Blank Blumberg T 224 PDF Template

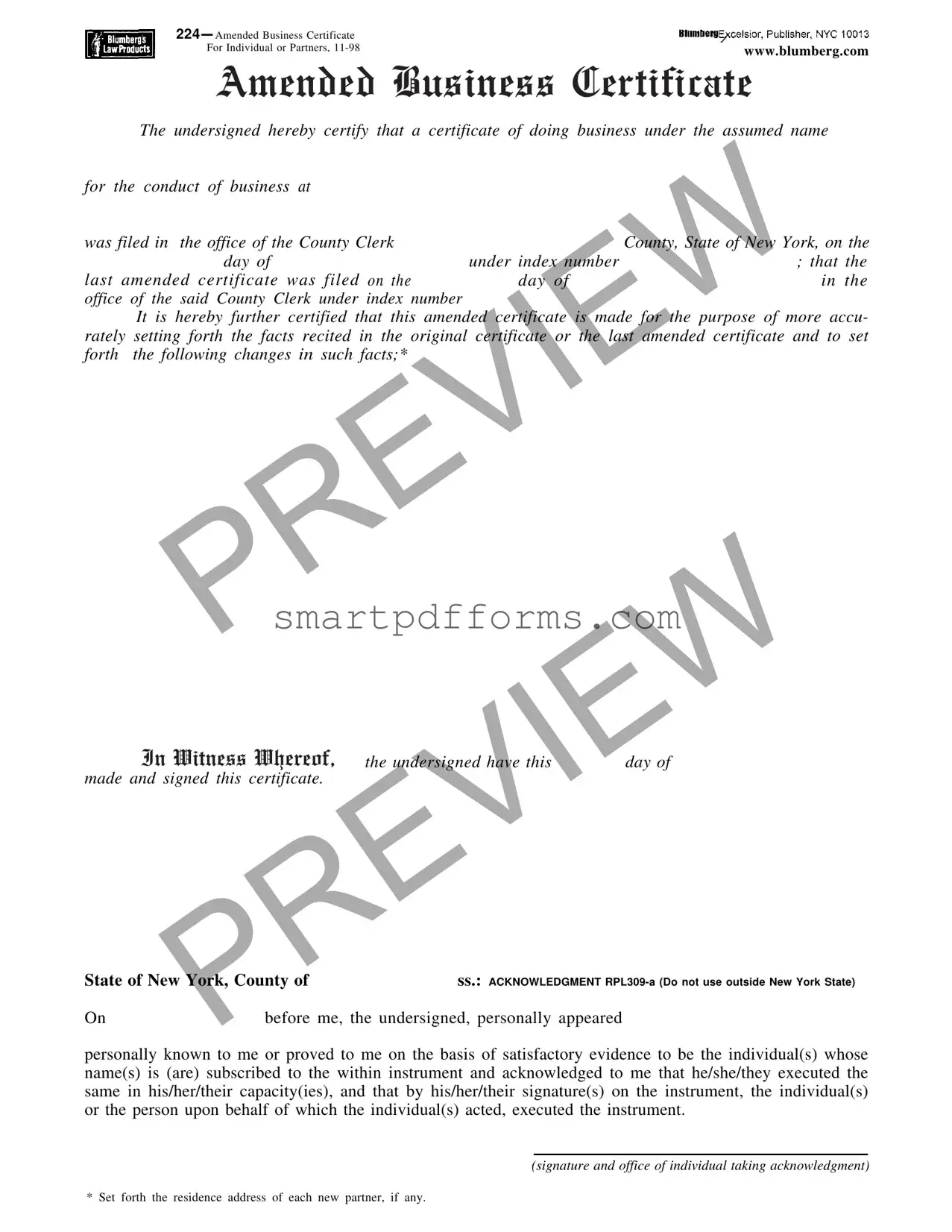

When individuals or partners decide to conduct business under an assumed name in the State of New York, they might encounter the need to amend the business certificate that officially records their business entity's details. This is where the Blumberg T 224 form, an Amended Business Certificate for Individuals or Partners, enters the scene. Initially filed in the office of the County Clerk where the business operates, the original certificate marks the legal acknowledgment of the business's assumed name. However, various situations—ranging from changes in partnership structure, business address adjustments, or the rectification of previously recorded information—necessitate the filing of this amended certificate. The T 224 form serves as a formal declaration of these changes, ensuring that the public record accurately reflects the current status of the business. With sections dedicated to acknowledging the original and any previously amended certificates, detailing the specific alterations being declared, and providing a legal attestation from the signatory or signatories that the information is correct, this document plays a crucial role in maintaining the transparency and integrity of business operations within the state. Its completion is backed by legal acknowledgments, tailored to both in-state and out-of-state filings, underscoring its importance in the legal and operational framework of New York's business environment.

