Blank Blumberg 120 PDF Template

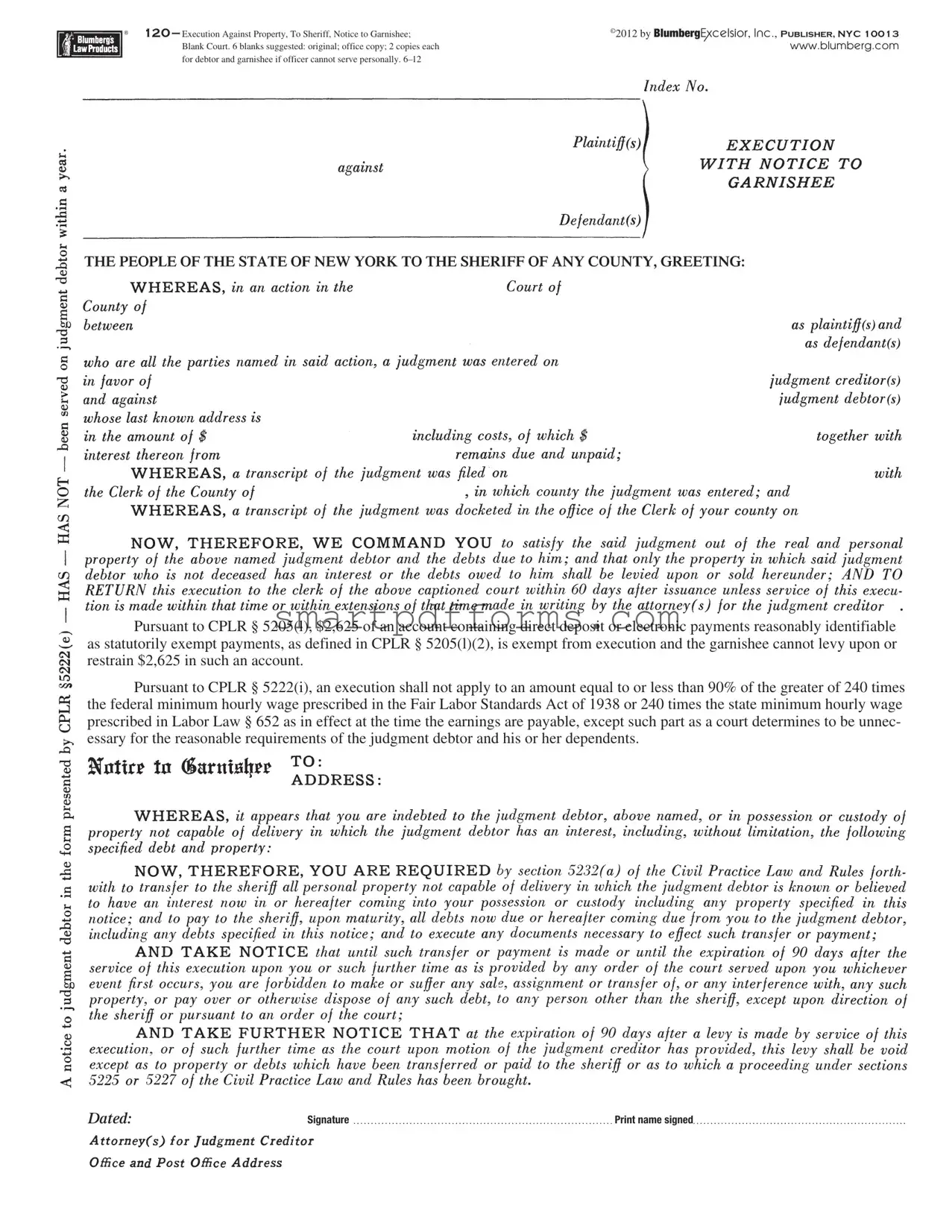

In navigating the complexities of executing judgments against property, the Blumberg 120 form serves as a critical legal document. Crafted by BlumbergExcelsior, Inc., and recognized within New York legal procedures, this form encapsulates a directive to sheriffs for the execution against property while concurrently issuing a notice to garnishees. The essence of this form lies in its structured approach to ensure that certain exemptions are upheld, in line with the Consolidated Laws of New York. Specifically, it delineates protections under CPLR § 5205(l), safeguarding $2,625 of an account against levy or restraint when such funds are direct deposits or electronic payments identifiable as statutorily exempt. Furthermore, it adheres to CPLR § 5222(i), setting limits on earnings execution to protect the judgment debtor's reasonable requirements and those of their dependents. The form also addresses nuances such as the handling of property owned jointly by defendants, some of whom may not have been served with a summons, underscoring the layered considerations in property execution processes. The Blumberg 120 form, thus, not only orchestrates the procedural execution against property but also embeds critical protective measures for debtors, presenting a balanced framework within the legal narrative of New York.

