Blank Arizona Repossession Affidavit PDF Template

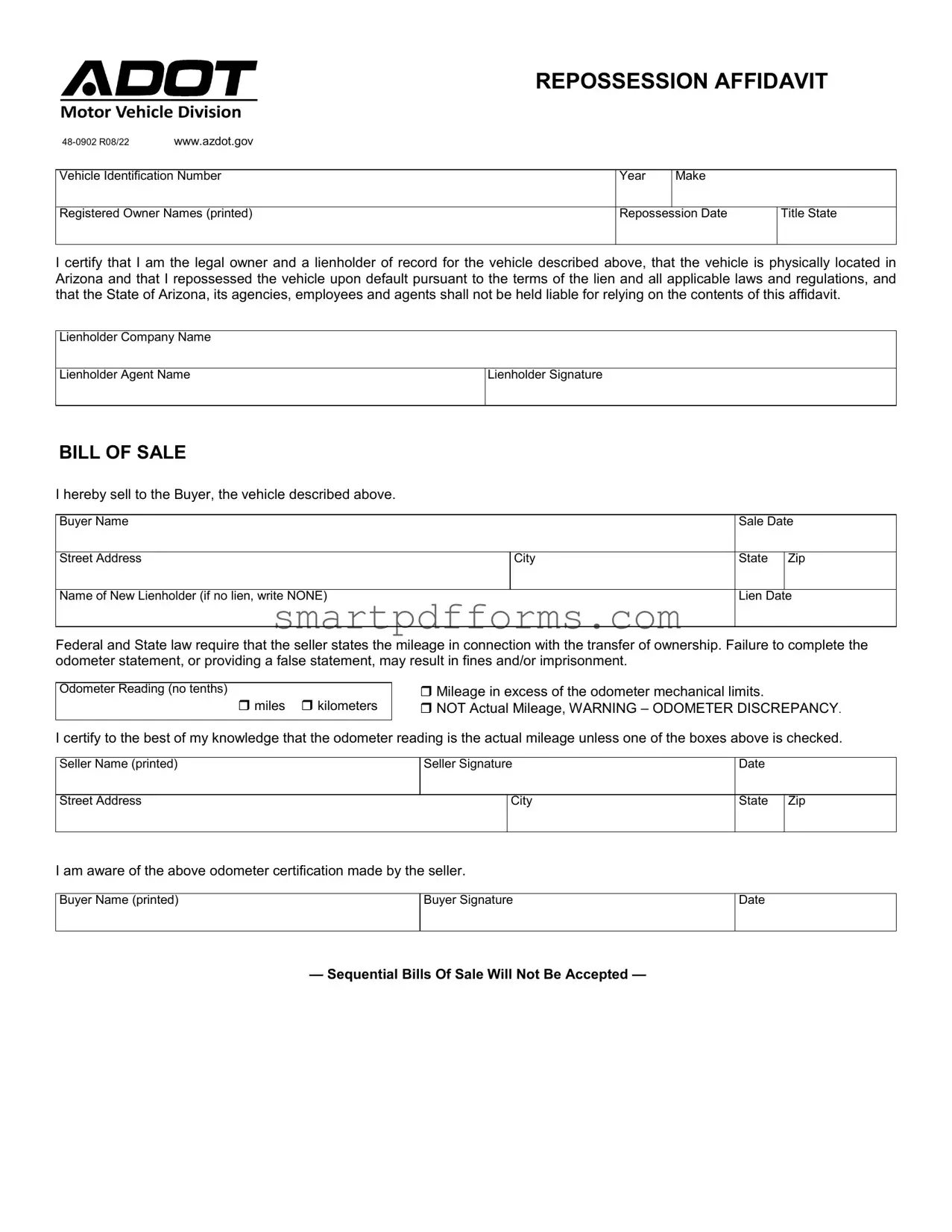

In the realm of vehicular transactions within Arizona, the Repossession Affidavit form holds a singular importance, serving multifaceted roles that bridge the gap between legal ownership changes and regulatory compliance. This document, formally referenced as Vehicle Division 48-0902 R08/22 and accessible through the state's Department of Transportation website, encapsulates detailed information critical for the lawful repossession and subsequent sale of a vehicle. It meticulously records vehicle specifics including the Vehicle Identification Number, year, make, and the registered owner's name(s), alongside the repossession date and the title state, thus ensuring a transparent account of the vehicle's legal status and location. Further, it acts as a declarative statement where the lienholder, asserting legal ownership due to a lien on the vehicle, acknowledges repossessing the vehicle upon the original owner's default in accordance with lien terms and applicable laws. This affidavit also includes a segment serving as a bill of sale, which not only facilitates the sale from the lienholder to a new buyer but also necessitates the disclosure of odometer readings—a requirement underscored by federal and state mandates to prevent fraudulent practices. Through this dual function, the Repossession Affidavit form orchestrates a seamless transition of ownership while safeguarding all parties involved against potential liabilities, thereby playing a pivotal role in maintaining the integrity of vehicle transactions in Arizona.

Preview - Arizona Repossession Affidavit Form

REPOSSESSION AFFIDAVIT

Vehicle Division

www.azdot.gov |

|

|

|

|

|

|

|

|

|

Vehicle Identification Number |

Year |

Make |

|

|

|

|

|

I |

|

Registered Owner Names (printed) |

Repossession Date |

Title State |

||

|

|

|

|

I |

I certify that I am the legal owner and a lienholder of record for the vehicle described above, that the vehicle is physically located in Arizona and that I repossessed the vehicle upon default pursuant to the terms of the lien and all applicable laws and regulations, and that the State of Arizona, its agencies, employees and agents shall not be held liable for relying on the contents of this affidavit.

Lienholder Company Name |

|

|

|

|

|

|

|

Lienholder Agent Name |

Lienholder Signature |

|

|

|

I |

|

|

BILL OF SALE |

|

|

|

I hereby sell to the Buyer, the vehicle described above. |

|

|

|

|

|

|

|

Buyer Name |

|

Sale Date |