Preview - Blumberg T 224 Form

|

|

For Individual or Partners, |

www.blumberg.com |

|

Amended Business Certificate

The undersigned hereby certify that a certificate of doing business under the assumed name

for the conduct of business at

was filed in |

PREVIEW |

|

|

the office of the County Clerk |

County, State of New York, on the |

||

|

day of |

under index number |

; that the |

last amended certificate was filed on the |

day of |

in the |

|

office of the said County Clerk under index number |

|

||

It is |

hereby further certified that this |

amended certificate is made for the purpose of |

more accu- |

rately setting forth the facts recited in the original certificate or the last amended certificate and to set forth the following changes in such facts;*

personally knownPREVIEWto me or proved to me on the basis of satisfactory evidence to be the individual(s) whose |

|||

|

In Witness Whereof, |

the undersigned have this |

day of |

made and signed this certificate. |

|

|

|

State of New York, County of |

ss.: ACKNOWLEDGMENT |

||

On |

before me, the undersigned, personally appeared |

|

|

name(s) is (are) subscribed to the within instrument and acknowledged to me that he/she/they executed the same in his/her/their capacity(ies), and that by his/her/their signature(s) on the instrument, the individual(s) or the person upon behalf of which the individual(s) acted, executed the instrument.

(signature and office of individual taking acknowledgment)

* Set forth the residence address of each new partner, if any.

ACKNOWLEDGMENT IN NEW YORK STATE (RPL

State of New York |

} |

ss.: |

State of |

} |

ss.: |

||||||

|

|

||||||||||

County of |

|

|

|

County of |

|

||||||

|

|

|

|

|

|

|

|

||||

On |

|

|

before me, the undersigned, |

On |

before me, the undersigned, |

||||||

personally appeared |

|

|

|

personally appeared |

|

|

|||||

personally known to me or proved to me on the basis of satisfac- |

personally known to me or proved to me on the basis of satis- |

||||||||||

tory evidence to be the individual(s) whose name(s) is (are) sub- |

factory evidence to be the individual(s) whose name(s) is (are) |

||||||||||

|

|

|

PREVIEW |

|

|

||||||

scribed to the within instrument and acknowledged to me that |

subscribed to the within instrument and acknowledged to me |

||||||||||

he/she/they executed the same in his/her/their capacity(ies), and |

that he/she/they executed the same in his/her/their capacity(ies), |

||||||||||

that by his/her/their signature(s) on the instrument, the individ- |

and that by his/her/their signature(s) on the instrument, the indi- |

||||||||||

ual(s), or the person upon behalf of which the individual(s) acted, |

vidual(s), or the person upon behalf of which the individual(s) |

||||||||||

executed the instrument. |

|

|

|

acted, executed the instrument, and that such individual made |

|||||||

|

|

|

|

|

|

|

|

such appearance before the undersigned in |

|

|

|

|

|

|

(signature and office of individual taking acknowledgment) |

( insert city or political subdivision and state or county or other place acknowl- |

|||||||

|

|

|

|

|

|

|

|

edgment taken) |

|

|

|

|

|

|

|

|

|

|

|

|

(signature and office of individual taking acknowledgment) |

||

|

|

Certificate |

|

BUSINESS UNDER |

NAME OF |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

Amended |

PREVIEW |

|

|

||||||

. |

|

|

|

|

|

|

|

|

|

|

|

O |

|

|

|

|

|

|

|

|

|

|

|

N |

|

|

|

|

|

|

|

|

|

|

|

INDEX |

|

|

|

|

|

|

|

|

|

|

|

Form Data

| Fact | Detail |

|---|---|

| Form Name | Blumberg T 224 - Amended Business Certificate for Individual or Partners |

| Purpose | To accurately amend details in the original or last amended business certificate. |

| Relevance | Applicable specifically within the State of New York. |

| Governing Laws | Under the New York State Real Property Law (RPL) 309-A for acknowledgments within New York State and RPL 309-B for acknowledgments outside New York State. |

| Filing Requirement | Required to be filed in the office of the County Clerk in the county where the business is located. |

| Key Component | Includes setting forth the changes in facts from the original or last amended certificate and may include adding new partners with their residence addresses. |

Instructions on Utilizing Blumberg T 224

Filling out the Blumberg T 224 form is a critical step for individuals or partners who need to amend their business certificate in the State of New York. This form allows you to accurately update the original or last amended certificate with new details. The process is straightforward but requires attention to detail to ensure the accuracy of the information provided. Follow these steps to accurately complete the Blumberg T 224 form.

