Blank Bank Change Order PDF Template

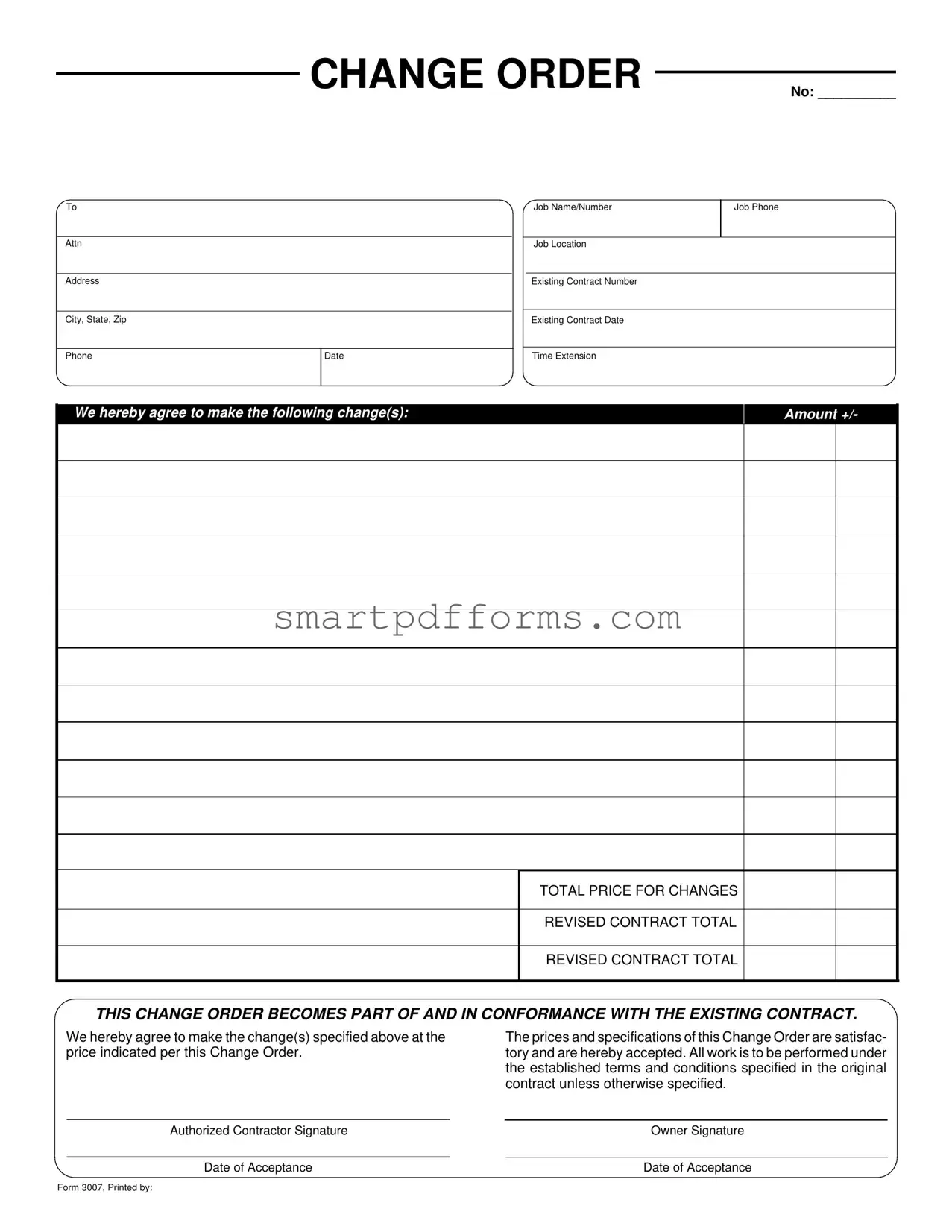

Managing financial transactions with precision is crucial in any business, especially when it comes to amending existing contracts. The Bank Change Order form serves as a vital tool in this process, allowing for the seamless modification of terms within an ongoing contract. This document, identified by a unique Change Order Number, specifies the job name or number, job phone, attention, job location address, and existing contract details including number, date, and the city, state, and zip of the contract location. It outlines the changes agreed upon by the parties involved, detailing any adjustments in the amount and totaling the revised contract amount. This ensures that both the contractor and the owner are in clear agreement about the scope and cost of the modified work, making this change legally binding. The form includes spaces for the authorized contractor's and the owner's signatures, alongside the date of acceptance, solidifying the agreement. By becoming a part of the existing contract, the Change Order upholds the terms and conditions previously established unless noted otherwise. This document is not only about financial adjustments but also about upholding the integrity of contractual agreements and ensuring mutual satisfaction.

