Blank Bir 2305 PDF Template

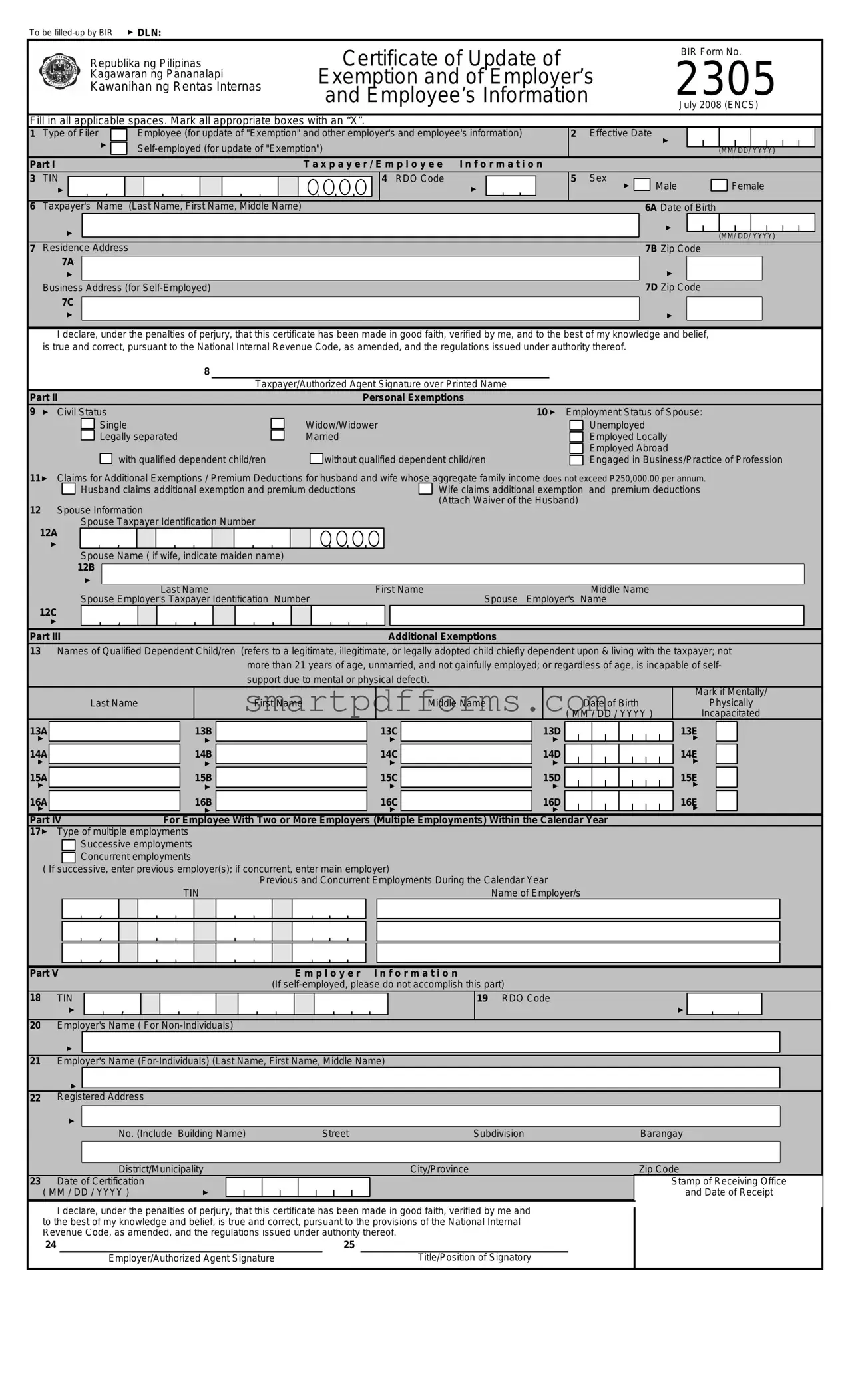

Understanding the intricacies of tax-related documentation is crucial for both employers and employees within the Philippines, and the BIR (Bureau of Internal Revenue) Form No. 2305 stands out as a pivotal document in this arena. Designed to facilitate updates regarding exemption status along with employer and employee information, this certificate plays a vital role in ensuring accurate tax deductions and entitlements. Filled with sections ranging from taxpayer identification to personal exemptions and additional allowances for dependents, the form caters to a wide array of updating needs — from changes in civil status to employment transitions that could affect one’s tax liabilities. Moreover, for those navigating the complexities of having multiple employers within the same fiscal year, it provides a structured way to declare such situations, ensuring proper tax computations are done in accordance with the National Internal Revenue Code, as amended. With every field meticulously designed to capture essential information, the BIR 2305 form epitomizes the bureau’s effort to streamline tax processes, making it easier for individuals to comply with their obligations while optimizing their tax benefits where possible.

Preview - Bir 2305 Form

To be

Republika ng Pilipinas Kagawaran ng Pananalapi

Kawanihan ng Rentas Internas

Certificate of Update of |

BIR Form No. |

|

2305 |

||

Exemption and of Employer’s |

||

and Employee’s Information |

||

|

July 2008 (ENCS) |

Fill in all applicable spaces. Mark all appropriate boxes with an “X”.

1 |

Type of Filer |

|

|

|

Employee (for update of "Exemption" and other employer's and employee's information) |

|

2 |

Effective Date |

|

|

|

|

|

|

|

|

|

|

|

|

I |

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I |

|

|

|

|

► |

I |

I |

|

I |

|

I |

I |

I |

I |

I |

|||||||||||||||||

|

|

|

|

|

|

►CJ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(MM/ DD/ YYYY) |

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Part I |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

T a x p a y e r / E m p l o y e e |

I n f o r m a t i o n |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

3 |

TIN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 RDO Code |

|

|

|

|

|

5 |

Sex ► |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

□ |

Male |

|

|

|

|

|

|

Female |

|

|

|

|||||||||||

|

►I |

|

|

I |

|

I |

I |

I I I |

I |

I I I |

|

I |

Ioo,o,ol |

|

I |

► |

I I I |

I |

|

I |

|

|

|

|

|

|