- Identify the county in which the original certificate of doing business under the assumed name was filed. Write this information in the space provided for "County, State of New York."

- Enter the date on which the original certificate was filed in the designated space.

- Provide the index number assigned to the original certificate in the appropriate field.

- If applicable, indicate the date the last amended certificate was filed and its corresponding index number in the relevant sections.

- In the section designated for changes, clearly describe the adjustments or updates you're making to the original certificate's facts. This could involve setting forth new facts or correcting previously submitted information.

- Include the residence address of each new partner if the amendment involves adding partners to the business.

- Sign and date the certificate on the provided lines to officially make the amendment request.

- For the acknowledgment section within New York State (RPL 309-A), ensure the form is signed by a notary or authorized official who can attest to the identity of the signee(s) and their capacity to execute the document. Include the date of acknowledgment and the official’s signature and title.

- If the acknowledgment needs to be performed outside of New York State, use the RPL 309-B section and follow similar steps for acknowledgment as mentioned above, making sure to specify the city, political subdivision, and state or county where the acknowledgment is taken.

Once completed, the form should be filed with the county clerk's office where the original certificate was filed. This filing will formalize the amendments. Remember to keep a copy for your records and verify with the county clerk’s office if any additional steps or fees are required to process your amendment successfully.

Obtain Answers on Blumberg T 224

- What is the Blumberg T 224 form used for?

- Where should the Blumberg T 224 form be filed?

- How can one obtain a Blumberg T 224 form?

- What information is needed to complete the Blumberg T 224 form?

- Is there an acknowledgment section in the form for filings outside of New York State?

The Blumberg T 224 form, also known as the Amended Business Certificate for Individuals or Partners, serves a very specific purpose. When an existing business operating under an assumed name in New York State needs to update or correct information previously submitted, this form must be filled out and submitted. The amendment may involve changing the business address, adding or removing partners, or correcting any previously inaccurate information. It ensures that the public record reflects the current and correct details about the business.

This form should be filed with the County Clerk's Office in the county where the original business certificate was submitted. Since business certificates are a matter of local jurisdiction, submitting the amendment to the correct county clerk is critical for it to be recognized and processed appropriately.

The Blumberg T 224 form can be obtained directly from the Blumberg website at www.blumberg.com. Additionally, it may be available at some legal supply stores or from the County Clerk’s office where one intends to file the document. Downloading it directly from the official source ensures you have the most current version of the form.

Completing the Blumberg T 224 form requires specific information regarding both the original and the last amended certificate, if applicable. Essential details include the index number of the original certificate, the date it was filed, and similar information for the last amendment filed, if any. Furthermore, it's important to accurately describe the changes being made to the business certificate. For new partners, including their residence address is required. Lastly, the form must be signed by the individuals involved, in the presence of a notary public for acknowledgment.

Yes, the Blumberg T 224 form includes specific acknowledgment sections tailored for both filings within New York State (RPL 309-A) and those outside of New York State (RPL 309-B). This ensures that the form accommodates the legal requirements for acknowledging documents, depending on where the notarization takes place. It highlights the flexibility of the form to be used by businesses that might be operating or expanding beyond New York but still need to file changes to their business certificate within the state.

Common mistakes

Not updating the business address: Failing to accurately update the business address causes confusion and may lead to legal complications.

Inaccurate filing dates: Entering incorrect dates for the original or last amended certificate filing can invalidate the document.

Omitting new partner details: Neglecting to set forth the residence address of each new partner, as required, can lead to issues with the business’s legal standing.

Misidentifying the type of amendment: Not specifying or misidentifying the reason for the amendment leads to ambiguity about the changes made.

Improper acknowledgment: Failing to execute the acknowledgment properly, whether in New York State (RPL 309-A) or outside it (RPL 309-B), can render the filing invalid.

Incorrect index number: Using an incorrect index number for the original or last amended certificate creates filing discrepancies.

Forgetting to sign: Not having the required signature(s) on the instrument means the certificate might not be legally binding.

Ignoring county clerk details: Leaving out or inaccurately filling in the office of the county clerk where the amendment is filed can lead to processing delays or rejections.

