Blank Boe 448 PDF Template

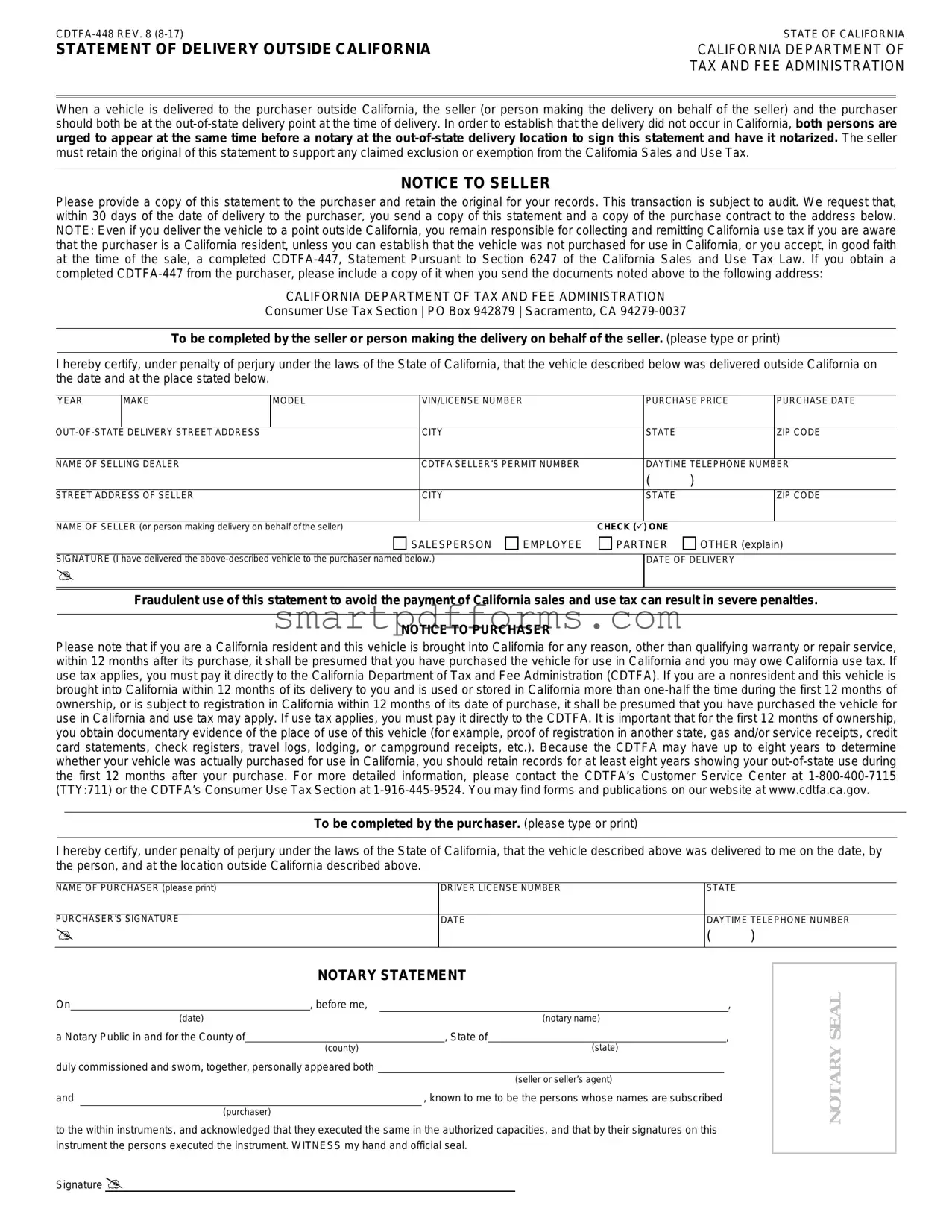

The CDTFA-448, issued by the State of California and revised in August 2017, is a critical document for transactions involving the sale and delivery of vehicles outside of California. This form, titled "Statement of Delivery Outside California," serves a crucial role by enabling sellers to establish that the sale occurred outside the state's jurisdiction, thereby exempting the transaction from California Sales and Use Tax under specific conditions. Both the seller or the person acting on the seller's behalf and the buyer are required to be present at the delivery location outside California to sign this statement before a notary, ensuring its credibility and the legality of the claim for tax exclusion or exemption. The document outlines the seller's responsibilities, including retaining the original statement for records, providing the buyer with a copy, and submitting necessary documents to the California Department of Tax and Fee Administration (CDTFA) within 30 days following the delivery. It also emphasizes the importance of including a completed CDTFA-447 form if the sale involves a California resident intending not to use the vehicle in California. Moreover, the form contains a notice to the purchaser regarding potential tax liabilities if the vehicle is used or stored in California under certain conditions within the first 12 months post-delivery. Hence, the CDTFA-448 form plays an indispensable role in ensuring compliance with California’s tax laws, providing a structured procedure for sellers and buyers regarding out-of-state vehicle deliveries, and maintaining the integrity of tax exemption claims for such transactions.