|

|

□ |

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

6 |

Taxpayer's |

Name |

(Last Name, First Name, Middle Name) |

|

|

|

|

|

|

|

|

|

|

6A Date of Birth |

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

► |

|

I |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I |

|

► |

I |

I |

|

I |

|

I |

I |

I |

I |

I |

I |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(MM/ DD/ YYYY) |

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

7 |

Residence Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7B Zip Code |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

7A► |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

l |

|

► |

I |

|

I |

|

I |

|

I |

|

I |

|

|

|

||||

|

Business Address (for |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7D Zip Code |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

7C► |

|

I |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I |

|

► |

I |

|

I |

|

I |

|

I |

|

I |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

I declare, under the penalties of perjury, that this certificate has been made in good faith, verified by me, and to the best of my knowledge and belief, |

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

|

is true and correct, pursuant to the National Internal Revenue Code, as amended, and the regulations issued under authority thereof. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxpayer/Authorized Agent Signature over Printed Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

Part II |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Personal Exemptions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

9 |

► Civil Status |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10 ► |

Employment Status of Spouse: |

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

□ |

Single |

|

|

|

|

|

□ |

|

Widow/Widower |

|

|

|

|

|

|

|

Unemployed |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

□ |

Legally separated |

□ |

|

Married |

|

|

|

|

|

|

BEmployed Locally |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

□ |

|

|

|

|

|

|

|

|

|

|

|

□ |

|

|

|

|

|

|

|

|

|

□ |

Employed Abroad |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

with qualified dependent child/ren |

|

|

|

|

without qualified dependent child/ren |

|

|

□ |

Engaged in Business/Practice of Profession |

|

|

|||||||||||||||||||||||||||||

11 ► |

Claims for Additional Exemptions / Premium Deductions for husband and wife whose aggregate family income does not exceed P250,000.00 per annum. |

