Blank Beneficiary Planner PDF Template

Preparing for the future, especially in the context of what happens after we pass away, can often be a daunting task. Yet, it is an essential step to ensure that our wishes are respected and that we leave everything in order for our loved ones. Recognizing this need, Colonial Penn Life Insurance Company has developed a unique tool known as the Beneficiary Planner. This document is not just another form; it is a comprehensive guide designed to simplify the process of communicating your final wishes to family members or friends. The planner serves as a central place to record vital information, ranging from the location of important papers to specific details about bills that need to be paid or accounts that should be cancelled. It goes beyond the basics, providing space for all relevant data you might want to pass on, ensuring nothing is left unsettled. The guide is thoughtful enough to include additional space, should you need it, reinforcing its role as a flexible and indispensable resource. You're encouraged to not only fill it out thoroughly but also to share its contents with a trusted person, keeping it in a secure location and updating it as necessary. This planner thus stands as a testament to Colonial Penn's commitment to offering valuable services to its policyholders, ensuring that in times of grief, practical concerns are clearly outlined and easily accessible, reducing the burden on those we care about most.

Preview - Beneficiary Planner Form

How to Use Your

Beneficiary Planner

This unique Beneficiary Planner has been prepared for

you by Colonial Penn Life Insurance Company, as a special service to our policyholders. It has been designed to make it

very easy for you to tell a family member or friend where things are...

and what your wishes may be after you pass away. This helpful planning guide provides room for you to fill in such vital information as...

♦Where your important papers are;

♦What needs to be taken care of;

♦What bills need to be paid or accounts cancelled;

♦And much more.

Please take some time to complete the information in this valuable resource guide. (If you need additional room in specific areas, you can add a sheet of paper.) Then, be sure to go over the information with a trusted family member or friend, put this guide in a safe place, and tell that person where the safe place is for their future reference. We also recommend that you review the information periodically and keep it

Preparing this information is a helpful way for you to get organized. Plus, it will be a great help to your family, your friends, and even your pets.

More About You and Your Family

Single Married Widow/Widower Divorced

Name of Spouse

Maiden Name

Number of Children

Form Data

| Fact | Detail |

|---|---|

| Purpose | The Beneficiary Planner is designed to make it easier for individuals to communicate their posthumous wishes and the location of important documents to a trusted family member or friend. |

| Origin | This planner is provided by Colonial Penn Life Insurance Company as a special service to its policyholders. |

