Blank Bill Payment Checklist PDF Template

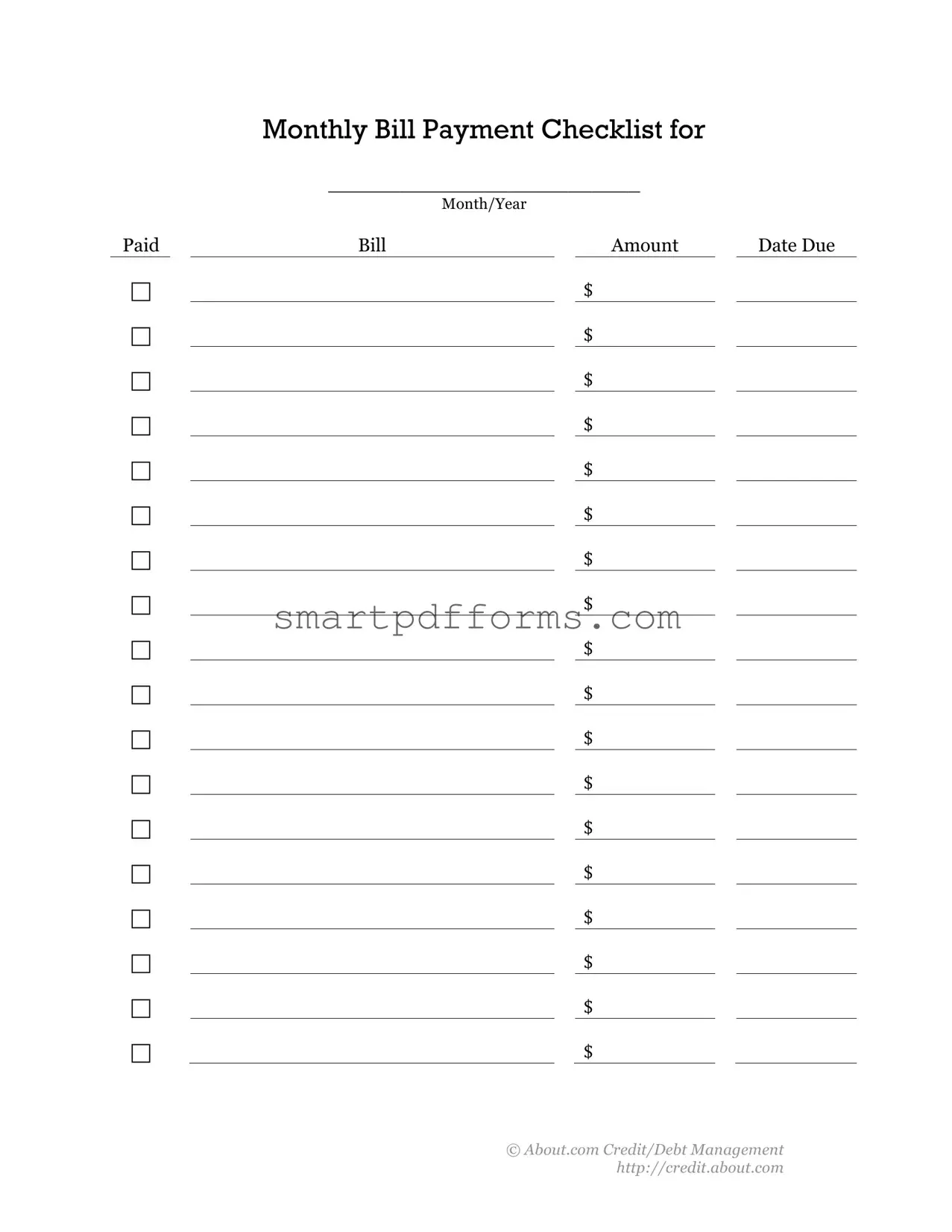

Managing monthly finances can often feel like navigating a labyrinth, especially when trying to keep track of due dates, amounts, and ensuring everything is paid on time to avoid late fees or negative impacts on one's credit score. Enter the Bill Payment Checklist, a simple yet profoundly effective tool designed to bring order to chaos. Designed with spaces to list down each bill, the amount due, and its corresponding due date alongside a convenient checkbox to mark once paid, this form provides a visual snapshot of one's monthly financial obligations. Predated boxes encourage prompt payment pacing, making it easier for individuals to manage their finances efficiently. Originating from a credit and debt management perspective, clearly, the goal here is not only organization but also financial responsibility. Whether printed for a physical binder or used digitally, the adaptability of this form to different users' needs highlights its practicality in everyday financial management. As a straightforward guide from About.com Credit/Debt Management, its utility is enhanced by its accessibility, available for anyone seeking to impose a sense of order on their bill payment processes.

Preview - Bill Payment Checklist Form

PAID

Monthly Bill Payment Checklist for

__________________________

MONTH/YEAR

|

BILL |

|

AMOUNT |

|

DATE DUE |

|

|

|

|

||

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

$ |

|

|

|

|

|

|

|

|

©About.com Credit/Debt Management http://credit.about.com

Form Data

| Name of Fact | Detail |

|---|---|

| Primary Function | Tracks monthly bill payments to ensure timely fulfillment. |

| Key Components | Checkbox for paid status, Month/Year, Bill, Amount, and Due Date. |

| Customization | Designed for any month or year, adaptable to personal or business use. |

| Visual Aid | Includes checkboxes to visually mark off paid bills. |

| Resource Origin | Created by About.com's Credit/Debt Management section. |

| Copyright Notice | Includes a copyright notice for About.com. |

| Usage Cost | Free for personal use, highlighting accessibility for all users. |

| Governing Law(s) for State-Specific Forms | Not applicable as it is a general tool not governed by specific legal statutes. |

Instructions on Utilizing Bill Payment Checklist