||||

|

□ |

Husband claims additional exemption and premium deductions |

□ |

Wife claims additional exemption and premium deductions |

|

|

|

|

(Attach Waiver of the Husband) |

||

12Spouse Information

|

Spouse Taxpayer Identification Number |

12A |

I I I I I I I I I I I I I 00,0,01 |

► |

Spouse Name ( if wife, indicate maiden name)

|

12B► |

I |

|

First Name |

I |

|

|

Last Name |

Number |

Middle Name |

|

► |

Spouse Employer's Taxpayer Identification |

Spouse |

Employer's Name |

||

I I |

I I I I I I I I |

I I I I |

I I 11 |

I |

|

12C |

|

|

|

|

|

Part III |

|

|

|

Additional Exemptions |

|

13Names of Qualified Dependent Child/ren (refers to a legitimate, illegitimate, or legally adopted child chiefly dependent upon & living with the taxpayer; not more than 21 years of age, unmarried, and not gainfully employed; or regardless of age, is incapable of self- support due to mental or physical defect).

Last Name |

I |

First Name |

|

Middle Name

I |

|

I |

Mark if Mentally/ |

Date of Birth |

Physically |

||

( MM / DD / YYYY ) |

Incapacitated |

13A |

|

|

|

|

13B |

|

|

|

|

I |

13C |

13D |

|

|

|

|

|

13E |

|

|

|

► |

|

|

|

|

J |

|

|

|

|

► |

► |

I |

I |

I |

I |

I |

|

► |

□ |

|

|

14A |

|

|

|

|

14B |

|

|

|

|

I |

14C |

14D |

|

|

|

|

|

14E |

|

||

► |

|

|

|

|

J |

|

|

|

|

► |

► |

I |

I |

I |

I |

I |

|

► |

□ |

|

|

15A |

|

|

|

|

15B |

|

|

|

|

I |

15C |

15D |

|

|

|

|

|

15E |

□ |

|

|

► |

|

|

|

|

J |

|

|

|

|

► |

► |

I |

I |

I |

I |

I |

|

► |

|

||

16A |

|

|

|

|

16B |

|

|

|

|

I |

16C |

16D |

I |

I |

I |

I |

I |

16E |

|

|

|

► |

|

|

|

|

J |

|

|

|

|

► |

► |

|

► |

□ |

|

||||||

Part IV |

|

|

For Employee With Two or More Employers (Multiple Employments) Within the Calendar Year |

|

|

|

|

|

|

||||||||||||

17 ► |

Type of multiple employments |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

□ Successive employments |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

□ Concurrent employments |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

( If successive, enter previous employer(s); if concurrent, enter main employer) |

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

Previous and Concurrent Employments During the Calendar Year |

|

|

|

|

|

|

|

|

|

|||||

|

I I |

|

I I I |

TIN |

|

I I I |

|

|

I |

|

Name of Employer/s |

|

|

|

|

|

|

|

|

||

|

I |

I |

I I I |

I |

I |

I |

|

|

|

|

|

|

|

|

|

|

|

||||

|

I I |

' |

I I I |

I |

I I I |

I |

I I I |

I |

I |

I |

|

|

|

|

|

|

|

|

|

|

|

|

I I |

I |

I I I |

I |

I I I |

I |

I I I |

I |

I |

I |

|

|

|

|

|

|

|

|

|

|

|

Part V |

|

|

|

|

|

E m p l o y e r I n f o r m a t i o n |

|

|

|

|

|

|

|

|

|

|

|||||

|

► |

I I |

' I I I |

I I I I |

(If |

|

|

|

|

|

►I |

|

|

I |

|||||||

18 |

I I I I |

I |

I |

I |

I |

|

|

|

|

|

I |

I |

|||||||||

TIN |

|

|

|

|

|

|

|

|

|

|

19 RDO Code |

|

|

|

|

|

|

|

|

|

|

20 Employer's Name ( For

► I

I

21Employer's Name

J |

Last Name |

First Name |

Middle Name |

22Registered Address

► I

I

No. (Include Building Name) |

Street |

Subdivision |

Barangay |

I

District/Municipality |

|

|

|

|

|

|

|

|

City/Province |

|

23 Date of Certification |

|

|

|

|

|

|

|

|

|

|

|

I |

|

I |

|

I |

|

|

|

I |

|

( MM / DD / YYYY ) |

► |

I |

I |

I |

I |

I |

||||

I declare, under the penalties of perjury, that this certificate has been made in good faith, verified by me and to the best of my knowledge and belief, is true and correct, pursuant to the provisions of the National Internal Revenue Code, as amended, and the regulations issued under authority thereof.