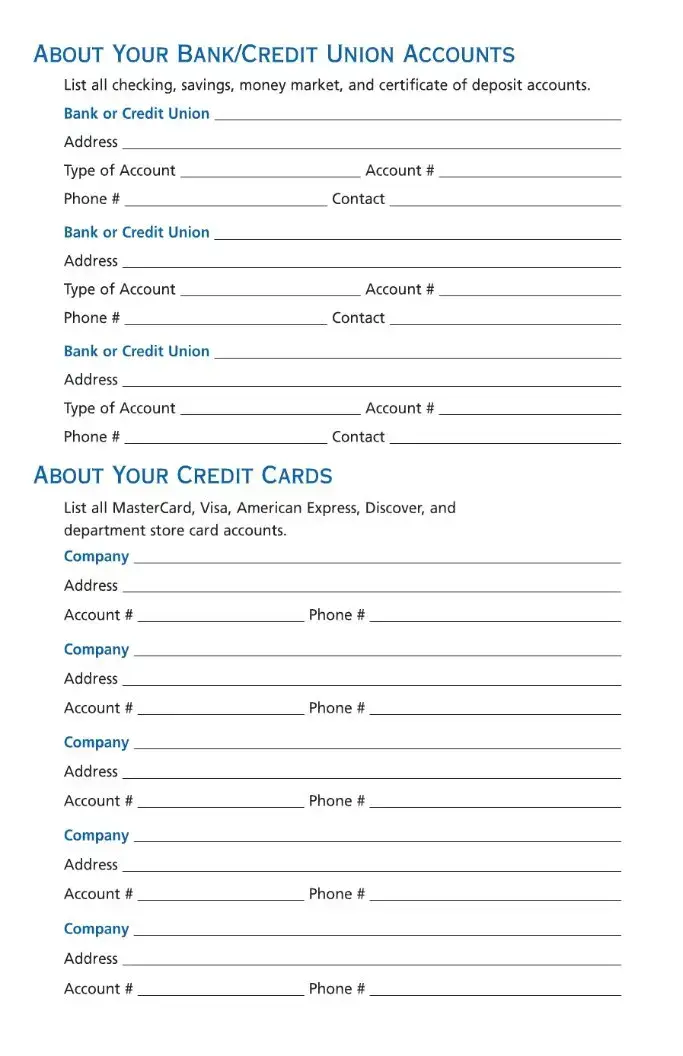

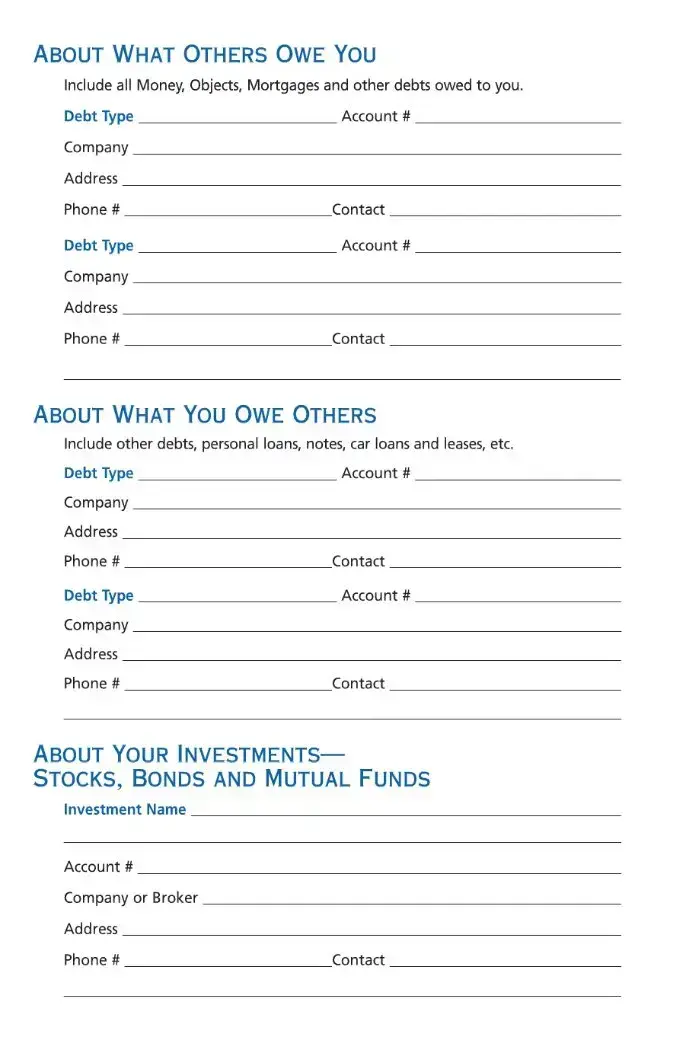

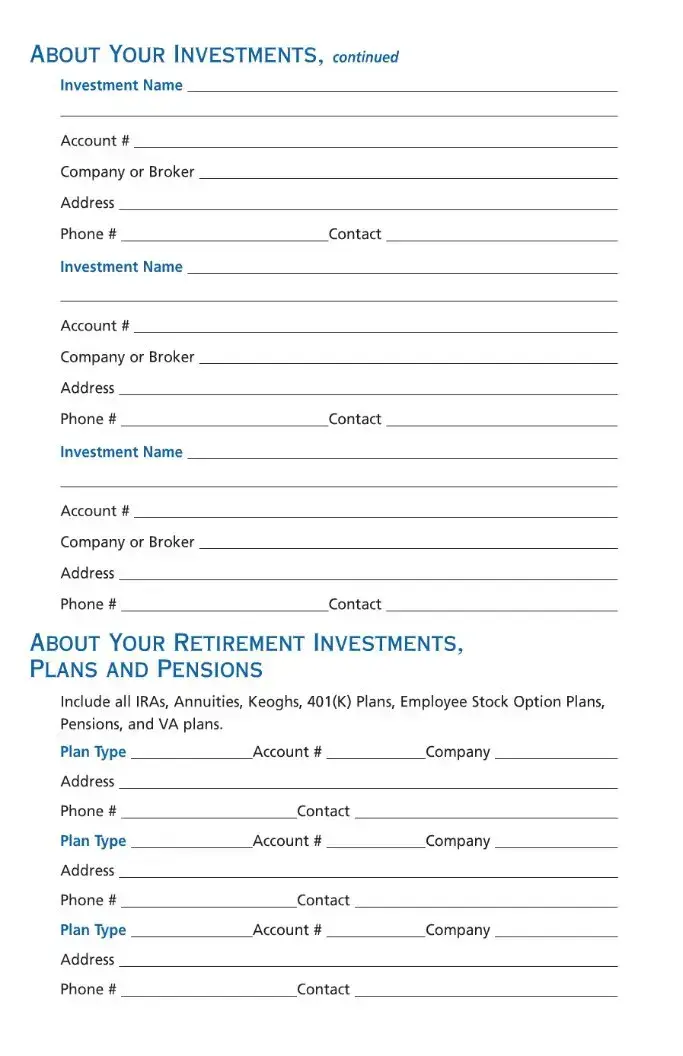

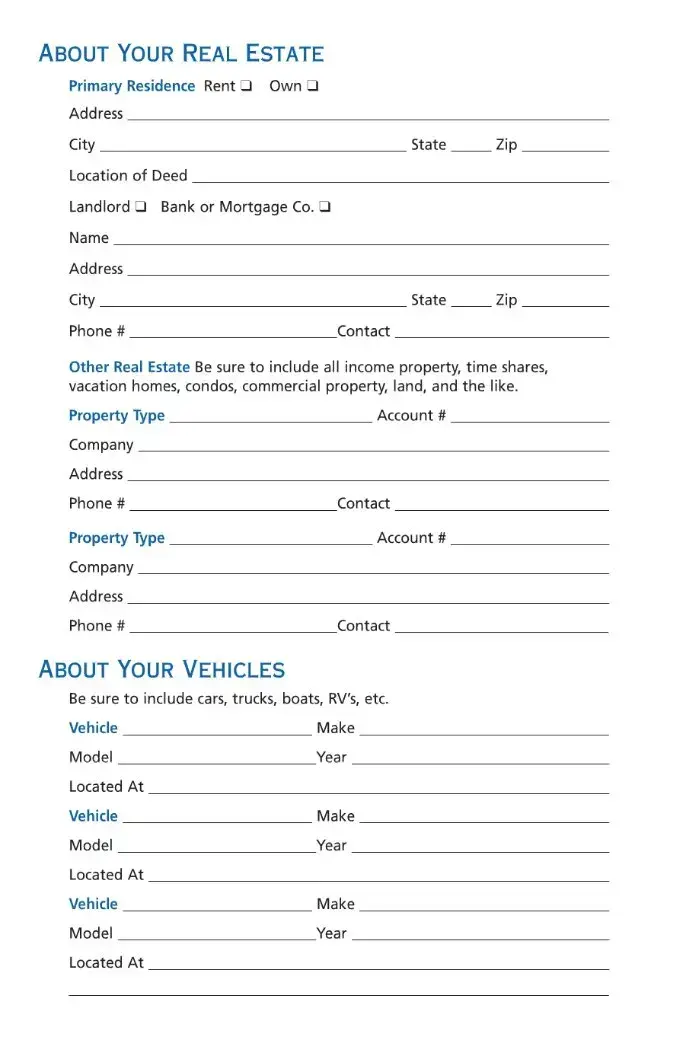

| Contents | It includes sections to note the location of important papers, tasks that need to be addressed, bills and accounts that require cancellation, and other key personal information. |

| Usage | Policyholders are encouraged to fill out the planner, discuss it with a trusted individual, and store it in a safe place for future reference. |

| Maintenance | It is recommended that the information within the planner be reviewed periodically to ensure it remains current. |

| Benefit | Completing the planner assists in organization and provides invaluable aid to family, friends, and even pets, in the event of the policyholder's passing. |

