Blank Borrowers Certification Authorization PDF Template

Embarking on the journey of securing a mortgage can often seem like navigating through a maze of paperwork, each document a crucial step towards homeownership. One of the pivotal pieces in this complex puzzle is the Borrowers' Certification and Authorization form. This form not only plays a vital role in the initial application process but also lays the groundwork for the financial transparency and trust between the borrowers and the lender. By completing this form, the undersigned borrowers certify that all the information provided in their loan application is true and accurate, covering details from the purpose of the loan to their income and liabilities. It's a declaration that no part of their financial story has been misrepresented. Furthermore, this document empowers the lender or their authorized parties to verify the provided information, ensuring the integrity of the application. This not only includes checks before the loan is finalized but extends to any point in a quality control process. Moreover, it explicitly acknowledges the severe consequences of knowingly providing false information, a safeguard that underscores the seriousness of the commitment being made. The Borrowers' Certification and Authorization form is more than just a procedural necessity; it is a testament to the trust and responsibility that underpin the financial relationship between borrower and lender.

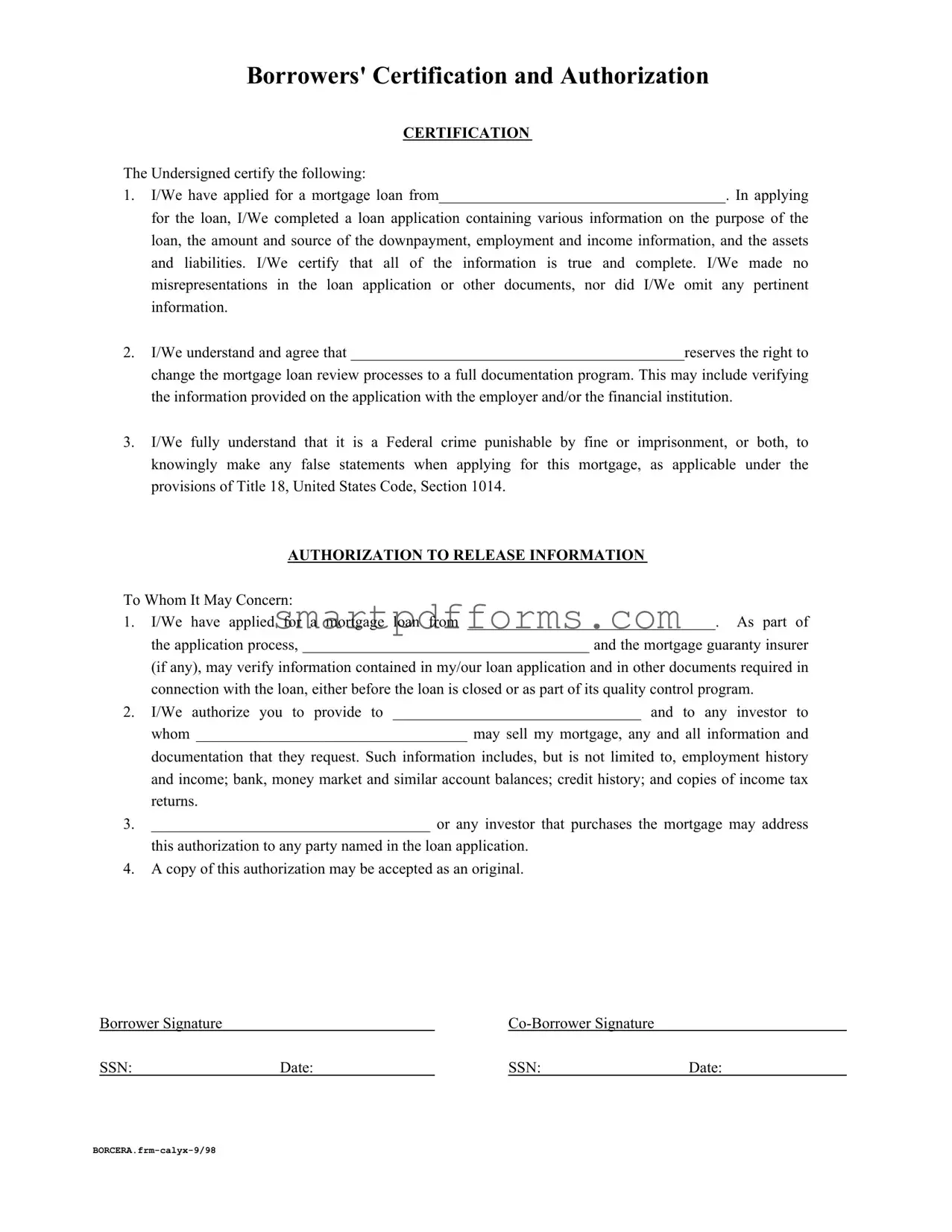

Preview - Borrowers Certification Authorization Form

BORROWERS' CERTIFICATION AND AUTHORIZATION

CERTIFICATION

The Undersigned certify the following:

1.I/We have applied for a mortgage loan from_____________________________________. In applying for the loan, I/We completed a loan application containing various information on the purpose of the loan, the amount and source of the downpayment, employment and income information, and the assets and liabilities. I/We certify that all of the information is true and complete. I/We made no misrepresentations in the loan application or other documents, nor did I/We omit any pertinent information.

2.I/We understand and agree that ___________________________________________reserves the right to change the mortgage loan review processes to a full documentation program. This may include verifying the information provided on the application with the employer and/or the financial institution.

3.I/We fully understand that it is a Federal crime punishable by fine or imprisonment, or both, to knowingly make any false statements when applying for this mortgage, as applicable under the provisions of Title 18, United States Code, Section 1014.

AUTHORIZATION TO RELEASE INFORMATION

To Whom It May Concern:

1.I/We have applied for a mortgage loan from ________________________________. As part of the application process, _____________________________________ and the mortgage guaranty insurer (if any), may verify information contained in my/our loan application and in other documents required in connection with the loan, either before the loan is closed or as part of its quality control program.

