Blank Bmo Direct Deposit PDF Template

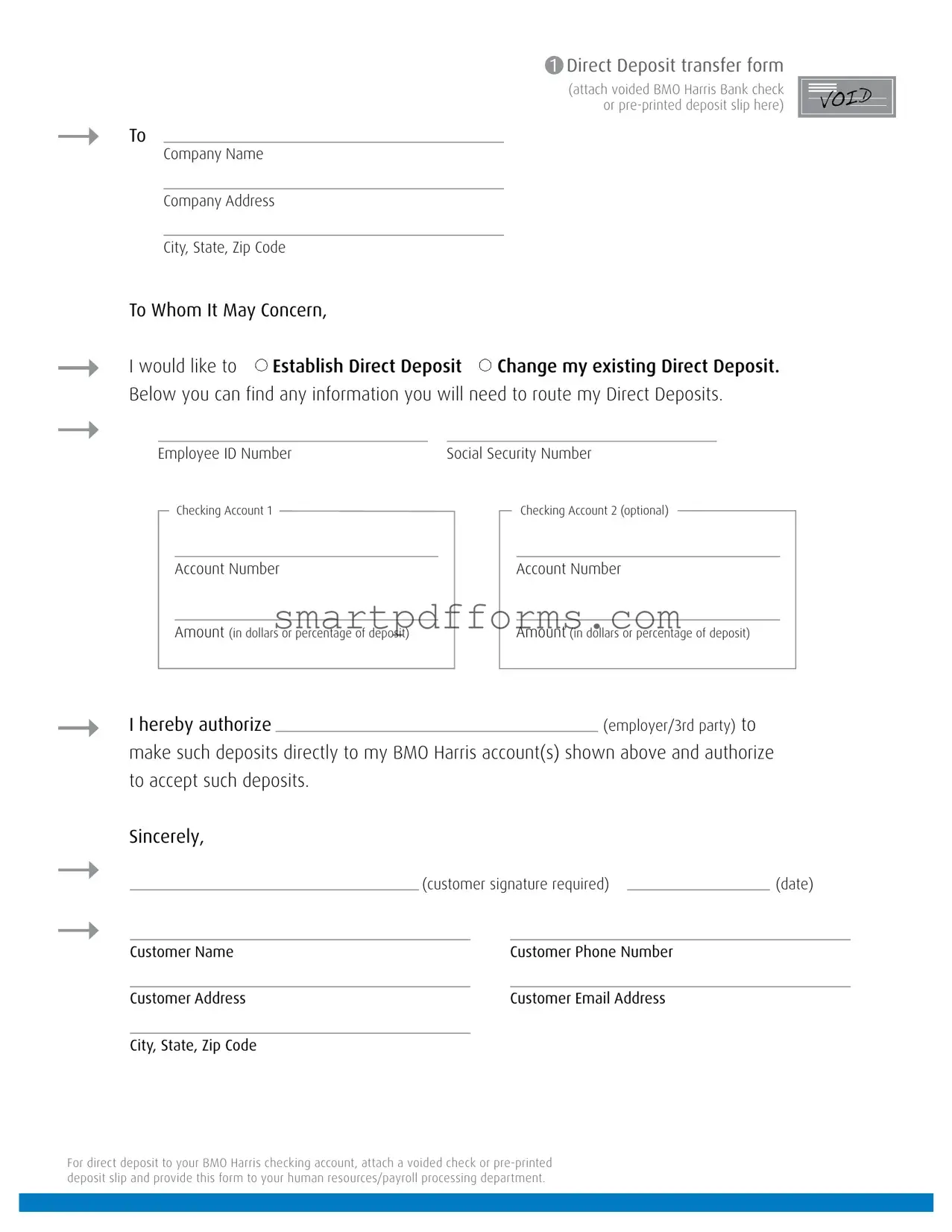

Facilitating the smooth transition of funds from an employer or third party to an individual's bank account, the BMO Direct Deposit form serves as a crucial instrument for both convenience and efficiency in managing one’s finances. Crafted to address a range of needs, this form allows individuals to either establish a new direct deposit or modify an existing one, thereby ensuring that the specific requirements of the account holder are met with precision. Detailed within the form are essential fields such as the Employee ID Number, Social Security Number, and pertinent bank account information, including the option to distribute funds across multiple checking accounts and specify the allocation either in dollars or as a percentage of the total deposit. Additionally, the form mandates the inclusion of a voided BMO Harris Bank check or a pre-printed deposit slip as a measure of verification and to facilitate the accurate routing of funds. To complete the process, the form requires the account holder’s authorization through a signature, alongside their contact information, reinforcing the secure and personalized nature of this financial service. Individuals interested in streamlining their income deposits into their BMO Harris checking accounts will find this form an indispensable tool in attaining financial organization and efficacy.

Preview - Bmo Direct Deposit Form

1 Direct Deposit transfer form

(attach voided BMO Harris Bank check or

To

Company Name

Company Address

City, State, Zip Code

To Whom It May Concern, |

|

|

|

|

||

I would like to |

Establish Direct Deposit |

Change my existing Direct Deposit. |

||||

Below you can find any information you will need to route my Direct Deposits. |

||||||

|

|

|

|

|

||

|

Employee ID Number |

|

Social Security Number |

|||

Checking Account 1

Checking Account 2 (optional)

Account Number

Account Number

Amount (in dollars or percentage of deposit)

Amount (in dollars or percentage of deposit)

I hereby authorize |

|

|

|

|

(employer/3rd party) to |

|

||

make such deposits directly to my BMO Harris account(s) shown above and authorize |

|

|||||||

to accept such deposits. |

|

|

|

|

|

|

|

|

Sincerely, |

|

|

|

|

|

|

|

|

|

|

(customer signature required) |

|

|

(date) |

|||

|

|

|

|

|

||||

Customer Name |

|

|

Customer Phone Number |

|

||||

|

|

|

|

|

||||

Customer Address |

|

|

Customer Email Address |

|

||||

|

|

|

|

|

|

|

|

|

City, State, Zip Code |

|

|

|

|

|

|

|

|