Instructions on Utilizing Beneficiary Planner

Filling out the Beneficiary Planner form is a considerate step that ensures clarity and eases the burden on your loved ones after your departure. This form, provided by Colonial Penn Life Insurance Company, organizes essential information about your important documents, wishes regarding your assets, instructions for ongoing payments, and more. Ensuring that all this vital information is recorded and shared with someone you trust secures your peace of mind and aids your family or friends in navigating through their responsibilities efficiently. Let's walk through the steps needed to complete the form effectively.

- Review the form comprehensively to understand the type of information you'll need to gather.

- Gather all necessary documents and information, including the locations of important papers, account details that need to be managed, and any specific wishes you have regarding your assets and affairs.

- Choose the section titled "More About You and Your Family." Mark your current status (Single, Married, Widow/Widower, Divorced).

- Fill in your full name, including the maiden name if applicable, in the designated area.

- Indicate the number of children you have, if any.

- Proceed to the section where you can list where your important papers are kept. Be as specific as possible to avoid any confusion.

- Document any tasks that need attention, such as bills that need to be paid or accounts that should be canceled. Provide necessary details for each task.

- Add any additional sheets of paper if you require more space for any section. Ensure these sheets are securely attached and clearly marked to indicate which section they correspond to.

- Go over the completed form with a trusted family member or friend. This step is crucial to ensure they understand your wishes and know where to find this form.

- Store the guide in a safe and secure location. Remember, it’s just as important to tell your trusted person where this location is.

- Review and update the form periodically. As your circumstances or wishes change, it’s important to keep this document current to reflect any new instructions or information.

By thoughtfully completing the Beneficiary Planner form, you're not only organizing your affairs but also making a compassionate effort to guide your loved ones through a difficult time. Taking the time now to articulate your wishes and directions can alleviate stress and confusion for those you care about when it matters most. Remember, clarity is a gift, especially during periods of grieving and adjustment.

Obtain Answers on Beneficiary Planner

-

What is a Beneficiary Planner and why is it important?

A Beneficiary Planner is a document designed to assist individuals in organizing and conveying their final wishes and essential information to a designated family member or friend. This includes the location of important documents, instructions for settling affairs, and details on bills and accounts that need attention after one's passing. Its importance lies in its role in ensuring that your essential tasks are known and can be managed efficiently, providing peace of mind and reducing stress for your loved ones during a difficult time.

-

How does the Beneficiary Planner work?

The Beneficiary Planner serves as a comprehensive guide, equipped with sections for you to fill in critical information such as the whereabouts of important papers, financial obligations that need to be addressed, and other instructions. It is designed for ease of use, allowing the addition of extra pages if more space is needed. The planner should be shared with a trusted individual who will act on this information, ensuring it is stored in a safe location and its location communicated to the said individual.

-

Who should complete a Beneficiary Planner?

Any individual, regardless of marital status or family size, is encouraged to fill out a Beneficiary Planner. It is beneficial for adults of all ages to prepare for the future and provide clear instructions for their loved ones. Filling this planner out and keeping it updated makes the process of managing one's affairs significantly easier for family members or friends during a time of loss.

-

What should be done after completing the Beneficiary Planner?

Upon completing the Beneficiary Planner, it is crucial to discuss the contents and its location with a trusted family member or friend who is likely to handle your affairs. This ensures that they are aware of your wishes and know where to find the necessary information when needed. Furthermore, regularly reviewing and updating the information in the planner is recommended to reflect any changes in your life or preferences.

-

Is the Beneficiary Planner legally binding?

