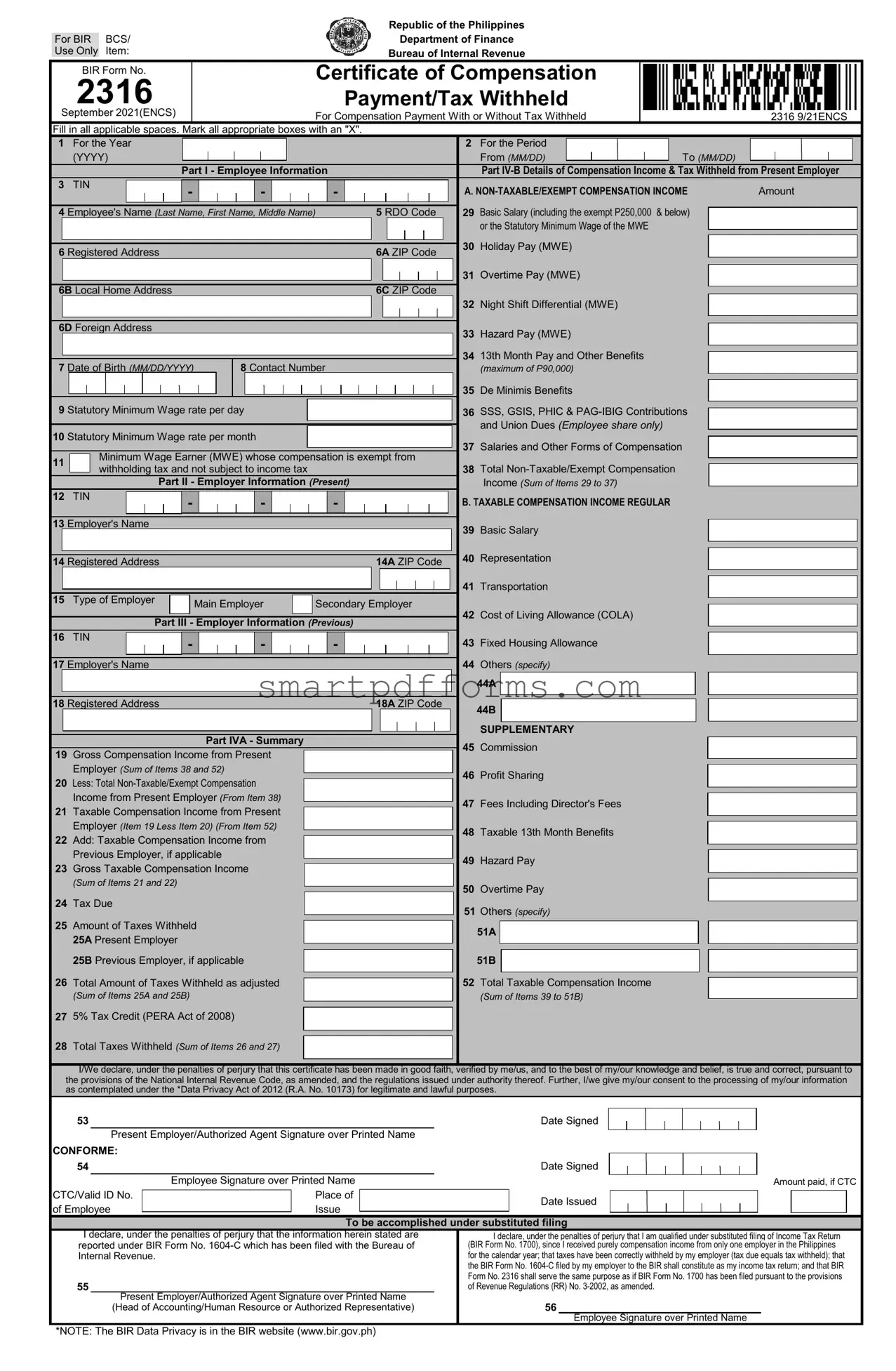

Blank Bir 2316 PDF Template

Understanding the BIR Form 2316 is crucial for both employees and employers in the Philippines. This certificate, issued by the Bureau of Internal Revenue (BIR), details an employee's compensation and the taxes withheld by their employer throughout the year. It serves a dual purpose: for employees, it's a necessary document for filing their annual income tax returns, especially for those eligible for substituted filing; for employers, it’s a compliance requirement to be fulfilled annually. The form captures a wide array of information, including non-taxable and taxable compensation, deductions such as SSS, GSIS, PHIC, and PAG-IBIG contributions, and other benefits received by the employee. It also contains sections dedicated to employer information, making it a comprehensive record of an individual's employment and tax status within a particular year. With the Data Privacy Act of 2012 in consideration, the BIR 2316 form also emphasizes the confidentiality and proper handling of personal information. This document not only helps in ensuring compliance with the National Internal Revenue Code but also aids employees in understanding their tax liabilities and entitlements, reaffirming the importance of accuracy and honesty in its preparation and submission.

Preview - Bir 2316 Form

|

|

|

|

|

|

|

|

|

Republic of the Philippines |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For BIR |

BCS/ |

|

|

|

|

|

|

Department of Finance |

|

|

|

|

|

|

|

||

|

Use Only |

Item: |

|

|

|

|

|

|

Bureau of Internal Revenue |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BIR Form No. |

|

|

|

|

|

Certificate of Compensation |

|

|

|

|

|

|

|

||||

2316 |

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

Payment/Tax Withheld |

|

|

|

|

|

|

|

|||||

|

September 2021(ENCS) |

|

|

|

|

|

For Compensation Payment With or Without Tax Withheld |

