Blank Business Income Statement Pdf PDF Template

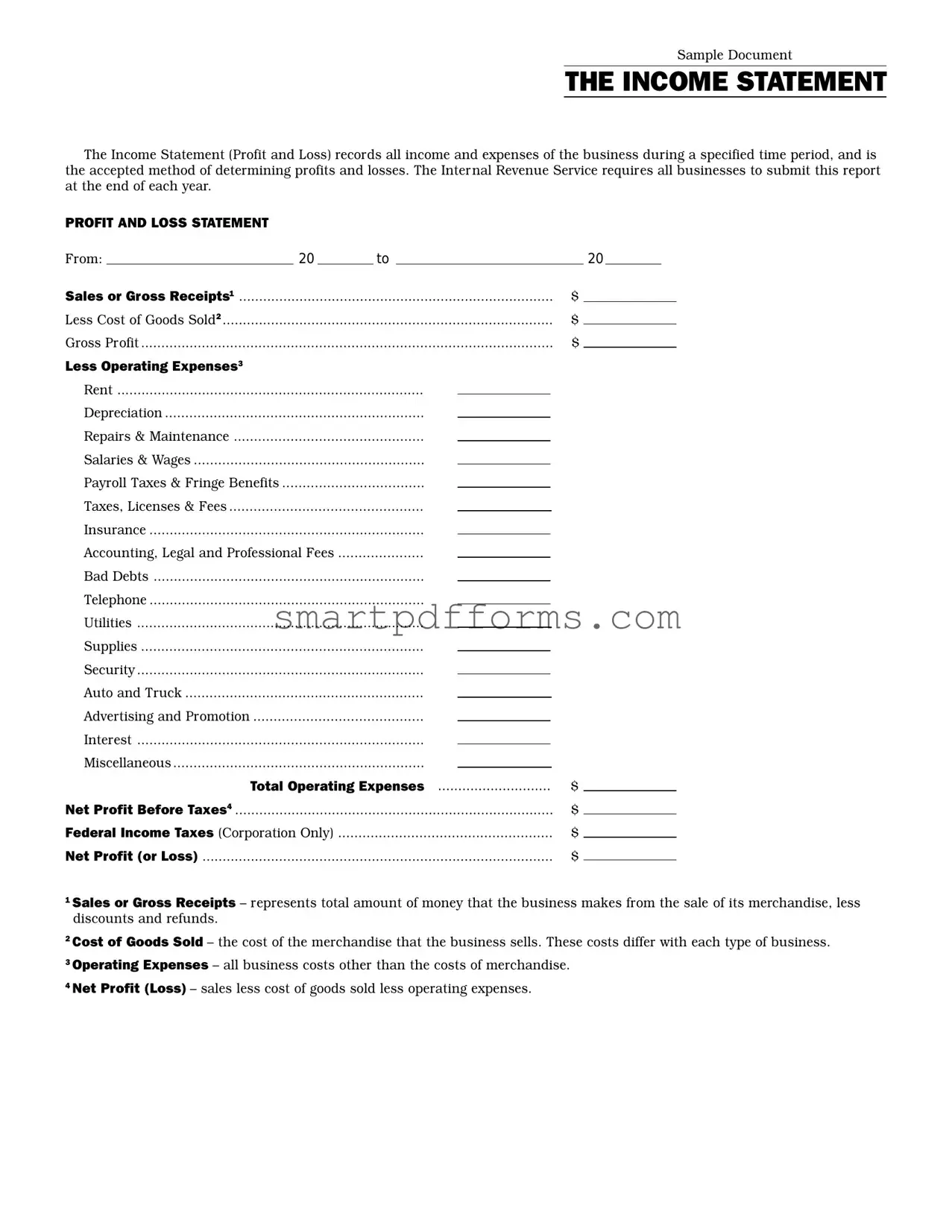

The Income Statement, also known as the Profit and Loss Statement, plays a crucial role in the financial documentation landscape of businesses. Tasked with capturing all income and expenses over a defined period, it serves as the key instrument for determining a business's profitability. It is meticulously structured, detailing revenues under sales or gross receipts, and subtracting the cost of goods sold to reveal the gross profit. Further, it deducts operating expenses—including rent, salaries and wages, taxes, and more—to calculate the net profit before taxes. The necessity of this document extends beyond internal assessment; the Internal Revenue Service mandates its submission at the end of each fiscal year for all businesses, exemplifying its importance in tax evaluation and compliance. Therefore, the Business Income Statement PDF encapsulates a comprehensive snapshot of financial health, guiding stakeholders in making informed decisions while ensuring adherence to regulatory requirements.

Preview - Business Income Statement Pdf Form

Sample Document

THE INCOME STATEMENT

The Income Statement (Profit and Loss) records all income and expenses of the business during a specified time period, and is the accepted method of determining profits and losses. The Internal Revenue Service requires all businesses to submit this report at the end of each year.

PROFIT AND LOSS STATEMENT |

|

|

|

|

|

|

|

|

|

|

From: |

|

20 |

|

to |

|

|

20 |

|

|

|

Sales or Gross Receipts1 |

|

|

|

$ |

|

|

|

|||

Less Cost of Goods Sold2 |

|

|

|

$ |

|

|

|

|||

|

|

|

|

|

|

|||||

Gross Profit |

|

|

|

$ |

|

|

|

|||

|

|

|

|

|

|

|||||

Less Operating Expenses3 |

|

|

|

|

|

|

|

|

|

|

Rent |

|

|

|

|

|

|

|

|

||

Depreciation |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|||

Repairs & Maintenance |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|||

Salaries & Wages |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|||

Payroll Taxes & Fringe Benefits |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|||

Taxes, Licenses & Fees |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|||

Insurance |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|||

Accounting, Legal and Professional Fees |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|||||

Bad Debts |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|||

Telephone |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|||