While the Beneficiary Planner is an incredibly useful tool for organizing and communicating your wishes, it is important to understand that it is not a legally binding document like a will. For legal documents and arrangements such as the distribution of assets, appointing guardians for minors, or establishing power of attorney, consulting with a legal professional is advisable. The Beneficiary Planner complements these legal documents by ensuring that your practical day-to-day affairs are in order as well.

Common mistakes

When filling out the Beneficiary Planner form, designed by Colonial Penn Life Insurance Company, it is intended to simplify the communication of one’s final wishes and whereabouts of vital documents for family members or friends. Despite the straightforward design, there are common pitfalls that can significantly affect the utility of this document. Being aware of these mistakes is crucial for ensuring the document fulfills its intended purpose.

Not providing precise locations of where important papers are stored can lead to confusion or these documents being overlooked when they are most needed.

Failing to specify account information for bills and subscriptions that need to be canceled can burden family members with avoidable financial responsibilities.

Forgetting to add additional pages for sections that require more detail can lead to incomplete instructions, leaving wishes unfulfilled.

Overlooking the need to review and update the document regularly renders the planner obsolete due to changes that naturally occur over time.

Not specifying the wants for digital assets, including social media and online accounts, can lead to complications in managing online presence posthumously.

Assuming one conversation is enough to ensure the designated person understands all the details and locations of documents can result in misunderstandings.

Choosing a trusted person who is not suited for the responsibility, either due to geographical distance, personal traits, or their own life situation, can impede the execution of one’s final wishes.

A common oversight is not making the document easily accessible for the designated person, which can negate all preparation efforts if the document cannot be found in a timely manner.

Failing to communicate the existence and purpose of the Beneficiary Planner to the essential parties can result in the document being underutilized or ignored.

Each of these mistakes carries the potential to complicate what is already a difficult time for loved ones. Attention to detail, regular updates, and clear communications are key in ensuring your Beneficiary Planner fulfills your intentions and serves as the helpful guide it was designed to be.

Documents used along the form

Ensuring one's affairs are in order before passing away is not only a wise decision but also a kind gesture to ease the burden on family and friends left behind. The Beneficiary Planner is a pivotal tool in this planning process. However, to ensure comprehensive coverage of one's last wishes and the disposal of their estate, several other documents should be considered. Here's a list of other forms and documents often used in conjunction with the Beneficiary Planner to provide a more complete estate plan.

- Last Will and Testament: This legal document outlines how one's assets and estate will be distributed among beneficiaries after their death. It also nominates an executor to oversee the process.

- Power of Attorney: This allows an individual to appoint someone else to manage their financial and legal affairs if they become incapacitated.

- Health Care Proxy: Similar to a Power of Attorney, this document appoints someone to make medical decisions on one's behalf, should they be unable to do so themselves.

- Living Will: Often working in tandem with a Health Care Proxy, this document specifies one's wishes regarding medical treatment and life support in cases of terminal illness or incapacitation.

- Trust Documents: For those who have established a trust, these documents are crucial for managing assets during and after the trustor's lifetime, providing details on asset distribution and the roles of trustees.

- Life Insurance Policies: Essential for informing beneficiaries about the details of life insurance policies, including the provider, policy number, and benefit amount.

- Letter of Intent: This personal letter can provide specific wishes regarding one's funeral arrangements or other personal messages to loved ones, not covered in the legal documents.

While the Beneficiary Planner is an essential start, incorporating these additional documents ensures a well-rounded approach to estate planning. They collectively protect assets, specify personal wishes, and provide clear instructions, significantly reducing the administrative burden on loved ones during a difficult time. It is advisable to review these documents periodically and update them as life circumstances change. Remember, an ounce of preparation is worth a pound of cure when it comes to estate planning.

Similar forms

Last Will and Testament: The Last Will and Testament is a legal document that outlines one's wishes regarding the distribution of their assets and the care of any dependents after death. Similar to the Beneficiary Planner, it serves the purpose of guiding loved ones on how to proceed in the event of one’s passing, although the Last Will covers legal distribution of assets more formally.