|

|

|

2316 9/21ENCS |

|||||||

|

Fill in all applicable spaces. Mark all appropriate boxes with an "X". |

|

|

|

|

|

|

|

||||||||||

|

1 For the Year |

|

|

|

|

|

|

2 For the Period |

|

|

|

|

|

|

|

|

|

|

|

(YYYY) |

|

|

|

|

|

|

From (MM/DD) |

|

|

|

|

To (MM/DD) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

Part I - Employee Information |

Part |

||||||||||||||

3 |

TIN |

|

|

|

A. |

Amount |

|

|

- |

- |

- |

|

|||

4 Employee's Name (Last Name, First Name, Middle Name) |

|

5 RDO Code |

29 Basic Salary (including the exempt P250,000 |

& below) |

|

||

|

|

|

|

|

or the Statutory Minimum Wage of the MWE |

|

|

6 Registered Address |

|

|

|

|

|

|

|

6A ZIP Code |

30 |

Holiday Pay (MWE) |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

31 |

Overtime Pay (MWE) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6B Local Home Address |

|

|

|

|

|

|

|

6C ZIP Code |

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

32 |

Night Shift Differential (MWE) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6D Foreign Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

33 |

Hazard Pay (MWE) |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

34 |

13th Month Pay and Other Benefits |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

7 Date of Birth (MM/DD/YYYY) |

8 Contact Number |

|

|

|

|

|

|

|

|

|

|

|

(maximum of P90,000) |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

35 |

De Minimis Benefits |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

9 Statutory Minimum Wage rate per day |

|

|

|

|

|

|

|

|

|

|

|

|

|

36 SSS, GSIS, PHIC & |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

and Union Dues (Employee share only) |

10 Statutory Minimum Wage rate per month |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

37 |

Salaries and Other Forms of Compensation |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