Preview - Boe 448 Form

STATE OF CALIFORNIA |

|

STATEMENT OF DELIVERY OUTSIDE CALIFORNIA |

CALIFORNIA DEPARTMENT OF |

|

TAX AND FEE ADMINISTRATION |

When a vehicle is delivered to the purchaser outside California, the seller (or person making the delivery on behalf of the seller) and the purchaser should both be at the

must retain the original of this statement to support any claimed exclusion or exemption from the California Sales and Use Tax.

NOTICE TO SELLER

Please provide a copy of this statement to the purchaser and retain the original for your records. This transaction is subject to audit. We request that, within 30 days of the date of delivery to the purchaser, you send a copy of this statement and a copy of the purchase contract to the address below. NOTE: Even if you deliver the vehicle to a point outside California, you remain responsible for collecting and remitting California use tax if you are aware that the purchaser is a California resident, unless you can establish that the vehicle was not purchased for use in California, or you accept, in good faith at the time of the sale, a completed

CALIFORNIA DEPARTMENT OF TAX AND FEE ADMINISTRATION

Consumer Use Tax Section | PO Box 942879 | Sacramento, CA

To be completed by the seller or person making the delivery on behalf of the seller. (please type or print)

I hereby certify, under penalty of perjury under the laws of the State of California, that the vehicle described below was delivered outside California on the date and at the place stated below.

YEAR |

MAKE |

MODEL |

VIN/LICENSE NUMBER |

PURCHASE PRICE |

PURCHASE DATE |

|

|

CITY |

STATE |

|

ZIP CODE |

||

NAME OF SELLING DEALER |

|

CDTFA SELLER’S PERMIT NUMBER |

DAYTIME TELEPHONE NUMBER |

|||

|

|

|

|

( |

) |

|

STREET ADDRESS OF SELLER |

|

CITY |

STATE |

|

ZIP CODE |

|

NAME OF SELLER (or person making delivery on behalf of the seller)

CHECK () ONE

SALESPERSON

EMPLOYEE

PARTNER

OTHER (explain)

SIGNATURE (I have delivered the

DATE OF DELIVERY

Fraudulent use of this statement to avoid the payment of California sales and use tax can result in severe penalties.

NOTICE TO PURCHASER

Please note that if you are a California resident and this vehicle is brought into California for any reason, other than qualifying warranty or repair service, within 12 months after its purchase, it shall be presumed that you have purchased the vehicle for use in California and you may owe California use tax. If use tax applies, you must pay it directly to the California Department of Tax and Fee Administration (CDTFA). If you are a nonresident and this vehicle is brought into California within 12 months of its delivery to you and is used or stored in California more than

To be completed by the purchaser. (please type or print)

I hereby certify, under penalty of perjury under the laws of the State of California, that the vehicle described above was delivered to me on the date, by the person, and at the location outside California described above.

NAME OF PURCHASER (please print) |

DRIVER LICENSE NUMBER |

STATE |

|

|

|

|

|

|

|

PURCHASER’S SIGNATURE |

DATE |

DAYTIME TELEPHONE NUMBER |

||

|

|

( |

) |

|

NOTARY STATEMENT

On |

, before me, |

|

|

|

|

|

, |

||||

|

|

(date) |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

(notary name) |

|

|

|||

a Notary Public in and for the County of |

|

|

|

, State of |

, |

||||||

|

|

|

|

(county) |

|

|

|

(state) |

|

|

|

duly commissioned and sworn, together, personally appeared both |

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

(seller or seller’s agent) |

|

|

|

and |

|

|

, known to me to be the persons whose names are subscribed |

|

|

||||||

|

|

(purchaser) |

|

|

|

|

|

|

|

|

|

to the within instruments, and acknowledged that they executed the same in the authorized capacities, and that by their signatures on this instrument the persons executed the instrument. WITNESS my hand and official seal.