Preview - Blumberg 120 Form

120 — Execution Against Property, To Sheriff, Notice to Garnishee; |

©2012 by BlumbergExcelsior, Inc., PUBLISHER, NYC 10013 |

Blank Court. 6 blanks suggested: original; office copy; 2 copies each |

www.blumberg.com |

for debtor and garnishee if officer cannot serve personally. |

|

Pursuant to CPLR § 5205(l), $2,625 of an account containing direct deposit or electronic payments reasonably identifiable as statutorily exempt payments, as defined in CPLR § 5205(l)(2), is exempt from execution and the garnishee cannot levy upon or restrain $2,625 in such an account.

Pursuant to CPLR § 5222(i), an execution shall not apply to an amount equal to or less than 90% of the greater of 240 times the federal minimum hourly wage prescribed in the Fair Labor Standards Act of 1938 or 240 times the state minimum hourly wage prescribed in Labor Law § 652 as in effect at the time the earnings are payable, except such part as a court determines to be unnec- essary for the reasonable requirements of the judgment debtor and his or her dependents.

DATED: |

Signature |

Print name signed |

ENDORSEMENT

Please take notice that the following named defendants were not served with a summons herein, viz.:

and that, as to them, the execution must be restricted as below prescribed.

An execution against property shall not be levied upon the sole property of such a defendant, but it may be collected out of real and personal property owned by him jointly with the other defendants who were summoned or with any of them, and out of the real and personal property of the latter or any of them.

Attorney(s) for

Name and Address of Garnishee

Address of Judgment Debtor

Location of Property

INDEX NO.COURTCOUNTY OF

EXECUTION

|

|

|

AGAINST PROPERTY |

|

|

|

|

With Notice to Garnishee |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LAW OFFICES OF |

|

|

|

|

Plaintiff(s) |

|

|

|

against |

|

|

|

|

|

Defendant(s) |

|

|

|

|

|

|

|

|

|

|

|

Sheriff of any County |

Attorney(s) for |

|||

Levy and collect as within directed |

Office and Post Office Address |

|||

with interest from |

|

|

||

besides your fees, etc. |

Dated and time received |

|||

Sheriff

Form Data

| Fact Number | Fact Detail |

|---|---|

| 1 | The Blumberg 120 form is designated for executions against property, with notice provided to the garnishee. |

| 2 | It is used to direct the sheriff to levy and collect property as specified within the document to satisfy a judgment. |

| 3 | Under CPLR § 5222(i), the form acknowledges that a certain amount of earnings (related to minimum wage calculations) is protected from execution to ensure the judgment debtor and their dependents' reasonable needs are met. |

| 4 | CPLR § 5205(l) specifies that up to $2,625 of an account with directly deposited or electronically paid funds, identifiable as statutorily exempt, is exempt from execution and cannot be levied by a garnishee. |

| 5 | This form is subject to New York law, as evident by its referrals to the Civil Practice Law and Rules (CPLR) for procedural guidance. |

Instructions on Utilizing Blumberg 120

Filling out the Blumberg 120 form, titled "Execution Against Property, To Sheriff, Notice to Garnishee," is a critical step in the process of executing a judgment by garnishing wages or levying property. This document is instrumental in notifying the sheriff and the garnishee (the entity holding the debtor's assets) of the details of the debt, exemptions to it, and the specific property or accounts to be levied against. Understanding each section of the form ensures accurate and prompt processing, which is essential for the creditor to enforce the judgment. Below are the step-by-step instructions to fill out this form correctly.

- Begin by entering the court information at the top of the form, including the court name and county.

- Fill in the "Index No." with the case number assigned by the court.

- Under "Law Offices Of", enter the name and address of the attorney representing the plaintiff(s).

