Blank Bir PDF Template

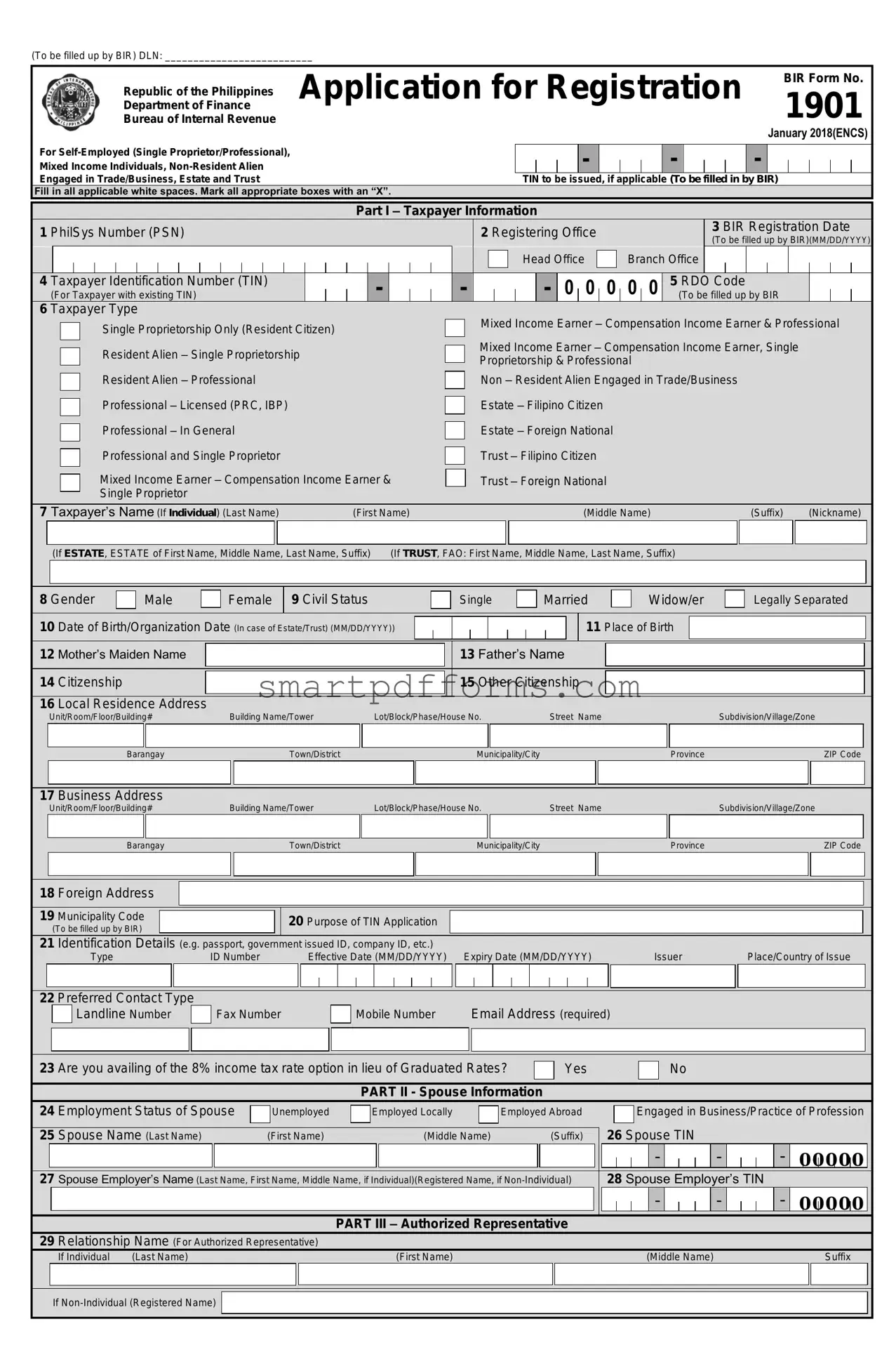

The Bureau of Internal Revenue (BIR) Form No. 1901, as updated in January 2018, is a crucial document for self-employed individuals, single proprietors, professionals, mixed-income individuals, non-resident aliens engaged in trade or business, estates, and trusts in the Philippines. This form serves as an application for registration with the BIR, a pivotal step in ensuring compliance with tax obligations. It outlines the necessary taxpayer information, including personal details, contact information, and specifics about the taxpayer's type, which can range from single proprietorships to trusts. Additionally, the form comprises sections dedicated to spouse information, business details, authorized representatives, and the types of taxes applicable. Also included are declarations under oath regarding the truthfulness of the information provided and consent for data processing under the Data Privacy Act of 2012. The BIR Form No. 1901 is also used to apply for the Taxpayer Identification Number (TIN) and to specify the tax regime under which the applicant will be taxed, including options for availing of a simplified 8% income tax rate in place of graduated rates. Lastly, this comprehensive document covers documentary requirements, fee payments, and penalties for possessing more than one TIN, emphasizing the importance of accurate and lawful registration for tax purposes.

