Blank Bmo Deposit PDF Template

In today's fast-paced business world, managing financial transactions with accuracy and efficiency is crucial for success. The BMO Electronic Business Account Deposit Slip plays a fundamental role in streamlining deposit processes for businesses, ensuring that deposits made at branches and ATMs are handled promptly and correctly. This form, specifically designed for BMO's business customers, encompasses various features aimed at simplifying banking transactions. Key elements of the form include spaces for the account name, date, transit and account number, which are crucial for identifying the destination of the funds. The form is meticulously designed to accommodate the details of checks, cash, and coins, along with a section for MasterCard deposits, reflecting the diverse nature of modern banking transactions. An essential precaution outlined is the requirement for the deposit slip to be complete; otherwise, it risks not being processed. Additionally, the form supports BMO’s Around the Clock Deposit service but necessitates careful adherence to guidelines, such as proper completion and physical preparation of the slip. Instructions for filling out the form are clear, directing users to enter specific information about checks—including the identification and total number—and to accurately tally cash and coins to ensure the form’s automatic calculation functions perform correctly. The necessity of printing and initialing copies of the completed deposit slip underscores the importance of maintaining a record of the transaction for both the depositor and the bank. This procedural care fortifies the security and accuracy of deposits, marking the BMO deposit slip as an indispensable tool for businesses in managing their day-to-day financial transactions.

Preview - Bmo Deposit Form

BMO electronic Business Account Deposit Slip is for deposits made at branches and ATMs. Incomplete deposit slips can result in deposits not being processed.

IMPORTANT:

If this deposit slip is used for Around the Clock Deposit service:

•It must contain the Name of Account, Date, and Transit and Account Number and be completed, as indicated below.

•Once completed and printed, the deposit slip must be cut to the size indicated on the form, before depositing in the Around the Clock Depository.

How to complete your electronic Business Account Deposit Slip:

1.Complete ALL mandatory fields on the top left and right sides of Deposit Slip:

•Name of Account

•Date

•Transit and Account Number

2.On the left side of the Deposit Slip, complete:

•The Cheque Identification (i.e. Name on Cheque and/or Cheque Number) with corresponding dollar amount

•Enter the total number of cheques listed on the deposit slip in the “# of Cheques field”

3.On the right side of the Deposit Slip, add the total amount of Cash, Coins, and MasterCard as it appears in the deposit

Note: The form will automatically calculate Subtotal and Total fields.

4.Print copies of the completed Deposit Slip, one for your records and one

to be submitted with the deposit. Initial both copies of the Deposit Slip in the Depositor’s box located at the top right corner.

163104 (01/16) 21/04/2016 4:29 pm

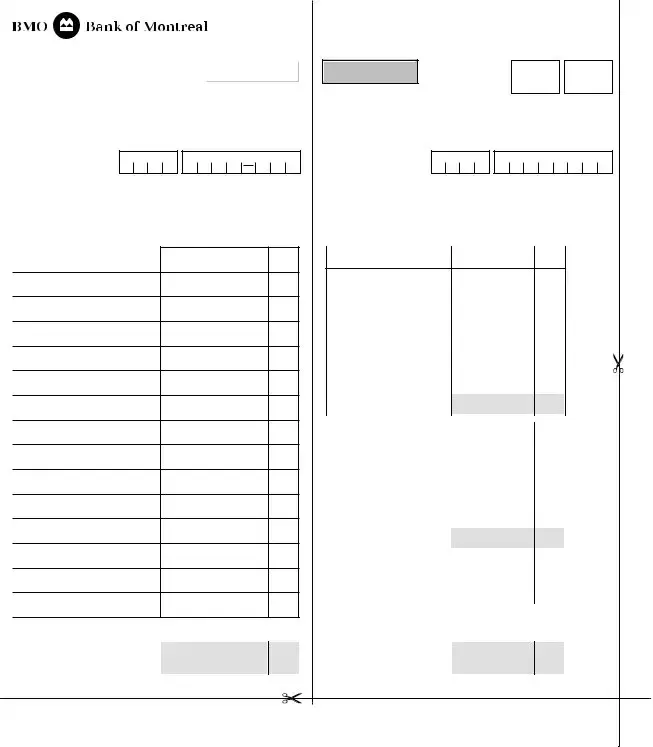

BUSINESS ACCOUNT DEPOSIT SLIP

|

|

Reset form |

NAME OF |

|

|

ACCOUNT |

|

|

DATE |

TRANSIT NO. ACCOUNT NO. |

|

Print Form

CREDIT

DATE

INITIALS

DEPOSITOR’S

TRANSIT NO. ACCOUNT NO.