- On the line for "Plaintiff(s) against Defendant(s)", write the names of the plaintiff(s) on the left and the defendant(s) on the right, respectively.

- Specify the sheriff's county to whom the document is addressed at the place designated for "Sheriff of any County".

- In the section provided, fill out the name and address of the garnishee, which is the organization or individual that will be required to withhold assets from the debtor.

- Enter the address of the judgment debtor and the location of the property targeted for levy, if applicable.

- Detail the amount of money to be collected, including principal, interest, and any additional fees or costs associated with the collection, in the space provided.

- Complete the "DATED" line with the date the form is filled out.

- At the bottom of the form, under "Signature", the attorney for the plaintiff(s) must sign and then print their name to validate the form.

- If applicable, note any defendants who were not served with a summons in the "ENDORSEMENT" section, along with instructions on restricted execution as it pertains to them.

After completing these steps, the form should be carefully reviewed for accuracy before submission. Mistakes or omissions can delay the process of execution against property or garnishment, potentially impacting the efficiency and success of collecting on a judgment. Once finalized, the appropriate copies should be distributed as indicated: an original for the sheriff's record, an office copy, and the necessary duplicates for both the debtor and garnishee, ensuring all parties are duly notified.

Obtain Answers on Blumberg 120

What is the Blumberg 120 form?

The Blumberg 120 form, titled "Execution Against Property, To Sheriff, Notice to Garnishee," is a legal document used in the state of New York. Its primary purpose is to facilitate the process of executing a judgment by enabling the levy against a debtor's property. This forms part of the legal procedures set out under the Civil Practice Law and Rules (CPLR) wherein it specifies how a sheriff is directed to levy property to satisfy a judgment. The form also contains provisions for notifying a garnishee—the entity that holds the debtor's property or owes the debtor money.

How is the Blumberg 120 form used?

The form is used by judgment creditors to instruct the sheriff to seize or levy a debtor's property in accordance with a court's judgment. Furthermore, it serves to notify the garnishee of the levy. This is done through the inclusion of sections that detail the judgment, the amount owed, the names and addresses of the debtors and garnishees, and specific exemptions that protect a portion of the debtor's assets from execution. Correct and thorough completion of the form is critical to ensure lawful processing of the execution against property.

What are the protected exemptions under the CPLR as mentioned in the Blumberg 120 form?

The Blumberg 120 form outlines specific exemptions under the CPLR § 5205(l) and § 5222(i) that protect a portion of the debtor's assets from being levied. Firstly, it states that $2,625 of an account with direct deposit or electronic payments, which can be identified as statutorily exempt payments, is exempt from execution. This could include, for example, social security payments or unemployment benefits. Additionally, the form mentions an execution shall not apply to an amount equal to or less than 90% of the greater of 240 times the federal or state minimum hourly wage. This exemption aims to ensure that debtors retain sufficient funds to meet their and their dependents' reasonable requirements.

Can all of a debtor's property be levied using the Blumberg 120 form?

No, not all of a debtor's property can be levied by using the Blumberg 120 form. The form itself outlines specific exemptions to protect a portion of the debtor’s assets, ensuring they have enough to cover basic living expenses. Additionally, it clarifies that property owned solely by a named defendant who was not served with a summons cannot be levied. Only property owned jointly with other defendants or their individual property may be subject to levy under this execution.

What information is required to complete the Blumberg 120 form?

To complete the Blumberg 120 form, one needs to provide detailed information regarding the judgment, including the index number, court, county of execution, amount due with interest, names and addresses of the judgment debtor and garnishee, and the location of the property to be levied. Additionally, it requires the signature and printed name of the attorney or the judgment creditor authorizing the action. Careful attention to detail and accuracy is paramount to ensure the legality and effectiveness of the execution.

Where can one obtain the Blumberg 120 form?

One can obtain the Blumberg 120 form directly from the BlumbergExcelsior, Inc. website or through legal supply stores that offer Blumberg legal forms. It is important to ensure that the most current version of the form is used to comply with any recent changes in law or procedure. Legal professionals often keep a stock of these forms on hand to expedite the process of executing judgments against property.