11 |

|

|

Minimum Wage Earner (MWE) whose compensation is exempt from |

|

|

|||||||||||||||||||||||

|

|

|

|

|||||||||||||||||||||||||

|

|

withholding tax and not subject to income tax |

|

|

|

|

|

|

|

|

|

|

38 |

Total |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

Part II - Employer Information (PRESENT) |

|

|

|

|

|

|

|

|

|

|

|

Income (Sum of Items 29 to 37) |

||||||||||

12 |

TIN |

|

|

B. TAXABLE COMPENSATION INCOME REGULAR |

|

- |

- |

- |

|

13 Employer's Name |

|

|

39 Basic Salary |

|

|

|

|

|

|

14 Registered Address |

|

|

|

|

14A ZIP Code |

40 |

Representation |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

41 |

Transportation |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

15 |

Type of Employer |

|

Main Employer |

|

Secondary Employer |

|

|

|||||||

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

42 |

Cost of Living Allowance (COLA) |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

Part III - Employer Information (PREVIOUS) |

||||||||||||

|

|

|

|

|||||||||||

16 |

TIN |

|

|

43 |

Fixed Housing Allowance |

|

- |

- |

- |

||

17 Employer's Name |

|

|

44 |

Others (specify) |

|

44A

18 Registered Address |

18A ZIP Code |

44B |

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SUPPLEMENTARY |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

Part IVA - Summary |

|

|

|

|

|

|

|

|

45 Commission |

|

||||||

19 |

Gross Compensation Income from Present |

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

Employer (Sum of Items 38 and 52) |

|

|

|

|

|

|

|

|

46 |

Profit Sharing |

|

|||||

20 |

Less: Total |

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

Income from Present Employer (From Item 38) |

|

|

|

|

|

|

|

|

47 |

Fees Including Director's Fees |

|

|||||

21 |

Taxable Compensation Income from Present |

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

Employer (Item 19 Less Item 20) (From Item 52) |

|

|

|

|

|

|

|

|

48 |

Taxable 13th Month Benefits |

|

|||||

22 |

Add: Taxable Compensation Income from |

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

Previous Employer, if applicable |

|

|

|

|

|

|

|

|

|

49 |

Hazard Pay |

|

||||

23 |

Gross Taxable Compensation Income |

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

(Sum of Items 21 and 22) |

|

|

|

|

|

|

|

|

50 |

Overtime Pay |

|

|||||

24 |

Tax Due |

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

51 Others (specify) |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

25 |

Amount of Taxes Withheld |

|

|

|

|

|

|

|

|

|

|

|

51A |

|

|

|

||

|

|

25A Present Employer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

25B Previous Employer, if applicable |

|

|

|

|

|

|

|

|

|

|

|

51B |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

26 |

|

|

|

|

|

|

|

|

|

|

|

52 Total Taxable Compensation Income |

|

|||||

Total Amount of Taxes Withheld as adjusted |

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

(Sum of Items 25A and 25B) |

|

|

|

|

|

|

|

|

|

|

|

(Sum of Items 39 to 51B) |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

27 |

5% Tax Credit (PERA Act of 2008) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

28 |

Total Taxes Withheld (Sum of Items 26 and 27) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I/We declare, under the penalties of perjury that this certificate has been made in good faith, verified by me/us, and to the best of my/our knowledge and belief, is true and correct, pursuant to the provisions of the National Internal Revenue Code, as amended, and the regulations issued under authority thereof. Further, I/we give my/our consent to the processing of my/our information as contemplated under the *Data Privacy Act of 2012 (R.A. No. 10173) for legitimate and lawful purposes.

|

53 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date Signed |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

Present Employer/Authorized Agent Signature over Printed Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CO |

NFORME: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

54 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date Signed |

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

Employee Signature over Printed Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amount paid, if CTC |

||||||

|

CTC/Valid ID No. |

|

|

|

Place of |

|

|

|

|

|

|

Date Issued |

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

of Employee |

|

|

|

Issue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

To be accomplished under substituted filing |

||||||||||||||||||||

|

|

I declare, under the penalties of perjury that the information herein stated are |

|

I declare, under the penalties of perjury that I am qualified under substituted filing of Income Tax Return |

|||||||||||||||||||||||||

|

|

reported under BIR Form No. |

(BIR Form No. 1700), since I received purely compensation income from only one employer in the Philippines |

||||||||||||||||||||||||||

|

|

Internal Revenue. |

|

|

|

|

|

for the calendar year; that taxes have been correctly withheld by my employer (tax due equals tax withheld); that |