Preview - Bir Form

(To be filled up by BIR) DLN: __________________________

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Application for Registration |

BIR Form No. |

||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

Republic of the Philippines |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1901 |

|

||||||||||||

|

|

|

|

|

|

Department of Finance |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

Bureau of Internal Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

January 2018(ENCS) |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

|

- |

|

|

|

|

|

|

|

|||||||||||||

|

|

Mixed Income Individuals, |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

Engaged in Trade/Business, Estate and Trust |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TIN to be issued, if applicable (To be filled in by BIR) |

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||

|

Fill in all applicable white spaces. Mark all appropriate boxes with an “X”. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part I – Taxpayer Information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

1 PhilSys Number (PSN) |

|

|

|

|

|

|

|

|

|

|

|

|

2 Registering Office |

|

|

|

|

|

|

|

|

|

|

3 BIR Registration Date |

|

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(To be filled up by BIR)(MM/DD/YYYY) |

|

|||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Head Office |

|

|

|

|

Branch Office |

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 Taxpayer Identification Number (TIN) |

|

|

|

|

|

- |

|

|

|

|

- |

|

|

|

|

|

|

|

- |

0 |

|

0 |

|

0 |

|

0 |

|

0 |

|

5 RDO Code |

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

(For Taxpayer with existing TIN) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(To be filled up by BIR |

|

|

|

|

|

|

|||||||||||||||||||||||||||||

6 Taxpayer Type

Single Proprietorship Only (Resident Citizen) |

Resident Alien – Single Proprietorship |

Resident Alien – Professional |

Professional – Licensed (PRC, IBP) |

Professional – In General

Professional and Single Proprietor |

Mixed Income Earner – Compensation Income Earner & |

Single Proprietor |

Mixed Income Earner – Compensation Income Earner & Professional

Mixed Income Earner – Compensation Income Earner, Single Proprietorship & Professional

Non – Resident Alien Engaged in Trade/Business

Estate – Filipino Citizen

Estate – Foreign National

Trust – Filipino Citizen

Trust – Foreign National

7 Taxpayer’s Name (If Individual) (Last Name) |

(First Name) |

(Middle Name) |

(Suffix) |

(Nickname) |

|||

|

|

|

|

|

|

|

|

|

(If ESTATE, ESTATE of First Name, Middle Name, Last Name, Suffix) |

(If TRUST, FAO: First Name, Middle Name, Last Name, Suffix) |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8 Gender |

Male |

Female |

9 Civil Status |

Single |

Married |

Widow/er |

Legally Separated |

|

10 |

Date of Birth/Organization Date (In case of Estate/Trust) (MM/DD/YYYY)) |

|

11 Place of Birth |

|

||||

12 |

Mother’s Maiden Name |

|

|

13 Father’s Name |

|

|

||

|

|

14 |

Citizenship |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15 Other Citizenship |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16 |

Local Residence Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

Unit/Room/Floor/Building# |

|

Building Name/Tower |

|

|

Lot/Block/Phase/House No. |

Street Name |

|

|

|

|

|

|

Subdivision/Village/Zone |

|

|

||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Barangay |

|

|

|

|

|

Town/District |

|

|

|

|

|

|

|

|

|

Municipality/City |

|

|

|

|

|

|

|

|

|

|

|

|

Province |

|

|

ZIP Code |

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

17 |

Business Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

Unit/Room/Floor/Building# |

|

Building Name/Tower |

|

|

Lot/Block/Phase/House No. |

Street Name |

|

|

|

|

|

|

Subdivision/Village/Zone |

|

|

||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Barangay |

|

|

|

|

|

Town/District |

|

|

|

|

|

|

|

|

|

Municipality/City |

|

|

|

|

|

|

|

|

|

|

|

|

Province |

|

|

ZIP Code |

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreign Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

18 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

19 Municipality Code |

|

|

|

|

|

|

|

|

|

|

20 Purpose of TIN Application |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

(To be filled up by BIR) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

21 |

Identification Details (e.g. passport, government issued ID, company ID, etc.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

|

|

|

|

Type |

ID Number |

|

|

Effective Date (MM/DD/YYYY) |

Expiry Date (MM/DD/YYYY) |

|

Issuer |

|

Place/Country of Issue |

|

|

||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

22 Preferred Contact Type |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

Landline Number |

|

|

Fax Number |

|

|

|

|

|

|

Mobile Number |

|

Email Address (required) |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

23 |

Are you availing of the 8% income tax rate option in lieu of Graduated Rates? |

|

|

|

|

|

|

|

Yes |

|

|

|

|

|

No |

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PART II - Spouse Information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