Common mistakes

Filling out legal documents can be a daunting task, and the Blumberg 120 form, officially titled "Execution Against Property, To Sheriff, Notice to Garnishee," is no exception. This document plays a crucial role in the process of executing a judgment by allowing creditors to notify garnishees (typically banks or employers) that they are required to seize the debtor's assets or wages to satisfy a debt. Making mistakes on this form can lead to delays, additional expenses, or even the dismissal of the execution attempt. Here are 10 common mistakes to avoid:

- Leaving blanks unfilled: Not completing all the required fields can cause significant delays. Each blank is there for a reason, be it the name of the garnishee or the address of the judgment debtor.

- Incorrect information: Entering incorrect details, such as the wrong index number or court county, can lead to the document being sent to the wrong place or not being processed at all.

- Not providing specific property details: The form requires specific information about the location and nature of the property to be levied. Vague descriptions can invalidate the process.

- Failure to acknowledge exemptions: The form outlines certain exemptions under CPLR § 5205(l) and § 5222(i). Ignoring these exemptions when they apply can lead to legal consequences.

- Inaccurate calculation of exempt amounts: Incorrectly calculating the exempted amount from execution can result in unlawful seizures of property, opening the door to legal challenges.

- Not including interest or fees: Forgetting to add the calculated interest from the judgment date or the sheriff's fees can result in the garnishment amount being lower than what is actually owed.

- Overlooking the endorsement section: Not complying with the requirement to notify about defendants not served can restrict enforcement against certain properties.

- Misidentifying the garnishee: Incorrectly identifying or providing inaccurate information about the garnishee can result in the document being served to the wrong entity.

- Not updating addresses: Using outdated addresses for either the debtor, garnishee, or attorney can prevent the necessary parties from receiving the document.

- Forgetting to sign and date: An unsigned or undated form is not valid in the eyes of the law, making it essential to double-check these elements before submission.

To avoid these common pitfalls, always review the instructions provided with the form carefully, double-check your entries, and consult with a professional if you're unsure about any part of the process. Proper completion of the Blumberg 120 form is key to successfully executing a judgment against a debtor's property.

Documents used along the form

When dealing with the enforcement of judgments and the process of garnishment, the Blumberg 120 form serves as a crucial document to begin the collection from a debtor's assets. However, navigating the legal pathways to satisfy a judgment often requires more than just this single form. Several other documents frequently accompany the Blumberg 120 form, each playing a vital role in ensuring a smooth legal process for the enforcement of judgments.

- Notice of Garnishment: This document is sent to the garnishee, often a bank or employer, to notify them of the legal obligation to withhold assets or earnings from the debtor for the benefit of the creditor. It provides specific details about the garnishment order and the amount to be withheld.

- Judgment Transcription: To enforce a judgment, the creditor needs a transcript of the judgment from the court clerk where the judgment was entered. This official document proves the existence of a valid judgment and is necessary to proceed with enforcement actions in another jurisdiction or to record the judgment with the county to place a lien on property.

- Property Execution Form: Similar to the Blumberg 120, this form is directed towards the sheriff or marshal and authorizes the seizure of property owned by the debtor. It specifies the types of property that can be seized and sold to satisfy the judgment, including vehicles, real estate, and personal belongings.

- Income Execution Form: This legal document is used to garnish wages directly from the debtor’s employer. It outlines the portion of the debtor’s earnings that will be deducted each pay period and transmitted to the creditor until the judgment is satisfied, following state and federal garnishment limits.

Together, these documents form a toolkit for creditors seeking to enforce judgments through the garnishment of wages and seizure of assets. Understanding the purpose and proper use of each can significantly impact the effectiveness of the collection process. Handling these forms with the attention to detail they require ensures that creditors navigate the legal landscape efficiently, maximizing the potential to recover debts owed to them.

Similar forms

The Blumberg 120 form, known as "Execution Against Property, To Sheriff, Notice to Garnishee," is integral in the judicial process, particularly in the execution phase following a judgment. This document shares similarities with a variety of legal forms and notices related to asset seizure, judgment enforcement, and debtor protection laws. Here are nine documents similar to the Blumberg 120 form:

- Writ of Execution: This legal order enforces a judgment obtained by a creditor against a debtor, allowing for the seizure of assets owned by the debtor. Similar to the Blumberg 120 form, it is directed toward law enforcement officers, detailing what assets are to be seized to satisfy a judgment.