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

the BIR Form No. |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

Form No. 2316 shall serve the same purpose as if BIR Form No. 1700 has been filed pursuant to the provisions |

|||||||||||||||||

|

55 |

|

|

|

|

|

|

|

|

|

of Revenue Regulations (RR) No. |

||||||||||||||||||

|

|

|

|

|

Present Employer/Authorized Agent Signature over Printed Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

(Head of Accounting/Human Resource or Authorized Representative) |

56 |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employee Signature over Printed Name |

|||||||||||

*NOTE: The BIR Data Privacy is in the BIR website (www.bir.gov.ph)

Form Data

| Fact Name | Description |

|---|---|

| Form Number and Title | BIR Form No. 2316 - Certificate of Compensation Payment/Tax Withheld |

| Issuing Body | Bureau of Internal Revenue (BIR), Department of Finance, Republic of the Philippines |

| Document Version | January 2018 (ENCS) |

| Scope and Purpose | For Compensation Payment With or Without Tax Withheld |

| Who Fills the Form | Both the employer and the employee are responsible for filling and signing the form. |

| Minimum Wage Earner Exemption | Details special tax exemptions for Minimum Wage Earners (MWE), including non-taxable income components. |

| Substituted Filing Declaration | Includes a declaration under penalties of perjury that the form serves the same purpose as filing an Income Tax Return for qualified employees. |

| Governing Laws | National Internal Revenue Code, as amended, and the Data Privacy Act of 2012 (R.A. No. 10173). |

Instructions on Utilizing Bir 2316

Filling out the BIR Form No. 2316 is a procedural step that requires careful attention to detail. It's designed to ensure that employees' compensation and tax withholdings are correctly documented. The form plays a crucial role in the Philippines' tax system, helping both the employer and employee fulfill their tax-related obligations. The following steps will guide you through the process of completing this form accurately.

- Start by entering the applicable year in the section marked "For the Year" at the top of the form.

- Fill in the period covered, specifying the start and end dates in the format (MM/DD) under "For the Period".

- Proceed to Part I - Employee Information, entering the employee's Tax Identification Number (TIN) in the space provided.

- Input the employee's name in the order: Last Name, First Name, Middle Name where indicated.

- Enter the RDO Code and the employee’s registered address along with the ZIP Code.

- Provide the local home address if different from the registered address and include both the local and foreign ZIP Code if necessary.

- Enter the employee’s date of birth (MM/DD/YYYY) and contact number.

- Specify the statutory minimum wage rate per day and month, and check if the employee is a Minimum Wage Earner (MWE).

- Move to Part II and enter the employer's information, starting with the TIN, name, and registered address of the current employer. Don’t forget to indicate if this is the main or secondary employer.

- In Part III, repeat the process for any previous employer within the tax year, including their TIN, name, and address.

- Part IV-B focuses on the details of the compensation income and tax withheld. Begin by detailing the non-taxable/exempt compensation income.

- Under the TAXABLE COMPENSATION INCOME section, list down the basic salary, representation, transportation, and other taxable income received, including the total non-taxable/exempt and taxable incomes.

- Conclude by summarizing the gross compensation income from present employer, less the total non-taxable/exempt income, to find the taxable compensation income from the present employer. Add any taxable income from a previous employer if applicable.

- Fill out the tax due, the amount of taxes withheld by the present and if applicable, previous employer, and the total amount of taxes withheld as adjusted.

- Finally, certify the form by entering the date signed, and having both the employee and the present employer or authorized agent sign over their printed names. Remember to also include any relevant CTC/Valid ID No., and place and date of issue details, especially if filing under substituted filing conditions.