|

|

|

|

|

Street Address |

City |

State |

Zip |

|

I |

|

I |

Name of New Lienholder (if no lien, write NONE) |

|

Lien Date |

|

|

|

|

|

Federal and State law require that the seller states the mileage in connection with the transfer of ownership. Failure to complete the odometer statement, or providing a false statement, may result in fines and/or imprisonment.

Odometer Reading (no tenths)

miles kilometers

Mileage in excess of the odometer mechanical limits.

NOT Actual Mileage, WARNING – ODOMETER DISCREPANCY.

I certify to the best of my knowledge that the odometer reading is the actual mileage unless one of the boxes above is checked.

Seller Name (printed)

Seller Signature

Date

Street Address

City

State Zip

I am aware of the above odometer certification made by the seller.

Buyer Name (printed)

Buyer Signature

Date

— Sequential Bills Of Sale Will Not Be Accepted —

Form Data

| Fact Name | Description |

|---|---|

| Form Identification | The Arizona Repossession Affidavit form is identified by the Vehicle Division as number 48-0902 R08/22. |

| Governing Law | This affidavit allows for the repossession of vehicles in Arizona under the conditions that the lienholder has a legal right upon the debtor's default, in accordance with all applicable Arizona laws and regulations. |

| Essential Information | The form requires details such as the Vehicle Identification Number (VIN), year, make, registered owner names, and the repossession date, alongside the lienholder's information. |

| Odometer Statement Requirement | Under both federal and Arizona state law, sellers must provide the mileage of the vehicle at the time of transfer. Failing to do so, or providing false information, can lead to penalties including fines and imprisonment. |

| Limitations on Sale | The form mentions that sequential Bills of Sale will not be accepted, emphasizing the need for a legitimate, one-time change of ownership following the vehicle's repossession. |

Instructions on Utilizing Arizona Repossession Affidavit

Filling out the Arizona Repossession Affidavit is an important step in the process of legally repossessing and transferring ownership of a vehicle. This document ensures that the repossession process is conducted in accordance with state laws and provides a clear record of the transaction. Below are detailed instructions on how to accurately complete the form.

- Start by filling out the Vehicle Identification Number (VIN) of the repossessed vehicle.

- Next, enter the Year and Make of the vehicle to identify it further.