TELLER’S

DD MMM YYYY

DD / MMM / YYYY

LIST OF CHEQUES

PLEASE LIST FOREIGN CHEQUES ON SEPARATE DEPOSIT SLIP

CHEQUE IDENTIFICATION |

AMOUNT |

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

# OF CHEQUES |

TOTAL |

$ |

0.00 |

0 |

DEPOSITED |

||

|

CHEQUES |

|

163104 (01/16) 21/04/2016 4:29 pm

DD MMM YYYY

DD / MMM / YYYY

CASH COUNT |

AMOUNT |

|

|

X 5 |

0.00 |

|

|

|

X 10 |

|

0.00 |

|

|

|

|

|

|

|

|

|

X 20 |

|

0.00 |

|

|

|

X 50 |

|

0.00 |

|

|

|

X 100 |

|

0.00 |

|

|

|

X |

|

0.00 |

|

|

|

X |

|

0.00 |

|

TOTAL CASH |

|

$ |

0.00 |

|

|

(NOTES) DEPOSITED |

||||

|

|

|

|

|

|

|

|

|

X $1 COIN |

|

0.00 |

|

|

|

X $2 COIN |

|

0.00 |

|

|

|

X |

|

0.00 |

|

|

|

X |

|

0.00 |

|

|

|

Loose Coin |

|

|

|

|

|

|

|

|

|

DEPOSITED |

|

$ |

0.00 |

|

|

TOTAL COIN |

|

|

|

|

|

MASTERCARD |

|

$ |

|

|

|

|

|

|

|

|

|

# OF |

|

TOTAL |

|

0.00 |

|

CHEQUES |

|

CHEQUES |

$ |

|

|

0 |

|

DEPOSITED |

|

|

|

|

|

|

|

|

|

TOTAL |

|

$ |

0.00 |

|

|

CHEQUES |

|

|||

|

DEPOSITED |

|

|

|

|

|

1 - Branch Copy |

|

2 - Customer Copy |

||

Form Data

| Fact Number | Fact Detail |

|---|---|

| 1 | The BMO electronic Business Account Deposit Slip is designed for use at both branches and ATMs. |

| 2 | Incomplete deposit slips may cause processing delays or result in deposits not being processed. |

| 3 | For the Around the Clock Deposit service, the deposit slip must include the Name of Account, Date, and both the Transit and Account Number. |

| 4 | The filled and printed deposit slip has to be cut to the size indicated on the form before depositing in the Around the Clock Depository. |

| 5 | It's mandatory to complete all fields on the top left and right sides of the Deposit Slip, including Name of Account, Date, Transit Number, and Account Number. |

| 6 | On the left side of the Deposit Slip, the Cheque Identification (Name on Cheque and/or Cheque Number) and corresponding dollar amount need to be filled out. |

| 7 | The right side of the Deposit Slip is designated for the total amount of Cash, Coins, and MasterCard entered. |

| 8 | The form automatically calculates the Subtotal and Total fields based on the entered amounts. |

| 9 | Depositors are required to print and initial two copies of the completed Deposit Slip: one for branch submission and one for their records. |

| 10 | Governing laws for the BMO Deposit form may vary by state, emphasizing the importance of checking state-specific requirements and laws. |

Instructions on Utilizing Bmo Deposit

When preparing to make a deposit into your business account at BMO, using the electronic Business Account Deposit Slip is a crucial step for ensuring your funds are correctly credited. This process involves filling out the slip thoroughly, covering all mandatory fields to avoid any processing delays. Whether you're depositing checks at a branch, via an ATM, or through the Around the Clock Deposit service, accuracy and completeness are vital. Here's how to accurately complete your deposit slip for a smooth transaction:

- Start by filling out all mandatory fields on the top left and right sides of the Deposit Slip. These include:

- Name of Account

- Date

- Transit and Account Number

- On the left side of the Deposit Slip, provide details for:

- The Cheque Identification, including Name on Cheque and/or Cheque Number, along with the corresponding dollar amount.

- Enter the total number of cheques you're depositing in the “# of Cheques field”.

- Move to the right side of the Deposit Slip to add the total amount of Cash, Coins, and MasterCard transactions, if applicable. This portion of the form will calculate Subtotal and Total fields automatically.

- Print two copies of the completed Deposit Slip. Keep one for your records and submit the other with your deposit. Don't forget to initial both copies in the Depositor’s box located at the top right corner.

