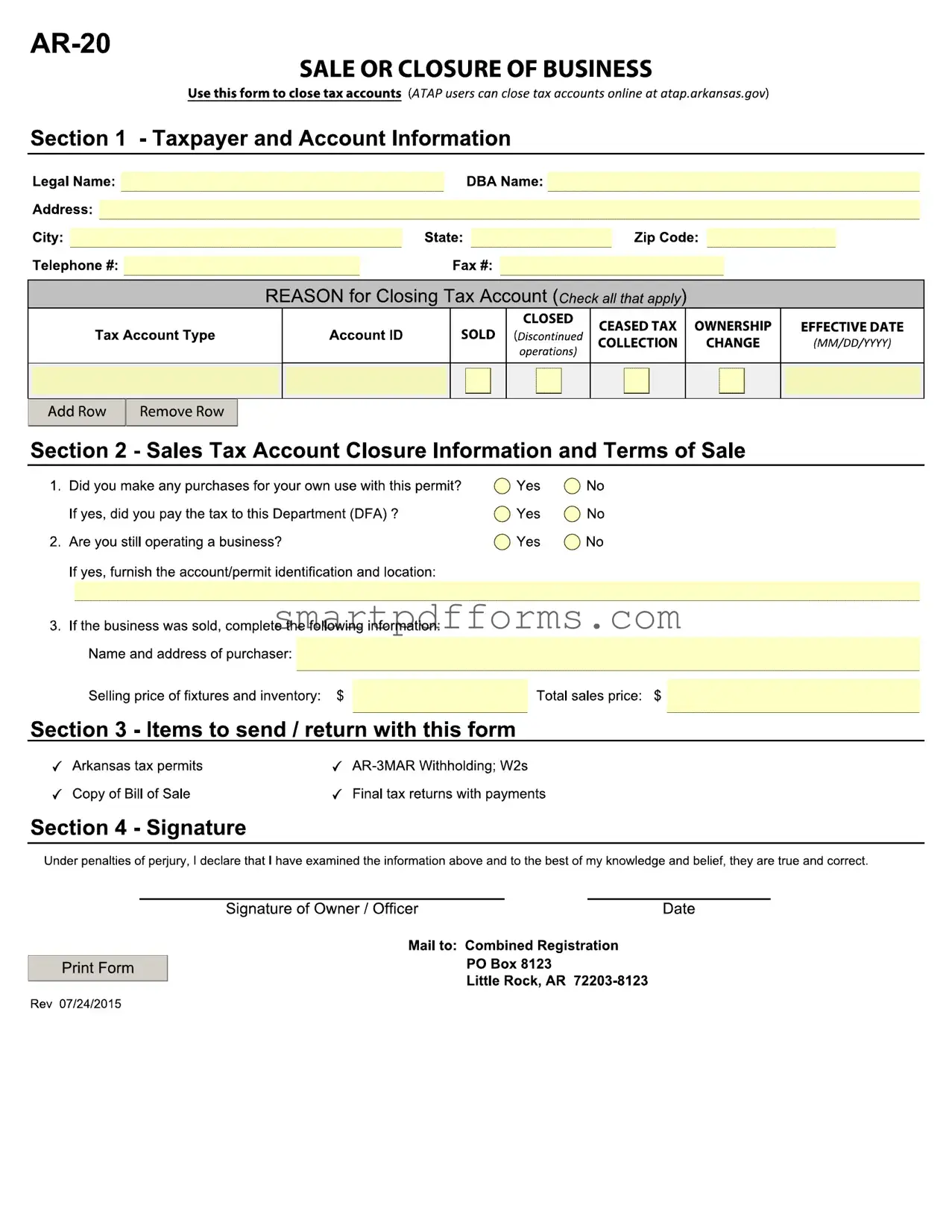

Blank Ar 20 PDF Template

When a business goes through significant changes such as sale, closure, or a change in ownership, managing the tax implications of these changes is critical. The AR-20 form, utilized specifically within the state of Arkansas, serves as a vital tool for business owners navigating the closure or sale of their business relative to state tax obligations. By filling out the AR-20 form, business owners can officially close their tax accounts with the state, ensuring a smooth transition during the period of change. The form requires detailed information about the taxpayer and account, including legal and doing business as (DBA) names, contact information, and specific reasons for the account closure, which could range from a sale to ceasing tax collection. Additionally, it gathers data on sales tax account closure and terms of the sale if applicable, asking for information on the business’s operation status post-sale and details regarding any transactions made under the permit. The documentation required to accompany the form, including copies of sale bills, tax permits, and final tax returns, ensures that all relevant information is considered. By signing under penalties of perjury, the owner or officer acknowledges the accuracy and completeness of the information provided, sealing the formal process of closing or altering the business's tax status within the state of Arkansas.