2.I/We authorize you to provide to ________________________________ and to any investor to whom ___________________________________ may sell my mortgage, any and all information and documentation that they request. Such information includes, but is not limited to, employment history and income; bank, money market and similar account balances; credit history; and copies of income tax returns.

3.____________________________________ or any investor that purchases the mortgage may address this authorization to any party named in the loan application.

4.A copy of this authorization may be accepted as an original.

Borrower Signature |

|

|

|

|

SSN: |

Date: |

|

SSN: |

Date: |

Form Data

| Fact Number | Fact Detail |

|---|---|

| 1 | The form is used for borrowers to certify the accuracy of the information provided in their mortgage loan application. |

| 2 | Borrowers certify that all information in their application is true, complete, and without misrepresentations or omissions. |

| 3 | The lender reserves the right to shift the mortgage loan review process to a full documentation program, involving verification of application information. |

| 4 | Making false statements on the mortgage application is a Federal crime, punishable by fine or imprisonment under Title 18, United States Code, Section 1014. |

| 5 | Borrowers authorize the release of information to the lender and any potential investor regarding their employment, income, accounts, credit history, and tax returns. |

| 6 | This authorization allows the lender or any investor who buys the mortgage to request documentation from any party named in the loan application. |

| 7 | A copy of the authorization can serve as an original, indicating physical or digital copies have the same legal standing. |

| 8 | The form includes sections for both the borrower and co-borrower to sign and provide their social security numbers and the date. |

Instructions on Utilizing Borrowers Certification Authorization

Filling out the Borrowers Certification Authorization form is a crucial step in the mortgage application process. This document certifies the accuracy of information provided on the loan application and authorizes the lender to verify this information. It's important to complete this form accurately to avoid any potential legal implications. Following the outlined steps will ensure that the process is smooth and efficient.

- Start by reading the entire document carefully to understand the certifications and authorizations you are making.

- In the section labeled "CERTIFICATION," locate the blank line in the first item. Here, write the name of the mortgage lender from whom you have applied for a loan.

- After reading the three points under CERTIFICATION, if you agree and certify all statements to be true, proceed to the next section.

- In the "AUTHORIZATION TO RELEASE INFORMATION" section, fill in the first blank with the name of the mortgage lender to whom you are applying. This should match the name you provided in the first section.

- Next, for each blank space that follows in the authorization section, repeat the name of the lender or provide any additional names as required by the context. This includes any potential investors to whom the mortgage may be sold.