Preview - Bank Change Order Form

CHANGE ORDER

No: __________

To |

Job Name/Number |

Job Phone

Attn |

|

|

Job Location |

|

|

|

|

Address |

|

|

Existing Contract Number |

|

|

|

|

City, State, Zip |

|

|

Existing Contract Date |

Phone

Date |

Time Extension |

We hereby agree to make the following change(s):ecified change(s)

Amount +/-

TOTAL PRICE FOR CHANGES

REVISED CONTRACT TOTAL

REVISED CONTRACT TOTAL

THIS CHANGE ORDER BECOMES PART OF AND IN CONFORMANCE WITH THE EXISTING CONTRACT.

We hereby agree to make the change(s) specified above at the price indicated per this Change Order.

The prices and specifications of this Change Order are satisfac- tory and are hereby accepted. All work is to be performed under the established terms and conditions specified in the original contract unless otherwise specified.

Authorized Contractor Signature |

Owner Signature |

|

|

|

|

Date of Acceptance |

Date of Acceptance |

|

Form 3007, Printed by:

Form Data

| Fact Name | Description |

|---|---|

| Form Identification | This document is identified as a Bank Change Order form, specifically labeled as Form 3007. |

| Purpose | It's utilized to officially request changes to an existing contract, especially in construction or service agreements. |

| Key Components | Includes details such as Change Order Number, Job Name/Number, Contact Information, Job Location, Existing Contract Details, and the specific changes requested including their financial impact. |

| Financial Details | The form outlines the amount to be added or deducted, providing a clear calculation of the total revised contract amount. |

| Validity and Integration | States that once signed, this Change Order becomes an integral part of the existing contract. |

| Approval Mechanism | Requires signatures from both the Authorized Contractor and the Owner, alongside dates of acceptance to ensure mutual agreement. |

| Conformance Clause | Clarifies that all work performed under the Change Order will adhere to the terms specified in the original contract unless noted otherwise. |

| Adherence to Original Terms | Emphasizes that the new changes must be executed in accordance with the established conditions of the original contract. |

| Governing Law | Not explicitly mentioned in the provided form content, the governing law would typically be the law of the state where the contract is executed or where the property in question is located. |

Instructions on Utilizing Bank Change Order

Completing a Bank Change Order form is essential when you need to adjust the details or scope of an existing contract with a bank, whether it's due to unforeseen circumstances or mutual agreement between the parties to modify the terms. Accuracy and attention to detail are crucial in filling out this form to ensure that both parties are clear about the changes and agree to the updated terms. Here’s how you can fill out the form step-by-step:

- Begin with the CHANGE ORDER No: Fill in the change order number assigned to this particular change. This helps in tracking and referencing the change among other documents related to the contract.

- Under To Job Name/Number, provide the specific job name or number associated with the contract that is being adjusted.

- Fill in the Job Phone with the contact number for the job site or main contact's direct line.

- Under Attn (attention), write the name of the individual or department this change order is addressed to.

- In the section labeled Job Location Address, City, State, Zip, enter the full address where the job is taking place.

- Fill in the existing Contract Number and Date to identify the original contract being modified.

- Provide the Phone Date Time Extension if available, to offer another way of reaching the contract holder if needed.

- Clearly specify the change(s) being made to the contract in the space provided. Describe in detail what is being modified, added, or removed.

- In the Amount +/- field, indicate the financial impact of the change, whether it’s an increase or decrease in the total contract value.

- Enter the TOTAL PRICE FOR CHANGES which is the sum of all changes if there are multiple.

- Calculate and note the REVISED CONTRACT TOTAL, which factors in the new changes.

- Both the Authorized Contractor and the Owner must sign and date the form in their respective fields under Date of Acceptance to signify their agreement to the changes.

After completion, this Change Order becomes an integral part of the existing contract, modifying it as per the agreed-upon terms. It's recommended to keep a copy of this form with the original contract documents for future reference and to ensure both parties have access to the updated contract specifications.

Obtain Answers on Bank Change Order

-

What is a Bank Change Order form?

A Bank Change Order form is a document used to authorize and document changes to an existing banking or financial transaction. It outlines the specifics of the change, such as adjustments in amounts, terms, or other key details originally agreed upon in a contract or agreement.

-

Who needs to sign the Bank Change Order form?