With the meticulously structured Bill Payment Checklist, managing your monthly finances becomes streamlined and transparent. This tool aids in avoiding missed payments and ensures that your financial obligations are met in a timely manner. By cataloging your monthly bills, this checklist fosters a disciplined approach to financial planning. Here are the steps to effectively fill out your Bill Payment Checklist:

- Identify the month and year for which you are preparing the checklist and enter it at the top where it says "__________________________ MONTH/YEAR."

- For each bill you have, start filling out the columns in order. Begin with the name of the bill under "BILL."

- Next, enter the amount due for each bill in the column labeled "AMOUNT."

- Proceed to fill in the "DATE DUE" for each bill, ensuring accuracy to avoid any late payments.

- As you pay each bill, mark the checkbox under "PAID" to keep track of your payments and maintain financial organization.

- Continue this process for every bill you have for the month, making sure every payment is accounted for on the checklist.

- Review the completed checklist to ensure that all due dates are correct and that no bill has been missed. This helps in prioritizing your payments.

- Keep the checklist in a visible or regularly accessed place to remind you of upcoming payments and to easily mark off bills as they are paid.

- Update the checklist as needed, should any bill amounts or due dates change during the month.

This checklist not only helps in keeping financial commitments in check but also serves as a record of payments made throughout the month. Regular use of the Bill Payment Checklist can greatly improve one's financial management practices and peace of mind.

Obtain Answers on Bill Payment Checklist

Managing monthly bills can be a daunting task, but a Bill Payment Checklist can simplify the process. Let's address some frequently asked questions to help you navigate the use of this valuable tool effectively.

-

What is a Bill Payment Checklist, and how can it help me manage my finances?

A Bill Payment Checklist is a simple yet powerful tool designed to help you track and manage your monthly bills. By listing all your bills, their amounts, and due dates in one place, it provides a clear overview of your financial obligations for the month. This organization aids in ensuring that you pay your bills on time, avoiding late fees and negative impacts on your credit score. Additionally, it can help you identify areas where you might be able to cut back or save money.

-

How should I fill out the Bill Payment Checklist?