For direct deposit to your BMO Harris checking account, attach a voided check or

Form Data

| Fact Name | Description |

|---|---|

| Purpose of Form | This form is used to establish or change Direct Deposit arrangements with an employer or third party, allowing them to deposit funds directly into one or two specified BMO Harris checking accounts. |

| Required Documentation | A voided BMO Harris Bank check or pre-printed deposit slip must be attached to the form to provide proper account verification for the direct deposit setup. |

| Authorization | By signing the form, the customer authorizes their employer or third party to deposit funds directly into their designated BMO Harris account(s) and permits the bank to accept these deposits. |

| Governing Law | While the form facilitates the process of direct deposit into a BMO Harris account, the actual governing laws would be those applicable to banking and employment regulations within the account holder's state and federal laws relevant to banking and electronic funds transfer. |

Instructions on Utilizing Bmo Direct Deposit

To ensure your direct deposit is successfully set up or changed with BMO Harris, it's important to fill out the Direct Deposit Form correctly. This ensures your payments are deposited in a timely and secure manner into your BMO Harris checking account(s). Accurate completion helps avoid delays. Below are the steps to correctly fill out the form.

- Firstly, decide whether you are establishing a new direct deposit or changing an existing one. Mark the appropriate choice at the top of the form.

- Include the Company Name and Address where indicated. This is usually your employer or the party making the direct deposit into your account.

- Input your Employee ID Number and Social Security Number in the spaces provided. These are crucial for identifying your account.

- For the Checking Account 1 section, enter the Account Number. If you're splitting your deposit into two accounts, repeat this step for Checking Account 2.

- Specify the Amount you want deposited into each account. This can be a dollar amount or a percentage of the total deposit.

- Sign the form to authorize your employer or third party to deposit into your account(s) and to authorize BMO Harris to accept these deposits. Include the date next to your signature.

- Fill out your personal information below the signature, including your name, phone number, address, and email address.

- Finally, attach a voided BMO Harris Bank check or pre-printed deposit slip to the form. This provides BMO Harris with the necessary banking information.

- Submit the completed form to your human resources/payroll processing department.