24 Employment Status of Spouse |

|

Unemployed |

|

Employed Locally |

|

Employed Abroad |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

25 Spouse Name (Last Name) |

(First Name) |

|

(Middle Name) |

(Suffix) |

||

Engaged in Business/Practice of Profession

Engaged in Business/Practice of Profession

26 Spouse TIN

-

-  -

-

-

-

0 0 0 0 0

|

27 Spouse Employer’s Name (Last Name, First Name, Middle Name, if Individual)(Registered Name, if |

28 Spouse Employer’s TIN |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

- |

|

|

|

|

- |

|

0 0 |

0 |

|

0 |

|

0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

PART III – Authorized Representative |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

29 Relationship Name (For Authorized Representative) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

If Individual |

|

(Last Name) |

|

|

(First Name) |

|

|

|

(Middle Name) |

|

|

|

|

|

|

|

|

|

Suffix |

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If

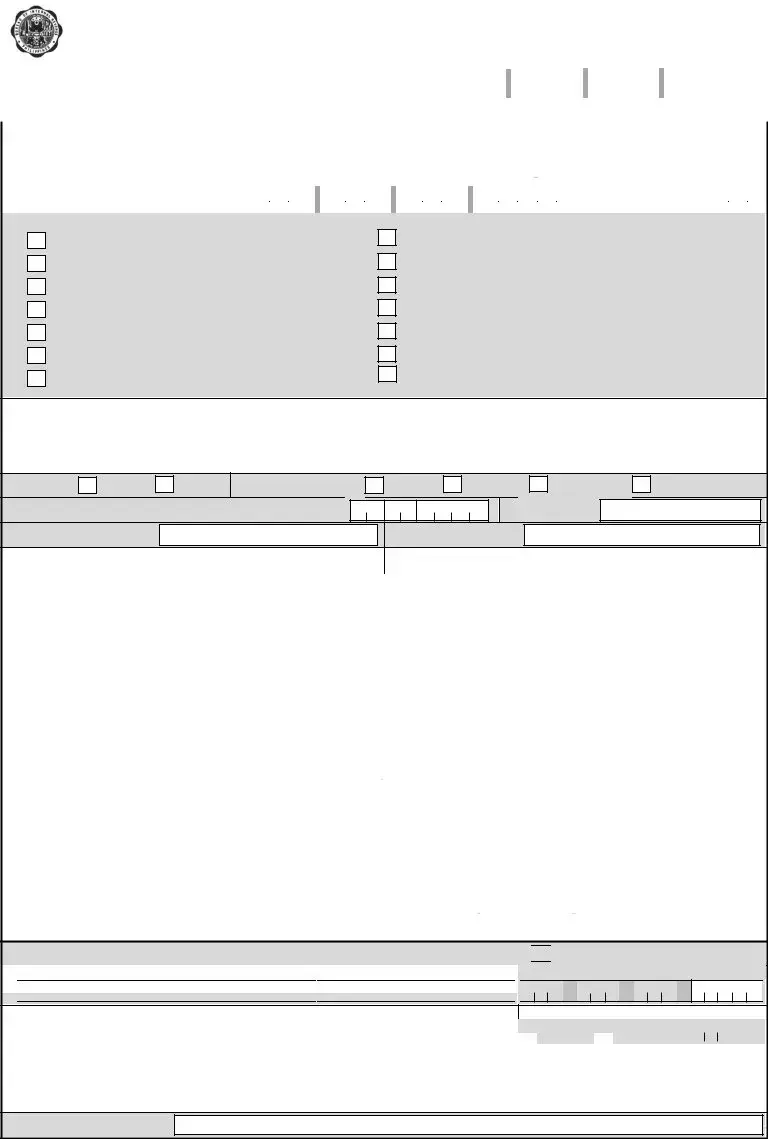

Page 2 – BIR Form No. 1901

30 Relationship Start Date (MM/DD/YYYY)

31 Address Types

Residence

Place of Business

Place of Business

Employer Address

Employer Address

32 Local Residence Address

|

|

Unit/Room/Floor/Building# |

|

Building Name/Tower |

|

Lot/Block/Phase/House No. |

Street Name |

|

Subdivision/Village/Zone |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Barangay |

|

|

Town/District |

|

|

|

Municipality/City |

|

|

Province |

|

|

ZIP Code |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

33 Preferred Contact Type |

|

|

|

Landline Number |

Fax Number |

Mobile Number |

Email Address (required) |

Part IV – Business Information

34 Single Business Number

35 Primary/Secondary Industries (Attach additional sheet/s, if necessary) |

|

|

|||

Industry |

Trade/Business Name |

|

Regulatory Body |

||

Primary |

|

|

|

|

|

Secondary |

|

|

|

|

|

Industry |

Business Registration Number |

Business Registration Date |

PSIC Code |

Line of Business |

|

(MM/DD/YYYY) |

(To be filled up by BIR) |

||||

|

|

|

|||

Primary |

|

|

|

|

|

Secondary |

|

|

|

|

|

36 Incentives Details

36A Investment Promotion

(e.g. PEZA, BOI)

36B Legal Basis

(e.g. RA, EO)

36C Incentive Granted

(e.g. Exempt from IT,VAT,etc.)