The form must be signed by both the Authorized Contractor and the Owner. It ensures that both parties agree to the specified changes and the associated costs or adjustments in the original contract.

-

How does a Change Order affect the existing contract?

A Change Order, once signed by all necessary parties, becomes an integral part of the existing contract. It modifies the contract in accordance with the new terms outlined in the order, including any adjustments to the total price or terms of service.

-

What should be included in the description of the change(s)?

The description should clearly and concisely detail the change(s) being made. This includes any additions, deletions, or modifications to the scope of work, materials, job location, timelines, or costs. The aim is to ensure full understanding and agreement by both parties.

-

Can a Bank Change Order form be used for any contract?

While the form is designed to document changes to bank or financial transactions, it's essential to review the specific terms and conditions of the original contract. Some contracts may require a specific form or process for changes to be recognized legally.

-

What happens if one party does not agree to the Change Order?

If either party does not agree to the proposed changes, the Change Order cannot be finalized or become part of the existing contract. In such cases, parties must negotiate to reach an agreement, or the original terms of the contract remain in effect.

-

How should the "TOTAL PRICE FOR CHANGES" be calculated?

The "TOTAL PRICE FOR CHANGES" should be calculated by accurately summing all adjustments specified in the Change Order, whether they are increases or decreases. This figure should reflect the total financial impact of the changes on the original contract price.

-

Is it necessary to specify the existing contract details?

Yes, it is crucial to specify details like the Existing Contract Number, Job Name/Number, and the original contract date. This information ensures that the Change Order is clearly linked to the correct contract, avoiding confusion or misinterpretation.

-

What is the importance of the "Date of Acceptance"?

The "Date of Acceptance" is vital as it marks the official agreement to the changes by both parties. It also helps in tracking when the changes were made and can be used as a reference point for any future disputes or clarifications regarding the contract modifications.

Common mistakes

When filling out a Bank Change Order form, it's crucial to avoid common mistakes to ensure the process runs smoothly. Here's a list of frequently observed errors:

- Not Including the Change Order Number: The form often goes unrecognized without its specific Change Order No., causing delays.

- Leaving the Job Name/Number Blank: This is essential for identifying the project associated with the change order.

- Omitting Job Location Address Details: Full details such as city, state, and ZIP are critical for correct order processing.

- Forgetting to Add Existing Contract Number and Date: This can lead to confusion about which contract the changes apply to.

- Not Clearly Specifying the Changes: Vague descriptions can lead to disputes or incorrectly executed work.

- Skipping the Amount +/-: Not indicating the financial impact (either an addition or deduction) of the changes can lead to billing errors.

- Incorrect Totals: Failing to properly calculate the Revised Contract Total, including the changes, often leads to financial discrepancies.

- Signature Omissions: Not having the Authorized Contractor and Owner signatures can invalidate the document.

Additionally, paying attention to the smaller details can prevent further mistakes:

- Always double-check for accurate and complete information before submission.

- Ensure dates and times are included and accurate, reflecting when the change order should take effect.

- Clarify any terms that may have changed from the original contract in the sections provided.

By avoiding these errors, the change order process will be more efficient and legally compliant, ensuring all changes are correctly implemented into the project.

Documents used along the form

When dealing with banking and finance, the Bank Change Order form is crucial for modifying contracts with precision and agreement from all parties involved. However, this document rarely operates in isolation. Other forms and documents often accompany it to ensure comprehensive management of financial transactions, contract changes, and communications between parties. Understanding these complementary documents can offer a clearer view of the banking process and provide additional legal and operational security.

- Amendment Agreement: This document officially modifies the terms of an existing contract. Unlike a change order, which is more common in construction and service-related contracts for changing orders or job specifications, an amendment can apply to any contract type. It revisions anything from payment terms to delivery schedules, making it broader in application.

- Notice of Completion: Following the execution of changes detailed in a Bank Change Order, a Notice of Completion is often filed. This document signals the successful implementation of the agreed-upon modifications. It plays a critical role in financial transactions, especially in industries like construction, by marking the end of a particular phase or the entire project, thus triggering final payments or the release of retainage.

- Assignment of Contract: This form facilitates the transfer of contractual rights and obligations from one party to another. In the context of a Bank Change Order, if a party wishes to assign their role and responsibilities to a third party post-change order agreement, an Assignment of Contract ensures that the new party assumes all associated duties, rights, and liabilities under the original and amended contracts.

