least three days before closing. It allows for final review of the agreed financial obligations and terms.

- Proof of Homeowners Insurance: Lenders require borrowers to obtain homeowners insurance to protect the property from damage. This document provides proof of insurance coverage.

- Title Search and Title Insurance: These documents ensure that the property is free of liens or disputes. Title insurance protects the lender and buyer from potential future ownership issues.

- Purchase Agreement: This legally binding document outlines the terms and conditions of the sale, including price and closing date, between the buyer and seller.

- W-2 Forms and Tax Returns: These documents verify the borrower’s income and financial stability over the previous years, crucial for loan approval.

- Credit Report: Lenders pull borrowers' credit reports to evaluate credit history and determine loan eligibility and interest rates.

- Property Tax Records: Documentation of property taxes provides lenders with an assessment of annual tax obligations that may affect the borrower's ability to pay the mortgage.

Navigating a real estate transaction can be complex, requiring careful attention to detail and a thorough understanding of the documents involved. By recognizing the purpose and necessity of each of these forms and documents, parties involved can ensure a smoother, more compliant transaction process. It's always recommended to consult with a professional to understand the specifics and implications of each document fully.

Similar forms

The Uniform Residential Appraisal Report (URAR) shares similarities with the HVCC Appraisal Certification Form in ensuring that the appraisal process is conducted according to specific standards. Both documents emphasize the appraiser's qualifications, require adherence to regulatory compliance, and focus on the accurate representation of the property's market value without external influence.

The Loan Estimate and the HVCC Appraisal Certification Form both play crucial roles in the mortgage lending process by providing detailed information relevant to the transaction. Although the Loan Estimate outlines the terms and costs associated with the mortgage, it indirectly requires a fair appraisal, complementing the HVCC's direct approach to ensuring appraisal integrity.

Closing Disclosure forms, much like the HVCC Appraisal Certification Form, are pivotal in the real estate transaction process. They detail the final loan terms and costs. Both documents share a commitment to clarity and accuracy for the benefit of the borrower, ensuring that transactions are transparent and fair.

The Appraiser Independence Requirements (AIR) document is aligned with the HVCC Form in its core purpose of maintaining the appraiser's impartiality and independence. Both sets of guidelines dictate the conditions under which appraisals are conducted to prevent undue influence and ensure honest valuation.

Fannie Mae’s Desktop Underwriter (DU) Validation Service Verification Report relates to the HVCC Appraisal Certification Form in that they both serve to validate certain elements of the mortgage lending process. While the DU report focuses on verifying the borrower's income, employment, and assets, the HVCC ensures the property's valuation is accurate and free from influence.

The Exterior-Only Inspection Residential Appraisal Report parallels the HVCC Appraisal Certification Form by mandating specific appraisal standards and procedures, albeit with a focus on external property features. Both documents contribute to a thorough and compliant appraisal process.

Home Equity Conversion Mortgage (HECM) Financial Assessment Form, though distinct in its application to reverse mortgages, aligns with the HVCC Appraisal Certification Form in ensuring that appraisals and assessments are carried out fairly and accurately, emphasizing the protection of all parties involved in the mortgage process.

The Flood Hazard Determination Form complements the objectives of the HVCC Appraisal Certification Form by requiring specific property assessments, in this case, for flood risk. Both forms are integral to the overall appraisal and lending processes, ensuring properties are evaluated correctly for their respective risk factors.

Appraisal Update and/or Completion Report (Form 1004D) is akin to the HVCC Appraisal Certification Form in that it is used to confirm the property's current status and any changes in valuation. Both documents underscore the need for ongoing transparency and accuracy throughout the appraisal process.

The Property Inspection Waiver (PIW) is an interesting comparison to the HVCC Appraisal Certification Form because it represents a scenario where an appraisal may not be required, under specific conditions. However, when appraisals are conducted, the HVCC's guidelines ensure they're done without undue influence, aligning with the PIW’s underlying principle of streamlining the mortgage process while ensuring the property's value is genuinely represented.

Dos and Don'ts

When filling out the Appraisal HVCC form, it's crucial to maintain integrity and follow the guidelines strictly to ensure a fair and unbiased appraisal process. Here are some dos and don'ts that can help guide you through this process.

- Do ensure that the appraiser is selected based on qualifications and proximity to the property without undue influence from loan production staff.

- Do prohibit direct communication between the appraiser and the loan production staff to prevent any possible influence on the appraisal value.

- Do verify the appraiser's license or certification status through ASC.gov to ensure they are properly accredited.

- Do check that the appraiser does not appear on the FNMA/FHLMA Exclusionary List to maintain compliance with HVCC requirements.

- Don't provide the appraiser with prohibited data that might influence the value, opinion of market condition, or construction of the appraisal, such as the owner's estimate of value or a target value.

- Don't condition payment for services or the promise of future engagements on the appraised value or any other opinions expressed in the appraisal.

- Don't attempt to influence the appraiser's development or construction of the appraisal outside of a valid and complete executed purchase contract.

- Don't send comparable sales as part of the initial order except for the purpose of a bona fide quality assurance review that meets minimum standards for factual information.