36D No. of Years

36E Incentive Start Date

(MM/DD/YYYY)

36F Incentive End Date

(MM/DD/YYYY)

|

|

37 Details of Registration / Accreditation |

|

|

|

|

FROM |

|

|

|

|

TO |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

37A Registration / Accreditation Number |

|

|

37B Effectivity Date (MM/DD/YYYY) |

|

|

|

|

(MM/DD/YYYY) |

|

37C Date Issued (MM/DD/YYYY) |

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

37D Registered Activity |

|

|

37E Tax Regime (Regular, Special, |

|

37F Activity Start Date |

|

37G Activity End Date |

|

|

|||||||||||||||||||||||||

|

|

|

|

|

Exempt) |

|

|

|

(MM/DD/YYYY) |

|

|

|

(MM/DD/YYYY) |

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

38Facility Details

38A Facility Code |

F |

38B Facility Type |

PP |

SP |

WH |

SR |

GG |

BT |

|

RP |

Other (specify) |

|

(To be filled up by BIR) |

|

|

|

|

|

|

|

|

|

|

|

|

38C Facility Address |

|

|

|

|

|

|

|

|

|

|

|

|

Unit/Room/Floor/Building# |

Building Name/Tower |

|

Lot/Block/Phase/House No. |

|

Street |

Name |

|

|

Subdivision/Village/Zone |

|||

|

Barangay |

Town/District |

|

|

Municipality/City |

|

|

|

Province |

ZIP Code |

||

Part V – Tax Type

39Tax Types (this portion determines your tax liability/ies) (To be filled up by BIR)

|

|

|

|

|

|

Form Type |

|

ATC |

|

|

|

|

|

|

Form Type |

ATC |

|

|

|

|

|

|

Withholding Tax |

|

|

|

|

|

Registration Fee |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Compensation |

|

|

|

|

|

|

|

Percentage Tax |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Expanded |

|

|

|

|

|

|

|

Stocks |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Final |

|

|

|

|

|

|

|

Overseas Dispatch And |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amusement Taxes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fringe Benefits |

|

|

|

|

|

|

|

Under Special Laws |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

VAT & Other Percentage |

|

|

|

|

|

|

|

Other Percentage Tax under NIRC (specify) |

|

|

||||

|

|

|

|

Percentage Tax |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ONETT not subject to |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CGT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Percentage Tax on |

|

|

|

|

|

|

|

Documentary Stamp Tax |

|

|

||||

|

|

|

|

Winnings & Prizes |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

On Interest Paid On Deposits And |

|

|

|

|

|

|

|

Regular |

|

|

|

|

|

|

|

|

|

|

Yield on Deposits/Substitutes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income Tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(ONETT) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Excise Tax |

|

|

|

|

|

Capital Gains – Real |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

Property |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Alcohol Products |

|

|

|

|

|

|

|

Capital Gains – Stocks |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Automobile & Non- |

|

|

|

|

|

|

|

Donor’s Tax |

|

|

|

|

|

|

|

|

|

|

Essential Goods |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cosmetics Procedures |

|

|

|

|

|

|

|

Estate Tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mineral Products |

|

|

|

|

|

|

|

Miscellaneous Tax (specify) |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Petroleum Products |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sweetened Beverages |

|

|

|

|

|

|

|

Others (specify) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tobacco Products |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tobacco Inspection Fees |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Page 3 – BIR Form No. 1901