After submitting this form, your direct deposit setup or changes will be processed by your employer or the third party and BMO Harris. Keep an eye on your account to confirm the changes have been made correctly. This setup ensures your payments are deposited efficiently and securely, directly into your BMO Harris account(s).

Obtain Answers on Bmo Direct Deposit

Frequently Asked Questions about the BMO Direct Deposit Form

How do I set up Direct Deposit to my BMO Harris checking account?

To set up Direct Deposit to your BMO Harris checking account, you will need to fill out the Direct Deposit Transfer Form. This form asks for your preference to either establish a new direct deposit or change your existing direct deposit settings. Required information includes your Employee ID Number or Social Security Number, your account numbers, and the amounts (in dollars or percentage) you wish to deposit into each account. Ensure to sign the form, attach a voided BMO Harris Bank check or a pre-printed deposit slip, and submit this documentation to your employer’s human resources or payroll processing department.

Can I direct my deposit into two different checking accounts?

Yes, the BMO Direct Deposit form allows you to split your deposit into two different checking accounts. You have the option to include a primary checking account (Checking Account 1) and an optional secondary account (Checking Account 2). For each account, you will need to specify the deposit amount, either as a dollar figure or as a percentage of the total deposit. This flexibility enables you to manage your finances more conveniently according to your personal or household budgeting needs.

What information do I need to provide to change my existing Direct Deposit?

If you wish to change your existing Direct Deposit setup, you must fill out the Direct Deposit Transfer Form, indicating the change option. The necessary information includes your Employee ID Number or Social Security Number and the details of the checking account(s) you wish to direct your deposits to. Be sure to detail the allocation of funds if you're using more than one checking account. After completing the form, attach a voided check or pre-printed deposit slip for the new account(s) and submit it to your employer’s payroll department.

How do I authorize the initiation or change of my Direct Deposit?

For either initiating a new Direct Deposit or changing an existing one to your BMO Harris account, the form requires your authorization. You authorize the transaction by providing all the requested information on the Direct Deposit Transfer Form, including your account details and the amounts to be deposited. Importantly, your signature at the bottom of the form is crucial, as it signifies your agreement for BMO Harris to accept direct deposits from your employer or a third party into the account(s) you've specified. Make sure to date your signature to validate the authorization.

Common mistakes

When completing the BMO Direct Deposit form, individuals often overlook or mishandle several key areas. Recognizing and avoiding these mistakes can ensure that the direct deposit process is smooth and error-free. Below, we detail nine common errors made during this process:

Not attaching a voided check or pre-printed deposit slip – The form specifically requests one of these documents to ensure the bank information is accurate. Failing to attach this can lead to errors in processing.

Incorrectly entering the Employee ID Number or Social Security Number – Accuracy with these numbers is crucial as they identify the individual and ensure the deposit goes to the correct account.

Misunderstanding the purpose of Checking Account 1 and Checking Account 2 fields – Some people mistakenly believe they must fill both fields. The second account is optional and meant for those who want to distribute their deposit across two accounts.

Entering incorrect account numbers – An account number error can direct funds to the wrong account, resulting in significant delays and complications.

Not specifying the deposit amount correctly – Whether it's a dollar amount or a percentage of the deposit, clearly stating how much should go into each account is essential. Vagueness or mistakes here can affect financial planning.

Omitting the authorization for the employer or third party to make and accept deposits – This written permission is a legal requirement for direct deposit. Without it, the process cannot proceed.

Forgetting to sign and date the form – A signature is mandatory for processing the direct deposit request, and the date helps track the submission.

Neglecting to provide accurate contact information – The customer's name, phone number, address, and email address are critical for any follow-up or clarification needed.

Failure to provide the form to their human resources/payroll processing department – Simply completing the form is not enough; it must be submitted to the appropriate department to initiate the direct deposit process.

By being mindful of these areas, individuals can increase the likelihood of a hassle-free direct deposit setup with their BMO Harris checking account.

Documents used along the form

Direct Deposit forms, such as the BMO Direct Deposit form, are crucial for streamlining the process of receiving funds into bank accounts. These direct deposits can include payroll, government benefits, and other types of transfers. However, for efficient processing and to adhere to legal and procedural requirements, additional forms and documents often complement the Direct Deposit form. Below is a list of such documents typically used in conjunction with the BMO Direct Deposit form, each with a brief description:

- Voided Check: A voided check is needed to provide the employer or depositing entity with the account number and bank routing number, ensuring proper fund transfer to the correct account.