Signature

NOTARY SEAL

Form Data

| Fact | Detail |

|---|---|

| Form Title | CDTFA-448 REV. 8 (8-17) Statement of Delivery Outside California |

| Governing Body | California Department of Tax and Fee Administration (CDTFA) |

| Purpose | Establishes that the delivery of a purchased vehicle occurred outside California to claim exclusion or exemption from California Sales and Use Tax. |

| Requirement for Notarization | Both the seller (or delivery person on behalf of the seller) and the purchaser should be present at the out-of-state delivery location to sign the statement before a notary. |

| Responsibility After Sale | The seller remains responsible for collecting and remitting California use tax if aware that the purchaser is a California resident, unless criteria for exemption are met as detailed on the form. |

| Notice to Purchaser | Purchasers are warned that if the vehicle is brought into California within 12 months under conditions that do not qualify for exemption, it will be presumed purchased for use in California, and use tax may apply. |

| Record Keeping | Purchasers are advised to keep documentation of the vehicle's use outside California for at least eight years, due to the CDTFA’s ability to audit and determine use tax liability. |

| Governing Laws | Subject to the laws of the State of California regarding perjury and the payment of California sales and use tax. |

Instructions on Utilizing Boe 448

For individuals and businesses involved in the sale of a vehicle to a purchaser outside of California, it's crucial to accurately complete the CDTFA-448 form. This document plays a vital role in proving that the sale and delivery of a vehicle did not occur within California, offering a way to claim exclusion or exemption from California Sales and Use Tax for the seller. It requires specific information about the sale and the out-of-state delivery details, to be filled out by both the seller (or the seller's agent) and the purchaser. Additionally, the form must be notarized at the out-of-state delivery location with both parties present. Following these steps carefully ensures compliance with state tax laws and supports the tax-related claims of the seller.

- Begin by gathering all necessary information regarding the vehicle sale, including the year, make, model, VIN/license number, purchase price, purchase date, and the detailed address of the out-of-state delivery location.

- Under the section "To be completed by the seller or person making the delivery on behalf of the seller," type or print clearly the requested vehicle details and the out-of-state delivery address including city, state, and zip code.

- Enter the name of the selling dealer or, if applicable, the seller directly involved in the transaction. Also, provide the CDTFA seller's permit number and a daytime telephone number where the seller or their representative can be reached.

- Next, type or print the street address of the seller, along with the city, state, and zip code to ensure accurate seller identification.

- Fill in the name of the seller (or the person making the delivery on behalf of the seller) and check the appropriate box that represents their relationship to the sale (e.g., salesperson, employee, partner, other).

- Sign and date the form in the provided space to certify the delivery of the vehicle to the purchaser at the specified out-of-state location. Remember, this act must be done in the presence of a notary public.

- For the purchaser's section, the buyer should type or print their name, driver license number, and state. Then, the purchaser must sign and date the form and provide a daytime telephone number.

- Ensure both the seller (or the seller's agent) and the purchaser appear before a notary public at the out-of-state delivery location. The notary will then complete the "Notary Statement" section, confirming the identities of both parties and acknowledging their signatures on the form.

- After completing and notarizing the form, the seller should provide a copy to the purchaser and retain the original for their records. Additionally, within 30 days of the delivery, the seller must send a copy of this completed and notarized statement, along with a copy of the purchase contract (and a completed CDTFA-447 form, if applicable), to the California Department of Tax and Fee Administration at the address provided in the notice to the seller.

By following these detailed steps, sellers can ensure compliance with California's regulations on the sale and delivery of vehicles to purchasers outside the state, and properly claim their eligibility for tax exceptions or exemptions. Both sellers and purchasers should keep copies of all relevant documents, as transactions could be subject to future audits by the California Department of Tax and Fee Administration.

Obtain Answers on Boe 448

What is the purpose of the Boe 448 form?

The Boe 448 form, issued by the State of California's Department of Tax and Fee Administration, serves as a legal document verifying that a vehicle was delivered to a purchaser outside of California. This form helps establish that the sale is exempt from California sales and use taxes under certain conditions.

Who needs to complete the Boe 448 form?

Both the seller (or the person making the delivery on behalf of the seller) and the purchaser need to complete and sign the Boe 448 form at the out-of-state delivery location, preferably in the presence of a notary.

What information is required on the Boe 448 form?

