Blank Arizona Annual Report PDF Template

Filing an Arizona Annual Report is a critical task for many businesses operating within the state, overseen by the Arizona Corporation Commission Utilities Division. This comprehensive form serves as a yearly check-in for companies, requiring them to update or confirm various pieces of information related to their organization. Key sections include updating the company's name and doing-business-as (dba) name if necessary, providing exhaustive company and management contact details, and answering questions regarding significant changes during the year—such as changes in ownership or compliance issues with regulatory authorities. Additionally, companies must specify their type of ownership, the counties in Arizona where they are authorized to operate, the types of telecommunications services they provide, and detailed statistical data on their operations within the state. This includes the number of customers, revenue, asset values in Arizona, and compliance with financial obligations like the Regulatory Assessment and AZ Universal Service Fund. The Arizona Annual Report form not only ensures companies are accountable and transparent but also plays a crucial role in regulatory and public oversight.

Preview - Arizona Annual Report Form

ARIZONA CORPORATION COMMISSION

UTILITIES DIVISION

ANNUAL REPORT MAILING LABEL – MAKE CHANGES AS NECESSARY

Please click here if

Please click here if

Please list current Company name including dba here:

__________________________________________________________________________

ANNUAL REPORT

FOR YEAR ENDING

12

31

2020

FOR COMMISSION USE

ANN 03

20

COMPANY INFORMATION

Company Name (Business Name) _________________________________________________________

Mailing Address ____________________________________________________________________________

(Street)

_________________________________________________________________________________________

(City)(State)(Zip)

__________________________________________________________________________________________

Telephone No. (Include Area Code)Fax No. (Include Area Code)Cell No. (Include Area Code)

Email Address______________________________________________________________________________

Local Office Mailing Address _______________________________________________________________

(Street)

__________________________________________________________________________________________

(City)(State)(Zip)

Customer Service Phone No. (Include Area Code)

Website address ___________________________________________________________________________

MANAGEMENT INFORMATION

Management Contact:_________________________________________________________________________________

Management Contact:_________________________________________________________________________________

(Name)(Title)

_______________________________________________________________________________________________________________________

(Street) |

(City) |

(State) |

(Zip) |

|

|

|

|

Telephone No. (Include Area Code) |

Fax No. (Include Area Code) |

Cell No. (Include Area Code) |

|

Email Address______________________________________________________________________________

Regulatory Contact:___________________________________________________________________

Regulatory Contact:___________________________________________________________________

(Name)

(Street) |

(City) |

(State) |

(Zip) |

|

|

|

|

Telephone No. (Include Area Code) |

Fax No. (Include Area Code) |

Cell No. (Include Area Code) |

|

Email Address______________________________________________________________________________

2

Statutory Agent:__________________________________________________________________________

(Name)

________________________________________________________________________________________________________________________

(Street)(City)(State)(Zip)

____________________________________________________________________________________________________________

Telephone No. (Include Area Code)Fax No. (Include Area CodeCell No. (Include Area Code)

Attorney:________________________________________________________________________________

|

|

(Name) |

|

|

|

|

|

(Street) |

(City) |

(State) |

(Zip) |

_______________________________________________________________________________________________________________________

Telephone No. (Include Area Code)Fax No. (Include Area Code)Cell No. (Include Area Code)

Email Address:_____________________________________________________________________________

Important Changes During the Year

Yes __ No __

For those companies not subject to the affiliated interest rules, has there been a change in ownership or direct control during the year?

If yes, please provide specific details in the box below.

Yes __ No __

Has the company been notified by any other regulatory authorities during the year that they are out of compliance?

If yes, please provide specific details in the box below.

3

OWNERSHIP INFORMATION

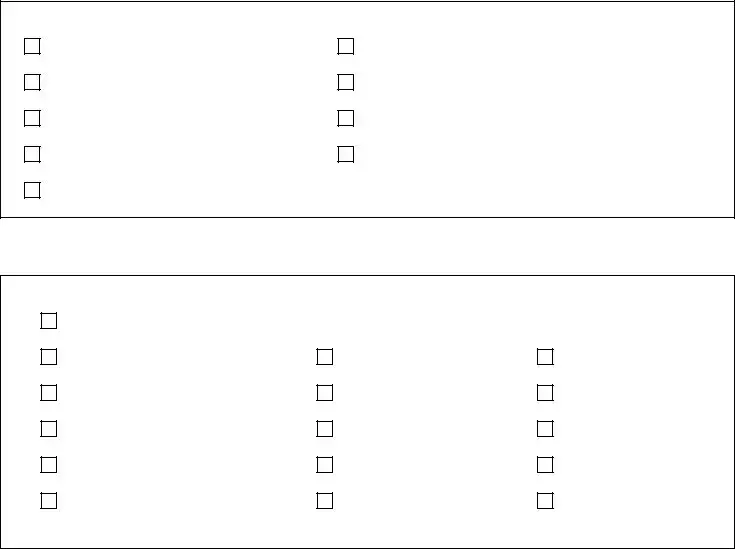

Check the following box that applies to your company:

Sole Proprietor (S)

Partnership (P)

Bankruptcy (B)

Receivership (R)

CCorporation (C) (Other than

Other (Describe)______________________________________________________________________

COUNTIES SERVED

Check the box below for the counties in which you are certificated to provide service:

STATEWIDE

APACHE

GILA

LA PAZ

NAVAJO

SANTA CRUZ

COCHISE

GRAHAM

MARICOPA

PIMA

YAVAPAI

COCONINO

GREENLEE

MOHAVE

PINAL

YUMA

4

SERVICES AUTHORIZED TO PROVIDE

Check the following box(es) for the services that you are authorized to provide:

Resold Long Distance/Interexchange Telecommunications Services (RLD) Resold Local Exchange Telecommunications Services (RLEC)

Facilities Based Private Line Telecommunications Services Alternative Operator Service Provider

Other (Specify)______________________________________________________________________

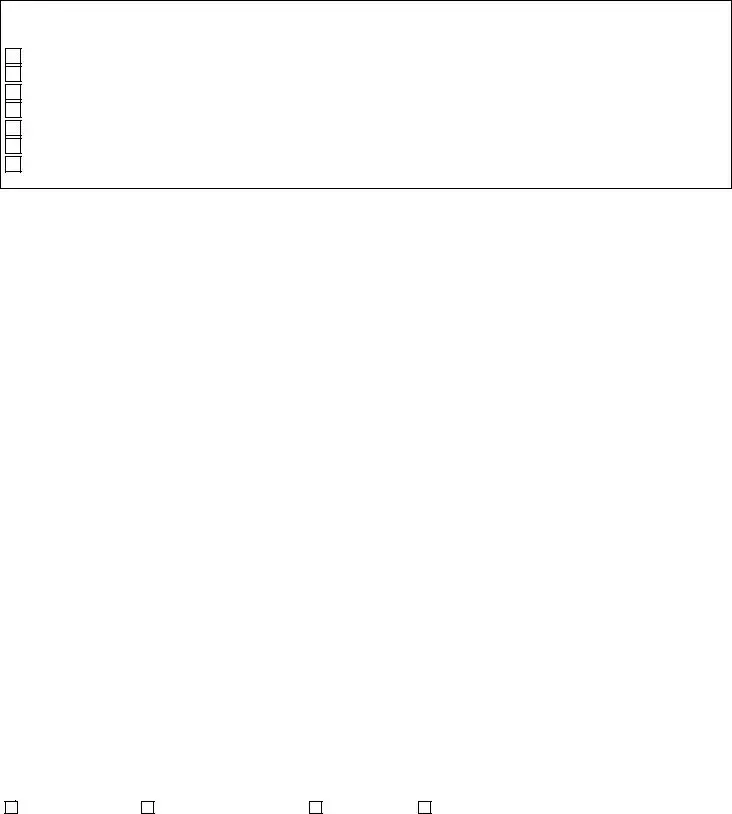

STATISTICAL INFORMATION

TELECOMMUNICATION UTILITIES ONLY

Total number of residential local exchange access lines

Total number of residential local exchange customers

Total number of business local exchange access lines

Total number of business local exchange customers

Total quantity of phone numbers assigned to Company

Total phone numbers assigned to Customers by Company

Total number of long distance residential customers

Total number of long distance business customers

Total intrastate local exchange revenue from Arizona operations

Total intrastate long distance/interexchange revenue from Arizona operations Total intrastate revenue from Arizona operations

Total intrastate income from Arizona operations

Value of Company’s total assets in Arizona Value of Company’s total assets

(Value of Company’s total assets in Arizona)/(Value of company’s total assets)

Current amount of deposits, prepayments, and advances from customers

(not including monthly service bills)

Current amount of performance bond

Current amount of Irrevocable Sight Draft Letter of Credit

Check box if Company is current on payments for:

Regulatory Assessment |

AZ Universal Service Fund |

AZ 911/E911 |

Circuit |

Voice over Internet |

Switched |

Protocol (“VoIP”) |

_______________ |

________________ |

_______________ |

________________ |

_______________ |

________________ |

_______________ |

________________ |

__________________________________

RetailOther

_______________ ________________

__________________________________

__________________________________

$_________________________________

$_________________________________

$_________________________________

$_________________________________

$_________________________________

$_________________________________

%_________________________________

$_________________________________

$_________________________________

$_________________________________

AZ Telephone Relay Service

5

UTILITY SHUTOFFS/DISCONNECTS

MONTH

Termination without Notice

Termination with Notice

OTHER

TOTALS →

OTHER (description):

__________________________________________________________________________________________

__________________________________________________________________________________________

__________________________________________________________________________________________

__________________________________________________________________________________________

__________________________________________________________________________________________

__________________________________________________________________________________________

6

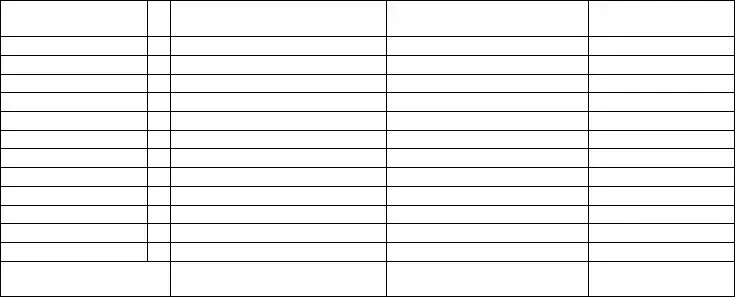

VERIFICATION

AND

SWORN STATEMENT

VERIFICATION

STATE OF ________________

I, THE UNDERSIGNED OF THE

Intrastate Revenues Only

COUNTY OF (COUNTY NAME)

NAME (OWNER OR OFFICIAL) TITLE

COMPANY NAME

DO SAY THAT THIS ANNUAL UTILITY REPORT TO THE ARIZONA CORPORATION COMMISSION

FOR THE YEAR ENDING

MONTH |

DAY |

YEAR |

12 |

31 |

2020 |

HAS BEEN PREPARED UNDER MY DIRECTION, FROM THE ORIGINAL BOOKS, PAPERS AND RECORDS OF SAID UTILITY; THAT I HAVE CAREFULLY EXAMINED THE SAME, AND DECLARE THE SAME TO BE A COMPLETE AND CORRECT STATEMENT OF BUSINESS AND AFFAIRS OF SAID UTILITY FOR THE PERIOD COVERED BY THIS REPORT IN RESPECT TO EACH AND EVERY MATTER AND THING SET FORTH, TO THE BEST OF MY KNOWLEDGE, INFORMATION AND BELIEF.

SWORN STATEMENT

IN ACCORDANCE WITH THE REQUIREMENT OF TITLE 40, ARTICLE 8, SECTION 40- 401, ARIZONA REVISED STATUTES, IT IS HEREIN REPORTED THAT THE GROSS OPERATING REVENUE OF SAID UTILITY DERIVED FROM ARIZONA INTRASTATE UTILITY OPERATIONS DURING CALENDAR YEAR 2020 WAS:

Arizona Intrastate Gross Operating Revenues Only ($)

$___________________________

(THE AMOUNT IN BOX ABOVE

INCLUDES $_________________

IN SALES TAXES BILLED, OR COLLECTED)

**REVENUE REPORTED ON THIS PAGE MUST INCLUDE SALES TAXES BILLED OR COLLECTED. IF FOR ANY OTHER REASON, THE REVENUE REPORTED ABOVE DOES NOT AGREE WITH TOTAL OPERATING REVENUES ELSEWHERE REPORTED, ATTACH THOSE STATEMENTS THAT RECONCILE THE DIFFERENCE. (EXPLAIN IN DETAIL)

SIGNATURE OF OWNER OR OFFICIAL

TELEPHONE NUMBER

SUBSCRIBED AND SWORN TO BEFORE ME

A NOTARY PUBLIC IN AND FOR THE COUNTY OF

THIS |

|

DAY OF |

(SEAL)

MY COMMISSION EXPIRES____________________________

COUNTY NAME

MONTH |

20__ |

|

|

SIGNATURE OF NOTARY PUBLIC

7

VERIFICATION

AND

SWORN STATEMENT

RESIDENTIAL REVENUE

STATE OF ARIZONA

I, THE UNDERSIGNED

OF THE

INTRASTATE REVENUES ONLY

COUNTY OF (COUNTY NAME)