Once completed, ensure that the deposit slip is cut to size if using the Around the Clock Depository service. Attention to detail is key to ensure that your deposit goes through without any hitches, keeping your business operations running smoothly.

Obtain Answers on Bmo Deposit

What is the BMO electronic Business Account Deposit Slip used for?

This deposit slip is designed for business account holders at BMO to make deposits at branches and ATMs more efficiently. It ensures that all necessary details about the deposit are captured correctly, which includes information about checks (cheques), cash, and coins. It is vital to use this form to expedite the processing of your deposits and avoid any processing delays due to incomplete information.

How do I correctly fill out the BMO Deposit Slip?

To fill out the deposit slip accurately, begin by completing all mandatory fields, which include the Account Name, Date, Transit Number, and Account Number, located at the top left and right sides of the deposit slip. On the left side, list each cheque with the payee’s name and/or cheque number and the corresponding amount. Enter the total number of cheques in the provided field. On the right side, add the total amounts of Cash, Coins, and MasterCard payments, if applicable. The form's automated feature will calculate the Subtotal and Total fields for you.

Is it necessary to print and initial the deposit slip?

Yes, after completing the deposit slip, you should print two copies. One copy is for your records, and the other should accompany your deposit. It is important to initial both copies in the Depositor’s box at the top right corner of the deposit slip. This serves as a confirmation that you have reviewed and verified the details of the deposit.

What should I do with the deposit slip for the Around the Clock Deposit service?

For those utilizing BMO's Around the Clock Deposit service, it is crucial to ensure that the deposit slip is filled out with the Account Name, Date, and Transit and Account Numbers. After completing and printing, you must cut the deposit slip to the size indicated on the form before depositing it into the Around the Clock Depository. This extra step is required to fit the deposit slot dimensions and ensure the deposit is processed correctly.

What happens if I don't complete the deposit slip correctly?

Incomplete deposit slips may cause deposits not to be processed as intended. Ensuring that all sections of the deposit slip are correctly filled out, including the details of checks, cash, and coins, helps avoid processing delays. It's also a good practice to double-check the deposit slip for accuracy before printing and submitting it with your deposit.

Can I list foreign cheques on the BMO Business Account Deposit Slip?

No, foreign cheques require a separate deposit slip. The BMO Business Account Deposit Slip is only intended for local currency (CAD) transactions. If you have foreign cheques to deposit, please ask for or download the correct deposit slip form specifically designed for foreign cheques to ensure accurate processing of your deposit.

Where can I find the BMO Business Account Deposit Slip form?

The BMO Business Account Deposit Slip can be accessed online through the BMO website or obtained at a local BMO branch. For digital access, navigate to the banking resources or forms section of the BMO website. Alternatively, visiting your nearest BMO branch allows you to pick up physical copies and possibly receive assistance or answers to any questions you might have about completing the deposit slip correctly.

Common mistakes

When filling out a BMO electronic Business Account Deposit Slip, attention to detail matters a lot. Mistakes can lead to delays or errors in processing your deposit. Let’s talk about eight common mistakes people make and how to avoid them.

Not completing all mandatory fields on both the top left and right sides of the Deposit Slip. These fields include the Name of Account, Date, Transit, and Account Number. This information is crucial for correctly associating the deposit with the right account.

Forgetting to list the cheque identification. This includes the name on the cheque and/or the cheque number, along with the corresponding dollar amount. Accurate identification ensures each cheque is accounted for correctly.

Omitting the total number of cheques deposited in the “# of Cheques” field. This overview helps verify that all cheques have been processed as intended.

Incorrectly adding the total amount of cash, coins, and MasterCard deposits on the right side of the Deposit Slip. Precise amounts are necessary for the form to automatically calculate the Subtotal and Total fields correctly.

Not initialing both copies of the Deposit Slip in the Depositor’s box at the top right corner. This step is required for the validation of the deposit slip.

Printing issues: Not printing the completed Deposit Slip or printing it in a non-legible way. Ensure you have a clear printout, one to keep for your records and one to submit with the deposit.

Failing to cut the deposit slip to the size indicated on the form when using the Around the Clock Deposit service. Proper size is necessary for the machines to accept and process the deposit slip.

Leaving the deposit slip incomplete when using it for the Around the Clock Deposit service. It is essential to ensure that the Name of Account, Date, Transit, and Account Number are correctly filled out for processing.

Avoid these common mistakes by carefully reviewing your BMO electronic Business Account Deposit Slip before submission. Correct and complete entries will help ensure your deposit is processed smoothly and swiftly.