- In the space provided at the end of the document for the borrower's and co-borrower's (if applicable) signatures, each person should sign their name.

- Beneath the signatures, write the Social Security Number (SSN) for both the borrower and co-borrower next to their respective names.

- Finally, ensure that the date is entered next to both the borrower's and co-borrower's SSN. This date reflects when the authorization is signed and must be accurate.

After completing and signing the form, it is ready to be submitted to the lender as part of your mortgage application package. The lender will then use this authorization to verify the information you have provided. It's important to keep a copy of this form for your records. Remember, accuracy and honesty in all provided information are vital to the success of your loan application and to avoid any legal consequences related to misinformation.

Obtain Answers on Borrowers Certification Authorization

What is a Borrower's Certification and Authorization Form?

A Borrower's Certification and Authorization Form is a document that a loan applicant signs to certify that all the information they have provided in their loan application is true and complete. The form also grants permission to the lender, and other relevant parties, to verify this information. This might include checking employment history, income, bank balances, credit history, and tax returns. It's a step to ensure the integrity of the application process and to comply with legal requirements.

Why do I need to sign this form?

Signing this form is crucial because it acknowledges your understanding of the seriousness of providing accurate information on your loan application. It also indicates your agreement to let the lender verify your information to assess your loan request accurately. Without this authorization, the lender might not be able to proceed with the loan review and approval process. It helps protect against fraud and ensures that the loan decision is based on accurate and verified information.

What happens if I knowingly provide false information on my application?

If someone knowingly provides false information on their mortgage application, it is considered a federal crime, punishable by fines or imprisonment, or both. This action falls under Title 18, United States Code, Section 1014. It shows the seriousness of the matter and underscores the importance of honesty in the application process.

Can a lender verify my information without my permission?

No, a lender requires your explicit authorization to verify your personal and financial information as part of the mortgage application process. This is why the Borrower's Certification and Authorization Form is important. By signing this form, you give the lender and other authorized parties permission to obtain and verify your information. Without your consent, the lender is limited in the verification steps they can take, which could influence the outcome of your loan application.

Is a photocopy of the Borrower's Certification and Authorization Form as valid as the original?

Yes, a photocopy of the Borrower's Certification and Authorization Form can be accepted as an original. This provision ensures that the verification process is not hindered by the formality of requiring an original document. It allows the lender and other authorized parties to proceed with verifying your information even if they only have a copy of your authorization.

Common mistakes

Filling out the Borrowers' Certification and Authorization form is a critical step in the mortgage application process. However, it's common for applicants to make mistakes that could potentially affect the outcome of their loan approval. Below are four common mistakes made when filling out this form:

Inaccurate Information: One of the most significant errors is providing inaccurate information about employment, income, assets, and liabilities. It is crucial to double-check all details for their accuracy to ensure all information is true and complete, just as the certification section demands. Misrepresentation or omitting pertinent information can lead to severe consequences, including legal actions.

Overlooking Changes in Mortgage Loan Review Processes: Applicants often overlook the lender's right to change the mortgage loan review process to a full documentation program. Acknowledging and preparing for this possibility can help in making the mortgage application process smoother and faster.

Failure to Recognize the Legal Implications: Underestimating the severity of knowingly making false statements on a mortgage application is another common mistake. As the form explicitly states, such an act is a Federal crime and can result in fines or imprisonment. It is vital for applicants to comprehend the full legal implications of their declaration.

Not Understanding the Authorization to Release Information: Many applicants do not fully grasp the extent of the authorization they are giving to lenders and any potential investors to verify their information. This section authorizes the lender to obtain information about employment history, income, account balances, credit history, and even income tax returns. Being aware of what this entails can help set realistic expectations about the privacy of one’s financial information throughout the mortgage process.

To avoid these mistakes, applicants should carefully review every section of the form, ensure the accuracy of the information provided, and seek clarification on any section they do not understand. Being thorough and fully informed helps in ensuring the integrity of the mortgage application process.

Documents used along the form

When submitting a Borrowers' Certification and Authorization form, it's essential to ensure all necessary documents are in order to streamline the mortgage application process. These documents play a crucial role in verifying the information provided and ensuring compliance with lending standards. Below is a list of documents that are often used alongside the Borrowers' Certification and Authorization form, each serving a specific purpose in the mortgage application process.