Utilities |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|||

Supplies |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|||

Security |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|||

Auto and Truck |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|||

Advertising and Promotion |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|||

Interest |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|||

Miscellaneous |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|||

|

Total Operating Expenses |

$ |

|

|

|

|||||

|

|

|

||||||||

Net Profit Before Taxes4 |

|

|

|

$ |

|

|

|

|||

Federal Income Taxes (Corporation Only) |

|

$ |

|

|

|

|||||

Net Profit (or Loss) |

|

|

|

$ |

|

|

|

|||

|

|

|

|

|

|

|||||

1Sales or Gross Receipts – represents total amount of money that the business makes from the sale of its merchandise, less discounts and refunds.

2Cost of Goods Sold – the cost of the merchandise that the business sells. These costs differ with each type of business.

3Operating Expenses – all business costs other than the costs of merchandise.

4Net Profit (Loss) – sales less cost of goods sold less operating expenses.

Form Data

| Fact Name | Detail |

|---|---|

| Document Title | The Income Statement |

| Purpose | Records all income and expenses during a specified time period |

| Also Known As | Profit and Loss Statement |

| Requirement | Required by the Internal Revenue Service annually |

| Main Components | Sales or Gross Receipts, Cost of Goods Sold, Gross Profit, Operating Expenses, Net Profit Before Taxes |

| Key Calculation | Net Profit (Loss) = Sales - Cost of Goods Sold - Operating Expenses |

| Governing Law | Federal Tax Law |

| Important Categories of Expenses | Rent, Depreciation, Salaries & Wages, Taxes, Insurance, Advertising, etc. |

| Significance of Net Profit (or Loss) | Indicates the financial performance of the business |

Instructions on Utilizing Business Income Statement Pdf

Filling out the Business Income Statement PDF form accurately is crucial for managing your business finances and ensuring compliance with the Internal Revenue Service (IRS) requirements. This document helps in recording all income and expenses during a specific period, providing a clear picture of profit and loss. Follow these steps to complete the form effectively, ensuring all financial data is accurately reflected.

- Enter the start and end dates of the reporting period at the top where it says "From: 20__ to 20__".