Preview - Ar 20 Form

Form Data

| # | Fact | Detail |

|---|---|---|

| 1 | Form Name | AR-20 SALE OR CLOSURE OF BUSINESS |

| 2 | Purpose | Used to close tax accounts |

| 3 | Online Option | ATAP users can close tax accounts online at atap.arkansas.gov |

| 4 | Section 1 Content | Taxpayer and Account Information including legal name, DBA name, contact details, and reason for closing tax account |

| 5 | Reasons for Closing | Includes options like sold, closed (discontinued operations), ceased tax collection, ownership change |

| 6 | Section 2 Content | Sales Tax Account Closure Information, Terms of Sale, and Purchases for Own Use Inquiry |

| 7 | Items to Return with Form | Includes Arkansas tax permits, a copy of the bill of sale, AR-3MAR Withholding, W2s, and final tax returns with payments |

| 8 | Signature Requirement | Signature of Owner / Officer under penalties of perjury |

| 9 | Submission Address | Mail to: Combined Registration PO Box 8123 Little Rock, AR 72203-8123 |

Instructions on Utilizing Ar 20

When the time comes to close your business, or if you've sold it, the task of winding down various aspects can be daunting. One crucial step in the process is informing the taxation authorities to avoid future misunderstandings or liabilities. The AR-20 form serves this exact purpose for businesses in Arkansas. Completing this form accurately ensures that your tax accounts are closed properly, and you're in good standing with the state. Follow these steps to fill out the AR-20 form meticulously.

- Start with Section 1, the "Taxpayer and Account Information." Here, you will need to provide the legal name of the business alongside its address in the fields provided. Include the "Doing Business As" (DBA) name if applicable.

- Fill in the city, state, and zip code related to the business address. Then, add your telephone and fax numbers in the designated spaces.

- Indicate the REASON for Closing Tax Account by checking the appropriate box(es) that apply to your situation: Sold, Closed (Discontinued operations), Ceased Tax Collection, Ownership Change. You can choose more than one if necessary.

- For each tax account type you are closing, use the “Add Row” button to create a new entry and fill in the “Account ID” and the “EFFECTIVE DATE” (MM/DD/YYYY) when the closure or change will take effect.

- Move to Section 2, "Sales Tax Account Closure Information and Terms of Sale." Answer the questions about purchases made with the permit and whether tax was paid to the Department (DFA). Check "Yes" or "No" accordingly.

- If you're still operating a business, specify the account/permit identification and its location when asked.

- If the business was sold, provide the name and address of the purchaser along with the selling price of fixtures and inventory, and the total sales price.

- In Section 3, "Items to send / return with this form," ensure you have included all required items such as Arkansas tax permits, a copy of the Bill of Sale, AR-3MAR Withholding and W2s, and final tax returns with payments.

- Lastly, in Section 4, sign the form to affirm that the information provided is accurate to the best of your knowledge. Print your name if you are the owner or an officer of the company, and then put the date next to your signature.

- Review the entire form to ensure all information is correct and complete. Mail the signed form and any accompanying documents to the address provided: Combined Registration PO Box 8123 Little Rock, AR 72203-8123.

Filling out the AR-20 form is a significant step in the process of closing your business. It informs the Arkansas Department of Finance and Administration about your decision and prevents potential legal and financial issues related to state tax obligations. Take your time to fill out the form accurately and comply with the submission deadlines to ensure a smooth transition.

Obtain Answers on Ar 20

-

What is the AR-20 form used for?