After completing these steps, it's important to review the form thoroughly to ensure all information is accurate and complete. This detailed documentation is vital for both personal and organizational tax compliance. Following these steps carefully will help streamline the process, making it less daunting and more efficient.

Obtain Answers on Bir 2316

What is BIR Form No. 2316?

BIR Form No. 2316 is a certificate issued by employers in the Philippines to certify an employee’s compensation and tax withheld for a calendar year. It outlines details like non-taxable and taxable income, including basic salary, benefits, and deductions. Additionally, this form serves as proof that the tax due has been correctly withheld by the employer, fulfilling the employee's obligation for income tax return filing under substituted filing conditions.

Who should issue BIR Form No. 2316?

The form should be issued by the employer, both the main and secondary if applicable, to their employees who received compensation income, whether subject to withholding tax or not. It is the responsibility of the employer to ensure that the form is accurate and is issued to the employees on or before January 31 of the following year.

When is BIR Form No. 2316 required to be submitted?

Employers need to furnish two copies of the completed BIR Form No. 2316 to each employee on or before January 31st of the year following the taxable year. For employees qualified under the substituted filing, the form itself, when issued by the employer, serves as the Income Tax Return. The employer also has the responsibility to file this form with the Bureau of Internal Revenue (BIR) along with BIR Form No. 1604-C, reflecting an annualized summary of all taxes withheld.

Can BIR Form No. 2316 be used for loan or visa applications?

Yes, BIR Form No. 2316 is an important document that can be used by employees for various applications such as loans, visas, and other cases where proof of income is required. It confirms the amount of your income that has been taxed, making it a crucial document for financial and legal transactions. Always ensure you receive this form from your employer, check for accuracy, and keep it filed for such purposes.

Common mistakes

When filling out the BIR Form No. 2316, several common mistakes can lead to inaccuracies or processing delays. It's essential to approach this task with careful attention to detail to ensure compliance and avoid potential issues with the Bureau of Internal Revenue (BIR).

- Not reviewing personal information thoroughly: Inaccuracies in basic details such as name, TIN, or registered address can lead to significant processing delays.

- Incorrectly filling in compensation details: Misreporting income, whether taxable or nontaxable, can affect tax computations and liabilities.

- Omitting previous employer's information: Failing to include compensation details from a previous employer within the same tax year can result in underreported income.

- Miscalculating total taxable and non-taxable compensation: Errors in adding up these amounts may lead to incorrect tax withheld calculations.

- Forgetting to include de minimis benefits correctly: These benefits are often overlooked or entered inaccurately, affecting the overall taxable income assessment.

- Not verifying tax withholdings: It's crucial to ensure that the amount of taxes withheld, as reported, matches the employer's records to avoid discrepancies.

- Ignoring the declaration section: Skipping the consent for processing information under the Data Privacy Act of 2012 or not acknowledging the declaration under perjury can nullify the form.

Ensuring accuracy in each section of the form not only complies with tax laws but also streamlines the process of income tax filing. Individuals are advised to consult with a tax professional if they encounter difficulties in filling out the form or have specific concerns regarding their tax situation.

Documents used along the form

The BIR Form 2316 is a crucial document for employees and employers alike in the Philippines, serving as a certificate of compensation payment/tax withheld. It outlines an employee's annual income, tax deductions, and other pertinent financial data. However, navigating the realm of taxation and employment documentation doesn't stop with the 2316 form. Several other forms and documents play vital roles in ensuring compliance with tax regulations and facilitating smoother financial transactions and records for individuals and organizations.

- BIR Form 1604-C - This form is known as the Annual Information Return of Income Taxes Withheld on Compensation. Companies use this to report the total income taxes withheld from their employees throughout the year.

- BIR Form 1700 - The Income Tax Return (ITR) for Individuals Earning Purely Compensation Income, including those who are engaged in business or practice their profession under an employer-employee relationship.