Start by writing the name of each bill you need to pay in the month, including utilities, rent or mortgage, credit card payments, loans, and any other recurring or one-time bills. Next to each bill, note the amount due and the due date. Check off each bill as you pay it, ensuring that nothing gets overlooked. It's also helpful to note the method of payment for your records.

-

Can the Bill Payment Checklist be used for any month or year?

Yes, the Bill Payment Checklist is designed to be versatile and can be used for any month or year. Simply fill in the "MONTH/YEAR" section at the top of the form with the current month and year. This feature makes it a timeless tool that can be utilized month after month, year after year, to manage your bills.

-

Where can I find a Bill Payment Checklist?

You can create your own checklist based on the format provided by resources like About.com's Credit/Debt Management site, or you can find templates online. Many financial management websites and personal finance software offer downloadable or printable bill payment checklists.

-

Is there any cost associated with using a Bill Payment Checklist?

Typically, there is no cost associated with using a Bill Payment Checklist. Many websites and financial advisories offer free templates that you can download and print. If you prefer a digital solution, there are also free apps and software tools available that include bill tracking and payment checklist features. However, some premium finance management tools with advanced features may have a fee.

- Benefits include the ease of managing payments and preventing late fees.

- It's an effective strategy for enhancing financial organization and planning.

By incorporating a Bill Payment Checklist into your monthly financial routine, you can take a big step towards better financial health and peace of mind. It simplifies the bill-paying process, makes sure you don't miss any payments, and could even assist in budgeting and saving in the long run.

Common mistakes

One common mistake occurs when individuals fail to write clearly and legibly. This can lead to confusion or errors when reviewing the form later. Important information should be written in a clear, easily readable manner to avoid misunderstandings regarding bill amounts or due dates.

Another frequent oversight is not double-checking the accurate due dates and amounts for each bill before adding them to the checklist. This can result in missed payments or paying the wrong amount, which could lead to late fees or other financial penalties. It's essential to verify each bill's details against the actual bill or statement to ensure accuracy.

Forgetting to update the checklist after paying a bill is another error that can have significant consequences. This oversight could lead to unnecessary confusion or the assumption that a bill has not been paid, possibly resulting in duplicate payments. It's crucial to immediately mark off or update the checklist upon making a payment to maintain an accurate record of bill management.

Lastly, a critical mistake is not including all monthly bills on the checklist. This can happen when people overlook periodic bills that do not have a monthly frequency, such as quarterly or annual payments. Failing to account for every due payment can lead to unexpected financial shortfalls or missed payments. To prevent this, thorough review and inclusion of all financial obligations, regardless of their frequency, is advisable.

Documents used along the form

When it comes to managing personal finances, staying organized is crucial. Among the myriad tools available, the Bill Payment Checklist plays a fundamental role in ensuring timely payments and avoiding late fees. However, to maintain a comprehensive overview and a smooth financial management process, several other documents often complement this checklist. Each serves a unique purpose, fitting into the broader context of personal financial planning.

- Budget Planner: A Budget Planner is pivotal for tracking income versus expenses over a given period, allowing individuals to allocate funds appropriately across various categories, including savings, essentials, and discretionary spending. It provides a snapshot of financial health and aids in making informed spending decisions.

- Monthly Income Tracker: This document lists all sources of income within a month, including salaries, bonuses, and other earnings. It complements the Bill Payment Checklist by ensuring that there is a clear understanding of available resources for bill payments.

- Expense Tracker: The Expense Tracker delves deeper into where money is going, beyond the fixed monthly bills captured on the Bill Payment Checklist. By recording all expenditures, individuals can identify patterns, uncover unnecessary expenses, and adjust their spending habits accordingly.

- Debt Repayment Plan: For those managing debt beyond monthly utility bills and subscriptions, a Debt Repayment Plan outlines strategies for paying down debts, including loan amounts, interest rates, minimum payments, and prioritization of repayment. It is essential for those looking to reduce debt systematically and efficiently.