NAME (OWNER OR OFFICIAL) |

TITLE |

|

|

COMPANY NAME

DO SAY THAT THIS ANNUAL UTILITY REPORT TO THE ARIZONA CORPORATION COMMISSION

FOR THE YEAR ENDING

MONTH DAY YEAR

12 31 2020

HAS BEEN PREPARED UNDER MY DIRECTION, FROM THE ORIGINAL BOOKS, PAPERS AND RECORDS OF SAID UTILITY; THAT I HAVE CAREFULLY EXAMINED THE SAME, AND DECLARE THE SAME TO BE A COMPLETE AND CORRECT STATEMENT OF BUSINESS AND AFFAIRS OF SAID UTILITY FOR THE PERIOD COVERED BY THIS REPORT IN RESPECT TO EACH AND EVERY MATTER AND THING SET FORTH, TO THE BEST OF MY KNOWLEDGE, INFORMATION AND BELIEF.

SWORN STATEMENT

IN ACCORDANCE WITH THE REQUIREMENTS OF TITLE 40, ARTICLE 8, SECTION 40- 401.01, ARIZONA REVISED STATUTES, IT IS HEREIN REPORTED THAT THE GROSS OPERATING REVENUE OF SAID UTILITY DERIVED FROM ARIZONA INTRASTATE UTILITY OPERATIONS RECEIVED FROM RESIDENTIAL CUSTOMERS DURING CALENDAR YEAR 2020 WAS:

ARIZONA INTRASTATE GROSS OPERATING REVENUES

$_________________________

(THE AMOUNT IN BOX AT LEFT INCLUDES $_____________________________

IN SALES TAXES BILLED, OR COLLECTED)

*RESIDENTIAL REVENUE REPORTED ON THIS PAGE MUST INCLUDE SALES TAXES BILLED.

SUBSCRIBED AND SWORN TO BEFORE ME

A NOTARY PUBLIC IN AND FOR THE COUNTY OF

THIS |

|

DAY OF |

|

|

|

(SEAL)

MY COMMISSION EXPIRES

SIGNATURE OF OWNER OR OFFICIAL

TELEPHONE NUMBER

NOTARY PUBLIC NAME

COUNTY NAME

MONTH |

20__ |

|

|

SIGNATURE OF NOTARY PUBLIC

8

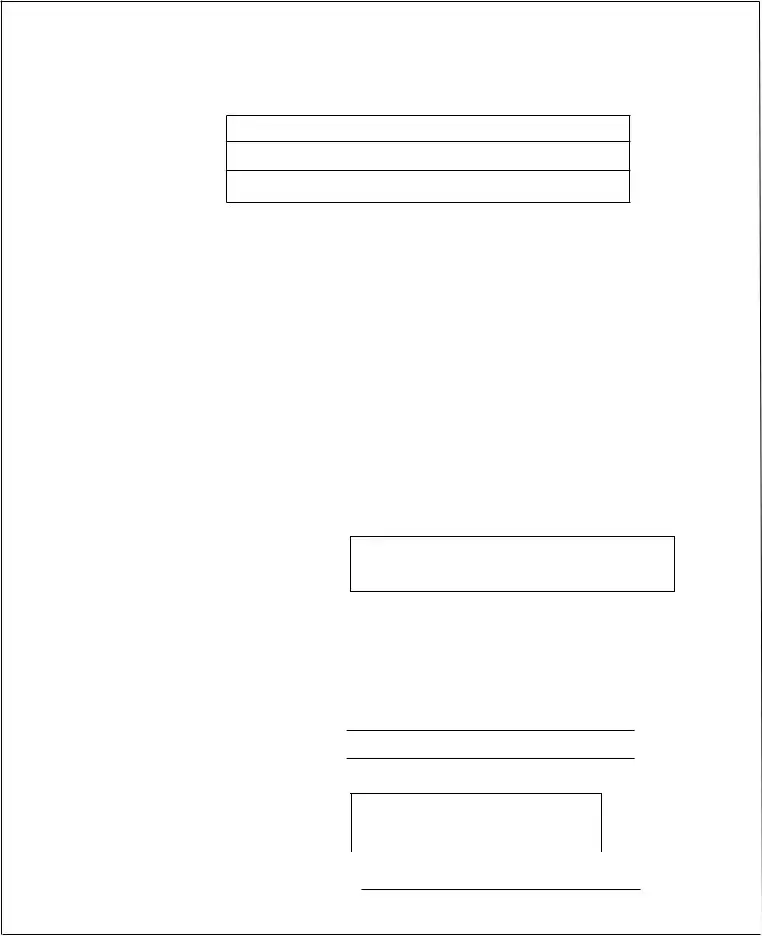

FINANCIAL INFORMATION

Income Statements:

Attach to this annual report a copy of the company’s

Alternative templates are provided for this information. Please select one from Figure 1A, Figure 1B or Figure 1C.