- In the Registered Owner Names section, print the name(s) of the vehicle's registered owner(s) as recorded before repossession.

- Specify the Repossession Date, which is when the vehicle was legally repossessed by the lienholder.

- Indicate the Title State to denote where the vehicle was originally titled.

- In the declaration part, confirm your status as the legal owner and a lienholder of record for the vehicle, acknowledging that the vehicle was repossessed in accordance with the lien terms and applicable laws and that it is physically located in Arizona.

- Enter the Lienholder Company Name to identify the legal entity that repossessed the vehicle.

- Provide the name of the Lienholder Agent—the individual acting on behalf of the lienholder company during the repossession process.

- The Lienholder must sign their name to validate the affidavit.

- For the bill of sale section, if applicable, begin by entering the Buyer Name, who the vehicle is being sold to post-repossession.

- Fill out the Sale Date to record when the vehicle was sold to the new owner.

- Provide the Buyer’s Street Address, City, State, and Zip.

- If there is a new lienholder, enter their name in the Name of New Lienholder section. If there is no new lien, write "NONE."

- Indicate the Lien Date if a new lien is being recorded.

- Under the odometer certification, fill in the Odometer Reading and specify whether the mileage is in miles or kilometers. Check the appropriate box if the mileage exceeds the odometer’s mechanical limits or if there is an odometer discrepancy.

- Print the Seller Name and sign the form to certify the accuracy of the odometer reading and the conditions of sale.

- Lastly, the buyer should print and sign their name acknowledging their awareness of the odometer certification.

Following these steps carefully will ensure that the Arizona Repossession Affidavit is filled out correctly and legibly. This document serves as an essential proof of the transition of vehicle ownership under the conditions of repossession and sale, which is crucial for both the lienholder and the new owner. Ensuring that all information is accurate and complete is paramount to prevent legal issues and to provide a clear record of the transaction.

Obtain Answers on Arizona Repossession Affidavit

What is an Arizona Repossession Affidavit?

An Arizona Repossession Affidavit is a legal document used by the lienholder (typically a financial institution or an individual who has a security interest in the property) to assert their right to repossess a vehicle when the borrower defaults on their loan terms. This affidavit confirms that the lienholder has legally taken possession of the vehicle and outlines the essential details of the repossession process, including the vehicle's identification number, the registered owner's name, and the repossession date.

Who needs to complete the Arizona Repossession Affidavit?

The lienholder or their authorized agent is required to complete the Arizona Repossession Affidavit. It is crucial for affirming the transfer of ownership from the original owner to the lienholder or a new owner, in cases where the vehicle is sold following its repossession.

What information is needed to fill out the form?

To properly fill out the Arizona Repossession Affidavit, the following information is needed: the Vehicle Identification Number (VIN), year, make of the vehicle, registered owner's name(s), repossession date, details about the lienholder including the company name and agent name, along with the new buyer's details if the vehicle is being sold. Additionally, accurate odometer readings and compliance with federal and state law regarding odometer disclosure are required.

Are there any specific legal requirements or regulations that govern the use of the Arizona Repossession Affidavit?

Yes, completing the Arizona Repossession Affidavit must be done in accordance with all applicable laws and regulations governing vehicle repossession and sale in Arizona. This includes adhering to specific procedures for repossession, providing accurate odometer readings, and ensuring that the affidavit accurately represents the condition and status of the repossessed vehicle. Failure to comply may result in serious consequences including fines and/or imprisonment.

What are the consequences of not completing the Arizona Repossession Affidavit correctly?

Failure to accurately complete the Arizona Repossession Affidavit can lead to legal and financial repercussions. These may include penalties such as fines and imprisonment for providing false odometer statements, as well as potential liability for any discrepancies or issues arising from the repossession and sale process. It is essential for the lienholder to ensure that all information provided in the affidavit is correct and that all legal requirements are met.

How does completing the Arizona Repossession Affidavit protect lienholders?

Completing the Arizona Repossession Affidavit helps protect lienholders by legally documenting the repossession and any subsequent sale of the repossessed vehicle. It serves as proof that the lienholder has followed all necessary legal procedures and has the right to take possession of and sell the vehicle. This protection is vital in safeguarding the lienholder's interests and in preventing potential disputes over ownership or the repossession process.