- Financial Goals Worksheet: Setting short-term and long-term financial goals is key to successful financial planning. This worksheet helps individuals define their goals, whether it's saving for a vacation, building an emergency fund, or investing in retirement, making it easier to allocate funds purposefully each month.

Together, these documents form a robust framework for managing personal finances. While the Bill Payment Checklist ensures bills are paid on time, complementary tools such as the Budget Planner and Expense Tracker offer a more detailed view of an individual's financial picture. Monitoring income and expenses diligently, while keeping an eye on broader financial goals, provides a well-rounded approach to financial health and stability.

Similar forms

A Budget Tracker is similar to the Bill Payment Checklist as both documents are used to monitor financial obligations and ensure that payments are planned and tracked over time. A Budget Tracker typically goes further by including income sources and allocating amounts for savings or investments in addition to listing expenses.

A Monthly Expense Spreadsheet closely resembles the checklist, providing a mechanism for individuals to list and track their monthly expenses, including bills. However, it often incorporates more detailed categorizations and may allow for the recording of variable expenses alongside fixed bills.

The Debt Repayment Plan document shares commonalities with the Bill Payment Checklist through its focus on scheduling payments. Specifically, it outlines a strategy for paying down debt over time, frequently including prioritization of debts based on interest rates or balances, similar to how bills might be prioritized by due date.

A Financial Planning Worksheet is akin to the checklist by assisting individuals in organizing their financial commitments. This document often encompasses a wider range of financial planning activities, from budgeting and saving to insurance and investment planning, including bill management as an integral component.

The Household Expenses Worksheet parallels the Bill Payment Checklist in its role to help families or individuals track and manage their monthly expenses. It typically lists common household expenses, offering a comprehensive view that includes, but is not limited to, monthly bills.

A Cash Flow Statement for personal finance, while more complex, shares the objective of tracking inflows and outflows of money, similar to tracking bill payments with the checklist. It differs by providing a detailed view of an individual's or family’s financial health over a period, including net cash flow after all income and expenditures.

The Annual Financial Overview document, although utilized less frequently than a monthly checklist, serves a related purpose by offering a bird’s eye view of a year’s worth of financial activities including bills, income, investments, and other financial transactions. This helps in long-term financial planning and assessment.

A Rent Payment Schedule is specialized towards tracking rental payments but operates under a similar premise to the Bill Payment Checklist. It helps a renter ensure that rent is paid on time, often including details such as payment amounts, due dates, and late fees, akin to managing various bill payments.

Dos and Don'ts

When filling out the Bill Payment Checklist form, individuals have an effective tool at their disposal for managing their monthly expenses. Attention to detail and accuracy are essential in ensuring financial stability and avoiding late payments. Below are several recommendations to follow, as well as practices to avoid, to ensure the form is utilized most effectively.

Recommended Practices:

- Before adding any information, verify the month and year at the top of the form to ensure that all entries correspond to the correct billing period.

- Clearly write the name of each bill or creditor next to the corresponding checkbox to maintain an organized record.

- Accurately list the amount due for each bill, without rounding, to ensure a precise financial overview.

- Record the due date for each bill to track upcoming payments and prioritize accordingly.

- Utilize the checkboxes to visibly mark off bills as they are paid, providing a quick reference to what is outstanding.

- Review the form for any missed entries or inaccuracies that could affect your budget or payment schedule.

- Keep the form in a consistent, secure location where it can be easily accessed and updated as needed.

- Update the form immediately after a payment is made, reinforcing good financial habits.

- Consider using the form as a basis for a digital record, providing a backup and an easy way to analyze spending over time.

- Consult with a financial advisor if unsure about how to best utilize the form for personal budgeting practices.

Practices to Avoid:

- Do not leave the form incomplete; failing to list all monthly bills could lead to oversight and missed payments.

- Avoid guessing amounts or due dates, as inaccuracies can disrupt your budget.

- Do not ignore due dates listed on the form, as this can lead to late payments and potential penalties.