(All

Arizona Administrative Code, R14.2.1115.F, states that one of the items required in this Annual Report is a statement of income for the reporting year

Balance Sheets:

Alternative templates are provided for this information. Please select one from Figure 2A or Figure 2B.

(All

Arizona Administrative Code, R14.2.1115.F, states that one of the items required in this Annual Report is a balance sheet as of the end of the reporting year

ALL INFORMATION MUST BE

RESULTS IN ARIZONA.

9

Docket No. _____________________Year Ending:

Company Name: ___________________________________________________

FIGURE 1A

Account Description |

$ Amount |

Revenues:

Expenses:

Operating Income:

Net Income:

Attachment 1

10

Form Data

| Fact | Detail |

|---|---|

| Governing Entity | Arizona Corporation Commission Utilities Division |

| Form Purpose | To collect annual operational data from telecommunications utilities |

| Report Year | For the year ending December 31, 2020 |

| Key Sections | Company Information, Management Information, Ownership Information, Counties Served, Services Authorized to Provide, Statistical Information |

| Ownership Types | Sole Proprietor, Partnership, Bankruptcy, Receivership, Corporation (C), Subchapter S Corporation, Association/Co-op, Limited Liability Company, Other |

| Service Areas | Statewide and specific counties |

| Services Types | Resold and facilities-based telecommunications services among others |

| Regulatory Compliance | Companies must disclose any out-of-compliance notifications from regulatory authorities |

| Statistical Reporting | Includes detailed operational and financial data |

| Submission Requirement | Annually by telecommunications utilities operating in Arizona |

Instructions on Utilizing Arizona Annual Report

Once it's time to file the Arizona Annual Report, companies must provide accurate and up-to-date information to the Arizona Corporation Commission Utilities Division. This form is crucial for maintaining the compliance and operational legality of your business within the state. The steps outlined below will guide you through the process of filling out the form correctly, ensuring all necessary details are correctly reported to the Commission.

- Review the pre-printed Company name on the mailing label. If it is incorrect or outdated, click the provided link to update it, including any dba (doing business as) names.

- Enter the Company Name (Business Name) in the designated area.

- Provide the full Mailing Address, including street, city, state, and zip code.

- List all contact numbers: Telephone No. (with area code), Fax No. (with area code), and Cell No. (with area code), along with the Email Address.

- Fill in the Local Office Mailing Address, following the same format as the main mailing address.

- Include the Customer Service Phone No. and the company's Website address.

- Under the MANAGEMENT INFORMATION section, provide details for a management contact and a regulatory contact, including their name, title, address, phone numbers, and email addresses.

- Enter the name and contact information for the company's Statutory Agent and Attorney, if applicable.

- Answer the questions regarding Important Changes During the Year, indicating 'Yes' or 'No', and provide specific details if necessary.

- Select the appropriate box to indicate your company's ownership structure (Sole Proprietor, Partnership, etc.) and specify if not listed.

- Indicate the counties served by checking the corresponding boxes.

- Check the boxes for the services authorized to be provided by your company.

- Under STATISTICAL INFORMATION, enter all requested details regarding telecommunications utilities, such as the number of local exchange access lines, customers, assigned phone numbers, revenue, and company assets in Arizona.

- Confirm if the company is current on payments for regulatory assessments and other listed obligations by checking the appropriate boxes.

After completing all the required sections of the Arizona Annual Report form, review the information thoroughly to ensure accuracy and completeness. This form is critical for the state to assess your company's operations and compliance status accurately. Make sure to submit it by the designated deadline to avoid any issues with your company's standing in Arizona.

Obtain Answers on Arizona Annual Report

What is the Arizona Annual Report for the Utilities Division?

The Arizona Annual Report for the Utilities Division is a comprehensive document that regulated utility companies must complete and submit annually. It includes detailed sections on company information, management and regulatory contacts, ownership details, the counties and services provided, and financial and statistical data about the company's performance over the past year.

Who needs to file the Arizona Annual Report?

Any utility company operating within the state of Arizona and regulated by the Arizona Corporation Commission's Utilities Division must file the Arizona Annual Report. This includes providers of telecommunications, water, electricity, and gas services.