Living Will: A Living Will, or a health care directive, specifies an individual's wishes regarding medical treatment and life-support measures in cases where they become unable to communicate their decisions. Like the Beneficiary Planner, it is prepared in advance to direct family and friends on personal wishes, though focused on medical scenarios ahead of time.

Power of Attorney: Power of Attorney (POA) is a document that grants someone else the authority to act on one’s behalf in legal or financial matters. The Beneficiary Planner shares with POA the fundamental idea of preparing for a time when one may not be able to manage their affairs personally.

Life Insurance Policy: Life insurance policies are contracts with an insurance company that, in exchange for premium payments, provide a lump-sum payment to beneficiaries upon the policyholder's death. Similar to the Beneficiary Planner, it's a tool for planning ahead to support loved ones financially after one’s death.

Funeral Planning Declaration: This document lets individuals specify their preferences for funeral services, burial or cremation, and other post-death arrangements. It aligns with the Beneficiary Planner in the aspect of outlining posthumous wishes to relieve family members of the burden of making those decisions.

Durable Financial Power of Attorney: This variant of POA specifically grants someone authority over another’s financial matters and remains in effect if the grantor becomes incapacitated. It’s akin to the Beneficiary Planner by ensuring financial affairs are taken care of by a trusted party.

Trust Documents: Trusts are arrangements where a trustee holds assets for the benefit of a third party, the beneficiary. Trusts, akin to the Beneficiary Planner, help manage and distribute assets according to the grantor's wishes, sometimes beyond death.

Estate Plan: An Estate Plan is a comprehensive approach to managing one's assets and life choices in matters of health care, guardianship, and beyond. It typically includes a will, POA, trusts, and more. Like the Beneficiary Planner, it’s a way to clearly articulate one's wishes and instructions for a variety of situations.

Dos and Don'ts

When filling out the Beneficiary Planner form, it is essential to approach the task with diligence and care. The purpose of this document is to simplify the process of communicating your final wishes and the location of important documents to those you trust. Below are some important dos and don'ts to keep in mind:

- Do take your time to gather all necessary information before you begin filling out the form. Accuracy is key to ensuring your wishes are clearly understood.

- Do review the form's sections carefully to ensure you don't overlook any critical areas that need your input. This includes details about important papers, account information, and specific wishes regarding your estate.

- Do consider adding a separate sheet of paper if you find the provided space insufficient to capture all the necessary details about a specific topic. Make sure to clearly reference this additional information in the main form.

- Do discuss the completed form with a trusted family member or friend. It's crucial that someone close to you is aware of the existence of this document and understands its contents.

- Do store the form in a safe, secure location and ensure that at least one trusted person knows where to find it. This can include a safe deposit box, a personal safe, or any secure place that is protected from theft, loss, or damage.

- Don't rush through the process. Filling out the Beneficiary Planner requires thoughtfulness and consideration to accurately reflect your wishes and information.

- Don't leave any sections incomplete unless they truly do not apply to you. If you're uncertain about how to fill out a part of the form, seek advice rather than skipping it.

- Don't forget to review and update the form periodically. Life changes, such as marriage, divorce, the birth of a child, or the acquisition of substantial assets, may affect your initial entries.

- Don't neglect to communicate any updates you make to the form to the trusted individual(s) who are aware of the document. Keeping them informed ensures that they will always have the most current information.

By following these guidelines, you can make the Beneficiary Planner an effective tool, helping to alleviate potential stress and confusion for your loved ones during a difficult time. Remember, preparation today can make a significant difference tomorrow.

Misconceptions

When it comes to estate planning, misunderstandings can complicate an already emotionally charged process. The Beneficiary Planner form, created by Colonial Penn Life Insurance Company, is a tool intended to simplify these matters, yet misconceptions abound. Here are ten common ones, clarified for better understanding.

- It's mainly for the wealthy. Many think that the Beneficiary Planner is designed only for those with extensive assets. Yet, its primary goal is to organize vital information, making it useful for anyone, regardless of their financial status.

- It replaces a will. This is a significant misunderstanding. While the Beneficiary Planner helps in organizing your wishes and vital information, it does not legally substitute a will or other estate planning documents.