The form requires details about the vehicle being sold, including its year, make, model, VIN/license number, and purchase price, as well as the purchase date. It also requires the out-of-state delivery address and contact information for both the seller and the purchaser.

Is notarization required for the Boe 448 form?

Yes, both the seller and purchaser are urged to appear before a notary at the time of delivery to sign the statement and have it notarized to verify the authenticity of the declaration.

What should be done with the original Boe 448 form?

The seller must retain the original completed Boe 448 form to support any claimed exclusion or exemption from California sales and use taxes. This is crucial for audit purposes.

Are there any additional steps after completing the form?

The seller is required to send a copy of the Boe 448 form and a copy of the purchase contract to the Consumer Use Tax Section of the California Department of Tax and Fee Administration within 30 days of the sale. If a CDTFA-447 form is obtained from the purchaser, this should also be included in the documents sent.

What are the consequences of not complying with the Boe 448 form requirements?

Fraudulent use of the Boe 448 form to avoid the payment of California sales and use tax can lead to severe penalties. Sellers are responsible for collecting and remitting California use tax if they are aware that the purchaser is a California resident and the vehicle was purchased for use in California.

How can purchasers ensure compliance?

Purchasers should retain records of out-of-state use of the vehicle for at least eight years, as the CDTFA may audit transactions up to eight years past the purchase date. This documentation can include proof of registration in another state, service receipts, and travel logs among other evidences.

Where can additional information be found?

For more detailed information about the Boe 448 form and related procedures, individuals can contact the CDTFA’s Customer Service Center or the Consumer Use Tax Section, or visit the CDTFA’s website.

Common mistakes

Filling out the BOE-448 Form, "Statement of Delivery Outside California," requires careful attention to detail. Many individuals make common mistakes that can lead to issues with their transactions, potentially resulting in penalties or delays. Recognizing these errors upfront can save a substantial amount of time and hassle.

Not having both the seller (or the seller's agent) and the purchaser present at the out-of-state delivery location: It's crucial for establishing that the delivery occurred outside of California.

Failure to notarize the document: The presence of a notary serves as a legal witness to the signatures, which is a requirement of the form to ensure authenticity.

Incorrect or incomplete vehicle information: This includes the vehicle's year, make, model, and VIN/license number. Any inaccuracies here can invalidate the statement's purpose.

Omitting prices and dates: Both the purchase price and the date of the purchase are essential for the document to be considered complete.

Leaving out the seller's details: Accurate information regarding the seller, including the CDTFA seller’s permit number, address, and daytime telephone number, is mandatory.

Not checking the appropriate seller's relation: Indicating whether the person completing the form is the salesperson, employee, partner, or other, and explaining if "other" is selected, is a step often missed.

Forgetting signatures and delivery dates: Both the seller’s or seller's agent’s and the purchaser’s signatures, along with the date of delivery, legally bind and validate the form.

Ignoring the notary section: This section is critical and must be filled out by a notary to certify the authenticity of the preceding information.

Lack of foresight regarding evidence: Keeping records and evidence proving the vehicle's use outside California is suggested, yet many individuals disregard this advice.

Incorrect understanding of tax responsibilities: Failing to comprehend when California use tax is applicable, especially for residents or for use of the vehicle within California, leads to legal and financial complications.

Addressing these common mistakes ensures that the process of declaring a vehicle’s out-of-state delivery is as smooth and error-free as possible. Given the legal implications and potential for audit, paying close attention to detail when completing the BOE-448 form cannot be overstated.

Documents used along the form

Dealing with vehicle transactions across state lines can get a tad complex, especially when trying to navigate through the necessary paperwork to ensure everything is compliant with tax laws. The BOE-448 form, also known as the Statement of Delivery Outside California, plays a crucial role in transactions where a vehicle is sold and delivered outside of California. However, this form is just one of several documents that might be necessary to ensure a smooth and compliant transaction. Here's a look at other forms and documents often paired with the BOE-448 form to facilitate these cross-state vehicle sales.

- CDTFA-447: This form, known as the Statement Pursuant to Section 6247 of the California Sales and Use Tax Law, is essential for sellers who need to establish that the purchaser, though a California resident, intends to use the vehicle primarily outside of California. It's crucial when the seller wants to apply for an exemption from collecting California use tax at the time of sale.

- Bill of Sale: A comprehensive document that serves as proof of the transaction between buyer and seller. It details the sale and is critical for both parties as a record of the sale price, date, and terms.