What information do I need to gather before filling out the report?

Before starting the report, companies should gather the following information: company name and contact information, management and regulatory contacts, details about any significant changes in ownership or control, county certification(s), services provided, statistical data about service usage, and financial figures related to Arizona operations.

Are there any sections in the report that might not apply to all companies?

Yes, certain sections of the report may not be applicable to all companies. For example, companies not providing telecommunications services will not need to fill out the section entitled "STATISTICAL INFORMATION TELECOMMUNICATION UTILITIES ONLY." Similarly, specific types of ownership structures or operational changes will lead to different responses in the report.

How do I submit the Arizona Annual Report?

The report can be submitted to the Arizona Corporation Commission Utilities Division either through mail, using the provided mailing label, or electronically through the Commission's online portal, if available. It's essential to ensure that the report is complete and submitted by the designated deadline.

What happens if a company fails to submit the report on time?

Failure to submit the Arizona Annual Report on time can result in penalties, including fines and potential suspension of the utility's certification to operate within the state. It is crucial for companies to comply with reporting deadlines to maintain their operational status.

Can corrections be made after the report has been submitted?

Yes, if errors or omissions are found in the report after submission, companies should contact the Arizona Corporation Commission Utilities Division promptly to amend the report. Providing accurate and up-to-date information is essential for regulatory compliance and operational transparency.

Are there resources available to help with filling out the report?

The Arizona Corporation Commission provides guidance documents and, in some cases, workshops or online resources to aid companies in completing the Annual Report. It is advisable to review these resources or contact the Commission directly for assistance.

How important is the Arizona Annual Report for a utility company?

The Arizona Annual Report is crucial for regulated utility companies. It plays a significant role in maintaining regulatory compliance, ensuring the transparency of operations, and facilitating the ongoing evaluation of utility services in Arizona. The information collected assists the Commission in overseeing utility services and ensures that companies operate in the public interest.

Common mistakes

Filling out the Arizona Annual Report form is crucial for maintaining the good standing of your company with the Arizona Corporation Commission. However, even seasoned professionals can trip up on this seemingly straightforward task. Let's dive into some common mistakes people make when completing this form, so you can avoid them:

**Not updating company information.** It's easy to overlook, but if your company has undergone any changes, such as a new dba (doing business as) name, address, or contact information, make sure these are reflected in your annual report.

**Skipping management and regulatory contacts.** The report requires you to list details for key contacts including management and regulatory representatives. Failing to provide this information can cause delays.

**Forgetting to list the statutory agent or attorney.** These sections should not be neglected. The statutory agent acts as the company's official point of contact for legal matters, and listing an attorney is also important for correspondence regarding any legal issues.

**Overlooking important changes.** If there have been any significant changes during the year, such as changes in ownership or control, or if the company has been notified of non-compliance by regulatory authorities, these need to be reported. It's a mistake to ignore these questions.

**Incorrectly identifying the company type.** Ensure you correctly identify whether your company is a Sole Proprietorship, Partnership, C Corporation, etc., as this affects regulatory requirements.

**Not accurately reporting the counties served.** Your service areas must be correctly identified for both regulatory compliance and for the accuracy of public records.

**Misreporting authorized services.** It is crucial to accurately report the services your company is authorized to provide, including any changes that may have occurred during the reporting period.

**Errors in statistical information.** The financial and operational statistics section is often a source of errors. Make sure to double-check your numbers for accuracy, especially regarding total revenue, assets in Arizona, and customer data.

Remember, the key to smoothly navigating the annual report process is attention to detail and having all your company's current information on hand before you start filling out the form. This will save you time and help avoid the hassle of correcting mistakes after submission.

- Double-check every section for accuracy and completeness.

- Update information as needed to reflect the current status of your company.

- Ensure financial information is accurate and up-to-date.

- Review the form with a colleague or professional advisor if you're unsure.

Avoiding these common mistakes can help ensure that your filing process is smooth and that your company remains in good standing with the Arizona Corporation Commission.

Documents used along the form

When filing the Arizona Annual Report, several other forms and documents might be required or useful to ensure compliance with Arizona's regulations and to facilitate various business operations. These documents each serve unique purposes and are crucial for maintaining the legal and operational framework of a company:

- Articles of Incorporation: This document officially forms and establishes a corporation in Arizona. It contains essential details like the corporation’s name, purpose, initial business address, and information about its shares and incorporators.