- It's too complicated to fill out. Contrary to what some might believe, the Beneficiary Planner has been designed for ease of use. Its structured sections guide you through entering critical information without overwhelming legal jargon.

- It's only about financial information. While the planner does include sections for financial details, it encompasses much more. It prompts you to note locations of important papers, account information, and even personal wishes regarding after-life arrangements.

- Once completed, it's done forever. Life changes, and so do your circumstances and wishes. The planner is meant to be a living document, one that you should review and update periodically to reflect any significant changes.

- It's legally binding. Another common misconception is that the Beneficiary Planner has legal authority. While it serves as an essential guide for your loved ones, it does not have legal weight like a will or power of attorney.

- No one under 50 needs one. Planning for the unexpected is wise at any age. The Beneficiary Planner can be particularly helpful for younger people to organize their affairs, even if they believe they have fewer concerns.

- It's only for parents. Single individuals, married couples without children, and even friends can benefit from knowing one another's wishes and where important documents are kept. It's about making things easier for those you care about, regardless of your family structure.

- Filling it out is too time-consuming. Although it requires some initial effort to gather and input information, the time invested is minimal compared to the time and stress saved for your loved ones later on.

- It's unnecessary if you have already discussed your wishes with family. Verbal discussions are important, but memories can fade or be misinterpreted. The Beneficiary Planner provides a tangible reference, ensuring your wishes are clear and accessible when needed.

Removing these misconceptions can pave the way for more effective planning. With the Beneficiary Planner, you're not only organizing your affairs; you're also providing a priceless gift of clarity and peace of mind to those you love.

Key takeaways

When considering how to effectively fill out and use the Beneficiary Planner form, there are several key takeaways to keep in mind. These insights are crucial for ensuring that your wishes are clearly communicated and can be executed as intended after your passing. The following points highlight the most important aspects of using the Beneficiary Planner provided by Colonial Penn Life Insurance Company:

- Location of Important Documents: The form prompts you to list where your important papers are located. This is vital as it aids your family or friends in quickly finding essential documents such as your will, insurance policies, and financial records.

- Final Arrangements: It allows room for you to specify any particular desires you have for after you pass away. This could include funeral arrangements, burial or cremation preferences, and any specific instructions you wish to have followed.

- Financial Obligations: You can outline what bills need to be paid, which accounts need to be closed, and how to handle any ongoing financial responsibilities. This is crucial for preventing potential late fees or other complications with your estate.

- Additional Instructions: The form provides flexibility for you to add any additional sheets of paper if you need more space. This is particularly useful for listing detailed instructions or information that does not fit in the provided sections.

- Review and Update: The form should be periodically reviewed and updated to reflect any changes in your life circumstances or wishes. Keeping the information current ensures your instructions remain relevant and executable.

- Communicate with a Trusted Person: It’s essential to discuss the contents of your Beneficiary Planner with a trusted family member or friend. Sharing where you’ve stored this guide and going over its contents can greatly ease the management of your affairs after you're gone.

- Safe Storage: Once completed, the Beneficiary Planner should be kept in a safe place known to a trusted person. This ensures the document is secure and can be accessed when needed.

- Benefiting Your Circle: By organizing your information and wishes, you're not only ensuring your affairs are in order but also easing the burden on your family, friends, and even pets after your passing. This thoughtful preparation can be a final act of love and consideration for those you care about.

In summary, the Beneficiary Planner form serves as a comprehensive tool for recording vital information and wishes regarding your personal and financial matters. Its effective use necessitates careful thought, regular updates, and open communication with someone you trust. By taking these steps, you can provide invaluable guidance and peace of mind for your loved ones during a difficult time.

Popular PDF Forms

Weis Careers - Prospective employees are advised that the application remains active for 60 days, encouraging them to reapply if not contacted within this timeframe for continued consideration.

Claim on Insurance - Directions for submitting relevant medical reports and invoices to support your claim for specific benefits like hospitalisation or fractures.

Mental Health Treatment Plan Template - Targets social work and human services professionals, providing a comprehensive guide for treatment planning within diverse client populations.