Can the affidavit be used for vehicles repossessed outside of Arizona?

The Arizona Repossession Affidavit is specifically designed for use within the state of Arizona. It asserts that the repossessed vehicle is physically located in Arizona. For vehicles repossessed outside of Arizona, lienholders must consult the laws and regulations of the respective state to ensure proper legal procedures are followed.

What should be done with the Arizona Repossession Affidavit after its completion?

After completing the Arizona Repossession Affidavit, the lienholder should submit it to the appropriate Arizona state agency, typically the Arizona Department of Transportation (ADOT) or its Vehicle Division. This step is crucial for updating the state’s vehicle records, thereby formally transferring ownership in accordance with state laws. Retaining a copy for records is also advisable, as it may be needed for future reference or in case of disputes.

Common mistakes

Filling out the Arizona Repossession Affidavit form accurately is crucial for ensuring a smooth vehicle repossession process. However, individuals often make mistakes that can lead to complications. Here are four common errors:

Not verifying vehicle information: It's imperative to double-check the vehicle identification number (VIN), make, model, and year against the vehicle's documents. Mistakes in these details can invalidate the affidavit.

Omitting lienholder details: The form requires specific information about the lienholder, including the company name and agent's name. Leaving these sections blank or incomplete can lead to processing delays.

Inaccurate odometer reading: Incorrectly stating the odometer reading, or neglecting to indicate if the mileage exceeds the mechanical limits or if there's a discrepancy, may result in legal issues. Accurate disclosure is necessary for compliance with federal and state law.

Sequential Bills of Sale: The explicit instruction that sequential Bills of Sale will not be accepted is often overlooked. This means each transaction must be documented separately and not as a continuation or series from a previous bill of sale.

Furthermore, when completing this form, individuals commonly overlook:

- Failing to provide detailed buyer information, including their name, address, and acknowledgment of the odometer certification.

- Not ensuring that all signatures are present, including those of the seller, buyer, and lienholder agent. Every signature is vital for the affidavit's validity.

- Omitting the sale date or lien date, which are crucial to document the timeline of ownership and lien status changes.

- Assuming state agencies, employees, and agents will not verify the accuracy of the information provided. It's essential to certify that all details in the affidavit are true and correct to the best of one's knowledge.

Documents used along the form

When dealing with the repossession of a vehicle in Arizona, the Arizona Repossession Affidavit form is a critical document that initiates the formal process. However, to complete this process effectively and lawfully, several additional forms and documents are typically required. These documents encompass a range of information that supports the repossession and subsequent actions like the sale or transfer of the repossessed vehicle.

- Notice of Default and Right to Cure: This notice is sent to the borrower before repossession, informing them of the default and providing a final opportunity to rectify the situation.

- Repossession Log: Records details of the repossession process, including the date, time, and manner of repossession, as well as any personal property found within the vehicle.

- Condition Report: A detailed account of the vehicle’s condition at the time of repossession, including photographs and a list of any damages or modifications.

- Personal Property Inventory: Lists items found in the vehicle that do not belong to the lienholder and outlines steps for the borrower to reclaim them.

- Notice of Sale: Informs the borrower of the intention to sell the vehicle, providing details about the time and place of the sale, allowing the borrower a chance to redeem the vehicle.

- Bill of Sale: A document provided at the time of the vehicle's sale, recording the transaction details including the buyer, seller, and vehicle information.

- Odometer Disclosure Statement: Required under federal law, this statement certifies the vehicle's mileage at the time of sale and notes any discrepancies.

- Release of Lien: Issued by the lienholder to remove their interest in the vehicle once the debt has been satisfied or the vehicle is sold.

- Power of Attorney: Sometimes needed if the repossession or sale of the vehicle requires someone to act on behalf of the lienholder or seller.

- Title Application: Required to transfer the vehicle’s title from the seller or lienholder to the buyer or new owner following the sale.

To navigate the complexities of the vehicle repossession process in Arizona courageously, understanding the purpose and requirements of each document is vital. Lienholders, alongside their legal representatives and agents, are advised to prepare these documents accurately to ensure compliance with state laws and protect all parties’ interests. This careful preparation mitigates potential legal challenges and streamlines the repossession and sale process, ultimately facilitating a smoother transition of the vehicle to its new owner.