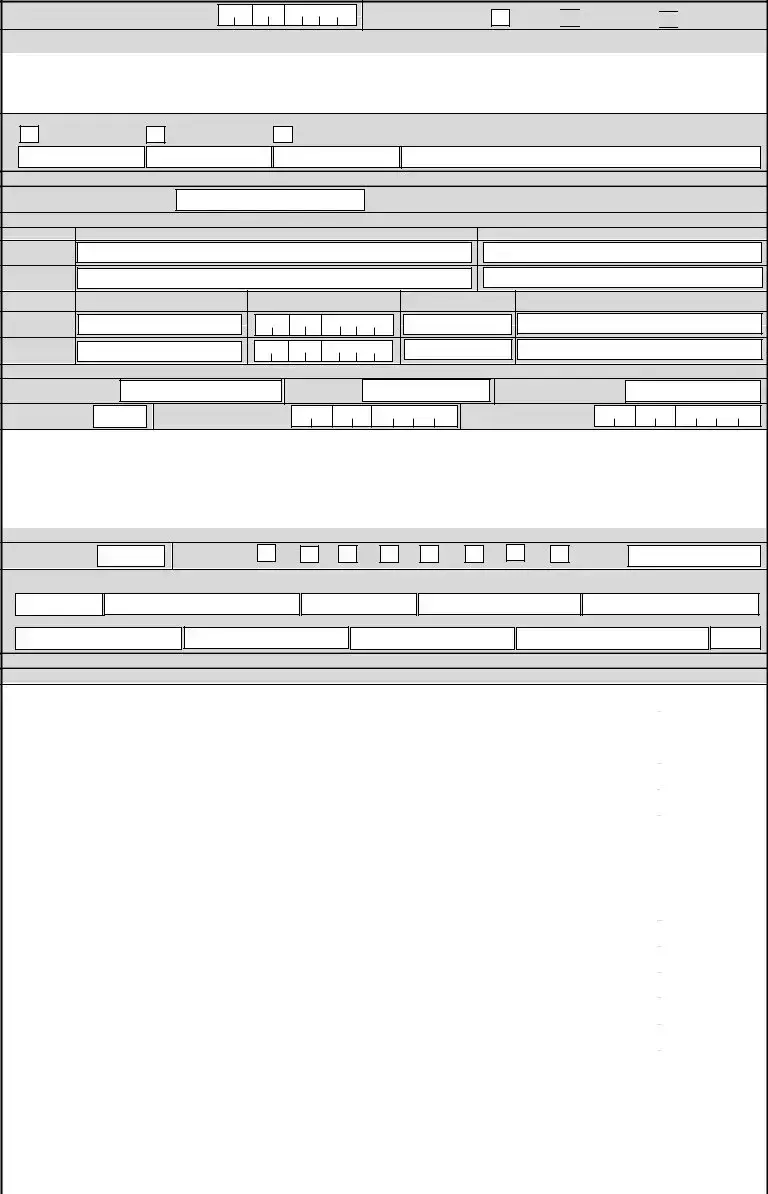

Part VI – Authority to Print

40 Authority to Print Receipts and Invoices

40A Printer’s Name |

40B Printer’s TIN |

- |

- |

- |

40C Printers Accreditation Number

40D Date of Accreditation (MM/DD/YYYY)

40D Date of Accreditation (MM/DD/YYYY)

40E Registered Address

|

|

Unit/Room/Floor/Building# |

Building Name/Tower |

Lot/Block/Phase/House No. |

Street Name |

|

Subdivision/Village/Zone |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Barangay |

|

Town/District |

|

Municipality/City |

|

|

Province |

|

ZIP Code |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

40F Contact Number |

40G |

|

|

40H Manner of Receipt/Invoices |

|

|

|

Bound |

|

|

|

Loose Leaf |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

40I Descriptions of Receipts and Invoices |

|

(Additional Sheet/s if Necessary) |

|

|

|

|

|

|

|||||||

Others

TYPE |

NO. OF |

|||

BOXES/BOOKLETS |

||||

Description |

|

|||

|

|

|

||

VAT |

LOOSE |

BOUND |

||

NO. OF

SETS PER

BOX /

BOOKLET

NO. OF COPIES PER SET

SERIAL NO.

|

|

START |

|

END |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part VII - For Employee with Two or More Employees (Multiple Employments) Within the Calendar Year

41 Type of Multiple Employments

Successive employments (With previous

employer/s within the calendar year)

Concurrent employments (With two or more employers at the same time

with the calendar year)

(If successive, enter previous employer/s; if concurrent, enter secondary employer/s)

Previous and Concurrent Employments During the Calendar Year

41A Name of Employer

41C Name of Employer

42Declaration

41B TIN of Employer

- |

- |

- |

41D TIN of Employer

- |

- |

- |

I declare, under the penalties of perjury, that this application has been made in good faith, verified by me and to the best of my knowledge and belief, is true and correct, pursuant to the provisions of the National Internal Revenue Code, as amended, and the regulations issued under the authority thereof. Further, I give my consent to the processing of my information as contemplated under the *Data Privacy Act of 2012 (R.A.

No. 10173) for legitimate and lawful purposes.