It is crucial to complete the Blumberg T 224 form with accurate and complete information to ensure that the amended business certificate accurately reflects the current status and details of the business. Addressing these common mistakes can save time, avoid legal issues, and ensure that business operations comply with state requirements.

Documents used along the form

When handling business documentation, especially in the state of New York, the use of the Blumberg T 224 form, or the Amended Business Certificate for Individuals or Partners, is a critical step for individuals seeking to update their business certificate. This form is often accompanied by a series of other important documents to ensure comprehensive and compliant business filings. Below is a list of common documents used in conjunction with the Blumberg T 224 form.

- Original Business Certificate: This is the initial certificate filed when a new business name is established or when a business begins operations under an assumed name. It serves as the foundational document to which the amended certificate makes changes.

- Articles of Organization: For LLCs, this document outlines the basic structure of the company, including its name, purpose, and the information regarding its members or managers. It’s foundational for establishing the business with the state.

- Operating Agreement: Often used alongside the Articles of Organization, this document details the operational procedures, financial decisions, and ownership percentages of the business. It's crucial for managing internal affairs.

- Partnership Agreement: For businesses operated by multiple individuals or entities, this agreement outlines the responsibilities, profit distribution, and operational roles of each partner. It's vital for clarity and dispute resolution.

- DBA (Doing Business As) Registration: For businesses operating under a name different from their legal name, this registration allows for the public acknowledgment of the assumed name.

- Business Licenses and Permits: Depending on the industry and location, additional licenses or permits may be required to legally operate the business. These documents are complementary to the business certificate.

- Certificate of Good Standing: This document proves that a company is legally allowed to do business in the state and has complied with all necessary filings and fees. It is often required for financial transactions or contracts.

Together with the Blumberg T 224 form, these documents form a comprehensive package required for properly managing and operating a business. Each document serves a distinct purpose, from establishing the business’s legal framework to ensuring compliant operations. To ensure accuracy and compliance, individuals may seek professional guidance when preparing and filing these documents.

Similar forms

The Original Business Certificate for Individuals or Partners form is closely related to the Blumberg T 224 form. Both documents are used by individuals or partnerships to officially record the operation of a business under an assumed name, often referred to as a "doing business as" (DBA) name, with the major difference being that the T 224 form is used to amend previously filed information.

The Change of Business Address Form shares similarities with the T 224, especially when the amendment involves updating the business location. While dedicated specifically to address changes, the underlying purpose of updating business records aligns closely with one of the T 224's functions.

A Partnership Amendment Form is another document similar to the T 224 form. It's designed for partnerships that need to officially document changes such as partner departures, new partners joining, or changes in profit sharing ratios, echoing the amendment functions of the T 224 regarding partnership details.

The Business Name Change Form is related to the T 224 in the context of amending the assumed business name. While the specific document may focus exclusively on the name change aspect, it shares the goal of updating official records to reflect current business operations.

Certificate of Discontinuance of Certain Businesses Form can be seen as a counterpart in certain situations where a business is ceasing operations under an assumed name, or when specific partnerships are dissolved, contrasting with the T 224's role in updating existing records for continuing operations.

A New Business Certificate for Individuals or Partners shares its foundational use with the T 224 by establishing a legal record of a business's assumed name. Whereas the new business certificate initiates this process, the T 224 is utilized for subsequent changes.

The LLC Operating Agreement Amendment Form parallels the T 224 when an LLC needs to make official changes to its operating agreement, which may include shifting member responsibilities or adjusting ownership structure, underscoring the broader theme of documenting updates to business operations.

Finally, the Corporate Bylaws Amendment Form relates to the T 224 in the corporate realm, where changes to a corporation's bylaws are made. Similar to how the T 224 amends information for sole proprietors or partnerships, this form serves to officially record updates within a corporate structure.

Dos and Don'ts

Filling out the Blumberg T 224 form, an Amended Business Certificate for Individuals or Partners, is a crucial step for business owners looking to update their business details in the state of New York. Approaching this document with the right knowledge and care ensures the process is smooth and the submitted information is accurate. Here are some dos and don'ts to consider when completing this form:

- Do read through the entire form before starting to fill it out to understand all the requirements and the information you need to provide.

- Do ensure that the information you're amending matches the original or last amended certificate accurately excluding the changes you're making.

- Do set forth the residence address of each new partner, if applicable, as required by the form.

- Do double-check the accuracy of all dates, including when the original certificate was filed and when any previous amendments were made.

- Do have the form notarized, as acknowledgment by a notary public is a critical step for the form's validation.

- Don't use the form outside New York State, as it's specifically designed for amendments within this jurisdiction.