- Employment Verification Letter: This document confirms an individual's employment status and income, which some organizations require before setting up direct deposits.

- Bank Account Verification Letter: A letter from the bank confirming the account holder’s account details and status. It further assures the employer that the account is active and can receive funds.

- Payroll Setup Authorization Form: Companies might need this internal document completed alongside the Direct Deposit form to authorize the setup within payroll systems.

- IRS Form W-9: Used mainly for contractors, the W-9 form is required for tax reporting purposes. It provides the taxpayer identification number or social security number to the entity making the payments.

- Government Benefit Enrollment Forms: For receiving government benefits through direct deposit, specific enrollment forms for programs like Social Security or veterans’ benefits are necessary.

- Identification Documents: Photo ID, such as a driver’s license or passport, is often required to verify the identity of the account holder during the setup process.

- Change of Direct Deposit Request Form: If switching banks or accounts, this form communicates the request to the employer or depositing entity to update the direct deposit information.

- Account Ownership Verification Documents: Documents proving the account ownership, such as a bank statement or account agreement, are sometimes required for verification purposes.

- Pre-printed Deposit Slip: Similar to a voided check, a pre-printed deposit slip can provide the necessary account and routing numbers for setting up a direct deposit.

In conclusion, while the Direct Deposit form is a pivotal document for initiating direct deposits into BMO Harris bank accounts or any banking institution, the process often requires additional forms and documentation. These additional documents serve to verify the identities, account details, and eligibility of the individuals involved, ensuring a smooth and secure transaction process. Whether for payroll, government benefits, or other transfers, being prepared with the appropriate documentation is key to facilitating a hassle-free setup.

Similar forms

Payroll Authorization Form: This document is quite similar to the BMO Direct Deposit form, primarily because it serves a fundamental purpose in facilitating the payment process from employer to employee. In both scenarios, the individual grants permission for direct transactions into their bank accounts. Where the Direct Deposit form focuses more on where the money should land, the Payroll Authorization form might dive deeper into specifics such as the timing of payments (e.g., bi-weekly, monthly) and may also include options for tax withholdings and other deductions.

Bank Account Authorization Form: This form shares a purposeful resemblance with the BMO Direct Deposit form in terms of providing essential information for transactions to occur between two parties. The Bank Account Authorization form is used to authorize the use of a bank account for various reasons, such as setting up automatic payments for bills. Like the Direct Deposit form, it requires personal and bank account details, but its use extends beyond payroll to include other financial transactions.

Automatic Bill Payment Form: Although used in a slightly different context, the essence of an Automatic Bill Payment form echoes the BMO Direct Deposit form. This form is used to authorize recurring payments from a bank account to a third party, such as utility, insurance, or mortgage companies. Similarities lie in the routing and account information sections, as well as in the authorization given by the account holder. However, the focus shifts from depositing funds into the account to withdrawing funds for bill payment.

Tax Refund Direct Deposit Form: This document is especially akin to the BMO Direct Deposit form in intention—both involve transferring funds directly into a bank account. The Tax Refund Direct Deposit form is filled out when one wishes to have their tax refund electronically sent to their bank account, thus requiring one to provide personal identification, as well as bank routing and account numbers. The core similarity is in empowering the transfer of funds without needing a physical check, thereby expediting and securing the process.

Dos and Don'ts

When completing the BMO Direct Deposit form, accuracy and attention to detail are critical. These are actions individuals should and shouldn't take during the process:

- Do carefully read the entire form before starting to ensure a clear understanding of the requirements.

- Do not rush through filling out the form; taking your time can prevent errors that might delay the direct deposit setup.

- Do verify your employee ID number and social security number for accuracy; these are key pieces of information that need to be correct.

- Do not guess your account information; incorrect details can divert your deposit to the wrong account. Confirm your account numbers by checking them against your bank records.

- Do decide in advance how much of your deposit you’d like to go into each account if you choose to split your deposit between two accounts.