24 |

|

25 |

|

|

Employer/Authorized Agent Signature |

|

Title/Position of Signatory |

Zip Code

Stamp of Receiving Office

and Date of Receipt

Form Data

| Fact Name | Description |

|---|---|

| Form Purpose | This form is used for the update of exemption status and for the change of employer’s and employee’s information. |

| Filer Types | It distinguishes between employees updating their exemption status and other information, and self-employed individuals updating their exemption status. |

| Declaration Requirement | A declaration under the penalties of perjury is required, indicating the form is made in good faith and is, to the best of the filer's knowledge, true, and correct. |

| Governing Law | This form submission is pursuant to the provisions of the National Internal Revenue Code, as amended, and the regulations issued under its authority in the Philippines. |

Instructions on Utilizing Bir 2305

Filling out the BIR Form No. 2305 is a straightforward process, essential for updating your exemption status along with any changes in employer or personal information. This form serves a crucial role in ensuring that your employment records, particularly those relating to tax exemptions and deductions, are up-to-date. Follow these steps to complete the form accurately:

- Start with the top section where it states "To be filled-up by BIR," leave this as it will be completed by the office.

- For the "Type of Filer", mark the box next to "Employee" if you are updating information related to employment. If you are self-employed and need to update your exemption status, mark "Self-employed".

- Enter the "Effective Date" for when the changes should be applied in the format MM/DD/YYYY.

- Proceed to Part I - Taxpayer/Employee Information:

- Enter your 9-digit Tax Identification Number (TIN) in the space provided.

- Fill in your RDO Code which is specific to your location.

- Check the appropriate box to indicate your Sex (Male or Female).

- Provide your Taxpayer's Name (Last Name, First Name, Middle Name) in the space allotted.

- Input your Date of Birth in MM/DD/YYYY format.

- For "Residence Address," include your complete current living address along with the Zip Code.

- If self-employed, also fill in your Business Address and its Zip Code.

- Under Part II - Personal Exemptions, mark your Civil Status and the Employment Status of your spouse if applicable. If you have dependents, indicate this by marking the apt boxes and fill in spouse information if married.

- In Part III - Additional Exemptions, list down names of qualified dependent child/ren, their birth dates, and mark if they are mentally/physically incapacitated.

- For employees with multiple employers within the calendar year, complete Part IV by specifying the type of multiple employments and listing down previous and concurrent employers as required.

- Part V - Employer Information must be filled out with your current employer’s details, unless you are self-employed.

- Ensure that all parts of the form relevant to your filing status and personal circumstances have been accurately filled.

- Review the form, and then sign and date the bottom of the form where it says "Taxpayer/Authorized Agent Signature" and "Date". If applicable, your employer will also need to complete their portion of the form and sign it.

Once completed, submit the form to the nearest BIR office or through any prescribed submission method. Ensure to keep a copy of the filled-out form for your records. Submitting this form correctly is vital for maintaining accurate tax exemption status and ensuring compliance with tax regulations.

Obtain Answers on Bir 2305

What is the BIR Form 2305 used for?

The BIR Form 2305 is a certificate that is used for updating an employee's exemption status and other information related to both the employer and the employee. It's necessary when there are changes in personal details, civil status, employment information, or when updating exemptions for dependents.

Who needs to fill out the BIR Form 2305?

This form should be completed by employees who need to update their "Exemption" status and other personal and employment information with the Bureau of Internal Revenue (BIR). Self-employed individuals also use this form for updating exemption details.

What are the key sections of the BIR Form 2305?