___________________________

Taxpayer/Authorized Representative

(Signature over Printed Name)

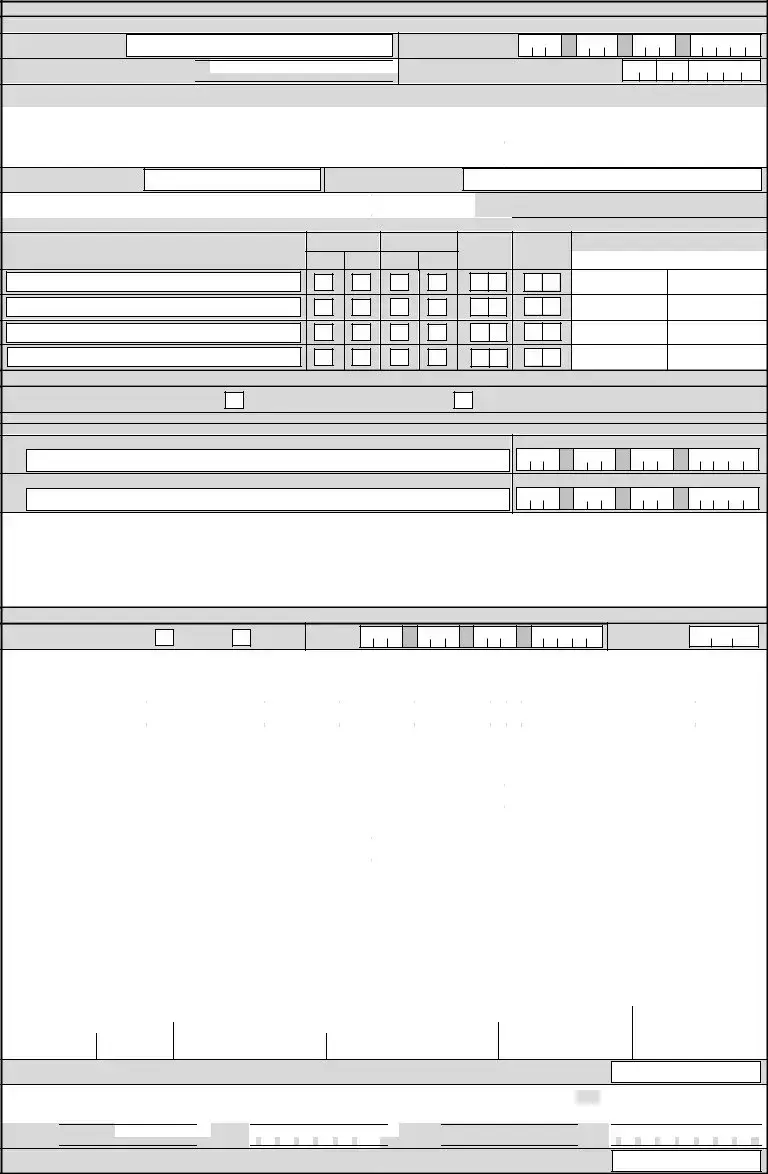

Part VIII – Primary/Current Employer Information

43 Type of Registered Office |

Head Office |

Branch |

44 TIN |

- |

- |

- |

45 RDO Code |

Office |

|

|

46 |

Employer Name If Individual |

|

(Last Name) |

|

|

|

|

|

|

|

|

|

(First Name) |

|

|

|

|

|

|

(Middle Name) |

|

|

|

|

|

(Suffix) |

|

|

|

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If |

|

(Registered Name) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

47 |

Employer Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

Unit/Room/Floor/Building# |

|

|

|

|

|

|

Building Name/Tower |

|

|

|

Lot/Block/Phase/House No. |

Street Name |

Subdivision/Village/Zone |

|

|

|||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Barangay |

|

|

|

|

|

|

|

|

|

|

Town/District |

|

|

|

|

|

|

|

|

|

|

|

Municipality/City |

|

|

|

|

|

|

|

Province |

|

|

|

|

|

|

|

ZIP Code |

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

48 |

Contact Details |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

Landline Number |

|

|

Fax Number |

Mobile Number |

|

|

|

|

|

|

Email Address (required) |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

49 Relationship Start Date (MM/DD/YYYY) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

50 Municipality Code (To be filled up by BIR) |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

51 Declaration |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stamp of BIR Receiving Office |

|

|||||||||||||||||

|

|

|

|

|

I declare, under the penalties of perjury, that this application has been made in good faith, verified by me and to the best of my knowledge and belief, is true and |

|

|

and Date of Receipt |

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

correct, pursuant to the provisions of the National Internal Revenue Code, as amended, and the regulations issued under authority thereof. Further, I give my consent |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||

|

|

to the processing of my information as contemplated under the *Data Privacy Act of 2012 (R.A. No. 10173) for legitimate and l awful purposes. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

_____________________________________________ |

|

|

|

|

|

|

|

________________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||

|

|

|

|

|

EMPLOYER/AUTHORIZED REPRESENTATIVE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title/Position of Signatory |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

(Signature over Printed Name) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Part IX – Payment Details |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