The AR-20 form is designed for business owners in Arkansas who wish to notify the state's taxation authorities of the sale or closure of their business. It allows for the formal closing of tax accounts associated with the business. Online closure is also an option for users of the Arkansas Taxpayer Access Point (ATAP) platform.

-

Who needs to complete the AR-20 form?

Any business owner in Arkansas planning to sell their business, cease operations, stop tax collections, or undergo an ownership change is required to complete the AR-20 form. This ensures that the state's Department of Finance and Administration (DFA) is informed, and the business's tax accounts are properly closed.

-

What information is needed to fill out the AR-20 form?

To fill out the AR-20 form, business owners need to provide their legal name, business name (DBA Name), the address of the business, contact information, and the reason for closing the tax account. Additional details are required if the business was sold, including the name and address of the purchaser, selling price of fixtures and inventory, and the total sales price. The appropriate sections for sales tax account closure information, terms of sale, and a final declaration signed by the owner or an officer of the business are also necessary parts of the form.

-

Are there any specific items that need to be sent or returned with the AR-20 form?

Yes, when submitting the AR-20 form, business owners must also include any Arkansas tax permits they have, a copy of the bill of sale (if the business was sold), the AR-3MAR form for withholding along with W2s, and final tax returns with payments. These items are crucial for the accurate and complete closure of the business's tax accounts.

-

Can I submit the AR-20 form online?

Yes, for users registered on the Arkansas Taxpayer Access Point (ATAP) platform, it is possible to close tax accounts online, providing a convenient and efficient alternative to mailing the AR-20 form. This digital submission streamlines the process, making it easier for business owners to comply with state requirements as they conclude their operations or transfer ownership.

-

Where should the AR-20 form be mailed?

If opting to submit the AR-20 form via mail, it should be addressed to the Combined Registration PO Box 8123, Little Rock, AR 72203-8123. It is important to ensure that all required documents accompany the form to avoid delays in the closure process of the tax accounts.

Common mistakes

When filling out the AR-20 form, which is used for the sale or closure of a business in Arkansas, individuals often make mistakes that can delay the process or result in incorrect record-keeping. The following details some of the common errors to avoid:

Incorrect or Incomplete Taxpayer and Account Information: The first section requires accurate details about the taxpayer and the account. A common mistake is not providing the full legal name, incorrect address, or forgetting to include the doing-business-as (DBA) name. Ensure that all fields are completed correctly, including the telephone and fax numbers, to avoid processing delays.

Failing to Indicate the Reason for Closing the Tax Account Properly: The form requires you to check all reasons that apply to the closure of your tax account, such as sale, ceased tax collection, or an ownership change. Occasionally, individuals forget to mark these options or do not accurately reflect the situation, leading to confusion and possible misinterpretation by the Department of Finance and Administration (DFA).

Omitting Sales Tax Account Closure Information and Terms of Sale: The second section asks specific questions about sales tax and operational status after the sale or closure. Neglecting to answer whether purchases were made for personal use with the permit, if tax was paid to the DFA, or if the business is still operating under different accounts or locations, can be problematic. Additionally, failing to provide detailed information about the business sale, including the purchaser's name, address, and the sales price of fixtures and inventory, can hinder the process.

Not Sending Required Documents or Returning Arkansas Tax Permits: Section three lists items that must be sent or returned with the form, such as Arkansas tax permits and a copy of the Bill of Sale. A frequent oversight is not including these necessary documents, or the AR-3MAR Withholdings and W2s, alongside final tax returns with payments. This omission can cause delays in the closure process and might result in incomplete record closure with the DFA.

To ensure a smooth and efficient closure process, pay special attention to accurately completing each section of the AR-20 form and adhere to the checklist of items to send or return. This diligence will help to avoid common pitfalls and foster a more straightforward transition during the sale or closure of your business.

Documents used along the form

When handling the closure or sale of a business, utilizing the AR-20 form is a critical step for duly notifying the Arkansas Department of Finance and Administration about the cessation of operations or change in business ownership. However, the AR-20 form often doesn't stand alone in the process. A series of other crucial documents and forms complement its submission, ensuring a thorough and compliant approach to closing out the business's fiscal and legal responsibilities.

- Copy of Bill of Sale: This document provides proof of the transaction involved in the sale of the business, detailing the terms, conditions, and the parties involved. It's paramount for confirming the transfer of assets and responsibilities.