- Taxpayer/Employee Information

- Personal Exemptions

- Additional Exemptions

- For Employees With Two or More Employers (Multiple Employments) Within the Calendar Year

- Employer Information

When should an employee fill out and submit the BIR Form 2305?

An employee should fill out and submit this form whenever there are changes in their exemption status, such as marriage, the birth of a child, change in employment, or when there are updates to personal information that affect their tax liabilities.

How does one determine the type of filer category in the BIR Form 2305?

The "Type of Filer" is determined based on the individual's employment status. An "Employee" refers to those updating information related to employment and exemptions, while "Self-employed" pertains to those updating their exemption status independently.

What information about dependents is required in the BIR Form 2305?

For the section on dependents, the form requires the names of qualified dependent children, including their date of birth, and indicates if they are mentally or physically incapacitated. This information is crucial for claiming additional exemptions.

Is it mandatory to update the employer and employee's information?

Yes, it is important to keep the employer and employee's information updated on the BIR Form 2305. This ensures that records are accurate and can affect tax calculations and liabilities.

How does the civil status affect the BIR Form 2305?

Changes in civil status, such as getting married or legally separated, can affect an individual's exemption status and tax liabilities. This form allows for the adjustment of personal exemptions based on the current civil status.

What steps should be taken if there are errors in the filled-out BIR Form 2305?

If errors are found after submission, it's important to inform your employer or the BIR immediately. A corrected form should be submitted with the accurate information to avoid any discrepancies or potential issues with tax filings.

Common mistakes

Filling out the BIR Form No. 2305 is critical for ensuring that your exemption and employment information are up to date with the Bureau of Internal Revenue (BIR). However, certain mistakes can complicate or delay the process. We'll discuss seven common errors to avoid when completing this form.

Not filling in all applicable spaces – It's important to provide all requested information. Leaving a required field blank can lead to processing delays.

Failing to mark the appropriate boxes with an "X" – This form requires clear indications of your choices, especially in sections dealing with civil status, employment status of the spouse, and claims for additional exemptions.

Incorrectly filling in the Effective Date – The effective date should reflect the actual date from which the changes should apply, formatted as MM/DD/YYYY.

Misreporting Taxpayer Identification Number (TIN) or RDO Code – Both the taxpayer's and the employer’s TIN and RDO codes must be accurately reported to avoid mismatches in the BIR’s records.

Omitting Spouse Information – If married, providing spouse information is crucial, especially if claiming additional exemptions for the spouse or dependent children.

Listing incorrect or incomplete Dependent Child/ren Information – The names, birth dates, and if applicable, the condition of dependents, need to be listed completely and accurately. Remember, criteria such as age, marital status, and employment status of the dependent are important.

Signing without verifying the accuracy of the information – The declaration at the end of the form asserts that the information is true, correct, and made in good faith. Ensuring the accuracy of the information before signing is crucial to avoid penalties.

Avoiding these mistakes helps in the smooth processing of your form, ensuring that your records with the BIR are up-to-date. This can prevent potential issues and is essential for compliance with Philippine tax regulations.

Documents used along the form

Filing the BIR Form No. 2305 is a critical step for employees and self-employed individuals looking to update their exemption status and other pertinent information with the Bureau of Internal Revenue (BIR) in the Philippines. Alongside this form, several other documents are often required or used to ensure accurate and comprehensive processing. Understanding these documents helps streamline the updating process and ensures compliance with BIR regulations.

- Birth Certificate: Essential for verifying the taxpayer's date of birth, especially when claiming additional exemptions for dependents.

- Marriage Certificate: Required when updating civil status or when claiming exemptions for a spouse.

- Waiver of the Husband: Needed if the wife is claiming additional exemptions and the husband is waiving his right to these exemptions.

- Employment Contract: Helps verify employment status and income details for self-employed individuals or those employed abroad.

- Valid ID cards: Government-issued identification is crucial for verifying the identity of the taxpayer and their dependents.

- Proof of Income: Documents such as pay slips or income statements are necessary for verifying the income level, particularly when claiming premium deductions based on aggregate family income.

- DTI Registration: For self-employed individuals, showing proof of business registration from the Department of Trade and Industry is necessary when updating or providing business address information.