- Don't leave blank spaces for important information; make sure every relevant section is completed to avoid the form being rejected.

- Don't sign the form without ensuring all entered information is correct and all necessary changes have been clearly listed.

- Don't forget to include the index numbers of the original and last amended certificates to ensure continuity and reference for the county clerk.

By following these guidelines carefully, you can complete the Blumberg T 224 form efficiently and correctly, aiding in the smooth continuation of your business operations under its assumed name or with new partners. Always consider seeking advice from a professional if you're unsure about any details related to your amended business certificate.

Misconceptions

Understanding legal documents is crucial for businesses and individuals alike. The Blumberg T 224 form, officially known as the Amended Business Certificate for Individuals or Partners, is a crucial document for those conducting business under an assumed name in New York. However, there are several misconceptions about this form that need clarification. Here, we demystify the most common misunderstandings.

It's only for corporations: One common misconception is that the T 224 form is solely for use by corporations. In reality, this form is designated for individuals or partnerships amending a previously filed business certificate. It is not limited to corporations but is also applicable to sole proprietors and partnerships needing to amend their business details.

It serves as a business license: Another misunderstanding is that filing the T 224 form acts as a form of business licensing. However, this form is an amendment certificate, used to update information about a business already operating under an assumed name. It does not serve as a license to commence or continue business operations.

Filing is optional: Many believe that filing amendments via the T 224 form is optional. However, to maintain accurate and current records with the County Clerk's office in New York, any changes to the business as outlined in the original or last amended certificate must be officially updated with this form. It's a legal requirement for ensuring public and governmental transparency.

There's no need for legal acknowledgment: A significant misconception is that the form does not require notarization or legal acknowledgment. Contrarily, the form must be signed in the presence of a notary or similar authority who confirms the identity of the signee and their understanding and intent in executing the document.

It's only applicable in New York City: The reach of the T 224 form is often underestimated, with some assuming it's only relevant in New York City. This document is applicable throughout New York State, including all counties, not just within the city's jurisdiction.

It can be used for name changes: There's a confusion that the T 224 form can be used to change the name of the business. While it is used to amend certain information, a name change typically requires a new business certificate, not just an amendment of the existing one.

Every partner needs to sign: While the form does include provision for partnership amendments, there is a misconception that every partner must sign the form. However, the form only requires the signature of the partner(s) executing the amendment, provided that they have the authority to do so on behalf of the partnership.

Immediate processing: Lastly, there is a belief that once submitted, the T 224 form is processed immediately. Processing times can vary based on the county and the current workload of the clerk's office. Patience and sometimes follow-up may be necessary to ensure the amendment is recorded.

Clarifying these misconceptions is crucial for individuals and partnerships to navigate their legal obligations accurately. The Blumberg T 224 form is an essential document for maintaining the integrity and legality of business operations under an assumed name in New York. Understanding its purpose, requirements, and the process is vital for compliant business practices.

Key takeaways

When filling out and using the Blumberg T 224 form, individuals or partnerships looking to amend a business certificate in New York should carefully consider the following key takeaways:

- Ensure that all parties involved are accurately named and that their roles are clearly identified. This enhances clarity and legal compliance.

- The original filing date with the county clerk and the index number of the initial business certificate need to be clearly mentioned. This helps in tracing the original documentation and establishing continuity.

- If any amendments were previously made, the details of the last amended certificate, including its filing date and index number, must be included. This information is crucial for a comprehensive understanding of the business's legal history.

- The form is specifically designed to make amendments to more accurately present facts or introduce changes from the original or last amended certificate. Specific changes need to be explicitly stated for legal accuracy and integrity.

- Signatories need to provide their residence addresses, especially if new partners are being included in the amendment. This requirement ensures accountability and transparency.

- The acknowledgment section is vital and must be duly signed in the presence of a notary to verify the identity of the signatories and their understanding and agreement to the amendments. There are separate acknowledgment sections for within New York State (RPL 309-A) and outside New York State (RPL 309-B), ensuring proper legal procedures are followed depending on the jurisdiction of acknowledgment.

Attention to detail and adherence to procedural requirements are key when amending a business certificate using the Blumberg T 224 form. Properly documenting changes ensures legal compliance and secures the integrity of the business’s legal documents.

Popular PDF Forms

Car Fax Free - Provide comprehensive subscriber information, including your contact details and CARFAX Account number, for a streamlined correction process.

Section 245 of Income Tax Act - The form requires taxpayer identification details, including name, address, and identification number.