Similar forms

Vehicle Title Transfer Form: Similar to the Arizona Repossession Affidavit, this document is used to change the ownership record of a vehicle. It involves stating the vehicle identification number, the year, make, registered owner names, and addresses of both the seller and buyer. It also requires the odometer reading, highlighting its significance in defining the vehicle's value and condition, just like the affidavit.

Loan Agreement: This document outlines the terms of a financial agreement between two parties, akin to the Arizona Repossession Affidavit which involves a lienholder and a borrower. In both cases, the documents specify the conditions under which the ownership of the property (a vehicle, in the case of the affidavit) can be transferred or reclaimed upon default.

Notice of Default and Right to Cure: This is a notice sent to a borrower when they default on their loan, giving them a chance to rectify the default to avoid repossession. It's closely related to the affidavit since repossession action starts only after such a notice is considered or assumed to be ignored, implying an underlying agreement breach similar to the affidavit's context.

Lien Release Document: This form is used when a lien on a vehicle is paid off, and the lienholder removes their interest in the property, enabling ownership transfer. It mirrors the Arizona Repossession Affidavit's aspect of lienholders declaring their legal interest and action upon a vehicle, but from the conclusion perspective of the lienholder’s interest being settled.

Odometer Disclosure Statement: By law, this statement must be filled out during the sale of a vehicle to certify the mileage. The Arizona Repossession Affidavit requires a similar declaration in its section concerning the vehicle sale after repossession, emphasizing the importance of accurate mileage reporting in the transactions involving vehicles.

Power of Attorney for Vehicle Transactions: This document authorizes someone else to make decisions regarding the sale, purchase, or registration of a vehicle on behalf of the owner. It's akin to the affidavit where the lienholder acts with authority over the vehicle upon default, executing decisions like repossession and sale, often through designated agents or representatives.

Security Agreement: This contract specifies that a property (in this case, a vehicle) serves as collateral for a loan, detailing the lienholder's right to repossess the property if the borrower defaults. The Arizona Repossession Affidavit is a follow-up to such an agreement, enacted when repossession becomes necessary due to default.

Conditional Sales Contract: This agreement allows the buyer to use the property while payments are made, but the seller holds title to the property until it’s fully paid for. If payments are not made, the seller can repossess the property. This process closely parallels the repossession affidavit, which is executed when the buyer defaults on payments under such a contract involving a vehicle.

Dos and Don'ts

When filling out the Arizona Repossession Affidavit, certain practices must be adhered to in order to ensure the process is carried out correctly and legally. Below are eight important dos and don'ts to consider:

- Do ensure that all printed names match the identification and documents of the individuals involved. Consistency in names across all documentation is crucial for legal validation.

- Do accurately enter the Vehicle Identification Number (VIN). Double-check to make sure every letter and number is correct to avoid issues with vehicle identification.

- Do provide the precise date of repossession. This date is important for legal records and the potential resolution of disputes.

- Do confirm that the vehicle is indeed physically located in Arizona at the time of completing the affidavit. This fact must be true to comply with state requirements.

- Don’t leave any sections incomplete. Every field must be filled out unless specifically marked as optional. Incompleteness can lead to rejection of the affidavit.

- Don’t guess the odometer reading. This information should be accurate and truthful. If unsure, verify before submitting. Incorrect or fraudulent entries can lead to serious legal consequences.

- Don’t forget to check the appropriate box if the mileage on the odometer exceeds its mechanical limits or if there’s an odometer discrepancy. Transparency here is crucial.

- Don’t sign the affidavit without ensuring all information is correct. Once signed, you are attesting to the accuracy and truthfulness of the information provided. Any errors identified after signing could complicate the process.

Adhering to these guidelines will assist in the smooth and lawful execution of the Arizona Repossession Affidavit form. It's essential to approach this document carefully and thoroughly, recognizing its legal implications and the importance of precision in the information provided.

Misconceptions

When discussing the Arizona Repossession Affidavit, there are several common misconceptions that can lead to confusion. It's important to clarify these to ensure that individuals understand their rights and obligations accurately.