- Avoid the practice of not marking off paid bills, which can result in uncertainty about what has been settled.

- Do not misplace the form or keep it in a location where it is not regularly seen and updated.

- Refrain from solely relying on a paper checklist; consider complementing it with digital tools for redundancy.

- Avoid cluttering the form with unnecessary information that does not pertain to bill payments.

- Do not procrastinate on updating the form after making a payment, as this can lead to confusion.

- Avoid using the checklist without regularly reconciling it with bank statements or online accounts.

- Do not disregard the importance of seeking professional financial advice when facing uncertainty or budgeting difficulties.

Misconceptions

When managing monthly finances, the use of a Bill Payment Checklist can be incredibly helpful in ensuring all payments are made in a timely manner. However, there are several misconceptions about the function and benefit of using such a checklist. Understanding these misconceptions can lead to more efficient financial management practices.

Only for People Struggling Financially: A common misconception is that a Bill Payment Checklist is only for those who are struggling to make ends meet. In reality, it is a useful tool for anyone wanting to organize their finances, keep track of payments, and ensure timely payment of bills, regardless of their financial situation.

Too Time-Consuming to Maintain: Some individuals believe that maintaining a Bill Payment Checklist is time-consuming. However, once set up, it takes only a few minutes each month to update. The time saved by avoiding late payments and the associated fees more than compensates for this initial effort.

Limits Flexibility in Managing Finances: Another misconception is that using a checklist limits one’s flexibility in managing finances. On the contrary, it provides a clear overview of monthly expenses and due dates, making it easier to plan and adjust financial allocations as needed.

Electronic Payments Make it Redundant: With the rise of online banking and automatic payments, some might think a Bill Payment Checklist is redundant. Yet, not all bills might be suitable for automatic payments, and such a checklist can complement electronic payments by providing a comprehensive view of all financial obligations, ensuring nothing is missed.

Only Necessary for People with Many Bills: It’s often thought that a Bill Payment Checklist is only necessary for individuals with a large number of bills. Everyone, regardless of the number of bills they have, can benefit from the clarity and oversight provided by maintaining a checklist. It helps prevent overlooked payments and supports better financial health.

The Bill Payment Checklist, therefore, serves as a valuable tool for managing personal finance, offering clarity, and ensuring the timely payment of bills. Dispelling these misconceptions encourages a proactive approach to finance management, suitable for anyone wanting to improve their financial discipline.

Key takeaways

Managing personal finances often includes regular bills that you have to stay on top of, like utilities, rent, or credit card payments. Using tools like a Monthly Bill Payment Checklist can help you avoid late payments and manage your budget more effectively. Here are some key takeaways about how to effectively fill out and use such a form:

Stay Organized: The Monthly Bill Payment Checklist helps you keep track of all your bills in one place, making it less likely for you to forget a payment.

Plan Ahead: By filling out the month and year at the top of the checklist, you can focus on the bills due in that specific period, which aids in financial planning.

Bill Tracking: Listing each bill by name, along with the amount due and the due date, gives a clear overview of your financial obligations.

Mental Peace: Marking off each bill as it's paid, thanks to the checkbox feature, provides a visual progress of your payments and can reduce stress.

Financial Discipline: Regularly using the checklist can instill a habit of reviewing and managing your finances, leading to better financial health over time.

Accountability: The checklist acts as a personal accountability tool, reminding you of the importance of timely payments and the consequences of neglect, such as late fees or credit score impacts.

Whether you're managing your finances for the first time or looking to improve your financial health, a Monthly Bill Payment Checklist is a simple yet effective tool to help you stay on track. Remember, the key to financial stability is not just about earning but also about efficient and responsible management of your resources.

Popular PDF Forms

Minnesota Accident Report - Documents insurance coverage details, crucial for post-accident claims and settlements.

State Farm Disbursement Request Form - This form is a formal step in the claims process, representing the insured’s approval of the completed work and the agreed payment to contractors.