- Articles of Organization: Required for Limited Liability Companies (LLCs) to legally establish their business in the state. This includes the LLC’s name, duration, management structure, and the address of its known place of business.

- Statement of Change of Known Place of Business Address or Statutory Agent: This form is used when a company needs to update its official business address or change its statutory agent with the Arizona Corporation Commission.

- Trade Name Registration: Filed to register a trade name (also known as a DBA - 'doing business as') with the state. This does not establish legal entity status but allows a business to operate under a name other than its legal name.

- Annual Minutes: While not filed with the state, businesses often prepare annual minutes of shareholder and board of directors meetings to maintain internal records of decisions and changes.

- Operating Agreement: Essential for LLCs, this internal document outlines the operational procedures, financial decisions, and rules for the company. Though it's not filed with the state, it’s critical for clarifying the business structure.

- Corporate Bylaws: Similar to an Operating Agreement but for corporations, detailing the rules that govern the corporation’s operations and management. It’s an internal document and not filed with the state.

- Shareholder Agreement: An agreement among a company's shareholders outlining how the company should be operated and the shareholders' rights and obligations. This is particularly essential for closely-held corporations.

- Employer Identification Number (EIN) Confirmation Letter: After applying for an EIN from the IRS, businesses receive this confirmation letter. It’s crucial for tax purposes and often required for banking and business transactions.

- Professional Licenses: Depending on the nature of the business, companies might need to secure state or local licenses to lawfully conduct their business activities in Arizona.

Collectively, these documents support a business's legal and operational structure, ensuring compliance, facilitating governance, and enabling certain business activities under Arizona law. Understanding and managing these documents efficiently is crucial for the smooth operation and compliance of any business operating in Arizona.

Similar forms

Business Registration Forms: Similar to the Arizona Annual Report form, business registration forms are required for establishing a legal entity with a state. They both necessitate providing detailed company information, including but not limited to the business name, mailing addresses, and management contacts. These forms serve to formalize a company's presence within the legal and regulatory framework of a state.

Change of Address Forms: Just as the Arizona Annual Report form allows for updates to a company's mailing address, change of address forms are dedicated documents used by individuals and businesses to update governmental and financial institutions of their new mailing addresses. They both ensure that important communications and documents reach the intended recipients promptly.

Ownership Update Forms: These documents, much like the section in the Arizona Annual Report that inquires about changes in ownership or control, are used to record significant changes in the ownership structure of a business. They are critical for maintaining transparent and up-to-date records with regulatory authorities, helping ensure that all legal and financial responsibilities are accurately assigned.

Regulatory Compliance Forms: This category of documents, which encompasses reports and notifications similar to those found in the Arizona Annual Report form, is essential for companies to communicate their adherence to state and federal regulations. These forms might include details on compliance with specific industry regulations, changes in regulatory status, or the outcome of regulatory reviews—mirroring the report's section on regulatory notifications.

Annual Financial Statements: Though more focused on the financial aspects of a company, annual financial statements and the Arizona Annual Report share the commonality of requiring annual submission. Both documents provide a snapshot of the company’s status and operations over the past year, including financial health for annual financial statements and operational, management, and regulatory updates for the annual report. The financial data and asset valuations found in the Arizona Annual Report form bear resemblance to the detailed financial disclosures in annual financial statements.

Dos and Don'ts

When preparing to fill out the Arizona Annual Report form for the Corporation Commission Utilities Division, attention to detail and accuracy is critical. This document serves as an official record of your company's operational and financial status. Here are ten guidelines to help ensure that you navigate this process smoothly and accurately:

- Do check the pre-printed company name and address on the mailing label. If there are discrepancies, make the necessary corrections to reflect your current business name, including any doing business as (dba) names.

- Do not overlook the section for important changes during the year. Specifically disclose any change in ownership, control, or compliance issues with regulatory authorities.

- Do verify that the management and regulatory contact information is up to date. Include accurate telephone numbers, fax numbers, if applicable, and email addresses for all contacts listed.

- Do not guess when providing statistical information. Review your records carefully to ensure that you report the correct numbers for local exchange access lines, customer counts, revenue, assets in Arizona, and other specified metrics.

- Do select the correct type of entity that describes your company (e.g., Sole Proprietor, C-Corporation, Limited Liability Company, etc.). This classification impacts your reporting requirements and how the commission processes your report.

- Do not forget to check the appropriate boxes for the counties where you are certified to provide service and for the types of services you are authorized to offer.

- Do provide specific details if you answer "Yes" to questions about changes in ownership, direct control, or compliance issues noted by other regulatory authorities.