- Garnishment Notice: A document that orders a third party, often an employer (for wages) or a bank (for accounts), to withhold assets belonging to the debtor. Like the Blumberg 120, it is a method used by creditors to collect on debts through interception of the debtor’s assets.

- Bank Levy: A legal process through which a creditor instructs a bank to seize funds from a debtor's bank account under a court order. It shares the purpose of the Blumberg 120 form in terms of targeting assets for judgment recovery.

- Notice of Levy: This notice informs the debtor that a levy has been placed on their assets. Similar to the Blumberg 120, it details the action being taken due to a judgment and specifies the assets being targeted, such as bank accounts or other property.

- Order of Attachment: A preliminary legal procedure used to seize a debtor's property while a lawsuit is ongoing, to ensure that the property remains available to satisfy a future judgment. It echoes the preemptive nature of the Blumberg 120 in securing assets before final judgment.

- Turnover Order: A court order requiring the debtor or a third party in possession of the debtor's assets to turn those assets over to a creditor or an officer of the court. It shares similarities with the Blumberg 120 form's goal of transferring assets from the debtor or garnishee to satisfy a creditor’s judgment.

- Property Lien Notice: A legal claim against property as security for the payment of a debt. Although it's generally a passive document in comparison, it shares the Blumberg 120's underlying aim of ensuring debts are paid through the debtor’s existing assets.

- Exemptions Notice: Informs the debtor of their rights to claim certain assets as exempt from seizure under the law. The Blumberg 120 form also makes reference to exemptions, specifically regarding the limits on what can be taken from a debtor's account directly.

- Income Execution Order: A directive to an employer to withhold a portion of the debtor’s earnings to satisfy a judgment. This document aligns with the Blumberg 120 form in its approach to satisfying debts by intercepting assets, though it specifically targets income.

Each of these documents serves a unique role within the broader legal landscape of debt collection and asset protection. However, their purpose aligns closely with that of the Blumberg 120 form: to enforce legal judgments and ensure that creditors can collect what is owed to them, while also respecting legal limits and protections afforded to debtors.

Dos and Don'ts

Filling out the Blumberg 120 form, an execution against property notice, requires careful attention to detail and a good understanding of the instructions. Here’s a compiled list of do's and don'ts to guide you through this process.

Do's:Read the entire form thoroughly before starting to ensure you understand each section.

Use black ink or type when filling out the form to ensure that all information is legible and can be reproduced clearly.

Fill in all the blanks accurately, referring to legal documents for precise information to avoid any mistakes.

Check the exemptions under CPLR § 5205(l) and CPLR § 5222(i) carefully to ensure you are not attempting to levy against exempt assets.

Sign and print your name where indicated to validate the form. An unsigned form may lead to unnecessary delays or be considered invalid.

Make the required number of copies as suggested (original, office copy, copies for debtor and garnishee) to ensure all parties receive the necessary information.

Consult with a legal professional if you encounter any uncertainties while filling out the form to ensure compliance and correctness.

Don’t overlook the specific instructions regarding the service of the document if the officer cannot serve personally.

Don’t guess on any information. If you’re unsure about a detail, verify it with authoritative sources or seek legal advice.

Avoid filling out the form in a rush. Take your time to ensure all information is accurate and complete.

Don’t use pens that bleed through or are not dark enough to be easily copied, as this can cause legibility issues.

Do not leave any blanks unfilled; if a section does not apply, clearly mark it as “N/A” (not applicable) instead of leaving it blank.

Resist the temptation to levy against property that is clearly exempt under the law to avoid legal complications.

Don’t forget to include the date and time when the execution against property was received, as this is crucial for the enforcement process.

Correctly completing the Blumberg 120 form is critical for the enforcement action to proceed without delay. Taking the time to carefully address each section and following these do's and don'ts will help smooth the process.

Misconceptions

Misconception 1: The Blumberg 120 form is outdated and no longer in use. Contrary to this belief, the Blumberg 120 form continues to be a relevant document in legal proceedings involving execution against property. It serves as a critical tool for attorneys and sheriffs in the process of garnishment and asset seizure.

Misconception 2: Anyone can fill out and submit the Blumberg 120 form. In reality, this form requires careful completion by professionals with a comprehensive understanding of the legal process. Attorneys typically manage this task to ensure that all legal requirements are met and to avoid any missteps that could compromise the garnishment process.