- AR-3MAR Withholding, W2s: Essential for businesses with employees, this form reports the final wages paid and the withholding tax details to the state. It ensures that all employment tax responsibilities have been met up to the point of sale or closure.

- Final tax returns with payments: Submitting the final state tax returns for the business confirms that all tax liabilities up to the point of cessation have been accounted for and paid. This includes sales tax, use tax, and any other relevant state taxes.

- Arkansas Tax Permits: Returning any issued tax permits is a necessary step in the closure process. It signifies that the business will no longer collect taxes on sales or transactions.

- Certificate of Dissolution: For corporations, this document officially dissolves the business entity with the state. It's critical for formally ending the company's legal existence and responsibilities.

- Notice of Business Closure: While the AR-20 form indicates the closure to the tax agency, a broader notice may be needed for other government entities, creditors, and customers, outlining the closure's specifics and any ensuing obligations.

Together, these documents facilitate a comprehensive conclusion to a business's operations, addressing legal, fiscal, and administrative responsibilities. The AR-20 form starts the process, but the supplementary documents ensure everything from final payroll taxes to the legal dissolution of the entity is handled correctly. This meticulous approach helps former business owners avoid legal pitfalls and ensures a clean slate following the closure or sale.

Similar forms

IRS Form 8822, Change of Address: Similar to the AR-20 form, the IRS Form 8822 is used to report a change in address to the Internal Revenue Service. Both forms are crucial for ensuring that important tax-related communication reaches the taxpayer or business owner following a significant change, such as a move or, in the case of the AR-20, the closure or sale of a business.

Form 4506-T, Request for Transcript of Tax Return: While the AR-20 form is used to notify tax authorities of the closure of a business and settle final tax accounts, Form 4506-T is used by individuals and businesses to request a transcript of their tax return. Both forms are integral to managing tax responsibilities efficiently, specifically when undergoing significant financial or operational changes.

Form SS-4, Application for Employer Identification Number (EIN): Form SS-4 is used when a business needs to obtain an EIN, which is required for tax filing and reporting purposes. Although the AR-20 form is utilized to close tax accounts, both the AR-20 and Form SS-4 bookend the lifecycle of a business’s tax journey — from opening to closure.

State Specific Sales Tax Permit Application Forms: Each state may have its own form for businesses to apply for a sales tax permit, necessary for collecting and remitting sales tax. The AR-20 form is used to close such accounts in Arkansas. Despite varying by state, these forms and the AR-20 share the common purpose of managing sales tax obligations under changing business conditions.

Form 966, Corporate Dissolution or Liquidation: Similar to the AR-20, Form 966 is filed with the IRS when a corporation decides to dissolve or liquidate. Both documents are necessary for informing respective tax authorities of significant changes to a business’s operational status, ensuring compliance with tax laws during periods of transition.

Dos and Don'ts

When it comes to handling business matters, paperwork can often be a critical component in ensuring everything is processed correctly. One such document that may come into play for business owners in Arkansas is the AR-20 form, which is used for the sale or closure of a business. Navigating this form correctly is essential, so here are six dos and don'ts to keep in mind:

- Do carefully read through the entire form before you start filling it out. It’s important to understand each section to ensure you are providing the correct information.

- Do ensure that all taxpayer and account information is filled out thoroughly, including the legal name, address, and telephone number. Accuracy in this section is crucial for proper processing.

- Do check all reasons that apply for closing the tax account in Section 1. Whether it's a sale, closure, ceased tax collection, or an ownership change, your clarity here affects the form’s processing.

- Don't forget to include the effective date of the sale or closure in the format MM/DD/YYYY. This date is vital for the proper closing of accounts.

- Don't overlook Section 3, which outlines the items to send or return with this form, such as Arkansas tax permits and the final tax returns with payments. Missing documents can delay processing.

- Don't rush through the signature section. The declaration under penalties of perjury requires careful attention, and the signature verifies that all provided information is true and correct.

By following these guidelines, you can ensure a smoother process in completing and submitting the AR-20 form. It’s always a good idea to double-check your paperwork and consult with a professional if you have any doubts or questions about the process.