- Under "Sales or Gross Receipts", input the total amount of money the business made from sales, after deducting any discounts and refunds.

- For "Less Cost of Goods Sold", enter the cost associated with the merchandise your business sold. Remember, these costs vary depending on the type of business.

- In the "Gross Profit" section, calculate this value by subtracting the Cost of Goods Sold from Sales or Gross Receipts, and input the result.

- List all operating expenses under "Less Operating Expenses", including:

- Rent

- Depreciation

- Repairs & Maintenance

- Salaries & Wages

- Payroll Taxes & Fringe Benefits

- Taxes, Licenses & Fees

- Insurance

- Accounting, Legal and Professional Fees

- Bad Debts

- Telephone

- Utilities

- Supplies

- Security

- Auto and Truck

- Advertising and Promotion

- Interest

- Miscellaneous

- After listing all operating expenses, calculate the total and input it in the "Total Operating Expenses" field.

- To find the "Net Profit Before Taxes", subtract the Total Operating Expenses from the Gross Profit, and enter the result.

- If your business is a corporation, enter the "Federal Income Taxes" amount next.

- Finally, calculate and record the "Net Profit (or Loss)" by subtracting Federal Income Taxes (for corporations) from Net Profit Before Taxes. If not a corporation, just carry over the Net Profit Before Taxes.

After completing these steps, review the form to ensure all information is correct and no section has been missed. This careful attention to detail ensures your business's financial activities are accurately represented, facilitating informed decision-making and adherence to regulatory requirements.

Obtain Answers on Business Income Statement Pdf

What is a Business Income Statement PDF form?

A Business Income Statement PDF form is a document that records all income and expenses of a business during a specific period. It provides a detailed account of profits and losses by tallying up revenues, the cost of goods sold, and operating expenses. The outcome of this calculation reveals the net profit or loss a business has incurred over the period. This form is crucial for both internal assessment and fulfilling the Internal Revenue Service's yearly reporting requirements.

Why is the Business Income Statement important?

The Income Statement is essential for several reasons. It offers businesses a clear view of their financial performance, helping to understand how well they are managing their income and expenses. This insight is vital for making informed decisions about future investments, budgeting, and strategies for growth. Additionally, since the IRS requires businesses to submit this report annually, it plays a significant role in compliance and tax preparation.

What is included in the Operating Expenses section?

The Operating Expenses section lists all costs a business incurs outside of the direct costs of merchandise. This includes rent, depreciation, repairs & maintenance, salaries & wages, payroll taxes & fringe benefits, taxes, licenses & fees, insurance, accounting, legal & professional fees, bad debts, telephone, utilities, supplies, security, auto & truck, advertising and promotion, interest, and miscellaneous expenses. These expenses are subtracted from the gross profit to help determine the net profit or loss.

How is the 'Net Profit (or Loss)' calculated?

To calculate the 'Net Profit (or Loss),' a business must first determine the gross profit by subtracting the cost of goods sold from sales or gross receipts. Then, all operating expenses are deducted from the gross profit. For corporations, federal income taxes are also subtracted. The final figure after these deductions is the net profit (or loss), indicating the financial performance and profitability of the business over the specified period.

What does 'Sales or Gross Receipts' mean?

'Sales or Gross Receipts' refer to the total amount of money that the business receives from the sale of its merchandise, accounting for any discounts or refunds issued. This figure represents the business's primary source of income before any expenses are deducted. It serves as the starting point for calculating the business's gross profit and, subsequently, its net profit or loss.

Who needs to file a Business Income Statement?

All businesses are required to prepare and submit an Income Statement to the Internal Revenue Service at the end of each fiscal year. This requirement applies regardless of the size or type of the business. Keeping accurate and detailed Income Statements is also good practice for business owners to monitor their company's financial health and make informed strategic decisions.

Can the Business Income Statement be used for planning future business activities?

Yes, the Business Income Statement is an invaluable tool for planning future business activities. By analyzing past performance, businesses can identify trends, areas for improvement, and opportunities for growth. This analysis can guide budgeting, investment decisions, and strategy development. It can also help businesses set realistic financial goals and benchmarks for future periods.