- BIR Form 1902 - This is the Registration Form for new employees, used to update or validate their registration information under the Employee's employer in the Philippines.

- BIR Form 1601-C - This monthly remittance form of income taxes withheld on compensation is utilized by employers to remit the total monthly tax deducted from their employees' salaries.

- PhilHealth MDR (Member Data Record) - A document issued by PhilHealth, providing the official record of a member's personal information, dependents, and membership history.

- SSS Static Information Sheet - A summary of a member's recorded contributions and personal information, generated by the Social Security System (SSS).

- PAG-IBIG MDF (Member's Data Form) - Used for updating or registering with the PAG-IBIG Fund, this form records a member's personal information, employment history, and beneficiaries.

- Employment Contract - A legally binding document between an employer and an employee that outlines the terms and conditions of employment, including job duties, salary information, and duration of employment.

- Company ID or Valid Government ID - While not a form, having a valid identification document is essential for proving one's identity in various transactions related to employment, tax filing, and other official matters.

Understanding and properly using these documents can significantly ease the complexity of managing tax and employment-related requirements, keeping both employers and employees in good standing with the law. With a clearer comprehension of each form's purpose and the information it contains, navigating through tax season can become a more streamlined and stress-free experience.

Similar forms

Form W-2 (Wage and Tax Statement) in the United States: Similar to the BIR Form 2316, the Form W-2 is issued by employers to employees in the United States. It details the employee's income, tax withholdings, and benefits for the fiscal year. Like the 2316, it's a critical document for income tax reporting purposes.

P60 (End of Year Certificate) in the United Kingdom: The P60 serves a similar purpose as the BIR Form 2316 in the Philippines, by summarizing an employee's total income and taxes paid throughout the financial year. It is issued by employers in the UK to their employees at the end of each tax year.

T4 Slip (Statement of Remuneration Paid) in Canada: The T4 slip is the Canadian counterpart, detailing the employee's earned wages and taxes deducted by the employer. This form is necessary for individuals to complete their annual income tax returns, akin to the role of Form 2316 in the Philippines.

Group Certificate in Australia: Similar to BIR Form 2316, the Group Certificate (now replaced by the PAYG payment summary) was an annual statement provided by employers to employees in Australia, summarizing the employee's earnings and the amount of tax withheld. It is essential for personal income tax filings.

ITR-1 Form (Sahaj) in India: Although serving a broader purpose, the ITR-1 Form closely relates to Form 2316, as it is used by individuals earning income from salaries, one house property, other sources, and agricultural income up to ₹5,000. It compiles an individual's income and tax information for the year.

Dos and Don'ts

Filling out the BIR Form 2316 is an essential duty for both employers and employees in the Philippines, primarily pertaining to compensation and tax withheld. To ensure accuracy and compliance with the Bureau of Internal Revenue's requirements, here are several dos and don'ts to consider:

- Do ensure that all the information provided is accurate and complete. Cross-check your details with official documents to avoid discrepancies.

- Do mark the appropriate boxes with an "X" as instructed, ensuring that your responses reflect your current status accurately.

- Do report all taxable and non-taxable income as clearly segregated in the form to reflect the correct amounts in each category.

- Do provide your Tax Identification Number (TIN) and ensure it matches the TIN in your other official tax documents.

- Don't leave any applicable spaces blank. If a section does not apply to you, make sure to mark it with an "N/A" to indicate its irrelevance.

- Don't estimate or guess amounts. Use your payroll and other financial records to report exact figures.

- Don't forget to sign and date the form. Your signature verifies that the information provided is true and correct to the best of your knowledge.

- Don't disregard the privacy consent section at the end of the form, as it pertains to your agreement with the processing of your personal information in accordance with the Data Privacy Act of 2012.

Following these guidelines can help ensure the process is smooth and compliant with the national tax laws, avoiding potential issues or discrepancies that might arise from incorrect form submission.