- Do not ignore the boxes for indicating payments current on regulatory assessments and contributions to the AZ Universal Service Fund, AZ 911/E911, and other relevant funds. Your answers must accurately reflect your payment status.

- Do ensure that your listed statutory agent, attorney, and any other official contacts are currently authorized to act in those capacities for your company.

- Do not rush through the form without double-checking all entered information for accuracy. Mistakes or omissions can cause delays or require resubmission, complicating your compliance efforts.

By following these guidelines, you can help ensure that your annual report submission is complete, accurate, and in compliance with the Arizona Corporation Commission's requirements. This proactive approach helps maintain your company's good standing and supports your ongoing business operations in the state.

Misconceptions

Many people have misconceptions about the Arizona Annual Report form that can lead to confusion and errors when attempting to complete it. Here are six common misunderstandings and the correct information for each:

Only corporations need to file it: This is a misconception. The Arizona Annual Report must be filed by various types of business entities, including sole proprietorships, partnerships, C corporations, S corporations, limited liability companies, and more. The form adapts to gather specific information pertinent to the entity type reporting.

It's the same as filing federal annual reports or taxes: The Arizona Annual Report is distinct and separate from any federal reporting requirements, such as federal tax returns. It is specific to the State of Arizona and focuses on information relevant to the state’s regulatory requirements.

The report is optional: Filing the Arizona Annual Report is not optional for entities that are required to do so under state law. Submitting this report is mandatory and must be done within the prescribed timelines to remain in compliance with Arizona state regulations.

Submission is due at the end of the fiscal year: The due date for the Arizona Annual Report is not necessarily aligned with the end of a company's fiscal year. Entities should check specific deadlines that apply to their business type and ensure they file the report accordingly to avoid penalties.

Information provided doesn’t affect the public record: On the contrary, much of the information provided in the Arizona Annual Report becomes part of the public record. This includes details about the management, ownership, and operational areas of the entity, making accurate and thoughtful completion of the report crucial.

It’s only about financial information: While financial information is an important aspect of the Arizona Annual Report, the form also gathers details on management, regulatory contacts, statutory agents, and changes in the company structure or ownership. Thus, it provides a comprehensive overview of the company’s current status beyond just financials.

Understanding these misconceptions is vital for any business entity required to file an Arizona Annual Report. Ensuring accurate and timely submission is crucial for compliance and maintaining good standing with the state.

Key takeaways

When completing the Arizona Annual Report form, it's vital to ensure all pre-printed information such as the company name and address is current and correct. If not, there is a provision to update this information at the beginning of the form to reflect the company's current details.

The form requires detailed information about the company's management, including contact details for the management contact, regulatory contact, statutory agent, and attorney, if applicable. This ensures that the Arizona Corporation Commission Utilities Division has the necessary contacts for any correspondence or regulatory requirements.

Companies are required to disclose any significant changes during the year, such as changes in ownership or direct control, and compliance status with other regulatory authorities. This transparency helps maintain up-to-date records and ensures compliance with state laws and regulations.

The form distinguishes between different types of corporate structures, including Sole Proprietorships, Partnerships, C Corporations, Subchapter S Corporations, Limited Liability Companies, etc. Selecting the correct corporate structure is crucial as it affects regulatory obligations and reporting requirements.

Service areas and types of services provided must be clearly indicated, including the counties in which the company is certificated to provide service and the specific types of telecommunications services offered. This information helps the Utilities Division to monitor and manage the provision of services throughout the state.

Statistical data related to telecommunications utilities are required, including the number of local exchange access lines, customers, phone numbers assigned, and financial data such as intrastate revenue and the value of assets in Arizona. This detailed information assists in the regulatory assessment and oversight of telecommunications services within the state.

- Ensure accuracy in updating pre-existing information about the company.

- Provide comprehensive management and contact information.

- Disclose any significant changes in ownership or compliance status.

- Select the appropriate corporate structure from the options provided.

- Accurately indicate service areas and types of services offered.

- Submit detailed statistical and financial data as required for telecommunications utilities.

Popular PDF Forms

2166-9-2 - Enables an in-depth analysis of NCO competencies, including technical, tactical, and professional skills.

Form 944 Vs 941 - This document allows businesses to summarize yearly wages paid, taxes withheld, and employer's portion of social security and Medicare taxes.

New Jersey Realtors® Standard Form of Residential Lease - Details the declaration of the licensee business relationship, clarifying the professional roles and responsibilities of real estate agents involved.