Is it necessary to include every listed operating expense, even if it doesn't apply to my business?

Not all operating expenses listed on the Income Statement will apply to every business. Each business should only include the expenses that are relevant to its operations. The objective is to provide an accurate representation of the business's financial activities. Omitting inapplicable expenses helps achieve this goal and ensures the Income Statement accurately reflects the business's net profit or loss.

Common mistakes

When businesses tackle the task of completing their Income Statement, a document crucial for tracking profitability and fulfilling tax obligations, several common mistakes can detract from the accuracy and usefulness of this financial report. Understanding these errors is essential for ensuring that the Income Statement reflects a true and fair view of the business's financial performance.

-

Not adequately separating personal and business expenses: Business owners sometimes inadvertently include personal expenses as business deductions. This mix-up can lead to an inaccurate representation of the business's operating expenses and, ultimately, its net profit or loss. It's crucial to rigorously categorize expenses to maintain the integrity of the Income Statement.

-

Incorrectly classifying expenses: Misclassifying expenses can distort the understanding of where a business is spending its money. For example, listing a long-term asset purchase as an expense rather than capitalizing the asset over its useful life can significantly impact the reported net profit or loss.

-

Overlooking indirect expenses: Some businesses fail to account for indirect expenses such as depreciation, insurance, or administrative salaries in the operating expenses section. These costs, while not directly tied to the production of goods or services, still affect the financial outcome and should be included to capture the complete cost of operations.

-

Failing to recognize or accurately report bad debts: Bad debts, or amounts owed to the business that are likely to be uncollectible, need to be identified and accounted for correctly. Neglecting to write off bad debts can overstate the business's income, presenting a financially healthier picture than reality.

-

Incorrect calculation of the cost of goods sold: The cost of goods sold must accurately reflect the direct costs associated with the production of the goods sold by the business. Mistakes in this calculation can misrepresent the gross profit, skewing any analysis based on these figures.

-

Misunderstanding the concept of gross profit: It is important to correctly distinguish between gross receipts from sales and the gross profit. Gross profit is calculated after subtracting the cost of goods sold from sales or gross receipts. A misunderstanding here can lead to incorrect financial analysis and business decisions.

-

Omitting or inaccurately reporting income taxes: For corporations, accurately reporting federal income taxes is imperative. Errors in this area can result in an inaccurate depiction of the net profit or loss for the period. Ensuring that taxes are correctly calculated and reported is pivotal for compliance and accurate financial reporting.

To sidestep these pitfalls, businesses must approach the preparation of their Income Statement with diligence and attention to detail. By avoiding these common mistakes, the Income Statement can serve as a reliable tool for financial analysis, strategic planning, and compliance with tax obligations. Engaging with financial professionals can further safeguard against these errors, ensuring that the business's financial health is accurately portrayed.

Documents used along the form

When preparing financial documentation for a business, the Business Income Statement PDF is crucial for recording income and expenses within a specific period. However, it works best when complemented by other important financial documents. These documents each serve unique purposes but collectively provide a comprehensive view of a business's financial health.

- Balance Sheet: This document outlines the company’s financial position at a specific point in time, listing assets, liabilities, and shareholders’ equity. It helps in understanding what the business owns and owes.

- Cash Flow Statement: It provides a detailed breakdown of the cash inflow and outflow from operations, investing, and financing activities over a period, highlighting the company's liquidity and financial flexibility.

- Accounts Receivable Aging Report: This tracks the outstanding invoices of a business by age. It is essential for managing and collecting receivables efficiently.

- Inventory Management Reports: These reports give insights into the stock of goods a business has on hand. Effective inventory management aids in meeting customer demand without overstocking or stockouts.

- Business Plan: Although not a financial statement, a business plan is critical as it outlines the company's goals, strategies, market analysis, and financial projections. It guides the overall direction and financial planning of the business.