Misconceptions

There are several misconceptions about the BIR Form 2316 in the Philippines. It's essential to address these misconceptions to ensure proper understanding and compliance. Here are nine common misunderstandings:

It's only for employees, not employers. This form is crucial for both employees and employers. Employees receive it as proof of income and tax payments, while employers must submit it to comply with regulatory requirements.

Form 2316 is the final tax clearance. While it does serve as a certificate of withholding tax, it's not considered the final tax clearance. Employees still need to file an Income Tax Return if necessary, depending on their income and tax situation.

Only those with tax dues need it. Regardless of whether you owe taxes or not, if you're earning a salary, this form is relevant as it details your earnings and the taxes withheld within a given year.

It's only necessary for current employment. If you've switched jobs within a year, a Form 2316 from each employer for that year is necessary to accurately file your annual Income Tax Return.

No need to preserve the document. Keeping a copy of your Form 2316 is essential. It serves as a valuable record when applying for loans, visas, or when needing to verify income and tax compliance.

Income below the taxable amount doesn't need this form. Even if your income falls below the taxable limit, this form acts as a record of your income and that no tax was due.

All bonuses are taxable. The form actually specifies that the 13th-month pay and other benefits up to a certain amount are non-taxable. This highlights that not all bonuses are subject to tax.

The form is the same every year. The Bureau of Internal Revenue (BIR) might update the form or its requirements, so it's important to ensure you're using the correct version for the current year.

Form 2316 is difficult to understand. With the correct information and guidance, understanding and filling out Form 2316 can be straightforward. There are resources available to help both employers and employees navigate through it.

Clarifying these misconceptions ensures better compliance with tax regulations and helps both employees and employers manage their financial and legal responsibilities more effectively.

Key takeaways

The BIR Form No. 2316 is an integral document for both employees and employers in the Philippines, encapsulating vital information on compensation income, tax deductions, and exemptions. Understanding its key elements and proper utilization can provide clarity and compliance for all parties involved. Here are six key takeaways related to filling out and using the BIR Form No. 2316 effectively:

- Ensure accuracy in the Employee Information section, including correct Taxpayer Identification Number (TIN), name, date of birth, and contact details. This foundational data is crucial for the identification and verification of the individual's tax records.

- Comprehensively detail both Non-Taxable/Exempt and Taxable Compensation. This includes basic salary, statutory minimum wage exemptions, benefits, and other forms of compensation. Accurate reporting is essential for determining the correct tax dues and exemptions.

- For individuals classified as Minimum Wage Earners (MWE), it's important to note their exemption from withholding tax, as well as income tax, provided their earnings do not exceed the statutory minimum wage or their total taxable income does not surpass the tax-exempt threshold.

- The form serves as a certificate under the Substituted Filing system, allowing individuals receiving purely compensation income from a single employer within the Philippines, and whose taxes have been correctly withheld, to forgo filing a separate income tax return (BIR Form No. 1700).

- Both the Employer and Employee sections must be completed with consenting signatures, affirming the accuracy and truthfulness of the information provided. This mutual verification acts as a safeguard against perjury and ensures accountability.

- Lastly, the declaration of consent for Data Privacy in accordance to the Data Privacy Act of 2012 (R.A. No. 10173) is a critical aspect of the form, highlighting the commitment to protect personal information and use it strictly for legitimate and lawful purposes.

Adherence to these guidelines not only fosters transparency and trust between employees and employers but also facilitates smoother interactions with the Bureau of Internal Revenue (BIR), ensuring compliance with the national tax regulations.

Popular PDF Forms

Veterans Aid and Attendance Program - Healthcare providers detail the veteran’s physical and mental impairments to help the VA make an accurate benefit determination.

Canadian Citizen Returning to Canada - Personal information collected is protected but may be shared with other government bodies for legal enforcement.

Lost License Plate Ct - The application process involves verification of sale documentation for accuracy.