By adhering to these guidelines, lenders and appraisers can ensure that the appraisal process remains unbiased, fair, and in compliance with the HVCC, safeguarding the integrity of the appraisal and the interests of all parties involved.

Misconceptions

Understanding the appraisal process and the specific documents involved, like the HVCC Appraisal Certification Form, can often give rise to misconceptions. Addressing these misunderstandings is essential for both industry professionals and homeowners. Here are nine common misconceptions about the HVCC Appraisal Certification Form and explanations to clarify each.

The HVCC completely restricts communication between appraisers and lenders. While the HVCC sets strict guidelines to prevent undue influence on the appraiser by the lender, it doesn’t prohibit all communication. It ensures that any communication does not compromise the appraisal’s integrity.

Appraisers are selected randomly under HVCC guidelines. The selection of an appraiser is not random but is based on criteria including qualifications, proximity to the subject property, and compliance with appraisal engagement standards.

Homeowners can provide an estimated value to influence the appraisal. Under HVCC, prohibited data includes the homeowner's estimate of value. The appraiser’s valuation must be independent and based solely on professional judgment and comparable market analysis.

The lender can condition the appraiser’s fee on the appraisal outcome. The lender is strictly prohibited from conditioning payment or future engagements on the appraised value or opinions expressed in the appraisal.

Comparable sales provided by the lender are always acceptable for appraisal use. Comparable sales cannot be included as part of the initial order under HVCC guidelines. However, bona fide quality assurance review processes can require minimum standards for factual information, which may include comparable sales verification.

All appraisal orders under HVCC must go through third-party appraisal management companies (AMCs). While using AMCs is one way to comply with HVCC guidelines, lenders can also have direct engagement with appraisers as long as they adhere to the strict non-influence protocols set by HVCC.

Appraisers are prohibited from discussing their appraisal with anyone. Appraisers can discuss their appraisal, but only in a manner that does not breach HVCC’s non-influence requirements and adheres to confidentiality and ethical standards.

Once an appraiser is on a watch/exclusionary list, they cannot perform any appraisals under HVCC. The HVCC requires that an appraiser's license or certification status be verified via the ASC.gov website and that they do not appear on the FNMA/FHLMA Exclusionary List. Being on a watch list doesn't automatically preclude appraising under HVCC, but appearing on the exclusionary list does.

The HVCC is only focused on residential property appraisals. While the primary focus of HVCC guidelines is on residential property appraisals to safeguard against undue influence and ensure integrity, the principles of unbiased and independent appraising it advocates are essential across all types of property appraisals.

By clarifying these misconceptions, professionals and consumers can better navigate the complexities of the appraisal process and ensure that appraisals are conducted fairly, accurately, and without undue influence, in line with HVCC guidelines.

Key takeaways

Filling out and using the Appraisal HVCC form is a vital part of the appraisal process for properties, explicitly designed to maintain high standards of integrity and independence. Understanding the key elements can significantly help lenders, appraisers, and borrowers navigate their responsibilities and expectations effectively. Here are several takeaways that outline the critical aspects of this form:

- Appraiser Selection: Lenders are responsible for selecting appraisers based on their qualifications, proximity to the property, and compliance with the Home Valuation Code of Conduct (HVCC). This ensures appraisals are conducted by proficient and suitable professionals.

- Communication Restrictions: Direct communication between the appraiser and loan production staff is prohibited to prevent undue influence. Any such communication must be reported to the lender’s Quality Control (QC) staff, maintaining the appraisal's integrity.

- Compliance with HVCC: All interactions between the lender and the appraiser are designed to fully comply with the HVCC, safeguarding the appraisal from any attempts by the loan production staff to influence the appraisal's outcomes such as value, market conditions, or other aspects.

- Prohibited Information: Information that could improperly influence the appraised value, such as the owner’s estimated value, target value, purchase price (outside of a valid purchase contract), loan amount, comparable sales, or loan-to-value ratio (outside of a valid purchase contract), cannot be provided to the appraiser.

- Appraisal Development: The lender is barred from attempting to influence the construction and development of the appraisal. Only bona fide quality assurance reviews are allowed, emphasizing factual data's accuracy and adherence to minimum standards.

- Independence of the Appraisal Process: The process reaffirms the independence of the appraisal by stating that payment for services or promises of future engagement cannot be contingent on the appraised value, market conditions, or any other opinions expressed in the appraisal.

- Appraiser Credentials: It is mandatory for the lender to verify the status of the appraiser’s license or certification through the ASC.gov website and ensure the appraiser is not listed on the FNMA/FHLMC Exclusionary Lists to maintain a level of trust and credibility in the appraisal performed.

By adhering to these guidelines, the appraisal process maintains its integrity, fostering trust among all parties involved. The HVCC form serves as a cornerstone in achieving transparent, unbiased, and fair appraisals, essentially contributing to the health and stability of the real estate market.

Popular PDF Forms

Central Registry Release of Information Form - The process ends with the Central Registry staff verifying and signing off on the search results.

1099 Write Off List - Offers a method for self-employed individuals to figure their due contribution to the national social insurance programs.