Misconceptions

Misconceptions about the AR-20 form can lead to confusion and mistakes when it comes to handling the closure or sale of a business correctly. Let's clear up some of these misconceptions to ensure accurate and efficient use of the form.

Any business can use the AR-20 form for any purpose. This is not true. The AR-20 form is specifically designed for businesses that are closing or selling. It is used to close tax accounts with the Arkansas Department of Finance and Administration.

The AR-20 form is the only document needed to close a business. While the AR-20 form is crucial, it is part of a broader set of documents required for properly closing a business, including final tax returns, Arkansas tax permits, and a copy of the Bill of Sale, if applicable.

Completing the AR-20 form closes your business automatically. Filling out and submitting the AR-20 form is a step in the process, but actual closure involves several legal and administrative steps, including notifying all relevant parties and settling all outstanding obligations.

You can complete the AR-20 form online only. Although the Arkansas Taxpayer Access Point (ATAP) offers the option to close tax accounts online, the AR-20 form needs to be mailed to the specified address for processing.

There's no deadline for submitting the AR-20 form. The timing of submitting this form is crucial as it affects the final tax liabilities and any potential penalties for late notification about the closure or sale of the business.

Any business information can be provided in Section 1. Section 1 requires specific information, including legal name, DBA (Doing Business As) name, address, and tax account details. Providing accurate and comprehensive information is mandatory for the proper processing of the form.

Section 2 is optional if you didn't sell your business. Even if the business wasn't sold, Section 2 asks for details regarding purchases made for personal use with the business permit, which are relevant for tax purposes.

The reason for closing your tax account doesn't matter. It's necessary to check all reasons that apply for closing the tax account in the dedicated section, as it helps the Department of Finance and Administration process your form accurately.

Signature section is a formality. The signature section of the AR-20 form is legally binding. Signing under penalties of perjury means that you confirm the information provided is accurate to the best of your knowledge and belief.

Understanding the correct use and requirements of the AR-20 form can smooth the process of closing or selling a business, ensuring all tax and legal obligations are met adequately.

Key takeaways

When it comes time to close a business in Arkansas, understanding how to properly fill out and use the AR-20 form is crucial. This document is designed to navigate you through the closure or sale of a business, ensuring you adhere to state tax regulations. Below are five key takeaways to guide you through this process effectively.

- Understand the Purpose: The AR-20 form is specifically used for notifying the Arkansas Department of Finance and Administration (DFA) about the sale or closure of a business. Its primary function is to close tax accounts, a necessary step to avoid future tax liabilities related to the business.

- Know When to Use It: This form should be used whenever there's a significant change regarding your business status, such as discontinuation of operations, sale, or change in ownership. It's important to file this form promptly to ensure all tax accounts are settled or transferred appropriately.

- Complete All Sections Thoroughly: The form requires detailed information about the taxpayer and account, the reason for closing the tax account, and specifics about the sales tax account closure, if applicable. Accurate and comprehensive details are essential for a smooth process.

- Gather Necessary Documents: Alongside the AR-20 form, ensure you have all related documents ready to send. These include Arkansas tax permits, a copy of the Bill of Sale, AR-3MAR Withholding, W2s, and final tax returns with payments. These documents support the information provided in the form and are critical for the closure process.

- Adhere to Signature and Submission Guidelines: Once all information is provided and documents are prepared, the form must be signed under the penalties of perjury by an owner or officer of the business. It signifies that all information is accurate to the best of your knowledge. Following a review, mail the completed form and accompanying documents to the specified address in Little Rock, Arkansas.

Filling out and submitting the AR-20 form is a straightforward process once you understand these key points. Ensuring accuracy and completeness when dealing with administrative tasks like this can save a significant amount of time and protect you from potential legal and financial complications in the future.

Popular PDF Forms

Ontario Tenant Application Form - Strategically designed to gather all pertinent information, streamlining the landlord’s decision-making process.

What Documents Do I Need to File Taxes - The H&R Block checklist facilitates a hassle-free drop-off service, allowing for a quick and efficient tax preparation process.

Pageant Registration Form - The grand show will take place on February 16th at 7 PM in the CLC Ballroom. Don't miss it!