- Tax Returns: Filed annually, tax returns document earnings and taxable income of the business to the government. They are necessary for compliance with tax laws.

- Bank Statements: These provide a record of the business’s transactions through its bank accounts, offering a real-time insight into its financial activity.

Utilizing the Business Income Statement PDF along with these documents enables a business to gain a full perspective on its financial health, make informed decisions, and comply with regulatory requirements. Each document plays a pivotal role in financial planning, analysis, and reporting.

Similar forms

Balance Sheet: Similar to the Business Income Statement, a Balance Sheet is a critical financial document for a business. While the Income Statement offers a dynamic view of the business's profitability over a certain period, the Balance Sheet provides a static snapshot of the company's financial position at a specific point in time. It lists the company's assets, liabilities, and shareholders' equity, thereby offering a quick overview of what the company owns and owes, as well as the equity invested by the shareholders. Both documents are essential for assessing the financial health of a business, but from different angles.

Cash Flow Statement: This document is akin to the Business Income Statement in that it tracks the financial performance of a business over a period. However, the focus of the Cash Flow Statement is on the liquidity aspect, specifically the inflows and outflows of cash. It categorizes cash flow into three main activities: operating, investing, and financing. Despite differences in focus, both the Cash Flow Statement and the Business Income Statement are indispensable for understanding the overall financial performance of a business, with one focusing on profitability and the other on liquidity.

Statement of Retained Earnings: This financial document shares a connection with the Business Income Statement through its focus on profitability and its impact on shareholders' equity. The Statement of Retained Earnings reconciles the beginning and ending retained earnings for a certain period, highlighting how much profit was retained in the business versus distributed to shareholders as dividends. It directly uses the net profit (or loss) figure from the Income Statement to show how retained earnings have changed, illustrating the profitability's longer-term impacts on the business's equity.

Statement of Comprehensive Income: This is another financial statement that exhibits similarities to the Business Income Statement, with a broader scope. The Statement of Comprehensive Income includes all revenues, gains, expenses, and losses, but it goes further to report on items not included in the net income, such as unrealized gains and losses on investments and foreign exchange. By encompassing both the typical income statement items and additional comprehensive income components, it provides a complete picture of a company's financial performance over a specified period.

Dos and Don'ts

When filling out the Business Income Statement PDF form, it is important to adhere to certain best practices to ensure that the document accurately reflects the financial performance of your business. Below is a list of things you should and shouldn't do:

Do:- Review all sections thoroughly before starting: Understanding each section will help ensure that all relevant information is accurately reported.

- Gather required documents: Sales records, receipts for expenses, and other financial documents will provide the necessary information to complete the form.

- Use accurate and recent data: Ensure that all figures entered correspond to the specified time period to maintain the integrity of the income statement.

- Include all sources of income: Beyond just sales or gross receipts, any additional income should be reported to provide a comprehensive overview of the business's financial health.

- Estimate figures: Use exact numbers wherever possible to avoid discrepancies that could impact financial analysis and tax liabilities.

- Leave sections blank: If a section does not apply to your business, indicate this appropriately; do not just leave it empty.

- Forget to deduct returns and allowances from sales: This ensures that the gross receipts accurately reflect the net amount of sales revenue.

- Ignore minor expenses: Even small amounts can add up and significantly affect the profit and loss statement, so include all operating expenses.

By following these guidelines, you will help ensure that your Business Income Statement accurately and fully captures your business's financial activities, which is crucial for effective management and regulatory compliance.

Misconceptions

Understanding the intricacies of business financial statements, particularly the Income Statement, is crucial for entrepreneurs, investors, and various stakeholders. However, numerous misconceptions often cloud the accuracy and interpretation of these essential documents. It is important to delve into these misconceptions to ensure a clear understanding of what an Income Statement reveals about a business's financial health.

Misconception 1: The Income Statement gives a complete picture of a business’s financial health.

While the Income Statement is a critical financial document, it does not provide a full overview of a business's financial health. It focuses on revenue, expenses, and profit over a particular period but doesn't account for cash flows or asset and liability balances. For a comprehensive financial understanding, it should be reviewed alongside the Balance Sheet and Cash Flow Statement.