- Death Certificate: In cases of claiming exemptions as a widow or widower, a death certificate of the deceased spouse is required.

Each of these documents plays a vital role in ensuring that the updates on BIR Form No. 2305 are well-founded and comply with the pertinent guidelines set by the Bureau of Internal Revenue. Filing this form with the necessary supporting documents helps taxpayers accurately reflect their current status, prevent potential issues, and take full advantage of applicable exemptions and deductions.

Similar forms

The BIR Form No. 2305 is crucial for updating exemption statuses and both employer's and employee's information with the Philippine Bureau of Internal Revenue (BIR). There are other documents, especially in the realm of tax and employment regulations, that bear similarities in function and purpose to the BIR 2305 form. Here are eight examples:

- IRS Form W-4 (U.S.) - Similar to the BIR 2305, the IRS Form W-4 is used by employees in the United States to indicate their tax situation to their employer, dictating how much should be withheld from their paycheck for federal income taxes. It too deals with exemptions and adjustments based on dependent information.

- Form TD1 (Canada) - This is the Canadian equivalent for personal tax credits returns. Employees use this form to determine the amount of taxes to be deducted from their income, akin to how the BIR 2305 is utilized for updating exemption statuses in the Philippines.

- HMRC Starter Checklist (UK) - In the United Kingdom, new employees who don't have a P45 form use the Starter Checklist to inform their employer about their tax code. It shares the purpose of updating employment information to ensure proper tax calculation and deduction.

- Australian Taxation Office (ATO) Tax File Number Declaration (Australia) - This form functions similarly by collecting employee information to determine the correct amount of tax to withhold. Like the BIR 2305, it's critical for establishing tax-related employment details.

- Form 12A (Ireland) - Used by employees in Ireland to provide their employer with personal tax information. It is similar to the BIR 2305 in its role in updating tax exemption and employment status, ensuring taxes are correctly deducted by the employer.

- Employee's Withholding Allowance Certificate (EWAC) in various countries - Many countries have their version of a withholding allowance certificate, which functions like the BIR 2305, enabling employees to declare exemptions and adjustments for accurate tax withholding.

- Modification declaration form (France) - In France, employees must declare changes in their personal or familial situation for tax purposes using this form. It aligns with the function of the BIR 2305 form in updating personal exemptions based on life changes.

- Annual Information Return of Income Taxes Withheld on Compensation and Final Withholding Taxes (Philippines) - Although this document is more employer-focused, it complements the BIR 2305 by reporting the total income and taxes withheld throughout the year for employees, showcasing the relationship between employee declarations and employer reporting obligations.

Each of these documents, while serving a similar fundamental purpose of facilitating accurate tax withholding and ensuring compliance with respective tax laws, is tailored to the specific requirements and regulations of their country's tax system. They play a pivotal role in the tax and employment processes by providing essential information about the taxpayer and their employment situation.

Dos and Don'ts

When filling out the BIR Form 2305, individuals must ensure accuracy and completeness to avoid complications or delays in processing. Here are 10 essential dos and don'ts to guide you through the process:

- Do ensure that you have all the necessary information ready before starting, including your TIN (Taxpayer Identification Number) and your employer's TIN.

- Do fill in all applicable spaces with the correct and most updated information to prevent any need for correction later on.

- Do mark appropriate boxes with an “X” to indicate your choice clearly and avoid ambiguity.

- Do verify the accuracy of your personal and employment information, including your civil status and any changes therein, as this could affect your exemption status.

- Do include details of your qualified dependent child/ren, if applicable, as this could affect your claims for additional exemptions.

- Do not leave any mandatory fields blank. If a section does not apply to you, mark it appropriately with “N/A” or a similar indicator.

- Do not guess information especially when it comes to numerical data like the TIN, RDO Code, or Zip Code. Verify these details if you are unsure.

- Do not ignore the declaration part at the end of the form. The information you provide should be true and correct to the best of your knowledge and belief.

- Do not forget to have the form signed by the taxpayer or the authorized agent as this is a critical requirement for processing.