Documents used along the form

When managing business finances, the BMO electronic Business Account Deposit Slip is a crucial document for efficiently handling deposits at branches and ATMs. However, several other documents also play vital roles in ensuring smooth financial operations and record-keeping. These documents often accompany the deposit slip for a variety of reasons, including verification, reconciliation, and accounting purposes.

- Endorsement Stamp: This is a tool rather than a document, but it's used to endorse checks for deposit. The stamp includes the business name, account number, and a statement of endorsement. This streamlines the process of preparing checks for deposit, especially for businesses that process numerous checks.

- Bank Reconciliation Statements: After depositing, businesses use bank reconciliation statements to match their internal financial records with the bank’s records. This document helps in identifying any discrepancies or unauthorized transactions early.

- Deposit Verification Letter: Some businesses require a deposit verification letter from the bank, confirming the details of the deposited amount. This can be used for internal auditing and accounting verification purposes.

- Receipt Acknowledgement Form: When deposits are made, many businesses collect a receipt acknowledgement form from the bank. This serves as proof of deposit until the transaction is reflected in the business’s bank statement.

- Transaction Journal or Ledger Entry: After completing the deposit, businesses should update their financial ledgers or journals. This entry includes the date, amount, and nature of the deposit, maintaining an accurate and up-to-date financial record.

In conclusion, while the BMO electronic Business Account Deposit Slip is indispensable for making deposits, pairing it with relevant supporting documents such as acknowledgment forms, reconciliation statements, and the use of an endorsement stamp, ensures meticulous financial management. These documents collectively support the auditing process, improve accuracy, and provide legal proof of transactions, thereby amplifying the efficiency and security of financial operations within a business.

Similar forms

A Personal Checking Account Deposit Slip - Similar to the BMO electronic Business Account Deposit Slip, this slip is used by individuals to deposit money into their personal checking accounts. Both require the depositor to fill out details such as the account number and the amount being deposited, whether in cash or checks. However, the personal deposit slip may have less emphasis on business-related information like the name on the cheque.

A Bank Savings Account Deposit Slip - This slip is used for depositing funds into a savings account instead of a business account. Like the BMO Deposit Slip, it needs the depositor to list down the amount of money, differentiate between cash and checks, and include account details. The main difference lies in the type of account the funds are deposited into.

A Night Deposit Bag Slip - Many businesses use night deposit services to drop off their day's takings after hours. The slip accompanying the night deposit bag shares characteristics with the BMO Deposit Slip, such as needing account information and the deposit's total amount. The difference is in its use during non-operational hours and increased security measures.

A Wire Transfer Request Form - While primarily for electronic transfers, this form is similar to the deposit slip in that it requires detailed account information, including the account number and name. However, instead of detailing cash or checks, it will ask for the recipient's banking information and the transfer amount.

A Direct Deposit Enrollment Form - This form is used to set up automatic deposits into an account from an employer or other payer. Like the BMO Business Account Deposit Slip, it requires the account name, number, and financial institution details. The difference is that it's used for ongoing transactions rather than a one-time deposit.

A Foreign Currency Deposit Slip - Designed specifically for depositing funds in a currency other than the domestic currency of the account. This slip resembles the BMO Deposit Slip as it necessitates the completion of account information, the amount being deposited, and distinguishes the form of deposit (cash, checks). The key distinction is its focus on foreign currency conversions.

Dos and Don'ts

When filling out the BMO (Bank of Montreal) electronic Business Account Deposit Slip, it's important to follow specific steps and avoid common mistakes to ensure your deposit is processed smoothly. Below is a comprehensive list of dos and don'ts:

- Do ensure that all mandatory fields are completed on both the top left and right sides of the Deposit Slip, including the Name of Account, Date, and Transit and Account Number.

- Don't leave any mandatory fields blank, as this could result in your deposit not being processed.

- Do carefully list the Cheque Identification, such as Name on Cheque and/or Cheque Number, along with the corresponding dollar amount on the left side of the Deposit Slip.

- Don't approximate or misstate the total number of cheques or the total amounts, as accuracy is crucial for the correct processing of your deposit.

- Do add the total amount of Cash, Coins, and MasterCard deposits on the right side of the Deposit Slip as required.

- Don't forget to print copies of the completed Deposit Slip; one for your records and another to be submitted with the deposit.

- Do initial both copies of the Deposit Slip in the Depositor’s box located at the top right corner to authenticate them.

- Don't ignore the instruction to cut the Deposit Slip to size if you're using the Around the Clock Depository service. This ensures your slip fits the depository slot.

- Do list foreign cheques on a separate deposit slip, as mixing them with domestic transactions can complicate processing.