Misconception 2: The main purpose of the Income Statement is for tax preparation.

While it's true that businesses must submit their Income Statement to the Internal Revenue Service annually, its purpose extends beyond tax preparation. It serves as a key report for management to assess profitability, operational efficiency, and to inform business strategy and decision-making processes.

Misconception 3: Net Profit or Loss reflects the amount of cash a business has.

Net Profit on an Income Statement does not equate to the cash available within a business. It merely represents the financial performance, taking revenue and expenses into account. Actual cash flow is determined by considering other financial activities which are detailed in the Cash Flow Statement.

Misconception 4: Cost of Goods Sold includes all business expenses.

The Cost of Goods Sold specifically refers to the costs directly associated with the production of goods or services a business sells. It does not cover all business expenses. Many operating expenses, such as rent, salaries, and utilities, are recorded separately under Operating Expenses.

Misconception 5: Higher sales always lead to higher profits.

This is not necessarily true, as the profitability of a business is influenced by both its revenues and expenses. Even if sales increase, if the cost of goods sold or operating expenses increase at a higher rate, the net profit could diminish or even turn into a loss.

Misconception 6: All operating expenses are fixed and predictable.

While certain operating expenses might be fixed, such as rent or salaries, many can vary significantly over time. Examples include utility costs, which can fluctuate based on usage, and raw material prices, which can vary due to market conditions.

Misconception 7: The Income Statement is only useful for large corporations.

Regardless of size, all businesses can benefit from analyzing their Income Statement. It provides valuable insights into revenue streams, operational efficiency, and profit margins, contributing to informed decision-making and strategic planning for both small businesses and large corporations alike.

Debunking these misconceptions allows business owners, investors, and stakeholders to more accurately interpret Income Statements. This ensures a more informed approach to financial analysis, strategic planning, and overall business management, fostering sustainable growth and financial health.

Key takeaways

Filling out and properly using the Business Income Statement PDF is crucial for any business owner or manager. Here are nine key points to remember:

- Understand the purpose: The Income Statement is designed to record all income and expenses of the business during a specified time period, providing a clear picture of the business's profitability.

- Know the importance: This document is not just a record-keeping tool; it's a mandatory report for the Internal Revenue Service (IRS) at the end of each fiscal year.

- Pay attention to the time frame: The statement covers a specific period. Always ensure the dates at the top (From: 20__ to 20__) accurately reflect the period you're reporting on.

- Report Sales or Gross Receipts: This figure represents the total amount of money the business earns from the sale of goods or services, net of discounts and refunds.

- Calculate Cost of Goods Sold (COGS): For businesses that sell merchandise, this is a crucial deduction that represents the direct costs attributable to the production of the goods sold.

- Deduct Operating Expenses: These are the costs incurred during the normal operations of the business, excluding the cost of merchandise. They include rent, salaries, utilities, and more.

- Consider Depreciation: This non-cash expense reflects the wear and tear on assets over time and must be accounted for within operating expenses.

- Identify Net Profit Before Taxes: This is what remains after deducting the cost of goods sold and operating expenses from sales. It's a crucial indicator of the business's operational effectiveness before tax impact.

- Don’t overlook taxes: For corporations, federal income taxes need to be deducted to determine the final Net Profit (or Loss) for the period.

By keeping these key takeaways in mind, one can ensure they're not only complying with legal requirements but also gaining valuable insights into their business's financial health.

Popular PDF Forms

Long and Foster Rental Application - The inclusion of current and previous residence information aids in verifying rental history and assessing reliability as tenants.

Jimmy Johns Jobs - Consider applying for a position at Jimmy John's, where their application form asks for in-depth information about your background, hoping to place you in their energetic work environment.

When Documenting a Pre-job Briefing, It Is a Best Practice to Include the Date, Time, Attendees And: - Clarify job tasks, identify potential hazards, and set emergency procedures for a successful project kickoff.