- Do not leave the amount fields blank or ambiguous; clearly state the deposit amount or percentages if you're dividing the funds between accounts.

- Do attach a voided check or pre-printed deposit slip as requested. This document provides your employer with necessary bank information and reduces the possibility of errors.

- Do not forget to sign and date the form. Your signature is your authorization for the deposit, and omitting it may invalidate the entire process.

- Do keep a copy of the completed form and any accompanying documents for your own records. Should there be any disputes or discrepancies, you’ll have the necessary documentation on hand.

Adhering to these recommendations can streamline the process of setting up direct deposits to your BMO Harris account(s), ensuring that your funds are accurately and efficiently delivered to your chosen accounts.

Misconceptions

- One common misconception is that anyone can initiate a direct deposit without permission. However, the form clearly states that the customer must authorize their employer or a third party to make direct deposits, ensuring control and consent are maintained.

- Another misunderstanding is about the necessity of including both a Social Security Number and an Employee ID Number. This requirement ensures accurate identification and processing of the direct deposit transfer to the correct individual's accounts.

- Some believe that you can only direct deposit into one checking account, whereas the form provides an option for two separate accounts, allowing flexibility in managing finances.

- It's wrongly assumed that changes to direct deposit cannot be made once established. The form offers an option to either establish or change direct deposit instructions, making it easy to manage and update information as needed.

- Many think that a direct deposit can only be a fixed amount. However, the flexibility to specify amounts in dollars or percentage makes it adaptable to varying income streams or budgeting needs.

- There's a misconception that the form is complex and requires excessive information. In reality, it's straightforward, requiring only essential details to correctly route direct deposits.

- Some assume that a direct deposit setup is immediate. Though the process is efficient, it requires validation and processing time, especially for new setups or changes.

- A common misconception is that the form can be submitted without a customer signature. The form specifically requires a customer signature to validate the authorization for direct deposits, ensuring the customer's agreement and intent.

- Lastly, people often think they cannot attach a pre-printed deposit slip as an alternative to a voided check. The form accepts both, providing flexibility in fulfilling the requirements for initiating or changing a direct deposit.

Key takeaways

Filling out and using the BMO Direct Deposit form is a convenient way to streamline receiving payments such as salaries, dividends, or refunds directly into your bank account. It's important to understand the process, requirements, and benefits involved. Here are five key takeaways:

- Choice of Direct Deposit: The form allows individuals to either establish a new direct deposit arrangement or change an existing one. This flexibility is useful for those who are switching jobs, changing their banking details, or simply want to start receiving their payments directly into their bank account.

- Multiple Accounts Option: One can choose to have deposits made into one or two checking accounts. This feature is particularly beneficial for managing finances by allocating specific amounts or percentages of deposits to different accounts for saving or spending.

- Required Information: To successfully complete the form, personal and banking information is necessary. This includes the employee ID number, social security number, checking account numbers, and the amounts to be deposited in each account. Ensuring accuracy in these details is paramount to prevent any delays or errors in the deposit process.

- Authorization: By signing the form, the customer authorizes their employer or a third party (such as a tax refund agency) to deposit funds directly into their specified BMO Harris accounts. They also authorize the bank to accept these deposits. This dual authorization is a critical step in the process, emphasizing the individual's consent to the transaction.

- Attachment Requirement: Attaching a voided check or pre-printed deposit slip is an essential requirement when submitting the form. This attachment serves as a verification of the account details provided and helps in minimizing errors in depositing the funds into the correct accounts.

Ultimately, the BMO Direct Deposit form is a tool that facilitates the efficient transfer of funds into an individual's accounts, ensuring that they have timely access to their money. It simplifies the payment process for both the payer and the payee, reducing the reliance on physical checks and the associated delays. By carefully completing the form and providing the necessary authorizations and attachments, customers can enjoy the convenience and security of direct deposits.

Popular PDF Forms

Volleyball Rotation Sheet - Its meticulous design ensures that every aspect of the match lineup is considered, from player positions to strategic choices, fostering a fair and exciting game environment.

1120s K1 - It serves as a critical tool in ensuring that S corporations adhere to U.S. tax laws by detailing their earnings and how they are distributed.