By following these guidelines, you can help ensure your bank deposits through BMO are handled efficiently and with minimal chance of error. Remember, paying attention to the details can save you time and potential headaches in managing your business's financial transactions.

Misconceptions

When dealing with the BMO electronic Business Account Deposit Slip, various misunderstandings can arise, causing confusion and potentially errors in processing deposits. Below are eight common misconceptions clarified to ensure accurate and efficient use of this financial tool.

- Filling out the deposit slip is optional. A widespread misunderstanding is that completing the deposit slip is not mandatory for all types of deposits. In truth, to ensure the deposit is processed correctly, all sections of the deposit slip should be filled out, especially when utilizing services like the Around the Clock Deposit.

- It's acceptable to submit incomplete forms. Some might believe that partially completed forms will still be processed. However, incomplete deposit slips can lead to deposits not being processed at all, highlighting the importance of thoroughness when completing the form.

- Electronic and paper forms are processed the same way. While both electronic and paper forms serve the same purpose, the electronic Business Account Deposit Slip, when used for the Around the Clock Deposit service, requires cutting to size after printing. This unique requirement underscores the slight differences in handling between the two formats.

- Account information isn’t vital if the deposit slip is filled. Despite filling out the deposit details, neglecting to include the Name of Account, Date, Transit, and Account Number can result in processing failures. This data is crucial for identifying and crediting the correct account.

- The form doesn’t calculate totals. Contrary to this belief, the form is designed to automatically calculate the Subtotal and Total fields once the depositor inputs the individual amounts for checks, cash, coins, and MasterCard deposits. This feature aids in minimizing manual calculation errors.

- One copy of the completed form is sufficient. Depositors often think one copy of their completed form is enough. Yet, printing and initialing two copies—one for personal records and one for submission with the deposit—is necessary to ensure a verifiable transaction for both the bank and the depositor.

- Any size paper is acceptable for the deposit slip. When using the deposit slip for the Around the Clock Deposit service, it's crucial to cut the printed form to the indicated size. This requirement ensures the deposit slip fits properly into the depository, a detail that might be overlooked if assuming any paper size works.

- Listing cheques on the deposit slip is unnecessary. There's a misconception that cheques can be deposited without individual listing on the slip. In reality, the Cheque Identification section, including name on cheque and/or cheque number with corresponding dollar amount, must be completed for accurate and efficient processing, highlighting the importance of detail in financial transactions.

Clarifying these misconceptions about the BMO electronic Business Account Deposit Slip is key to avoiding processing delays and ensuring that financial transactions are conducted smoothly. Attending to the specific requirements and accurately completing the form are critical steps in this process.

Key takeaways

When using the BMO electronic Business Account Deposit Slip for branching and ATM deposits, here are 10 key takeaways to ensure a smooth experience:

- Complete all mandatory fields on the deposit slip accurately to avoid any processing delays. These fields include the Account Name, Date, Transit, and Account Number.

- For the Around the Clock Deposit service, ensure the deposit slip is fully completed with the required details and is cut to the specified size before depositing.

- On the left side of the Deposit Slip, list each cheque by providing the Name on the Check or Check Number with the corresponding dollar amount.

- Enter the total number of checks in the “# of Cheques field” to help keep your records organized and ensure all cheques are accounted for.

- On the right side of the Deposit Slip, specify the total amounts of Cash, Coins, and MasterCard separately. The form is designed to calculate Subtotal and Total fields automatically.

- Print two copies of the completed Deposit Slip—one for your records and one to accompany your deposit—to ensure you have a backup for your records.

- Both copies of the Deposit Slip should be initialed in the Depositor’s box located at the top right corner to authenticate them.

- Remember to list foreign cheques on a separate deposit slip to ensure they are processed correctly.

- The Deposit Slip form includes a section for counting cash notes and coins, helping you summarize the total cash and coin deposit precisely.

- The slip is divided into two parts labeled “1 - Branch Copy” and “2 - Customer Copy." Make sure the branch copy is submitted with the deposit, and retain the customer copy for your records.

In summary, correctly and completely filling out the BMO electronic Business Account Deposit Slip is crucial for ensuring that your deposits are processed smoothly and without delay. Taking the time to double-check the details and retaining a copy for your records will help in managing your account efficiently.

Popular PDF Forms

Concentra Authorization - Alerts to make arrangements for children or companions due to restricted access to the testing area.

Motorist Insurance - Explores the possibility of the claimant receiving unemployment benefits at the accident time.

Masshealth - A step-by-step guide for detailing work history and educational background when applying for MassHealth due to disability.