- Vehicle Title (or Application for Title): Required to transfer ownership of the vehicle, the title, or application for a new title (if the title is being held by a lienholder or if the vehicle is new), must be accurately filled out and signed by the seller and buyer.

- Odometer Disclosure Statement: Federally required for vehicles under ten years old, this document records the mileage of the vehicle at the time of sale, ensuring that the buyer is aware of the vehicle’s condition and history.

- Release of Liability Form: Used to notify the Department of Motor Vehicles (DMV) that the vehicle has been sold and the seller is no longer responsible for it. This helps protect the seller in case the vehicle is involved in an incident or accrues tickets after sale.

- Temporary Vehicle Import Permit: Necessary for vehicles that are being delivered to other states but intended for eventual use in California. This permit allows for temporary use in California under specific conditions before formal registration.

- Proof of Insurance: Insurance is often required before a vehicle can be registered by the buyer in their state. Proof of insurance is usually necessary to complete the vehicle’s registration process after the sale.

This suite of documents, alongside the BOE-448 form, creates a comprehensive package that addresses various legal and regulatory requirements for selling a vehicle and delivering it outside of California. Sellers must ensure they complete and retain copies of these forms, as they not only facilitate a smooth transfer of ownership but also offer protection in case of audits or disputes. Compliance with these requirements will help both the seller and the purchaser navigate the complexities of interstate vehicle sales and use tax obligations efficiently.

Similar forms

The CDTFA-447 form, "Statement Pursuant to Section 6247 of the California Sales and Use Tax Law," operates similarly to the CDTFA-448 by requiring declarations regarding the purchase and use of tangible personal property to ensure compliance with California tax laws. Wherein the CDTFA-448 concerns vehicle delivery outside California, the CDTFA-447 addresses the buyer’s intent and use regarding tax exemption claims.

The Bill of Lading document, often used in shipping, shares similarities with the CDTFA-448 by documenting the receipt, shipment, and delivery details of goods. Both serve as critical evidence for verifying the location and transfer of goods between seller and purchaser.

A Sales Invoice similarly outlines the transaction details between a buyer and seller, including price, description, and date of sale, akin to the vehicle-specific information outlined in the CDTFA-448; however, it often lacks the same depth of legal declaration.

The Vehicle Title Transfer form bears resemblance by being an essential document for the legal transfer of vehicle ownership, indicating the parties involved and transaction specifics, akin to how the CDTFA-448 identifies the seller, purchaser, and details of the vehicle’s out-of-state delivery.

The Notary Acknowledgement form shares the aspect of notarization with the CDTFA-448, which confirms the identity of the signatories and validates the signatures, providing an official attestation to the occurrence of the vehicle delivery outside California.

IRS Form 8300, "Report of Cash Payments Over $10,000 Received in a Trade or Business," parallels the CDTFA-448 in its regulatory nature, requiring detailed reporting of specific transactions to a governing authority to ensure legal and tax compliance.

Proof of Insurance for Out-of-State Vehicle Registration documents are necessary for registering and using a vehicle in a new state, similarly to how the CDTFA-448 form is used to document the notarized statement of out-of-state delivery, important for tax exemption reasons.

Dos and Don'ts

When filling out the BOE-448 form, it's essential to follow specific guidelines to ensure the process is completed correctly. Below are 10 do's and don'ts to help guide you through this process.

- Do ensure both the seller and purchaser are present at the out-of-state delivery point when filling out the form.

- Do make sure to appear before a notary at the out-of-state delivery location with both the seller and purchaser present to have the statement notarized.

- Do provide a copy of the fully completed and notarized statement to the purchaser and keep the original for the seller’s records.

- Do send a copy of this statement along with a copy of the purchase contract to the California Department of Tax and Fee Administration (CDTFA) within 30 days from the date of delivery.

- Do type or print clearly all required information to avoid any misunderstandings or processing delays.

- Do not forget to check (✔) the appropriate box indicating your relationship to the seller (e.g., salesperson, employee, partner, or other).

- Do not leave any sections incomplete; all requested information must be provided.

- Do not sign the form without verifying all the information is accurate and truthful.

- Do not disregard the importance of retaining copies of the form and associated documents for future reference or audit purposes.

- Do not attempt to use the BOE-448 form fraudulently to avoid paying California sales and use tax, as severe penalties may result.

Following these guidelines can help ensure a seamless and compliant process when declaring an out-of-state vehicle delivery, thereby avoiding potential legal and financial complications.