- Misconception 1: The affidavit allows the lienholder to bypass legal processes for repossession.

This is not true. The affidavit is a formal declaration that the lienholder has repossessed the vehicle according to Arizona laws and regulations. Legal processes need to be followed before the affidavit can be legitimately filed.

- Misconception 2: Only the vehicle's lienholder needs to sign the affidavit.

While it's correct that the lienholder's signature is crucial, the document also requires signatures from the seller (in the Bill of Sale section) and the buyer when ownership is being transferred. This ensures a clear record of consent and transaction from all parties involved.

- Misconception 3: The affidavit serves as a replacement for the vehicle title.

Actually, the affidavit does not replace the vehicle title. It is a document used in the process of repossessing the vehicle and transferring ownership, but the official vehicle title must be properly transferred through the Arizona Department of Transportation (ADOT).

- Misconception 4: Filling out the odometer section is optional.

Contrary to this belief, federal and state law require the odometer reading to be stated accurately during the transfer of ownership. Failing to complete this section or providing false information can lead to serious legal consequences, including fines and imprisonment.

- Misconception 5: The affidavit can be used for vehicles located outside Arizona.

The affidavit specifies that the vehicle must be physically located in Arizona. It cannot be used for vehicles located in other states, underscoring the importance of the vehicle's location in the repossession process as defined by Arizona law.

- Misconception 6: Any type of sale can be recorded on the affidavit.

Sequential Bills of Sale will not be accepted as noted in the affidavit. This implies that the sale recorded must be the immediate transfer of ownership following the repossession, not an indication of subsequent sales.

- Misconception 7: The affidavit guarantees the lienholder's ownership.

While signing the affidavit, the lienholder certifies being the legal owner and lienholder of the vehicle. However, this declaration is subject to verification and must be supported by official records and the completion of legal processes.

- Misconception 8: Any discrepancies in the odometer reading are irrelevant.

On the contrary, the affidavit specifically addresses the importance of accurate odometer readings. Marking the correct box if the mileage exceeds mechanical limits or is not the actual mileage is crucial to avoid the warning of an odometer discrepancy.

Understanding these misconceptions and the actual requirements of the Arizona Repossession Affidavit can help ensure that the repossession process is conducted legally and smoothly.

Key takeaways

When working with the Arizona Repossession Affidavit form, it's essential to understand its components and requirements to ensure a smooth process. Here are the key takeaways to keep in mind:

- Vehicle Information is Critical: You must provide accurate details of the vehicle, including the Vehicle Identification Number (VIN), year, and make.

- Ownership and Repossession: The form requires you to affirm that you are the legal owner and lienholder of the vehicle and that the vehicle is physically located in Arizona at the time of repossession.

- Repossession Conditions: It's declared that the vehicle was repossessed upon default, adhering to the lien's terms and relevant laws and regulations.

- Indemnification: By signing the affidavit, you indicate that the State of Arizona, including its agencies, employees, and agents, is not liable for actions taken based on the document’s contents.

- Bill of Sale: The form serves dual purposes, acting also as a bill of sale, where you can officially sell the repossessed vehicle to another buyer, with sections to fill out the buyer’s information and sales details.

- New Lienholder Information: If the vehicle will have a new lienholder following the sale, their information must be included. If not, you should mark the section as NONE.

- Odometer Disclosure: Federal and state laws require the disclosure of the vehicle’s mileage at the time of transfer. The form includes options to indicate if the mileage exceeds mechanical limits or if there's an odometer discrepancy.

- Lienholder Representation: The form needs the lienholder's company name, the agent handling the repossession, and their signatures to validate the affidavit and bill of sale.

- Accuracy is Key: Providing false information, especially regarding the odometer statement, can lead to penalties, including fines or imprisonment.

Completing this form accurately and diligently is crucial for the legality of the repossession and subsequent sale, protecting the interests of all parties involved.

Popular PDF Forms

How to Count Present and Absent in Excel - Certified providers can utilize the Daily Attendance Record to fulfill state compliance while providing evidence of responsible child supervision and care.

Postalease Fehb Worksheet - For assistance with FEHB changes due to special circumstances, HRSSC is available to guide USPS employees through the process.