- Loan Application Form: This is a comprehensive document where the borrower details personal, employment, and financial information. It serves as the foundation for the mortgage application.

- Credit Report Authorization Form: Allows the lender to obtain the borrower's credit report from credit bureaus. It's used to assess the borrower’s creditworthiness.

- Appraisal Report: An evaluation of the property's worth completed by a licensed appraiser. Lenders require this to ensure the property's value meets or exceeds the loan amount.

- Income Verification Documents: These can include recent pay stubs, W-2 forms, or 1099 forms, providing proof of the borrower's income.

- Asset Documentation: Bank statements or other documents verifying the assets the borrower declares on the loan application. This might also include proof of down payment.

- Debt Documentation: Lists all current debts to give lenders a complete picture of the borrower’s financial obligations.

- Title Insurance Policy: Protects the lender and borrower against problems with the property's title. It's necessary for verifying that the seller legally owns the property.

- Closing Disclosure: Provided by the lender, this document outlines the final terms of the loan, including the interest rate, closing costs, and other loan expenses. It's essential for the borrower to review before closing.

Together with the Borrowers' Certification and Authorization form, these documents create a complete package that lenders can review to make informed decisions. Keeping these documents organized and readily available can help expedite the loan approval process. Remember, preparing thoroughly for your mortgage application not only demonstrates responsibility but can also pave the way for a smoother, more efficient path to securing your loan.

Similar forms

Loan Estimate and Closing Disclosure Forms: Similar to the Borrowers' Certification and Authorization form, these documents are essential in the loan application process. They provide applicants with details about the estimated costs associated with obtaining a mortgage, including interest rates, monthly payments, and closing costs. Both sets of forms are designed to ensure that borrowers have a full understanding of their financial obligations before proceeding.

Uniform Residential Loan Application: This comprehensive application collects detailed information about the borrower, similar to the Borrowers' Certification and Authorization form. It includes data on employment, income, assets, liabilities, and the property being purchased. The purpose of both documents is to assess the borrower's creditworthiness and ability to repay the loan.

IRS Form 4506-T (Request for Transcript of Tax Return): Like the authorization section of the Borrowers' Certification and Authorization form, IRS Form 4506-T permits lenders to verify income information by obtaining direct access to the borrower's tax returns. This verification helps ensure the accuracy of the financial information provided in the loan application.

Credit Report Authorization Form: This document, very much like part of the Borrowers' Certification and Authorization form, gives the lender permission to check the credit history of the applicant. The main purpose is to evaluate the borrower's creditworthiness by reviewing past credit behavior, which is crucial for decision-making in the loan approval process.

Gift Letter: When part of the down payment comes as a gift, lenders require a signed letter stating that the money is indeed a gift and not a loan that needs to be repaid. This document complements the financial information the borrower provides in the Borrowers' Certification and Authorization form, ensuring a thorough understanding of the borrower's financial sources.

Appraisal Disclosure Forms: These forms inform the borrower that an appraisal will be conducted to determine the property’s value. Similar to the Borrowers' Certification and Authorization form, appraisal disclosures are a standard requirement, providing clear communication on procedures that affect the loan's processing and approval.

Right to Receive Appraisal Form: This form ensures that borrowers are aware of their right to receive a copy of the appraisal report, echoing the transparency and borrower awareness seen in the Borrowers' Certification and Authorization form. It is part of regulatory requirements designed to keep borrowers fully informed about important aspects of their loan application.

Dos and Don'ts

When filling out the Borrowers Certification and Authorization form, it is crucial to heed both what you should and should not do to ensure the process is smooth and accurate. Adhering to these guidelines not only simplifies the application process but also helps in preventing any legal issues that may arise due to misinformation or misunderstanding.

Do:- Review all sections of the form carefully before filling it out to ensure you understand every part.

- Provide accurate and complete information regarding your employment, income, assets, and liabilities to avoid any discrepancies.

- Understand the implications of the authorization to release information section, as it permits the lender to verify your details.

- Use black or blue ink if the form is to be filled out by hand to ensure legibility.

- Keep a copy of the completed form and any other documents submitted for your records.

- Leave any fields blank. If a section does not apply, fill in with "N/A" or "None" to indicate the question has been read and answered.