Misconception 3: The Blumberg 120 form applies only to bank accounts. While bank accounts can be targeted for garnishment, the scope of this form also extends to other types of property. It encompasses any assets owned by the debtor, including wages and personal property, provided they meet certain conditions outlined by law.

Misconception 4: There are no exemptions to the enforcement of the Blumberg 120 form. This assumption is incorrect. Specific exemptions protect a portion of the debtor's assets from garnishment. For instance, a segment of an account containing direct deposits identified as statutorily exempt payments is safeguarded against execution.

Misconception 5: The form can be applied to the property of any individual related to the debtor. Actually, the enforcement is quite specific. Property solely owned by individuals not named in the summons cannot be levied upon. Jointly owned property, however, may fall within the scope of the garnishment, highlighting the need for precise legal navigation.

Misconception 6: The Blumberg 120 form leads to immediate asset seizure. The process isn't immediate. After the form is filled out and submitted, there are steps, such as notices and potentially hearings, that must be undertaken before any property seizure can occur. This ensures fairness and adherence to legal protocols.

Misconception 7: Filling out the form guarantees the recovery of owed amounts. While the form is a step toward asset recovery, there's no assured outcome. The debtor may not have sufficient recoverable assets, or legal exemptions might significantly reduce the amount that can be seized.

Misconception 8: Digital versions of the form are not legally valid. This is not true. Digital or electronically filed versions of the Blumberg 120 form are acceptable, provided they meet the specific requirements and are filed through appropriate channels. This reflects the legal system's adaptation to modern technology.

Misconception 9: The form can only be served by the sheriff. While the sheriff plays a vital role in the enforcement process, the initial step of serving the form can involve other legal professionals. The form requires meticulous preparation and understanding of whom it should be served to, including the debtor and garnishee, which can be handled by attorneys.

Key takeaways

When dealing with the Blumberg 120 form, used for Execution Against Property, it's crucial to focus on accurate completion and understanding its purpose. It serves as a notice to both the sheriff and garnishee in property execution processes. Here are key takeaways that should be noted:

- Form Introduction: The Blumberg 120 form facilitates the process of execution against property, highlighting the necessary steps to be taken by a sheriff and informing the garnishee—typically a bank or employer—about the proceedings.

- Multiplicity of Copies: It's recommended to prepare multiple copies of the form. Specifically, six blanks are suggested: the original for filing, an office copy for records, and two copies each for the debtor and the garnishee, especially in cases where the officer cannot serve personally.

- Exemptions for Direct Deposits: According to CPLR § 5205(l), a specific exemption applies to accounts receiving direct deposits or electronic payments that can be identified as statutorily exempt. An amount up to $2,625 in such accounts is protected from execution or restraint by the garnishee.

- Earnings Exemption: The form also emphasizes an earnings exemption under CPLR § 5222(i), safeguarding an amount equivalent to or less than 90% of 240 times the federal or state minimum hourly wage, whichever is greater. This protection considers the necessary expenses for the judgment debtor and their dependents.

- Signature and Endorsement: Completing the form requires the attorney's signature, printed name, and a statement of endorsement if certain defendants were not served with a summons, detailing restrictions on execution against their sole property.

- Joint Property Collection: Execution against property can occur from real and personal property owned jointly by the summoned defendant(s) or any of them, emphasizing the collective liability in property owned with others.

- Details Required for Execution: Essential information needed includes the name and address of the garnishee, the judgment debtor, the property's location, and the specific amount for collection by the sheriff, emphasizing the thorough identification of all parties and assets involved.

- Professional Representation: The contact information for the attorney(s) handling the execution must be distinctly provided, ensuring clear communication channels between the sheriff, garnishee, and legal representatives.

Understanding and accurately completing the Blumberg 120 form is essential for the execution process against property, ensuring legal compliance and effectiveness in garnishment procedures. It underscores a balance between the creditor's right to collect and the protection of certain assets for the debtor.

Popular PDF Forms

Police Vehicle Inspection Form Template - Highlighting both the necessity for a clean vehicle interior and the importance of functional safety equipment, this form is comprehensive in scope.

Da 3161 Example - Includes a provision for the end item identification, including manufacturer and model details.