Misconceptions

Understanding the Boe 448 form, officially known as the CDTFA-448 REV. 8 (8-17), is crucial for businesses and individuals involved in the sale and purchase of vehicles delivered outside California. Despite its significance, there are several misconceptions about this form:

- Misconception 1: The Boe 448 form is only for vehicle sales.

While the form primarily applies to vehicles, it's also relevant for any tangible personal property that could be subjected to use tax if brought into California.

- Misconception 2: Only the seller needs to complete the Boe 448 form.

Both the seller and the purchaser have crucial sections to fill out and sign, indicating that the delivery occurred outside California.

- Misconception 3: The form is unnecessary if the seller and buyer are both outside California.

Even if both parties are outside California, the form is essential for proving the transaction's location, especially for tax purposes.

- Misconception 4: Submitting the Boe 448 form nullifies the need for additional documents.

Submitting this form doesn't eliminate the requirement for other supporting documents, like the purchase contract or, if applicable, a CDTFA-447 form.

- Misconception 5: Digital signatures are acceptable for the Boe 448 form.

The document specifies that signatures must be obtained before a notary at the out-of-state delivery location, implying the need for physical signatures.

- Misconception 6: The form exempts the seller from all sales tax obligations.

Completing the form doesn't exempt the seller from collecting California use tax if the buyer is a California resident and the vehicle is intended for use in California.

- Misconception 7: Only California residents need to worry about this form.

Nonresidents who might bring the vehicle into California within 12 months of purchase also need to use this form to establish their tax obligations.

- Misconception 8: The form is only useful at the time of sale.

The CDTFA may audit transactions up to eight years later, making it important to retain this form and other related documents.

- Misconception 9: The Boe 448 form is the only way to prove out-of-state delivery.

While the form is crucial, the seller and the buyer should also gather other evidence such as service receipts and travel logs to support the delivery's location.

- Misconception 10: If the form is incorrectly completed, there are no consequences.

Fraudulent use or incorrect completion of the form can result in severe penalties, emphasizing the need for accuracy and honesty in its completion.

Correctly understanding and utilizing the Boe 448 form is essential for anyone involved in selling or purchasing vehicles or other tangible personal property that could be brought into California. Taking the time to properly complete and retain this form can help avoid potential complications and liabilities related to California's sales and use tax laws.

Key takeaways

When documenting the out-of-state delivery of a vehicle, the Boe 448 form is essential and contains specific steps and requirements that both the seller and the purchaser must follow. The guidelines are structured to ensure the transaction is appropriately recorded, potentially affecting tax obligations. Below are key takeaways from the Boe 448 form instructions:

- The form requires both the seller or the seller’s agent and the purchaser to be present at the out-of-state delivery location at the time of delivery.

- To confirm the transaction did not occur in California and to support any tax exemption claims, having the form notarized with both parties present is recommended.

- The original statement must be retained by the seller as part of their records to substantiate the claimed exclusion or exemption from California Sales and Use Tax.

- A copy of the Boe 448 form, along with a copy of the purchase contract, must be sent to the California Department of Tax and Fee Administration (CDTFA) within 30 days following the purchaser's receipt of the vehicle.

- Responsibility for collecting and remitting California use tax may still apply to the seller if the purchaser is a California resident, unless it can be established that the vehicle was not bought for use within California.

- In certain cases, obtaining a completed CDTFA-447 form from the purchaser and including it with the documents sent to the CDTFA can assist in supporting the seller’s tax position.

- For California residents, if the vehicle is brought into California within 12 months post-purchase for reasons other than warranty or repair services, it is presumed purchased for use in California, potentially incurring use tax.

- Nonresidents bringing the vehicle into California within the first 12 months and using or storing it for over half the time in California, or registering it in California, may also be presumed to have bought the vehicle for use in California. Use tax may apply in these scenarios as well.

- Purchasers are advised to keep records for at least eight years showing out-of-state use during the first 12 months to counter any potential tax assessments by the CDTFA.

Completing and using the Boe 448 form correctly is significant for both the seller and purchaser, explicitly involving tax liabilities and legal responsibilities within California. It is in the best interest of both parties to thoroughly understand and comply with the requisite points noted above.

Popular PDF Forms

Income Tax Exemption - The ST-119.1 form reinforces the importance of compliance with tax laws in non-profit and educational settings.

Hot Topic Application - Fill out a Hot Topic application today and open the door to a workplace that values and practices equal employment for everyone.