- Consent to Sublease Agreement: If the changes articulated in a Bank Change Order affect leasing arrangements—such as premises changes or the need for additional space—then a Consent to Sublease Agreement may be required. This document must be signed by the original lessor, confirming they agree to the subleasing terms. It safeguards the rights of all parties and maintains compliance with original lease agreements.

These documents, together with the Bank Change Order form, constitute a comprehensive set of tools for managing changes in banking and finance contracts. They ensure that all aspects of the change, from the agreement to implementation and even potential lease adjustments, are documented and legally sound. The collaboration of these documents provides a layered approach to managing contracts, offering clarity, legality, and procedural correctness for all parties involved.

Similar forms

Several documents share similarities with a Bank Change Order form, commonly used in the banking and finance sector. These documents, like the Change Order form, are pivotal in modifying previously agreed-upon terms, confirming transactions, or updating information within professional agreements. Here is a detailed look at each:

Amendment to Loan Agreement: This document mirrors the Bank Change Order form features by adjusting the terms of an existing loan agreement. It may modify interest rates, repayment schedules, or other critical loan terms, much like how change orders specify alterations to original contracts.

Service Agreement Modification: Similar to a change order, this document is used when the scope of a service agreement between two parties needs adjustment. It could involve changes in service delivery, timelines, or payment terms. Both documents formalize agreed-upon changes between involved parties.

Project Change Authorization: In project management, this document serves a similar purpose by authorizing changes to the project scope, budget, or schedule. It aligns with the process of a Bank Change Order form in ensuring all parties agree to the modifications before they are implemented.

Rental Agreement Amendment: This modification is applied to rental or lease agreements, adjusting terms like rent amount, lease duration, or property rules. It resembles a Bank Change Order in the way it formally records and implements agreed-upon changes between landlord and tenant.

Mortgage Modification Agreement: This document is used by homeowners seeking to change the terms of their mortgage, possibly to lower payments or change the loan’s length. It reflects the objective of a Bank Change Order form by amending previously established financial agreements.

Insurance Policy Endorsement: Insurance companies use endorsements to add, remove, or change coverage in an existing policy. The process mirrors the Bank Change Order form, emphasizing the mutual agreement upon new terms by all parties involved.

Employment Contract Revision: Similar to a Bank Change Order, this document formally captures any changes to an original employment contract, such as salary adjustments, position changes, or amendments to job duties, requiring agreement from both employer and employee.

Vendor Agreement Update: Often used in supply chain and procurement, this document modifies the terms of an existing agreement with a vendor or supplier. Its purpose aligns with that of a Bank Change Order by formally documenting and agreeing upon changes to the terms of supply, pricing, or delivery schedules.

Shareholder Agreement Adjustment: This document is utilized within corporations to amend the terms of a shareholder agreement, potentially affecting share allocation, voting rights, or dividends. It employs a similar mechanism to the Bank Change Order, necessitating the consent of affected parties before adjustments are made effective.

Credit Agreement Revision: Comparable to change orders, this document modifies the terms of a credit agreement between a borrower and a lender. Changes might include interest rates, repayment terms, or credit limits, ensuring both parties' agreement on new terms as with a Bank Change Order form.

Each of these documents, like the Bank Change Order form, plays a crucial role in updating and maintaining the accuracy of contractual arrangements across various sectors. Their primary function is to ensure that any changes are mutually agreed upon, clearly documented, and legally binding, safeguarding the interests of all parties involved.

Dos and Don'ts

When handling a Bank Change Order form, it's essential to approach the task with attention to detail and clear communication. Here are several do's and don'ts that can help ensure the process is completed accurately and effectively.

- Do review the existing contract thoroughly before filling out the change order form. Ensuring you understand all the terms and conditions will help you accurately reflect the changes being made.

- Do clearly specify the changes you're requesting. This includes detailing any additions or deletions to the scope of work, changes in materials, or adjustments in timelines.

- Do provide a detailed explanation for each change. This can help avoid misunderstandings and provides clear documentation of why changes are necessary.

- Do double-check the calculations for the additional or reduced costs associated with the changes. Ensure the totals and revised contract total accurately reflect these adjustments.

- Don't leave any fields blank. If a section does not apply, it's better to write "N/A" than to leave it empty. This helps confirm that no parts of the form were overlooked.

- Don't assume verbal agreements are sufficient. Even if changes have been discussed and agreed upon verbally, it's crucial that they are documented in writing using the change order form.

- Don't forget to get all necessary signatures. This form typically requires authorization from both the contractor and the owner to be valid and enforceable.