- Make assumptions about what information is required. If unsure, seek clarification to provide the most accurate answer.

- Alter the form's structure or content, as doing so might invalidate your application or lead to processing delays.

- Forget to sign and date the form. Unsigned forms are considered incomplete and cannot be processed.

By following these guidelines, applicants can navigate the complex process of applying for a mortgage with confidence and integrity, ensuring that all information provided is both accurate and truthful.

Misconceptions

There are several misconceptions surrounding the Borrowers' Certification and Authorization form that are commonly encountered. Understanding these misconceptions is crucial for individuals applying for a mortgage loan, ensuring they are well-informed throughout the process.

Misconception 1: Signing the Borrowers' Certification and Authorization form is merely a formality without legal consequences.

Misconception 2: The information I certify is only subject to verification before loan approval.

Misconception 3: The authorization to release information is limited to the original lender.

Misconception 4: A digital or photocopy of the Borrowers' Certification and Authorization form is not valid.

Many borrowers believe that the Borrowers' Certification and Authorization form is just procedural and lacks any real importance. However, when individuals sign this document, they are certifying that all the information provided in their loan application and related documents is accurate and complete. It is important to understand that knowingly providing false information is a federal crime that can result in fines or imprisonment. This underscores the serious nature of the certification process.

Some borrowers may assume that once their loan is approved, the information they have certified is no longer subject to verification. Contrary to this belief, the authorization allows the lender, and any potential investors who may purchase the mortgage, to verify the information contained in the loan application both before the loan closes and as part of ongoing quality control programs. This means the accuracy of your information can be scrutinized even after loan approval.

A typical misunderstanding is that the authorization to release information applies solely to the original lender specified in the loan application. However, the borrower also authorizes any investor to whom the lender may sell the mortgage, as well as the mortgage guaranty insurer (if any), to obtain all requested information and documentation regarding the borrower's employment history, income, account balances, credit history, and income tax returns. This broader authorization ensures that all parties involved in the lending and investing process have access to the necessary information.

Some individuals mistakenly believe that only an original signed copy of the Borrowers' Certification and Authorization form is valid. In reality, a copy of this authorization may be accepted as if it were an original. This flexibility facilitates easier transmission of documents between parties and expedites the verification process.

Understanding these key points about the Borrowers' Certification and Authorization form can demystify the mortgage application process, allowing borrowers to approach it with greater confidence and awareness of their responsibilities and rights.

Key takeaways

When filling out and using the Borrowers' Certification and Authorization form, it's essential to keep the following key takeaways in mind:

- The form serves as a declaration from the borrower(s) that the information they have provided in their mortgage application is accurate, truthful, and complete. Misrepresentations or omissions can have severe consequences.

- By signing the form, borrowers are aware that the lending institution retains the option to shift the mortgage loan review process to a more rigorous documentation verification method at any time.

- Borrowers are reminded that making false statements on their mortgage application is a federal crime, punishable by fine, imprisonment, or both, under Title 18, United States Code, Section 1014.

- The authorization section empowers the lenders, and any mortgage guaranty insurer involved, to verify information provided in the borrowers' loan applications. This process can occur before closing the loan and as part of the lender's quality control procedures after the loan has been issued.

- Borrowers consent for their personal and financial information to be shared, not just with the lending institution, but also with any potential investors to whom the mortgage might be sold. This information includes, but is not limited to, employment history, income, account balances, credit history, and income tax returns.

- The form allows the lender or any future mortgage investor to request verification information from any party named in the loan application. This broad authorization ensures that the lender can fully verify the borrower's financial and personal situation.

- A copy of this authorization is considered as valid as the original, which makes it easier for lenders and authorized parties to perform necessary verifications without needing to obtain a physical original signed document each time.

Understanding these key points can help ensure that borrowers are fully informed about the implications of signing the Borrowers' Certification and Authorization form. It helps in maintaining transparency between the borrower and lender, and it facilitates a smoother mortgage application process.

Popular PDF Forms

Officiant Opening Remarks - Strategies for making your wedding ceremony a reflection of your shared values and dreams for the future.

Can I Write a Letter Instead of a Will - Aids financial institutions in determining the correct way to present and verify their authority when acting as custodians or trustees in a Letter of Instruction.