52 |

For the Year |

|

|

|

|

|

|

|

|

|

|

|

53 Date of Payment (MM/DD/YYYY) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

54 ATC |

|

|

|

MC180 |

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

55 |

Tax Type |

|

|

|

|

|

RF |

|

56 Manner of Payment |

|

|

|

|

REGISTRATION FEE |

57 Type of Payment |

|

FULL PAYMENT |

|

|||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

58 Registration Fee |

58A |

|

|

59 BIR Printed Receipts / Invoices |

|

|

|

59A |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

60 Add: Penalties Surcharge |

Interest |

Compromise |

|

|

|

|

|

|

||

60A

60B

60B

60C

60C

60D

60D

61 Total Amount Payable (Sum of Items 58A, 59A and 60D)

*NOTE: The BIR Data Privacy Policy is in the BIR website (www.bir.gov.ph)

Documentary Requirements:

1.Any identification issued by an authorized government body (e.g. Birth Certificate, passport, driver’s license, Community Tax Certificate) that shows the name, address and birthdate of the applicant;

2.Photocopy of Mayor’s Business Permit; or Duly received Application for Mayor’s Business Permit, if the former is still in process with the LGU; and/or Professional Tax Receipt/Occupational Tax Receipt issued by the LGU;

3.Proof of Payment of Registration Fee (RF) (if with existing TIN or applicable after TIN issuance);

4.BIR Form No. 1906; (Select an Accredited Printer)

5.Final & clear sample of Principal Receipts/ Invoices;

Additional documents, if applicable:

a.Special Power of Attorney (SPA) and ID of authorized person, in case of authorized representative who will transact with the Bureau;

b.Franchise Documents (e.g. Certificate of Public Convenience) (for Common Carrier);

c. Photocopy of the Trust Agreement (for Trusts);

d.Photocopy of the Death Certificate of the deceased (for Estate under judicial settlement);

e.Certificate of Authority, if Barangay Micro Business Enterprises (BMBE) registered entity; f. Proof of Registration/Permit to Operate BOI/BOIARMM, PEZA, BCDA and SBMA

6.In case of registration of branches/facility types:

a.Photocopy of Mayor’s Business Permit; or Duly received Application for Mayor’s Business Permit, if the former is still in process with the LGU; and/or Professional Tax Receipt/Occupational Tax Receipt issued by the LGU;

or DTI Certificate;

b.Special Power of Attorney (SPA) and ID of authorized person, in case of authorized representative who will transact with the Bureau; if applicable

c. Proof of Payment of Registration Fee (RF)

d.BIR Form No. 1906; (Select an Accredited Printer) e.Final & clear sample of Principal Receipts/ Invoices;

POSSESSION OF MORE THAN ONE TAXPAYER INDENTIFICATION NUMBER (TIN) IS CRIMINALLY PUNISHABLE PURSUANT TO THE

PROVISIONS OF THE NATIONAL INTERNAL REVENUE CODE OF 1997, AS AMENDED

Form Data

| Fact Number | Fact Name | Description | Governing Law(s) |

|---|---|---|---|

| 1 | Form Identification | BIR Form No. 1901 is designed for the application for registration. | N/A |

| 2 | Applicable Taxpayers | This form is for Self-Employed individuals, Mixed Income Individuals, Non-Resident Aliens Engaged in Trade/Business, Estate and Trust. | N/A |

| 3 | Document Version | The form in reference is the January 2018 (ENCS) version. | N/A |

| 4 | Department Oversight | The Bureau of Internal Revenue under the Department of Finance governs the form. | N/A |

| 5 | Taxpayer Information | The form requires detailed taxpayer information including TIN, PSN, and other personal and business details. | N/A |

| 6 | Tax Types | It outlines specific tax liabilities and responsibilities of the registrant. | N/A |

| 7 | Penalty for Multiple TINs | Possession of more than one Taxpayer Identification Number (TIN) is criminally punishable. | National Internal Revenue Code of 1997, as amended |

| 8 | Authority to Print | Includes sections for the authority to print invoices and official receipts. | N/A |

| 9 | Data Privacy Acknowledgment | Contains consent clause for processing information under the Data Privacy Act of 2012. | Data Privacy Act of 2012 (R.A. No. 10173) |

Instructions on Utilizing Bir

After completing the BIR Form No. 1901, it initiates the registration process necessary for individuals and entities under several categories such as self-employed, professionals, and mixed income earners. The completion of this form is integral to becoming a recognized taxpayer by the Bureau of Internal Revenue, enabling you to conduct business legally in the Philippines. It is important to follow the steps accurately to ensure that all information is correctly provided, facilitating a smoother processing of your application. Below are detailed steps to fill out the BIR Form No. 1901.

- Begin with Part I – Taxpayer Information. Fill in your PhilSys Number (PSN), if available. Leave the sections marked "To be filled up by BIR" blank.

- For item 4, enter your Taxpayer Identification Number (TIN) if you already have one. If not, this will be provided by BIR.

- Select the appropriate Taxpayer Type in item 6 that accurately describes your tax status.