- Do not submit the form without attaching necessary documents, especially if you’re claiming additional exemptions or updating significant information like civil status or number of dependents.

By following these guidelines, you can ensure a smoother process in updating your exemption status and personal details with the BIR, helping prevent any potential issues or delays with your tax records.

Misconceptions

The Bureau of Internal Revenue (BIR) Form No. 2305, often surrounded by misconceptions, serves as an essential document for updating exemption status and information for both employers and employees in the Philippines. Such misunderstandings can lead to confusion and mistakes in compliance. Clarifying these misconceptions is crucial for ensuring that all transactions with the BIR are smooth and error-free.

Form 2305 is only for employees. This misconception overlooks that Form 2305 also accommodates updates for self-employed individuals, albeit for exemption updates exclusively.

Updates can only be made annually. Contrary to this belief, updates on the Form 2305 can be made anytime there's a change in the taxpayer's status or information that affects their tax exemption.

It's optional for updating exemptions. Many fail to realize the importance of updating their status through Form 2305, which is mandatory for accurately capturing one's tax exemption credentials.

Filling up Form 2305 automatically updates all BIR records. While Form 2305 updates specific exemption and employment information, it does not automatically update all details across all BIR databases. Other forms may be required for different updates.

There's no need to update the form if there's no change in marital status. Any significant life changes, not just marital status, like additional dependents or changes in employment, necessitate an update via Form 2305.

Only the employer can file Form 2305 for their employees. While employers often assist in this process, employees can also file Form 2305, especially if they are updating personal exemptions or correcting personal information.

Submission of Form 2305 is purely manual. While manual submission is common, technological advancements have allowed for the electronic processing of Form 2305 in some areas, facilitating easier submission and processing.

There's no deadline for submitting Form 2305. Depending on the update's nature, there might be specific deadlines (e.g., for those affecting year-end adjustments), making timely submission crucial.

Incorrect information on Form 2305 has no consequences. Misdeclarations or errors in Form 2305 can lead to incorrect tax calculations and potential penalties, emphasizing the need for accuracy.

All taxpayers must fill out every section of Form 2305. Taxpayers need to complete only the relevant sections applicable to their circumstances, not the entire form. Ensuring the correct portions are filled out helps streamline the process.

Proper understanding and completion of BIR Form No. 2305 play a pivotal role in ensuring compliance with tax regulations and avoiding unnecessary complications. Taxpayers should consult with professionals or the BIR for guidance to correct any misconceptions and ensure accurate and timely updates.

Key takeaways

Understanding how to properly fill out and use the BIR Form 2305 is crucial for both employers and employees. Here are key takeaways from the instructions provided with the form:

- The BIR Form 2305 is designed to update an employee's exemption status and other relevant information for both the employee and the employer.

- It is important to fill in all applicable spaces in the form and to ensure that all necessary boxes are marked with an “X” where required.

- This form is applicable to both employees, for updating their exemption status and information, and to self-employed individuals for the same purpose.

- Correct and accurate Taxpayer Identification Number (TIN), RDO Code, and other personal information are critical to avoid processing delays or errors.

- The form requires detailed taxpayer/employee information including civil status and information concerning the employment status of a spouse, which affects exemption claims.

- Employees are also required to declare any qualified dependent children, which can impact the calculation of exemptions.

- For employees working with two or more employers within the calendar year, the form has a section dedicated to detailing multiple employments, either successive or concurrent, and previous or current employers must be listed.

- The signature of the taxpayer or authorized agent at the end of the form, along with the declaration, is a affirmation that the information provided is true and correct under penalty of perjury.

Filling out the BIR Form 2305 accurately is crucial for ensuring compliance with tax regulations and for ensuring the correct calculation of tax exemptions and deductions. It is an important administrative task for both individuals and employers within the Philippines.

Popular PDF Forms

Letter Va Statement in Support of Claim Example - The VBA VA 21-4138 form is a critical tool for veterans in rural or remote areas, who may rely on written statements to convey the details of their claims effectively.

De 6 - It is crucial to accurately report the total subject, PIT wages, and PIT withheld for each employee.