- Don't hesitate to seek clarification or legal advice if there are any aspects of the form or the process that are unclear. Ensuring that both parties fully understand the agreement can help prevent disputes down the line.

Misconceptions

Understanding the Bank Change Order form is essential for those in the construction, banking, and legal fields, but there are several misconceptions about its usage and purpose. Here, we'll explore and correct nine common misunderstandings:

- Misconception 1: The Bank Change Order form is only for banking institutions. Contrary to its name, the form is not exclusive to banks. It's widely used across various industries, particularly in construction, to amend contracts and agreements.

- Misconception 2: It can only be used to increase the contract price. While often used to adjust contract costs, the Bank Change Order form can indicate both increases and decreases in price.

- Misconception 3: Any change can be made unilaterally. Changes require agreement from both parties involved, typically the contractor and the client, ensuring that both sides accept the alterations before they're implemented.

- Misconception 4: Verbal agreements are sufficient for minor changes. To protect both parties and ensure clarity, all changes, no matter how small, should be documented using this form or a similar official document.

- Misconception 5: The form is complex and difficult to complete. Although it requires specific information, the Bank Change Order form is designed to be straightforward, ensuring clear communication of any contract changes.

- Misconception 6: It's legally binding without signatures. The form requires signatures from both the authorized contractor and the owner to validate any changes agreed upon, making it a legally enforceable document.

- Misconception 7: The original contract terms cannot be modified using this form. While it primarily focuses on financial adjustments, it can also incorporate changes to the scope of work, timelines, or other original terms, if both parties agree.

- Misconception 8: Use of the form is optional for contract changes. For clear accountability and to avoid disputes, using this formal document for any changes in the contract is considered best practice rather than optional.

- Misconception 9: A change order can be processed without a detailed description of the adjustments. A comprehensive description of the changes, including how they impact the overall contract, is necessary to ensure transparency and mutual understanding.

Correcting these misconceptions can streamline processes, prevent disputes, and ensure that projects run smoothly and efficiently. It's crucial for all parties involved to understand the importance and correct use of the Bank Change Order form to foster successful, professional relationships and project outcomes.

Key takeaways

Understanding how to fill out and use the Bank Change Order form requires attention to detail and a clear grasp of the procedures involved. Here are key takeaways to ensure the process is handled correctly and efficiently.

- Correctly Identifying the Change Order No: It's crucial to accurately fill in the Change Order Number at the top of the form, as this uniquely identifies the current amendment in relation to the original contract.

- Detailing Job Information: The form requires specific information such as the Job Name/Number, Job Phone, Attention (Attn), and Job Location Address. This information should be filled in without errors to avoid any confusion or delays.

- Contract Information: Accurately transcribing the Existing Contract Number, City, State, Zip, and the Existing Contract Date ensures that the change order is correctly linked to the existing contract.

- Communication Details: Providing up-to-date phone numbers and noting the Date and Time of the Change Order submission facilitates effective communication and timely processing.

- Detailing Changes: Clearly describe the agreed-upon changes in the specified section. This clarity prevents misunderstandings and establishes a clear scope of work under the change order.

- Financial Terms: Documenting the Amount +/-, and both the TOTAL PRICE FOR CHANGES and REVISED CONTRACT TOTAL accurately, is essential for financial clarity and to avoid disputes.

- Contract Continuity: It's important to understand that this Change Order becomes part and parcel of the existing contract, adhering to the original terms unless stated otherwise.

- Signatures are Binding: The signature of both the Authorized Contractor and Owner, along with the Date of Acceptance, legally binds both parties to the terms of the Change Order.

- Legal Compliance: Ensuring that the Change Order complies with all applicable laws and regulations is vital for its enforceability and to protect the interests of all parties involved.

- Record Keeping: Maintaining a copy of the completed Change Order form within project documentation and contract files is essential for future reference, especially in the event of disagreements or audits.

Note that the absence of clear instructions, incomplete forms, or the missing signatures could delay or void the Change Order. It's advisable to review the completed form for accuracy and completeness before submission. Cooperation and open communication between the contractor and property owner smooth the path for implementing changes, ensuring that the project remains aligned with the parties' expectations and legal requirements.

Popular PDF Forms

Cf 1R Alt Hvac - Highlights the requirement for a setback type thermostat in all HVAC alterations, enhancing energy savings.

How to Apply at Dollar Tree - Clarification about the application not being a contract of employment reinforces the at-will employment policy.

Non Refundable Portion of Employee Retention Credit - It includes specific sections for calculating the correct amounts of taxes owed or refunded.