- Complete item 7 with your name as required. Ensure to fill out the name fields according to whether you are registering as an individual, estate, or trust.

- Indicate your gender in item 8 and civil status in item 9.

- Provide your Date of Birth or Organization Date in item 10, and include your Place of Birth in item 11.

- Items 12 and 13 ask for your parents' names. Fill these out as applicable.

- In items 14 and 15, state your citizenship. If you hold dual citizenship, specify your other citizenship in item 15.

- Item 16 requires your local residence address. Ensure all parts of the address are complete.

- For your Business Address in item 17, provide the full address where your business is located or will operate.

- Complete the taxpayer Information section by providing details required up to item 23, including your preferred contact type and if you are availing of the 8% income tax rate option.

- In Part II, if applicable, fill in your spouse’s information starting from item 24 to item 28.

- For the Authorized Representative in Part III, enter the required information if someone will act on your behalf in dealing with BIR.

- Part IV asks for Business Information. Fill in the necessary details about your business, including Single Business Number and your industry classification.

- Details on incentives, registrations, and your specific business operations must be filled in Parts IV and V as applicable.

- In Part VI, provide the necessary details if you will have printed receipts and invoices. This includes choosing your printer and describing the receipt and invoice formats.

- Part VII is for employees with multiple employments during the calendar year. Complete this section if this situation applies to you.

- Read the declaration in Part VIII carefully. Once you have ensured all provided information is accurate and complete, sign the declaration in the fields provided. Your signature attests to the truthfulness and accuracy of all information on the form.

- Remember to attach the necessary documentary requirements listed on the last page of the form. These documents support the information you have provided and are crucial for the successful processing of your registration.

After the form and all attachments are submitted according to BIR’s submission guidelines, your application will be reviewed. During this process, you might be contacted for additional information or clarification. Once your application is approved, you will receive your official taxpayer identification and can commence or continue your business activities in compliance with the Philippine tax laws.

Obtain Answers on Bir

What is BIR Form No. 1901 and who should use it?

BIR Form No. 1901 is used for the application for registration for self-employed individuals, including those with mixed incomes (such as earnings from employment and business/professional activities), non-resident aliens engaged in trade or business, estates, and trusts. This form is essential for these parties to be officially recognized as taxpayers, enabling them to comply with tax obligations under the law.

What information and documents are required to complete BIR Form No. 1901?

- Personal information, such as taxpayer’s name, address, and birthdate

- Business details, if applicable (e.g., business address, type of business)

- Spouse information, if married

- Authorized representative information, if any

- Documents: Government-issued ID, Mayor’s Business Permit or application receipt, Professional Tax Receipt/Occupational Tax Receipt from LGU, if applicable, proof of payment of the registration fee, and BIR Form No. 1906 (for printing receipts).

How is BIR Form No. 1901 processed and what are the next steps after submission?

Once the form is filled with all the necessary information and documents, it should be submitted to the appropriate Bureau of Internal Revenue (BIR) office. After submission, the BIR will process the application, which involves verifying the details and documents provided. If the application is approved, the BIR will issue a Certificate of Registration and an official taxpayer identification number (TIN) if not previously assigned. Taxpayers may also need to attend a tax briefing as part of their registration obligations.

Are there any fees associated with the registration process using BIR Form No. 1901?

Yes, there is a registration fee required when submitting BIR Form No. 1901. The fee covers the costs associated with processing the application and issuing the Certificate of Registration. Additionally, costs related to the printing of official receipts and invoices may apply, which involve getting an authority to print from the BIR and selecting an accredited printer.

What penalties could be incurred for failing to register or providing inaccurate information on BIR Form No. 1901?

Failing to register as a taxpayer or providing false or incomplete information on BIR Form No. 1901 can lead to penalties such as fines and potential legal action. Such non-compliance is considered an offense under the National Internal Revenue Code, and individuals may be held accountable for any tax discrepancies or evasion resulting from incorrect registration details.

Common mistakes

Filling out the BIR Form No. 1901 can be a complex process that requires careful attention to detail. Common mistakes often occur when individuals or representatives rush through the process without fully understanding the requirements. To help avoid these pitfalls, here is an expanded list of 10 mistakes commonly made during the completion of the form:

- Not filling in all applicable spaces: Many forget to complete all necessary fields, especially those that do not apply to them directly. If a section does not apply, it's important to mark it as "N/A" instead of leaving it blank.

- Incorrectly marking boxes: Each box should be marked with an “X” in the appropriate space. However, mistakes occur when boxes are either left unchecked or marked incorrectly, leading to confusion about the taxpayer's status or choices.

- Entering inaccurate taxpayer information: Names, TINs, and other personal details must match official documents. Any discrepancy, such as spelling errors or mismatched information, can complicate the registration process.